Basic Tips And Facts To Get A Lower Insurance Price

When buying or renewing a car insurance policy, a common question is, When does the price of car insurance go down?;Sometimes it seems like the cost is always going up for no good reason, especially if your car keeps getting older. However, the age of your car isnt the only determining factor when price is set. A few things can help you know when the cost of your car insurance will go down, and how to get the best price instead of waiting.

When To Consider Keeping Full Coverage

But there are other things to consider, too. Your financial situation is an important factor in deciding what kind of auto insurance coverage you need. The above rule only works if you have enough emergency savings or other assets to cover your costs if something were to happen. If you do not have the money readily available to pay for things like accident repairs, it may be worth it to pay a bit more premium for full coverage than to end up with coverage that is inadequate.

If you decide not to drop full coverage, consider speaking with your insurance agent about the possibility of reducing coverage limits. If it makes sense to drop coverage limits, you may be able to save some money after all. And dont forget, even if you cannot reduce your auto insurance cost now that youve paid off your loan, you still have the monthly car loan savings to look forward to.

Gap Insurance Vs Loan/lease Payoff

A loan/lease payoff is an alternative to gap insurance. Some car insurance companies wont offer gap insurance 30 days after you buy a car, but loan/lease payoff coverage is more flexible. Loan/lease payoff usually only covers 25 percent of the ACV of your vehicle. Before buying loan/lease payoff coverage, compare what you owe to your cars ACV to see if the payoff percentage will be enough to cover out of pocket costs in the case of a total vehicle loss.

You May Like: What Is Better Home Equity Loan Or Second Mortgage

You Have A Low Insurance Score

Every major insurance company uses a credit-based insurance score to calculate premiums where allowed by law. Like , insurance scores are based on credit report information, only they are used to predict a drivers likelihood of filing a claim. The rationale is that individuals who are careful with their money tend to be careful drivers, too.

However, insurance scores are controversial, so they are banned in Massachusetts, Hawaii, and California. Most other states also have restrictions on their use, which can be found on the state insurance regulators website.

Pro: Personal Loans Are More Flexible Than Auto Loans

Personal loans can be used to finance virtually anything. When you take out a personal loan, the lender deposits the lump sum amount into your bank account for you to use as needed, which puts the money directly in your pocket. A personal loan can also help if youre in a situation where you dont qualify for a traditional auto loan say, if youre buying a car from a private party seller.

Alternative to using a personal loan:

Also Check: How To Find Student Loan Number

When To Consider Paying Off A Car Loan

This is a big financial decision and you should give it enough careful thought, just like you did when you first got the car loan. Consider paying off your car if:

- You can afford it. If you dont have any other major, more expensive financial obligations, paying off your car loan makes sense. Youll free up money in your budget to put toward other things. But if you dont have the cash on hand, you may want to explore other options.

- You dont have other outstanding debt. Look at your budget, including how much you bring in and what youre paying out. If you want to save on total interest, you may have other types of debt thats a bigger obligation. Credit cards or personal loans often have higher interest rates than car loans, which means you may want to direct extra financial resources there.

- Youre saving for a big purchase. A car purchase itself is a major financial decision, but if youre trying to save for a home, lowering your DTI ratio and boosting your cash on hand is a big deal. You can do that through paying off your car loan early.

Not everyone has the financial power to pay off a car loan early. If you dont have the funds to do so, you may want to look into other options. Refinancing your car loan gives you the chance to lower your interest rate and reduce how much interest you pay over the life of the loan. But it could also extend your monthly payments, so its important to choose a financial path that fits your situation.

What Are Collision And Comprehensive Coverage

- Collision insurance will pay for damage to your car in an accident, no matter who is at fault. Its limited to damage that occurs while the car is moving: from an accident with another car to a single-car accident where you hit a light post.;

- Comprehensive coverage pays for damage to your car for instances like weather disasters, fire or hitting an animal. It may even pay for a chipped windshield and many policies do so without a deductible.

In general, however, your collision and comprehensive coverage will require a deductible, which you choose when you purchase your policy. A deductible is the amount youll pay before your coverage kicks in, and can be anywhere from $50 to $2,000 or more

Don’t Miss: What Is The Cheapest Student Loan Repayment Plan

Purchasing From A Dealer

Most car insurance experts recommend avoiding buying gap insurance from a car dealership. It can be tempting to buy gap insurance from your dealer to reduce the amount of time you go without it, but gap insurance rates from a dealership can be up to 4 times higher than car insurance company rates. Buying from a dealer can be the most convenient option, but you should always shop around for the best deal.

When To Consider Dropping Full Coverage

Whether reducing coverage after paying off your car loan is a possibility or not depends on the value of the car and your personal financial situation. As a general rule, the Insurance Information Institute recommends that full coverage may not be cost-effective if your cars actual cash value less than 10 times the insurance premium.

Another way to put it is, if your annual premium for full coverage is 10% of the actual cash value of your car, you may want to consider dropping full coverage. For example, lets say you live in California, your annual full coverage auto insurance premium is $1518 and your vehicle has an actual cash value of $8,000. Using this rule of thumb, having full coverage may not be cost-effective.

You might also consider dropping full coverage if you have large emergency savings and are confident you have adequate money to pay for any needed replacement or repair.

You May Like: How Do I Get My Student Loan Number

Eligibility For Credit Or Loan Insurance

To find out if youre eligible for credit or loan insurance, you usually need to:

- be above the minimum age to qualify, usually 18 years old

- be under the maximum age to qualify, often between 65 and 70 years old

- respond to a short health questionnaire of yes or no questions.

Based on your answers to the health questionnaire, you may be approved right away or you might need to take a medical exam before you can be approved.

Your insurance wont be valid if you do not provide accurate answers on this questionnaire. This means a claim wont be paid, even if youve paid premiums. Take your time in answering the questionnaire carefully and truthfully. Understand if youre eligible for coverage and ask questions if you have any. Take the documents home with you or consult with a medical professional if needed.

You may lose your coverage if:

- youre over your credit limit

- you owe any payments that are past the due date

- you have recent dishonoured payments on your account

Dishonoured payment happens if an automatic payment does not go through because you’ve reached your credit limit.

Cancelling Credit And Loan Insurance

You can cancel credit and loan insurance at any time. Check your certificate of insurance for the steps to take.

Usually you need to contact the insurance company. Keep in mind that the insurance company is often a different company than the financial institution where you signed up for insurance.

When your coverage starts, theres usually a 20 to 30-day review period, depending on your province or territory. The review period is sometimes called a free-look or trial. During this time, you can cancel the policy and get a refund for any premiums you have paid. If you dont want credit or loan insurance you are responsible for cancelling it. After the review period ends, if you dont ask your financial institution or insurance company to cancel this type of insurance, you will continue to receive insurance coverage and be charged a premium for it.

Read Also: How Much Can We Borrow Home Loan

When Does Car Insurance Go Down For Seniors

Many insurance companies offer discounts to seniors, or may even offer discounts if you are part of a senior group. Retiree discounts are also common.

Some insurance companies give young drivers the best car insurance rate, and others are best for seniors. Even if you have to pay a penalty for switching your insurance company, it may be worth it if you are going to get a lower rate.

Always check the pricing with a few insurance companies, regardless of your age group, to see whether they will offer you better rates.

How Getting Car Insurance Quotes Can Affect Your Credit Score

Getting a quote for car insurance won’t affect your credit score.

When you ask for a quote, insurance companies will run a soft check at most.

It’s only when you apply that a hard check comes into it. And again, that’s only if you pay monthly.

When you take out an insurance policy, you’ll be given a 14-day ‘cooling-off period‘ in which you can change your mind.

If you do change your mind and decide to go with another insurer, the first hard check will be on your record, and you’ll have another one for your new application.

That might be a problem if you’re trying to improve your credit score.

Don’t Miss: How To Get An Fha Loan With No Money Down

You Are Too Young Or Too Old

Teens are statistically more likely to cause car accidents than the average driver, so insurance companies charge them the highest premiums. Drivers who get their license at 16 years old usually see their premiums decrease with every year of experience, however, and age 25 is generally considered a turning point when premiums become considerably lower.

Experienced drivers in their 40s and 50s are often the cheapest to insure. But rates begin to rise again after age 65.

The Issue Of Depreciation

If you plan on paying your lien to save money on car insurance, reach out to your auto insurer right away after the lien is settled. ;You just might find the vehicle is worth less after years of wear and tear and consequently cheaper to insure than immediately after purchase. ;Though there are exceptions to the rule, in general, most new vehicles are comparably expensive to insure. Some auto insurers wont apply the depreciation reduction until customers speak up and request it. ;So dont be shy. You have done your part by paying off your car loan. You should reap the benefit in the form of lower auto insurance premiums.

It makes sense for the insurer to charge less to insure a vehicle that has aged a couple years as opposed to one that is brand new. ;As is often said, vehicles depreciate in value the moment they are driven off the lot. Add in all the wear and tear from driving 10,000 miles or more per year and the vehicle really is worth that much less after a couple years. ;So dont continue paying through the nose for car insurance. Be proactive, pay off your auto loan, raise the issue of depreciation with your insurer and shop around for the best rate.

Also Check: Is It Easy To Get Loan From Credit Union

Here’s What You Need To Know If You’re Financing Or Leasing A Car

Car insurance is necessary to stay protected financially on the road. In addition to liability insurance and collision coverage, you may also need to purchase gap insurance. Gap is an insurance industry acronym for “guaranteed auto protection”.

Whether you need car gap insurance can depend on the type of vehicle you purchase or lease. But is gap insurance worth it? It may be if you believe you may owe more money on a vehicle than your comprehensive auto insurance policy would pay out if you were to file a claim.

What Happens If You Dont Have Full Coverage On A Financed Car

You must purchase full coverage auto insurance when you initially finance the vehicle. If you choose to downgrade to liability insurance while you still owe money on the car, you are violating the contract with your lender. That means theyre legally allowed to cancel your auto loan and take the vehicle away from you.

While you can technically downgrade a financed car from full coverage to liability coverage while you still owe money on the vehicle, you should never do this. Even if your lender doesnt find out and take the vehicle back, youd still be fully responsible for any damages that occur to the vehicle.

Recommended Reading: How To Get Loan Signing Jobs

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Is It Always Good To Pay Off Your Car Loan Early

There are a few good reasons to pay off your car loan early:

- save money on interest

- free up the monthly car payment for other uses

- the extra payments are earning a guaranteed return equal to the interest rate of your loan

- eliminating the responsibility of the payment if something were to happen

There is one good reason to not pay off your car loan early, though:

- you could potentially earn more money by investing the extra money

What do I mean?

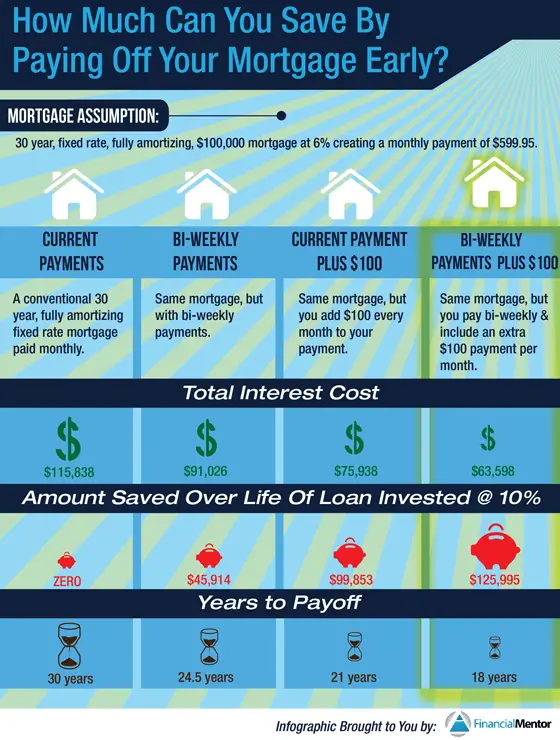

Lets say you have a $5,000 balance left on your car note at 4.7% and you have $5,000 sitting in savings. Should you take the money and pay off the debt?;

Paying off the car loan would earn you a guaranteed 4.7% which is pretty good, certainly more than you are earning in a savings account.

But could you earn more money by say investing in the stock market?;

Maybe. Maybe not.;

Lets take a look at some actual numbers.

If you had a loan with a balance of $5,000 at 4.7% being paid off over two years, you would pay $248 in interest. That is the guaranteed cost of that loan, so paying it off today would essentially earn you a guaranteed $248.

If you could earn more than $248 by investing the $5,000 then you could argue it would be a better financial decision. The trouble is the $248 in interest savings is guaranteed.

If you are comparing paying off the loan against investing in the stock market then you are not comparing apples to applesyou are comparing an investment with risks to a guaranteed return.

Not the same thing at all.;

Also Check: Are There Student Loan Forgiveness Programs

Enjoy Life With A Paid Off Car

Theres no denying that paying off a car loan often takes years of hard work, persistence, and sacrifice. Doing so, however, is a great feeling that can bring you a great deal of freedom and peace of mind.

Once youve paid off your loan, pat yourself on the back and enjoy the extra money in your pocket each month. After all, you earned it.

Ready to refinance your car loan?

How Car Insurance Is Affected After Paying Off Your Car Loan

After paying off a car loan, youll need to let your know to take the lenders name off the policy. Then, you can discuss what changes you want to make so that your policy can meet your needs now.

Factors that could affect your car insurance after paying off your loan:

- Not meeting loan requirements. Your lender probably required you to keep full coverage, which includes comprehensive and collision. Now that your lender isnt in the picture, consider dropping any options you no longer need.

- Dropping gap insurance. If you do drop gap insurance, you might replace it with roadside assistance if your cars warranty has run out.

- Depreciated car value. You can update your cars details on the policy, including its year and mileage. If its value has lowered, your insurance premiums could be lower and you may not need the same liability limits.

- Other life changes. Your age, marital or homeowner status may lower your rates or help you qualify for discounts.

Recommended Reading: How To Check If Loan Is Fannie Or Freddie