Fha Loans Accept Lower Credit Scores

Officially, the minimum credit scores required for FHA mortgage loans are:

- 580 or higher with a 3.5% down payment

- 500-579 with a 10% down payment

Though in fact, the average credit score for FHA buyers was 678 in 2021.

High credit scores are great if you have them. But past credit history mistakes take a while to repair.

FHA loans can help you get into a home without waiting a year or more for your good credit to reach the excellent level.

Other loan programs are not so forgiving when it comes to your credit rating.

Fannie Mae and Freddie Mac say they accept FICOs as low as 620. But in reality, some lenders impose higher minimum credit scores.

Stricter credit score minimums are part of the reason the average credit score for completed Fannie Mae and Freddie Mac home purchase loans was 757 in 2021 nearly 80 points higher than the average FHA score.

Purchase A Cheaper Home

If you have low interest student loans which will take many years to extinguish it may make sense to start your housing journey with a cheaper home that is a bit smaller or a bit further from work in order to get started on the housing ladder.

Some people view renting as throwing money away, but even if you put 20% down on a home you are 5X leveraged into a single illiquid investment. Getting laid off during a recession can lead to forclosure.

Over the long run other financial assets typically dramatically outperform real estate. Buying a home for most people is more about investing in emotional stability instead of seeking financial returns.

Real Estate Price Appreciation

Real estate can see sharp moves in short periods of time, though generally tends to keep up with broader rates of inflation across the economy over long periods of time. In 2006 near the peak of the American housing bubble the New York Times published an article titled This Very, Very Old House about a house on the outskirts of Amsterdam which was built in 1625. They traced changes in property values in the subsequent nearly 400 years to determine it roughly tracked inflation.

Longterm Stock Market Returns

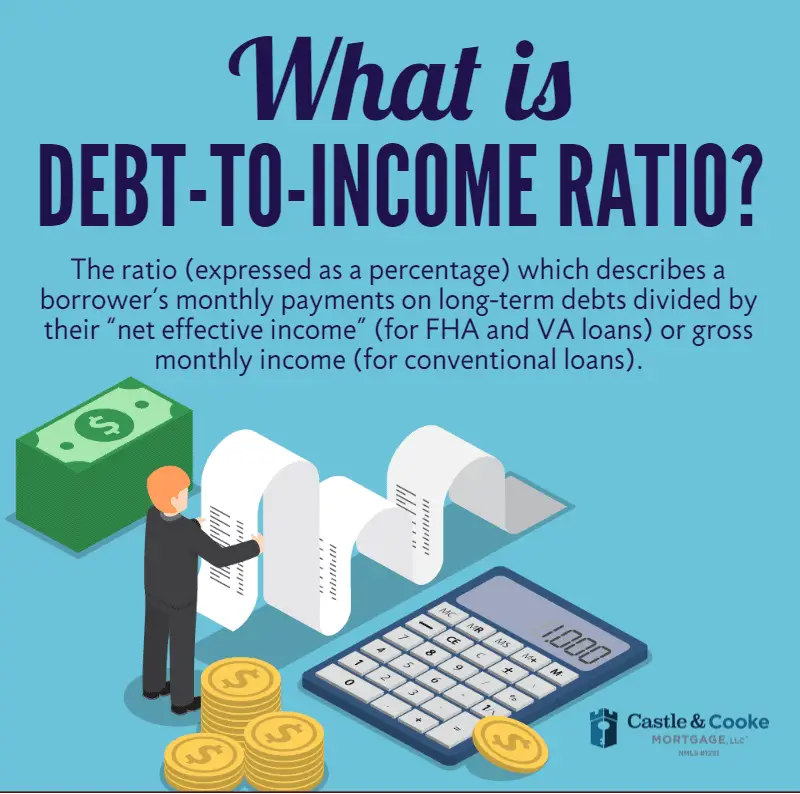

How To Calculate The Fha Debt To Income Ratio

When calculating the FHA debt to income ratio, you will start with your gross monthly income. Then, you will add up all of the required monthly payments that appear on your credit report. This includes credit card minimum payments, car payments, personal loans, other mortgages, etc. The only exception would be student loans since they are handled differently.

Here is an example of a debt to income ratio calculation. You can also use our debt to income calculator provided at the end of the article:

Gross monthly income = $6,200

- Proposed mortgage payment = $1,750

- Proposed monthly property taxes, insurance and HOA fees = $475

Total Monthly Obligations = $2,590

Debt to Income Ratio = $2,590 / $6200 = $41.7%

*Helpful HintsWhen shopping for a home, the property taxes will have a significant impact on your DTI calculation and ultimately how much home you will be able to purchase.

Read Also: How To Get My Student Loan Number

What Is Fha Dti

There are two types of DTIs to know. The front-end DTI is the percentage of your income that will go toward your mortgage payment each month. The back-end DTI is the percentage of your monthly income that will go toward all of your monthly obligations, including your mortgage.

Your DTI helps lenders determine your risk. Typically, the lower your DTI, the more options youll have available. On the other hand, if you have a high DTI, it might indicate you could not afford the mortgage, and thats a risky prospect.

Fha Credit Score Standards

You credit score and credit history are different but related sources of information lenders use to decide whether to approve your loan application. Your score is a predictive statistic and guess at your likelihood of repaying a loan.

When it comes to credit scores, bigger is better. Why? Lenders offer the best rates to borrowers who have the highest FICO credit scores.

The FHA minimum credit score is 500. However, if you want a loan with a 3.5 percent down-payment, then you must have a credit score of 580 or higher.

If you have a FICO credit score between 500 and 579, you are still eligible for an FHA loan. Borrowers with low scores must come up with a 10 percent down payment.

The 580 credit score standard is a bit deceiving in practice. It is common for lenders to place the bar higher and require a 620, a 680 or even higher score. Lenders may not go below the FHA’s minimum credit score, but are free to require higher scores.

These higher standards are known as lender overlays and they vary from lender to lender. Lenders add overlays as a precaution, especially on credit score requirements, because borrowers with low credit scores are more likely to default. Lenders worry about their overall FHA default rate. Lenders with high default rates are not allowed to stay in the FHA program and may receive financial penalties for making too many bad loans.

You May Like: How Can I Get Out Of My Car Loan

What Is A Good Debt

The lower your DTI ratio, the more likely you will be able to afford a mortgage opening up more loan options. A DTI of 20% or below is considered excellent, while a DTI of 36% or less is considered ideal. Compare your debt-to-income ratio to our measurement standards below.

| 36% or less | DTI ratio is good | A debt-to-income ratio of36/43 is favorable to lenders, because it shows you’re not overstretched. After paying your monthly bills, you most likely have money left over for saving or spending. |

|---|---|---|

| 37% – 50% | DTI ratio is OK | The maximum allowed DTIcan vary depending on the type of home loan you’re applying for and the requirements set by your lender. In most cases, the highest DTI that a homebuyer can have is 50%. |

| 51% or higher | DTI ratio is high | Just because you have a high DTI ratio doesn’t mean you can’t still qualify for a home loan. Lenders will look at your credit score, savings, assets, down payment and property value in addition to your DTI when considering your loan eligibility. Paying down debt or increasing your income can helpimprove your DTI ratio. |

Fha Foreclosure Waiting Period

If you have previously lost a home to foreclosure, you’ll have to wait three years before applying for an FHA loan. There are some exceptions, however, for circumstances like a serious illness.

Those who have experienced bankruptcy can also qualify for an FHA loan, though you’ll have to demonstrate that you’re now on better financial footing. Some allowances may be made on an individual basis, but in general, you’ll need to wait two years after a Chapter 7 bankruptcy and at least a year after a Chapter 13 bankruptcy to apply for an FHA mortgage.

Read Also: How To Check If Loan Is Fannie Or Freddie

High Debt To Income Ratio On Fha Loans

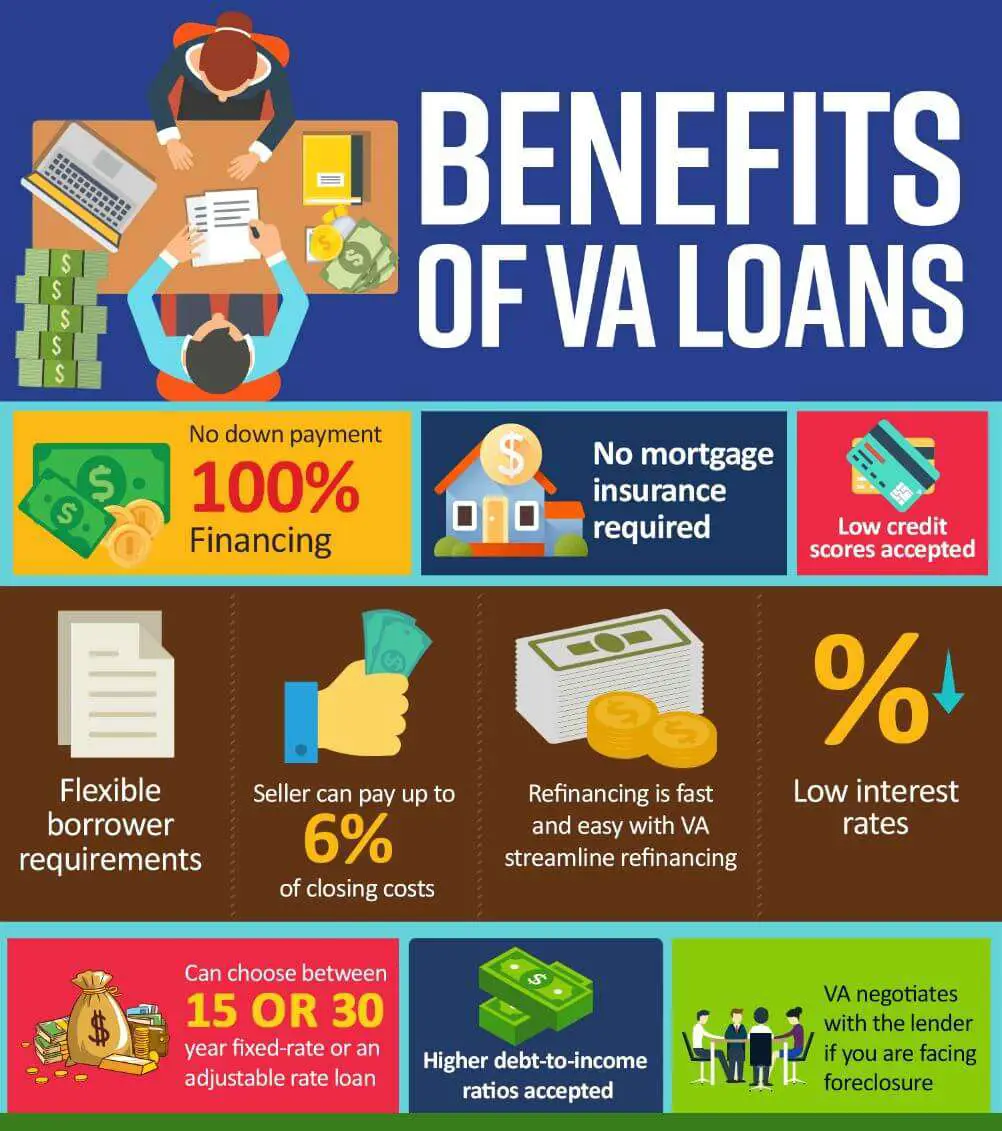

FHA Loans have the most generous debt to income ratio caps than any other mortgage loan program.

- Maximum front end debt to income ratio caps for FHA loans is 46.9% DTI

- Maximum back end debt to income ratio caps on FHA Loans is 56.9% DTI

- These ratios are for FHA home loan borrowers with credit scores of 620 FICO or higher

- For FHA borrowers with credit scores under 620 FICO, debt to income ratios are capped at 43%

Manual underwriting also caps debt to income ratios to 50% DTI with compensating factors.

What Income Is Used To Calculate Debt To Income Ratio

Debt to income ratios may be calculated using the following forms of income:

Wages for monthly employment is the primary determent of income

The following list includes other sources of income that can be used in addition to your monthly income. Non-taxable income can be increased by 15% for qualifying purposes. For instance, a borrower receives $1,000 in monthly benefits from the Social Security Administration. In order to qualify, the total annual gross income after adjustments would be $1,250.

401k income Alimony and child support Disability incomefrom your business Pensions Social security income

You May Like: How Long Does Loan Pre Approval Take

What Is Considered A Good Debt

What is the ideal debt-to-income ratio? Lenders usually say that the ideal front-end ratio should not be more than 28 percent, and the back-end ratio, including all costs, should be 36 percent or lower.

Is 4% debt-to-income ratio good?

Lenders prefer to see a debt-to-income ratio of less than 36%, with no more than 28% of that debt going to servicing your mortgage. Above that, the lender will probably reject the loan application because your monthly housing costs and various debts are too high in relation to your income.

Is 40 a good debt-to-income ratio?

The debt-to-income ratio of 20% or less is considered low. The Federal Reserve considers a DTI of 40% or more a sign of financial stress.

Going Bigger: Its Possible With Compensating Factors

The debt-to-income ratio for FHA home loans can be expanded to a DTI of as much as 50 percent. However, youll need compensating factors, which offset the risk of your higher debt load. Lenders check many dynamics before approving a mortgage, such as your job history, your credit score and your loan-to-value.

FHA guidelines mention specific factors that can compensate for a high DTI, but borrowers with a credit score below 580 are limited to a DTI of 43 percent regardless of compensating factors.

If your score is 580 or above, you may qualify for a loan with a DTI of 47 percent to 50 percent. However, having one of these additional qualifications may secure you a larger loan than youd otherwise qualify to get.

Note that FHA allows lenders to use compensating factors to expand DTI. It does not require them to do so.

Don’t Miss: Can I Pay My Golden 1 Auto Loan Online

What Income And Debt Is Used To Calculate Dti For An Fha Loan

Income for FHA loan

Your FHA lender wants your gross monthly income, which is how much you earn before taxes and other deductions are taken out. The following types of income can be used in your debt-to-income ratio for an FHA loan:

- Wages from an employer

- Disability income

- 401, social security, or other pensions

Debt for FHA loan

Your debts are recurring monthly payments, like rent, car loans, and credit cards. These are minimum payments, not account balances or principals . So if you owe $5,000 on a personalloan but your minimum monthly payment is $250, then youâd use the $250 as debt in your DTI ratio. The FHA considers the following as debts:

- Rent or monthly mortgage payments

- Child support or alimony

The FHA doesnât consider monthly utility bills, food costs, transportation, insurance premiums, retirement contributions, or savings contributions as âdebts,â even if they are recurring.

Convert The Result To A Percentage

The resulting quotient will be a decimal. To see your DTI percentage, multiply that by 100. In this example, lets say that your monthly gross household income is $3,000. Divide $900 by $3,000 to get .30, then multiply that by 100 to get 30. This means your DTI is 30%.

Take the first step toward the right mortgage.

Apply online for expert recommendations with real interest rates and payments.

Also Check: Who Can Get Personal Loan

The Fha’s Debt Ratio Limits

According to HUD Handbook 4000.1, FHA borrowers can have a maximum qualifying ratio 43%. Add up the total mortgage payment for your potential new home as well as your recurring monthly debt . Then divide that amount by your gross monthly income. That number should fall under 43% to qualify.

Many borrowers may have a high enough credit score to qualify for FHA loans and be able to make the down payment as well. But your debt-to-income ratio plays a big role in a lender determining whether you should be granted a loan. A good credit report is important, and it shows lenders that you have a history of making payments on time. But a debt ratio that’s too high tells them that you have high monthly expenses compared to how much money you earn and that you might not be the best at budgeting.

The FHA makes some discretionary exceptions for borrowers with debt ratios higher than 43% based on certain compensating factors. Borrowers who have higher credit scores, verified cash reserves, or Energy Efficient homes might be granted a loan despite higher debt-to-income ratios.

Fha Loan With High Debt To Income Ratios Mortgage Guidelines

In this blog, we will cover and discuss FHA loan with high debt to income ratios. Borrowers can qualify for FHA Loan With High Debt To Income Ratios with lenders that has no overlays. Many folks believe that all lenders have the same FHA Mortgage Requirements. However, that is not the case. All lenders originating and funding FHA Loans need to meet the minimum HUD Guidelines. However, a lender can have their own lending requirements that are above and beyond those of the minimum HUD Mortgage Requirements. These additional requirements are called FHA Lender Overlays. There are two types of debt to income ratios. In this article, we cover and discuss qualifying for FHA loans with high debt-to-income ratios.

In this article

You May Like: How Much Can I Borrow Fha Loan

What Are Debt Ratios

Your debt-to-income ratio gives lenders a clear picture of how much you owe each month to how much you earn. The debt ratio is calculated by dividing the sum of your monthly debts and dividing it by your total assets.

For your monthly debt, the FHA take into account all the money you owe: credit card or lines of credit payments, car payments, student loan payments, taxes, insurance, alimony and child support, as well as the amount of your potential new house payment. Your pre-tax income, wages, tips, child support, social security, amounts to your total monthly assets. The number you arrive at after dividing your total debt by assets is your debt-to-income ratio.

Fha Dti Ratio 2019 Formula

What is the formula to calculate the FHA Debt-to-Income Ratio? How can we calculate our DTI and stay ahead in the game?

Well, this is quite simple, isnt it? All you have to do is divided your monthly debts by your pre-tax income.

For instance, if the total of your recurring monthly debts is $2,000 and your gross monthly income, lets say, is $6,000, then you are going to have a DTI ratio of 33%.*

*This is just an example and has nothing to do with the requirement to be considered for the loan approval.

Formula of DTI = Monthly Income/Gross Income

So, this is how you can easily calculate your or anyones, such your friend to understand if you are able to qualify for the loan or not. If not, you have to prepare yourself for it.

HUD has instructed the special guidelines for both lenders and borrowers with regard to the FHA Debt-to-Income ratio and conventional Debt-to-Income ratio which, we believe, you must read out carefully to be familiar of what is required. Thats who you will learn more about the FHA DTI Limits and will be helpful for you in the long run.

The HUD speaks about the important of DTI in its guidelines. It says that DTI qualifying ratios are extremely important for the borrowers. Their qualification will determine that they will lend a loan and that will only happen if they meet certain expenses involved in the homeownership, and provide for borrowers family.

Don’t Miss: When Are Student Loan Payments Due

Fha Loan Requirements For 2022

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Mortgages backed by the Federal Housing Administration have different requirements from other types of home loans. Though you don’t have to be a newbie, FHA loans are often popular with first-time homeowners because they couple lower down payment requirements with more lenient standards for credit scores and existing debt. Here’s a rundown of the key FHA loan requirements.

Fha Front End Debt To Income Ratio Calculation

The front end debt-to-income ratio is a calculation that takes the monthly gross income divided by the mortgage payment, including taxes, insurance, mortgage insurance fee, and any other expense paid monthly. According to the guidelines of the Federal Housing Administration , the maximum front end ratio can be up to 40% depending on the borrower’s credit history.

Here’s an example. The borrower earns $2,000 and the anticipated mortgage payment is $800 a month. The front end calculation includes the real estate taxes, homeowner’s insurance, mortgage insurance premium, and any other required fees.

$650 /$2,000 = 33%

Recommended Reading: How To Get Income Tax Loan

Whats Included In Your Dti

On the debt side, your lender includes your monthly housing payment of principal, interest, property taxes, HOA dues , homeowners insurance and mortgage insurance.

FHA loans require mortgage insurance. Your debts also include minimum payments on your credit card balances, student loans, installment and other accounts. If your student loan payments cannot be documented, FHA loan guidelines assume a monthly payment of one percent of the balance.

Installment loans that will be paid off within 10 months wont count as part of your DTI. However, your lender must include the amount of that payment that exceeds 5 percent of your monthly income. So if you earn $4,000 a month, and your auto loan has six payments left at $500 a month, youll only be hit with $300 a month.

- $4,000 income * .05 = $200

- $500 payment – $200 = $300

If youre on the edge of being able to qualify, paying down an installment debt to less than ten remaining payments can be a good strategy for loan approval.