Loan Consolidation Caution: Don’t Mix Federal And Private Loans

As mentioned earlier, if you have both federal student loans and private student loans, you should consolidate them separately, not together.

Private student loans lack certain protections. Combining them with federal loans will disqualify you from applying for the benefits provided for federal student loans, such as to extending the loan-payment period , income-driven repayment plans, and federal loan forgiveness programs.

That would give you two loan payments per month, which is still simpler than four or five or more of them. And that’s before you go to grad school…

When Debt Consolidation Makes Sense

The main benefit of debt consolidation is that it can make staying on top of your payments more manageable. And consolidating debt can actually help you improve your credit score in some cases by lowering your credit utilization ratio and improving your credit mix .

Here are a couple scenarios when debt consolidation may make sense:

- You want to reduce your number of monthly payments. Consolidating debt allows you to combine multiple monthly payments into one single payment.

- You want to lower your interest rate. Consolidating debt may allow you to get a lower interest rate, which can help you save money over time.

What Is Student Loan Refinancing

When you refinance a student loan, you take out a new loan with a refinance lender that lender will pay off your old student loans, and youll begin making payments on your new debt. By refinancing your existing debt into a new loan, you could get a lower interest rate, lower monthly payment or both.

If you have multiple student loans, you can choose to refinance all, some or just one of them. For example, if you have federal and private student loans, you can choose to only refinance the private loans. Combining multiple loans into one can also help simplify your repayment.

While the government offers you the ability to consolidate your federal student loans, refinancing federal loans will convert them into private debt. That means youll lose access to federal loan benefits such as income-driven repayment plans and loan forgiveness programs. For that reason, refinancing federal student loans generally carries more downsides than refinancing private debt.

Read Also: Usaa Mortgage Credit Score Requirements

Should I Consolidate Or Refinance My Student Loans

Consolidation combines loans into one monthly payment with one servicer. Consolidating your loans may make it easier to keep track of your loans if you have more than one student loan with more than one servicer or company.

There are two types of consolidation loans. The type of consolidation loans available to you depends on whether you have federal or private student loans.

Private And Federal Student Loans

If youre like most graduating students, you probably have a mix of both private loans and federal loans. If thats the case, youve probably found out how hard it is to consolidate these types of loans together into one happily blended family. If youre looking to roll private loans or a mix of federal and private loans into one, youll have to go through a private lender under a process called refinancing.

Read Also: Do Mortgage Loan Officers Make Commission

What Is A Credit Score

Lenders usually use the FICO credit scoring model. A credit score is a numerical determinant ranging from 300-850. It is the reflection of the borrowers creditworthiness and trustworthiness.

The score depends on many factors, but mainly on the individuals prior performance, such as the timely payments of debt, credit usage, credit history length, recent activities, etc. The higher the score, the more creditworthy the individual is.

Usually, a score above 700 is considered good, while between 800-850, it is excellent. People in the U.S in 2020 had an average score of 710.

Many entities check credit scores for different purposes. You can observe its impact on daily life when:

- you want to get a new loan

- an employer makes a decision regarding hiring or promoting

- insurance company use a credit score to determine insurance costs

Cons Of Consolidating Your Student Loans

- Extended debt period means paying more interest over time

- Outstanding interest on individual loans becomes part of the consolidated loan principal

- Loss of borrower benefits like interest rate discounts, principal rebates and loan cancellation benefits on certain loans

- Youll lose credit for any pre-consolidation payments toward PSLF or an IDR plan*

- You cant pay off individual loans to lower your monthly payment

*The Department of Education announced temporary changes that allow PSLF-eligible borrowers to consolidate certain loans without losing credit for earlier payments. If you consolidate qualifying loans by Oct. 31, 2022, previous payments may still be eligible for PSLF. Find full details of the action steps you must take on the Federal Student Aid site.

Read Also: Auto Loan Self Employed

Questions To Answer Before Consolidating Or Refinancing Student Loans

You may want to make a single, lower monthly payment however, before you decide to consolidate or refinance, you should consider the pros and cons of each option. Answer these questions before you act:

- Are you saving money or are you just paying over a longer term, so youll end up paying more over the life of your loans?

- Will you lose any current student loan benefits, such as repayment options or Public Service Loan Forgiveness?

- Is your credit score sufficient for a lender to approve you for a consolidation or refinancing?

- Will your new loan be considered a student loan or a personal loan? If its not a student loan, will you lose out on an interest tax benefit?

- Will you have to pay any service fees to refinance your student loans?

- Will you lose any discounts that youve had with your loan originator?

How Does A Student Loan Consolidation Affect Your Credit Score

- How Does a Student Loan Consolidation Affect Your Credit Score?

Students graduate from college with an average of $30,000 in student loans, often carrying more than one loan at a time. Student loan consolidation can make it easier for borrowers by lumping multiple loan payments into one.

With student loan consolidation, your old loans are paid off by the lender, and you will be issued a new loan.

The process of consolidating your student loans requires an inquiry into your credit history, which can cause your credit score to drop slightly.

The drop is usually not very substantial, and your credit score can quickly come back up within a year or two.

Student loan consolidation can help your credit in the long run. It makes payment management easier and can, therefore, help build your credit.

You May Like: How To Stop A Student Loan Garnishment

Is Student Loan Consolidation Worth It

Student loan consolidation has become a popular choice for student loan borrowers. Theres no denying that college isnt cheap. Youve got tuition, books, housing, and food to think about. As a result, its common for most students to take out student loanssome have more than one loan from different lenders.

Student loan consolidation is a process that allows borrowers to bundle together all of their federal loans into one loan they will be responsible for paying back.

But, is student loan consolidation worth it? Student loans affect thousands of people across the country. Sure, if you have a degree you have a better chance at getting a job and making more money now.

However, even with a degree, you may still be struggling to pay off these loans long after college is over. Consolidating your student loans can be a smart financial move, but its not a decision to be taken lightly.

To save you the headache and make it an easy process, please read on. Below are answers to questions you might have about consolidating your student loans.

You Might Lose Some Benefits Associated With The Loans You’re Consolidating

Special Consideration for Military Servicemembers

If you’re an active-duty military servicemember, you’re eligible for an interest rate reduction to 6% under the Servicemembers Civil Relief Act for all federal student loans you took out before service if your military service materially affects your ability to pay the loan at the pre-service interest rate. But if you consolidate your loans while serving in the military, you won’t be eligible to receive this reduction.

Recommended Reading: Can You Refinance An Fha Loan

How Does Consolidating Student Loans Affect Credit

If you have student loan debt, youve probably been offered the option to consolidate your loans with the promise of lower interest rates and monthly payments. But how does consolidating student loans affect your credit?

Americans have amassed over $1.4 Trillion in higher education debt. Its no wonder there is a rising number of companies offering student loan consolidation help.

of consumers with $50,000 or more in student debt had credit scores of at least 800.

But what are the real benefits of consolidating your student debt? And how will it impact your credit? Lets find out right now.

Weighing The Pros And Cons Of Student Loan Consolidation

The student loan category is the fastest-growing category of US consumer debt. About 45 million borrowers own more than $1.67 trillion in student loans. Rising unemployment and challenging macro conditions make it tough for borrowers to meet their student loan obligations. To manage loans more efficiently, many students opt for loan consolidation. Under the Federal Direct Consolidation Loan program, you can consolidate all or some of your federal student loans into one loan. The Federal Direct Consolidation Loan program is only meant for federal student loans and not private loans.

However, there are certain private lenders that consolidate federal and private loans. You can also opt to refinance private student loans. Aside from banks and credit unions, online lenders like SoFi and LendKey have emerged as key players in the loan consolidation and refinancing business.

Tens of millions of Americans are facing a financial cliff if #studentloan relief isnt extended by #Congress!

You May Like: Refinance Options For Fha Loans

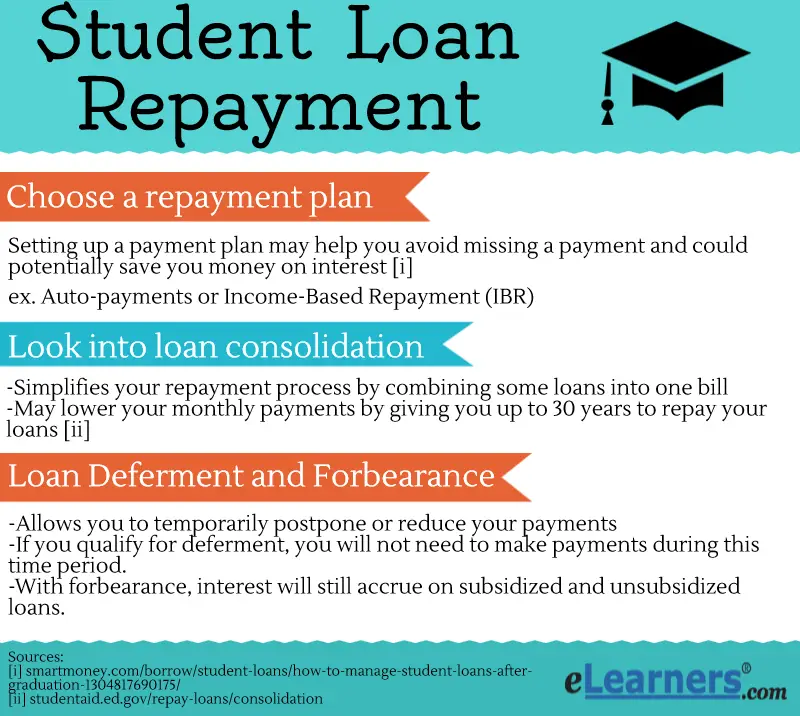

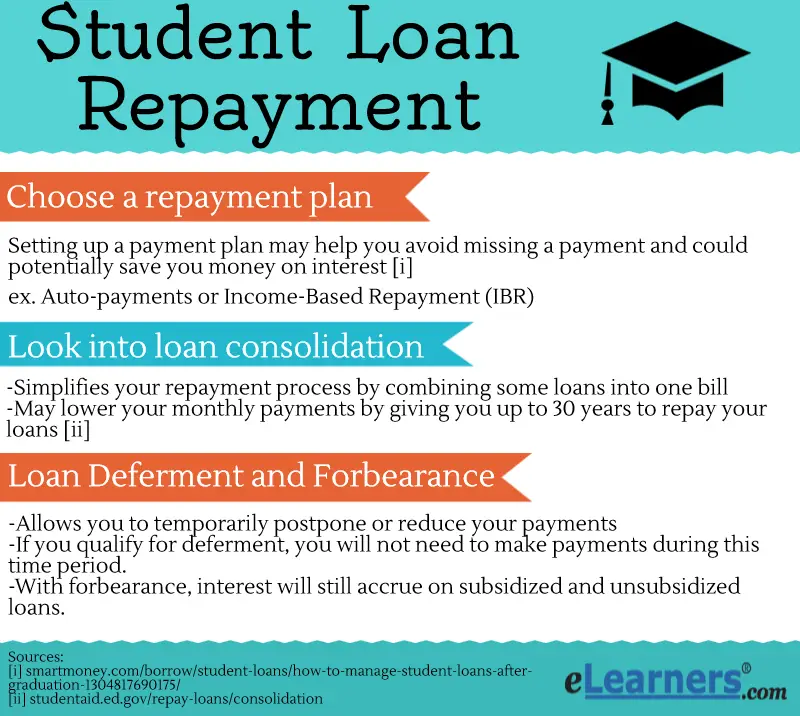

You Could Get Access To Different Repayment Options

By consolidating, you might get access to a repayment plan that wasn’t previously available to you. You can repay a Direct Consolidation Loan, in most cases, with:

- a standard repayment plan

- the Income-Contingent Repayment Plan

- the Pay As You Earn Repayment Plan

- the Revised Pay As You Earn Repayment Plan , or

- an Income-Based Repayment Plan.

How Do Refinancing And Consolidation Work

If you’re having trouble affording your student loan payments, loan refinancing and consolidation are two options you might be exploring. Both can simplify your loan repayment and reduce your payments, but they share few similarities beyond that. There is another option you can explore, and that is checking is you have a forgivable student loan.

Refinancing replaces one or more existing loans with a new one through a private lender, while consolidation goes through a program with the federal government and is only available for federal student loans. Here’s a quick summary of how they differ:

| Student Loan Refinancing vs. Consolidation | |

|---|---|

| Refinancing | |

| Can result in a lower monthly payment | Yes |

| Can qualify for a lower interest rate | Yes |

| Can result in a higher interest rate | Yes |

| Keeps access to federal loan benefits | No |

| Can pause payments in the future | Yes |

| Can still qualify for loan forgiveness | No |

| No |

You May Like: How To Find Out Where My Student Loans Are

Will Consolidating Student Loans Hurt My Credit

In general, direct loan consolidation has no negative effect on your credit. Unlike student loan refinancing, the federal government does not require a hard credit pull , a process that can have a small, short-term impact on your credit score and will show up on your credit report later. A new direct consolidation loan allows you to choose a comfortable monthly payment, making it less likely youll miss a payment or make a late payment.

Student Loan Consolidation Basics

If you have multiple federal student loans and want to simplify your payments, one option is to consolidate your debt with a Direct Consolidation Loan. When you consolidate your loans, the federal government issues you a new loan for the amount of your old ones. Moving forward, youll have one single payment and one large loan rather than several.

The interest rate on a Direct Consolidation Loan is fixed, meaning it will stay the same for the length of your loan. The rate is the weighted average of the interest on your previous loans.

By taking out a Direct Consolidation Loan, you can minimize the stress of your debt while retaining your federal loan benefits. Often, a Direct Consolidation Loan can help you qualify for beneficial federal programs such as income-driven repayment plans.

| Should I consolidate my loans? Review the pros and cons first | |

|---|---|

| Pros | |

| No credit check necessary to qualify Receive a single monthly bill Lower your monthly amount due Choose a new, more helpful federal loan servicer Switch from a variable interest rate to fixed Maintain or gain access to federal loan repayment plans and other government-exclusive safeguards | Your interest rate wont decrease Your principal could increase if youre consolidating loans with unpaid interest You could pay more over time Your progress toward forgiveness programs could be reset, and older federal loans could be stripped certain benefits, such as interest rate discounts |

Don’t Miss: Is Carmax Pre Approval A Hard Inquiry

What Loan Terms Are Available

The repayment term is the number of years you have to repay your debt in full. Lenders typically offer lower interest rates for shorter repayment terms and higher interest rates for longer repayment terms. Your monthly payments will be higher with shorter-term loans and lower with longer-term loans.

Many student loan refinance lenders offer loan terms of five, seven, 10, 15 and 20 years. Be sure to review how much is left on your current loans termif you refinance and extend your loan term considerably, you will likely end up paying more in interest over the life of your loan.

Why Should You Consolidate Federal Student Loans

Loan consolidation helps simplify the repayment process. You make a single monthly loan payment instead of multiple payments. Tracking different amounts and due dates of several loans could be a hassle for a borrower. Student loan consolidation provides flexibility regarding the duration and even interest rate when you consolidate through a private lender.

Also, the Federal Direct Consolidation Loan program doesnt involve a credit check. Individuals with bad credit can qualify to consolidate their federal student loans. The Federal Direct Consolidation Loan program can correct a borrowers student loans even if the individual is in default. The program also helps borrowers become eligible for several benefits like income-based repayment plans, loan forgiveness, deferment, and forbearance.

Don’t Miss: How Long Does It Take Sba To Approve Ppp

You Don’t Get A Grace Period

With a Direct Consolidation Loan, you don’t get a grace period. The repayment period starts immediately upon consolidation, and the first payment will be due in around 60 days. Though, if any of the loans you want to consolidate are still in the grace period, you can delay the processing of a Direct Consolidation Loan until the end of a grace period if you make this selection in the application.

Student Loan Consolidation Is Not Refinancing

Because the interest rate is fixed based on an average, the Direct Consolidation Loan may not really save you as much money as it wraps all the loans into one easy payment because well, people have a hard time keeping track of things.

Also, if were being honest, when debt outpaces income, we get depressed, pretend it doesnt exist, eat ice cream, and binge-watch Netflix.

But refinancing is a whole other animal.

For starters, you can refinance both your federal and private loans.

Since refinancing is only available through private lenders, you lose the federal benefits that come with those loans.

But the refinanced loan will have completely different terms and you may be able to negotiate a lower interest rate.

I recommend going through your credit union or shop around for one who will play ball. They are more than likely to kiss your rear on bargaining for your business.

Talk to a few credit unions and see who will offer the best terms. Of course, this will be based on your income and credit score so quit applying for credit cards.

You May Like: Stilt Loan Calculator

When Is The Best Time To Consolidate Student Loan

The best time to consolidate student loans is when a borrower has a high-interest rate that significantly affects their monthly payment.

Consolidating never hurts, because the borrower is either going to pay off their credit card and free up that money, or they will pay down the student loan.

However, there are many variables that go into the best time to consolidate student loans. What is best for you depends on a number of factors. Such as how much you owe, where your loans are, and whether you qualify for loan forgiveness. Generally, its advisable to seek expert advice.

What Is A Direct Consolidation Loan

The Direct Consolidation Loan process blends all of your existing federal loans into one new loan for the remaining life of the loan. With federal student loan consolidation, you now have only one loan payment due to one loan servicer each month with a new fixed rate. Its important to note that any private student loans you have cannot be consolidated with a Direct Consolidation Loan.

While consolidating federal education loans can make student loan borrowers lives easier from a payment perspective, direct student loan consolidation does not save any money. Your new interest rate with a direct consolidation loan is simply a weighted average* of your existing rates.

*How does a weighted average work? Say you have two qualifying student loans: one $10,000 loan with a 6% interest rate and another $5,000 loan with a 5% interest rate. Calculating your new rate works like this: Because $10,000 is of your total loan balance and $5,000 is , youd multiply each interest rate by that fraction and add the results: + = 5.67%. The weighted interest rate is then rounded up to the nearest one-eighth of 1% .

You May Like: How Long Does Sba Approval Take