How Do I Shop For A Home Equity Loan

Consider contacting your current lender to see what they offer you as a home equity loan. They may be willing to give you a deal on the interest rate or fees. Ask friends and family for recommendations of lenders. Then do some research into the lenders offerings and prepare to negotiate a deal that works best for you. Use the Shopping for a Home Equity Loan Worksheet.

Who Is Suitable For A Homeowner Loan

To be eligible to apply for a homeowner loan or any other secured loan where the loan is secured against equity, you need to have enough home equity in the first place.

Many secured homeowner loans set a minimum amount you must borrow, typically around £10,000. And because you cannot borrow against all your home equity, youll need more than this to borrow at least £10,000. Youll also need to be of a certain age and live in the UK for most of the year to make you a UK tax resident.

The above just makes you eligible to apply. To be approved your finances will need to be assessed. This is to ensure you can afford the loan and to prevent a situation where your home may be repossessed.

Is A Home Equity Loan The Best Way To Finance Major Home Repairs

You can pay for a major home repair like a new roof or a renovation like a kitchen remodel in a number of ways. Among them, a home equity loan allows you to access your home equity and provides generally lower rates than the rates on other loans.

Using your home equity has a number of advantages, but it also has downsides to consider. Mainly, when you use your home as collateral, you risk losing it to foreclosure if you can’t repay the loan.

Learn more about how to use a home equity loan to pay for major home repairs, as well as more about the pros and cons of this financing strategy.

Also Check: How To Receive Loan Forgiveness

How Much Of A Home Equity Loan Can I Get

The amount you can borrow with a home equity loan depends on how much equity youve built up in your home and what you own on your primary mortgage. Most lenders cap your combined loan-to-value ratio around 80%, meaning your primary mortgage and your home equity loan together cant be more than 80% of the homes value.

For example, say your home appraises for $400,000 and you currently owe $150,000 on your primary mortgage. Heres how to find your maximum home equity loan amount:

- Home value: $400,000

- Maximum combined loan amount: $320,000

- Existing mortgage balance: $150,000

- Maximum home equity loan: $170,000

The amount you can borrow also depends on your credit score, interest rate, and debt-to-income ratio .

When it comes to DTI, your lender will review your monthly loan and credit card payments and then compare this figure with your income to determine affordability. For this reason, two borrowers with similar incomes and the same amount of equity can qualify for different size home equity loans especially if one borrower has more debt than the other.

Home Equity Loan Example

Lets assume your current home value is $400,000 and your remaining balance on the loan is 200,000. This computes to a 50% LTV , which is considered a good percentage by most lenders for home equity loan purposes.

Your lender allows you to borrow up to 80% of your homes value, the maximum amount of borrowable equity would be $320,000 .

Following our formula, we take that number and subtract the remaining balance on the mortgage, which is $200,000 . $320,000 – $200,000 = $120,000.

$120,000 is the total amount you can borrow from home equity.*

Read Also: What Is The Lowest Mortgage Loan Amount

Check Your Credit Score First

Before you apply for a homeowner loan in the UK, make sure you check your credit score. You can do this for free with many credit reference agencies with a free trial. Create a reminder to cancel your subscription within the trial period or you could be stuck in an expensive contract you dont need.

If your credit score is not as good as you thought it was, there may be some quick fixes you can do before applying. Or you may prefer to improve your score over a longer period and then apply after.

Funding A Home Improvement Project

Home improvements are one of the most common uses for home equity loans and home equity lines of credit. Home improvements can help boost the value of your current home. Home equity loans are one of the most affordable ways to remodel your home, but keep in the mind the renovation costs they may surpass the amount of the loan.

You May Like: Would Student Loan Forgiveness Include Private Loans

How Can I Calculate My Home Equity

Its quite easy to calculate your home equity. All you have to do is subtract any remaining debts against your home from the current property value. For most people, this will simply require taking off the existing mortgage balance away from the value, but if you have additional debts secured against your property, you will also need to take away these amounts from the homes value.

For example, if your home is now worth £250,000 and you have a £125,000 mortgage then you have £125,000 home equity . If you already have a home equity loan of £30,000 then this would need to be subtracted as well, giving you £95,000 home equity.

The only difficult part is knowing what the value of your property currently is. Many people just use the price they paid for their home, but the value of your property may have changed even over a short period.

What Are Homeowner Loans

A homeowner loan is a type of secured loan that uses your home equity as collateral in the event you fail to keep up repayments. Thus, you need to be a homeowner with sufficient home equity to get a homeowner loan.

There are multiple terms to describe a loan secured against home equity. You may also know them as home equity loans and second charge mortgages. Only ever apply for one of these products from a bank or lender that is authorised and regulated by the Financial Conduct Authority.

Recommended Reading: How To Convert Fha Loan To Conventional

What If My Home Sells For Less Than The Loan Amount

This is something borrowers need to be aware of, although it is relatively unlikely.

As the maximum borrowed via equity release is 60 per cent, it would need to lose at least 40 per cent of its value before you were in negative equity.

However, if this is something that concerns you it is worth knowing that products offered by ERC members must have a no negative equity guarantee.

This means that, if the money from the eventual sale of the home is not enough to repay the outstanding loan, the borrower or their estate will not need to pay any extra.

However, in such an instance those inheriting the estate would be left with nothing from the value of the former family home.

You can compare equity release rates across ERC member products and find out more about how much you could potentially borrow with This is Money and Age Partnership+’s equity release comparison tool.

Equity And Home Appraisals

To determine whether you qualify and how much money you can borrow, a lender will have your home appraised. The home appraisal will tell the lender how much your home is worth.

Rocket Mortgage will allow you to borrow around 90% of the equity in your home. To figure out the amount you could obtain through a home equity loan, youd determine your loan-to-value ratio. To do this, subtract the remaining balance of your primary mortgage from 90% of the appraised value of your home. For example, if your home is appraised at $400,000 and the remaining balance of your mortgage is $100,000, heres how you would calculate the potential loan amount:

$400,000 x .9 = $360,000=$360,000 $100,000 = $260,000

This means you could secure $220,000 if you obtained a home equity loan.

Don’t Miss: What Are Conventional Loan Rates

Do I Need A Home Equity Loan

Home equity loans are often considered a smart choice should you need to access a large sum of cash quickly, but taking one can put your home at risk if you were to default. If you use this money to pay for home improvements, you may come out ahead, since many improvements add value to the home over time.

If you plan to use a home equity loan to pay off other debts or buy a car, its advisable to consider all your options before opting for a loan that could put your primary residence at risk.

Occasionally, predatory lenders may be willing to extend a higher-interest home equity loan even if they believe you wont be able to make the payments, or with too-good-to-be-true advertising that contains hidden fine print. Make sure you fully understand the terms of any home equity lending product before proceeding.

How Much Can You Borrow

To determine the amount you can borrow, you first need to determine the equity in your home. Thats done by using the appraised value of your home, minus the amount you currently owe on the home.

Example: Your home appraises for $400,000 and your current mortgage balance is $250,000. Therefore, the equity in your home is $150,000.

In addition to the equity in your home, lenders will also determine the amount you can borrow based on your creditworthiness. This is known as the combined loan-to-value ratio.

Example: Lets assume the lender approves you for 85% maximum combined loan-to-value for your loan based on your creditworthiness. If your current home appraises for $400,000 and your mortgage balance is $250,000, then you would have received a home equity loan up to $90,000.

Appraised Value

Home Equity Loan

$90,000

Just as you would expect with any other installment loan, the lender will determine the eligibility, terms and interest rate of your loan based on factors such as your income, assets, liabilities and .

Also Check: Can You Finance 2 Cars On One Loan

Example Of A Home Equity Loan

Say you have an auto loan with a balance of $10,000 at an interest rate of 9% with two years remaining on the term. Consolidating that debt to a home equity loan at a rate of 4% with a term of five years would actually cost you more money if you took all five years to pay off the home equity loan. Also, remember that your home is now collateral for the loan instead of your car. Defaulting could result in its loss, and losing your home would be significantly more catastrophic than surrendering a car.

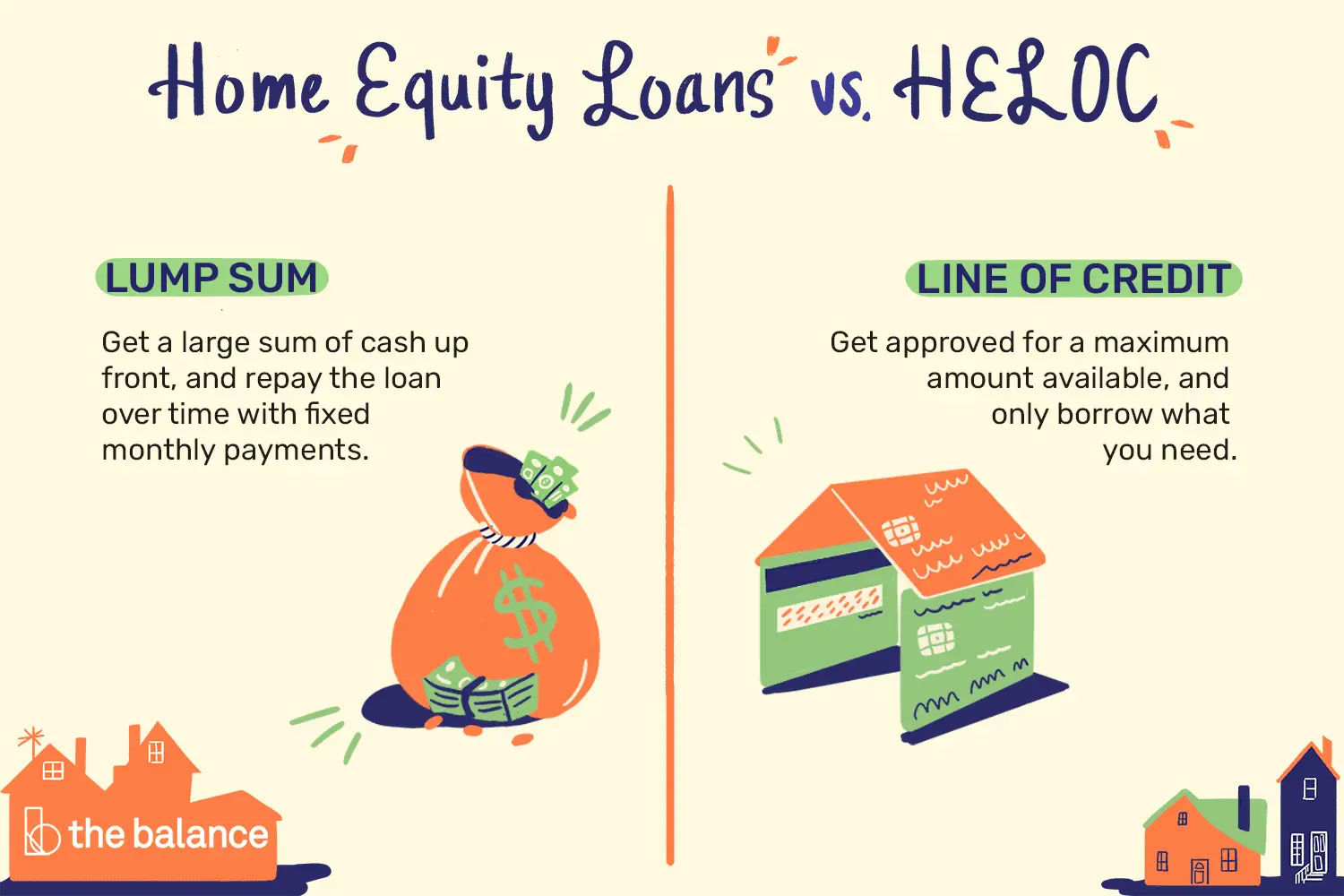

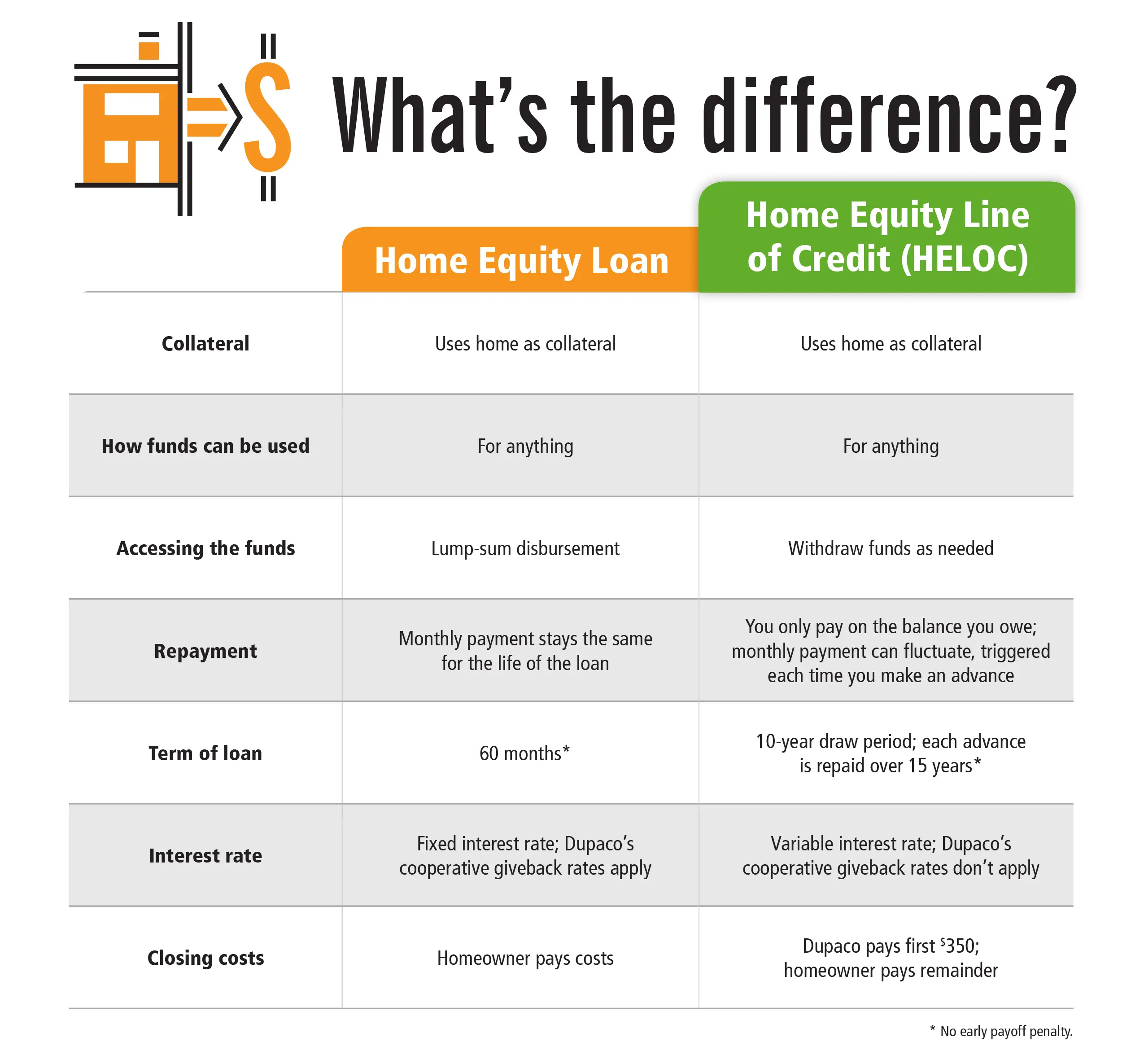

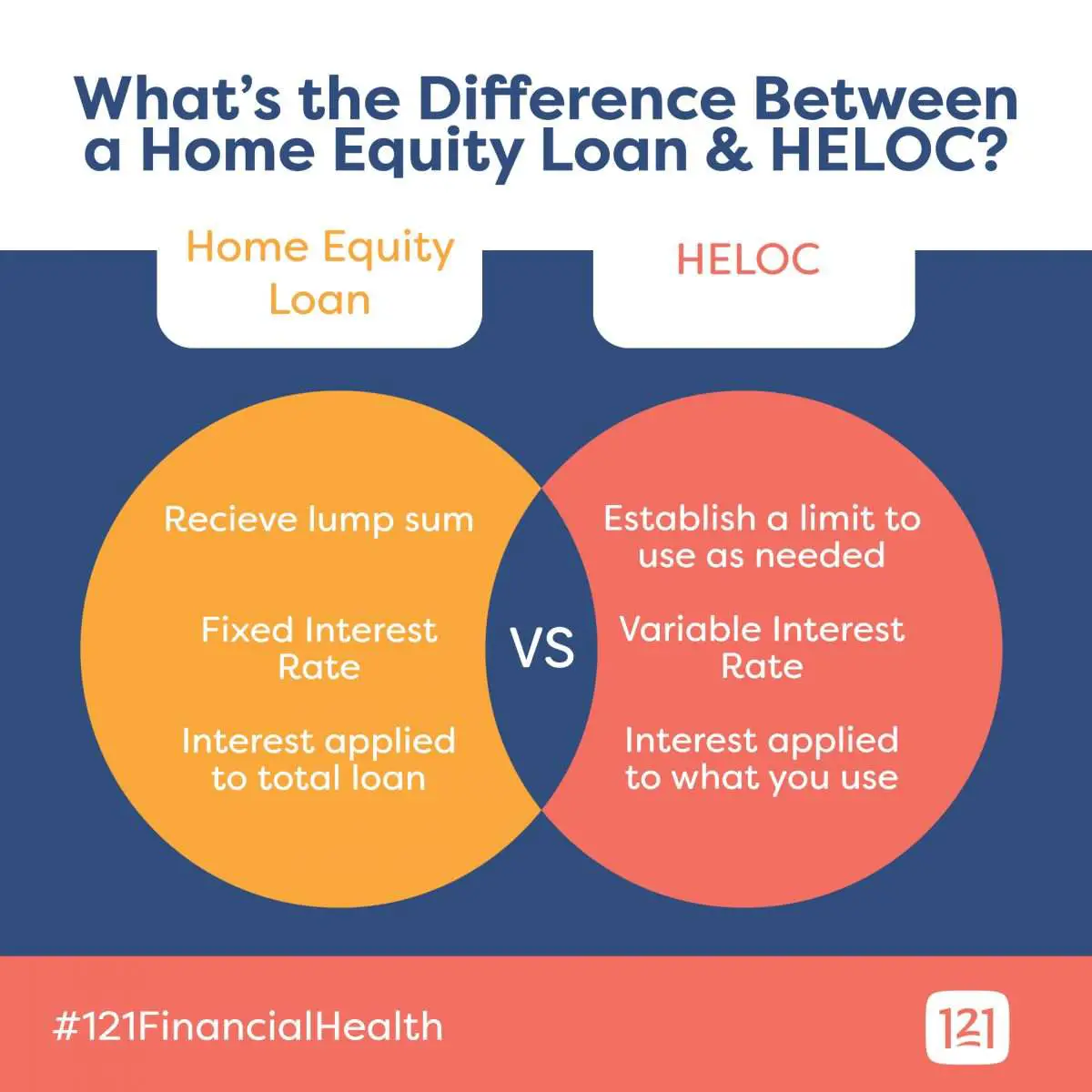

What Is A Heloc

A home equity line of credit, or HELOC, is a revolving credit line that usually comes with a variable interest rate. The lender approves you for a specific amount of money the line of credit that you can borrow from on demand.

Most HELOCs allow you to borrow from the account during a draw period,” around 10 years, using checks or a credit card tied to the account. Once you hit your credit limit, you can pay down the line and borrow from it again. As with a credit card, you pay interest only on the money you’re using.

At the end of the draw period you enter the “repayment period,” typically 15 to 20 years. Because the interest rate is variable meaning it can increase or decrease your payments may fluctuate. Lenders use a benchmark interest rate, such as the prime rate, to determine how to raise or lower the rate on a HELOC.

Before signing for the HELOC, ask which index your lender uses and how often the rate can change. You might find you’ll have an opportunity later to convert a portion of what you owe on the HELOC to a fixed-rate balance.

Depending on your creditworthiness and other factors, you may be able to borrow up to 85% of the value of your home, minus your mortgage balance. In other words, if you have $100,000 in home equity, you could potentially borrow as much as $85,000.

A home equity line of credit can provide a flexible way to borrow money, but payments can change. Here’s a fuller look at HELOC pros and cons.

Read Also: How Do I Figure Out My Loan Payoff Amount

Best Home Equity Loans Of 2022

Home equity loans are a popular way to get money for home improvements, education expenses or consolidate debt. This type of loan typically offers homeowners lower interest rates than most credit cards and can be repaid in fixed monthly payments.

Read on to see which banks are offering the best home equity loan options and some great ways to tap into your home equity.

What Are The Requirements To Get A Home Equity Loan

Though the specific requirements vary from lender to lender, there are a few things that youll need to qualify for a home equity loan.

- A reasonable amount of equity: Its important to keep in mind that, depending on your lenders LTV, you can typically only borrow between 80% to 90% of your equity. That means that if you havent paid much toward your home yet, you may not be able to get a home equity loan that covers its intended purpose.

- A good credit score: Having good credit makes it easier to qualify for loans. While home equity loans might be easier to get than other types of loans due to the security that using your home as collateral provides, good credit will help you secure a good interest rate.

- A good debt-to-income ratio: Lenders want to know that you can make payments on your loan. The lower your debt-to-income ratio, the easier it will most likely be for you to make monthly payments.

- A source of income: Your lender might ask for copies of your paystubs or other proof of income, so it knows youll have a way to repay the loan.

Also Check: What Kind Of Home Loan Can I Qualify For

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our loans reporters and editors focus on the points consumers care about most the different types of lending options, the best rates, the best lenders, how to pay off debt and more so you can feel confident when investing your money.

How Do You Build Home Equity

There are a few methods to improve your property equity. Here are some of the most common strategies that homeowners use:

Pay your loans on time: This one is pretty straightforward. Making your mortgage payments on time will help improve your credit score and, in turn, increase the equity in your home.

When you reduce your loan balances, the equity in your property increases. The majority of house loans are amortizing loans with equal monthly payments that go to both interest and principal. As the money that goes into the principal repayment gradually increases, building your equity will get faster every year.

Stay in your home for more than 5 years: If you stay in your home long enough, the amount of equity youve built up will exceed the costs associated with selling and buying a new property.

Accelerated mortgage payments: This is a term that refers to increasing the amount of money paid by borrowers to finance their homes.

Homeowners are most likely to make monthly mortgage payments or a total of 12 payments per year. If you divide your monthly payment into two equivalent payments, youll end up making 26 payments each year. This approach will eliminate a significant amount of interest, as well as help you pay off your mortgage and build property equity faster.

Putting down a larger down payment: A larger down payment will decrease the amount you need to borrow and, as a result, increase the equity in your home.

Read more: How to Invest in Real Estate?

Also Check: How Much Interest Will I Pay Student Loan

What You Cant Do With A Home Equity Loan

- You cant get a home equity loan for more than your house is worth. In fact, your home equity loan amount plus your current mortgage balance generally must be less than 90 percent of your homes value.

- You cant use investment or commercial properties, or manufactured homes to get a Discover Home Loan.

Remember, a home equity loan uses your home as collateral. Make sure youre comfortable financially with the amount you borrow and the terms of the loan. Your Discover Personal Banking Specialist can answer all your questions to help you make the right financial decisions.

Find your low,

Related Article

- Main

-

- Home loans made by Discover Bank.

Equity Release: How It Works And Advice

To help readers considering equity release, This is Money has partnered with Age Partnership+, independent advisers who specialise in retirement mortgages and equity release.

Age Partnership+ compares deals across the whole of the market and their advisers can help you work out whether equity release is right for you – or whether there are better options, such as downsizing.

Age Partnership+ advisers can also see if those with existing equity release deals can save money by switching.

You can compare equity release rates and work out how much you could potentially borrow with This is Money’s and Age Partnership+’s new equity release comparison tool.

Don’t Miss: Can Disabled Veterans Get Student Loan Forgiveness