What Is A Car Loan And How Does It Work

A car loan is a personal loan that is used to purchase a vehicle preowned or new. Over time, you will pay back the amount you borrowed from the lender, plus interest.

The car serves as collateral for the loan, and if you are unable to make payments on time, the lender can seize the vehicle.

You can get a car loan from a bank, dealership, online lender, or credit union.

An online lender is convenient and you can easily compare rates without leaving your home. Online lenders like Canada Drives and Car Loans Canada have partnerships with dealerships which accelerates the process from applying for a loan to getting your new car.

The various terms you should understand when applying for a car loan include:

Principal: This is the amount you borrow to purchase a vehicle.

Interest rate: This refers to the effective interest rate you pay on your loan. The car loan rate you qualify for varies with your , vehicle age, down payment, and the lenders prime rate.

The interest rate can be fixed or variable. For most car loans, your monthly payments stay the same . When you make a payment, a portion goes to offset the principal amount owed and the remainder goes to interest.

Loan Term: This is the length of time you have to pay back the car loan. It can range from 1-8 years .

The combination of a lower interest rate and a shorter loan term can help you save money on your car loan. Use the car loan calculator below to test various scenarios.

Can I Sell My Car With A Loan

It is possible to sell your car with an outstanding loan, but you may have to go through a few extra steps. If your car is worth less than what you currently owe on the loan, you have what’s known as negative equity meaning you may need to pay the difference out of pocket or refinance the remaining amount with a different type of loan.

If your car is worth more than what you currently owe, on the other hand, you may be able to pocket the difference in cash when you sell the car. Whatever your situation, reach out to your lender about your options, as each lender sets different rules for selling a car with a loan.

Can You Refinance A Car Loan

Yes, many lenders offer auto loan refinance opportunities, and several promise to make the process quick and easy. It can pay to refinance your loan in several different circumstances. For example, you might be able to improve your rate and monthly payment, shorten the term of your loan repayment, or extend the term if you’re having trouble making payments.

Recommended Reading: Reloc Line Of Credit

Best Credit Union For Auto Loans: Consumers Credit Union

Consumers Credit Union

- As low as 2.24%

- Minimum loan amount: None

-

No minimum or maximum loan amount

-

Offers new, used, and refinance loans

-

Offers transparent rates and terms

-

Lowest rates require excellent credit

-

Membership in credit union is required

Consumers Credit Union offers auto loan rates to its members as low as 2.24% for new car loans up to 60 months. Like other credit unions, it requires membership, but it’s easy to join. You can become a member by paying a one-time $5 membership fee. There are no geographic or employer requirements.

CCU doesn’t have a minimum or maximum loan amount. Your loan is approved based on your credit score, credit report, and vehicle information. There’s also no minimum loan termyou submit a request based on what you need.

Generally, borrowers with excellent credit will qualify for the lowest rates from Consumers Credit Union. But even members who have less than excellent credit have access to discounts. There’s a 0.5% discount available for those who autopay from a CCU account. The discount falls to 0.25% for those who make automatic payments from an outside financial institution.

Get A Copy Of Your Credit Score And Report

Before you start looking for a loan, check your credit score and credit report.

You can get your credit score free from several online sites. The score may not be the exact same score a lender uses, but it will be close.

Each of the three are required to provide one free credit report each year.

Look for any errors, outdated or false information, and dispute them. A quick way to improve your credit score and get a better interest rate on a car loan is to lower your credit utilization. That is the ratio of your credit card balance to your available credit. The less available credit you use, the better your score, so be sure to keep credit utilization below 30%. One quick and easy fix is to pay off your credit cards twice a month instead of at the end of your billing cycle.

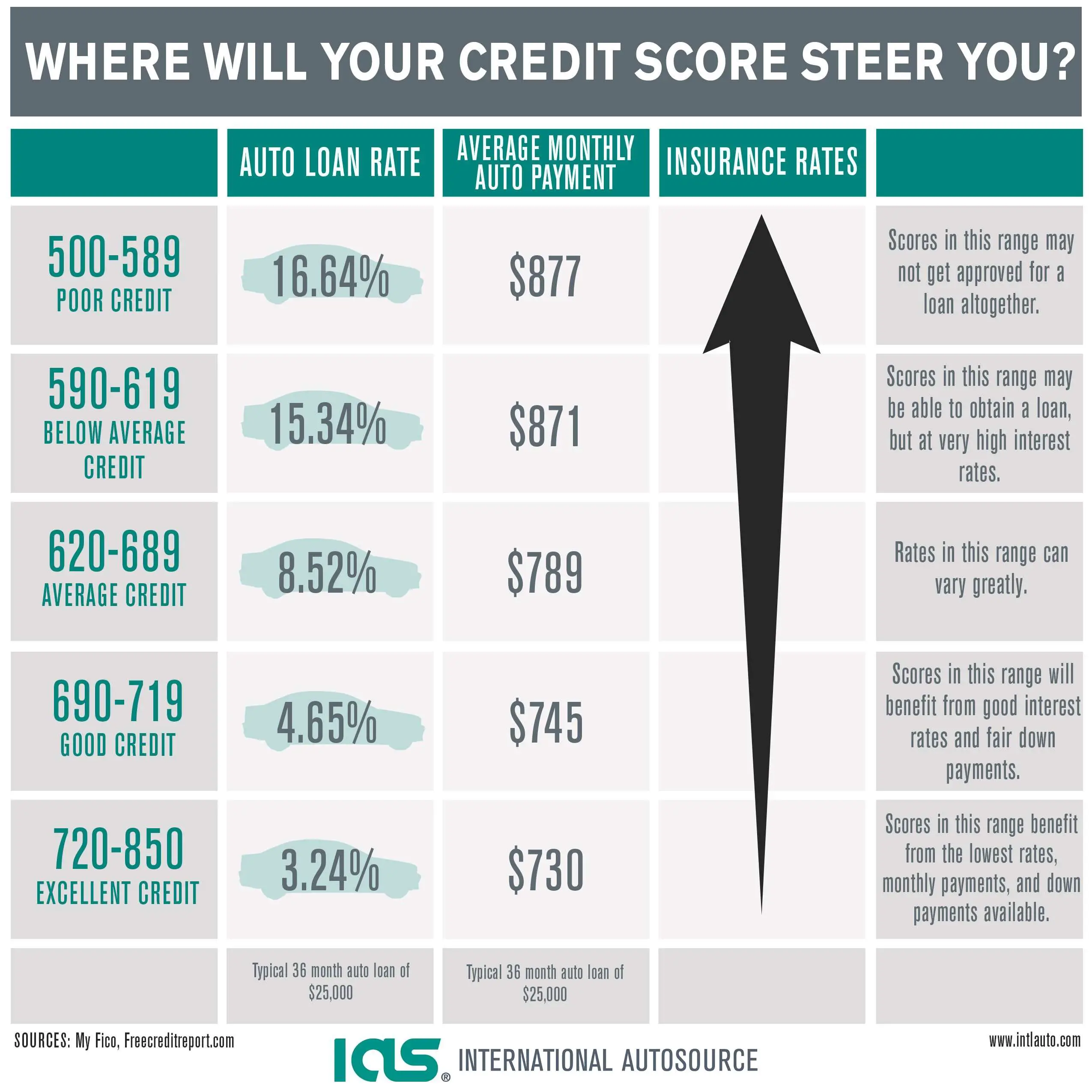

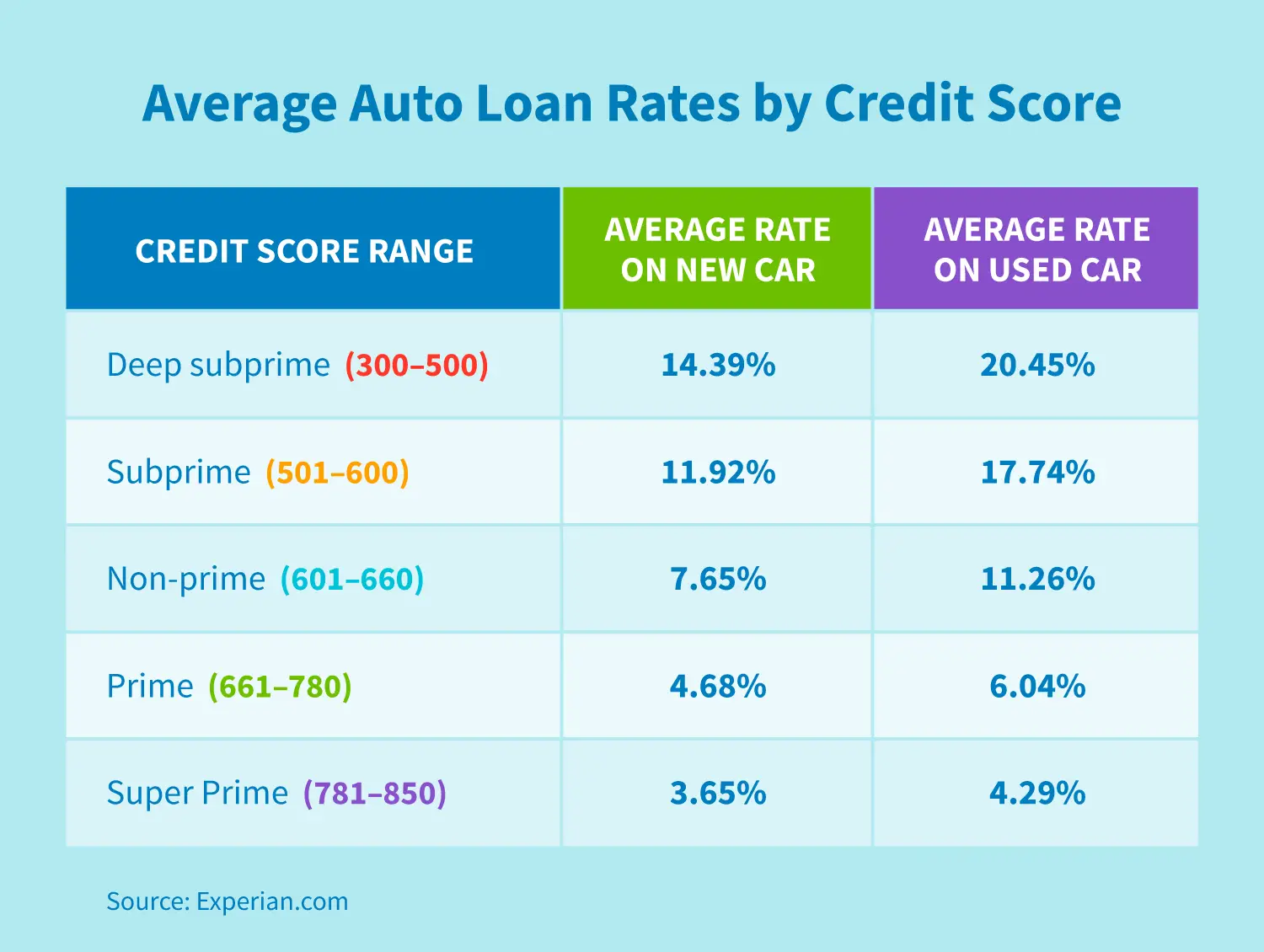

Lets see how your credit score affects the interest rate youll be charged. Lets assume youre buying a $20,000 car with a 20% down payment, so you need a $16,000 loan over four years.

Here is what the average car loan interest rate by credit score looks like:

| FICO Score |

|---|

| $5,699 |

The graph demonstrates the impact your FICO Score, the most widely used credit score, has on your interest rate, monthly payment and total cost. The exact same car can cost thousands of dollars more depending on your credit score.

Read Also: The Mlo Endorsement To A License Is A Requirement Of

Features And Benefits Of Car Loan

When it comes to car loans in India, in general, the following features and benefits are offered. Note that, the following is a generalized look at the advantages offered by car loans. Individually, car loan lenders may have highly customized and specialized offerings for their customer base.

- It helps you purchase a car even if you dont have all the money for it right now.

- Most car loans will finance the on-road price of the car.

- Some car loans will even finance 100% of the on-road price. This means no down payments.

- With some banks offering financing in the crores, you are not limited in your choice of cars

- Most car loan offerings in India are secured loans. This implies that the car serves as the security/collateral for the loan.

- Procuring a car loan is usually simple when compared to other loan products. Individuals with slightly unsavoury credit scores can also hope to procure one. However, this option differs from bank to bank.

- Car loans in India often offer fixed interest rate options. This means, you are always assured of a fixed amount that needs to be repaid monthly.

- Many lenders will offer interest rates based on your credit score so a high score to get you a cheaper loan.

- Car loans are not meant for just new cars. A used car loan can help you buy a pre-owned car.

Banks And Credit Unions

Most banks who offer auto loans provide similar rates as low as 3% to the most qualified customers. However, there is much variance amongst banks in the highest allowed APR, with top rates ranging from as low as 6% to as high as 25%. Banks who provide higher rate loans will generally accept applicants with worse credit, while more risk averse lenders wont offer loans to applicants with scores below the mid-600s.

The typical large bank has specific eligibility requirements for loans, including a mileage and age maximum for cars, and a dollar minimum for loans.

Generally, credit unions extend loans at lower interest rates than banks, have more flexible payment schedules, and require lower loan minimums . However, credit unions tend to offer loans exclusively to their membership, which is often restricted to certain locations, professions, or social associations.

| Financial Institution |

|---|

| 14.99% |

Recommended Reading: How Long It Takes For Sba To Approve Loan

What Is A Good Interest Rate For A Short

A short-term loan such as a car title loan from Rapid Auto Loans offers you quick cash when you’re facing financial hardship. Get the emergency money you need by using the value of your vehicle as collateral for the loan. Our car title loans help keep you from having your utilities shut off, out of foreclosure or being evicted, or even out of collections too. Our goal is to help our customers throughout Pompano Beach get the cash that they need fast.

Average Interest Rates By Term Length

Most banks and credit unions provide payment plans ranging from 24 to 72 months, with shorter term loans generally carrying lower interest rates. The typical term length for auto loans is 63 months, with loans of 72 and 84 months becoming increasingly common. The higher APRs of longer term auto loans, however, can result in excessive interest costs that leave borrowers upside downthat is, owing more on the auto loan than the car actually costs.

Heres a closer look at average interest rates across various loan terms for those with the strongest credit.

| Auto Loan Term | |

|---|---|

| 72 Month | 4.45% |

While longer term loans allow for a lower monthly payment, the extra months of accumulating interest can ultimately outweigh the benefit of their lower short term cost, especially for the consumer purchasing an older used car whose value will depreciate quickly.

Terms of 72 and 84 months are also usually available only for larger loan amounts or for brand new models.

For example, when paid over the course of 48 months, a $25,000 loan at a 4.5% interest rate will result in monthly payments of $570 and a total cost of $27,364. When paid over the course of 84 months in $348 monthly payments, this same loan at the same interest rate costs a total of $29,190 more than $1,800 pricier than at 48 months. For higher interest rates, the difference between short and long term payments will be even greater.

You May Like: Refinance Through Usaa

Heres How To Get The Lowest Interest Rate You Qualify For

If youre shopping for a new car, you may also be shopping for an auto loan to pay for it. Investopedias auto loan calculator and regularly updated ratings of the best auto loan rates can help you find a good loan with an attractive interest rate. Heres what else you need to know to get the best rate possible.

Best Overall: Penfed Credit Union

PenFed Credit Union

- As low as 0.99%

- Minimum loan amount: $500

PenFed Credit Union provides some of the best rates available. It also has flexible loan amounts and a number of auto loan options for members. Even though membership is required, a disadvantage for some, PenFed makes the requirements to join fairly straightforward.

-

Offers new, used, and refinance loans

-

Loan amounts from $500 to $100,000

-

Provides rate discounts for using its car buying service

-

Borrow up to 125% on new and used vehicles

-

High minimum loan amount for longer terms

-

Excellent credit history required for lowest rates

-

Membership in the credit union is required

Our top pick for auto loan rates, PenFed Credit Union, offers some of the lowest rates available.

At PenFed, rates for 36-month refinance loans start as low as 1.79%. Deep discounts are available for members who use the credit union’s car buying service, with rates starting as low as 0.99% annual percentage rate for a new car and 1.99% APR for a used vehicle.

You’ll have to become a member of the credit union, but the requirements to join are fairly easy to meet. Car loans from PenFed start as low as $500 and move up to $100,000, a wide range that beats out many of the lenders we surveyed.

Also Check: How To Find Out Where My Student Loans Are

More Ways To To Get A Good Interest Rate On A Car Loan

Aside from raising your credit score, opting for the shortest loan term you can afford, and choosing the right car, there are several other ways to get a better loan rate.

Shop around. A 0% promotional offer from a manufacturer or dealer could be hard to beat. Otherwise, you may find that dealer financing is more expensive than going through your local bank or or using an online lender. With a bank or credit union, you can apply for preapproval, which will tell you how much money they are prepared to lend you and at what interest rate. Being preapproved for a loan also gives you leverage in negotiating with the car dealer.

Negotiate. Just like the price of the car, the interest rate youll pay on a car loan can be negotiable, particularly at the dealership. Car dealers often work with one or more lenders. After they have reviewed your financial information, the lenders will propose an interest rate to charge you, known as the buy rate. The dealer, however, is likely to pad that rate and offer you a higher one as a way to increase their profit margin. That gives you some room to negotiate.

Get a cosigner. If a low credit score is the problem, then asking a relative or other person with a better score to cosign the loan could help you get a lower rate.

Best For Fair Credit: Carvana

Carvana

For fair credit borrowers in the market for a used vehicle, Carvana provides the ability to shop online for financing and a vehicle at the same time. It has no minimum credit score requirement, providing a financing solution for those with damaged credit.

-

Entirely online dealer and lender

-

No negotiation

-

Excellent credit borrowers get the lowest rates

-

Minimum income requirement of $4,000 annually

-

Only for used vehicles

As with most lenders, borrowers with the best credit get Carvana’s most competitive rates. Carvana does not advertise its rates or publish a table, but you can estimate your monthly payment with an online calculator. That said, even the calculator does not reveal the rate it is using. You must prequalify to know what your interest rate will be.

Carvana is a completely online used car dealer that also provides direct financing. It makes it possible to secure financing, shop for a vehicle, and get a used vehicle delivered without leaving your house. There is no credit score minimum for its financing program, making this an attractive option for fair credit borrowers. However, you must have an income of at least $4,000 annually and no active bankruptcies.

Recommended Reading: Usaa Car Loan Number

Car Loan Interest Rates In Summary

Though buying a car is exciting, paying attention to the details can end up saving you money.

Considerations like MSRP, maintenance cost, and gas mileage all play a part in what you’ll pay throughout ownership.

When you need a loan, doing your research ahead of time can secure you a better interest rate. Checking out different lenders and their specific rates and terms can minimize your payments over the loan term.

Going with a longer-term loan helps you lower monthly payments, allowing you to drive the car you want and still have money left over for essential household expenses.

Whether you’re shopping for a sports car or looking for something on a budget, Shift has the vehicle for you. And because Shift offers best-in-industry service contracts, you know your vehicle is good to go mile after mile.

Interest Is What You Pay To Borrow Money From A Lender When You Finance The Purchase Of A Vehicle

Interest charges are included in your monthly loan payment and can add thousands of dollars to the amount you have to repay. Thats why its important to understand how car loan interest is calculated, what factors can affect your rate and how to minimize interest charges.

Recommended Reading: How Much Land Can You Buy With A Va Loan

What Are Other Important Car Ownership Costs To Consider

Beyond the cost of monthly car loan payments, car insurance can be a significant expense. Make sure you understand car insurance rates and the best car insurance companies available in order to select the best car insurance coverage for your needs.

Estimate your monthly payments with our handy Auto Loan Calculator.

The Cost Of Bad Credit

Let’s look at how higher interest rates affect a car loan, using an example. Let’s say you’re buying a used car, and the loan is for $14,000 with a term of 60 months . Check out how different auto loan interest rates influence the monthly payment and overall cost of the car:

| Monthly Payment | |

| $8,185 | $22,185 |

Using the average used car loan interest rates from the first table, you can see that as credit scores drop and the interest rate increases, the total cost of financing goes up dramatically.

Don’t Miss: How Much Does An Auto Loan Affect Credit Score

Things To Consider Before Financing A Car

If its not already obvious, there is a lot to consider before financing a car. If you have poor credit, the list gets even longer and the options fewer.

Before making the decision to finance, consider all the factors and how they work for you. Important things to consider include interest rates, loan terms, credit pulls, rate shopping, gap insurance, taxes and fees.

Factors to consider:

- Interest rate. This depends on the term of the loan, type of car and your credit score.

- Loan terms. It can range from 24 to 84 months.

- Rate shopping. Apply for pre-approval from several lenders to see the rate options.

- Some lenders only work with specific dealerships.

- Down payment. Money you put toward buying the car that you dont finance. The bigger down payment, the less you have to borrow.

- Gap insurance. Insurance you buy from a dealer or bank that closed the gap between what you owe on the car and what the primary insurer thinks its worth.

- Funding: An offer for the maximum loan you can get at the best interest rate. It can go right into your bank account or be a certificate that goes to the dealer.

No matter what your financial situation, the goal should be to pay the lowest amount possible over the term of the loan. One common mantra is that a car isnt an investment. Keep that in mind. An investment makes you money. A car costs you money. You want to be in the best position possible, particularly if youre on a tight budget.