Fha Minimum Down Payment: 35%

With an FHA loan, the minimum down payment depends on your credit score. If you have a credit score that’s 580 or higher, the minimum down payment is 3.5%.

If your score falls between 500 to 579, the minimum down payment required is 10%. FHA guidelines sometimes refer to this as the Minimum Required Investment it just means the down payment.

Income And Proof Of Employment

You will need to be able to verify your employment history to qualify for an FHA loan. You should be able to provide proof of income through pay stubs, W-2sand tax returns. There are technically no income limits, but you will need enough income to have an acceptable DTI ratio. Having a higher income will not disqualify you from receiving a loan.

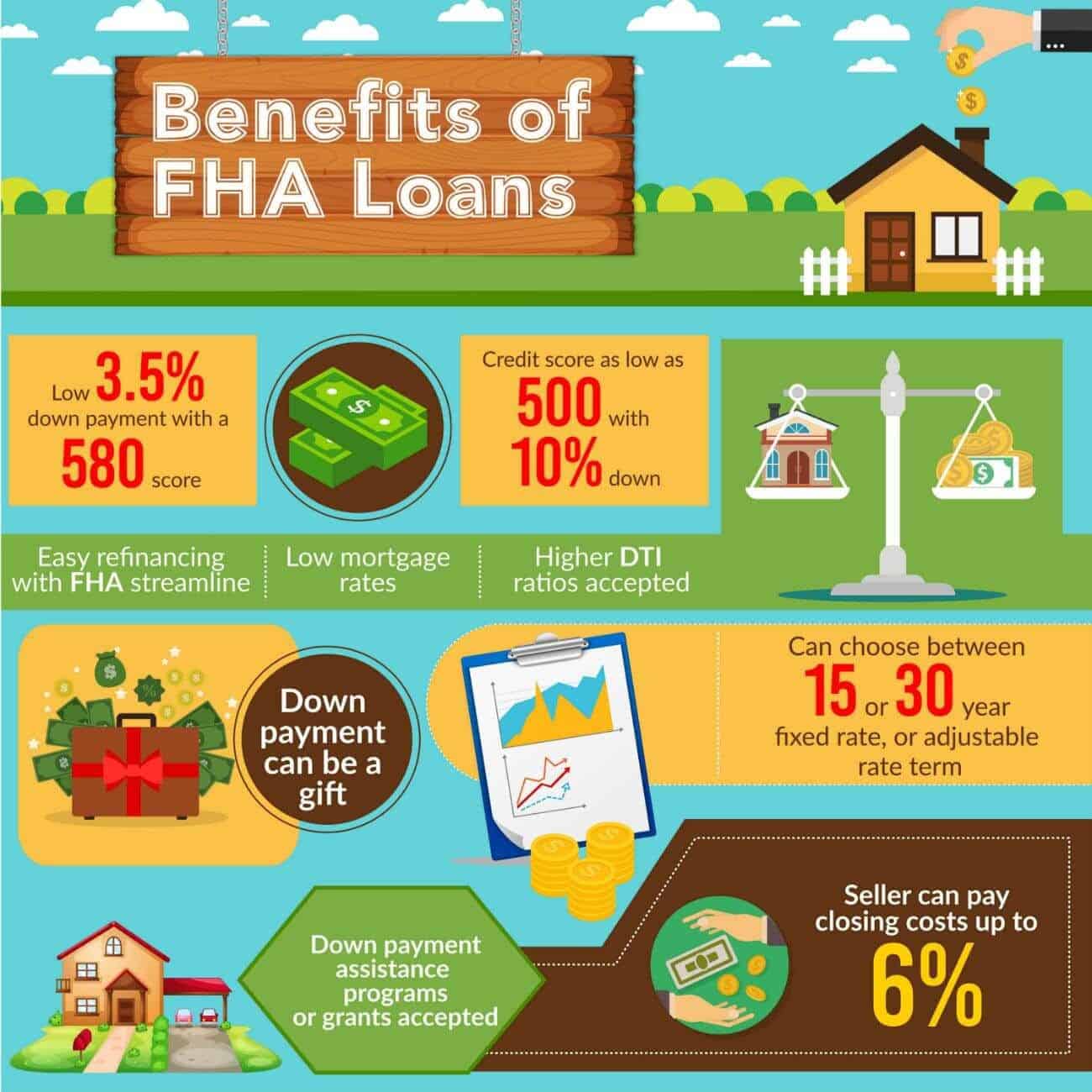

Benefits Of Fha Loans: Low Down Payments And Less Strict Credit Score Requirements

Typically an FHA loan is one of the easiest types of mortgage loans to qualify for because it requires a low down payment and you can have less-than-perfect credit. For FHA loans, down payment of 3.5 percent is required for maximum financing. Borrowers with credit scores as low as 500 can qualify for an FHA loan.

Borrowers who cannot afford a 20 percent down payment, have a lower credit score, or cant get approved for private mortgage insurance should look into whether an FHA loan is the best option for their personal scenario.

Another advantage of an FHA loan it is an assumable mortgage which means if you want to sell your home, the buyer can assume the loan you have. People who have low or bad credit, have undergone a bankruptcy or have been foreclosed upon may be able to still qualify for an FHA loan.

Read Also: Fha Loan Requirements For House

What Is An Fha Loan

FHA loans are often one of the most misunderstood types of programs that a homebuyer can go with and it is important that we decipher some of these points, so thank you for jumping in! They have proved to be extremely helpful and an important tool for making the American dream of buying a home come true for so many.

Not everyone can afford the strict financial requirements of the mortgage industry we are living in today, so in comes a Federal Housing Administration loan. This is a government-insured loan that has more lenient standards the borrower has to meet and lower down payment requirements, so it is a very popular and effective option for thousands of borrowers. One of the reasons lenders are able to offer this government program is because the borrower is required to pay for mortgage insurance, which in turn ensures the lender if the borrower were to not make good on their mortgage. There are ways to get rid of private mortgage insurance on an fha loan for those of you who used an FHA loan prior to June 2013.

The availability of this program certainly helps so many prospective home buyers out there make it happen, and most people dont even realize it is available to them! Next, we will dissect the ins and outs of how the FHA loan process works.

Requirements Protect Borrowers And Lenders

InvestopediaForbes AdvisorThe Motley Fool, CredibleInsider

Homebuyers looking to finance a home purchase with a Federal Housing Administration loan are sometimes surprised they are not allowed to purchase a particular property because it doesn’t meet FHA property requirements.

The FHA has put these minimum property standard requirements into place in order to protect lenders, but they protect buyers, too.

Read Also: What Is The Best Payday Loan

Pros And Cons Of Fha Loans

Before you fill out a loan application, heres a quick recap of FHA loan pros and cons.

| FHA loan pros | |

|---|---|

| You may qualify with a lower credit score than conventional loans | Youll pay higher mortgage insurance costs |

| You may qualify with more debt than a conventional loan | You wont have as much borrowing power due to FHA loan limits |

| You can purchase a two- to four-unit home with a down payment as low as 3.5% | You cant use an FHA loan to finance a second home or investment property |

| You dont have to be a first-time homebuyer to qualify | Youll pay mortgage insurance for the life of the loan in most cases |

| Youll have several loan programs to choose from with lenient qualifying requirements | You pay mortgage insurance regardless of how much equity you have |

| You wont be subject to any income maximums | Youre more likely to end up with a higher-priced mortgage loan |

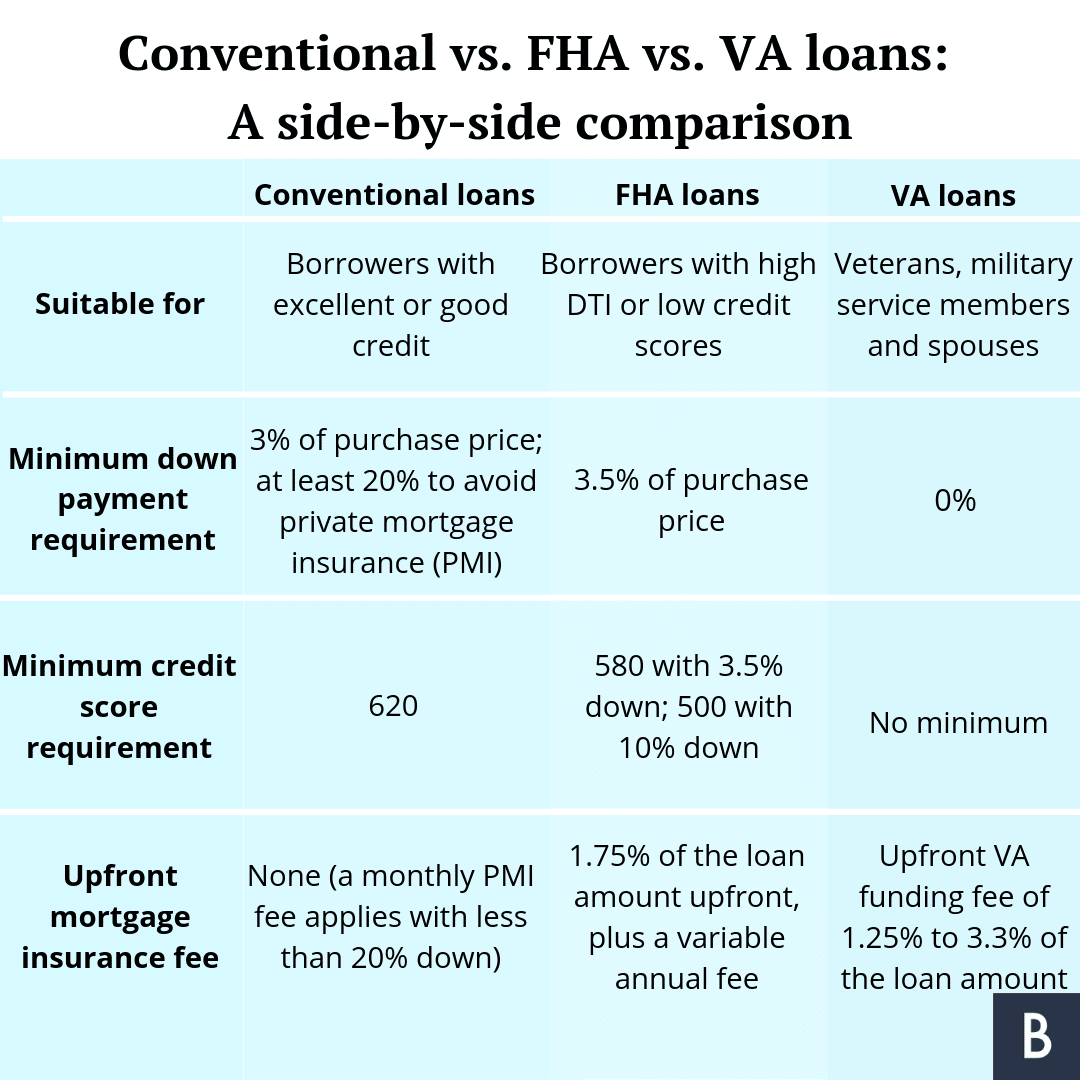

Fha Vs Conventional Loans: Pros And Cons

This next section may be important for those of you that believe you may be able to qualify for both types of loans. It is important to remember that both have their advantages and disadvantages.

The obvious advantages for FHA include much softer credit standards and lower down payment amounts. You can have a past foreclosure/bankruptcy and if cleared up still be approved. Also, you have the option to use a relative as a borrower who will not occupy the property to help you qualify if needed. They are also eligible for streamline refinances which allows you to refi cheaper and quicker when rates dip. Finally, many times FHA carries a lower base interest rate than conventional which they are able to do because of the other areas you are paying.

Conventional loans have the huge bonus of not having to pay MI if you are able to put 20% down for the home. No matter the down payment for FHA you will be required to have MI. PMI on a conventional loan will drop off at 78% LTV, but the FHA insurance will last the whole loan if you put down less than 10%. You can also purchase investment and vacation homes with conventional which is not an option for FHA unfortunately. Anything outside the loan limits would need to be conventional as well.

Don’t Miss: What Is Apr Rate On Home Loan

Who Qualifies For A Heloc

Qualifying for a home equity line of credit requires a steady income, a decent credit score , and enough equity to borrow against. You can typically qualify if you have more than 20% equity in the home, meaning you owe less than 80% of its value on your current mortgage.

Many homeowners find HELOCs attractive. As second mortgages, theyre one of the least expensive ways to borrow. And, as lines of credit, HELOCs are highly flexible. You can borrow, repay, and re-borrow as often as you want up to your credit limit.

In this article

What Are The Downsides Of An Fha Loan

A major drawback of FHA loans is the high cost of FHA mortgage insurance, which must be paid for the life of the loan if you make the minimum 3.5% down payment. FHA county loan limits also curtail your buying power, since theyre set at 35% below conforming conventional loan limits in most counties across the U.S.

Don’t Miss: When Can You Apply For Parent Plus Loan

How Do Helocs Work

HELOCs are a revolving line of credit. During the draw period, you can take out money as many times as you need via check or a debit card, as long as it’s below your total loan amount. You must also make minimal monthly payments, typically just for the interest that accrues during the draw period. As you repay your HELOC, this money is added back to your revolving balance .

Once the draw period comes to an end, you enter the repayment period, which usually lasts between 10 to 20 years. At this point, you can’t take more money out of your HELOC. Once you’re in the repayment period, your monthly payments will increase because you must start paying back the principal in addition to the accrued interest.

You can typically borrow up to 85% of your home’s value, minus the amount you still owe on your mortgage. To determine how much equity you have in your home, subtract your remaining mortgage balance from the house’s current market value. So if your house is worth $500,000 and you have $300,000 left to pay off on your mortgage, you would have $200,000 in equity. If you borrowed 85% of your home’s equity, your loan amount would be $170,000.

How Does An Fha Loan Work

If you have a credit score of at least 580, you can borrow up to 96.5% of the value of a home with an FHA loan, as of 2022. That means the required down payment is only 3.5%.

If your credit score falls between 500 and 579, you can still get an FHA loan as long as you can make a 10% down payment.

With FHA loans, the down payment can come from savings, a financial gift from a family member, or a grant for down payment assistance.

Is an FHA Mortgage a Bargain?

Read Also: How To Use Va Loan For Investment Property

Fha Loan Requirements Summary

There are quite a few FHA loan requirements when it comes to qualifying, documentation and various other requirements. However, FHA loans are the best option for at least 25% of the United States population. An FHA loan is a great way to finance your home so let us help you to get connected to an FHA lender who is an expert in your area.

Low Down Payments Of As Little As 35% Of The Homes Purchase Price With A 580 Credit Score Or Higher

You can borrow up to 96.5% of a homes value with an FHA loan, which translates to a low down-payment requirement of 3.5%. Conventional loans typically cover a smaller percentage of the mortgage which require down payments of 5% to 20%. The better your financial profile, the more you can borrow, and the less down payment required in any loan.

Recommended Reading: How Much Loan Can I Get On 60000 Salary

Equity Needed For A Heloc

To qualify for a home equity line of credit, you need enough home equity available that you can borrow from it while leaving a certain portion untouched. That means youd need more than 15-20% equity in the home to qualify. Lenders want you to keep at least some of the equity in your home as a financial cushion in case the loan defaults.

Many HELOC lenders allow you to borrow up to 85% of your homes value when your primary mortgage and HELOC are combined. This is your combined loan-to-value ratio or CLTV.

For example, suppose your homes value is $400,000 and you still owe $250,000 on your primary mortgage. This is how the basic HELOC calculation works out:

- Maximum CLTV is 85%

- 85% of $400,000 is $340,000

- Existing mortgage balance is $250,000

- $340,000 – $250,000 = $90,000

- Maximum HELOC amount = $90,000

Some lenders will let you borrow up to 90% of your home value using a HELOC, while others cap the maximum HELOC amount at 80 percent. So ask about lenders guidelines when shopping around for your loan.

Remember that your home equity is the amount by which your homes appraised market value exceeds your current mortgage balance. You wont know the amount for sure until an appraisal takes place. But you probably have a good enough idea of your homes value for some back-of-an-envelope calculations. You can also check with Realtor.com and Redfin.com to see a current estimated value.

Fha Foreclosure And Bankruptcy Waiting Periods

If you lost a home to foreclosure, youll need to wait three years before you can take out an FHA loan. With a Chapter 7 bankruptcy you can apply for an FHA loan within two years of your discharge date. This waiting period is much shorter than conventional loans, which require a seven-year wait after a foreclosure or four years after a bankruptcy.

Also Check: What Kind Of Mortgage Loan Should I Get

Fha Loan Requirements: What Are They

Of course, you want to cover all your bases for the program so you know if you will definitely be approved. There are far too many to cover in this article, but we will be sure to prepare you as best we can. We have gone over some of the qualifications above but here is a summary so you can take a look at the minimum and at least see where you stand with most lenders and this program.

When putting 3.5% down you can have a minimum credit score of 580, but you actually can go as low as 500 if you have enough assets to put 10% down. There is give and take there if you have better credit than assets or vice versa. Also, dont be afraid that you are going to get a super high-interest rate because of the lower credit score and down payment amount. This program helps protect against that. They also usually carry lower closing costs and fees because they know they are dealing with borrowers who dont have a ton of cash to throw at the down payment in the first place. This program can also help if you are a younger person just establishing credit, as it only requires at least 2 tradelines like a credit card and car loan or 2 credit cards on your credit report minimum. If this all fits you, then FHA might be the way to go!

What Is A Gse Loan

The term GSE loan refers to a mortgage loan that conforms to the rules and standards of a GSE such as Federal Home Loan Banks , Fannie Mae, Freddie Mac, or Farmer Mac. A GSE loan is not generated by a GSE but by a private lender who agrees to conform to GSE rules.

“When deciding whether to choose a government-sponsored enterprise loan or a conventional loan, there are many factors to consider from the perspective of the consumer,” says LBC Mortgage founder and CEO, Alex Shekhtman.

“One key difference between the two types of loans is that GSEs may be more willing to lend to borrowers with weaker credit, whereas conventional lenders typically require a higher credit score,” Shekhtman says. “This may make GSE loans a better option for those who do not have perfect credit.”

Important: Mortgage loans are either conforming or nonconforming. A GSE mortgage loan must be a conforming loan that meets certain rules and standards, including a specific loan limit, in order to qualify for services by a GSE.

Loans that do not follow these rules are considered nonconforming. One example of a nonconforming loan is a jumbo loan or mortgage loan on a property that costs more than the maximum loan amount for a conforming loan.

Recommended Reading: How To Get Approved For Investment Property Loan

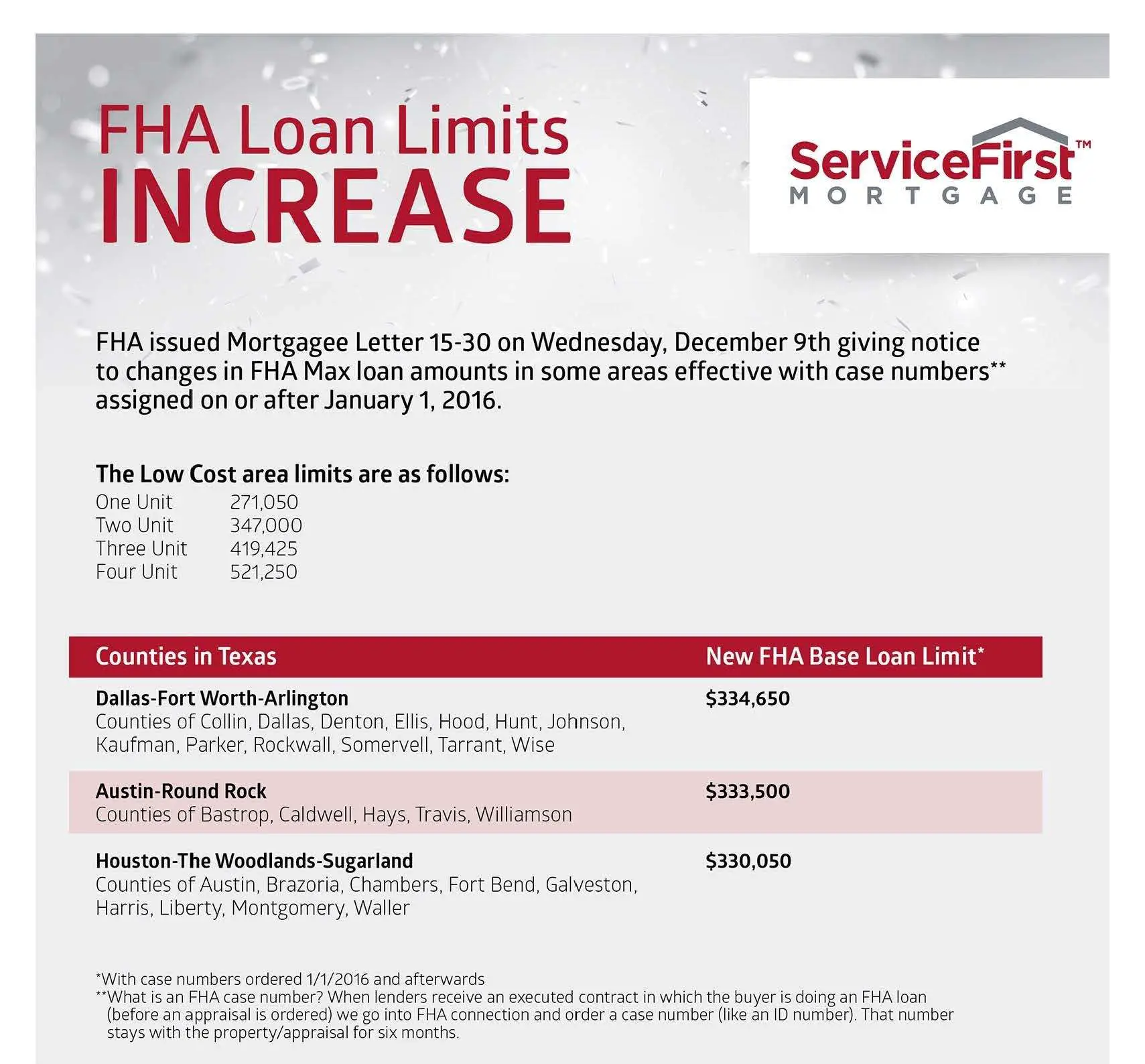

What Are The Federal Housing Administration Loan Limits

FHA loans have limits on how much you can borrow. These are set by region, with lower-cost areas having a lower limit than the usual FHA loan and high-cost areas having a higher figure .

There are “special exception” regionsâincluding Alaska, Hawaii, Guam, and the U.S. Virgin Islandsâwhere very high construction costs make the limits even higher.

Elsewhere, the limit is set at 115% of the median home price for the county, as determined by the U.S. Department of Housing and Urban Development .

The chart below lists the 2022 loan limits:

| 2022 FHA Loan Limits |

|---|

Fha Loan Requirements Vs Usda Loans

USDA loans are backed by the United States Department of Agriculture. These loans are for eligible borrowers who meet certain income requirements and want to purchase a property in a USDA-eligible zone, which is usually a rural or underpopulated area.USDA loans donât require a down payment, which can be helpful for many borrowers.

Itâs very possible that youâll be approved for both an FHA and a USDA loan if you meet the income and property location requirements. If you are looking to preserve cash with a lower down payment, then youâd opt for the USDA loan, whichdoesnât require a down payment. If you prefer having a little more equity in the property with a higher down payment, then youâd go for the FHA loan.

You May Like: How Much Do Loan Officers Make

Equal Credit Opportunity Act

But there is a light at the end of the tunnel. As long as your 401k, pension, or Social Security benefits are scheduled to continue for over three years, getting an FHA loan can be a fairly straightforward process. In fact, your age or retirement status should not even be a factor in getting a loan as long as your finances fit into the FHA guidelines. The Equal Credit Opportunity Act has made it illegal for a lender to discriminate against age for any qualified borrower.

The Fha Is Not A Mortgage Lender

The FHA is not a mortgage lender. Its a mortgage insurer.

The acronym FHA stands for Federal Housing Administration, a government agency within the U.S. Department of Housing and Urban Development .

The FHA doesnt make mortgage loans to home buyers or refinancing households. Rather, the FHA provides mortgage insurance to banks, credit unions, and other lenders which make loans meeting the FHA requirements listed above.

The FHA would reimburse lenders for part of their losses if your loan went into foreclosure or the short-sale process.

Its this FHA insurance that helps lenders extend credit even when you have a lower credit score and a smaller down payment.

Read Also: How Do I Get Out Of Car Loan

What Is A Heloc And How Does It Work

A home equity line of credit can be a convenient way to access cash, but you must be prepared to put your home up as collateral to secure the loan.

Alix Langone

Reporter

Alix is a staff writer for CNET Money where she focuses on real estate, housing and the mortgage industry. She previously reported on retirement and investing for Money.com and was a staff writer at Time magazine. She has written for various publications, such as Fortune, InStyle and Travel + Leisure, and she also worked in social media and digital production at NBC Nightly News with Lester Holt and NY1. She graduated from the Craig Newmark Graduate School of Journalism at CUNY and Villanova University. When not checking Twitter, Alix likes to hike, play tennis and watch her neighbors’ dogs. Now based out of Los Angeles, Alix doesn’t miss the New York City subway one bit.

A home equity line of credit, or HELOC, is a home loan that allows you to tap into your home’s equity over an extended period of time.

A HELOC functions as a revolving line of credit that you can continually access. The time period when you can draw money from your line of credit is called the draw period, and it’s typically 10 years. This could be a good option if you need access to money but aren’t sure how much you’ll need . HELOCs may have lower interest rates than other types of home loans or personal loans.