Clean Up Your Credit Report

Your and history will almost always serve as the primary factor for the rates that lenders will offer you. These rates will influence your out-of-pocket monthly cost and the overall cost of the loan.

Credit score requirements vary by each lender. Most lenders will offer better rates to borrowers with scores above 670. Applicants with scores above 740 can potentially benefit from the lowest rates, including 0 percent APR deals offered by the manufacturer or dealership.

But having poor credit may not prevent you from finding a lender. Many lenders are inching away from traditional acceptance criteria and focusing on additional factors, such as education or job history.

Either way, it is in your best interest to improve your credit before applying for a loan. Grab a copy of your free credit reports from AnnualCreditReport.com, highlight any areas that need improvement and dispute any errors. Also, pay special attention to your debt-to-income ratio, which compares your monthly bills to your income. Doing so may help you score a competitive rate.

How Do I Apply For A Car Loan If I Have A Bad Credit History

There are some car loan providers that work specifically with poor-credit applicants. Before you begin your search, you should build up a small deposit and examine your budget to figure out how much you can reasonably afford to pay each month. Then begin to research and compare the different lenders who specialize in high-risk car loans.

Depending on how bad your credit history is, it may also be worth getting in touch with your current bank to see if it would be willing to consider your application. Make sure to contact your bank before submitting an application.

How Many Inquiries Is Too Many

Theres no one number that is too many, but generally, one credit inquiry every three to six months is not considered to be risky behavior by lenders and shouldnt affect your credit score too much. Multiple factors determine how many inquiries will affect your score, such as the length of your credit history and how many accounts you have. Keep in mind, hard credit inquiries remain on your credit report for two years.

Recommended Reading: What Properties Qualify For Fha Loan

Auto Loan: Get Your Credit In Check

The moment you decide a loan is in your future, check your . Your credit score, also known as a FICO score predicts your likelihood to repay a loan. Scores range from 300 to 850, with the average American having a score of 675. A top-tier score is 700 to 850, near-prime is 620 to 700 and subprime is less than 620 .

How do you know where you fit? Check out your credit report from the three main credit bureaus — Equifax, Experian and Trans Union. Thanks to the Fair and Accurate Credit Transaction Act, you can obtain a free report annually from each of the bureaus. Visit to get started. You can get an idea of your credit standing via the report, but for the actual score, you’ll need to pay a fee. If you are married and your spouse will be on the loan, be sure to check his or her score as well.

If you find that your score needs some improvement, try the following:

In addition to your score, your profession, proof of employment, home ownership and the ability to justify any issues on your report can also enhance your credit worthiness.

Now that you’ve taken this important step in the loan process, it’s time to determine how much you can afford.

Auto Loan: Planning And Organizing

When you are in the market for a new vehicle, consider shopping for your loan separately. Prequalifying for a loan allows you to go into a deal with funds already lined up, which means financing isn’t a discussion point until after you have most of the deal already worked out. Then, you can also bargain with the dealer for financing options. After all, you already have a loan lined up.

Don’t know where to start? Follow these steps:

Don’t Miss: Which Bank Gives Home Loan Easily

Check Your Credit Report

Your credit score and your income will determine how much you qualify to borrow and at what interest rate.

Dont apply for an auto loan without checking your credit report first. If there are any errors or incorrect information on your report, such as fraudulent activity, you could be turned down for a loan or offered only a very high interest rate.

Youre entitled to a free copy of your report every 12 months from each of the major reporting bureaus at AnnualCreditReport.com. If you find errors or evidence of fraud when you check your credit report, you should file a dispute to correct them, before you apply for a car loan.

Credit reports are the raw material used to calculate credit scores. Many banks, credit card issuers and personal finance services including NerdWallet also provide free online credit scores and report information. They are useful ways to gauge your progress, but they may not be the scores that lenders use to approve you. Most auto loan lenders use specialized scores that emphasize your history of repaying auto loans.

If your credit is subprime or poor typically a score of 600 or lower and you dont absolutely require a car right away, consider spending six months to a year improving your credit before you apply. Making payments on time and paying down credit card balances can help bolster your credit so you can qualify for a better loan.

What If I Change My Mind After Taking Out A Loan

Lets say you take out one of these loan options, and while repaying your loan, you decide that the loan isnt the right option for you. There are options you can pursue. If you are close to repaying, consider simply paying off the loan. You can also look into refinancing your loan. This process involves taking out a new loan to pay for an existing one. You can get new repayment terms, interest rates, and a new lender.

Recommended Reading: How To Calculate Car Loan Interest Per Month

How Do Car Title Loans Work

1.Apply

2.Get Pre-approved 2

3.Get Your Cash

An auto title loan is a secured loan with a lien on your vehicles title. How title loans work may seem complicated, but they are much simpler than people think. Before you look into other short term financial options like payday loans, or even credit card cash advances, you may want to consider a title loan. Max Cash Title Loans is here to tell you how car title loans work.

The amount you can get is based on your vehicles make, model, year, mileage, and general value of your car. Title loans use a vehicle as collateral in order to secure the loan funding, this gives lenders the ability to approve people despite poor credit or even past bankruptcy. Ability to repay the loan is also taken into consideration. The online title loan process is extremely simple, and fast. Many title loan borrowers are able to receive their funding the same or the next business day!5

To get started on the process, youll first want to gather the right documents. These include a copy of your car title, current insurance, proof of income, and drivers license. Next, give us a call, text or chat at and get approved.5 Or if you prefer, fill out the online application and well get back to you immediately. You dont even have to have a bank account to get started!

Considering Multiple Auto Loans And Your Credit

You can apply for as many auto loans as you want, although this may not be advisable. If your applications fall outside the typical 14 to 45-day window most credit scoring models allow, each additional hard inquiry will show up on your credit report.

Having a car loan may impact your credit score in a few ways depending on how you manage it:

- All car loans in your name show up on your credit report and this impacts your credit utilization. Your credit utilization represents the amount of credit you have relative to your total credit limit. The general rule of thumb is to keep your total credit utilization below 30%. If your new car loan amount pushes your credit utilization ratio over 30%, it could negatively impact your credit.

- Average age of credit: The average age of your credit is a factor that impacts around 15% of your score. Opening a new account via an auto loan will likely cause the average age of your credit accounts to decrease. This could in turn result in a slight credit score decrease. If you have a few long-term accounts though, it shouldnt make a big difference in your credit score.

- Payment history: Making on-time payments has the biggest impact on your credit score. This means if you continue to make payments on your car loan by the due date each month, this could help you build positive payment history and increase your score.

Also Check: How Much Can I Borrow For Home Improvement Loan

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Credit And Banking History

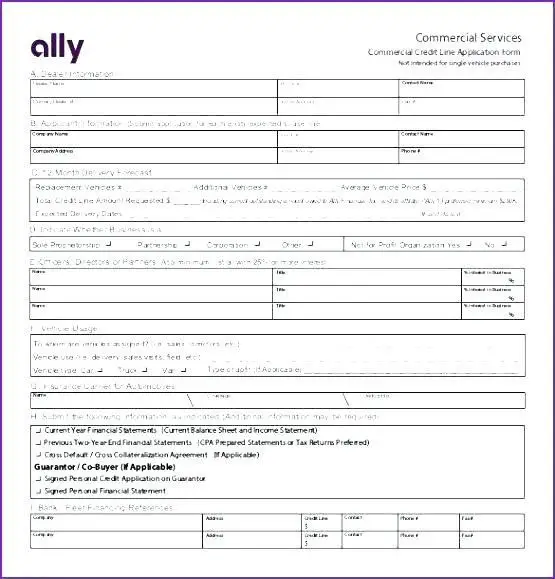

When you apply for a car loan, youll need to provide lenders your Social Security number, as well as your name, address and date of birth so they can pull your credit. Auto lenders may utilize different , including FICO auto scores.

They also may review your credit history, including the type of credit accounts you have, when you opened them, the credit limit or loan amount, your account balance and payment history.

Debt-to-income ratio

Lenders are looking at your history to determine if you have late payments or unpaid bills, as well as your total debt obligations to determine if you have a low enough debt-to-income ratio to support an auto loan.

In addition, lenders may also look at public records and collections in your credit history, including bankruptcies, foreclosures, lawsuits, wage garnishment and liens. A past history of unpaid bills and collections, especially related to an auto loan, will adversely affect a lenders confidence in your ability to repay the loan.

Recommended Reading: Easy Student Loans To Get Without Cosigner

How Does Lendingtree Get Paid

LendingTree is compensated by companies on this site and this compensation may impact how and where offers appears on this site . LendingTree does not include all lenders, savings products, or loan options available in the marketplace.

Written by Jenn Jones | Edited by Katie Lowery | Updated November 30, 2022

LendingTree is compensated by companies on this site and this compensation may impact how and where offers appear on this site . LendingTree does not include all lenders, savings products, or loan options available in the marketplace.

More Lenders To Choose From

When you shop in-person for auto loans, you are limited to lenders in your area. When you opt for an online auto loan, you can choose from any lender in the country. Some online lenders are more willing to work with individuals with bad credit than lenders in your area. If you want more options, consider checking out the online auto loan market to see what is available for borrowers with your credit history, according to Consumer Reports.

Don’t Miss: Where Can I Get An Auto Loan With No Credit

What Do I Need To Apply For A Car Loan

At Mission Fed, we want to make the car loan process fast and easy. You will be asked to provide personal information such as your name, social security number, current address, employment, and income information. Depending on the application, we may require additional information such as prior address and employment history or other income related information.

Apply online, over the phone or at any Mission Fed branch. When you apply, Mission Fed will review your credit report to see if you qualify for a loan. Its a good idea to review your credit history to ensure that you can correct any mistakes and explain any irregularities to lenders if necessary, before applying for a loan. Review our Credit Guide for more information about how to help maintain a positive credit score.

Show Up With Financing

Financing is negotiable and can be confusing, so consider going with a pre-approved offer, like one through Chase Auto. With Chase Auto you can apply for financing and arrive at the dealership knowing exactly how much you can spend. A pre-approval is usually good for a specific amount of time for a certain amount of money.

Read Also: What Are Current Jumbo Loan Rates

Finance Your Next Car With Us

| 2013 – 2017 | $17.13 |

Must meet membership and account criteria. All loans subject to credit approval. APR = Annual Percentage Rate. APRs listed are our best rates. Your rate may be higher based on your credit history and other qualifying criteria. Programs, rate, terms and conditions subject to change without notice. Financing up to 120% based on Retail Kelley Blue Book for used vehicles. Rates and terms available on purchase, lease buyout or refinance. On refinances of Mission Fed Auto Loans, a fee may apply. First payment may be deferred up to 90 days for qualified members. Interest will accrue during the payment deferral period. Loan amounts and terms based on age, mileage and condition of vehicle. Restrictions apply.

Rate Break ProgramHave less than perfect credit? You may qualify for Mission Feds Rate Break Program, which could help you save up to 3% off your rate while you build up your credit.

Autoland Car Buying ServiceLet the Autoland experts handle every step of the car buying process including contactless delivery of your car to your home or a Mission Fed branch.

Protect Your New InvestmentWeve partnered with LiveSmart Insurance Services, LLC to offer auto insurance to our Mission Fed members. With member pricing, you can feel confident in coverage options.1

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

You May Like: How To Refinance Avant Loan

Which Option Is The Best Fit For Me

Now that you know the basics about each of these loans, you may be a little closer to figuring out the best option. However, if you are still deciding, below are some tips that will help you make a final lending decision:

Auto Loans Are Usually Best When You Want to Buy a Car

Car loans are usually the best choice if you want to purchase a new or used car, regardless of whether you have bad or excellent credit. There are a few reasons for this, one being that you are likely to find unique financing options from specific dealerships or when purchasing a particular make or model. And because these loans are catered specifically for a car purchase, their repayment terms are better suited for car payment payoff. It may also be easier to track the equity you have in your car with a car loan.

Personal Loans Work Best if You Have Different Expenses

One of the most flexible parts of a personal loan is that you can use it for almost any expense. The most common reasons people take out personal loans are to pay medical-related bills, pay their monthly bills, debt consolidation, finance large purchases, travel, and more. And you can split up how you use a personal loan, so you can take care of multiple expenses.