The Application Process In Order

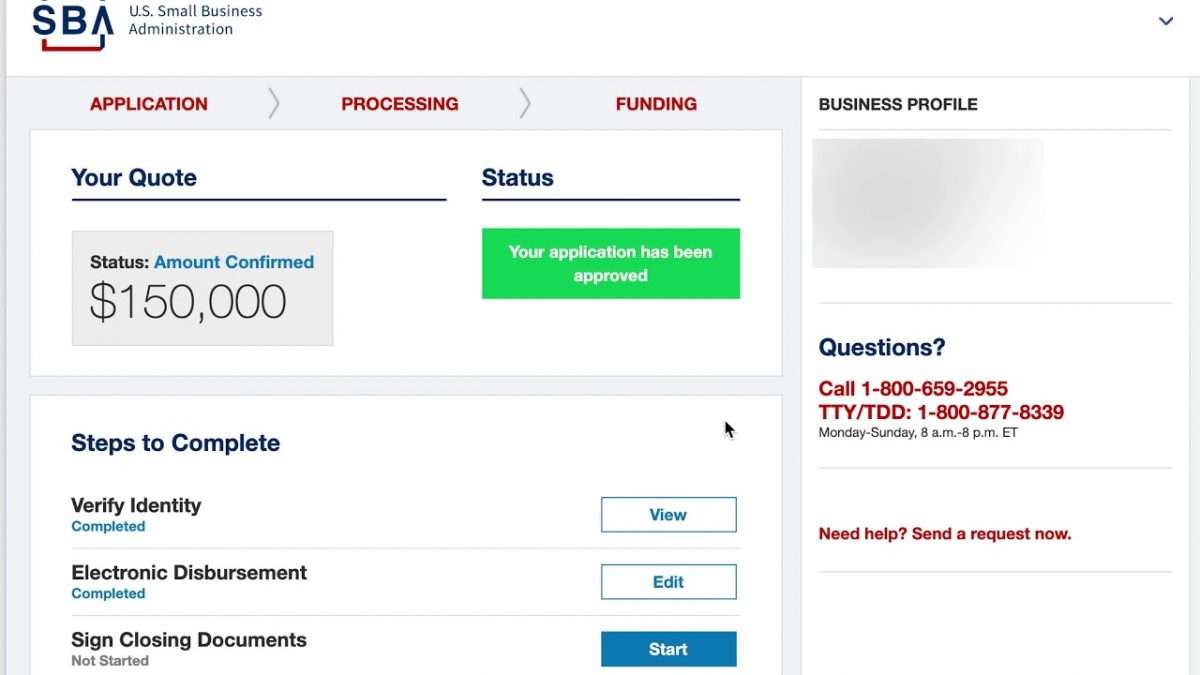

- Apply at DisasterLoanAssistance.sba.gov.

- Choose your loan amount up to the loan quote maximum.

- A loan officer will review your application and ask for more information if needed.

- A decision will be made and you will either be approved or your application declined.

If approved:

- Your loan funds will be transferred to your bank within 5â10 business days.

If declined:

Read Also: Usaa Car Loans Credit Score

What Do You Need To Be Eligible For An Sba Loan

To get an SBA loan, youre required to provide extensive financial documentation about your company to both the bank and the SBA. This allows the SBA to determine your eligibility and to see if the loan is a good fit for both the agency and your business.

The SBA has different qualifications for each of its loans. While there are numerous loan types available from international trade loans to veteran-focused lending programs the most common SBA loans are the 504 and 7. Regardless of which loan you decide to pursue, there are some major benefits to getting an SBA loan.

What Will You Need To Apply For An Sba Loan

As we mentioned before, lenders require the applicant to collect and submit a substantial amount of documentation for an SBA loan. So, after youve selected a lender and SBA loan program that works for your business, youll have to get all the required paperwork together. This can take a few weeks to collect, due to the number and variety of documents. These documents include the previous two years of financial statements, a business plan, the previous two to three years of business and personal income tax, business and credit report, resume and personal background statement. In addition to this, youll need to draft a business loan request, a summary of how you intend to use the loan, and a report detailing your businesss age and size.

Depending on what lender you go with, there be more, or less, paperwork involved. Its always better to strive to have all of the necessary paperwork, or even a bit extra, as business lenders tend to look more favorably upon applicants that are prepared.

In addition to the paperwork you will submit, you will need to fill out the lenders application for the loan and the required SBA forms. Some applicants like to have the help of their accountant and/or attorney when collecting some of the documents and filling out the application paperwork.

Recommended Reading: What Is The Average Motorcycle Loan Interest Rate

More Factors To Consider

Even in the most ideal scenario, the SBA loan process can be a long and arduous one. But as weve recently seen, other unforeseen roadblocks can emerge at any time to slow the process down even more.

The recent government shutdown, for example, included the SBA.

On an average day, the SBA processes hundreds of loans. During the shutdown, the agency was processing a much smaller volume, including certain disaster loans. Business owners who were already in the middle of the SBA loan process had to wait even longer to hear about the status of their application.

As of the publication date of this article, the U.S. government has reopened, but the SBA still has a significant backlog of loan applications to review meaning entrepreneurs who applied for loans months ago are likely still waiting on a verdict.

When the SBA works smoothly, it can still take a long time to hear back on funding requests. But, as the shutdown illustrates, other unforeseen variables can emerge at any time to slow the process down even more.

Before you apply for an SBA loan, its critical to do your due diligence and determine whether you can really afford to wait three months or more to get the financing you need to grow your business.

If you have the luxury of time on your side, you may find out an SBA loan is perfect for your needs. If not, you might want to look elsewhere for business financing.

asdfad

Make Your Pitch And Apply

Once youve narrowed down your search to a few vendors, its time to get everything together and make your pitch.

According to the SBA, lenders are more likely to approve applicants who can demonstrate industry expertise. This makes sense: Who wouldnt prefer lending to someone who knows the ins and outs of the industry theyre operating in?

Remember, this entire process can take up to 90 days and in some instances even longer. Before you decide to go down this route, make sure that your business can afford to wait that long for funding that may never end up coming in.

You May Like: Personal Loans No Credit Check

Speed Up The Process With An Sba Express Loan

Even when the SBA loan sounds ideal, the SBA loan process can be very long. Thereâs where the SBA Express loan comes in. You can sort of think of it as the little sibling to the SBA 7 loan.

You can use the Express loan just like a regular SBA 7 loan, but the application process is faster. The Express loan is only backed by a 50% guarantee by the SBA âwhich means youâll need to provide fewer documents and less paperwork. And that could shave off two to three weeks from the SBA loan timeline.

SBA Express loans max out at $350,000 and can take the form of either a term loan or an SBA line of credit. Theyâre more expensive than standard SBA loans because the guarantee isnât as high, so the lender will offer less ideal terms.

Sba Loan Process Vs Business Line Of Credit

More SBA loans are issued as term loans, but you might also be considering applying for an SBA line of credit, too. Or, even if you havenât looked at a business line of credit, you might want toâespecially if you want flexibility with how you can use your financing.

Business lines of credit from online lenders are some of the fastest ways you can get business financing in hand, and also have some of the lowest barriers for qualification.

Plus, with a business line of credit, these flexible ârevolvingâ lines of credit work like business credit cards, in which credit will become available again once you pay off your balance.

You May Like: What Is The Difference Between Direct Loan Subsidized And Unsubsidized

Sample Funding Times By Lender

| Lender |

|---|

| See Loan Offers |

Data as of 4/29/22. Offers and availability may vary by location and are subject to change.

Of course, some banks can fund you quicklyand some online lenders take longer than others. Take lending marketplaces. These companies shop around for loan offers for you, letting you compare potential loans.

So lending marketplaces can help you find a better deal than youd get by applying to just one lender. But that matchmaking process takes some timeusually a few daysso lending marketplaces will take longer than direct lenders will.

In other words, youll often find the fastest funding times at direct online lenders. But remember, your lender type isnt the only thing to think about.

Be Approved In 24 Hours With Lendthrive

Feeling apprehensive about getting an SBA loan? Are you worried the process will take too long and the money wont be there when you need it?

LendThrive, part of the AVANA Family of Companies, can approve you for a $25,000 to $150,000 small business loan in just 24 hours with a fixed interest rate.

If this sounds better than the one to three months it could take to get an SBA loan, contact LendThrive today and find out how we can help your business thrive!

Don’t Miss: Is There Any Loan For Buying Land

How Does The Sba Decide How Much I Get

The SBA will calculate economic injury according to a couple of different formulas spelled out in Disaster Loan Standard Operating Procedures. According to the SBA, economic injury is defined as:

change in the financial condition of a small business concern, small agricultural cooperative, small aquaculture enterprise, or PNP of any size attributable to the effect of a specific disaster, resulting in the inability of the concern to meet its obligations as they mature, or to pay ordinary and necessary operating expenses. Economic injury may be reduced working capital, increased expenses, cash shortage due to frozen inventory or receivables, accelerated debt, etc.

How To Apply For An Sba Loan

If youre thinking of applying for an SBA loan, get ready to wait.

While its not impossible to get an SBA loan approved in a relatively short period of time , more often than not the entire process will take at least two or three months.

Since many small business owners turn to loans when they need cash immediately, they usually dont have the luxury of waiting 90 days or more for a loan to potentially come in. Remember: SBA loans can be quite difficult to qualify for, so you could end up waiting for months, only to be declined.

Still, your business unique situation might be ideally suited for an SBA loan. If youve decided to apply for an SBA loan, heres what youll need to do.

Don’t Miss: How Much Interest Will I Pay For Student Loan

Create A Business Plan

You may not need a business plan to get an SBA loan. Not all loans or lenders require them. However, some will. And even if they dont, the information in your business plan can provide you and the lender with the information you need to demonstrate your ability to repay the loan. If you dont have one, get free business plan help at your local SBDC or from a SCORE mentor.

How Sba Loans Work

The SBA doesn’t lend money. It guarantees loans made by vetted banks, credit unions and other lenders, explains Funding Circle. In some cases, you might need to apply for a loan and be rejected by a commercial lender before the SBA guarantees your loan. The rejecting lender then makes the loan to you because the government guarantees it.

Why would the SBA guarantee a loan to you after a bank has already decided you’re not a good risk? The SBA exists to encourage entrepreneurship and help existing small businesses survive and flourish. Sometimes, businesses that are borderline risks for a bank are the kinds of small businesses the SBA wants to help. However, it wants commercial banks to look at you first, instead of the SBA becoming the first stop for countless small-business owners.

The SBA thoroughly reviews all paperwork, so you need to be a serious prospect. However, if the only things keeping you from getting a bank loan are issues such as a low credit score or no hard assets to put up to guarantee a loan, the SBA might help. The SBA also wants to assist startups and minority, veteran-owned, and women-owned businesses and has slightly looser qualifications for these types of businesses.

The initial SBA loan processing time can be reasonably quick, but your application might come back with questions. Even after the SBA approves the loan, your lender takes time to complete the loan process and get the money to you.

Also Check: How Much Is Mortgage Insurance Fha Loan

How Long Does It Take For An Sba Loan To Get Approved What Is The Sba Approval Time

If you are thinking about how long does it take to get an SBA loan after approval? The answer is about two to three months with most lenders. Some lenders may provide cash in as short as 30 days. The procedure necessitates patience, as potential borrowers must complete several forms and undergo extensive verification.

Online Business Loans And Lines Of Credit

Online lenders can be a good resource for newer companies or business owners with fair or bad credit. They also tend to fund loans more quickly than banks can, sometimes within a day. But their interest rates tend to be higher than those offered by banks.

Online lenders offering business loans and lines of credit include:

-

OnDeck: Business loans and lines of credit. Business owners with fair to good credit may be able to qualify for OnDeck loan products, but their interest rates can be high. Read NerdWallets OnDeck review.

-

Kabbage:Lines of credit only. Kabbage lines of credit are a good fit for business owners with fair credit who want fast access to capital, but their fee structure is complex. Read NerdWallets Kabbage review.

-

Funding Circle: Business loans only. Funding Circle tends to offer lower interest rates than other online lenders, but loans are more difficult to qualify for and take slightly longer to fund. Read NerdWallets Funding Circle review.

-

Bluevine: Lines of credit only. Bluevine lines of credit are available to business owners with as little as six months in business, but you may need to make frequent repayments. Read NerdWallets Bluevine review.

Recommended Reading: How To Find Your Student Loan Account Number For Irs

Sba Loan Process: Whats Involved

The SBA loan process can be confusing and difficult to navigate, particularly for first-time borrowers.

Hereâs an overview of the SBA loan process and how long each stage takes:

As you can see, there are a few steps involved from application to closing, and itâs important to be in close communication with your lender throughout the SBA loan process. If there are hiccups along the way, your lender will let you know of the best way to respond.

How Much Of A Down Payment Is Required For An Sba Loan

Certain SBA loans may require a down payment in the form of equity injection. A minimum of 10% is common. Depending on the requirements of the specific loan, this equity injection may come in the form of cash that isnt borrowed, a personal loan that can be serviced without using funds from the business, assets other than cash and/or debt that is on full standby .

You May Like: What Is An Fha Loan Florida

Why Do Sba Loans Typically Take So Long

Depending on the type of SBA loan youre applying for, the application itself could require detailed information that could take some time to gather. The more detailed and accurate your information, the better. While it may be tempting, you should not rush through completing your application.

Ideally, you wont be left to complete your application alone, but will work hand-in-hand with your lender. For example, at Stearns Bank, customers are more in control of the timeline of their SBA loan and have more influence over how quickly they receive their funds. The highly experienced lending team knows how to navigate the loan process, reducing the need for documentation whenever possible.

Finally, after the loan is approved by Stearns Bank, a convenient Customer Portal lets customers communicate with their loan team and securely provide any further documentation needed to keep the process moving.

What Is An Sba Express Loan & How Long Does It Take For Approval

Waiting too long for a traditional SBA loan may not be feasible, depending on your situation. However, if you need an emergency loan, the SBA Express Program may be worth considering. Its a simplified version of the 7 product with a maximum loan amount of $350,000. But this means it may be quicker to approve due to shorter lender underwriting times.

The average turnaround time for SBA express loans generally takes 36 hours. And that doesnt include the time it takes to get approval from your lender, which may add a few weeks. It usually takes 60 to 90 days for lenders to process an SBA loan application, but your overall timeline will look more like 30 to 60 days if youre going the express loan route.

You May Like: What Are The Different Types Of Loan

Is It Hard To Get An Sba Loan

Yes and no. Compared to some other business loan options, SBA loans usually have higher eligibility standards. But when compared to traditional loans, like bank loans, they are often similar in terms of the application process.

At the same time, these loans are designed to help businesses that cant get similar credit elsewhere, so you may have more luck getting an SBA loan than a comparable traditional loan from a financial institution. Just expect to put in some effort.

How To Find The Best Lender

While SBA loans are sometimes slow and frustrating, many small business owners have blamed the wrong institution for the problem. If you use a preferred lender like Stearns Bank, you are likely to have an entirely different experience than business owners who dont. Stearns Bank is typically able to approve loans in days, and their expert SBA lending team works hard to make sure the application process is quick and smooth.

Even if youll only be working with your lending team for a short period of time, it makes a huge difference when youre treated like an entrepreneur seeking a trusted finance partner. You should always feel respected and heard by your lender.

Although Stearns Bank is a nationwide lender, its roots are in small-town, Central Minnesota. Its lending team knows full well that with just a little bit of help and support, small businesses can transform entire communities. And should you give them a call, a friendly voice will answer on the very first ring.

Also Check: What Is The Max Conventional Loan Amount