Paying Off The Principal

The principal is the amount of money you borrowed. The longer the principal is left unpaid, the more interest accrues. In the early days of your loan, your payments would often go toward interest payments.

The key to saving money when using borrowed funds is to pay off as much of the loan as fast as you can. This could mean higher monthly payments, more frequent payments, or higher downpayments. The important thing is that each payment you make goes toward whittling down the loans principal. A shrinking principal leads to a much lower interest.

The first thing youll need to do when reducing your principal is paying a higher downpayment. The downpayment is the upfront amount you pay the dealer. The rest is paid for by your loan. The higher your downpayment, the less money you need to borrow to pay for the remaining balance. And because your loan isnt as big, you also reduce the size of your monthly payments. To get the best deal possible, your vehicles downpayment should amount to 20 percent of its price. If you can pay much higher, all the better.

If you have some extra income on hand, you might consider using it to pay off your car loan. One way to do this is by increasing the amount you allot to your monthly or biweekly payments. Call your lender and state that each extra amount you make is should go toward the principal. With each payment period, you take down a little more of your total balance.

Saving Money With Biweekly Payments

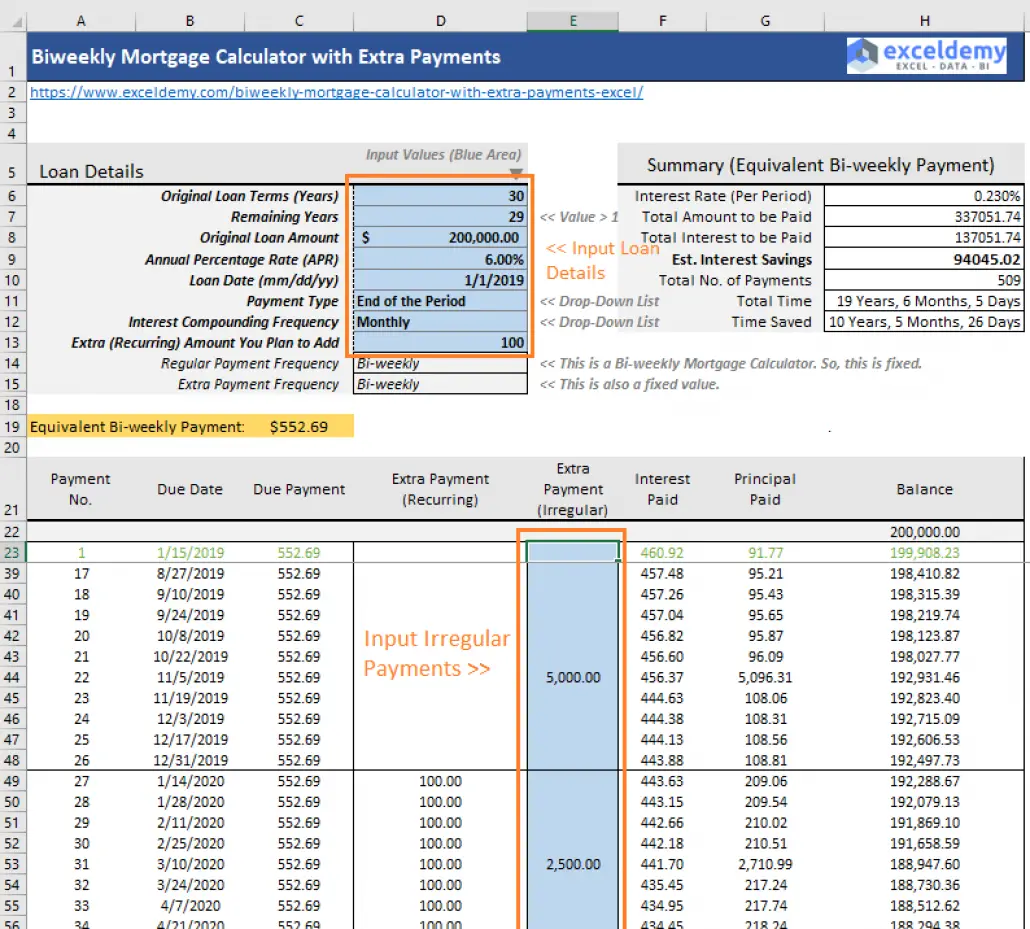

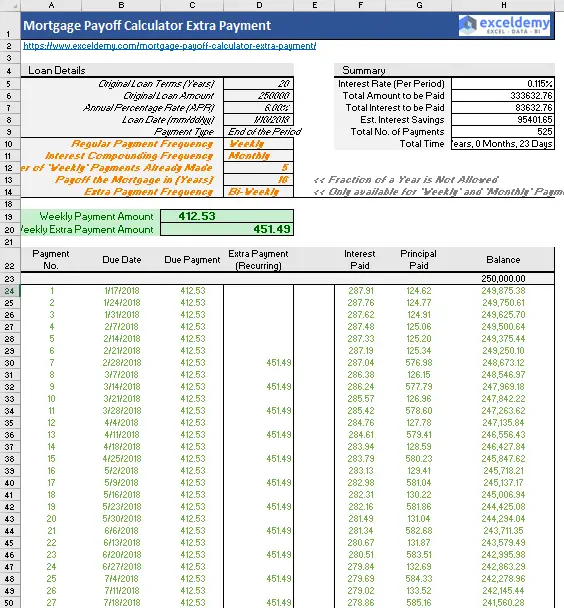

If you are looking to save money on large loans, there is one simple change you can make that could save you hundreds or thousands of in interest charges, and allow you to pay your loan off several months to years early. The secret is to cut your monthly loan payment in half. Then send this amount in every two weeks rather than once a month. Since a year has 52 weeks, you will make 26 payments. This is the equivalent of making 13 monthly payments instead of 12. If the biweekly loan payment arrangement is set up correctly, the extra loan payment all goes toward paying down the loan’s principal. Reducing the loan balance faster substantially reduces the total amount of interest that will paid. Let’s take a look at an example to see how this cost savings is achieved.

Biweekly Loan Payment Example

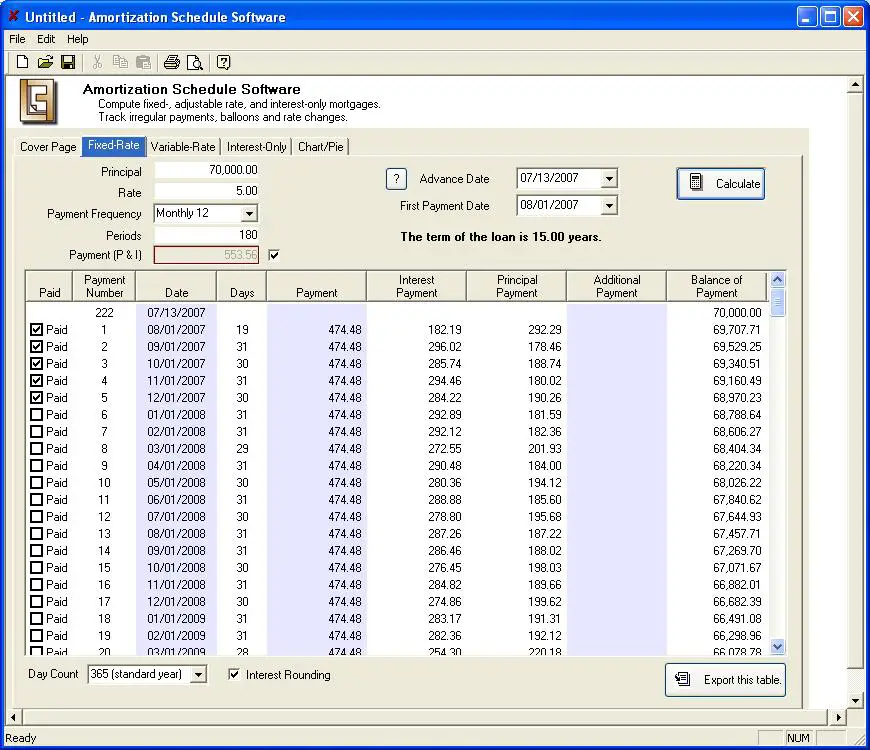

To find out how much you could potentially save on either a new or existing loan, you can plug in your numbers for principal loan balance, annual interest rate and amortization period . The above calculator will give you a comparison between the monthly and biweekly payment schedule.

Benefits of Biweekly Loan Payments

As you can see from the above example, biweekly loan payments result in several important benefits:

- Your loan can be paid off much faster

- Save tens of thousands in interest paid

- Build up home equity more quickly

In the above calculator all calculations are automatically done immediately, which enables you to adjust variables and see the impact of different changes.

Buying A Car With Cash Instead

Although most car purchases are made with auto loans in the U.S., there are benefits to buying a car outright with cash.

There are a lot of benefits to paying with cash for a car purchase, but that doesn’t mean everyone should do it. Situations exist where financing with an auto loan can make more sense to a car buyer, even if they have enough saved funds to purchase the car in a single payment. For example, if a very low interest rate auto loan is offered on a car purchase and there exist other opportunities to make greater investments with the funds, it might be more worthwhile to invest the money instead to receive a higher return. Also, a car buyer striving to achieve a higher credit score can choose the financing option, and never miss a single monthly payment on their new car in order to build their scores, which aid other areas of personal finance. It is up to each individual to determine which the right decision is.

Don’t Miss: What Is The Current Va Loan To Value Ltv Rate

Biweekly Payments: Risks And Rewards

A biweekly payment schedule splits the difference between lowering monthly payments or the principal. You divide your monthly payments into two. The resulting payments are much easier to blend into your budget, as long as you can remember them. As opposed to twelve months, there are 52 weeks in a year.

In effect, you are paying 26 times in a year, the equivalent of thirteen months. Thus, you can reduce the amount of interest you pay by lowering your balance faster.

There are caveats to the biweekly payment plan, however. You may end up paying extra charges for enrolling in a biweekly payment plan. So look for banks that arrange bi-weekly payments for free. The 2-week periods also do not align with the 12-month year. You must pay close attention to your budget and make room for months where you must pay three times. But you can resolve this by automating our payments every 2 weeks.

The benefits you receive from paying off your car loan early are incredible. For instance, you get a better leeway to choose your insurance policies once your car is paid off. Your coverage can now be tailored to match your actual needs. You also can gain a modest improvement on your credit standing. This can work to your advantage if your next life goal is to buy a house.

- Emergency Funds: Save for a rainy day.

- Savings: Build a fortune.

- Repayments: Pay off your other debts.

What Are The Advantages Of Biweekly Payments

As a consumer, you don’t want to be paying down debt any longer than you really have to. Your goal should be toget rid of debtas quickly as you possibly can without hurting your bottom line.

Biweekly car payments can make this possible for you.

When you are making what amounts to an extra payment on your vehicle every year, you’re going to start knocking down your loan principal a lot quicker than you would otherwise.

Read Also: What Are Assets For Home Loan

Is It Right For You

While the end result of using this payment method is certainly attractive, it’s not without its risks. Should you decide to enroll in a biweekly payment program with your lender, you’ll more than likely be entering into a contract that forces you to adhere to making twice-monthly payments no matter what.

For some, this lack of flexibility isn’t ideal. If you only receive a paycheck once a month or if you’re self-employed and can’t rely on a set income, you may find that having a payment automatically deducted from your account every two weeks without the option to put it off until the end of the month beneficial. Thus, the biweekly payment plan is typically more suited to those who get a paid twice monthly.

Also, this is a long-term plan for those who intend to stay put for at least 10 years. The positive effects of a biweekly payment schedule won’t be evident for some time, so you would be paying extra money every year for no reason if you decided to move.

How Bi Weekly Payments Work

Since there are 52 weeks in a year, you would make 26 payments total, which would work out to be one extra payment that would be applied to your loan principal.

As long as you don’t miss any payments, you would be paying down the debt you owe more quickly without really noticing it.

It’s why so many dealerships are starting to suggest the idea of biweekly car payments to their customers.

Don’t Miss: What If Student Loan Is Not Enough

Cutting The Lifetime Costs Of Car Loans

Guide published by Jose Abuyuan on June 26, 2020

The fastest and cheapest way you can pay for a car is by paying for it in cash. The obvious advantage is that you need not worry about monthly payments anymore. That is, of course, only the tip of the iceberg. You also receive generous cash discounts from your dealer if you buy in cash. Moreover, you save on interest payments, which could go up to the thousands for longer loan terms.

Of course, not everybody has the money to buy all but the most throwaway of lemon junkers. And sometimes, the car we need or want is a few thousand dollars out of our budget. So, the order of the day is usually to secure a car loan. This means that youd pay a higher price because of the interest payments. Likewise, you must also contend with negative equity. Over time, your loan might exceed your cars resale value.

Fortunately, you have plenty of options to lower the financial impact of your car. The right moves can help you slash the lifetime costs of your vehicle loan.

Bi Weekly Auto Loan Calculator

Before you agree to start making biweekly car payments, it’s important for you to sit down and crunch the numbers to see if it makes sense for you.

Our bi-weekly auto loan calculator is a great tool to get accurate numbers in a snap. It illustrates how much you can save on interest for the car you’re interested in buying.

To take a look at why bi weekly car payments are starting to become more popular, see our detailed FAQ below.

Also Check: What Is 30 Year Fha Loan

How The Payment Calculator Works

When youre buying or financing a vehicle, a lot of terms and numbers may fly your way, and our payment calculator helps boil down all of them to determine what you actually may be paying. Our loan calculator here takes all of that information and converts it into weekly, bi-weekly or monthly payments, helping make the vehicle buying and financing process that much easier, knowing how it fits within your budget, allowing you to properly manage your money now and into the future across the ownership of the vehicle.

How Biweekly Payments Can Save Borrowers Money

If you’ve recently taken out a loan or started using a credit card, chances are you’ve received some kind of offer from your lender to enroll in a biweekly payment program. Instead of sending in one payment each month, you send in half of your monthly payment every two weeks, effectively shaving off years from your loan.

It sounds too good to be true, and it almost is. Before you take your lender up on the offer to start making biweekly payments, it’s important to understand how this program works and if it’s right for you.

Don’t Miss: Why Should I Refinance My Car Loan

How Does It Work

First, let’s take a look at how biweekly payments work.

Because there are 52 weeks in a year, sending in a payment every two weeks equals out to 26 half-payments each year, or 13 full ones. Instead of going towards interest, that “extra” payment gets applied to your loan’s principal amount, meaning you’ll end up reaching your loan’s payoff date sooner. In today’s economy, you could expect to finish paying off your loan four years sooner by making biweekly payments. As a result, you’ll save money on interest.

Biweekly Car Loan Calculator

This calculator shows how much your bi-weekly car payments will be compared to monthly payments and how much interest you will pay over the duration of the loan. To help borrowers save on interest, this calculator uses the thirteenth month method, which sets bi-weekly payments to half the regular monthly payment amount. As there are 26 bi-weekly payment periods per year, this is effectively the same as making a thirteenth monthly payment each year, which helps pay off the loan much quicker.

You May Like: How Does The Student Loan Process Work

Other Mortgage And Financial Calculators

In addition to the standard mortgage calculator, this page lets you access more than 100 other financial calculators covering a broad variety of situations. Choose from calculators covering various aspects of mortgages, auto loans, investments, student loans, taxes, retirement planning and more.

All rights reserved. Mortgageloan.com® is a registered service mark of ICB Solutions, a division of Neighbors Bank, Equal Housing Lender Member FDIC, NMLS # 491986 ICB Solutions or Mortgageloan.com does not offer loans or mortgages. Mortgageloan.com is not a lender or a mortgage broker. Mortgageloan.com is a website that provides information about mortgages and loans and does not offer loans or mortgages directly or indirectly through representatives or agents. We do not engage in direct marketing by phone or email towards consumers. Contact our support if you are suspicious of any fraudulent activities or if you have any questions. Mortgageloan.com is a news and information service providing editorial content and directory information in the field of mortgages and loans. Mortgageloan.com is not responsible for the accuracy of information or responsible for the accuracy of the rates, APR or loan information posted by brokers, lenders or advertisers.

Term Of Biweekly Loan

One of the advantages of biweekly car loan payments is the fact that you are making 26 payments each year, rather than 24. These additional payments will reduce the length of your loan. This portion of the calculator will tell you how long you have to make those biweekly payments before the loan will be paid in full.

Recommended Reading: How Much Income To Qualify For Home Loan

Why Should I Use This Payoff Method

Think about it for every year you use a bi-weekly schedule, thats one less month of added interest on your loan or that line of credit. That can be a considerable difference with loans like your mortgage or even just on your credit cards. For a 4-year auto loan, that would mean you could finish paying the full amount off in the first few months of that last year. With a mortgage, you could save years on the payoff, which would save you thousands of added interest.

Consider taking your highest rate debt and using this tactic to reduce the total payment amount. You can also use our loan calculator to see if you can afford more debt. Compare the costs of paying once per month, versus twice per month. Youll see your principal balance begin to diminish before long, and youll save in total interest charges.

The calculator below can help you assess the value of moving to a bi-weekly payment schedule on a single line of credit. If this looks like a good option, call your lender to see if theyll allow you to adjust your payment schedule. If you have multiple loans you want to restructure, look online for a reputable debt restructuring service provider.

Where To Find The Extra Money

Yes, money doesn’t grow on trees, but there is plenty of it hanging around ready for you to pick. You just have to know where to look. Besides the usual suggestions of brown bagging and skipping your morning latte, here is a savings list with over a hundred ways to cut back and a Washington, D.C. based organization that provides help and motivation to save more, America Saves. By incorporating some of these ideas, and adding a dash of perseverance, you will be driving your car down Debt Freedom Lane in no time.

Also Check: H& r Block Tax Loan

Strategies To Save Money

Unless you have a sizable personal savings or you happen to be independently wealthy, chances are good that you’ll need to finance a vehicle purchase through a lender. And there’s nothing wrong with this approach – consumers do it every day.

However, you do need to exercise due diligence when it comes to selecting suitable financing options if you don’t want to end up overpaying for your automobile. As a consumer, the onus is on you to choose the most favorable terms.

This can be difficult to determine. And there’s no denying that purchasing a vehicle requires some amount of financial know-how. But with a bit of knowledge under your belt, you should be able to find the financing options that are most likely to save you money.

Here are a few tips that should get you on track for affordable financing and an automobile purchase that doesn’t break the bank.

The Calculation Of The Car Loan

The calculation of car loan payments is done using the following variables

- Car amount : The purchase amount of the car

- Trade-in vehicle value : The amount offered for the trade-in vehicle or using the value of your actual car to buy another one

- Trade-in vehicle balance : The remaining amount or the amount you still have to pay for you current vehicle toward the purchase of another one

- Down payment : The amount of money you invest in the purchase of the car to reduce the amount of the loan

- Interest rate : This car loan rate is the standard rate offered by your dealership, seller or your bank, credit union or other financial institution. This rate can be fixed, variable, increasing, decreasing, etc.

Also Check: Can Grandparents Apply For Parent Plus Loan

Current Local Auto Loan Rates

We publish current local auto loan rates for new & used vehicles. Car buyers can use these quotes to estimate competitive loan rates before dealing with an auto dealership in a negotation where the dealer has the upper hand and charges too high of an interest rate or tries to require unneeded extended warrany programs as a condition for extending funding.

Variable Rate In Canada

This rate, as its name suggests, is variable and depends primarily on the Bank of Canada’s Policy Interest rate. The Policy Interest rate increased greatly between July 2017 and October 2018, going from 0.50% to 1.75% in less than 14 months. Then drastically drop to 0.25 in a single month due to COVID-19. Learn more about recent policy interest rate . < / p>

Whatever the variable rate is considered more risky, it may be advantageous to lean towards this loan solution in order to reduce the fees or upfront payments.

Recommended Reading: Can I Include My Car Loan In Debt Consolidation