Where Can I Find Competitive Car Loan Rates In Canada

Comparing car loan rates offered by different banks, credit unions and online lenders is critical to finding the deal thats best for you.

- Banks or credit unions. Since you have an established relationship with your bank already, it might be easier to get approved for a car loan, even if you dont have the best credit. Banks and credit unions also tend to offer the most competitive rates.

- Online lenders. Some online lenders may be willing to provide car loans for fair or poor credit, even if they cant get approval from their bank though they may not get the lowest car loan rates available. Online lenders also tend to be the quickest to approve loans and disburse funds.

Best Car Loans And Lenders For February 2022

Need to borrow money to pay for a new or used car? These companies offer the best rates.

Pallavi Kenkare

Pallavi is an editor for CNET Money, covering topics from Gen Z to student loans. She’s a graduate of Cornell University and hails from Atlanta, Georgia. When she’s not editing, you can find her practicing bookbinding skills or running at a very low speed through the streets of Charlotte.

A direct deposit of news and advice to help you make the smartest decisions with your money.

Best Big Bank Lender: Capital One

Capital One

Capital One gives car shoppers the peace of mind of working with a major secure lender, placing it in the top spot as the best big bank lender.

-

Pre-qualify with a soft credit check

-

Big bank lender provides security

-

Must contact dealer directly to confirm vehicle is in stock

-

Loans only available through the lenders network of dealers

Understandably, some people aren’t as comfortable using lesser-known or niche lenders for something as crucial as an auto loan. If you want the backing of a major financial institution with a household name, Capital One may be your best bet. If you’re in the market for a new or used car, you can submit a request to get pre-qualified for auto financing through the bank’s Auto Navigator program. This early step does not affect your credit since it is a soft pull.

The pre-qualification is then valid at more than 12,000 dealers throughout the nation, each of which you can find on Capital One’s website. Just present the qualification note at a participating dealership and begin the full application process once you find the perfect ride.

Read Also: How Much House And Car Can I Afford

What Is The Best Car Loan In Malaysia

In Malaysia, car loan interest rates differ based on several criteria, which notably include the make and model of the car, the age of the car , the financial standing of the borrower, the loan amount, the repayment period as well as the entity providing the loan. Generally, it is a good idea to make comparisons between several lenders before signing up for a car loan, and the easiest way to do so is using iMoney’s online car loan calculator.

To use our online calculator, simply choose the make and model of your car then drag or key in your preferred loan amount and loan period at the top of this page. Upon completion, the online car loan calculator in Malaysia would generate a list of available car loan packages fitting your requirements, starting with the ones with the best rates at the top. By clicking on “fixed rate” or “variable rate” tabs below the calculator, you can switch between the two major categories of car loans. Keep changing the fields until you see a package you like, and then click on the best car loan for you by clicking on the Apply Now button to sign up. Our online application service is FREE and available for all.

Pentagon Federal Credit Union

Loan amount: Financing up to 110 percent $500 to $100,000Terms: 36 to 84 months

Serving members in all 50 states and the District of Columbia, as well as military bases in Guam, Puerto Rico and Okinawa, PenFed Credit Union offers its members substantial options for car financing. You can join if youre a member of the U.S. military, an employee of the U.S. government or other qualifying organization, or if you belong to a group like the National Military Family Organization or Voices for Americas Troops.

This credit union also offers an online car-buying service tool. This tool allows members to search for new or used cars and get a variety of information such as its value compared with the asking price, as well an alert showing any PenFed discounts available. Additionally, interest rates on auto loans drop to as low as 0.99% APR on cars purchased through PenFeds car buying service.

Don’t Miss: Firstloan Com Legit

Best Car Loan In The Philippines

iMoney helps you choose which auto loan is right for you! There are two ways to avail for auto loans with major banks. One is the traditional way where the bank has an inventory of cars that the client can choose from. The other method is for the client to pick their car of choice , and the bank provides for a used car loan.

What Is A Car Loan

Auto loan is one of the most sought after financial products in the market right now. Transportation has grown to be more of a necessity rather than a luxury in the Philippines mainly due to substandard transportation system and the heavy traffic around the metro. Whether it’s for a used or brand new car, auto loan gives the opportunity for Filipino families, especially the growing middle class, the chance to purchase their own car.

You May Like: What Happens If You Default On A Sba Loan

Get Current Auto Loan Rates And Choose A Loan Thats Right For You

Car loan interest rates change frequently, so its important to keep track of them. Your loans interest rate influences how much youre going to pay for month to month. And a lower interest rate can mean thousands of dollars in savings. Our rate table can help you know the best time to buy a new or a used car.

Current auto loan interest rates| 4.40% |

Consumers Credit Union Reviews

Consumers Credit Union has a relatively strong standing in the industry. It is accredited by the BBB and holds an A+ rating from the organization.

There arent many Consumers Credit Union customer reviews across review sites. However, the positive reviews we found praise the lenders good customer experience, consistently great rates and low fees.

Customers are also pleased to be part of a member-owned organization instead of a bank. That said, people who reported a negative experience with Consumers Credit Union report technical issues and delays with applications.

Our team reached out to Consumers Credit Union for a comment on these reviews but did not receive a response.

Don’t Miss: Unsubsidized Loan Definition

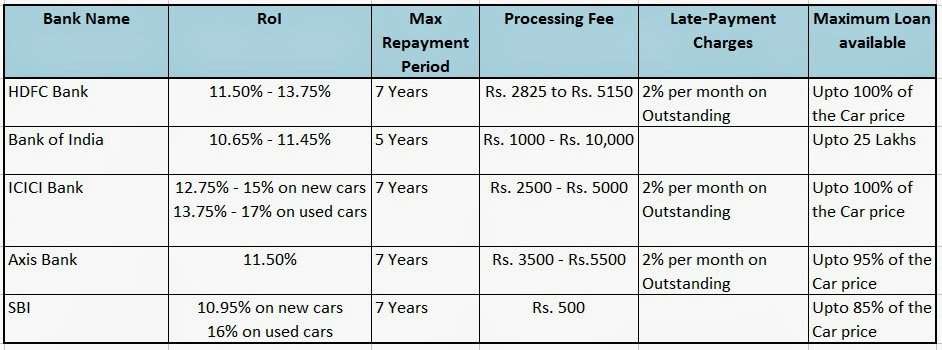

Check Top Car Dealers In India

Car dealerships in India are committed to providing quality services across all areas of car servicing and maintenance. Majority of the car dealers in India have tie-ups with the automakers to impart training to their technicians in maintenance, diagnostics, system check, etc. Staff training and expanding the facilities is a continuous process taken up by dealers to ensure that customers receive the best value for the money they pay. Right from the sale of brand-new cars and used cars to periodic maintenance and customer support, the dealership outlets offer a wide variety of services. Nowadays, most dealers list out their services online to ensure a seamless customer experience without requiring face-to-face interactions.

What Is The Difference Between An Auto Loan And A Personal Loan

It’s possible to use a personal loan or an auto loan to finance a vehicle, but the two differ in some important ways:

- Purpose: Personal loans are unsecured or secured and can be used for many different purposes, including to finance a vehicle, pay for a vacation, or make improvements to a home. Car loans, however, are strictly to finance a vehicle and are secured against the vehicle you purchase. The vehicle serves as collateral.

- Interest rates: Because auto loans are secured, rates on car loans are generally lower than personal loans.

- Availability: Auto loans are typically easier to obtain than personal loans, especially for those with a poor credit history.

Read Also: Bayview Loan Servicing Reviews

Can I Sell My Car With A Loan

It is possible to sell your car with an outstanding loan, but you may have to go through a few extra steps. If your car is worth less than what you currently owe on the loan, you have what’s known as negative equity meaning you may need to pay the difference out of pocket or refinance the remaining amount with a different type of loan.

If your car is worth more than what you currently owe, on the other hand, you may be able to pocket the difference in cash when you sell the car. Whatever your situation, reach out to your lender about your options, as each lender sets different rules for selling a car with a loan.

Auto Approve: Best For Refinancing

Auto Approve only offers car loan refinancing, not purchase loans. However, it does this well. While drivers with poor credit may not be eligible for an Auto Approve loan, those who are eligible may find interest rates as low as 2.25 percent.

Auto Approve holds BBB accreditation, an A+ rating, and a 4.7 out of 5.0-star customer review score based on about 400 reviews. As even a one-percent interest rate reduction could save you hundreds of dollars, theres no reason not to see what refinancing offers you can find with Auto Approve.

| Auto Approve Pros | |

|---|---|

| Does not offer loans to drivers with very bad credit or no credit | |

| Easy and fast application process |

To learn more about this provider, read our complete Auto Approve review. You can also visit AutoApprove.com to compare rates.

Read Also: Usaa Used Car Loan

Car Financing: Is It Better To Get A Loan

Paying in cash is simply risky for buying a car. It destroys your cash flow and even before a normal working Pinoy has that amount of cash, the value of the car has already diminished. Car financing through a loan is the best option for anyone who plans to enjoy the benefits of the car and to also make sure that someones cash flow is in top shape.

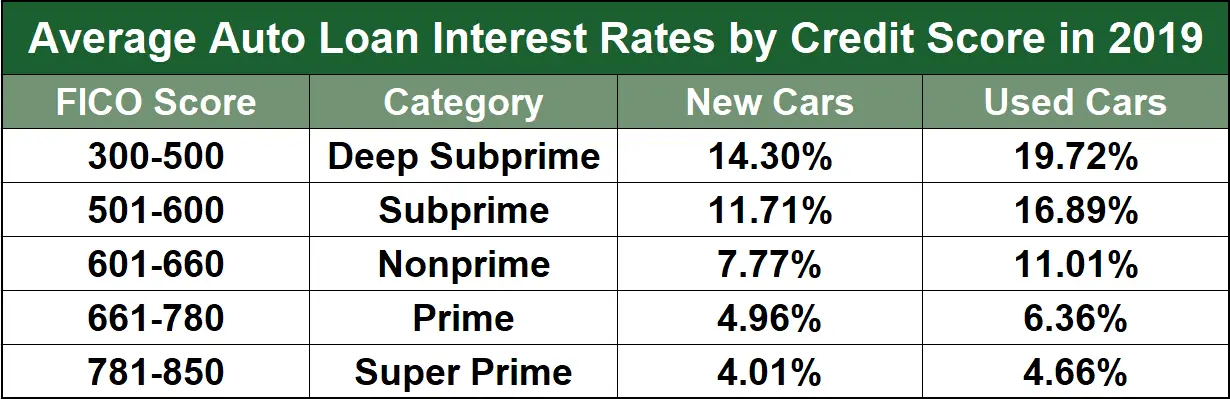

Can You Negotiate Apr On A Car

Yes, you can negotiate APR the same way you negotiate the cars price by showing the dealer that your own lender gave you a lower rate. You can also ask the dealer what it would take to get a tier bump. Dealers sort borrowers into tiers by credit score the higher the tier, the lower your APR. They may say that you need to put more money down or get a cosigner in order to reach a higher tier.

Read Also: Can You Refinance With An Fha Loan

Nasa Federal Credit Union

Loan amount: $5,000 to $125,000Terms: Up to 84 months

NASA Federal Credit Union offers flexible terms and low rates for new and used car financing as well as for auto loan refinancing. Members include current and retired employees of NASA Headquarters, any NASA Center or Facility or NAS, plus employees or members and their families of one of NFCUs partner companies or associations.

Members can apply online and get preapproved quickly. By having financing already in place, members have the advantage at the car dealership because they can focus on negotiating the car price instead of the loan terms. NASA Federal also has a credit protection product available to its members.

Compare Auto Loan Providers

As mentioned, one of the simplest ways to find the best auto loan rates is to shop around. Do this before you get in the room with a loan officer at a car dealership. You can get as many pre-approval offers as you want, as long as you make sure they only require a soft credit check. When youre ready to go ahead with an offer, you can do a full loan application with the financial institution that gives you the best auto loan rates.

Also Check: Loan Officer Commission Percentage

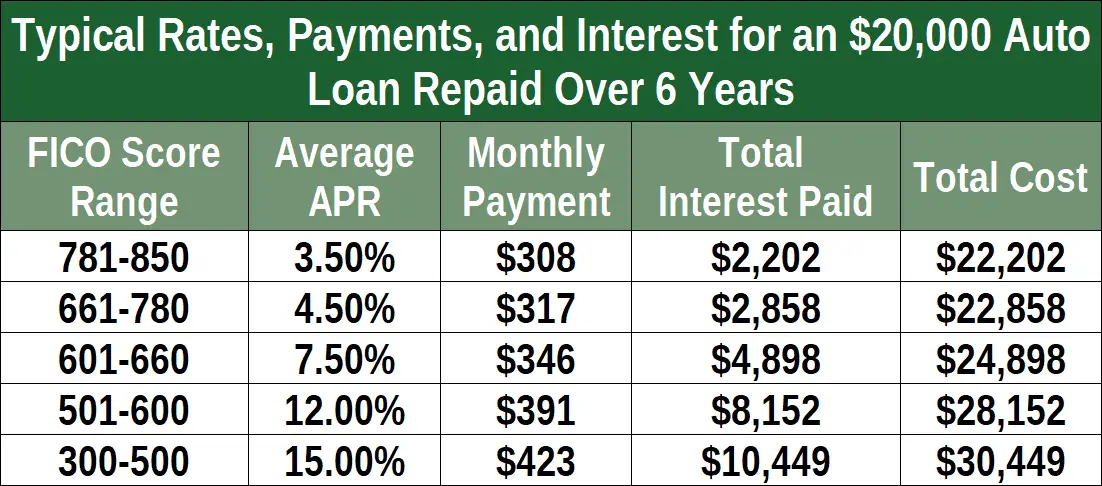

What Is A Good Interest Rate For A Car Loan

The average APR for an auto loan was 9.46% in 2020, but its possible to get a lower rate, especially if your credit is strong. tend to offer some of the lowest starting rates weve seen if you meet their membership requirements, which may be easier than you think. Car manufacturers offer 0% financing, but those deals require high credit scores and only apply to certain models. Used car loans tend to have higher starting rates than new, but manufacturers do offer APR deals on certified pre-owned cars.

How To Get The Best Car Loan Interest Rate

Something you can do to lower your interest rate is raise your credit score. While it takes time to improve your credit score, there are several steps you can take to improve it, like paying your bills on time or keeping the balances on your credit cards low.

Asking for a shorter loan term is another way to lower your interest rate since youll be borrowing from a lender for a shorter period of time. While this isnt a realistic option for everyone, if youre able to afford the higher monthly payments from short-term loans, its a solid way to decrease your overall financing costs.

If you have a poor or no credit history, getting a cosigner for your loan agreement might be a viable option for lowering your interest rate. Having a reliable, willing friend or family member sign on to take responsibility for the loan in case you default on it might make lenders feel as though youre less of a risk, and therefore offer lower interest. Be cautious when doing this though, since your relationship with the cosigner could be harmed if you fail to pay off your loan and theyre left with the bill.

Also Check: Usaa Prequalify Auto Loan

How Do I Apply For A Car Loan

As mentioned, every lender and dealership has its own loan requirements. However, there are a few personal and financial details that youll have to provide to qualify for the best car loan in 2022, such as your:

- Name, address, and other personal information

- Bank account details and other financial information

- Employment status and job title

- Vehicle make, model, and cost

- Down payment amount

Although your may be less significant for some lenders and dealerships, you may also have to fill out a credit application, so they can check your credit report. The healthier your credit is, the easier it will be to get approved for a car loan with a decent interest rate and repayment plan.

How Do Auto Loans Work

Auto loans are typically secured loans that charge simple interest, interest calculated on your loan balance, over two to seven years. Your auto loan interest rate is determined by your , loan term and amount, along with the value of the car itself.

While many buyers shop for a car loan at the same time theyre shopping for a car, a better way is to compare annual percentage rates across multiple lenders to make sure youre getting a competitive rate.

If the dealer can beat it, youll know youre getting a fair offer.

Why you should compare auto loan ratesComparing loan rates before you buy a new or used car puts you in a stronger negotiating position at the dealership. This is true whether you have strong credit or need a car loan for bad credit. The lenders above are a good place to start your search.

Recommended Reading: Does Carmax Pre Approval Affect Credit Score

How To Refinance A Car Loan

Once youve weighed your options and decided a refi is the way to go, follow these simple steps.

7 steps to apply for an auto refinance

Documents Needed To Refinance Your Auto Loan

To refinance any kind of loan, some documentation is required. These pertain to personally identifiable information, income, residence and your cars specifications, among others.

‘shadow Edition’ Of Bmw 3 Series Gran Turismo Launched

On Thursday, BMW Group India announced the launch of the BMW 3 Series Gran Turismo Shadow Edition. The car which will be available in colour options – Alpine White, Melbourne Red Metallic, Black Sapphire Metallic and Estoril Blue Metallic has been priced at Rs.42.50 lakh. The 3 Series Gran Turismo Shadow Edition which will be will be powered by a petrol engine will be available in limited numbers.

The car which is being produced at the BMW Chennai plant will be laced with black kidney grilles, LED headlamps and taillights, 18-inch alloy wheels etc. BMW claims that engine churns out 255PS of power and 350 Nm of torque. The car which can accelerate to 0 100 kmph in 6.1 seconds as per the company will have six airbags, ABS with brake assist, Cornering Brake Control , electronic vehicle immobiliser, dynamic stability control which includes dynamic traction control, side-impact protection etc.

24 August 2020

Also Check: Will Va Loan On Manufactured Homes