What You Can Do With The Cash

Qualified borrowers can use cash proceeds from their refinance to make home upgrades, pay down high-interest loans and credit cards, take a vacation, or for any other purpose. Low-interest rates and flexible payment terms make it a great time to invest in your home or use equity to pay off other expenses.

No Private Mortgage Insurance Requirements

On a typical loan, a buyer who makes a down payment less than 20% would likely need to purchase mortgage insurance. Private mortgage insurance, or PMI, protects the lenders stake in the property but is paid for by the borrower. The premiums for this coverage are folded into your monthly mortgage payments, adding to an already hefty repayment plan.

Since VA mortgages are backed by the U.S. government and have no down payment required, PMI is not necessary, giving eligible applicants yet another opportunity to save on their homebuying journey.

Your Ltv Ratio And Private Mortgage Insurance

Your loan-to-value ratio will also determine whether you have to pay private mortgage insurance. For conventional loans, borrowers who want to avoid paying private mortgage insurance will need to make a down payment of 20 percent of the value of the home. FHA purchase loans will allow you to have a loan-to-value ratio of up to 96.5 percent. USDA, VA and other specialty loan types may allow for a 100 percent LTV for a purchase loan.

Also Check: When Do Student Loan Payments Start After Graduation

Who Should Consider A 15

Homeowners who want to save significantly on their home loan and can afford to pay the higher monthly mortgage payments are best suited for 15-year mortgages. Thats because these types of loans tend to have lower interest ratesgovernment-supported agencies like Fannie Mae and Freddie Mac tend to impose loan-level price adjustments, which drive up the costs of 30-year mortgages.;

Borrowers considering 15-year mortgages need to consider whether they can afford the monthly payments, as they will be higher compared to a 30-year or 20-year mortgage because you are paying the loan off in less time. Its critical that you determine whether you have ample savings set aside and room in your budget to afford the higher payments in addition to your other monthly obligations.;

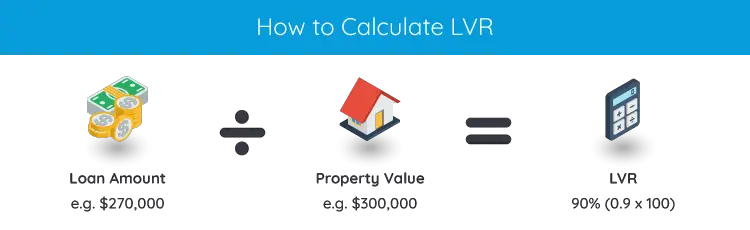

How To Calculate The Loan

To calculate the LTV ratio, divide the loan amount or loan balance by the propertys appraised value.

New Home Purchase

When purchasing a home, calculating your DTI ratio is easy. If you are putting 5% down, your DTI ratio is 95%, 10% down = 90% DTI, and so on.

For a $200,000 home with a loan amount of $180,000, take 180,000 and divide by 200,000 it equals 0.9. Move the decimal over to get 90%.

- Enter 180,000 on your calculator or phone.

- Divide it by 200,000

- Youll get 0.9, or 90%; this is your LTV ratio.

Existing Homeowners

If you want a home equity loan or cash-out refinance, you will be able to convert up to 80% of your homes equity.

For example, if you have a home with a market value of $200,000 and a loan balance of $100,000, your current loan-to-value ratio is 50%. You will be able to get a loan up to 80% of the LTV ratio, or $60,000 minus closing costs.

|

Current Home Value |

|

$55,500 |

Also Check: What Is The Average Auto Loan Interest Rate

Alternatives To A Cash

The primary reason anyone considers a cash-out refinance is to raise cash relatively quickly. Whether it is for pleasure or investment, a cash-out refi provides an opportunity to access some much needed cash at interest rates that may be more forgiving than a personal loan, credit card advance, or even a home equity line of credit. Of course, there are some alternatives to cash-out refinancing that allow consumers to raise some much needed cash without putting their homes or investment properties at risk. We would be remiss if we didn’t spend at least a little time talking about those alternatives, and how they compare to cash-out refinancing.

What Is A Loan

Your loan-to-value ratio is the percentage of a homes value youll need to borrow after youve determined your down payment. If you put in a 20% down payment, your LTV is 80%; if you put down 10%, your LTV is 90%, and so on.;

The calculation for LTV is:;

Loan amount ÷ appraised home value = LTV ratio

The higher the loan-to-value ratio, the more of a risk a borrower poses to a lender.;

Also Check: What Kind Of Loan For Land

Refinance Calculator Freedom Mortgage

Use our free mortgage refinance calculator to help estimate how much you might save by lowering your interest rate.

5 days ago Not all applicants will receive the very best rates when taking out a mortgage or refinancing. Credit scores, loan term, interest rate types

2 days ago For people who plan to stay in the home for several more years, it might make sense to refinance if it means cutting the interest rate by;

What Is A Va Cash

A VA cash-out refinance replaces your existing mortgage with a new VA home loan. Typically, the new VA mortgage has a bigger loan amount than your current one, allowing you to receive cash back at closing.

However, youre not required to cash out home equity with this loan. You can also use a VA cash-out refinance to replace a non-VA loan with a VA loan and lower your interest rate.

Recommended Reading: When To Apply For Ppp Loan Forgiveness

Presume Housing Market Shifts

Based on your homes location and how many people are interested in buying a home, your property value could naturally increase over time as demand increases. Of course, the market could experience a downturn. Before you decide to refinance your mortgage, try using the Federal Housing Finance Agencys House Price Calculator to see how homes in your area have appreciated in value.

With a lower LTV, you may qualify for a loan you werent eligible for when you purchased your home. It could be time to refinance your mortgage to improve your interest rate, take cash out or eliminate PMI.

What Exactly Is Private Mortgage Insurance

Private Mortgage Insurance is insurance lenders require most homeowners to take out when they make a down payment of less than 20% of the home’s purchase price. This insurance cost is typically tacked onto your monthly mortgage payment and is required until 20% of the principal amount is reached.

With an Elements VA Loan, no PMI is required. You can save up to $25,000 in PMI costs over the course of your loan!

Recommended Reading: Is My Loan Fannie Mae

Migration Away From Cities

Initially the virus spread fastest in large cities and metro areas where people are densely populated. Lockdowns and political instability caused some people who lived in big cities to see limited upside in the high rents as their favorite venus remained closed, they were able to work from home, working from home in a cramped home proved frustrating, and saw months of violent protests and looting sweeping across the country

Hundreds of the protests were violent with mainstream media outlets celebrating only 7% of the protests turned violent.

Social media news feeds shared many of the most extreme aspects which would have typically been hidden from the public. A crowd of BLM-antifa activists celebrating the cold blooded murder of Aaron Danielson who wore a Patriot Prayer hat in Portland.

Almost any loving parent who sees vidoes of arbitrary murders wants to go away from wherever that activity happens.

The political instability, economic instability, health scare, and violance have caused a rise in demand for suburban and rural single family homes while office rents in major cities fell. The stock prices of many homebuilders have increased sharply in response to the new wave of demand for consumers for single family homes.

What Are The Differences Between A 15

Both a 15-year and 30-year mortgage are fixed-rate loans. The biggest difference between the two is that they have different loan terms. A 30-year mortgage will take 30 years, or 360 monthly payments. Compare this to a 15-year term, which will take less time and where borrowers will end up paying less in interest over the loans life of 180 months.;

Since a 30-year mortgage spreads out your monthly payments for a longer period of time, youll make lower monthly payments compared to one for a 15-year term. However, itll also mean that youll end up paying more interest throughout the lifetime of the loan because of both the duration of the loan and, typically, a higher interest rate.;

You May Like: What Is Auto Loan Interest Rate

Key Points And Considerations For Cash Out Refinances

Of course, as with any financial transaction, things are rarely as simple as they may seem on the surface, and there are a few key points that need to be considered. First, and foremost, is the amount of equity in your property. This will determine how much money you can access in a cash-out refinance, and while there are some generally accepted industry standards the ultimate loan-to-value limit will be set by your lender. Equally important are the rates and terms of your new mortgage. As attractive as cash-out mortgage refinancing may be, it can lead to trouble if your new loan comes with higher interest rates and an unusually restrictive repayment plan. It’s also worth remembering that in most cases your new mortgage will be subject to the same vetting as any other loan, and the terms you are offered will be dependent upon your credit history, current employment, and overall financial profile.

If you are considering the possibilities of a cash-out refinance, there are a few important points to review:

Mortgage Seasoning Requirements

Most lenders will refuse to approve a cash-out refinance on any property with less than 12 months of seasoning. This is to prevent buyers from flipping and/or serially refinancing properties. Ideally, to qualify for a cash-out refinance at acceptable rates and terms, you should have at least 36 to 48 months of seasoning on your existing mortgage.

Maximum Loan-to-Value Limits

Income Tax Implications

Tax Deductible Allowances

Closing Costs

Find Out If You Qualify For A Mortgage

Loan-to-value is the ratio of how much youre borrowing compared to your homes worth. Its a simple formula, but its the basis for most mortgage lending.

Once you know your LTV, you can figure out which mortgages youre likely to qualify for and which lender offers the best rates for your situation.;

Popular Articles

Don’t Miss: What Size Mortgage Loan Can I Qualify For

What Does Ltv Have To Do With Risk

Well, a relationship between a lender and a borrower is based on trust. Lenders loan borrowers money with the expectation that the borrower will pay back the loan in full, with interest.

Lets say a mortgage has a high LTV, and the borrower defaults on their loan after which the property goes into foreclosure. Because the down payment was low, the lender runs the risk of losing a lot of money on their investment if the home sells for less than the original appraised value.;

Because of this relationship between lender and borrower, loan-to-value ratio is one of several factors, including credit score and annual income, that determines the interest rate a borrower will have to pay on a loan. The riskier the loan is for the lenderthe higher the LTV ratiothe higher the interest rate will be for the borrower.;

In addition, borrowers who have an LTV of 80% or higher will often need to take out private mortgage insurance , which can tack on a couple hundred extra dollars to monthly mortgage payments.

How Big Of A 30

There are a few considerations to look into when determining how much of a mortgage you can afford. While lenders consider factors include your assets, liabilities, and income, your DTI will be the most significant factor in determining how much you can afford. The front-end DTI considers how much of your monthly income goes toward housing expenses. Lenders want to see this ratio at 28% or less.

You May Like: How To Get Loan Signing Jobs

The Highltv Refinance Option

HIRO formally known as the HighLTV Refinance Option is a mortgage relief program run by Fannie Mae.

The HIRO program was originally created to help homeowners whose property values were stagnant or falling. In those markets, some borrowers lost equity or saw their mortgages go underwater.

An underwater loan is one where the borrower owes more on their home loan than the property is worth. These types of loans arent eligible for standard refinance programs. Fannie Maes HighLTV Option helped solve that problem.

The good news is that underwater homes are becoming increasingly rare.

As the housing market heated up during Covid, most homeowners saw their properties increase in value. And as a result, the number of highLTV and underwater loans dropped significantly.

Now, many homeowners are eligible to refinance even without a special highLTV program. But they might not know it yet.

Even if you bought your home recently, or you had a highLTV loan in the past, you should double check your mortgage status with a lender.

Theres a good chance youve gained more equity over the past year than you realize. And you might qualify for a refinance without any extra assistance.

You can start your eligibility check right here.

Whats Behind The Numbers In Our Loan

This calculator helps you unlock one of the prime factors that lenders consider when making a mortgage loan: The loan-to-value ratio. Sure, a lender is going to determine your ability to repay including your , payment history and all the rest. But most likely, the first thing they look at is the amount of the loan youre requesting compared to the market value of the property.

An LTV of 80% or lower is most lenders sweet spot. They really like making loans with that amount of LTV cushion, though these days most lenders will write loans with LTVs as high as 97%.

Lets see how your LTV shakes out.

Read Also: What The Highest Apr For Car Loan

What Is The Current Va Loan To Value Ltv Rate

loan-to-valueVAloan-to-value

Beside above, is LTV based on appraisal or purchase price? Loan-to-Value or LTV is the amount of money you’re borrowing as a percentage of your home’s value. With a refinance, the LTV is equal to your loan size divided by your home’s appraised value. For a purchase, LTV is based on the sales price of the home, unless the home appraises for less than its purchase price.

Also asked, what does 60% LTV mean?

LTV stands for loan-to-value and, put simply, it’s the size of your mortgage in relation to the value of the property you want to purchase. This means that 75% of the property’s value is paid for by your mortgage and 25% is paid for out of your own money .

Is VA funding fee included in LTV?

b. Loan-to-Value . VA will no longer guaranty refinancing loans when the LTV exceeds 100 percent. Inclusion of any funding fee that is financed, in part or whole, cannot cause the loan to exceed the reasonable value of the property.

Va Loans Vs Fha Loans

FHA loans, or Federal Housing Administration loans, are another type of government-insured mortgage that provides a path to homeownership for buyers who cant qualify for a conventional home loan.

Both mortgage structures provide substantial benefits for homebuyers, but VA and FHA loans cannot be used on the same home. Both programs require the financing to go towards your primary residence, so you cant use them to purchase an additional property either.

Don’t Miss: What Are The Qualifications For First Time Home Buyers Loan

Todays Refinance Rates Us Bank

Browse and compare current refinance rates for various home loan products from U.S. Thats why a mortgage APR is typically higher than the interest rate;

Refinancing may provide an opportunity to get a better interest rate or make a good mortgage even better. Either way, youll increase your short- and long-term;

4 days ago Mortgage interest rates forecast and trends: Will rates go down in September But this knowledge can help home buyers and refinancing;

View current home loan rates and refinance rates for 30-year fixed, A fixed interest rate means your rate stays the same for the life of the loan so;

How to refinance a home loan · Figure out your why for refinancing. Do you want a lower mortgage rate? · Shop around and apply. Pick your three to five refi;