New Students From England

Most full-time and part-time students can apply online to Student Finance England.

Set up a student finance online account.

Log in and complete the online application.

Include your household income if needed. Your parent or partner will be asked to confirm these details.

Send in proof of identity, if needed.

If you cannot apply online, use the form finder to get the forms you need. You can if you want to apply online but you cannot use a computer without help.

Can You Claim Interest On Student Loans Canada

In 2021, or sooner, you can only claim the interest paid on that loan if you have repaid such a loan by 2020, as well as your closest family members. Interest you have not yet claimed can be added to any amount you claim. There is no risk of claiming interest if you did not pay taxes on it during the tax year.

Repaying Your Federal Student Loans

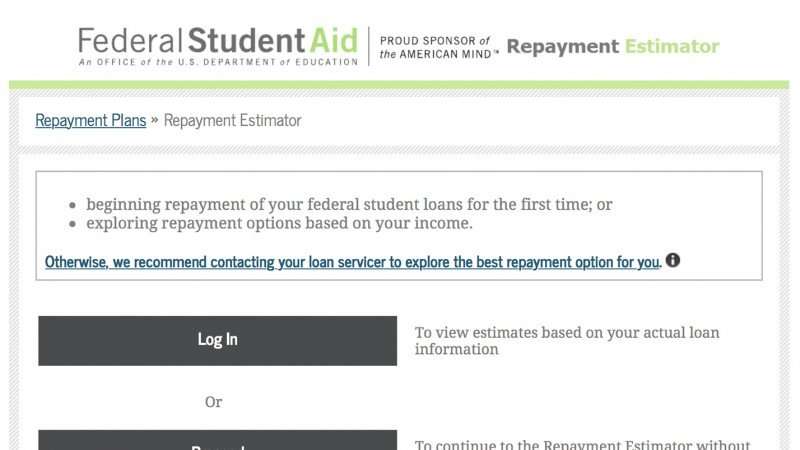

When it comes to repaying your student loans, you can choose from several repayment methods.

If you fail to notify your loan servicer , you will automatically be enrolled in the Standard Repayment Plan. Under the Standard Repayment Plan, you will pay the same monthly payment for 120 months .

For more information on how to repay and where to repay your federal loans, visit the Federal Student Aid website. To estimate your monthly payment, use the student loan payment calculator.

You May Like: Fha Loan Limits In Texas

Check The Federal Student Aid Site

Studentaid.gov contains information on all federal student loans. Its the easiest way to determine if your loans are federal and get any loan information you may need. If you dont see your loan information on studentaid.gov, you dont have a federal student loan.

You access the site with your FSA ID to see your loan amount, status, servicer, outstanding balance and disbursement details. You can also apply for loan consolidation or sign up for an income-driven repayment plan there.

» MORE: Federal student loan forbearance pauses payments until Oct. 1

Wells Fargo Private Student Loans

Wells Fargo no longer offers private student loans or student loan consolidation.

Wells Fargo has exited the student loan business. Our private student loans have been transitioned to a new loan holder and repayment will be managed by a new loan servicer, Firstmark Services, a division of Nelnet.

For assistance with transferred loans:

- Please call or

- Visit Firstmark Services online

Avoid processing delays: If you have been notified that your student loan has transferred to Firstmark Services, please ensure that payments are sent directly to the Firstmark Services payment address using your new account number. Wells Fargo will only forward misdirected payments for the period defined in your transfer communications. After that period has passed, misdirected payments will be returned.

Your Tax Information Is Available Online: If you have been notified that your student loan has transferred, your student loan interest information for 2021 will be available online at Firstmark Services beginning on January 31, 2022. To view your tax documents online, create or log in to your Firstmark Services account. Once logged in, select Documents then Tax Information. Primary borrowers who made qualifying payments in 2021 may also receive an Internal Revenue Service Form 1098-E from both Wells Fargo and Firstmark Services in the mail. The Wells Fargo 1098-E will be issued by January 31, 2022. More details are available below.

Always consult your tax advisor for individual tax guidance.

Read Also: How To Get Leads As A Loan Officer

Public Service & Teacher Loan Forgiveness Programs

The Public Service Loan Forgiveness Program was enacted by Congress in 2007 to encourage individuals to enter and continue to work full-time in public service jobs. Under this program, borrowers may qualify for forgiveness of the remaining balance due on their eligible federal student loans after they have made 120 payments on those loans, under certain repayment plans, while employed full time by certain public service employers. The Teacher Loan Forgiveness Program is intended to encourage individuals to enter and continue to teach in certain elementary and secondary schools that serve low-income families. Eligible teachers may qualify for loan forgiveness of up to a combined total of $17,500 in principal and interest. For more information on both of these programs go to www.studentaid.gov and click on the Loan Forgiveness links under Managing Repayment.

Apply For A Graduate Plus Loan

Inquiries should be directed to .

Read Also: Refinance Options For Fha Loans

Refinancing Student Loans Pros And Cons

Another option to consider is to refinance your student loans. There are pros and cons to that strategy, with pros including the following:

Loans can be combined into one single loan and payment, which can be easier to manage. Some private lenders, including SoFi, will consolidate federal and student loans and refinance them into one loan. Terms can be adjusted a longer-term can help to lower the payment, while a shorter one can help to reduce the amount of interest paid back over the loans life.

In addition, there may be choices between fixed-rate and adjustable-rate loans, and a cosigner with good credit and solid income may help the borrower get a better rate.

Cons of refinancing include:

Refinancing federal student loans with a private lender means that borrowers will lose access to benefits associated with federal student loans, including income-driven options and loan forgiveness programs. Other federal protections that will no longer apply include federal deferment or forbearance where payments may be temporarily paused. Most federal student loans have a grace period during which you dont have to make any loan payments. If you refinance your loan soon after graduation, you might lose out on that benefit if your private lender doesnt honor existing grace periods.

Recommended: Pros and Cons of Refinancing Student Loans

What Is A Grace Period

This is a six-month period of time after youve left school before youre required to start making payments on your Direct Subsidized and Unsubsidized loans. For graduate and professional students with Grad PLUS loans, you have a similar six-month deferment period after leaving school before you begin repayment. For more information about grace and other stages in a student loan life cycle, see Stages of a Student Loan.

Recommended Reading: Fha Loan Maximum Texas

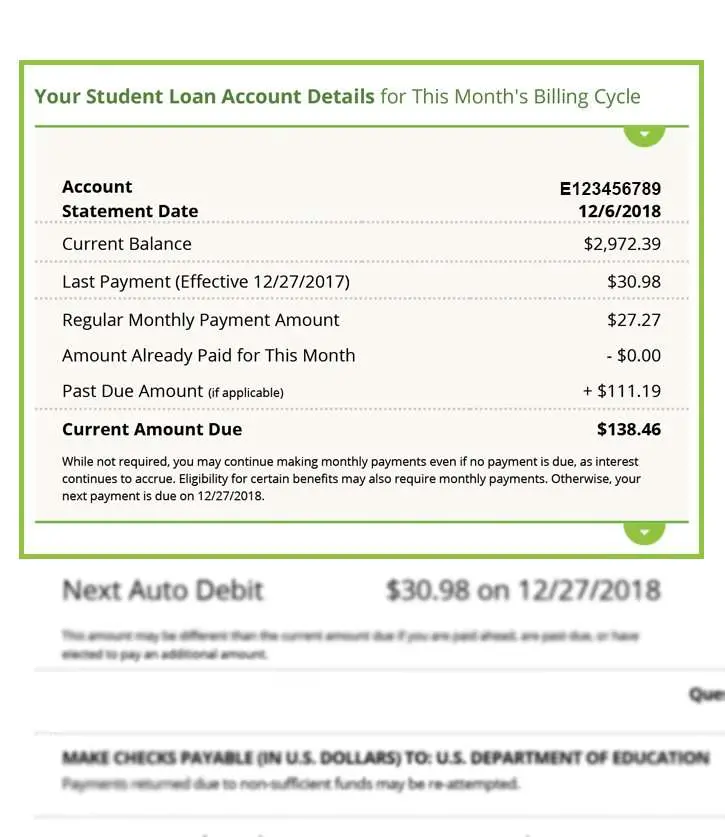

What Is A Student Loan Account Number

A student loan account number is a unique multi-digit number given to you by your student loan servicer. If you have more than one servicer, you will have more than one account number. Also, if you have federal student loans and private student loans with the same servicer, like Navient, you may have an account number for each loan type.

The main benefits of having a unique student loan account number are preventing identity theft and making it easier to claim the student interest deduction on your federal tax return.

Learn More:What Is Interest Capitalization On Student Loans?

What Is The Difference Between Auto Debit And Making A One

Auto debit is a convenient, simple payment option that offers you the peace of mind that comes with knowing your student loan payments are being made accurately and on time every month. You only have to sign up once to have all of your monthly payments made automatically.

Your Nelnet.com account allows you to make a one-time online payment even when your student loan payment is not due. Plus, you can direct your payment to specific loan groups. For more information on these and other ways to pay, see How to Make a Payment.

Read Also: Usaa Auto Loans

What Are The Advantages Of Making Automatic Monthly Payments Through Auto Debit

Auto debit is a convenient, simple payment option offering you the peace of mind that comes with knowing your student loan payments are being made accurately and on time.

Nelnet does not charge a service fee for using auto debit. In addition, you don’t need to use stamps, envelopes, or a check, which saves you time and money.

Additionally, when you sign up for auto debit, you may be eligible for a 0.25% interest rate reduction * while your account is in an active repayment status.

*Your lender may modify or terminate its borrower benefit program at its discretion and without prior notice. Your failure to satisfy benefit eligibility requirements may result in the loss of benefit. Some lenders do not offer this benefit. back

Federal Student Aid Information Center

The Federal Student Aid Information Center serves the public with information about the federal student aid application process and can provide comprehensive assistance in English and Spanish on general information related to federal student aid, the FAFSA application, FAFSA corrections, FAFSA4caster, the US Dept of Educations grant and loan programs and student loan history.

800-433-3243 phone

Also Check: How Much Can I Qualify For A Car Loan

Getting Your Loan Out Of Collection

When you miss 9 months of payments, your federal student loan is sent to the Canada Revenue Agency for collection. Once in collection, you are no longer able to get student aid. To be able to get student aid again, you must bring your loan up to date.

- Contact the CRA to make a payment arrangement and bring your loan up to date

For the provincial or territorial part of your student loan, you need to contact your province or territory. For borrowers from Saskatchewan you may contact the CRA for both federal and provincial parts of your student loan.

Dont Know Who Your Loan Servicer Is

You need to know who your servicer is to look up your student loan account number.

To find out who your federal student loan servicer is, log into the federal governmentâs student loan website with your FSA ID. If you donât know your login , call the Federal Student Aid Information Center at this phone number: 1-800-433-3243.

Keep your contact information up to date so your financial aid servicer can always stay in contact with you.

Who services federal student loans? Through 2021, there are eight federal Direct Loan servicers most borrowers work with:

You May Like: Capital One Auto Finance Approval

Why Do I Still Receive Phone Calls And Letters From Nelnet About My Payment Being Late When I’ve Already Made A Payment Or Applied For A Deferment Or Forbearance To Bring My Account Up To Date

Regulations require us to contact you by phone and through mail until your account is up to date. If youve brought your account up to date and youre still receiving messages from us saying your payment is late, this is likely because the payment, deferment, or forbearance is still being processed. If you’ve recently made a payment or applied for a deferment or forbearance, please allow 7 to 10 days for mailing and processing. You can check the status of your account at Nelnet.com.

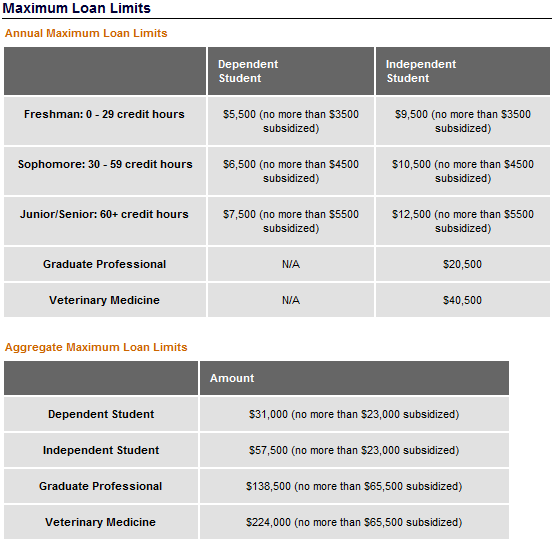

William D Ford Federal Direct Parent Plus Loan

Your browser does not support this video.In the Direct Loan program, the U.S. Department of Education is the lender for your student loan. The Direct PLUS loan program is available to parents of a dependent undergraduate student who is eligible for financial aid. Unlike the Direct Loans for students, though, parents applying for a Direct PLUS Loan must meet certain credit criteria.

Application Process: To apply for a Direct PLUS Loan,

Borrowing Limits: The amount a parent can borrow is based on the students enrollment, grade level and other financial aid received. Based on these factors, the Financial Aid Office will determine the maximum amount you can borrow.

Interest Rates and Fees: for information on interest rates and fees associated with the Direct Loan program.

Don’t Miss: Mlo Endorsement

Can I View My Previous Correspondence Online

When you sign up for electronic correspondence, your messages are stored for 12 months. After 12 months, they are deleted. If you want to keep messages longer than 12 months, you can save them to your own computer, a computer disc, or a flash drive before they are deleted by the system. Note: If you delete a message from your inbox, there is no way to restore it.

Manage Your Student Loan Balance

Sign in to your student loan repayment account to:

- check your balance

- see how much youve repaid towards your loan

- see how much interest has been applied to your loan so far

- make a one-off repayment

- set up and amend Direct Debits

- check which repayment plan youre on

- print proof of your repayment plan if you need to show it to your employer

- tell the Student Loans Company if youve changed your contact details

- view letters and emails SLC has sent you

Don’t Miss: Car Loans With A 600 Credit Score

How To Find Student Loan Account Number

The only surefire way to stay current with your student loan information is to know your student loan account number.

When you apply for a student loan, your account number will be issued to you. Finding it out wont be a difficult process.

After you apply for student aid via the federal website Studentaid.gov, youll go through an application process to find qualifying loans.

Youll receive an official letter detailing your imminent student loan and future repayment processes after approval.

Your student account number should be highlighted, boldfaced, or plainly identifiable in such a letter.

There are several ways for you to find your 10-digit student loan account number.

How Long Does It Take For My Deferment Or Forbearance Application To Be Reviewed

It typically takes about three business days from the day we receive your application. To potentially reduce this time, apply online: log in to Nelnet.com and click Repayment Options. Many deferments and forbearances requested online are processed within 24 hours. If we need additional information from you to fully process your application, we’ll let you know and then process the deferment or forbearance once you have provided what we need.

Recommended Reading: Fha Mortgage Insurance Cut Off

Supports For Students Affected By Wildfires

Are you affected by the current wildfire situation? Do you need help with your student loan payments?

- If you have Canada loans, or Canada and Alberta loans, contact the National Student Loans Service Centre to fast track your application for the Repayment Assistance Plan.

- For Alberta Student Loans, call 1-855-606-2096

Currently in School

If your studies have been disrupted as a result of the wildfires, and you have:

- Extended your study period

- Withdrawn from studies, or

- Your financial circumstances have changed.

Notify the Alberta Student Aid Service Centre, or login to your Student Aid Account and submit a Request for Reconsideration. Eligible students may receive up to $7,500 in Alberta Student loan funding to help cover unexpected costs relating to the wildfire. Supporting documentation may be required to verify the costs.

Does Student Loan Affect Tax Return

Depending on your income, you may be able to deduct student loan interest. A reduction in your taxable income is possible if you spent money on student loans last year. A deduction of up to $2,500 can lower your taxable income by $625 if youre in the 25% tax bracket, thereby reducing your taxes by that much.

You May Like: Does Usaa Do Student Loans

What Happens If I Don’t Renew My Income Information Or If I Become Ineligible For A Reduced Payment Amount While Im Enrolled In An Income

The four IDR Plans Income-Based Repayment , Income-Contingent Repayment , Pay As You Earn Repayment, and Revised Pay As You Earn were designed so your payment will reflect your income as it changes over time. For that reason, its necessary to provide us with your current income information annually.

If you choose not to provide us with your current income information each year, or we determine your current income makes you ineligible for a reduced payment amount, in most cases you will remain on your IDR Plan. Your interest will be added to the principal amount of your loan , and your payment amount will be adjusted to the amount you would have paid on a Standard Plan at the time you entered the IDR Plan. This most likely will result in an increase to your monthly payment amount. The only IDR Plan that is different is REPAYE. If you are on REPAYE and dont recertify your income, youll be removed from REPAYE and placed on the REPAYE Alternative Repayment plan.

Why Dont I Receive Billing Statements While Im In School

If youre enrolled at least half time at an eligible school and arent currently required to make payments, Nelnet wont send you a monthly billing statement. Nelnet sends a monthly billing statement about three weeks before each due date.

In your online account at Nelnet.com, you have 24/7 access that allows you to:

- Update your demographic information to make sure you receive all of Nelnets important messages about your account

- Sign up for Nelnet eCorrespondence

- View your account summary

For more information on ways to pay, see How to Make a Payment.

Don’t Miss: Usaa Auto Loan Rates Credit Score