When Will You Receive Student Loan Forgiveness Key Details On Timing

President Joe Biden speaks about the student loan forgiveness as Education Secretary Miguel Cardona … listens in the South Court Auditorium on the White House complex

Copyright 2022 The Associated Press. All rights reserved.

The Biden administration is in various stages of implementing multiple student loan forgiveness initiatives. But depending on what program borrowers apply for and when they submit their loan forgiveness application, there could be wildly different timelines for receiving relief.

Heres what borrowers can expect.

Student Loan Debt In Our Country

Loan forgiveness has been a hot topic for many years, and remained a strong talking point during the 2020 election season. Now that the COVID-19 crisis is winding down, will across-the-board loan forgiveness be the next move for our administration? Only time will tell.

Whether you have student loan debt or not, though, forgiveness could still mean big things for the US. For starters, it would allow many borrowers the flexibility to pay off other debt, such as their mortgage or credit card balances, and contribute more toward savings.

When Do Student Loan Payments Start Again After A Hardship

Most student loan providers will offer a period of forbearance or deferment if you are experiencing a financial hardship. This means that you wont have to make any payments on your student loans for a set period of time. Once the hardship period is over, your loans will go back into repayment and youll need to start making payments again.

Depending on your situation, you may be able to get a deferment or forbearance for:-Unemployment

Recommended Reading: How To Loan In Bank

Will The Student Loan Payment Freeze Be Extended Again

The pause on federal student loan payments is slated to expire on Dec. 31, 2022, with payments expected to resume on Jan. 1, 2023. Nothing is set in stone, but in his announcement, Biden said he was continuing the moratorium “one final time” to the end of the year.

In addition, private servicers of federal student loans have lobbied to end the payment moratorium this year.

When Should I Start Making Student Loan Payments Again

Federal student loan payments and interest rates have been paused since 2020. While borrowers arent on the hook for payments until early 2022, this doesnt mean they cant start planning now.

Stephanie ColestruckAugust 18, 2021

In This Article

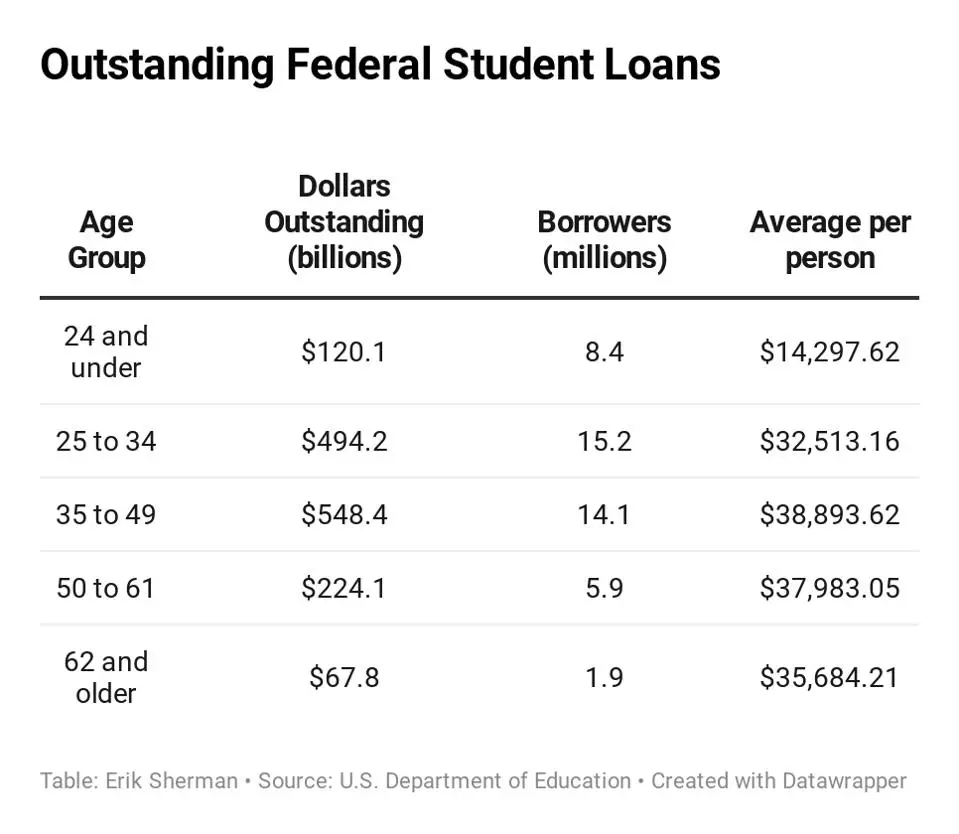

Today, student loan debt in the U.S. totals more than $1.73 trillion, with the average American owing around $39,351. So, whether youre managing federal or private student loans, youre definitely not alone.

Thanks to the CARES Act of 2020, many saw monthly payment relief during the COVID-19 crisis. This included a moratorium on both monthly payments and accruing interest for federal borrowers.

But as we start to see a light at the end of the pandemic tunnel, when should you expect to start making payments again? Read on for an overview of how to prepare for federal vs. private student loan payments.

Read Also: Can You Have 2 Fha Loans

I Didnt Make Any Federal Student Loan Payments Since March 2020 Do I Get Credit Toward Student Loan Forgiveness

Yes, one of the great benefits for student loan borrowers is that you will get credit for federal student loan payments during the Covid-19 pandemic, even if you didnt make any. This is helpful for anyone pursuing student loan forgiveness through an income-driven repayment plan after 20 years or 25 years, or student loan cancellation through the Public Service Loan Forgiveness program. Practically, you would get credit for making a student loan payment each month from March 2020 through September 2021, even if no student loan payment was made. This is especially helpful for student loan borrowers who are pursuing public service loan forgiveness, which requires 120 monthly federal student loan payments.

The Downside Of Student Loans

Lets review some of the downsides of student loans are. On average, the typical college graduate has $36,000 in student loans. This is a massive figure and often equates to monthly payments in excess of $300 $400.

Not only is this a massive figure in present times, but college is also becoming increasingly more expensive. Plenty of college graduates are graduating with a standard degree, and are six figures + in student debt! What side effects does this have on the economy?

There are a variety of variables that are impacted by a crippling student loan amount.

Recommended Reading: What Is Mortgage Loan Pre Approval

Who Can Take Advantage Of Administrative Forbearance

If the Department of Education owns your loan or if you have a defaulted FFEL Program loan, you should be eligible for the administrative forbearance benefits. Student loan servicers placed eligible student loans into automatic administrative forbearance. You can call your servicer if you have questions.

Payment Amount And Due Date

Wondering what your payment amount and due date will be? Once the payment pause ends, youll receive your billing statement or other notice at least 21 days before your payment is due. This notice will include your payment amount and due date.

In the meantime, you can get an estimate of your payment amount and due date through your loan servicer. Contact your loan servicer online or by phone.

Recommended Reading: How Much Down Payment For New Construction Loan

What Are My Relief Options If I Don’t Have Qualifying Loans

If you do not have qualifying loans, your servicer may offer other forms of financial relief. Some of your options include:

- Requesting administrative forbearance directly with your loan servicer

- Determining whether you qualify for economic hardship deferment or an unemployment deferment

- Refinancing student loans, though this option is best for private student loans

If you put non-federal loans into forbearance, your loans will continue accruing interest. You will have a larger balance to repay once your payments resume.

Which Student Loans Are Affected By The End Of Student Loan Relief

This student loan relief only impacted federal student loans. Therefore, beginning February 1, 2022, you will need to make monthly federal student loan payments again. Temporary student loan relief due to the Covid-19 pandemic didnt apply to private loans. Beginning February 1, 2022, you would make both private and federal student loan payments as you did before the Covid-19 pandemic. .

Also Check: How Does Car Trade In Work With Loan

How Can I Get A Lower Interest Rate On My Student Loans

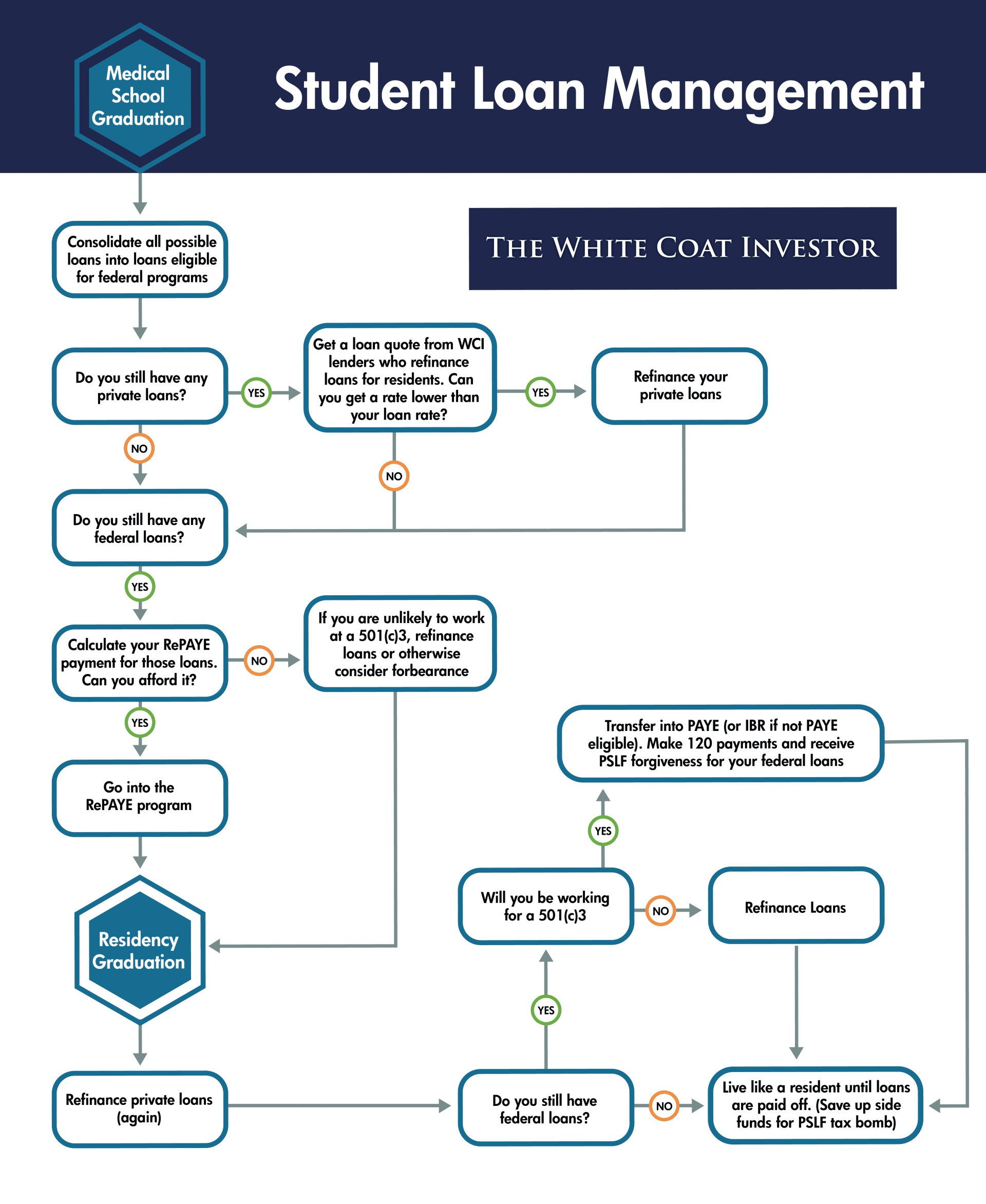

The best way to get a lower interest rate on your student loans is through student loan refinancing. Student loan refinancing helps you get a lower rate for private and federal loans, and also can lower your monthly student loan payment. Rates start at 1.74% now, and you can choose a fixed or variable interest rate.

To qualify, you should be employed or have a signed job offer, have stable monthly income to pay student loans and other living expenses, and at least a 650 credit score. When you refinance student loans, the resulting loan is a private loan. So, if youre pursuing any federal repayment plans or benefits such as income-driven repayment or public service forgiveness, for example, you may want to refinance only your private loans. However, some borrowers prefer to refinance both private and federal loans. It depends on your unique situation.

The end of temporary student loan relief doesnt have to be scary. The most important part is to understand all your options and have a clear strategy. Here are some popular ways to save money and pay off student loans faster:

When Borrowers Will Receive Student Loan Forgiveness Under The Idr Account Adjustment

The Biden administration is in the early stages of rolling out yet another loan forgiveness program, called the IDR Account Adjustment. Similar to the Limited PSLF Waiver, this initiative will allow the Education Department to retroactively count past loan periods towards a borrowers 20-year or 25-year loan forgiveness term under Income Driven Repayment plans, even if they are not presently in such a plan.

The initiative will be implemented automatically for borrowers who have government-held federal student loans next summer, with a target implementation date of July 1, 2023. Borrowers who accrue enough past credit under the initiative to reach their 20-year or 25-year IDR term will see automatic loan forgiveness. The IDR Account Adjustment will also benefit PSLF borrowers, effectively providing many such borrowers with a second shot at relief if they missed the deadline for the Limited PSLF Waiver.

Some borrowers will need to consolidate their loans through the Direct consolidation program to qualify of maximize the benefits. To receive this credit toward IDR… a borrower must have Direct Loans or FFEL loans managed by the Department, according to an Education Department face sheet. Borrowers who have other types of federal loans have to consolidate into the Direct Loan program to receive the credit…. All borrowers must apply for consolidation by May 1, 2023, to get the full benefits of the one-time account adjustment.

Don’t Miss: Lending Tree Personal Loan Calculator

Are My Federal Student Loan Payments Due October 1 2021

If Biden doesnt extend student loan relief, then September 30 would be the final day. That means student loan payments would resume starting October 1, 2021, but thats not necessarily when student loan payments are due. Your specific due date for your student loans is between you and your student loan servicer.

Will The Cares Act Be Extended

Many borrowers may be wondering if the federal student loan deferment will be extended beyond Aug. 31. No one knows for sure at this point, but it does seem possible President Biden has already extended the deferment four times during his presidency.

U.S. Secretary of Education Miguel Cardona has indicated that another extension is possible.

“I dont have any information now to share with you about when it would end or what the conversations are about when its going to be lifted,” he told a Senate subcommittee in June.

“I know we have a date, and it could be that its extended. Or it could be that it starts there. But what I will say is that our borrowers will have ample notice.”

President Biden has also received pressure from activist groups and top Democrats to extend the student loan deferment and provide more meaningful debt cancellation. So a CARES Act extension seems to be on the table, but its unclear whether or not it will happen.

In the meantime, federal borrowers should assume that their student loan payments will resume on Sept. 1 until they learn otherwise. To get started on refinancing your student loans, visit Credible and compare prequalified rates from multiple lenders.

You May Like: How To Compare Student Loan Rates

Will My Student Loans Get Cancelled

Some student loan borrowers think its possible that student loans get cancelled, while others say that student loan cancellation has been cancelled. Biden has now cancelled nearly $3 billion of student loans since becoming president. This includes student loan cancellation of $1 billion of student loans for 72,000 student loan borrowers. Biden cancelled another $1.3 billion of student loans for 41,000 borrowers with total and permanent disability. Biden also cancelled $500 million of student loan debt for 18,000 student loan borrowers under the borrower defense to student loan repayment rule. Last week, Biden cancelled $55.6 million of student loans as well, meaning Biden has cancelled $1.5 billion of student loans this way. Student loan cancellation and the temporary student loan forbearance are separate topics. The Biden administration is considering student loan cancellation, but any decision on wide-scale student loan forgiveness wont impact whether temporary student loan relief gets extended. Its possible that both or neither happen.

Theres no guarantee either way whether student loan relief will be extended. In any case, make sure your are prepared financially and strategically for student loan repayment. Here are some popular options to save money:

Could The Payment Pause Be Extended Again

The Education Department said this would be the “final extension” of the respite, which has now been in effect since March of last year.

Still, experts say a lot depends on the state of the pandemic and economy come February.

If you’re still unemployed or dealing with another financial hardship because of Covid, you’ll have options whenever payments resume.

Applying for an economic hardship or unemployment deferment will allow you to postpone your payments without interest accruing. If you don’t qualify for either of those, you can still use a forbearance to continue suspending your bills.

For those who expect their struggles to last a while, it may make sense to enroll in an income-driven repayment plan. These programs aim to make borrowers’ payments more affordable by capping their monthly bills at a percentage of their discretionary income and forgiving any of their remaining debt after 20 years or 25 years.

Don’t Miss: How Can You Get Rid Of Student Loan Debt

Apply For Other Types Of Help

Coronavirus relief measures arent the only way to get help with your federal student loans. The Department of Education offers other types of assistance to eligible student loan borrowers under normal circumstances.

For example, once this automatic forbearance period ends, you can apply to put your federal student loans into deferment status if you need to temporarily reduce or postpone your payments. Keep in mind, however, that interest may continue to accrue on your loans even while your payments are on hold.

Applying for an income-driven repayment plan is another option you might want to consider. If you qualify, your monthly payment will adjust according to your income and family size, and you could have your remaining balance discharged after 20 to 25 years of payments.

Paying On Private Student Loans Again

If youre carrying private student loan debt, you most likely know that it doesnt qualify for the same COVID-19 relief options as federal loan debt. And chances are youve been making regular payments on your loans this whole time anyway.

Debt forgiveness programs only apply to federal student loans, so you wont be able to snag an income-driven repayment plan with private debt. But you still have options to make your debt repayment a bit more manageable for your budget:

Recommended Reading: Which Student Loan Servicer Is Best

Why Was The Student Loan Payment Pause Extended

The payment pause has been extended a number of times, with the most recent extension announced in August 2022. In a press release, the administration made it clear a final extension is necessary to help borrowers still impacted by the pandemic.

While the economy continues to improve, COVID cases remain at an elevated level, and the President has made clear that pandemic-related relief should be phased out responsibly so that people do not suffer unnecessary financial harm, the press release states.

Will Student Loan Forbearance Be Extended Again

Now, we find out will student loan forbearance be extended again, When Are Federal Student Loans Due and biden student loans.

As the economy recovers, the Education Department is less likely to continue extending the forbearance period. While another extension is not impossible, federal student loan borrowers should prepare to resume making regularly scheduled payments in September.

Forbearance is a temporary relief from monthly payments for borrowers who are experiencing an economic hardship that prevents them from making their scheduled payments. For example, if you lost your job or experienced a medical emergency, you may be eligible for forbearance. If you are eligible for forbearance, it means your loans will be temporarily deferred while youre in school or during other periods of non-payment. You will not accrue interest during this period and will not lose eligibility for financial aid programs such as Pell Grants.

You May Like: Loan Agency For Bad Credit

Student Loan Forgiveness Under The Limited Pslf Waiver

The Biden administration created the Limited PSLF Waiver last year to address ongoing issues with Public Service Loan Forgiveness, a federal student loan forgiveness program geared towards borrowers who commit to working for nonprofit or government organizations. Under the waiver, the Education Department can retroactively count past loan periods as qualifying payments towards loan forgiveness under PSLF that previously would have been rejected. This includes past periods of repayment, as well as certain past periods of deferment and forbearance.

Through the Limited PSLF Waiver, many borrowers will advance their progress towards eventual loan forgiveness. Those who cross the threshold of 120 qualifying PSLF payments as a result of the waiver will have their qualifying federal student loans discharged.

The Limited PSLF Waiver officially ended on October 31. But The Education Department is still processing applications. Heres what to expect in terms of timing:

Thus, for some borrowers, receiving relief through the Limited PSLF Waiver program could take many months, and borrowers should be prepared for a long process.

What Is My New Interest Rate

Beginning in March 2020, federal student loans temporarily had a 0% interest rate. This means that no new interest accrued on your federal student loans during the temporary student loan forbearance period. Private loans didnt have this benefit. Beginning February 1, 2022, your student loans will include their regular interest rate that you had before the Covid-19 pandemic. . Since federal student loans today have a fixed interest rate, you should have the same interest rate that you had in March 2020. That said, some older federal student loans had a variable interest rate, so if you have an older federal student loan, your interest rate may have changed.

You May Like: What Is Comparison Rate Home Loan

Will There Be Any More Student Debt Forgiveness

Judging by the length of time it took Biden to make a decision on widespread student loan debt forgiveness, it’s unlikely that any further forgiveness will be given to all student loan borrowers via executive order. It’s not clear yet if Biden’s current order to cancel $10,000 to $20,000 for all federal student loan borrowers will be challenged in court or if anyone even has the standing to file a lawsuit against it.

The political climate on student loan debt forgiveness is likewise murky: An Ipsos/NPR poll found that a majority of Americans approve of canceling $10,000 of student loans, but support for forgiveness decreased at higher levels of relief. In addition, 59% of Americans are worried that student loan forgiveness will make inflation worse. According to a separate CNBC/Momentive survey from early August, nearly a third of respondents opposed student loan forgiveness for anyone.

While further widespread student loan debt forgiveness is unlikely, the Department of Education continues to discharge loans of specific borrowers — the agency has canceled $32 billion of student loans during Biden’s term. Following temporary changes to the Public Service Loan Forgiveness program in October 2021, more than 175,000 borrowers have had their student loans extinguished, totaling more than $10 billion as of August 2022.