Jumbo Vs Conforming Loan

That jumbo loan amounts are higher than conforming loan amounts isnt the only characteristic that sets them apart.

For one, youll need a good credit score. Conforming lenders have a 620 minimum jumbo lenders typically want to see a minimum credit score of 700.

Jumbo loans are typically manually underwritten, meaning a loan underwriter physically reviews each mortgage application and decides on approval or denial. This differs from conventional loans, which are often processed through an automated underwriting system.

You can expect to pay more for a jumbo home loan, too. Rates are anywhere from 12.5 to 37.5 basis points higher than conventional mortgage rates, according to lending experts.

For example, if youre quoted a 2.75% rate for a 30-year fixed-rate conforming loan, a jumbo loan rate could range from 2.875% to 3.125%. Prior to the COVID-19 outbreak, Rodriguez said, jumbo rates were lower than conforming loan rates.

Youll also need a significantly larger down payment. As discussed above, lenders often require 20% down for a jumbo mortgage. By contrast, its possible to qualify for a conforming loan with a minimum 3% down payment.

Who Qualifies For A Jumbo Mortgage

A jumbo mortgage is a loan that falls outside of the conforming loan limits set by the FHFA. A jumbo loan allows you to purchase a home with a sale price over conforming loan limit . Typically, jumbo loans require high credit scores, low DTI, and cash reserves. Who is a Jumbo designed for? A jumbo 30-year fixed-rate mortgage is a convenient way to finance your dream home without requiring a second mortgage or tying up cash. If you are looking to buy a high-priced or luxury home and have a lower debt-to-income ratio, a higher credit score, and a larger down payment, a jumbo loan may be right for you. Jumbo loans typically have stricter loan requirements, however, Geneva Financial is excited to offer two new jumbo loan products with unique guidelines.

Trailblazer Jumbo product gives you the ability to expand your loan options when looking for competitively priced non-conforming offering. This product is designed for borrowers with higher loan amounts and will help meet your unique needs:

Prime Non-Conforming

Loan Amounts Up To $3,000,000

Cash-Out Available to $500,000

Credit Scores as Low as 660

LTV Up to 90%

Max 75% LTV for Investment Properties

Max 80% LTV for Second Homes

Owner Occupied, Second Home or Investment Property

Gift Funds & Seller Concessions Allowed

30 Year Fixed Available

First Time Homebuyers Allowed

SFD/SFR, Condo, and 2-4 Units Permitted

Loan Amounts Up To $3,000,000

Credit Scores as Low as 620

DTI Up to 55% Considered

Jumbo Loan Requirements For Each Loan Type

Some lenders break down their requirements by loan type, so youll need to meet different standards if youre buying a home, refinancing, buying an investment property, or doing a cash-out refinance.

Jumbo loan requirements can vary greatly depending on the lender you choose. Here are some typical examples of the requirements for each type:

Also Check: Diy Loan Agreement

Good Candidates For A Jumbo Loan

If your new homes purchase price exceeds conforming loan limit in your area, a jumbo loan may be your best option.

Just keep in mind that to qualify and afford the monthly payments on a jumbo loan, youll need a healthy income. Thats true even if youre not making a big down payment.

We only recommend people take out mortgages they are comfortable making the on, says Catlin.

We often see people put less money down initially and then pay the mortgage balance down in chunks later. That can be especially smart when they have a home to sell, expect stock to vest, or will be inheriting money.

Also, says Jeanette, say interest rates are low and you can invest the down payment money in something else that will earn a higher rate of return. In this case, pursuing a low down payment jumbo loan can make sense.

What If I Cant Find A House Within The Conforming Limits

If you want to own a home in some of the most expensive housing markets in the U.S., youll probably need a jumbo loan. Dont worry, though youre not alone. With the currently sizzling housing market, many people are finding that even modest homes require a jumbo mortgage in some areas.

Because of this demand, lenders are becoming more comfortable offering jumbo mortgages. Rocket Mortgage® currently offers the Jumbo Smart loan, which offers loans up to $2.5 million, doesnt charge PMI and seeks to streamline the amount of paperwork that lenders have traditionally required for amounts above the conforming loan limits.

Don’t Miss: Capitol One Car Loan

Cutting Down Payment Down To Size

Traditionally, you needed at least a 20% down payment in order to get a jumbo loan. This makes clearing the bar to homeownership much harder for those in areas that are particularly high cost.

The Jumbo Smart loan from Rocket Mortgage® lets you buy a home with a down payment of as low as 10.01% for a 1-unit property. If you want a 2-unit property, the minimum down payment is 15%.

While this is not insignificant, it does make things quite a bit easier if youre saving for a house.

The Benefits And Disadvantages Of A Jumbo Loan Mortgage

The benefit of securing a jumbo loan mortgage is as simple as being able to purchase and finance a home thats worth more. For borrowers who want to purchase that home on the waterfront or a larger estate, these loans become the only route to doing so unless you make a large down payment.

There are drawbacks to jumbo loan mortgages, though. They tend to be harder to obtain, requiring a larger amount of income. You also need to show proof of income, credit score, and have a larger down payment to purchase them.

You May Like: Chase Mortgage Recast Fee

Don’t Miss: Usaa Auto Loan Approval

Be Aware Of Possible Discrepancies

One consideration to make is that changes in government bodies arent always fast enough to keep up with changes. Areas that already have high population can quickly become the next county to see an increase to median housing prices if there is a wave of new residents flocking to the area.

For example, if Sacramento County which has a conforming loan limit of $598,000 started seeing large numbers of new home buyers then the median price will begin to rise. If it breaks $598,000 then new buyers will either need to have a large enough down payment to bring the total loan amount down or go with a jumbo loan instead.

Figuring out which option is best for you and your current financial situation takes an experienced professional such as any of the members on the Potempa Team. We would be honored to help you along your home purchase journey to help you stay on budget and on schedule so please dont hesitate to get started with us when the time is right!

Tips For Finding The Right Lender

- Before you sign off on any loan, its important that you understand your current financial situation and future financial plans. A financial advisor can help with that. Finding a qualified financial advisor doesnt have to be hard. SmartAssets free tool matches you with up to three financial advisors in your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- If youre interested in taking out a large loan, its important that you do your research. SmartAssets list of the best jumbo mortgage loan lenders can help start your search.

- If youre a first-time homebuyer, youll want to make sure youre not missing any important information. Check out SmartAssets guide to the best mortgage lenders for first-time homebuyers to learn more.

Also Check: Usaa Refinancing Car Loan

Why Should I Get A Jumbo Loan From Primelending

There are multiple reasons to apply for a jumbo loan from PrimeLending, which are there to meet the needs of all types of borrowers . Here are just some of the benefits:

- We offer loans up to 80% of the homes value that require 20% down1

- Fixed-rate and adjustable-rate jumbo loans are available

- Some jumbo loan programs allow down payments in the form of a gift

At PrimeLending, we know that buying a home is unique for everybody. Just because the home prices on a jumbo loan are high, it doesnt necessarily mean the borrower is particularly wealthy. Not everyone has the same needs, budgets, advantages or options. Often, youre at the mercy of the market, which is different depending on where you live. Thats what makes a jumbo loan so appealing. That $500,000 house in a small town in the Midwest could be quite extravagant, but a house for the same cost in parts of California could be quite modest. Many jumbo loan borrowers need this type of mortgage to buy large, expensive homes. But for others, this loan is used by a wider range of people looking for a mortgage in a housing market where the home prices are high, well above the local or national average.

About Us

Are There Jumbo Loan Limits

Since jumbo loans are not centrally regulated, mortgage lenders get to set their own jumbo loan limits. For example, at the time of this writing in Mar. 2022, Rocket Mortgage offered jumbo loans up to $2.5 million while loanDepot allowed jumbo loan amounts up to $3 million.

Home buyers in ultra high-cost areas hoping to buy multi-million-dollar properties will likely want to look for local mortgage lenders that specialize in high-balance jumbo loans tailored to their market.

Recommended Reading: Ida Auto Finance

Lenders May Require Cash Reserves

Lenders need to know that you can make consistent, regular payments on a jumbo loan. Your lender will ask you for bank statements to prove that you have money in the bank to keep up with payments. Its not uncommon for lenders to ask jumbo borrowers to have up to 12 months worth of expenses in reserve before they can get a loan.

Having cash in your bank account isnt the only way to meet reserve requirements. Lenders may consider up to 70% of your retirement account as well, so you dont need to cash out all of your funds to meet the reserve rule. In some cases, business and gift funds may also go toward your reserve requirements.

How Do Jumbo Mortgage Rates Compare To Conforming Loan Rates

It makes sense that lenders might charge higher interest rates on jumbo loans because, as mentioned before, theres so much risk involved. However, market data suggests that interest rates on jumbo loans are very competitive with market rates.

At todays rates, the difference between conforming and nonconforming loans ranges from just 0.25% to 1%. In fact, some jumbo loans have rates that are lower than other mortgage loans.

Recommended Reading: Can I Buy A Second House With My Va Loan

What Are The Qualifications For A Jumbo Mortgage

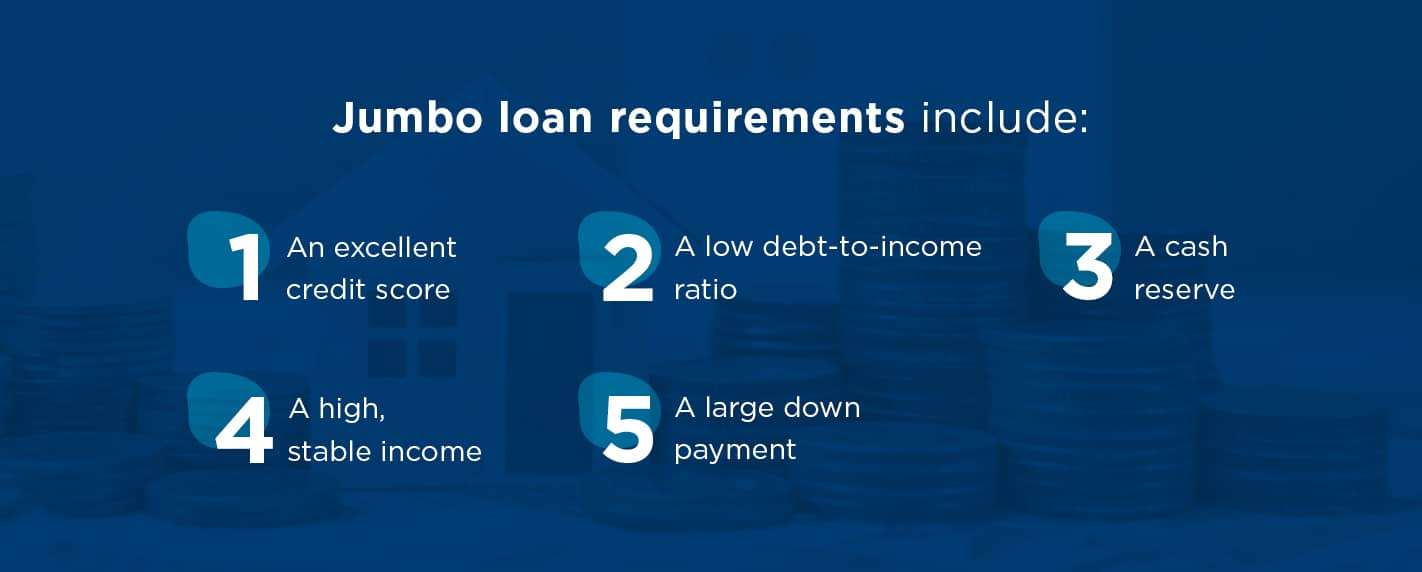

Jumbo loans tend to have more strict underwriting rules than conventional or FHA loans due the nature of these loans. Borrowers are generally required to

- Have good credit and a lower debt-to-income ratio

- Put at least 10% down at closing

- Retain additional funds in reserve after closing. The amount of reserves required may vary depending on credit scores and other factors.

You May Like: How Much Is Mortgage On A 1 Million Dollar House

Jumbo Financing: Get Started

If youre looking for a home in a high-cost area or need to refinance a larger loan balance, then a jumbo loan could fit your needs.

At Better Mortgage, you can get pre-approved in as little as 3 minutes. Start the process today to find out if a jumbo loan is the mortgage option that makes sense for you.

Read Also: Usaa Credit Score Requirements

Why Do Some Loans Have Limits

The higher the amount of a loan is, the more risk a lender takes on by providing it. Conforming loans will always revolve around housing costs for that specific area and the limit is capped at what the analysts for each agency determine is the best balance of risk and loan amount limits. Once these limits are surpassed, youre no longer eligible for a conforming loan and must utilize a different lending solution.

What Are The Benefits Of A Jumbo Loan

The main benefit for borrowers is that a jumbo mortgage lets you borrow more than the limits imposed by Fannie and Freddie. For instance, if youd like to borrow $1 million against a $1.5 million home, a jumbo loan makes it possible.

Some borrowers prefer to finance more of the homes cost rather than tying up cash, making the jumbo mortgage a helpful financial tool and part of an overall investment strategy. You can still get a competitive interest rate and finance the home of your choice without being restricted by the dollar limit on conforming mortgages.

Read Also: Usaa Vehicle Refinance

How Are Jumbo Loans Different From Other Mortgages

Because jumbo loans are above the conforming loan limit set by the Federal Housing Finance Agency , they are classified as non-conforming.

That non-conforming title matters for borrowers. As non-conforming loans, jumbo mortgages are not eligible for purchase by Fannie Mae or Freddie Mac, the agencies that set lending requirements for most home loans.

Since jumbo loans dont fall within Fannie and Freddies jurisdiction, lenders get to set their own requirements. What that means for you as a borrower is that guidelines for credit, income, down payment, and other important qualifying factors might vary from one lender to the next.

So if youre in the market for an expensive home and a jumbo loan, make sure to shop around and find a lender that meets your needs.

Jumbo Loans: A Solution For Higher

Gone are the days where $500,000 plus homes automatically mean luxury or mansion. Sure if you live in a small town, that price point may align with something lavish, but if you live in Denver or Washington D.C., it could be somewhat modest.

With home values increasing, you may find yourself in need of greater financing to make your homeownership dream come true. Thats where a jumbo loan comes in. Jumbo loans are loans that exceed the Federal Housing Finance Agency limit. If your required loan amount is even $1 over your areas conforming loan limit, it falls into jumbo loan status.

As long as you qualify, you can take out a jumbo mortgage and use it to finance your primary residence, investment property, vacation home, or second family home. Just keep in mind jumbo loans are issued by private lenders and are not backed by government-sponsored entities like Fannie Mae or Freddie Mac so, requirements may vary.

Heres what you need to know when shopping around for a jumbo loan.

Also Check: Car Loan Amortization Formula

How A Jumbo Loan Works

If you have your sights set on a home that costs close to half a million dollars or moreand you don’t have that much sitting in a bank accountyou’re probably going to need a jumbo mortgage. And if youre trying to land one, youll face much more rigorous credit requirements than homeowners applying for a conventional loan. Thats because jumbo loans carry more credit risk for the lender since there is no guarantee by Fannie Mae or Freddie Mac. There’s also more risk because more money is involved.

Just like traditional mortgages, minimum requirements for a jumbo have become increasingly stringent since 2008. To get approved, youll need a stellar credit score700 or aboveand a very low debt-to-income ratio. The DTI should be under 43% and preferably closer to 36%. Although they are nonconforming mortgages, jumbos still must fall within the guidelines of what the Consumer Financial Protection Bureau considers a qualified mortgagea lending system with standardized terms and rules, such as the 43% DTI.

Your Rate Will Probably Be Higher

As with a conforming loan, your jumbo loan rate will depend on factors like your credit score, down payment, and term length. Usually, you can expect jumbo loan rates to be a little higher than conforming loan rates.

Between the relatively large principal and the higher rate, you have the potential to pay a hefty chunk in interest over the years. This doesn’t necessarily mean you shouldn’t take out a jumbo loan, but it’s something to keep in mind.

Don’t Miss: When Should I Refinance My Fha Mortgage

How Do I Get A Jumbo Loan With 5% Down

Simply by shopping around. Check in with a few different mortgage lenders and ask about their minimum down payment for a jumbo loan.

Ask about credit score and income requirements, too, to see whether youre likely to qualify.

Youll likely have to look beyond your local bank, says Eric Jeanette, president of Dream Home Financing and FHA Lenders. There are many online lenders who have creative loan programs that local banks simply do not offer.

Another way to find a low down payment jumbo loan is to look to wholesale mortgage brokers.

Wholesale mortgage brokers have relationships with many lenders who can offer flexible terms and guidelines. They can also yield the most costeffective mortgage solutions for the jumbo loan market, says David Yi, president at Providence Mortgage.

When you find a lender offering lowdownpayment jumbo loans, you can fill out a preapproval application to verify your eligibility.

Then, once you have a signed purchase agreement on the home, your lender will be able to issue a final loan approval confirming the interest rate, loan terms, and closing costs on your new jumbo loan.

One thing to note: most lenders are not very forthcoming with information about their jumbo loans online. So dont expect to find everything you need on a lenders website.

Instead, get in touch directly with a loan officer or mortgage broker who can fill you in on the details.