Should I Take Out A Loan To Pay Off My Credit Card

Using a loan to pay off a credit card that has a higher interest rate or larger repayments can be helpful if you are struggling to meet your debts. A debt consolidation loan can also enable you to combine two or more other debts such as credit cards into a single monthly repayment.

When taking out any loan, be sure that the interest rate you will be paying is less than the interest rate on your debts its of little use to pay off one lender only to end up paying more through another. If you are struggling with maintaining your debt repayments, a useful idea is to take out the loan over a longer period thus reducing the size of your repayments to a more manageable level.

Where To Get A $10000 Loan In Canada

The different types of lenders below can help if you need to take out a $10,000 personal loan.

-

Banks

Banks are a solid option for borrowers with strong credit scores. Banks usually offer some of the lowest interest rates, but the application process is more involved. If you want to take out a $10,000 personal loan from a bank, make sure youre staying on top of all of your loan repayments ahead of applying to show banks youre a responsible borrower.

-

Online lenders

Online lenders are faster to fund loans than banks and credit unions. You dont need to submit as many documents, you can fill out the loan application in just minutes, and you can usually expect to receive your loan funds either the same day or the next business day. However, this group has higher rates on average. They tend to be your best bet if you have bad credit or no credit at all as they have more flexible eligibility requirements. Compare online lenders.

-

Peer-to-peer platforms

Rather than funding your loan directly, peer-to-peer lending platforms connect you to everyday Canadian investors who fund your loan. The application process is similar to an online lender, but it can take 1-2 weeks to get your money since youll have to wait for investors to fund it. Youll also need a credit score above 600 to qualify.

Banks And Credit Unions

You can also get a $10,000 personal loan through a traditional bank or credit union. This could be a good option if you prefer applying for a loan in person though you might also have the option to apply online, depending on the lender.

While online lenders are convenient, banks and credit unions sometimes offer benefits of their own. For example, if you already have an account with them, you might qualify for a rate discount. Also keep in mind that because credit unions are nonprofit organizations, they sometimes offer better rates and terms than banks or online lenders.

You May Like: Loan Officer Commission Percentage

Features Of Emi Calculator

- Graphical Representation: Learn how much will be the principal amount and interest will be paid in each EMI. This information will be presented to you in the form of a pie chart.

- Repayment Table: The repayment table, illustrates details with regard to your loan repayment. It helps you understand how much you will have to shell out each month so that you can plan the rest of your expenditures accordingly.

Home Loans And Credit Cards

Home loans can be complicated. It is smart to use an amortization schedule to understand your interest costs, but you may need to do extra work to figure out your actual rate. You can use our mortgage calculator to see how your principal payment, interest charges, taxes, and insurance add up to your monthly mortgage payment.

You might know the annual percentage rate on your mortgage, and keep in mind that APR can contain additional costs besides interest charges . Also, the rate on adjustable-rate mortgages can change.

With credit cards, you can add new charges and pay off debt numerous times throughout the month. All of that activity makes calculations more cumbersome, but its still worth knowing how your monthly interest adds up. In many cases, you can use an average daily balance, which is the sum of each days balance divided by the number of days in each month . In other cases, your card issuer charges interest daily .

Don’t Miss: Used Car Loan Calculator Usaa

Can I Get Bad Credit Loans With Guaranteed Approval For $10000 In Canada

Tread carefully if you encounter a lender advertising bad credit personal loans with guaranteed approval for $10,000. These loans are either a scam, predatory or have fine print that actually doesnt make them guaranteed.

Legitimate, responsible lenders do not guarantee approval. They evaluate a borrowers financial situation first before approving, and they clearly define their eligibility requirements.

If you want to increase your chances of approval on a $10,000 loan with bad credit, consider legitimate online lenders that often work with borrowers with bad credit. Online broker LoanConnect, for example, has a minimum credit score of 300. You can submit 1 application to find a selection of lenders that can potentially finance you.

Get a $10,000 personal loan with bad credit

Below are loan providers that specialize in working with borrowers with bad credit. They are more likely to approve bad credit loans for $10,000 than banks and credit unions.

| Personal loan provider | |

|---|---|

|

|

|

|

|

Requirements: min. income $1,900/month, no payday loan debt, debt payments less than $2,000/month, min. credit score 600 |

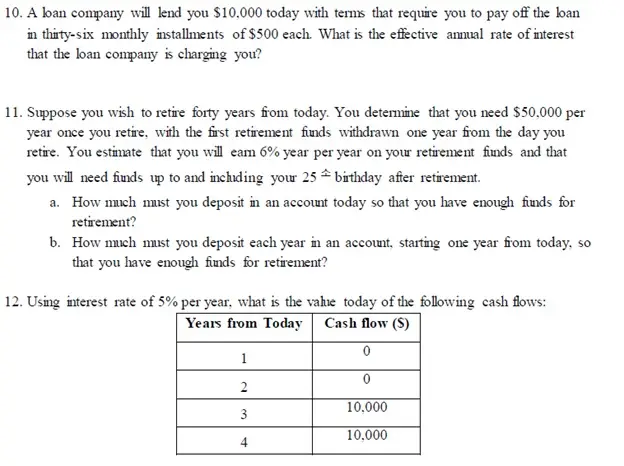

How Your Loan Term And Apr Affect Personal Loan Payments

When you take out a personal loan, two notable factors that will impact your loan payment include the loan term and APR. When you begin to compare loans from different lenders, a personal loan calculator will show different amounts for your monthly loan payment should the APR and loan terms differ.

Using a personal loan APR of 7.63% as an example, heres a simple breakdown of what the personal loan payment calculator can show you for a $5,000 loan and $10,000 loan.

| Your payments on a $5,000 personal loan | |

|---|---|

| Loan balance | |

| $5,610 | $6,030 |

In another scenario, the $10,000 loan balance and five-year loan term stay the same, but the APR is adjusted, resulting in a change in the monthly loan payment amount.

| Your payments on a $10,000 personal loan |

|---|

| Loan balance |

| $22,712 |

You May Like: How To Find Out Where My Student Loans Are

Why It May Be Worth Waiting To Borrow

Lenders will use a borrowers to measure risk and determine the likelihood of the personal loan being repaid. Excellent credit is preferred by lenders because it means the borrower is low risk, but it is not absolutely required to secure a personal loan.

Even though less-than-perfect credit may not disqualify you from being eligible for a personal loan, approval is not guaranteed. Odds of approval are much higher when you have a better credit score, so waiting to borrow until your credit score improves isnt a bad idea. Not only can it improve your odds of approval for the requested loan amount, but a higher credit score may also get you access to competitive loan terms.

Can You Finance A $10000 Car

Yes, it is possible to finance a $10,000 car. You can finance the car through both a bank or an auto dealer.

If you finance a car with a bank, you will likely get a better deal. If you try to finance the car with a dealership, the dealership will act as the middleman, and your rates could be higher.

Recommended Reading: How To Apply For Sss Loan

How Do You Get A $10k Personal Loan With Bad Credit

The first step you should take is to check your credit score. Is it really as bad as you think? If your , you should invest some time into rebuilding your credit score. If you need money ASAP, you should cut right to the chase and check personal loan offers. With a fragile credit score you will want to be careful checking offers. If a lender needs to do a hard credit pull to generate a loan offer, you should avoid applying. You will only want your credit pulled when you know you want to accept the terms. At Acorn Finance you can check personal loan offers without impacting your credit score. With a network of top national lenders, its likely that you will be able to find a lender with competitive terms at Acorn Finance. You can also apply to lenders who specialize in giving borrowers with bad credit the loans they need. Be careful with lenders who give loans to people with bad credit though, as they often have very high interest and very high APR. Make sure you review all your lending options and shop around before choosing one.

Online lenders and credit unions are usually more willing to give borrowers with bad credit small loans. Every lender and company are different though and some may be more willing to work with you than others.

Is It A Good Idea To Get A Personal Loan

Whether or not a loan is a good idea for you will depend on your personal circumstances and why you are looking to borrow several thousand pounds. If youre not sure you can afford to make the same repayment every month and you only need a thousand pounds, you could consider a instead.

For sudden costs that youll be able to pay off after a month or two, a credit card or even an arranged overdraft on your bank account may be more suitable than a personal loan, as it generally doesnt matter when you pay these debts off, as long as you make a minimum monthly repayment. At the other end of the spectrum, large amounts of money may require a secured loan also known as a homeowner loan.

An unsecured loan really shines in the middle ground. Its for an amount that is not too little but also not too large. Youll be tied to it for several years, but youll also be sure that you clear your debt by the end of the term, provided you keep up with your repayments.

Loans have the added advantage of not tempting you to spend more, with a credit card typically allowing you to keep using it until you hit your credit limit. A loan will therefore make it hard for you to get into any additional debt, as long as you put all your debt on it and cut up and cancel all your cards.

You May Like: Va Loans Investment Property

How Do I Find The Right Personal Loan For Me

If you need a personal loan for debt consolidation, home improvements, or another purpose, you might not know where to start. To find the right loan for your needs, keep the following points in mind:

Loan Payments Build Credit

Personal loans are pretty simple. You just have to make sure to submit your payments every month, and setting up automatic monthly payments from a bank account can go a long way in that regard. The most complicated part of the process is probably selecting the correct loan, but WalletHubs comparison tool makes that easy.

What is a good interest rate on a personal loan?

A good interest rate on a personal loan is 2.49% to 9%. The average APR for a two-year personal loan from a bank is 9.46%, according to the Federal Reserve, and the best personal loans have APRs as low as 2.49% for the most creditworthy borrowers. The rates you get will depend heavily on your credit, income, debt and other financial factors.read full answer

The best way to get a decent interest rate on a personal loan is to comparison shop and get pre-qualified. WalletHubs free personal loan pre-qualification tool helps you see which lenders have a high chance of approving you, as well as what interest rates you are likely to get if approved. You can then compare your pre-qualified offers to see what a good interest rate on a personal loan is for you personally.

Recommended Reading: How Much Loan Officer Commission

What Is The Average Interest Rate On A Personal Loan

Interest rates vary by state, lender, and a variety of other factors, including your:

- Debt-to-income ratio

- Loan term

So, what’s the average interest rate for a personal loan? That’s not easy to pin down because there are so many factors involved. Broadly speaking, however, we can break down the average interest rate by loan term and credit score.

The average interest rate for a 24-month personal loan was 9.34% as of August 2020, according to the most recent data from the Federal Reserve. Meanwhile, the national average interest rate for a 36-month personal loan was 9.21% at credit unions and 10.28% at banks as of June 2020 , according to the National Credit Union Administration.

Interest rates for personal loans vary considerably depending on your credit score. In general, the higher your credit score, the lower your interest rate will be. Here are the average upper limit interest rates you might expect, based on different credit scores:

| Poor | 32.0% |

If you have an excellent credit score, you may qualify for a 0% balance transfer credit card, which could be a cheaper option than a personal loan.

An Introduction To Personal Loans

A personal loan, also known as an unsecured loan, allows you to borrow a certain amount of money in exchange for paying a certain amount of interest, which will be charged as long as it takes you to pay off the loan. Once youve taken out such a loan, you will need to make a set repayment every month for a period of time that is previously agreed upon with your lender.

The representative is the rate that at least 51% of borrowers will be charged the actual rate your lender offers you could be quite a bit higher, depending on your credit score. This means that the monthly repayment and total amount repayable listed alongside any personal loan example should only be used as an indication of the minimum you will be asked to pay back.

You can use a personal loan for any number of things to help pay for a car or other large purchase, to consolidate debts, or for some necessary home renovations.

Unsecured loans also tend to come with lower interest rates than credit cards and allow you to borrow more than on cards. Most loans will furthermore offer a fixed APR and will set the repayments in advance, which means that you can be sure of how much you need to pay back each month, and plan accordingly.

In the same vein, many unsecured loans will charge a penalty not just for missing a payment , but also if you want to pay off the loan early. This early repayment charge is a maximum of two months interest so it is something to consider but not a deterrent to early repayment.

Recommended Reading: Usaa Rv Loan Reviews

How To Find A Competitive $10000 Loan

When considering what loan to apply for, it’s important to compare features of each loan to make sure you’ll receive a competitive offer. Here are some things to look at:

- Interest rate. Your interest rate will impact the total cost of your loan. The lower your interest, the less you’ll pay overall. In general, lenders will charge either a variable or fixed rate and the best rates go to borrowers with excellent credit.

- Fees. Common fees include origination fees and prepayment fees. You should also consider any ongoing fees as well. For the most part, these are all worked into the total cost of your loan the one exception being that sometimes origination fees are taken out of the amount disbursed to you.

- Repayment term. While a longer repayment term will lower your monthly payment, it does mean you will pay more in interest. Try to find a sweet spot between month-to-month affordability and overall cost.

- Turnaround time. The time it takes to get your loan approved and for it to arrive into your bank account will differ between lenders. Make sure the lender you apply with can get your loan amount to you when you need it.