What Occurs During Parent Plus Processing

- Once the loan application has been completed, the servicer performs a .

- The servicer notifies the parent of acceptance or rejection of the loan.

- If the loan is approved, funds are sent directly to MSU and applied against the student’s bill.

- Any PLUS funds that exceed MSU charges are given as a refund by the Student Accounts division of the Controller’s Office.

Finding A Plus Loan Lender

All new federal education loans, including the PLUS loan, are made through the Direct Loan program. To obtain a Parent PLUS loan, contact the colleges financial aid office.

The PLUS loan borrower will need to sign a Master Promissory Note , which covers a period of continuous enrollment. Annual borrowing is capped at the cost of attendance minus other aid. The college will draw down the funds from the Common Origination and Disbursement system and deposit them into the students account. After the funds are applied to tuition and fees , any remaining funds will be disbursed to the student to pay for textbooks and other college-related costs.

Parents who are considering a PLUS loan also often consider a home equity loan or an alternative loan. Have questions? Learn more about qualifying for a Parent PLUS Loan: Questions about Qualifying for the Parent PLUS Loan

What Is Public Service Loan Forgiveness How Did It Originate

The Public Service Loan Forgiveness is a program that was launched in 2007 in an effort to steer more college graduates into public service. As long as they made 10 years of payments on their federal student loans, the program promised to erase the remainder.

The program, however, proved anything but forgiving.

Before the October changes, only 16,000 borrowers had seen their debt forgiven, or discharged, according to the Education Department. About 1.3 million people are trying to have their debts discharged through the program.

One of the most problematic pieces of Public Service Loan Forgiveness: Many borrowers had the wrong type of loan and didn’t realize they weren’t eligible for relief.

When the loan forgiveness program was first introduced, many of the loans offered from the federal government were Family Federal Education Loans , or loans made through private entities but insured by the federal government.

The government stopped offering those loans in 2010 and now relies on direct loans the kind eligible for forgiveness. The Education Department said about 60% of borrowers with an approved employer hold FFEL loans.

Also Check: Auto Loan 650 Credit Score

Understand Private Student Loan Credit Requirements

Unlike most federal student loans, which dont require a credit check, private student loan lenders typically have borrowing requirements that can include a minimum credit score, minimum required income and a history of on-time loan repayment. Thats to make sure that youll repay the loan as agreed.

To qualify for a loan, youll need to have a in the good-to-excellent range. Lenders usually require a credit score of at least 650. Borrowers also have to show that they have enough income to afford their loan payments.

Who Can Apply For A Parent Plus Loan

In addition to passing a credit check, you must meet other requirements to apply for a parent PLUS loan.

-

You must be a parent. Only parents including adoptive stepparents can qualify for a parent PLUS loan. You can’t get a parent PLUS loan if you’re a grandparent or guardian, even if you’re legally responsible for a child.

-

Your child must be an undergraduate. Your child is only eligible if they’re a dependent undergraduate student who is enrolled at least half-time at an eligible Title IV college or career school. There aren’t parent PLUS loans for graduate students.

-

You both must be eligible for federal student aid. You and your child will need to meet general eligibility requirements for federal loans, including being a U.S. citizen or eligible noncitizen and having a valid Social Security number.

Also Check: Va Mpr Checklist

Private Student Loan Applications

Once you select the best student loan option for you, you will need to formally apply for the loan. If possible, apply for private student loans with a cosigner to receive the most favorable rate. Typically, you would chose your parent or guardian as a cosigner. Before you start your application, you and your cosigner should have the following materials handy:

Can You Get A Better Interest Rate With Private Lenders

The current interest rate for Direct PLUS Loans is a fixed rate of 6.28 percent . If you have a good credit score, you may be able to qualify for a better interest rate with a private lender. Look into private loan options and determine where you can get the best rates before deciding to apply for a parent PLUS loan.

Read Also: How To Apply For Sss Loan

Subsidized And Unsubsidized Federal Direct Loans

Federal Direct Loans are available to eligible undergraduate and graduate borrowers.

- Students must complete the Free Application for Federal Student Aid and eligibility is determined based on the cost of attendance, less other aid the student is receiving.

- Subsidized loans do not accrue interest while the student is enrolled at least half-time and during eligible periods of deferment or forbearance.

- Unsubsidized loans begin to accrue interest when the loan is disbursed to the students account.

- Students must be enrolled at least half-time in order to be eligible. Half-time for an undergraduate student is six semester hours and five hours for a graduate or professional student.

- Repayment is deferred as long as the student is enrolled at least half-time. After a student ceases to be enrolled at least half-time, a six-month grace period begins. Repayment begins at the end of the six-month grace period.

- The interest rate is a fixed rate for the life of the loan and caps at 8.25%.

- A variety of repayment plans are available. The standard repayment period is 10 years, but may extend to as much as a 30-year period.

What To Do If You Don’t Qualify For Parent Plus Loans

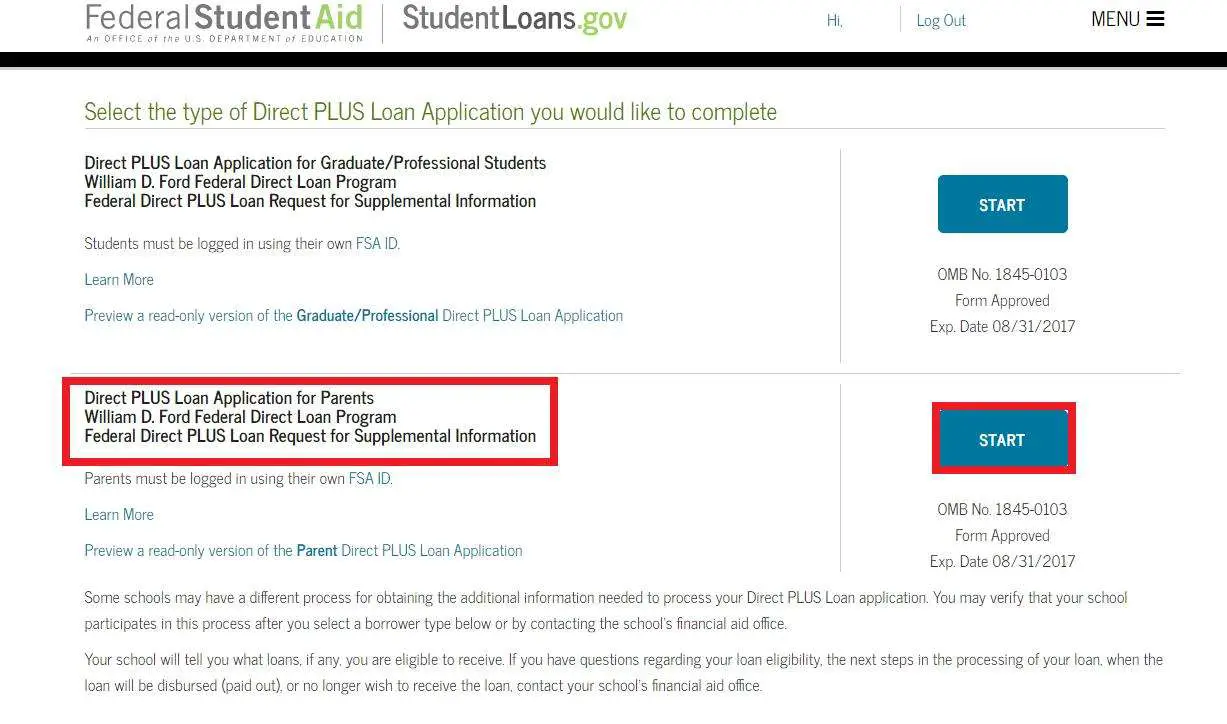

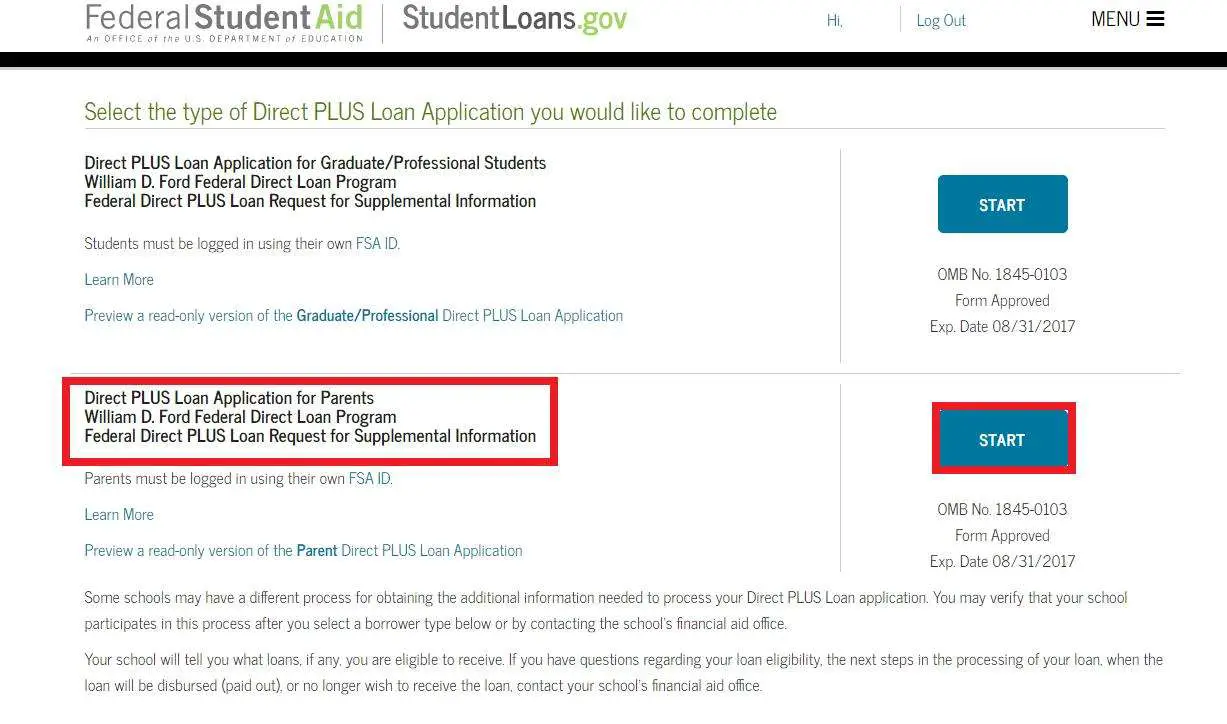

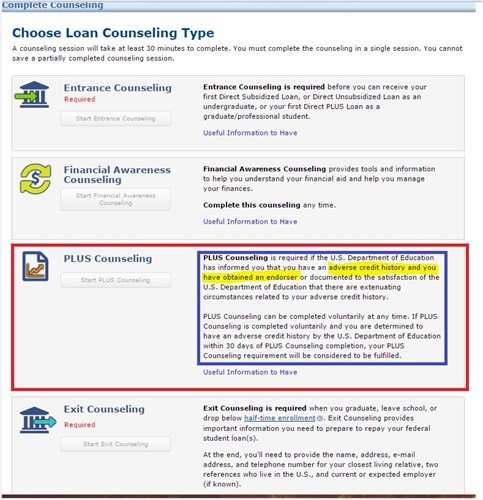

If you’re denied a parent PLUS loan because of the credit requirements, you could become eligible if you get an endorser which works similarly to having a co-signer for private student loans or if you can prove extenuating circumstances related to your adverse credit history.

If you qualify for a parent PLUS loan through either of these methods, you’re also required to complete credit counseling on the federal student loan website.

You can also consider borrowing or co-signing a private student loan if you cant meet the non-credit parent PLUS loan requirements for example, if you’re a grandparent. Borrowing privately may not be a solution if your credit is a problem if you can qualify with a private lender, your interest rate might be higher than it would be for a parent PLUS loan.

Don’t Miss: Usaa Graduate Student Loans

Calculate How Much Much You Want To Borrow

You can borrow the total amount of attendance costs for your child, minus any financial assistance or scholarships received. This includes tuition, fees, room and board, books, supplies, transportation and loan fees. Miscellaneous expenses, including a personal computer, child care, study abroad costs and disability-related expenses, may be eligible as well. The total amount varies by school.

Note that you can always borrow more in the future if you need. Do your best to only borrow what you need.

Private And Alternative Loans

Alternative Loans are offered through private lenders and are meant to provide additional educational funding only after a student has exhausted all other sources of funding such as federal and state aid. Hunter College does not recommend any specific lender/programs.

Alternative Loans are offered through private lenders and are meant to provide additional educational funding only after a student and his/her family has exhausted all other sources of funding such as federal and state aid. These loans are not guaranteed by the federal government and may carry high interest rates and origination fees. All the loans require a credit check and most will require a cosigner if the borrower has little or negative credit history.

Such loans are offered by private lenders, such as banks and credit unions, and students must apply directly to lenders. Those lenders, in turn, will contact Hunters Financial Aid Office, and the two parties work together to issue the loan funds through the university. Contact the lender of your choice for details about their program and application process.

Hunter College does not recommend any specific lender/programs. You are advised to use these loans sparingly, and you may wish to discuss your particular situation with the Office of Financial Aid.

You May Like: Usaa Home Loan Credit Score Requirements

How Much Can I Borrow

The maximum amount that can be borrowed in PLUS loans is the cost of attendance minus any other financial aid and resources.

To determine the maximum amount that can be borrowed, have your student can:

Please note if a borrower chooses the âmaximum loan amountâ while completing the PLUS application, the cost of attendance will be increased to accommodate theprocessing fee. As such, the borrowed amount may be more than anticipated.

If you only want to borrow enough to cover your bill, use your bill to determine amountsor use thePlanner to estimate if bills are not yet available. Do not forget to factor in theprocessing fee to ensure you estimate for an accurate disbursed amount.

How To Apply For Student Loans: Federal And Private

If you are a student paying for college, you will probably come across student loans. There are two main types of student loans that you need to know about: federal student loans and private student loans.

Even within these two categories of student loans, you will encounter different interest rates, terms, and repayment options. On top of this every familys financial situation is different and some loans may make more .

Jump ahead to:

Keep on reading to learn about how to apply for both federal and private student loans. If you are looking for more information on specific student loans and lenders, check out our list of best student loans.

Read Also: Auto Loan Payment Calculator Usaa

How To Apply For Private Student Loans

Unlike federal student loans, you can apply for private student loans at many different types of financial institutions. This means that it is important to shop around to find the best rate of interest. While federal student loans have specific timelines and deadlines, there are no such timelines with private student loans. Instead, students can apply for these loans at any point in time.

Parent Plus Loan Recap

A Parent PLUS loan is a type of Direct PLUS loan, which is offered to parents who have a student enrolled at least part-time in an eligible education program.

A Parent PLUS loan is a type of Direct PLUS loan, which is offered to parents who have a student enrolled at least part-time in an eligible education program.

Borrowers may be able to borrow an amount that equals but does not exceed the full cost of attendance, minus any other financial aid such as scholarships and grants that your child has received.

These loans are federally-funded and not subsidized. This means that the loan will accrue interest while the student is in school. Parent PLUS loans offer fixed interest rates and wont change throughout the life of the loan.

The interest rate for Parent PLUS loans disbursed for the 2020-21 school year is 5.30%. Its also important to note that as of October 1, 2019, Direct PLUS Loans have a fee of about 4.24% of the loan amount .

You May Like: Usaa Auto Loan Rates

Are There Additional Requirements Parents Must Complete

Funds cannot be disbursed to your student’s account until all requirements are complete. Borrowers must complete a Loan Agreement for the loan. After you are approved for the loan, you must:

If your loan application is denied and reinstated ,you must also complete Plus Credit Counseling.

Grad Plus Loan: 6 Things To Know Before You Apply

How Student Loan Hero Gets Paid

Student Loan Hero is compensated by companies on this site and this compensation may impact how and where offers appear on this site . Student Loan Hero does not include all lenders, savings products, or loan options available in the marketplace.

Student Loan Hero Advertiser Disclosure

Student Loan Hero is an advertising-supported comparison service. The site features products from our partners as well as institutions which are not advertising partners. While we make an effort to include the best deals available to the general public, we make no warranty that such information represents all available products.

Editorial Note: This content is not provided or commissioned by any financial institution. Any opinions, analyses, reviews or recommendations expressed in this article are those of the authors alone, and may not have been reviewed, approved or otherwise endorsed by the financial institution.

OUR PROMISE TO YOU: Student Loan Hero is a completely free website 100% focused on helping student loan borrowers get the answers they need. Read more

How do we make money? Its actually pretty simple. If you choose to check out and become a customer of any of the loan providers featured on our site, we get compensated for sending you their way. This helps pay for our amazing staff of writers .

Read Also: Usaa Used Car Refinance Rates

How Is Eligibility Determined

To apply for a Direct PLUS Loan, you must first complete the FAFSAand apply for the annual maximum Direct Unsubsidized Loan. To be eligible for a PLUS Loan, you must be enrolled at least half-time in a program leading to a professional or graduate degree. To apply for the loan, you will generally complete and sign a Master Promissory Note electronically or complete a paper application . First time PLUS Loan borrowers will also need to complete entrance counseling. The financial aid office determines how much you can borrow by subtracting your other estimated financial assistance from the cost of attendance set by the school. Any remaining balance is what could be covered through a Direct PLUS Loan. The financial aid office staff will certify your eligibility for the PLUS Loan.

You Must Pay A Loan Origination Fee

Beyond the interest that is accruing on your grad PLUS loan, an origination fee is deducted when your loan is disbursed, so youll receive a little less than what you actually borrow.

While the fee can change, it was 4.228% of the loan amount for the 2020-2021 academic year.

Federal Direct Unsubsidized Loans also charge a fee however, it was 1.057% for 2020-2021 a much more reasonable rate. Private lenders may or may not charge an origination fee for their loans. This means that it is worth investigating your private loan options and comparing them with graduate PLUS loans to make sure youre getting your best deal.

Also Check: How Long Does Sba Loan Take

Choose The Best Offer

When you have a few loan offers in hand, compare them to see which loan is the best for you. Then sign the loan documents and move forward with your education or paying off your loans.

If you have a cosigner, you may also want to get a term life insurance policy to protect your cosigner should anything happen to you. A term life insurance policy for the loan balance can be very inexpensive.

Remember, some private student loans require immediate payments, so make sure you double-check your lender and their repayment plans before you commit.

Plus Counseling Requirement For Parent Applicants With Adverse Credit History

The U.S. Department of Education added a requirement that PLUS Counseling must be completed by Direct PLUS Loan applicants with an adverse credit history who qualify for a Direct PLUS Loan by obtaining an endorser who does not have an adverse credit history, or who document to the satisfaction of the Department that there are extenuating circumstances related to the adverse credit information.

The PLUS Counseling requirement will apply to all Direct PLUS Loan applicants with an adverse credit decision date on or after March 29, 2015 regardless of the academic year or loan period associated with the Direct PLUS loan.

___________________________________________________________________

Read Also: Does Upstart Allow Co Signers

Petition For Plus Override Review

Federal regulations allow a specific amount of Federal Stafford loan eligibility to a student based on his/her grade level. If a student needs more than the amount allowed for Federal Stafford loan, the parent should apply for a PLUS. However, the Department of Financial Aid at Georgia Southern University realizes that students and their families experience circumstances which could keep a parent from being able to apply for PLUS such as Bankruptcy or Foreclosure. If you have/had an active bankruptcy or have had a foreclosure on your home, you may qualify for a PLUS Override. In order to be reviewed to see if you qualify, you must complete the Petition for PLUS Override Review form below and submit a court signed copy of your Bankruptcy or Foreclosure paperwork to the Financial Aid office.

___________________________________________________________________

What Is A Direct Plus Loan

Direct PLUS loans are federal loans that graduate or professional degree students or parents of dependent undergraduate students can use to help pay for education expenses.

Direct PLUS loans have a fixed interest rate and are not subsidized, which means that interest accrues while the student is enrolled in school. You will be charged a fee to process a Direct PLUS Loan, called an origination fee. An origination fee is deducted from the loan disbursement before you or the school receives the funds. A credit check is performed on applicants to qualify for a Direct PLUS Loan.

There are two types of Direct PLUS loans: the Grad PLUS loan and the Parent PLUS loan.

Grad PLUS loans allow graduate and professional students to borrow money to pay for their own education. Graduate students can borrow Grad PLUS loans to cover any costs not already covered by other financial aid or grants, up to the full cost of attendance.

To qualify for a Grad PLUS loan you must meet three criteria:

Parent PLUS loans allow parents of dependent students to borrow money to cover any costs not already covered by the student’s financial aid package, up to the full cost of attendance. The program does not set a cumulative limit to how much parents may borrow. Parent PLUS loans are the financial responsibility of the parents, not the student and cannot be transferred to the student upon the students completion of school.

To qualify for a Parent PLUS loan, you must meet three criteria:

You May Like: Becu Fha Loan