What Apr Does Santander Auto Financing Offer On Its Car Loans

Santander Auto financing offers a fixed apr car loan productthat ranges from 1.99% APR.

Your APR can vary depending on several factors, such as your credit score. Find out what your credit score is and whether there is any false or inaccurate information in your credit history with these credit monitoring tools.

Do I Have Room In My Budget For Extra Loan Payments

Extra loan payments can affect your budget just like any other expense. Before you start paying down a personal loan early, take a look at your current income and account balances. Youll want to avoid dipping into your savings to make extra payments, so make sure you have enough discretionary income to put toward your loan.

Best Bank For Refinancing Your Santander Loan

Best Auto Loan Refinance Companies of 2021

- Best for Great Credit: Credit Unions

- Best for Checking Rates Without Impacting Your Credit: Capital One.

- Best Trusted Name: Bank of America, Chase or WellsFargo.

- Best for The Most Options: WithClutch.

- Best for Members of the Military: USAA or Navy Federal CU.

- Best for Peer-to-Peer Loans: LendingClub although not recommendable.

- Digital Credit Union and PenFed.

Don’t Miss: Usaa Auto Lease Calculator

Message From Santander Bank

Santander Consumer USA Holdings Inc. is a public, full-service, consumer finance company focused on vehicle finance and third-party servicing. The company manages accounts for more than three million customers across all credit profiles. Headquartered in Dallas, TX, Santander Consumer USA Holdings Inc. is the parent company of Santander Consumer USA Inc.

Santander Consumer USA is committed to providing excellent service to our customers, our people and our community by placing our Simple, Personal and Fair values at the center of everything we do. We strive to treat customers as they like to be treated and earn shareholders an adequate and sustainable return, while recognizing our responsibility to help communities.

When you finance your vehicle through Santander Consumer USA, youre in the drivers seat with our MyAccount tool, Auto Pay payment option, Learning Center or other tools and resources. We look forward to providing you a positive customer experience on your road to car ownership.

I Have Changed My Insurance Do I Need To Notify Santander Consumer

Yes, any changes made to your insurance may impact the terms and conditions of your loan. You must always maintain full comprehensive and collision insurance on your vehicle, with Santander Consumer shown as the lien holder. Anything insurance arrangement other than this could put your contract into default.

You May Like: Alberta Student Loan Login

How Do I Make My Payments

We use a convenient pre-authorized payment system to take your payments. Select the most convenient date for your payment to be made and we will automatically withdraw the payment from your account. Just ensure your payment amount is in your bank account prior to your payment date. We also accept payments via Visa Debit and Mastercard along with MoneyGram and Western Union.

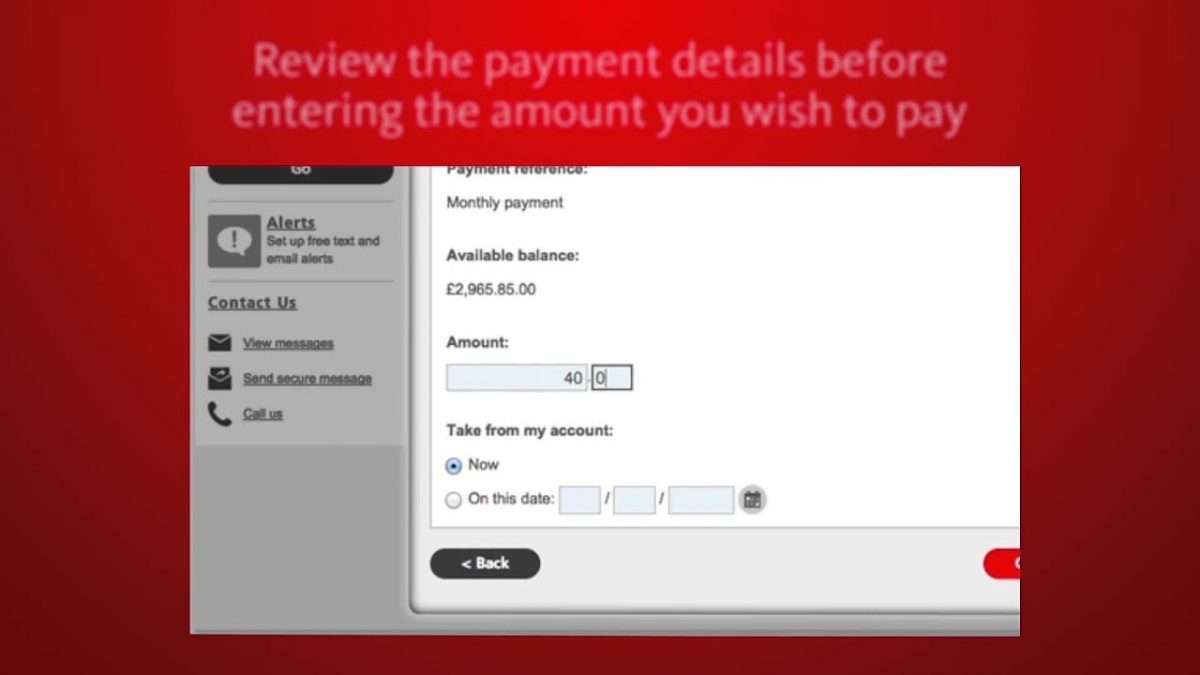

How To Make A Mortgage Payment At Santander Bank

Everybody manages their finances differently. Thats why we have 4 different ways to make mortgage payments.

Automatic Withdrawal

Like direct deposit, you can set up an automatic withdrawal from your checking or savings account for your residential mortgage. You will need to fill out an with information about your mortgage, the account you would like to make the withdrawal from, and the signatures of all account holders. You can also indicate what date you would like the payment to be withdrawn, as well as any additional amount beyond your minimum monthly mortgage payment that you would like to be withdrawn.

Once your form is completed, mail it and a voided check or deposit slip or a copy of your statement reflecting the account information you would like your payment withdrawn to:

Santander Bank

Pittsburgh, PA 15250-7306

Read Also: Apply For Capital One Auto Loan

Re: Beware Of Santander Auto Loans

Yes they suck, just went from a 16.9% car loan with them to a 1.79% with NFCU, drastic diffrence in rates. I dont even think that NFCU has a rate over 14.99%. But if your credit is beyond horrid and you need a ride they serve a purpose. Just dont Finance a 30k car with them, 10k and under is what I would recommend.

Is There A Penalty For Paying Out My Loan Early

No, there is no interest penalty for repaying your loan earlier than contracted. Contact customer service to find out what your payout amount is. Remember, you want to be quoted the payout on the exact date we will receive the funds as there could be a daily per-diem charge until the account is paid in full.

You May Like: Refinance Usaa Auto Loan

Am I Eligible For A Personal Loan

When reviewing your application information, a Consumer Lending underwriter at the bank reviews several factors to assess whether you qualify for the loan or line of credit, including your credit score and the amount of debt you have compared to your total income. You must be at least 18 years old and a resident of one of the following states to apply for a Santander Personal Loan: MA, RI, CT, NH, NJ, PA, NY, DE, ME, VT, MD, or DC.

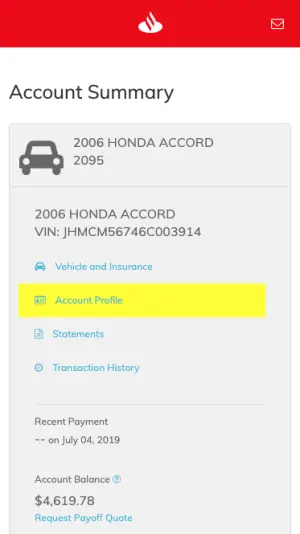

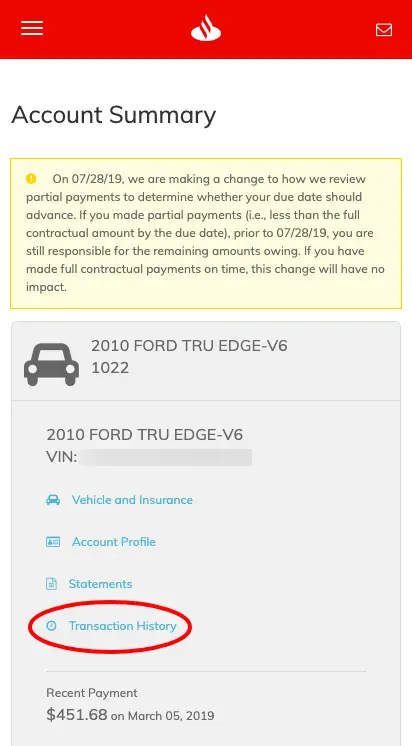

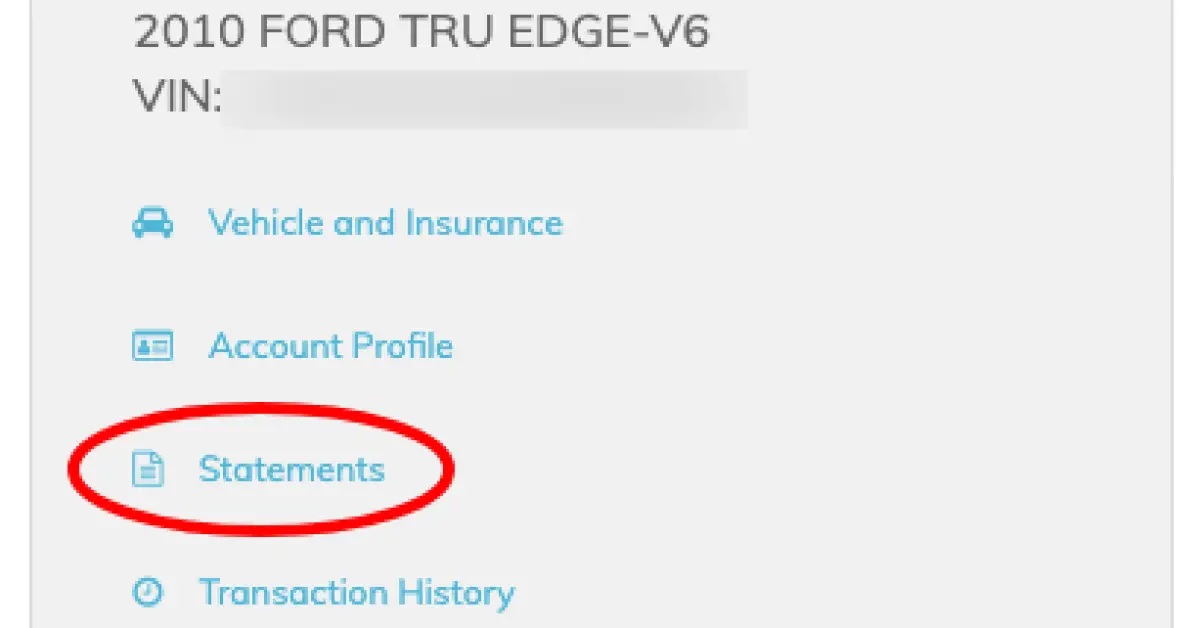

How Can I Make A Payment To My Loan Financed Through A Dealer

Payment options for auto loans that have been transferred toSantander Consumer USA Inc. are as follows:

Pay by Phone: Santander Consumer USA Inc. accepts payments from personal checking or savings accounts, credit and debit cards via telephone. Call toll-free at 1-888-222-4227, have your card information or bank account routing and check numbers available when you call. Please note that Fees may apply for this service. Online Payments: Make a payment online in the ‘My Account’ area of santanderconsumerusa.com.

IMPORTANT! You will need a valid email address and your social security number to establish an online account. Please note that Fees may apply for this service.

Payments are also accepted at any localSantander Branch. Payments may be mailed to: Regular Mail

AnswerRead Also: What Kind Of Loan For Land

Things To Consider Before Refinancing

Santander Auto Loan Review

Its easier to shop for car loans now than it has ever been before, but the wealth of options can make the experience a confusing, overwhelming task. This is where Car Talk can help. Santander Bank offers loans through various channels, including as Chryslers in-house financing partner. Were here to help you understand more about Santander, including the services it provides, so lets get started.

Compare Loan Rates and Save

Don’t settle for dealer financing, get loan quotes from multiple providers

Don’t Miss: Fha Loan Refinancing Options

How To Pay The Bill

Pay online: Customers can pay your Santander bill online by visiting .

Pay by phone: Customers can pay your Santander bill over the phone by calling 1-888-222-4227. Acceptable methods of payment include checking and savings accounts. Santander charges a $10.95 convenience fee for payments received by phone.

Payment stations: Customers can pay your Santander bill at authorized pay stations such as MoneyGram and Western Union.

- MoneyGram Customers will need the four-digit receive code, 1554, their account number, the company name and the city and state. The convenience fee ranges from $9.95 to $10.40.

- Western Union Customers can pay your Santander bill by visiting your local Western Union or calling 1-800-325-6000. You will need the city code, Pitstop, state code and your account information. Acceptable methods of payment include cash, credit cards and debit cards. A convenience fee is assessed to each payment.

Pay by mail: Customers can mail your Santander payment to:

Santander Consumer USA1010 W. Mockingbird Lane, Suite 100Dallas, TX 75247

Automatic deduction: Customers can have your Santander bill automatically deducted from your checking or savings account on a monthly basis. You will need to complete an authorization form and return to:

Santander Consumer USA Inc.Fort Worth, TX 76161-1245

Our Take On Santander Auto Loans: 25 Stars

The fact that Santander was recently the subject of a class-action lawsuit regarding auto loans with very poor loan-to-value ratios indicates this lender is not on the up and up. Overall, we do not recommend getting a Santander auto loan. Even if you have a poor credit score or open bankruptcy, youll likely be able to find bad credit auto loan offers from more reputable auto lenders.

| Our Rating |

|---|

Read Also: Bayview Home Loans

Santander Auto Loan Customer Service Contact Details Us

Santander Auto Loan

Fort Worth, TX 76161-1245

Reference Links: https://santanderconsumerusa.com/payments/phone

Santander Auto Loan Customer Service number for US Clients, email id, and other best ways to reach Santander Auto Loan Customer Service executive just call or send a mail to Customer service to get your problem resolved.

What To Do When You Cant Pay Your Santander Bill

Santander is one of the largest auto finance companies in the United States. Based in Dallas, Texas, Santander left its roots in the sealing of vehicles to focus on the financing of vehicles. Santander is owned by the publically owned company Banco Santander, considered as one of the safest banks in the world.

You May Like: Usaa Pre Qualify

Re: Santanderhow Much Am I Going To Regret This

So we are a couple months out and I was just curious if anyone knows about paying off their loan early with Santander? My payment is $350 and some change but I have been paying $400 every month. I know an extra $50 isn’t really a big deal but it’s an extra $600 per year and it’s what I can comfortable afford right now. Anyways…my actual question. How can I get Santander to apply it to the principal of my loan and not just apply to the front end with all the interest?

Would You Like To Change Your Payment Date

If you would like to request a change to your payment date please note the following:

- You can only change your payment date once in a 12-month period

- The first change after the inception of your agreement will be free of charge. For subsequent changes, there will be a fee of £25.00 payable by card before the change is made

- The change cannot be made when your payment date is within 4 working days

- If your agreement is a PCP agreement, your payment date can only be changed once in the entire life of your agreement as this would affect the Guaranteed Future Value of your vehicle

Read Also: Fha Mortgage Refi

Contact Us Santander Consumer Usa

https://santanderconsumerusa.com/support/contactContact Us | Santander Consumer USA. Contact Us. Please feel free to contact us in the following ways that is most convenient for you. Phone Numbers Need More Help? Check out our FAQs · Auto Financing · New Car Loans · Used Car

Disclaimer:

findcustomerservice.com is not affiliated or associated with Santander Auto Loan in any manner. findcustomerservice.com is only a Directory website that helps people contact customer service and support from leading companies around the world.

We do not offer any type of customer service or support for Santander Auto Loan. For Support or help Please Contact Santander Auto Loan Customer Service Official Channel.

How To Refinance Your Santander Auto Loan

- 1st Investors Financial Services

- and a few more.

Recommended Reading: Refinance Conventional Loan

How To Apply For A Santander Auto Loan

Santander loans are offered through your new or used car dealer. If you are buying a Chrysler product, the Santander loan may be labeled as Chrysler Financing. The application process depends on the dealer, but will generally involve:

- Your consent for the dealers financing department to pull your credit history report.

- An approval for the amount you requested to borrow.

- Discussion with your dealer on the cars final pricing and any add-ons you want, such as accessories or extended warranties.

- Complete paperwork with dealer financing department.

If you wish to apply with RoadLoans, you can head to its website and follow the instructions to apply online.

Schnelle Kreditentscheidung Schnelle Abwicklung Schnelle Auszahlung

Als erfahrene Finanzierungsspezialisten garantieren wir für eine schnelle Kreditentscheidung sowie eine schnelle und unkomplizierte Abwicklung. Unser optimierter Online-Prozess ermöglicht eine Auszahlung Ihres Darlehens innerhalb von 24 Stunden.1

- Flexible Anzahlung: Die flexible Anzahlung kann sowohl den Gesamtbetrag als auch monatliche Rate sowie Zinskosten verringern.

- Sondertilgung möglich: Mit Hilfe der Sondertilgung kann die Kreditlaufzeit verkürzt werden.

- Optional mit Schlussrate: Die optionale Schlussrate kann die monatliche Rate noch einmal beeinflussen.

Also Check: Stilt Loans

Santander Auto Loan Reviews And Reputation

Santander has a poor reputation when it comes to auto loans. It was the subject of a class-action lawsuit, and 34 state attorneys general filed claims that Santander issued unfair auto loans with excessive interest rates. The company also recently settled a lawsuit with the Consumer Financial Protection Bureau for violating consumer finance regulations.

Santander has a B rating from the Better Business Bureau and a customer review score of 1.1 out of 5.0 stars based on nearly 300 reviews. On Trustpilot, the company has a 1.4-star rating based on over 4,000 reviews.

What Requirements Do I Need

We recognize the fact that many vehicle purchasers do not fit a traditional lender’s criteria. While we want to remain as flexible as possible there are certain minimum requirements that a customer must meet. We will review applications from customers who may have had problems in the past and are looking to improve their credit profile. You must be fully discharged from any bankruptcy proceedings or have met your trustee’s conditions and are awaiting your discharge. You must not have any current substantial outstanding past due debt.

-

Income – You must have a minimum income of $1,800 per month. You must also be able to meet your debt servicing requirements. We will calculate a debt service ratio that takes into account your total monthly payments including vehicle payment, vehicle insurance, rent/mortgage payments and any other liabilities you may have.

-

Employment – Minimum three months on the job. Exceptions to this requirement can be made when you are taking a new job in the same or similar field of employment, and you were at the previous job for at least one year.

-

Residency – Minimum three months, unless there is a correlation to your employment situation.

Don’t Miss: Usaa Proof Of Residency Request Form

Myautoloan: Best Loan Marketplace

Rather than a direct provider of loans or an auto financing broker, myAutoloan is a loan marketplace. While you can get instant loan offers on the site too, this model allows you to input your information into the companys website and wait for offers to come to you. As a result, you can easily compare multiple loan offers to see which lender offers the best rates and terms for you.

Learn more in our full-length myAutoloan review.

Auto Credit Express: Best For Bad Credit

While many lenders turn borrowers with bad credit away, Auto Credit Express specializes in helping them. The broker works with dealers and lenders around the country to connect bad credit borrowers with partners who can offer a car loan. Auto Credit Express even works with people going through bankruptcy and other difficult financial situations.

Discover more in our in-depth Auto Credit Express review.

You May Like: Can You Use A Va Loan For Land

Santander Ist Deutschlands Grter Herstellerunabhngiger Kfz

Hier finden Sie alles, was Sie wissen müssen. Sollten Sie dennoch eine Frage haben, können Sie sich über unsere Hotline mit uns in Verbindung setzten und wir beantworten gerne alle Ihre Fragen. Natürlich stehen wir Ihnen mit unserer langjährigen Erfahrung im Bereich der Autofinanzierung mit Rat und Tat zur Seite und helfen Ihnen, das beste Angebot für Sie zu finden.

How To Pay Off A Loan Early

There are many different techniques for paying off a loan early. While many people will tell you that their way is best, its important to choose a method that works for your budget and lifestyle. Some effective payment methods include:

- Dividing your monthly principal and interest by 12, then adding that amount to your monthly payment. This adds up to 13 payments per year while eliminating the need for a large lump sum.

- Use additional money from a bonus, tax refund, or other unexpected windfall to help pay down your principal.

- If paying off your personal loan early is a top priority, consider looking for a source of additional income that you can dedicate to your goal. Consider taking on a side job, and then putting the money you earn toward your loan.

- Too busy for a side job? Consider a temporary cut in luxury purchases to fund additional loan payments

You May Like: Does Upstart Allow Co Signers