Who Is My Student Loan Servicer

Your student loan servicer is the company that manages your student loans. Essentially, its a third party that acts as a middleman between you and your lender. When you make a payment toward your student loan, it is managed by your loan servicer.

Student loan servicers work with borrowers to help manage their student loan repayment. If borrowers would like to change their repayment plan or apply for deferment or forbearance, they should discuss their options with their loan servicer first.

Borrowers do not choose their loan servicer, but rather, are assigned one. If you have federal student loans, your loan servicer is assigned by the Department of Education.

Below are nine loan servicers that currently manage federal loans, plus an additional loan servicer that deals with default resolution though be aware that this list may soon change.

Originally, the Department of Education had planned to change its roster of servicers in 2020, but while some new contracts have been announced, the only change as of December 2020 has been the departure of former servicer CornerStone.

| Loan servicer | |

|---|---|

| Default Resolution Group | 1-800-621-3115 |

If you have federal student loans, your answer to, Who is my student loan servicer? will be one of the companies on the list above. Note also that your loan servicer can change during the life of your loan, so make sure to check your student loan accounts for the most current information.

Do Student Loans Go Away After 7 Years

Student loans don’t go away after 7 years. There is no program for loan forgiveness or loan cancellation after 7 years. However, if it’s been more than 7.5 years since you made a payment on your student loan debt and you default, the debt and the missed payments can be removed from your credit report.

Campus Based Student Loans

Heartland ECSI is the Universitys contracted servicer for University of Illinois Campus Based Student Loan.

You can view your account online at Heartland ECSI. This website also has an available live chat feature. For more information on accessing and managing Campus Based Student Loan click on the links below:

To discuss Campus Based Student Loan by phone, borrowers may call Heartland ECSI at 549-3274.

You May Like: What Happens If You Default On An Sba Loan

Will My Student Loans Be Forgiven After 10 Years

However, through , borrowers who have made 10 years worth of payments while in a qualifying job such as positions in federal, state or local governments, a nonprofit organization or the U.S. military will now be eligible for loan relief no matter what kind of federal loan or repayment plan they have.

Paying Back Student Loan Debt

With federal student loans, there are multiple payment plans available:

Standard repayment plan: This is a ten-year repayment plan and students who choose this will typically pay less back, over time, than in other plans. This isnt a good choice if the student is interested in obtaining Public Service Loan Forgiveness . Graduated repayment plan: With this plan, payments increase every two years. This can help students who expect their income to increase, but they would pay more interest over time than if on the standard repayment plan. Extended repayment plan: Payments can be made during a period of up to 25 years. This can help with monthly payment amounts, but students will pay back more over the life of the loan than those who use the standard or graduated repayment plans. Income-based repayment plan : There are four different plans where student loan payments factor in the borrowers income this can be a good choice for those who plan to use PSLF, but borrowers will typically pay back more than under the standard plan.

PSLF is a forgiveness program that borrowers employed by a governmental or non-profit organization might qualify for. If a student has been denied for PSLF in the past, there is currently a Temporary Expanded Public Service Loan Forgiveness program to explore.

Recommended: How Much Do I Owe in Student Loans?

Don’t Miss: Usaa New Car Loan Rates

How Can I Find Out How Much Interest Was Paid On My Loans Last Year

The number will be on your 1098-E Student Loan Interest Statement, which you can access by logging in to mygreatlakes.org and selecting My Accounts »Tax Filing Statements. Your 2021 statement will be online starting January 13, 2022.

- If we have your current email address, we’ll send you an email reminder when your 1098-E is available online.

- If we don’t have your email address, we’ll send you a letterunless the interest you paid during 2021 is less than $600. If it’s less than $600, you can still access your 1098-E online, but we won’t send you a paper copy.

Please note: Because loan payments were not required and interest rates were at 0% during 2021, your interest paid was likely lower than in previous years.

If you definitely want to know when your 1098-E statement is available, check your profile to make sure we have your email address and you’re signed up to receive email communication from us. You can verify all your other contact information at the same time, too.

Is there a deadline for interest payments to be included on my 2021 1098-E?

Yesthe interest on payments received by 5:00 p.m. Central time on December 31, 2021 will be included on your 2021 1098-E. Interest on payments received or scheduled after that time will appear on next year’s statement.

What Should I Do After Finding My Loan Servicer

Once you know who your loan servicer is, you can create an account on their site. Youll usually create a username and password and then share relevant information like your full name, address and Social Security number. Youll also likely be asked to create several security questions and answers for your account as well.

Once you are registered, you can connect your bank information and make payments directly from your bank account. You can send checks as well.

Typically, youll get a 0.25% interest rate deduction if you sign up for automatic payments. If youre not interested in autopay, find out if you can sign up for online alerts to be reminded when a payment is due.

Knowing your student loan servicer is more than just knowing who to pay each month its knowing who to turn to if you need to change your repayment terms or apply for deferment or forbearance.

But since student loan servicers dont always give the best guidance, its important to do your own research so you can make the best student loan decisions for you.

Rebecca Safier and Dillon Thompson contributed to this report.

Don’t Miss: How Does Capital One Auto Loan Work

Select A Repayment Plan For Your Federal Student Loans

Within the grace period you may receive information about repayment from your lender. Youll have a choice of several repayment plans. Find the right one for you.

Most federal student loans are eligible for at least one income-driven or income-based repayment plan . These repayment plans are based on a percentage of your discretionary income. Theyre designed to make your student loan debt more manageable by reducing your monthly payment amount.

- Student Loan Payback Playbook

- A Consumer Financial Protection Bureau website for people to provide feedback on how to help student loan borrowers better understand available repayment options for paying off student debt. On this site, you can share your thoughts on the CFPB student loan Payback Playbook that borrowers could receive from their servicers, informing them of the available repayment options.

A program of the Bureau of the Fiscal Service

Option : Assistance With Login To Myloan Or Loan Repayment

Choose Option 3 if you need help with:

- Your username and/or password for your MyLoan online account.

- Your current loan balance.

- Accessing Repayment Assistance Programs if you are having difficulty repaying your loans.

- Updating your address if you are in repayment status.

- If you will be returning to school, you should also update your address in your Alberta Student Aid account:

|

7th Floor, 9940 106 StreetEdmonton, Alberta T5K 2V1 |

When submitting a form, please follow the instructions given on the form.Notice: Alberta Student Aid no longer accepts student loan and scholarship applications dropped off in person.

Recommended Reading: Usaa Auto Loan

How Much You Need To Repay

Verify your loan or line of credit contract to figure out the following:

- the total amount you owe

- the interest rate that will be applied to your debt

- how youll repay your debt

- how much youll pay

- how long it will take to pay back your debt

Contact the organization that provided your student loan or line of credit if you dont have the information listed above.

Finding Your Loan Information

If you are unsure which agency is servicing your defaulted student loan, you may retrieve your loan information from the National Student Loan Data System . This system contains financial aid information collected from schools, agencies, and other educational institutions. You will need your Federal Student Aid ID information to access your account. Or, you may contact the Federal Student Aid Information Center .

Recommended Reading: How Long For Sba Loan Approval

Acs Loan Servicing Problems Where To Find Help

5 hours ago Federal Loans : Log into StudentAid.gov, select My Aid in the top right corner, and see who is currently servicing your student loans. Private Loans : Either contact the school that originated the loan, or look on your credit report at AnnualCreditReport.com and see who

Preview / Show more

See Also: Contact Support, Credit Union Services Show details

How To Find Student Loan Account Number

The only surefire way to stay current with your student loan information is to know your student loan account number.

When you apply for a student loan, your account number will be issued to you. Finding it out wont be a difficult process.

After you apply for student aid via the federal website Studentaid.gov, youll go through an application process to find qualifying loans.

Youll receive an official letter detailing your imminent student loan and future repayment processes after approval.

Your student account number should be highlighted, boldfaced, or plainly identifiable in such a letter.

There are several ways for you to find your 10-digit student loan account number.

Recommended Reading: Should I Do Fixed Or Variable Student Loan

Most Frequently Asked Questions

How do I find out which companies are servicing my federal student loans?

You may have federal loans in addition to those serviced by Granite State Management & Resources. Get the details on all of your student loans and student loan servicers online through the Department of Education’s National Student Loan Data System at nslds.ed.gov. Youll need the same Federal Student Aid ID used to file FAFSA® to access your Federal Student Aid records online.

How do I access my account online?

Access your account by clicking Manage My Account from the homepage. If you are a first time visitor to our site, please complete the steps for online account access. You will need to have your nine-digit account number to create your account your nine-digit account number can be found on your monthly statement.

Through Manage My Account you can:

- Apply online for deferments or forbearances.

- Reset your own password.

- Access our convenient and secure online message system for monthly statements and correspondence.

- Access real-time information easily while logged into your account with the confidence of knowing it is password-protected and confidential.

How do I make that loan payment on behalf of a child/friend/spouse?

A parent or other third party can quickly and easily make a payment on an account online once they have been established as an . The Borrower must follow these quick steps to establish an authorized payer:

How do I request a pay-off statement?

How do I change my payment due date?

Find Student Loan On Fsa

If you dont have access to your information through the student loan provider, you can find your student loan account number from StudentAid.gov.

Just log in to your account using FSA ID which is the user ID you created when you made your FAFSA. Dont have access to your FSA ID? Use your e-mail or phone number instead.

Once youre logged in, you can locate the student loan account number in your documents. These documents are also printable. So if a proof is asked, you can take a document that shows your student loan account number.

Read Also: Can I Use A Va Loan For A Second House

Can You Go To Jail For Not Paying Student Loans

Can You Go to Jail for Not Paying Student Loan Debt? You can’t be arrested or sentenced to time behind bars for not paying student loan debt because student loans are considered “civil” debts. This type of debt includes credit card debt and medical bills, and can’t result in an arrest or jail sentence.

How To Check Private Student Loans

Unlike with federal student loans, there is no centralized database with all private student loan information.

And private student loans dont qualify for the current interest-free forbearance. They also arent being considered for student loan forgiveness. If you want to lower your payment or repay your private loan faster, consider student loan refinance.

Youll know your loans are through a private lender if you check studentaid.gov or use the other methods mentioned above and cant verify your loans are federal.

If you are not in touch with your lender, one good way to track down your private student loan debt is through your credit report. Pulling a free credit report wont affect your credit score and will give you a list of your debts. Your credit report will show your outstanding balance from the date the information was collected and will tell you which lender owns the debt. Contact the lender listed to get more information on your private student loan.

You can also check with your school. Because student loans are disbursed directly to the college, your schools financial aid office may have a record of where your loan money came from.

About the author:Cecilia Clark is a student loans writer with NerdWallet, where she helps readers navigate the landscape around college finances.Read more

Also Check: How Much Can I Get From Fha Loan

Don’t Miss: How To Find Out Where My Student Loans Are

More About The Fsa Id

The FSA ID replaced the Federal Student PIN in 2015, so students who havent taken out new student loans or havent logged into the Federal Student Aid website since 2015 might not have an FSA ID yet.

Students who dont have an FSA ID can create one on studentaid.ed.gov.. Once you sign up for an FSA ID, the federal government will verify your information with the Social Security Administration. Once your information is verified, you will be able to use your FSA ID to obtain information about your federal student loans.

The site, managed by the U.S. Department of Education, can provide a convenient way to get a full picture of all your federal loans, including:

How many federal student loans you have Their loan types The original balance on each loan Current loan balances Whether any loans are in default Loan service providers names Contact information of the loan service providers

Just Announced: Student Loan Repayments To Restart After Jan 31 2022

We are updating our websites and systems as quickly as possible. We appreciate your patience. Visit StudentAid.gov/coronavirus for updates.

For more information on your federal student loans serviced by GSM& R on behalf of Federal Student Aid , please visit our COVID-19 information page for Direct Loans. To view information regarding the servicing of all other GSM& R loans , including federal and alternative loans, please visit our COVID-19 information page for FFEL and Alternative Loans.

Donât Miss: How To Take Out Equity Loan

Also Check: Usaa Car Payment Calculator

Option : Information On Applying For And Receiving Student Aid

Choose Option 1 if you have questions about:

- How to apply for funding .

- Eligibility issues for funding.

- Application status.

- You can login to your Alberta Student Aid account to see your application status, payment schedule and your inbox.

If you are a current or recent student, login to your Alberta Student Aid account to update your address.

Why Federal Student Aid Is A Great First Stop

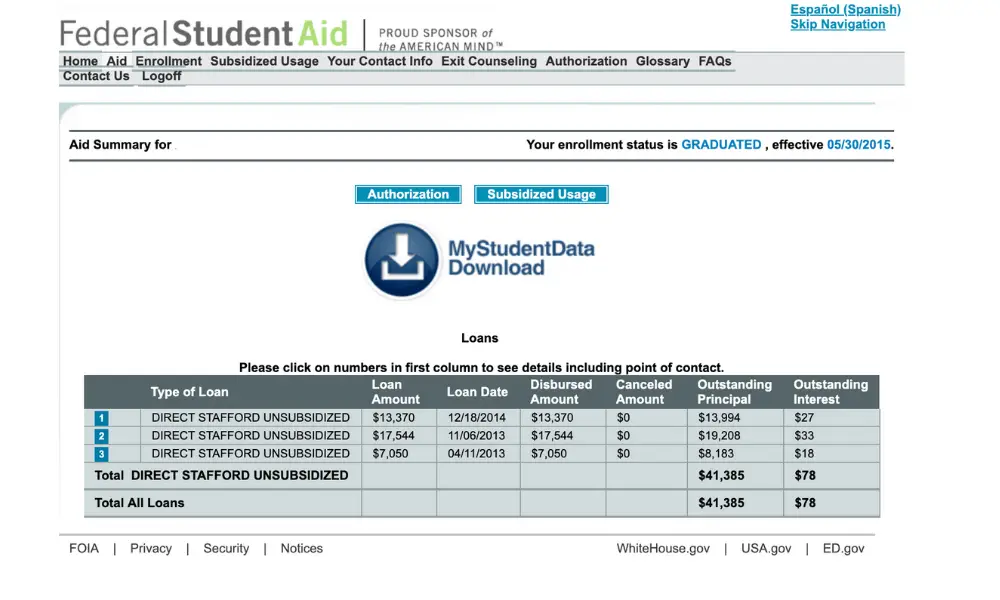

If you have student loan debt, its important to know just how much you owe. Knowledge is power, and your Federal Student Aid account can show you exactly what youre dealing with.

Once you understand how much you have to pay back, youll be one step closer to becoming debt-free. You should log in to your Federal Student Aid account every once in a while to see an accurate picture of your student loan debt.

When you start paying your loans off, log in frequently to see your balance drop. Visiting the student loan database will keep you motivated and allow you to track your progress.

Andrew Pentis and Cat Alford contributed to this report.

Also Check: Specialized Loan Servicing Payoff Request Form

Federal Direct Student Loan Program

The William D. Ford Federal Direct Student Loan program is funded directly from the U.S. Department of Education. For Federal Direct Loan and Federal Stafford Loan repayment information, borrowers must contact their loan servicer for repayment information. Borrowers can access their loan history at Federal Student Aid.

To sign Master Promissory Note:

Log Into The Fsas Loan Simulator

Once youre logged into the Federal Student Aid website, you can do a lot more than just locate your loans. Among the new tools of Next Gen, the loan simulator is a great one to start with.

Unfortunately, theres no similar tool that plug into all banks and could collect all your private student loans. You can employ our student loan calculators, however, to explore different possibilities and compare outcomes.

If youre considering postponing your repayment to focus on finding a job, for example, you could figure the cost of accruing interest on your debt with this calculator:

Recommended Reading: Credit Score For Usaa Personal Loan