Conventional Loan: 620 Credit Score

Non-government conventional mortgage loans charge higher interest rates and fees for borrowers with low credit scores.

Fannie Mae and Freddie Mac, the agencies that administer most of the conventional loans in the U.S., charge loan-level price adjustments, or LLPAs. These fees are based on two loan factors:

- Loan-to-value : LTV is the ratio between the loan amount and home value

As your LTV rises and your credit score falls, your fee goes up. For instance, a borrower with 20% down and a 700 credit score will pay 1.25% of the loan amount in LLPAs. But an applicant with a 640 score and 10% down will be charged a fee of 2.75 percent.

These fees translate to higher interest rates for borrowers. That means lower-credit score applicants will have higher monthly mortgage payments and will pay more interest over the life of the loan.

The majority of lenders require homeowners to have a minimum credit score of 620 for a conventional loan. But while that threshold is pretty low, the additional fees charged for poor credit often mean FHA loans are more affordable for bad-credit borrowers.

The Best Va Mortgage Lenders Of September 2022

Insider’s experts choose the best products and services to help make smart decisions with your money . In some cases, we receive a commission from our our partners, however, our opinions are our own. Terms apply to offers listed on this page.

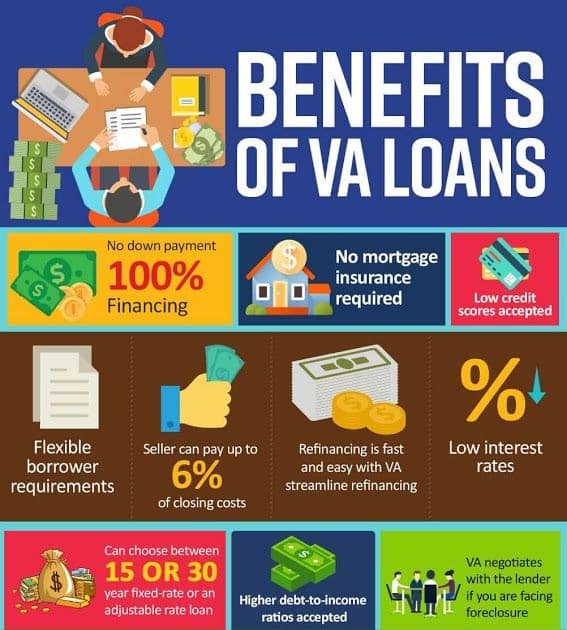

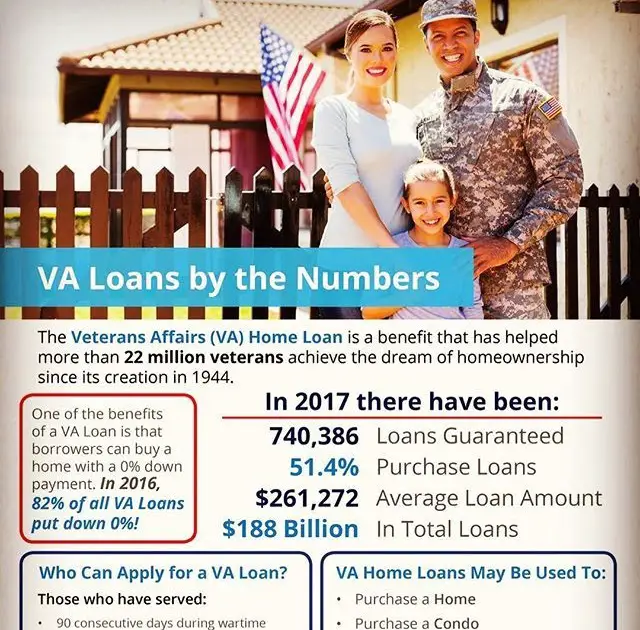

VA mortgages are a really valuable benefit for those who qualify for them. These home loans are available to active military, veterans, and their spouses. You can buy a home without making a down payment, and the VA doesn’t limit how much you can borrow. You’ll also probably pay a lower interest rate than you would on a conventional mortgage.

The best VA mortgage lenders have low minimum credit score requirements. Most have strong customer satisfaction and trustworthiness scores. And many have special features such as live online chat or digital closing options.

Other Va Loan Lenders We Considered

While there are many mortgage lenders with outstanding products and features, they dont necessarily have everything that could make them one of our top picks.

We reviewed the following lenders, and while they meet some of our criteria for top VA loan lenders , they ultimately didnt make the cut.

Veterans First

Thanks to its fully online mortgage process, Veterans First is a great choice for military members deployed overseas. Its focus on VA loans also means that the company is better prepared to attend to the specific needs of military members and veterans during the mortgage process.

On the other hand, Veterans Firsts specialization in VA loans means that it offers no other types of loans, which makes it less than ideal for anyone who doesnt qualify for these products. Its higher than average credit score requirement was also a deciding factor in keeping it out of our top list.

North American Savings Bank

North American Savings Bank is dedicated to servicing customers in the Kansas City, MO area, but it extends its mortgage services to individuals all over the U.S. In addition to standard VA loan products , it offers many mortgage options for individuals who are unable to provide traditional credit and income data.

- 12 branch locations limited to Missouri

- VA mortgage rates are higher than average

Read Also: Veterans United Home Loans Review

How To Improve Your Fico Scores

Improving your scores can require several months or can be as quick as a few days. If the borrower has multiple late payments and collections, the time required could be several months. However, some quick ways to improve your credit score are: lowering the balances on your credit cards below 30% of the balance, opening a secured credit card and eliminating Finance company accounts. If you would like help or more information, please call now 803 261 9267! Having an VA Loan or a Jumbo mortgage expert guide you through the process of obtaining a loan with bad credit is critical.

Bad Credit May Not Be The Only Hurdle

Veterans who’ve experienced a bankruptcy, foreclosure or short sale might face unique homebuying challenges beyond the hit to their credit score .

These negative credit events usually come with required waiting periods, also known as seasoning periods, during which the Veteran will likely be unable to close on a home loan. The length of these waiting periods can vary depending on the event and the type of loan you’re hoping to get.

Generally, the waiting periods for VA loans are shorter than the ones for conventional mortgages. But much like credit score minimums, guidelines on seasoning periods can vary by lender.

Broadly, though, one of the benefits of VA loans is that they allow Veterans to bounce back faster into homeownership after one or more of these big credit hits.

Recommended Reading: How To Calculate Dti For Fha Loan

Bnc National Bank: Nmls#418467

Min. credit score

On VA loans, BNC National Bank offers down payments as low as 0%.

View details

View details

Why we like it

BNC National Bank offers a robust variety of loans, but you have to reach out to a loan officer to get customized interest rates.

Pros

-

Offers a wide variety of loan types and products.

-

Has robust online capabilities, and an app for iOS and Android.

-

Mortgage interest rates are lower than typical, according to the latest data.

Cons

-

Has a limited number of physical mortgage offices.

-

No rate information is available without starting an application or speaking with a loan officer.

-

Does not offer home equity loans or lines of credit.

Personal Loans For Students

A college loan – be it federal or private – doesnt necessarily cover all the costs of college, and this is where personal loans for students can come in handy.

In 2018, the average cost per year for a 4-year degree reached $26,593, and at private institutions it was a staggering $41,468, according to the National Center for Education Statistics. These costs reflect only the price of tuition, fees, room, and board, and dont take into consideration all the other costs that can come with being a college student.

A growing number of students are turning to personal loans as a way to cover the costs in college, and are taking to the internet to find the right loan for them.

Recommended Reading: Loans With Bad Credit Same Day

Interest Rate Reduction Refinance

If you already have a VA loan, an Interest Rate Reduction Refinance Loan can reduce your monthly mortgage payment. It can also convert your mortgage from a variable interest loan to a fixed interest loan.

A fixed interest loan doesnât always lower your mortgage payment, but it will make sure itâs stable from month to month. Itâs also known as the Streamline Refinance Loan, because it streamlines your repayment process.

Va Home Loan Eligibility Does Not Guarantee Loan Approval

One of the most important things to remember about using VA home loan benefits is that your eligibility for the VA loan program does not guarantee you a loan. All VA loan applicants are required to financially qualify the same way all home loan applicants are regardless of the type of mortgage you seek.

That means credit scores, credit history, and other financial information will be very important for the purposes of home loan approval. The VA loan rulebook states, By law, VA may only guarantee a loan when it is possible to determine that the Veteran is a satisfactory credit risk, and has present or verified anticipated income that bears a proper relation to the anticipated terms of repayment.

The VA does not set FICO score requirements-that is the job of the lender, so your FICO score requirements may vary from one participating lender to another. That is one reason why it is so important to shop around for a participating lender-you may find more forgiving credit requirements from one company and not another.

Also Check: How Big Is Jumbo Loan

How Does Auto Loan Refinancing Work

An auto loan refinancing involves replacing your current auto loan with a new one, usually from a different lender. Its a method to re-start your auto loan with a reduced interest rate and the loan duration you want. The length of your new loan might match the number of months left on your current loan, or you can cut or prolong it.

Find Another Va Lender

Lets say your lender conducted a manual review and still rejected your loan application. Your next option is to look for VA mortgage lenders that accept more flexible borrower qualifications. Certain lenders like Guaranteed Rate are more willing to work with veterans buying a house with bad credit. Its our way of saying thank you for your service. If youre turned away by one lender, there could very well be another mortgage company out there thats more than willing to extend you a home loan.

Don’t Miss: What Is The Best Debt Consolidation Loan Company

Can Veterans Get A Car Loan After Bankruptcy

After bankruptcy, you can certainly qualify for a VA loan, and youll often have a shorter wait time than you would with a standard loan.

Getting a VA loan is not a quick or straightforward process after bankruptcy. It can lower your credit score by 130 to 240 points, according to credit scoring company FICO. A consumers credit score can take three to ten years to recover fully, and you may need to work for a significant portion of that time to restore your credit.

Depending on whether you filed for Chapter 7 or Chapter 13, you may have to wait until your bankruptcy is over to secure a car loan.

Many car loan companies will help you finance a car even if you have filed for bankruptcy. However, you should expect to pay hefty interest rates if you take out a car loan soon after achieving a bankruptcy discharge.

Who Can Qualify For An Fha Loan

There are certain requirements that a person needs to meet in order to be eligible for an FHA loan. There are certain minimum standards set by the FHA, but the private lenders might have their own rules. Generally, you will need to have a credit score of at least 500. However, there will usually be a higher down payment that you need to make if your credit score is below 580.

If your credit score is at least 580, the down payment can often be just 3.5%. However, this can rise to 10% of the home price if you have a lower credit score. There is the option to use gift money as a way to make the down payment for the FHA loan, which is useful. In terms of the minimum required debt to income ratio, it needs to be lower than 50. There are also minimum requirements that the home you are looking to purchase has to meet.

The FHA will need an appraisal that is outside of the regular home inspection. The FHA needs to be confident that this will be a good investment for the borrower. Finally, there will be FHA mortgage insurance that is built into each loan. An upfront mortgage insurance payment has to be paid when you obtain an FHA mortgage. There will then be monthly payments necessary in some cases.

Read Also: How To Apply For Fha Loan In Illinois

Tips For Finding A Va Loan

If youâve decided a VA loan is the best option for you, and youâve received your Certificate of Eligibility, there are many great lenders you can work with. Letâs explore how to get a VA home loan with poor credit.

While most VA loans will have similar qualifications and application requirements, they are not all created equal. In addition, lenders have the power to make the actual terms of the loan to best benefit their institution.

Here are five things to keep in mind on your search:

When it comes to finding a lender you trust, there are a few categories you may want to explore. Each has its advantages and disadvantages.

How To Get A Mortgage With A Low Or Bad Credit Score

Lenders consider four primary factors when reviewing a mortgage application:

Your credit score.

The amount of debt you carry compared to the income you receive, also called your debt-to-income ratio or DTI.

Your employment history.

The size of your down payment.

Two or three positive factors might outweigh a negative one. Here’s what you can do to improve each of them and bolster your chances of getting approved for a mortgage.

Don’t Miss: Is Student Loan Refinancing Worth It

How To Improve Your Credit Score For A Va Loan

- Manage your credit responsibly. The way borrowers use credit can impact their finances and ability to get a loan for a house. When you handle your credit responsibly by paying your bills on time or not exceeding your card limit you show lenders that youre a reliable borrower.

- Make sure your credit card balance is low. A high balance on your credit card can bring down your score, which is why its important to keep your balance reasonably low. We recommend you have a balance thats 30% or less of your cards limit.

- Pay outstanding debt and balances. When applying for a mortgage, lenders typically want to see your payment history and whether you have any outstanding debts. Because of this, you need to pay off your balances, and sometimes you cant move forward with the loan process until you do.

- Fix mistakes on your credit report. can sometimes include errors, leading lenders to reject your loan request. We recommend thoroughly reviewing your credit report and fixing any errors you may come across.

What Is The Minimum Credit Score Required For A Home Loan

Of course, private lenders are free to set their own credit score requirements, so there is no hard and fast rule specifying the minimum FICO score for a conventional loan. A survey of different lenders indicates that the minimum score may be around 620.

If you want an FHA or VA loan, youll need a credit score of at least 580. However, if you are willing to put down 10%, you can get an FHA home loan with a score as low as 500.

If your credit score is below 500, you may want to take steps to improve your credit, such as credit repair or debt management.

The process involves combing through your credit reports, which you can get for free from AnnualCreditReport.com, the only source authorized by federal law. Common mistakes include unknown accounts, unauthorized credit checks, and incorrect balances.

While DIY credit repair is possible, it is time-consuming and requires good organizational skills. Many consumers prefer to use credit repair companies to do all the heavy lifting with a credit bureau.

Typically, charge between $50 and $150 per month, depending on the level and aggressiveness of service. The usual subscription period is six months, but you can cancel or extend it as you see fit.

While these companies cant guarantee success, they commit to challenging a set number of questionable items each month. Your score should improve within two months after removing derogatory items that dont belong on your credit reports.

Recommended Reading: Does Va Loan Work For Manufactured Homes

What Credit Score Do I Need For A Bad Credit Loan

You dont need any credit score to get a payday loan. Thats one of this loan types biggest attractions. Payday lenders dont check for a poor credit score, and applying for one of their loans doesnt affect your credit.

Bad credit personal loan providers do check credit, and some lenders may turn you down when your credit is lousy. But many personal loan lenders have flexible attitudes toward credit scores, relying on other indicators such as the debt-to-income ratio.

Your DTI indicates whether you can afford new debt, and some lenders accept ratios as high as 50%.

Your poor credit score is also immaterial for certain other poor credit loans, including title, pawn, equity, and secured loan offerings. All of these rely on collateral to secure your loan. While easy to get, remember that you can lose your property if you fail to meet the loans obligations. That means you may find yourself without a home or a car if you default.

Unsecured bad credit personal loans are less risky since they dont require you to issue a lien on your personal property. A direct lender must go to court to wrest your assets from you if you default on an unsecured loan, a costly and risky pursuit. From a risk viewpoint, this is the best bad credit loan.

If you have a secured personal loan, the direct lender will have a much easier time seizing the collateralized asset. Bankruptcy does not protect you when you default on a secured personal loan.

How Is An Fha Loan Different From A Normal Mortgage

The main difference between an FHA loan and a regular type of mortgage loan is that the federal government will insure the FHA loan and they will therefore be easier to obtain. This means that people will lower credit scores can purchase a game.

There are also more favorable rules with FHA loans when it comes to monetary gifts from employers, charities, and family members. However, there are certain closing costs that might be associated with FHA loans that you wont find with a regular type of mortgage loan.

Don’t Miss: What Is The Best Private Loan For College