No Down Payment Mortgage

There are a number of options if youre in the market for no down payment mortgages. The U.S. government wants people to buy homes.

Its easy to see why.

The National Association of Home Builders estimates that homeownership drives between 15-18% of the countrys economy. Thats huge.

Without housing, the U.S. economy would basically stop.

So, Uncle Sam has created ways to buy with zero down, and will even give you a fantastic rate on these loans. No down payment mortgages often come with lower rates than loans that require 20% down.

The USDA, FHA, and VA loans all come from essentially the same place government-run organizations that want to spur homeownership.

You might be a renter, but the government doesnt want you to stay that way for long.

Its mission is to provide the average buyer with low- and no-down-payment loan options. And these government organizations dont even require that you have a high credit score. Lenient lending lifts the homeownership rate and drives the U.S. economy forward, and is a win for everyone.

No Down Payment: Va Loans

The VA loan is a nodownpayment mortgage available to members of the U.S. military, veterans, and surviving spouses.

VA loans are backed by the U.S. Department of Veterans Affairs. That means they have lower rates and easier requirements for borrowers who meet VA mortgage guidelines.

VA loan qualifications are straightforward.

Most veterans, activeduty service members, and honorably discharged service personnel are eligible for the VA program. In addition, home buyers who have spent at least 6 years in the Reserves or National Guard are eligible, as are spouses of service members killed in the line of duty.

Some key benefits of the VA loan are:

- No down payment requirement

- Belowmarket mortgage rates

- Bankruptcy and other derogatory credit information does not immediately disqualify you

- No mortgage insurance is required, only a onetime funding fee which can be included in the loan amount

In addition, VA loans have no maximum loan amount. Its possible to get a VA loan above current conforming loan limits, as long as you have strong enough credit and you can afford the payments.

How The Pandemic Has Affected Fha Loans

This past year, the lending industry has become more risk-averse as unemployment numbers rose to historic highs. The combination of low FHA interest rates and urgent need for cheap loans has led to increased demand for FHA loans, and that, in turn, has caused lenders to raise their eligibility standards. According to a report from the Urban Institute, the median credit score for a completed mortgage jumped from 741 in February to 764 in October and its not expected to let up anytime soon.

Homeowners with FHA loans have been disproportionately impacted by the pandemic, compared to those with conventional loans. In a survey conducted by the Mortgage Bankers Association, 10.76% of FHA borrowers surveyed had a loan either in the process of foreclosure or that was past due by 90 days or more.

As a result, you may find the FHA lending market to be much more competitive than usual. Prospective borrowers with fair credit who would have qualified for an FHA loan prior to the pandemic may now find their applications rejected or their interest rates higher.

To increase your chances of success, we recommend shopping around to get the best deal, as you may receive more competitive offers from particular lenders. Those who are rejected for FHA loans will want to take steps to rebuild their credit for the long term.

Recommended Reading: Usaa Auto Loans Rates

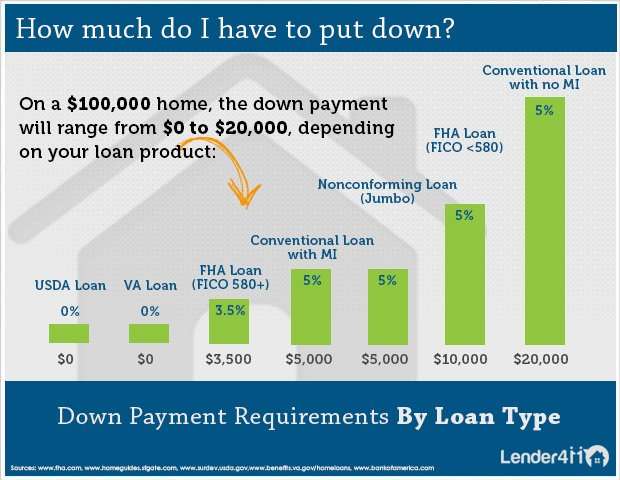

First Time Home Buyers Dont Need A Huge Down Payment

First time home buyers get access to many lowdownpayment mortgages.

For example, conventional loans let you buy a house with 3% down and a 620 credit score, and FHA loans allow a 3.5% down payment with credit as low as 580.

There are even mortgages for first time home buyers with 0% down. The two most common are USDA and VA loans. However these have special requirements, so not everyone will qualify.

Even if you cant get a zerodown loan as a first time home buyer, theres a good chance youll qualify with just 3% or 3.5% down.

What Is The Typical Down Payment On A House In 2021

According to OptimalBlue, the median payment for a single-family home was $28,300 in June 2021, but that number can vary from state to state. Also, according to a survey conducted by the National Association of Realtors in 2020, the average down payment percentage was 12% of the homes value.

How much is a down payment on a house in 2021?

| state |

|---|

| $32,900 |

You May Like: Car Loans With A 600 Credit Score

How Long Do You Have To Pay Pmi On An Fha Loan

If you put at least 10% on your loan amount, you will only need to pay the MIP for 11 years of your loan. If you invest less than 10%, you will pay MIP for the life of the loan. You may want to wait until you have at least 10% down before buying a home to lower your MIP payment amount.

How long until PMI is paid? If you have owned the home for at least five years and the loan balance does not exceed 80% of the new valuation, you can apply for PMI cancellation. If you have owned the home for at least two years, your remaining mortgage balance should not exceed 75%.

Use This Fha Mortgage Calculator To Get An Estimate

An FHA loan is a government-backed conforming loan insured by the Federal Housing Administration. FHA loans have lower credit and down payment requirements for qualified homebuyers. For instance, the minimum required down payment for an FHA loan is only 3.5% of the purchase price. The FHA mortgage calculator includes additional costs in the estimated monthly payment. Such as, a one-time, upfront mortgage insurance premium and annual premiums paid monthly.

This FHA loan calculator provides customized information based on the information you provide. But, it assumes a few things about you. For example, that youre buying a single-family home as your primary residence. This calculator also makes assumptions about closing costs, lenders fees and other costs, which can be significant.

Estimated monthly payment and APR example: A $175,000 base loan amount with a 30-year term at an interest rate of 4.125% with a down-payment of 3.5% would result in an estimated principal and interest monthly payment of $862.98 over the full term of the loan with an Annual Percentage Rate of 5.190%.1

Don’t Miss: Upstart Prequalify

What Is The Maximum Social Security Retirement Benefit For 2017

Inflation ticked higher this year, and as a result, the Social Security Administration is increasing Social Security payments by 0.3% in 2017. The slight increase in Social Security income means that the maximum monthly Social Security benefit at full retirement age next year will be $2,687 per month.

Low Down Payment: The Piggyback Loan

One final option if you want to put less than 20% down on a house but dont want to pay mortgage insurance is a piggyback loan.

The piggyback loan or 80/10/10 program is typically reserved for buyers with aboveaverage credit scores. Its actually two loans, meant to give home buyers added flexibility and lower overall payments.

The beauty of the 80/10/10 is its structure.

- With an 80/10/10 loan, buyers bring a 10% down payment to closing

- They also get a 10% second mortgage

- This leaves an 80% mortgage loan

- Since youre effectively putting 20% down, there is no PMI

The first mortgage is typically a conventional loan via Fannie Mae or Freddie Mac, and its offered at current market mortgage rates.

The second mortgage is a loan for 10% of the homes purchase price. This loan is typically a home equity loan or home equity line of credit .

And that leaves the last 10, which represents the buyers down payment amount 10% of the purchase price. This amount is paid as cash at closing.

This type of loan structure can help you avoid private mortgage insurance, lower your monthly mortgage payments, or avoid a jumbo loan if youre right on the cusp of conforming loan limits.

However, youll typically need a credit score of 680700 or higher to qualify for the second mortgage. And youll have two monthly payments instead of one.

Don’t Miss: Can I Buy A Second House With My Va Loan

Is It Harder To Get A Loan For A Duplex

The majority of homes for sale are single-family homes, which makes finding duplexes more difficult. There will be a greater selection of low-down-payment mortgages. It is possible that you will have to pay more for repairs and insurance if you own two units. If you want to borrow more money than you can afford, you can go for a higher loan limit.

Can You Get A Fha Loan With No Money Down

4.7/5no downmortgageno moneyFHA loanmortgageloandownlittledownmore on it

FHA Home Loans are a Zero Down MortgageFederal Housing Administration, or FHA, loans require a 3.5% down payment, which can be quite a lot of money. On a $300,000 home purchase, that’s $10,500. But, there is a somewhat obscure FHA rule that allows you to get around this requirement, in a way.

what is the down payment requirement for FHA loan? Typically an FHA loan is one of the easiest types of mortgage loans to qualify for because it requires a low down payment and you can have less-than-perfect credit. For FHA loans, down payment of 3.5 percent is required for maximum financing. Borrowers with credit scores as low as 500 can qualify for an FHA loan.

Likewise, people ask, how can I get a house with no money down?

If coming up with a down payment is a struggle, an alternative to buying a house with no money down is an FHA loan. The FHA does not offer a no–money down loan. However, they do allow for loans with a down payment as low as 3.5% of the home’s purchase price.

Do 80/20 loans still exist?

An 80/20 mortgage can save money on the front end of your home loan and over the course of the loan. Essentially, an 80/20 mortgage is a pair of loans used to purchase a home. The first loan covers 80 percent of the home’s price, while the second covers the remaining 20 percent.

How to Find a Down Payment to Buy a Home

Also Check: Average Interest Rate For Commercial Real Estate Loan

Using Rental Income To Qualify

An investment property can help you gain FHA financing when you use net rental income to qualify. The lender multiplies the gross rent you charge by a vacancy factor usually 25 percent to account for potential vacancy and repairs. It then subtracts the total monthly housing payment, including principal, interest, taxes and insurance, from this figure. If the calculation yields a positive, or net, figure, the lender can add the net rental income to your other gross monthly income.

References

Modified date: May. 26, 2019

A lot has been written about financing a home purchase, but what if you want to buy a plot of land? Whether you plan to build a home on the land, use it for farming or another type of business, or hold onto it as an investment, the borrowing process is different than obtaining a regular mortgage.

If youre ready to dive in already and youre looking for the simplest way of financing your land purchase, check out our list of the best mortgages available.

Whats Ahead:

What Is A Land Loan

A land loan is used to finance the purchase of a plot of land. Theyre used when a buyer is interested in buying a piece of land to build a home or utilize for business purposes. If youre interested in obtaining a land loan, the type you take out will depend on where youre buying land and how you intend to use the land.

The three most common types of land loans are raw land loans, unimproved land loans, and improved land loans.

Also Check: How To Lower Car Loan Payments

Recommended Reading: Car Loan With Credit Score Of 600

How Long Does It Take To Get Down Payment Assistance

How long it takes depends on the program and the type of assistance. Each state offers its own programs, as do different cities and organizations. These programs move at different speeds depending on the demand and size of the program.

Its important to know that, if you apply for down payment assistance, it may take longer to close on your home. The assistance program must work with your lender to secure the loan and the down payment funds. This can add time onto the closing process, depending on how quickly the down payment assistance program acts.

Bad Credit Only Tells Half The Story

People have low credit scores for various reasons, from late payments to just having a limited account history. Because of this, FHA-approved lenders look at more than just your credit score your entire credit history will be considered.

Example:

Borrower 1: Has a 620 credit score but has multiple late payments and collection accounts. They likely wont be approved even though they meet the credit score requirement.

Borrower 2: Has a 580 credit score but has no late payments or unpaid collections, but their score is low because they have only had credit accounts for a couple of years. Borrower 2 is more likely to be approved than borrower 1.

A clean credit report without much recent negative account history, even if its just a small sample size, is better than having long-established accounts with poor payment history.

Recommended Reading: What Happens If You Default On An Sba Loan

United States Department Of Agriculture Loan

The US Department of Agriculture loan helps people in rural areas buy homes with zero money down. To qualify for the Single Family Housing Guaranteed Loan Program, you have to meet certain income requirements described as low-to-moderate income which vary by state. The USDA is fairly liberal with its definition of rural and even considers some suburban areas .

Theres no minimum credit score to obtain a USDA loan, although a score of 640 or higher and a debt-to-income ratio below 41% typically qualifies for automatic underwriting, according to USDAloans.com.

Despite zero down payment obligation, the buyer is expected to pay an upfront funding fee equal to 1% of the total loan amount to protect against default, plus a USDA-specific 0.35% fee thats calculated as a percentage of the loan amount each year, but tacked on to monthly payments and paid to the mortgage lender.

Also Check: What Is Escrow In Mortgage Loan

Can You Buy A House With No Money Down

A nodownpayment mortgage allows firsttime home buyers and repeat home buyers to purchase property with no money required at closing, except standard closing costs.

Other options, including the FHA loan, the HomeReady mortgage, and the Conventional 97 loan, offer low down payment options with a little as 3% down. Mortgage insurance premiums typically accompany low and no down payment mortgages, but not always.

Furthermore, mortgage rates are still low.

Rates for 30year loans, 15year loans, and 5year ARMs are historically cheap, which has lowered the monthly cost of owning a home.

Recommended Reading: How Long Does The Sba Take To Approve Ppp Loan

More About Fha Loan Down Payments

1) Remember, the FHA does not offer down payment assistance. That doesn’t mean the agency doesn’t provide resources that can help you locate a DPA program in your area. These programs must meet adhere to federal regulations when providing down payment help to borrowers.

2) If you are concerned about your ability to credit qualify for an FHA mortgage, talk to a participating lender and ask some advice about your chances and what can help get you closer to loan approval. There’s no substitute for good credit and you’ll want to review your credit report long before you start filling out loan paperwork.

3) Your rental history can help boost your credit if you pay on time and have a pattern of doing so. But the catch is that your landlord must report this activity to the credit agencies. You’ll need a minimum of 12 months of on-time rent and utility payments anything less can seriously hurt your chances for loan approval.

Percent Down Mortgage Options

Todays home buyers have a wide variety of low and nodown payment mortgage options.

Youve likely heard of the 3.5% down FHA loan. But many firsttime home buyers dont know about Fannie Mae and Freddie Macs 3percentdown mortgages.

The HomeReady and Home Possible loans are geared toward lowerincome home buyers, with flexible guidelines that make homeownership more accessible.

These 3down mortgage loans launched a few years ago. Now, theyre among the most indemand programs for todays home buyers.

You May Like: Usaa Student Loans Review

What Are The Requirements For An Fha Loan

When you apply for an FHA loan, your lender has to follow certain regulations. The lending process will vary based on your credit scores and down payment amount.

To qualify for an FHA loan, you must meet these rules.

- Minimum credit scores Youll need minimum credit scores of at least 580 to qualify for a loan with a 3.5% down payment. Youll need minimum credit scores of 500 to qualify for one with a 10% down payment.

- Mortgage type Youll also need to buy, refinance or renovate a home with between one and four units and plan to use the residence as your primary home.

- Debtto-income ratio Your total monthly debt payments, including any mortgage, typically cant be more than 43% of your gross income.

- Financials Your lender will verify your credit and income as well as the value of the property you want to purchase.

Keep in mind that interest rates and loan terms can vary. You should shop around to see which lender offers you the most favorable terms for your situation.