The Fha Streamline Refinance

The FHA offers a refinance program called the which specifically ignores the DebttoIncome requirements present for an FHA purchase loan.

The official guidelines for the agencys streamline refinance program waive income verification and credit scoring as part of the mortgage approval process. Instead, the FHA looks to see that the homeowner has been making his existing mortgage payments on time and without issue.

If the homeowner can show a perfect payment history dating back 3 months, the FHA assumes that the homeowner is earning enough to pay the bills. DebttoIncome is not considered as part of the FHA Streamline Refinance.

How To Increase Your Mortgage Affordability

If you have found that your maximum affordability is lower than you expected, here are some reasons that might beand what you can do about it.

- GDS ratio: If your GDS ratio is limiting your mortgage affordability, youll need to increase your gross household income.

- TDS ratio: If its your TDS ratio, the likely culprit is existing debt. Focus on paying off your credit card balances or car loans to increase your mortgage affordability.

- Down payment: Youll need to save at least 5% of your homes purchase price or more, depending on the desired purchase price. If this is a limiting factor, consider options to increase your down payment, such as putting more money aside each month, accessing up to $35,000 in RRSP funds through the Home Buyers Plan or asking a family member for a monetary gift.

- Get a co-signer: Having a family member co-sign your mortgage will add their income to your application, increasing how much mortgage you can afford. Keep in mind that if you default on your payments, your co-signer will be responsible for the debt.

Should You Apply For A Mortgage With A High Dti

The average non-mortgage debt per person in 2021 was $25,112, according to a report by the credit bureau Experian. Unfortunately, these high debt balances can make it more difficult to qualify for a mortgage. You might find yourself wondering if its worth applying for a mortgage with a DTI thats near the top of your lenders allowed range.

First, know that theres little harm in simply applying for preapproval to see if you might qualify for a loan and how much you might qualify for. While there will be a hard inquiry on your that might lower your credit score by a few points, it can provide you with some valuable information.

Next, consider what your monthly budget would look like with a mortgage payment. The DTI requirements are there to reduce the risk for the lender, but they also help protect you as the borrower from getting in over your head.

You dont want to stretch yourself too thin and become house poor, which is when you buy as much home as possible, and then it takes up a majority of your income each month and youre penny-pinching or cant save for other goals, says Brittney Castro, the in-house CFP for the financial planning app Mint and the founder and CEO of Financially Wise.

Also Check: How Does Capital One Auto Loan Work

Your Debt And Salary Limit What You Can Afford

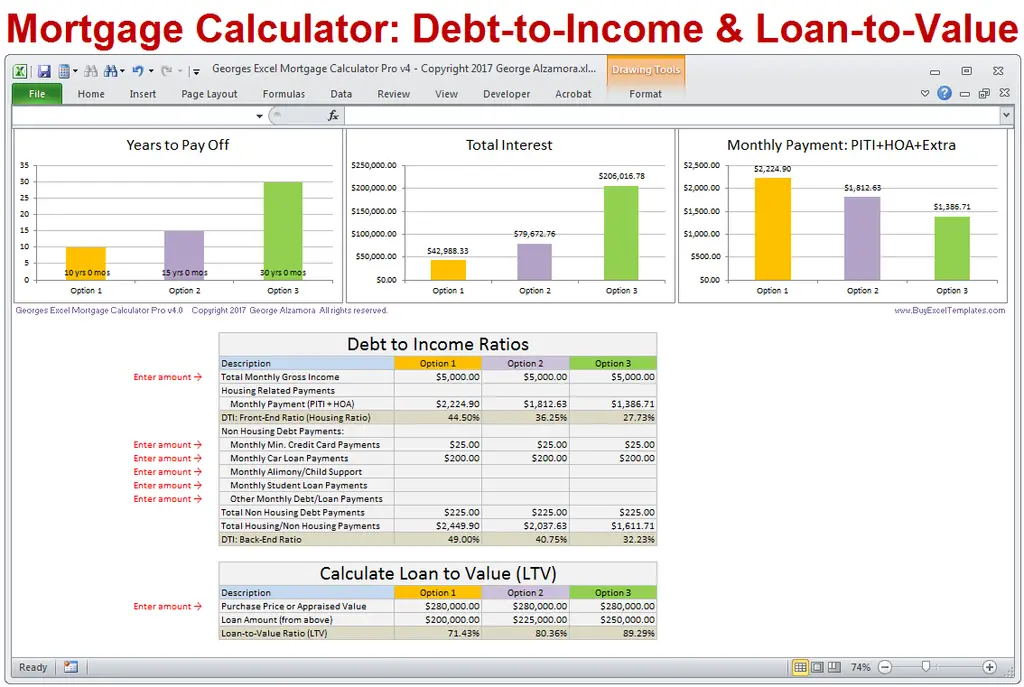

Besides showing you how much income you need to afford the home you want, this calculator also shows how your debts can compromise your chance for a mortgage. You can see how paying down debts directly affects your buying power. The fewer debts you have, the more of your salary can go toward the home, allowing you to afford a more expensive property. At the same time, more debts mean less money available, based on your current salary, to pay for – and qualify for – the home you want.

You can use this calculator to visualize how a higher or lower salary could change your ability to afford the home of your dreams. What if you got a raise? Or took a weekend job? You can vividly see how you could afford different homes with more income, or less.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

How much house can I afford?

$583,522

This DTI is in the affordable range. Youll have a comfortable cushion to cover things like food, entertainment and vacations.

*DTI is the main way lenders decide how much you can spend on a mortgage.

This DTI is in the affordable range. Youll have a comfortable cushion to cover things like food, entertainment and vacations.

*DTI is the main way lenders decide how much you can spend on a mortgage.

Recommended Reading: Usaa Auto Refinance Reviews

Calculating Your Income Is A Fairly Simple Exercise Unless Youre Applying For A Mortgage

Thats because, for Conventional and FHA loans, Fannie Mae and Freddie Macs guidelines determine income calculations and required documentation.

Even the income calculations for Jumbo loans are generally based on a more conservative version of FNMA and FMCCs guidelines.

And these guidelines are complex. They set out dozens of rules about what counts as income, how to calculate different types of income, and when certain types of documentation are required. But understanding how mortgage underwriters calculate your income before you apply for a loan will make for a far smoother home-buying process.

Youll know what you can afford right away so you can spend less time searching for a house and more time finding a place to call home.

To get you in your dream home as quickly as possible, well first provide an overview of how mortgage underwriters calculate your income. Then well run through specific types of income, how these different types of income are calculated, and what documentation youll need for each.

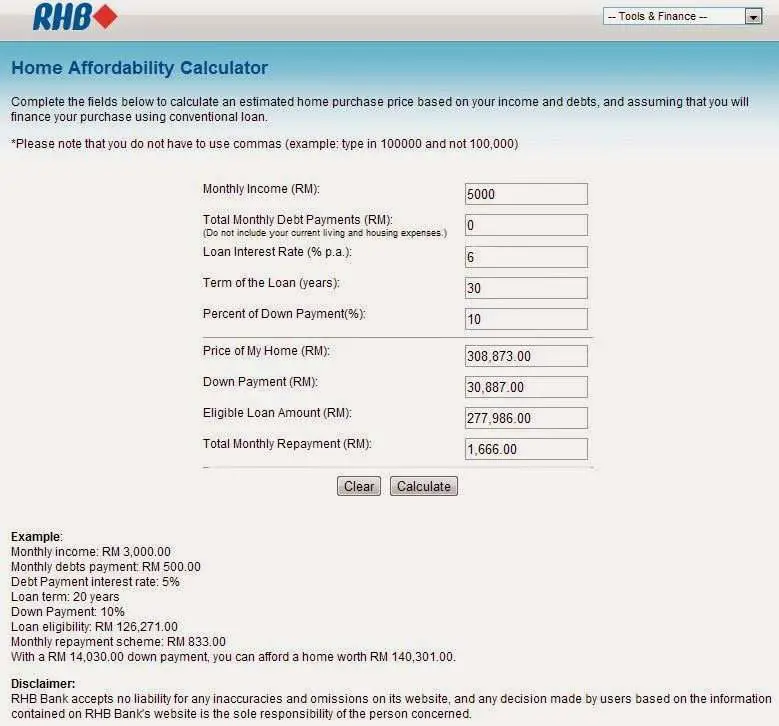

Will I Qualify For A Mortgage +

To know if you will qualify for a mortgage based on your current income, try our Mortgage Required Income Calculator. You will need to supply information about the cost of the Mortgage, down-payment, interest rates, and other liabilities, after which the calculator responds with the required minimum income to qualify for the loan.

Also Check: How To Get A Loan Officer License In California

A Home Affordability Calculator Doesnt Tell You:

- Whether the lender will approve you for financing at the sales price shown

- What your final mortgage interest rate or closing costs will be

- How much your payment might vary based on your actual credit score

The bottom line: While the home affordability calculator gives you an idea of what you might qualify for, youre better off getting a mortgage preapproval if youre looking for a dollar amount based on your unique financial circumstances.

MORTGAGE CALCULATOR TIP

Our calculator is pre-set to a conservative 28% DTI ratio. You can slide the bar up to an aggressive 50% DTI ratio to see how much more home you can buy. However, be sure your budget can handle the extra debt lenders dont look at expenses like utilities, car insurance, phone bills, home maintenance or groceries when they qualify you for a home loan. Lenders may also require a higher credit score, or extra mortgage reserves to cover a few months worth of mortgage payments, if the high payment becomes unaffordable.

How Much Can I Afford

How much you can afford to spend on a home in Canada is most determined by how much you can borrow from a mortgage provider. That is, unless you have enough cash to purchase a property outright, which is unlikely. Use the mortgage affordability calculator above to figure out how much you can afford to borrow, based on your current situation.

Also Check: How To Apply For Sss Loan

Know Whats Standing In Your Way

Unfortunately, not everyone is financially ready to buy a home. This Mortgage Income Calculator will show some people that buying, at least at this point, is not within their grasp and offer an understanding of what financial obstacles stand in the way.

This calculator may show you that not enough down payment is your problem. Or maybe its too much debt. Perhaps you simply need to earn more to buy the home you want and need. Or, if you reassess your ambitions, can you afford a less-expensive home?

How To Get A Lower Monthly Mortgage Payment

If youve got more debt, you might need to take on a lower monthly payment to keep your DTI ratio at 43%. Thankfully, there are a few strategies you can use to lower your monthly payment.

Although there are many tips and tricks to lowering your monthly mortgage payment, the top three are highly recommended and also effective: improving your credit score, taking a longer mortgage term and saving up for a 20% down payment.

Don’t Miss: How Long Does Sba Loan Approval Take

How Much Does Your Debt

Your DTI never directly affects your or . may know your income but they dont include it in their calculations. Your is still factored into your home loan application. However, borrowers with a high DTI ratio may have a high credit utilization ratio which accounts for 30 percent of your credit score. Lowering your credit utilization ratio will help boost your credit score and lower your DTI ratio because you are paying down more debt.

There’s never been a better time to buy a home.

Mortgage Experts can help you get there. Click below and request your free quote today.

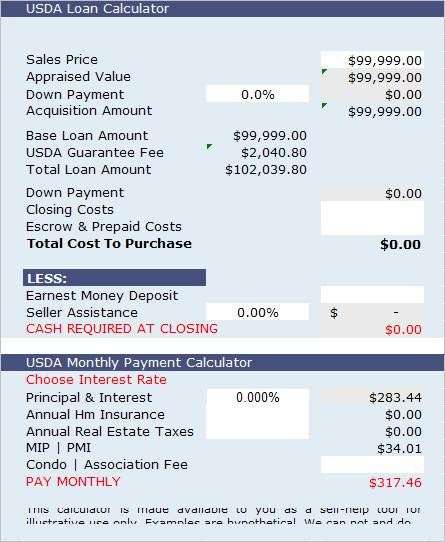

How Much House Can I Afford With A Usda Loan

Low- to moderate-income homebuyers searching for houses in USDA-designated rural areas may qualify for no-down-payment financing. The minimum score is typically 640, and buyers pay an annual and upfront guarantee fee instead of mortgage insurance. Strict income limits may cap how much home you can buy with a USDA loan, even if you meet the standard 41% DTI ratio requirement.

Recommended Reading: Fha Loan Refinance Calculator

How Much Do You Have For A Down Payment

Your down payment affects the amount you can borrow to buy a home and the size of your payments. This will impact your monthly budget.

You must have at least 5% for a down payment if the home purchase price is less than $500,000.

If the home purchase price is between $500,000 and $999,999.99, you must have at least 5% for the first $500,000 and 10% for the remaining amount.

For home prices $1 million or over, the down payment must be 20%.

If you are a first-time home buyer, you can borrow up to $35,000 from your RSP towards your down payment.1

1. First time home buyers can withdraw up to $35,000, in a calendar year, from their RSPs for a home purchase . They then have 15 years to repay their RSP . Find out more about the RSP Home Buyers’ Plan.

Step 5 of 6

How Much Mortgage Can I Qualify For

Lenders have apre-qualification processthat takes your finances into account to determine how much they are willing to lend you. Once the lender has completed a preliminary review, they generally provide a pre-qualification letter that states how much mortgage you qualify for. Get pre-qualified by a lender toconfirm your affordability.

You May Like: Usaa Car Loan Apr

Whats Behind The Numbers

NerdWallets Mortgage Income Calculator shows you how much income you need to qualify for a mortgage. It uses five numbers – home price, down payment, loan term, interest rate and your total debt payments – to deliver an estimate of the salary you need to buy your home. After those first five inputs, you can answer optional questions to refine your result.

How Much House Can I Afford With A Conventional Loan

Conventional loans are popular for borrowers with credit scores of at least 620 and DTI ratios of 45% or less. Some conventional loan programs allow down payments as low as 3%, but you can avoid mortgage insurance if you make at least a 20% down payment. Conventional lenders often assess mortgage insurance to cover their losses if you default, and its usually part of your monthly payment.

You May Like: Usaa Vehicle Loan Calculator

Calculating A 25% Dti

- Monthly Social Security Income : $6,000

- Monthly recurring debts: $500

- Monthly W2 income: $10,000

- Monthly recurring debts: $1,500

- Monthly selfemployment income: $10,000

- Monthly recurring debts: $2,000

- Monthly housing payment: $2,500

Most mortgage programs require homeowners to have a DebttoIncome of 40% or less, but loan approvals are possible with DTIs of 45 percent or higher. In general, mortgage applicants with elevated DTI must show strength on some other aspect of their application.

This can include making a large down payment showing an exceptionallyhigh credit score or having large amounts of reserves in the bank accounts and investments.

Also, note that once a loan is approved and funded, lenders not longer track DebttoIncome ratio. Its a metric used strictly for loan approval purposes. However, as a homeowner, you should be mindful of your income versus your debts. When debts increase relative to income, longterm saving can be affected.

Why Calculate Mortgage Affordability

When you’re looking to buy a home, it’s handy to know how much you can afford. Being able to calculate an estimate of how much you’re able to borrow is an important part of setting your budget.

You also need to determine if you have enough cash resources to purchase a home. The cash required is derived from the down payment put towards the purchase price, as well as the closing costs that must be incurred to complete the purchase. We can help you estimate these closing costs with the first tab under the mortgage affordability calculator above.

Taken together, understanding how large a mortgage you can afford to borrow and the cash requirements involved will help you determine what kind of home you should be on the look out for. To learn more about mortgage affordability, and how our calculator works, have a read of the information below.

Read Also: Usaa Student Loans Refinance

What Is The 28/36 Rule

Lenders may determine your ability to afford a new home by using the 28/36 rule. Breaking it down, the rule establishes that:

Housing expenses should be no more than 28% of your total pre-tax income. This includes your monthly principal and mortgage interest rate, annual property taxes, and private mortgage insurance payments .

Total debt should not exceed 36% of your total pre-tax income. This includes the housing expenses mentioned above credit cards, car loans, personal loans, and student loans so long as these monthly debt payments are expected to continue for 10 months or more.

In concrete numbers, the 28/36 rule means that a borrower who makes $5,000 a month should not spend more than $1,400 on housing costs every month. If youre a renter, thats the most you should spend on your lease to maintain good financial health.

However, for a homeowner, $1,400 should cover your monthly mortgage payment, as well as homeowners insurance premiums and property taxes.

The Va Interest Rate Reduction Refinance Loan

The is another refinance program which waives traditional home loan DebttoIncome requirements. Similar to the FHA Streamline Refinance, IRRRL guidelines require lenders to verify a strong mortgage payment history in lieu of collecting W2s and pay stubs.

The VA Streamline Refinance is available to military borrowers who can show that theres a benefit to the refinance either in the form of a lower monthly payment or a change from an ARM to a fixedrate loan.

You May Like: Capital One Car Loan Pre Approval Letter

How To Estimate Affordability

There is a rule of thumb about how much you can afford, based on the calculations your mortgage provider will make. The rule of thumb is you can afford a mortgage where your monthly housing costs are no more than 32% of your gross household income, and where your total debt load is no more than 40% of your gross houshold income. This rule is based on your debt service ratios.

Lenders look at two ratios when determining the mortgage amount you qualify for, which generally indicate how much you can afford. These ratios are called the Gross Debt Service ratio and Total Debt Service ratio. They take into account your income, monthly housing costs, and overall debt load.

The first affordability guideline, as set out by the Canada Mortgage and Housing Corporation , is that your monthly housing costs â mortgage principal and interest, taxes, and heating expenses – should not exceed 32% of your gross household monthly income. For condominiums, P.I.T.H. also includes half of your monthly condominium fees. The sum of these housing costs as a percentage of your gross monthly income is your GDS ratio.

Gross Debt Service Ratio

Calculator: Start By Crunching The Numbers

Begin your budget by figuring out how much you earn each month. Include all revenue streams, from alimony and investment profits to rental earnings.

Next, list your estimated housing costs and your total down payment. Include annual property tax, homeowners insurance costs, estimated mortgage interest rate and the loan terms . The popular choice is 30 years, but some borrowers opt for shorter loan terms.

Lastly, tally up your expenses. This is all the money that goes out on a monthly basis. Be accurate about how much you spend because this is a big factor in how much you can reasonably afford to spend on a house.

Input these numbers into our Home Affordability Calculator to get a clear idea of your homebuying budget.

Recommended Reading: Auto Loan Payment Calculator Usaa