Why Take Out A Second Mortgage

Homeowners can use their home equity loan or HELOC for a wide range of purposes. From a financial planning standpoint, one of the best uses of the funds is for renovations and remodeling projects that increase the value of your home. This way, you may increase available equity in your home while making it more livable.

Borrowers should be careful of cross-collateralization because it affects real estate lending terms.

You can also use the money to pay off other high-interest rate debt in an alternative type of debt consolidation. This could be especially helpful for paying off high-rate credit card balances. Youre effectively replacing a high-cost loan with a secured, low-cost form of credit.

Of course, you can also borrow to fund an overseas vacation, a new sports car, or possibly your childs education. Whether its worth eroding your equity is up to you and something to which youll want to give some serious thought.

Home Equity Loan Vs Cash

Home equity loans arent the only way you can borrow against your home equity. You can also choose to get the money you need through a cash-out refinance.

While home equity loans enable you to take out a second mortgage on your property, cash-out refinances replace your primary mortgage. Instead of obtaining a separate loan, the remaining balance of your primary mortgage is paid off and rolled into a new mortgage that has a new term and interest rate.

With a cash-out refinance, you receive funds for the equity in your home, just as you would with a home equity loan. Unlike a home equity loan, you only have one monthly mortgage payment.

If you choose to get a cash-out refinance, you usually can secure a lower interest rate than with a home equity loan. The reason for the discrepancy in interest rates has to do with the order in which lenders are paid in the case of defaults and foreclosures.

Home equity loan rates are generally higher because second mortgages are only paid back after primary mortgages have been. As a second mortgage lender, theres a higher risk that the sale price will be too low for the lender to recoup their costs.

Learn more about the differences between home equity loans and cash-out refinances.

Can I Get A Home Equity Loan Without A Job

Its unlikely. Lenders will be wary of how you will be able to repay the loan. But just because someone doesnt have a job, it doesnt mean they dont have a source of income. Non-employed income sources that may enable you to obtain a loan include pensions, Social Security retirement benefits, disability payments, and investment income, says Eberts.

Recommended Reading: Nslds Ed Gov Legit

Whats The Best Way To Borrow From Home Equity

There are three ways to tap into your homes equity: a home equity loan, home equity line of credit or cash-out refinance. Each loan has its own set of pros and cons, so its important to consider your needs and how each option would fit your budget and lifestyle. Before you apply for a loan, you should:

Your first mortgage is the one you used to purchase the property, but you can place additional loans against the home as well if youve built up enough equity. Home equity loans allow you to borrow against your homes value over the amount of any outstanding mortgages against the property.

Can I Shop Around For Better Terms And Cheaper Closing Costs

Definitely. It is best to shop around and compare lenders as well as things like terms and rates, Kumar says. Furthermore, if you refinance, your closing costs will often be less. Lastly, before applying for home equity financing, if you work to increase your credit score, you can qualify for better terms, including lower closing costs. Overall, it is always in your best interest to research the available options before deciding which is best for you and your family.

You May Like: How To Transfer A Car Loan

Equity Increases With Home Improvements

You can also increase your equity by completing home improvements. New mechanicals, landscaping, additions and renovations often boost your homes value, in turn increasing your equity stake.

Some of the most popular home improvements include minor kitchen remodels, exterior improvements, bathroom remodels and finishing basements. Its rare to complete a home improvement project with a 100% return on your investment, but you can come close if you take a strategic approach. Focus on improvements that buyers love, and be cautious of overimproving.

What Is The Difference Between A Home Equity Loan And A Cash

Home equity loans and cash-out mortgage refinances are both potential ways to get money for home renovations or unexpected expenses. That said, both options have their pros and cons.

While a home equity loan is a “second mortgage” that allows you to borrow additional funds for nearly any purpose, a cash-out refinance replaces your existing mortgage. With a cash-out refinance, you’ll take out a new mortgage for more than your outstanding loan balance, and then withdraw the difference in cash. Because of this, a home equity loan is typically best if you already have a good rate and terms on your current mortgage. A cash-out refinance only makes sense if you can qualify for a better interest rate on your mortgage and you don’t mind resetting your repayment term.

You May Like: Loan Originator License California

How Home Equity Loan Payments Are Calculated

The calculator on this page tells you how much you may be able to borrow, but it’s not a home equity loan payment calculator that figures monthly payments on a loan.

A home equity loan has equal payments every month. The monthly payments depend on three factors:

-

Loan amount.

-

Loan term. The term is the number of years it will take to pay off the loan. For a given amount and interest rate, a longer term will have lower monthly payments, but will charge more total interest over the life of the loan.

-

Interest rate. Usually, a longer loan term has a higher interest rate.

Take The Difference As Your Equity

Subtract your loan balance amount from your homes current market value.

Example: Fair market value of $315,000 minus $176,472 in loan payoff amount equals $138,628.

Remember, that doesnt mean you will pocket $138,628. At closing, youll still need to pay closing costs, which can include taxes, escrow fees and agent commissions, all of which can total 8% to 10% of the sale price. At 10% in closing costs, youll end up netting $124,765.

If you really want to get into the details of your profit, you may also want to subtract any money you spent getting your house ready to sell, like home improvements, repairs or staging.

Also Check: How To Reclassify A Manufactured Home

Is There A Simpler Option Than A Home Equity Loan In A Bankruptcy Situation

To rebuild your finances you need access to every financial tool possible, including the equity in your home. Having a bankruptcy on your record will make this more difficult. While bankruptcy is a legitimate method of dealing with a bad financial situation, it will damage your credit.

There is another financial tool that you may not be aware of called a leaseback. With the help of an experienced real estate investor, a leaseback can be a quick and simple solution for any homeowner in this situation.

Home Equity Loan Requirements

Qualification requirements for home equity loans will vary by lender, but here’s an idea of what you’ll likely need in order to get approved:

-

Home equity of at least 15% to 20%.

-

A credit score of 620 or higher.

-

Debt-to-income ratio of 43% or lower.

In order to confirm your home’s fair market value, your lender may also require an appraisal to determine how much you’re eligible to borrow.

Read Also: How Does Paypal Business Loan Work

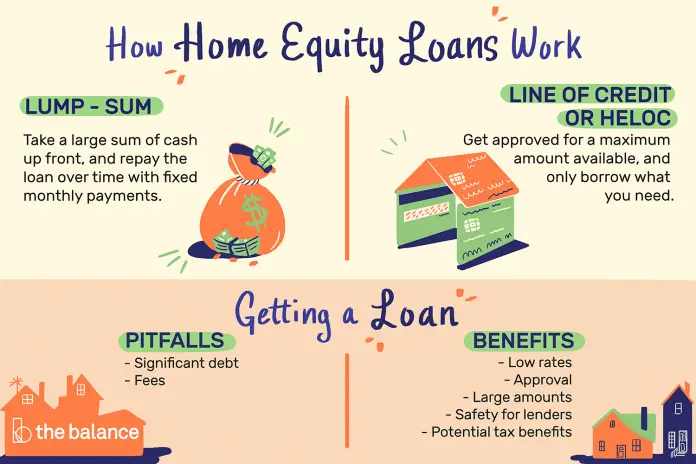

How Do Home Equity Loans Work

The amount of money you can borrow with a home equity loan or second mortgage is partially based on how much equity you have in your home. Equity is the difference between the value of your home and how much you owe on the mortgage.

An example may help illustrate: Lets say you own a house now valued at $300,000. You put down $30,000 when you bought it and have paid down $30,000 in mortgage principal. You would have $60,000 in equity in the home.

The lender would use this equity number in addition to your credit score and income to determine how much of a loan you will get. Your lender will need to pull your credit report and verify your income to determine the interest rate youll pay for your second mortgage.

Typically homeowners borrow up to roughly 85 percent of the equity in their home. The longer you pay down the mortgage and the more your home appreciates in value, the more equity you build up in the home and the larger a home equity loan you may qualify for.

If you get a home equity loan, you will receive the entire amount of the loan all at once, as opposed to a home equity line of credit, which works similar to a credit card, where you take just what you need when you need it, and then pay it off in monthly installments. Often, you have to pay off a home equity loan or second mortgage within about 15 years, though the terms vary. The interest rate on the loan is typically fixed.

If You Have Poor Credit

Home equity loans can be easier to qualify for if you have bad credit, because lenders have a way to manage their risk when your home is securing the loan. Nevertheless, approval is not guaranteed.

Collateral helps, but lendershave to be careful not to lend too much, or they can risk significant losses. It was extremely easy to get approved for first and second mortgages before 2007, but things changed after the housing crisis. Lenders are now evaluating loan applications more carefully.

All mortgage loans typically require extensive documentation, and home equity loans are only approved if you can demonstrate an ability to repay. Lenders are required by law to verify your finances, and you’ll have to provide proof of income, access to tax records, and more. The same legal requirement doesn’t exist for HELOCs, but you’re still very likely to be asked for the same kind of information.

Your credit score directly affects the interest rate you’ll pay. The lower your score, the higher your interest rate is likely to be.

You May Like: How To Get An Aer Loan

Can You Get A Home Equity Loan If You Have Bad Credit

Home equity loans can be easier to qualify for if you have bad credit, because lenders have a way to manage their risk when your home is securing the loan. Nevertheless, approval is not guaranteed.

Many borrowers can get a home equity loan or HELOC even with bad credit. Thats because youre using your home to guarantee the loan. Lenders like having property as collateral, so theyll work the

How Do I Grow My Home’s Equity

If youre sure all the information entered into the home equity loan calculator is correct and it shows you have less than 20% equity in your house, you probably wont be eligible for a loan or HELOC at this time. You may be able to speed up equity growth by:

-

Refinancing into a shorter-term mortgage.

-

Making home improvements that increase value.

-

Paying a little extra toward your mortgage principal every month.

More from NerdWallet

Recommended Reading: How Much Do Mortgage Officers Make

How To Qualify For A Home Equity Loan

Getting approved for a home equity loan is similar to going through the process for a new mortgage. Your lender will review your application along with your credit report, credit score, debt-to-income ratio, and your homes equity.

While each lender has its own approval criteria, youll typically need the following to qualify for a home equity loan:

- Youll generally need a credit score of at least 680 to qualify for most home equity loans though, the higher your score, the better your interest rate could be. And although you might get a loan with a score of 660, you could end up with a higher interest rate.

- DTI ratio: Your DTI ratio is the percentage of your monthly income that goes toward debt payments, including your mortgage, student loans, credit cards, and car payment. When applying for a home equity loan, your DTI ratio shouldnt exceed 43%.

- Equity: To qualify for a home equity loan, youll need to have at least 15% to 20% equity in your home. If your house is worth $250,000 and you owe $200,000 on your mortgage, your homes equity is $50,000, or 20%.

Learn More: Have Bad Credit and Want a Home Equity Loan? Heres What to Do

Can I Get A Home Equity Loan Or Heloc Without A Job

If you dont have a job, it might be hard to get a home equity loan or HELOC you might not meet the lenders income requirements. However, you might be able to qualify for a home equity loan if you have other sources of income.

Heres a list of non-employment income sources lenders might consider:

- Pension or retirement.

- Interest and dividends.

- Trust fund.

A lender will consider the income of a co-signer or co-borrower if you have one. That way, you could potentially meet the DTI requirements to qualify for a home equity loan or HELOC without a job. Before you apply, reach out to the lender to see what income sources are acceptable.

Read Also: How To Transfer Car Loan To Another Person

How To Use The Home Equity Loan Calculator

Enter your homes value .

Enter the amount remaining on the loan .

Choose the range that reflects your current credit score .

The tool will immediately calculate your current loan-to-value ratio. If you own at least 20% of your home , youll probably qualify for a home equity loan, depending on your financial track record.

The calculator will also show the dollar amount youll likely be able to borrow so you can determine whether a home equity loan meets your financial needs.

Home Equity Loans: How To Qualify

The first step in applying for a home equity loan is having enough equity in your home to qualify. Generally speaking, most home equity lenders will only let you borrow up to 85% of your homes value in total between your mortgage and a home equity loan.

For example, if your home is currently worth $400,000, you could owe a total of $340,000 on your mortgage and a home equity loan. So if you already owe $300,000 on your home, you could qualify to cash out another $40,000 with a home equity loan.

Depending on your situation, its likely youll need to have your property appraised to determine how much its worth in todays market. Your home equity lender will usually facilitate this process for you, although an appraisal fee is typically required.

Your is another factor that comes into play if you want to qualify for a home equity loan. While each lender has their own qualification criteria, youll have the best chance at approval if your FICO score is at least good meaning 670 or higher. And youre more likely to get the best rates and terms on a home equity loan if your FICO score is very good, which is generally 740 and higher.

Related: How to instantly improve your credit scores for free with Experian Boost.

Finally, a home equity lender will consider your debt-to-income ratio, which is how much debt you already have in relation to the income you bring in. Generally speaking, lenders prefer consumers with debt-to-income ratios of 43% or below.

Recommended Reading: What Happens If You Default On Sba Loan

Why Would I Want A Heloc

Borrowing for big expenses like consolidating debt, home repairs and improvements or to pay medical bills can be difficult. If you have equity in your home, a HELOC can seem like an easy way to get the big money you need.

Because your home is used as collateral for the loan meaning there is less risk for the lender because they can take your home in the event you default the interest you pay may be lower than the interest youd pay on other types of loans. But since the line of credit is secured by such a valuable asset, you might want to think twice about using it to pay for day-to-day expenses. Securing the line of credit with your home means the risk is on you and that may lose your home if you do not make required payments on time.

Learn more about which type of home improvement loan could be best for you.

How Not To Get Into A Bad Leaseback Agreement

Unfortunately, not all investors offer leasebacks to help homeowners. Some of them entice homeowners into an agreement with bad terms hidden in the contract and extremely low offer for the home. They intend to drain the homeowners funds and then keep the property they got for cheap.

A reputable leaseback company will discuss with the homeowner their ability to pay the lease amount prior to entering an agreement to find the best solution ensuring the win-win terms.

Before accepting the leaseback agreement terms, its imperative to do your research on the reputation of the company, read clients reviews, study the agreement terms and meticulously estimate your financial capabilities.

As a national platform connecting distressed homeowners with real estate investors, HouseCashin maintains relationships with reputable and professional leaseback firms all over the USA. To get equity from your home despite bad credit history and purchase the property back later, connect with a top-rated leaseback company in your location by filling out our simple online form.

David Cook

Recommended Reading: How To Get Loan Originator License