How To Save Money On Student Loans

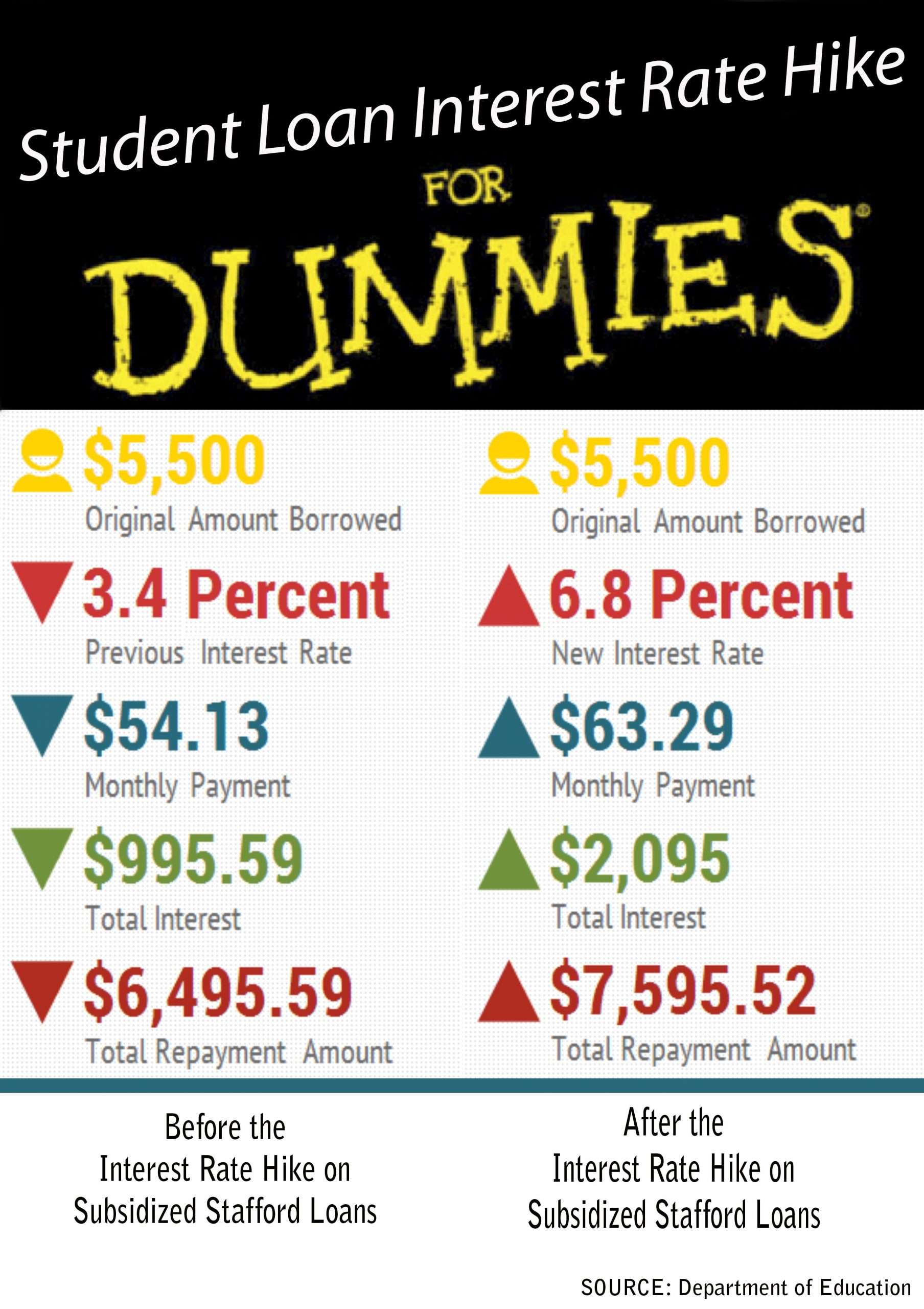

The interest rate on your student loan has a major effect on how much you ultimately pay. Even a slightly higher interest rate can equate to thousands of dollars in extra costs over the life of your loan.

Depending on your financial situation, you may be able to refinance your student loans into a new loan with a lower interest rate. This could reduce your monthly payment and lower the amount you pay in interest before your loan is paid off.

Private lenders offer student loan refinances . These allow you to combine multiple federal and private student loans into a single loan with one payment and interest rate. The interest rate you qualify for will depend on your finances and credit. The higher your credit score, the lower the interest rate youll typically qualify for. With excellent credit, the greater the chance that youd be able to qualify for an interest rate significantly lower than youre currently paying.

However, take caution before refinancing federal student loans into a new, private loan. By doing so, you lose access to the benefits that federal loans provide, including flexible repayment plans and student loan forgiveness programs. If you have poor credit, refinancing your loans is also not likely to yield you a good deal.

Pro tip:

To Receive Your Subsidized Or Unsubsidized Loan:

Latest Student Loans News

- Not only did the Department of Education established a temporary suspension of monthly payments and 0% interest rates, set to expire on August 31, 2022 but the U.S. Department of Education will also apply a fresh start on repayments. This means that the impact of any delinquency and defaults will be effectively eliminated, allowing borrowers to begin repayments in good standing.

- Student loan repayments restart in September of this year. If you plan on tackling your student loan debt for good, check our tips on how to pay off student loans fast.

- Interest rates on federal student loans are set to rise more than a percentage point starting in July of 2022. This increase will apply to loans issued for the 2022-2023 academic year.

Student loans are a financing option available to students and parents who are unable to cover education expenses out of pocket. There are two main types of student loans: federal and private.

Federal student loans are issued by the U.S. Department of Education. They tend to feature competitive rates and better repayment terms and protections. These are still loans, however, and they must be paid back with interest.

Private student loans are issued by private lenders. These types of student loans don’t offer the same protections as federal student loans, but they are an alternative for those who have taken the maximum federal student loan amount and still need help to fund their education.

Recommended Reading: Should I Get An Unsubsidized Student Loan

In The Interest Of Interest

“You usually don’t have to make payments while you’re in school or during the six-month grace period after school,” said Nikki Lavoie, a spokesperson for Navient, which provides student loan servicing for more than 12 million Americans. “But if you want to, you’ll likely save money.”

One of the biggest benefits to repaying loans early is reducing how much interest you’re paying overall, especially on loans where interest has been accruing.

“It’ll cost less in the future once you enter repayment if you get that principal down,” said Elaine Griffin Rubin, senior contributor and communications specialist at Edvisors. “And it will lower your monthly payments.”

Making early payments helped Ruth pay off her loan without paying a ton of interest. Today, four years after graduating, she has about $10,000 of loans left of the $37,000 she borrowed.

“I’ve been very strategic in how I pay everything off so I’m not getting eaten alive by paying interest,” said Ruth, who now works in publishing and lives in New York.

It’ll cost less in the future once you enter repayment if you get that principal down.Elaine Griffin Rubinsenior contributor and communications specialist at Edvisors

Student Lines Of Credit

If you have a student line of credit through your financial institution, you’ll have to pay the interest on the amount of money you borrow while youre still in school.

After you graduate, many financial institutions give you a 4 to 12-month grace period. During this time, you only have to pay the interest on your line of credit. After this period, youll pay back your debt through a repayment schedule agreed upon with your financial institution.

Contact your financial institution to get information about paying back your student line of credit.

Also Check: Army Student Loan Repayment Program

Include Payments In Your Budget

Build your student debt payments into your budget and make payments that are larger than the minimum payments. You can also speak with your financial institution about setting up automatic payments.

When planning your budget and automatic payments, make sure you know when your payments are due. Remember that if you have more than one loan or line of credit, you may have more than one payment due date.

The Difference Between Fixed And Variable Rates

Student loan interest rates can be either fixed or variable. Fixed interest rates are a type of interest rate that doesn’t change over your loan term, so youll know upfront how much your total cost to borrow will be and what your monthly payments will look like. Variable interest rates are a type of interest rate that changes based on market conditions, so your monthly payment may increase or decrease periodically.

Read Also: Is Parent Plus Loan Federal

How To Apply For A Private Student Loan

After you have done your research, it is time to fill out a private school loan application. Remember, if your credit score is below the excellent range, you will have a harder time getting a competitive APR rate. If you have the time to raise your credit score before applying for a private student loan, then do so. If your credit score is still too low or your credit history hasnt been fully established, you will need to find a family member or trusted individual with an excellent credit history that doesnt mind cosigning a loan with you. Being a cosigner is a big financial responsibilityif for some reason you fail to pay your loan, your cosigner will be responsible.

Filling out a private school loan application is straightforward, but you and your co-signer will need a few important documents, including the following:

- Your social security number

- Monthly rent or mortgage receipts

- Any other information that lays out your financial status.

You should also be prepared to share the following:

- The name of the college you are attending

- When youll be graduating

- Total college costs

- And how much you are requesting to borrow to cover those costs

You will also need to fill out the Private Education Loan Applicant Self-Certification form, which is provided by your school and will show the lender exactly what costs you face for your education.

Types Of College Loans

For many students, borrowing money also known as taking out a loan is a way to make their college dreams come true. But unlike other types of financial aid, loans have to be repaid with interest. Learn the facts about loans and you can borrow wisely.

Start by understanding some important definitions:

Defer: Some federal loans let you defer or delay paying the loan back until after you graduate.

Interest rate: The interest rate is the cost of borrowing money, and is usually a percentage of the loan that is added to the amount you borrow. The higher your interest rate, the more you’ll owe over time.

Need-based: Aid that is need-based is awarded to students who are determined to have financial need that is, the amount they are able to pay for college is less than the cost of attending the college. The federal government offers need-based loans to students. Eligibility for these loans is determined by the Free Application for Federal Student Aid .

Subsidized: Some federal loans are subsidized, which means the government pays the interest on the loan while you’re in college. Learn more about the rules for subsidized loans on ed.gov.

For more definitions related to loans and other financial aid, see the financial aid glossary.

Read Also: Where Can I Apply For Student Loan Without Cosigner

How To Work With Your Servicer

If you want to restart payments during the automatic forbearance, contact your student loan servicer its the private company that manages payment of your federal loans. But you don’t have to do anything to get the forbearance or the 0% interest rate.

To find out which loan servicer is yours, log in to studentaid.gov with your FSA ID.

You can get in touch with all of the loan servicer contact centers by calling 1-800-4-FED-AID.

For additional information visit studentaid.gov/coronavirus for forthcoming details.

About the author:Anna Helhoski is a writer and NerdWallet’s authority on student loans. Her work has appeared in The Associated Press, The New York Times, The Washington Post and USA Today. Read more

What Is A Student Loan Grace Period

For some types of student loans, particularly federal loans, you dont have to start making loan payments when the loan is disbursed. Instead, your loans are deferred, and you have a six-month period after you graduate, drop below half-time enrollment or leave school before you have to start repaying your debtyour grace period.

Also Check: How Much Down Jumbo Loan

How To Manage Student Loan Debt While In School

Does the whole idea of college debt seem overwhelming to you? Well, you arent alone. Thousands of students around the country are inundated by loan repayments. Somehow, they manage to work it out for themselves.

Their experience shows that the best way to pay off debts is to have a solid money management plan and follow it to a T. In fact, coming up with a strategy to manage your student loans is critical to your long-term financial health. Do it right, and youll be debt-free within a few years. Youll free yourself to go after your dream career, home or business. But, of course, its also a good idea to stay on the lookout for government debt forgiveness programs that you may qualify for to ease the burden. There are certain things that a student needs to consider to help them have little to no debt by the time they step out of their educational institute and into the world.

Other Ways To Save Money On Student Loans

Other strategies to help you save money on student loans include:

- Only borrow what you need. The more you borrow, the more youll have to pay back and the more interest youll accrue.

- Explore scholarships and grants. Your school may offer financial aid, including scholarships and grants. This money doesnt need to be paid back and reduces the amount you need to borrow. You may also qualify for work study, a program where youre employed while in school and earn money to help pay for your higher education expenses.

- Make interest-only payments while in school. Even though youre not required to, you can generally make interest-only payments while in school to avoid this interest being capitalized into your loan when you graduate.

- Set up automatic payments. Some student loan servicers will offer you a discount on your interest rate if you use an autopay feature, which deducts money for your student loan payment from your bank account automatically when its due.

If youre interested in a private student loan, consider one of our partners.

The companies in the table below are Credibles approved partner lenders. Whether youre the borrower or cosigner, Credible makes it easy to compare rates from multiple private student loan providers without affecting your credit score.

| Lender |

|---|

Read Also: How Do Lenders Calculate Student Loan Payments

Postpone Your Payments With Deferment Or Forbearance

Sometimes it may seem impossible to make your student loan payment. Maybe you decided to go back to grad school, your entry-level salary isn’t what you expected, or a health condition prevents you from workingbut you have deferment and forbearance options to postpone your payments and bring your account current without hurting your credit. Each option has its own eligibility rules and time limits. Read on to see which fits your unique situationwe almost always have a solution for you.

How We Chose The Best Private Student Loans

Since 2014, LendEDU has been reviewing private student loan lenders to determine the best in the industry. Our most recent evaluation consisted of 12 of our partners, including several of the largest in market share.

Here are the seven categories that we reviewed to score each lender:

Once we scored each lender, we then determined who was the best for different situations. If a lender wasn’t the best for anything, or they didn’t allow borrowers to choose between in-school or deferred payments, they were not included on this page.

Read Also: What Kind Of Loan For Home Improvement

Can I Start Paying On A College Loan Before Graduation

Question: I was wondering if I can start paying off a student loan before graduation? My daughter is currently a college junior and has a student loan. Id like to begin paying on the loan before she graduates. Any information would be helpful.

Paying on student loans before college graduation is a great idea. This will help to eliminate her student loan debt total and lighten the financial impact of paying for student loans after graduation.

Unfortunately, many students do not take these payments into account when planning their post-grad, new-career professional budget. Some students are shocked at the monthly payment totals of their repayment plans.

If she has any federal student loans via the Direct Loan Program, she will have a grace period before shell be required to begin paying back her loan balance. According to StudentAid.Gov, this grace period is generally six months. For a Perkins loan, the grace period is nine months.

Why Paying Back Your Federal Student Loans Before Graduation Is a Good Idea

The sooner you can begin to pay back these loans the better. While the Federal Direct Loans have a fixed rate , you can begin to tackle repayment earlier. This will cut your overall loan cost, and help you pay off your loan faster.

There are many reasons why beginning to pay back your student loans before graduation is a good idea.

There is no penalty for pre-paying these loans. You wont face any extra charges for starting your repayment before you graduate college.

If You Have Ffel Loans

If you have Federal Family Education Loans , you are entitled to receive the no-interest forbearance only if the government owns the loans. This wont be most FFEL borrowers most of the loans from the now-defunct program are commercially held.

You can find out who owns your loans by logging in to studentaid.gov using your FSA ID.

The only way to get the forbearance for commercially held FFEL loans is to consolidate your debt into a new direct loan. But there are downsides to consolidation:

-

Your repayment term will be extended.

-

Your interest rate will increase slightly.

-

Any unpaid interest will capitalize and be added to the total amount you owe.

Temporary interest-free payments may not be worth those additional long-term costs.

Plus, if youre already making payments on an income based repayment plan, those previous payments will no longer count toward forgiveness. Youll have to start all over.

Consolidation can make sense if you have FFEL loans and want to qualify for Public Service Loan Forgiveness. Otherwise, stick with your current loans.

If you’ve experienced a change in income, you can enroll in IBR or recertify early, if you’re already on this plan. IBR will still take into account your spouses income. Your loans are also eligible for unemployment deferment, which may make sense if youve lost your job but expect to start working again soon.

Read Also: How To Give Loan Online

If You Want To Pause Payments

You don’t have to do anything to get a forbearance to stop student loan payments. Interest wont continue to accrue, as it normally would.

A forbearance could give you breathing room to address other financial concerns.

If you are jobless or working reduced hours, a forbearance may free up cash to pay the rent and utilities or grocery bills. Even if your pay is unaffected, a forbearance could help you divert some money toward building an emergency fund or help you pay another, more pressing debt.

Usually forbearance is granted at the discretion of the servicer and interest will continue to build. In this case, the Education Department instructed all servicers to automatically place all loans into a forbearance without interest.

Tips For Comparing Low

Federal student loans provide the same fixed rate to every borrower regardless of credit history. Thats one of their biggest advantages. Its always best to take out the maximum amount of federal student loans you qualify for before turning your attention to private student loans.

When comparing private lenders, know that only the most creditworthy borrowerstypically those with good or excellent credit scores, steady income and low debt-to-income ratioswill qualify for the lowest advertised interest rates. Thats true if you apply with a co-signer, too the better their credit profile, the lower the interest rates youll receive.

If you have poor credit or no credit, consider working specifically with a lender that offers student loans for bad credit. Many undergraduates who dont yet have lengthy credit histories apply using a co-signer, which can make them eligible for a wider range of loans at lower interest rates. But if you dont have access to one, look into our picks for the best student loans without a co-signer.

Beyond interest rates, when deciding on a loan, consider features like available economic hardship programs, whether or not the lender allows you to release your co-signer after a period of time and the number of loan repayment schedules you can choose from.

Recommended Reading: What Documents Do I Need For Home Equity Loan