How Does Credit Affect Your Mortgage Affordability

The first step a lender typically takes upon receipt of a mortgage application is a credit checka request for your credit score and credit report from one or more of the three national credit bureaus .

Lenders typically have a minimum credit score they’re willing to consider when evaluating borrowers. Different lenders have different minimum score or “cut-off” requirements. Lenders use credit scores when deciding whether to offer a loan as well as when determining the fees and interest rates to charge.

In accordance with a widespread industry practice known as risk-based pricing, applicants with the highest credit scores typically are offered the lowest interest rates available. Those with lower credit scores are typically charged higher interest . The basis for this is the fact that individuals with higher credit scores are statistically less likely than those with lower scores to miss payments and require lenders to initiate collections, foreclosure or other loss-prevention measures.

Mortgage lenders often offer numerous loan packages, with different interest rates and fees, targeted to borrowers whose credit scores fall within a specific numerical rangesfor instance, one offer for applicants with credit scores of 800 or better another for those with scores of 720 to 799 and another for those with scores of 650 to 719. These are purely hypothetical examples each mortgage lender sets its own credit score requirements.

How Much Mortgage Can I Get If I Earn 30000 A Year

If you were to use the 28% rule, you would be able to repay a mortgage of $ 700 per month with an annual income of $ 30,000. Another guideline to follow is that your home should not pay more than 2.5 to 3 times your annual salary, which means that if you make $ 30,000 a year, your maximum budget is $ 90,000.

How much credit do I need for a 200k loan? A $ 200k loan with 4.5% interest rate over 30 years and a $ 10k down payment will require an annual income of $ 54,729 to qualify for the loan. You can even calculate further variations on these dimensions using the Loan Required Income Accountant.

Fha Mortgage Insurance Requirements

Lenders are willing to offer FHA loans because they know that in the worst case scenario, where they have to foreclose on a home, the FHA will pay them back. That’s why you’ll sometimes see the FHA described as insuring home loans.

That FHA backing is funded by you, the homeowner, via FHA mortgage insurance. You’ll be required to make an upfront mortgage insurance premium equal to 1.75% of the loan amount at closing, though this can be rolled into the loan. After that, you’ll make monthly mortgage insurance payments. If your down payment is 10% or more, you’ll have to make these payments for 11 years.

But if you make a down payment of less than 10% on an FHA loan, the only way to get out of paying monthly FHA mortgage insurance is to refinance into a conventional loan. FHA mortgage insurance can’t be canceled the way private mortgage insurance can. The amount of insurance you’ll pay is calculated based on the length and total cost of your mortgage as well as the amount of your down payment.

Read Also: Usaa Car Loans Reviews

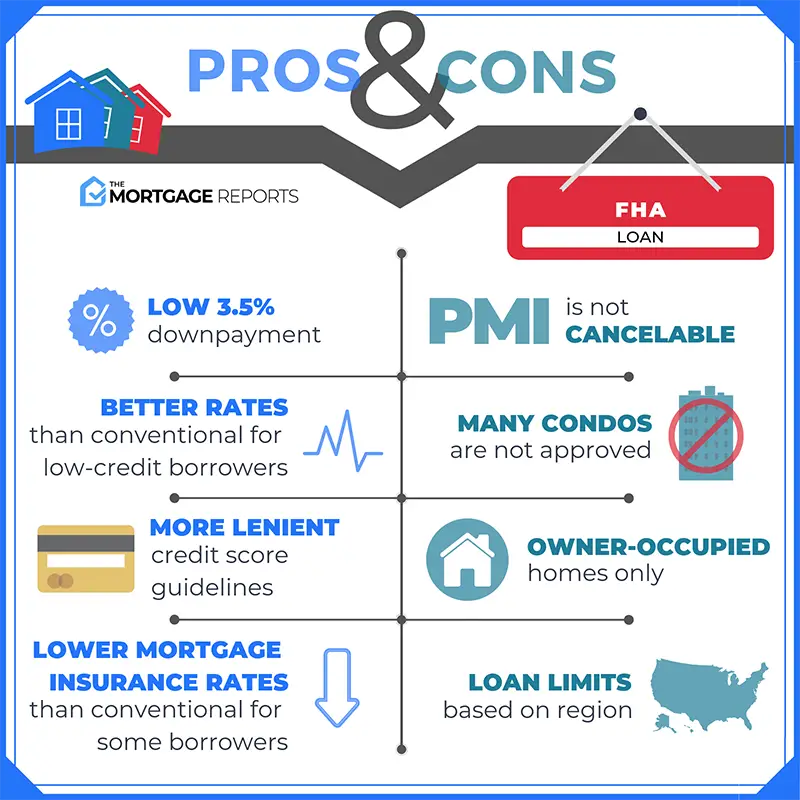

Benefits And Disadvantages Of Fha Loans

There are several benefits to FHA loans. They have lower credit score requirements, lower down payment requirements, and their overall qualifications and standards are easier for more individuals to meet. Conventional loan terms are set by private mortgage lenders. That means they tend to be harder to achieve.

However, FHA loans do require mortgage insurance. This is an added cost to your loan purchase and should factor into your monthly payment.

Youll likely benefit from an FHA loan if:

- You can afford the FHA minimum down payment requirement

- You have a credit score under 680

- You have little experience with mortgage loans

An FHA loan may not be right for everyone, especially those with a high credit score and a sizable down payment.

Required Income Calculator For A Home Purchase Or A Refinance

Have you found a home that you want to buy? Or plan on refinancing? Or you’re looking at homes around a certain price point. Can you get a loan to buy it? Need to see how much you can qualify for on a refinance?

This mortgage income calculator can give you the answer. This calculator not only takes into account the loan amount and interest rate, but also looks at a whole range of other factors that affect the affordability of a home and your ability to get a mortgage, including your other debts and liabilities that have to be paid each month, as well as costs like taxes and homeowner’s insurance that are part of the monthly mortgage payment.

It also makes it easy to see how changes in the mortgage rate or the loan amount affect the income required for a loan, by using the sliding adjusters below to change your results. Just start filling out the fields indicated below. Or scroll down the page for a detailed explanation of how to use the Mortgage Required Income Calculator.

- FAQ: Great tool to use as loan amount estimates change as you shop for a new home. Or for a refinance when the appraised value forces a change in loan amounts because of loan to value .

You May Like: Usaa Auto Loan Rates Today

What Are Your Closing Costs

Closing costs vary by state, city, and lender, which makes them hard to predict. But you’ll need to come up with the closing costs in cash – they don’t get rolled into your loan.

The fictional $200,000 mortgage referenced above would require you to come up with $4-6,000 in cash to pay for things like title insurance, appraisals, and attorneys.

Depending on your state, you can negotiate with the seller or the lender to avoid the closing costs. However, this isn’t always an option.

What Are The Miminum Income Requirements For Fha Loans

Related Articles

Buying a new home is one of the most significant investments most people make during their lifetime and saving up the money needed to get into a house can be daunting. If you don’t make a lot of money, an FHA loan can help as it has more flexible income guidelines and debt-to-income requirements than other loan types.

Tip

You must have a steady income for the past three years that can cover the house payment and MIP without taking your total debt beyond lender limits.

Recommended Reading: Usaa Auto Loans Bad Credit

Can I Get A Cash

Yes, you can get a cash-out refinance with an FHA loan. This allows you to exchange your current mortgage with a new, larger one. Then, you can put away the difference as cash to spend on financial needs like home improvements. The amount you receive through refinancing depends on your homes equity and value, though.

For an FHA cash-out refinance, borrowers need at least 20% in home equity. In addition to paying off your current loan, finding out your homes value through an appraisal will help you pinpoint the equity in your home.

Fha Loan Refinance Requirements

The requirements for refinancing your existing FHA home loan with the FHA streamline program are often simpler compared to buying a home with an FHA loan. You need to receive a real benefit from refinancing, typically by lowering your interest rate. You need to have had your current loan for a minimum of six months. You have to be up-to-date on your mortgage payments and have a recent history of paying your monthly mortgage bills on time.

The streamline program does not require a home appraisal or income verification. It also has more flexible credit and debt-to-income requirements. At Freedom Mortgage, we can help FHA homeowners refinance their homes with easy credit qualifications. Learn more about the FHA streamline refinance program.

Read Also: Capital One Auto Loan Application Status

Requirements: Monthly Income Needed For An Fha Loan

Elsewhere on this website, we have covered some of the minimum requirements for an FHA loan. Today, we will zero in on the amount of income thats needed to qualify for an FHA loan.

While the Federal Housing Administration does not have any specific income requirements for FHA loans, they do have some established guidelines for whats known as the debt-to-income ratio. This ratio can determine how much you are able to borrow with an FHA loan, based on your monthly income level.

In short: Most borrowers are limited to a total DTI ratio of no more than 43%. For well-qualified borrowers with compensating factors, the DTI can be as high as 50% in some cases.

Ask Freedom Mortgage About Fha Loans

Freedom Mortgage is the #1 FHA lender2 in the United States. To get started with your FHA loan application, contact a Freedom Mortgage Loan Advisor by visiting our Get Started page or by calling .

See Chapter 3 of the HUD Handbook 4150.2 for more information on the health and safety requirements of homes purchased with FHA loans. All chapters of the handbook can be found here.

You May Like: Usaa Approved Dealerships

Calculating The Income Required For A Mortgage

You’ve got a home or a price range in mind. You think you can afford it, but will a mortgage lender agree? Or you want to take cash out for a refinance and are not sure what loan amount you can qualify.

Mortgage lenders tend to have a more conservative notion of what’s affordable than borrowers do. They have too, because they want to make sure the loan is repaid. And they don’t just take into account what the mortgage payments will be, they also look at the other debts you’ve got that take a bite out of your paychecks each month.

- FAQ: To see if you qualify for a loan, mortgage lenders look at your debt-to-income ratio .

That’s the percentage of your total debt payments as a share of your pre-tax income. As a rule of thumb, mortgage lenders don’t want to see you spending more than 36 percent of your monthly pre-tax income on debt payments or other obligations, including the mortgage you are seeking. That’s the general rule, though they may go to 41 percent or higher for a borrower with good or excellent credit.

For purposes of calculating your debt-to-income ratio, lenders also take into account costs that are billed as part of your monthly mortgage statement, in addition to the loan payment itself. These include property taxes, homeowner’s insurance and, if applicable, mortgage insurance and condominium or homeowner’s association fees.

Fha Mortgages Vs Conventional Mortgages

Conventional mortgages, which are backed or owned by government programs like Fannie Mae and Freddie Mac, have very strict credit and income requirements.

FHA home loans, on the other hand, are more flexible in their underwriting and offer additional benefits to borrowers.

This flexibility means you dont necessarily have to be a high earner to buy the house you want. In exchange, you pay mortgage insurance premiums to the FHA along with your mortgaage payment.

| FHA Mortgages | |

| Min. FICO score of 580 and 3.5% down payment, or 500579 with 10% down | Min. FICO score of 620 for most lenders and 3%20% down payment |

| Can use gift funds for the entire down payment | Limits gift funds for the down payment |

| Sellers can contribute up to 6% for closing costs | Sellers can only contribute up to 3% for closing costs |

| DTI can be as high as 50 | DTI cannot exceed 36% |

| Only for the purchase of a primary residence | Can be used to purchase a second residence |

| Mortgage insurance is mandatory | You dont need mortgage insurance with a 20% down payment or 20% in equity |

| The property must be FHA-approved | You can purchase any property |

| FHA loan limits are set by HUD and vary by location | Conventional loan limit depends on your lender, income, creditworthiness, and other factors |

| No maximum or minimum income limits | Some government-backed programs have income caps |

Don’t Miss: Maximum Fha Loan Amount In Texas

How Do Fha Interest Rates Compare To Other Types Of Loans

If you’re trying to decide between an FHA or VA loan, you may be surprised to know how competitive FHA rates are. As of this writing, for example, FHA and conventional loan rates are running neck and neck. And the VA loan has a slightly lower interest rate.

Since FHA mortgage rates are competitive compared to other mortgage types, you can decide which mortgage to apply for based on more detailed factors, like your credit score and how much you have for a down payment.

Fha Loans In Nc And Sc

Are you looking for an FHA loan in North Carolina or South Carolina? Dash Home Loans offers FHA loans for qualified home buyers throughout the Carolinas.

FHA loans, which are backed by the Federal Housing Administration , may help qualify for a home if you do not meet other requirements. Theyre ideal for individuals and families with low to moderate income and less than perfect credit scores.

Read Also: Capital One Preapproved Auto Financing

Fha Mortgage Health Statistics

Historically, this market share has experienced lows and highs for a number of reasons, and it’s currently starting to go into a low point even with its popularity with the Millennial age group. The FHA’s mortgage market share by dollar volume was just 17.3% in the last quarter of 2016. A few reasons for this share shift are:

Housing Bubble

During the housing bubble credit standards were loose on conforming mortgages. This meant marginal home buyers had less incentive to seek out FHA loans since almost anyone with a pulse could “qualify” for a standard conforming mortgage.

Housing Market Crash

The FHA offers mortgages to people with lower credit scores and thin credit histories. When credit dried up in the wake of the housing market crash & many ARM loans reset many people rushed into FHA loans.

Fee Adjustment

Once the United States housing bubble crashed, the liquidity people had access to was drastically reduced. This caused an FHA share boost after the crash and this. The slow recovery, in turn, caused the FHA default rate shoot up and any cash reserves that the FHA set aside for emergencies was quickly depleted. To offset the losses, in 2013 the FHA to increase its fees. The fee increase caused dollar share of FHA loans to slide as:

- many people defaulted

- new borrowers preferred conforming loans which were in many cases cheaper on a relative basis

- people with strong credit profiles who used FHA loans refinanced into conventional mortgages

Determine The Piti Payment

PITI is the mortgage industry term for a homeowner’s monthly payment on mortgage principal, mortgage interest, property taxes and homeowners insurance. The industry standard is that a borrower’s PITI should add up to no more than 28 percent of his gross monthly income. With an FHA loan, 29 percent is acceptable. That allows buyers with a lower monthly income to qualify for a home.

Read Also: Fha Vs Conventional 97

How To Qualify For Fha Financing

While an FHA mortgage could be your best option for a home purchase, you must meet several FHA home loan requirements to qualify for FHA financing. While these requirements are similar to those of a conventional mortgage, FHA loan programs may have other restrictions that might not be right for you.

Income:DTI ratio:Down payment:Employment history:Home appraisal:Occupancy:

Understanding Federal Housing Administration Loans

In 2021, you can borrow up to 96.5% of the value of a home with an FHA loan. This means you’ll need to make a down payment of just 3.5%. You’ll need a credit score of at least 580 to qualify. If your credit score falls between 500 and 579, you can still get an FHA loan as long as you can make a 10% down payment. With FHA loans, your down payment can come from savings, a financial gift from a family member, or a grant for down-payment assistance.

It’s important to note that with an FHA loan, the FHA doesn’t actually lend you money for a mortgage. Instead, you get a loan from an FHA-approved lendera bank or another financial institution. However, the FHA guarantees the loan. Some people refer to it as an FHA-insured loan, for that reason.

In order to secure the guarantee of the FHA, borrowers who qualify for an FHA loan are also required to purchase mortgage insurance, and premium payments are made to FHA. Your lender bears less risk because the FHA will pay a claim to the lender if you default on the loan.

Though FHA loans require lower down payments and credit scores than conventional loans, they do carry other stringent requirements.

| For How Long You Pay the Annual Mortgage Insurance Premium |

|---|

| TERM |

Is an FHA Mortgage Still a Bargain?

You May Like: How Much Land Can You Buy With A Va Loan

Fha Maximum Financing Calculator

This calculator helps determine the minimum allowable down payment and maximum FHA mortgage allowed on a home purchase. It creates an estimate of closing costs and required upfront Mortgage Insurance Premium . This tool is designed to determine the FHA mortgage limit for a particular purchase, not the maximum allowed for any home in your state and county. To determine the maximum purchase price for your specific area you should use at the HUD.gov. Then, with that data in hand, use the below calculator to determine the required down payment, FHA mortgage limit and required upfront Mortgage Insurance Premium .