Fha Loan Down Payment

As mentioned above, youll need a down payment of at least 3.5 percent. It increases to 10 percent if your credit score is between 500 and 579.

If youre low on cash and this amount seems like a stretch, you may not be completely out of luck. FHA loans allow borrowers to draw down payment funds from sources other than their own savings, such as a gift from a relative or close friend, says Tait.

FHA loans are also appealing to buyers who dont have a lot of cash because of the FHAs flexible standards on who pays for closing costs, which must also be considered when purchasing a home. You could be eligible for seller credits at closing, which can possibly cover 100 percent of your closing costs, Tait adds.

Qualifying For An Fha Loan After Foreclosure Deed In Lieu Of Foreclosure Short

Buyers can purchase a home with an FHA Loan three years after a foreclosure, deed in lieu of foreclosure, or short sale. The waiting period starts three years from the recorded date after foreclosure or deed in lieu of foreclosure. The waiting period is three years from the short sale date which is reflected in the HUD Settlement Statement or the Closing Disclosure. Borrowers should not have any late payments after a housing event. Rebuilt and re-established credit after a housing event is highly recommended.

Fha Mortgage Insurance Requirements

Lenders are willing to offer FHA loans because they know that in the worst case scenario, where they have to foreclose on a home, the FHA will pay them back. That’s why you’ll sometimes see the FHA described as insuring home loans.

That FHA backing is funded by you, the homeowner, via FHA mortgage insurance. You’ll be required to make an upfront mortgage insurance premium equal to 1.75% of the loan amount at closing, though this can be rolled into the loan. After that, you’ll make monthly mortgage insurance payments. If your down payment is 10% or more, you’ll have to make these payments for 11 years.

But if you make a down payment of less than 10% on an FHA loan, the only way to get out of paying monthly FHA mortgage insurance is to refinance into a conventional loan. FHA mortgage insurance can’t be canceled the way private mortgage insurance can. The amount of insurance you’ll pay is calculated based on the length and total cost of your mortgage as well as the amount of your down payment.

Recommended Reading: Can You Put 20 Down On An Fha Loan

Fha Mortgage Insurance Rates & Requirements

FHA requires both upfront and ongoing monthly mortgage insurance fees. For most borrowers, the upfront fee 1.75% of the loan amount and 0.85% yearly.

The upfront mortgage insurance is usually financed into the loan amount, but it can be paid in cash at closing of the loan. The yearly premium is paid in monthly installments with each mortgage payment.

For instance, a $250,000 loan would require $4,375 in upfront mortgage insurance, resulting in a $254,375 total loan amount. In addition, the borrower would pay $177 per month in FHA mortgage insurance.

FHA mortgage insurance rates are determined by loan amount, loan term, and the loan-to-value. Here are current FHA monthly mortgage insurance rates. Keep in mind that the yellow box represents the vast majority of all FHA loans.

|

Original loan term more than 15 years |

|

Loan amount |

|

0.45% |

Hud Field Office Acceptance For Areas Without Building Codes

HUD requires that each property insured with an FHA mortgage meet one of the nationally recognized building codes or a State or local building code based on a nationally recognized building code. In areas where such State or local codes are used, HUD determines if the State or local code is comparable to the model building code.

There are also areas of the United States that do not have building codes. If no State or local building code has been adopted, the appropriate HUD Field Office will specify a building code that is comparable to one of the nationally recognized model building codes.

Don’t Miss: What Do You Need For Va Loan

Who Should Apply For An Fha Mortgage

FHA loans are an attractive option â particularly for first-time homebuyers who may struggle to afford a large down payment or have low, or even in some cases, a non-existent credit score.

However, you donât have to be a first-time homebuyer to qualify for an FHA loan.

FHA loans are also great for homebuyers with:

So, how do you qualify for a FHA loan? Here are 11 key requirements:

Fha Vs Conventional Loans

A conventional loan is a common alternative to an FHA loan. Though conventional mortgages require a stricter set of financial qualifications, they also typically come along with lower interest rates and mortgage insurance that comes off at 20% equity, which is why borrowers often consider refinancing their FHA loan to a conventional loan. Lets take a closer look at some of the differences between conventional and FHA loans.

You May Like: How Long Does An Auto Loan Approval Take

Proof Of Steady Employment

Mortgages must be repaid, and the FHA-approved lender will want assurances that the applicant can achieve this. The key to determining if the borrower can make good on their commitment is evidence of recent and steady employment.

This can be documented by tax returns and a current year-to-date balance sheet and profit-and-loss statement.

If you’ve been self-employed for less than two years but more than one year, you may still qualify if you have a solid work and income history in the same or a related occupation for the two years before becoming self-employed.

Who Qualifies For An Fha Loan

Qualifying for an FHA loan is often easier than qualifying for a conventional loan because the credit requirements aren’t as strict. You need a FICO credit score of at least 580 to qualify for a 3.5% down payment. If your score is between 500 and 579, you can still qualify for an FHA loan with a 10% down payment from some lenders.

FHA loan qualifications are relatively straightforward, but lenders can impose their own minimums on credit scores. Borrowers pay private mortgage insurance every month, which usually has an annual cost of around 0.85% of the loan amount. The PMI is rolled into your monthly payment and protects the lender if the borrower defaults on the loan.

Once you have paid off enough of the loan that you owe 80% or less of the home’s value, you can refinance your FHA mortgage to a conventional mortgage and get rid of your PMI payment. For more information, read about how an FHA loan works.

You need a FICO credit score of at least 580 to qualify for a 3.5% down payment. If your score is between 500 and 579, you can still qualify for an FHA loan with a 10% down payment from some lenders.

Recommended Reading: What Is The Lowest Interest Rate For Used Car Loan

History Of The Fha Loan

Congress created the FHA in 1934 during the Great Depression. At that time, the housing industry was in trouble: Default and foreclosure rates had skyrocketed, 50% down payments were commonly required, and the mortgage terms were impossible for ordinary wage earners to meet. As a result, the U.S. was primarily a nation of renters, and only one in 10 households owned their homes.

The government created the FHA to reduce the risk to lenders and make it easier for borrowers to qualify for home loans.

The homeownership rate in the U.S. steadily climbed, reaching an all-time high of 69.2% in 2004, according to research from the Federal Reserve Bank of St. Louis. In the first quarter of 2022, the rate stood at 65.4%.

Though principally designed for lower-income borrowers, FHA loans are available to everyone, including those who can afford conventional mortgages. In general, borrowers with good credit and strong financials will be better off with a conventional mortgage, while those with poorer credit and more debt can benefit from an FHA loan.

If You Have An Fha Loan You Can Lower Your Rate With An Fha Streamline Refinance

Another advantage for FHA-backed homeowners is access to the FHA Streamline Refinance.

The FHA Streamline Refinance is an exclusive FHA program that offers homeowners one of the simplest, quickest, and most affordable paths to refinancing.

An FHA Streamline Refinance requires no credit score checks, no income verifications, and home appraisals are waived completely.

In addition, via the FHA Streamline Refinance, homeowners with a mortgage pre-dating June 2009 get access to reduced FHA mortgage insurance rates.

Read Also: What Is Current Business Loan Interest Rates

Fha Loans Vs Conventional Loans

*The percentages show the market shares of each home financing option. Cash purchases of homes are responsible for 11% of the overall home financing. The diagram uses data from 2019.*

Conventional loan interest ratesare typically a little higher than FHA mortgage rates. Thats because FHA loans are backed by the Federal Housing Administration, which makes them less risky for lenders and allows for lower rates. FHA loan is a great loan type for people who do not have enough to cover the down payment. Some people may choose easy but expensive ways to raise funds for the down payment simply because they are not aware of other options. For example, a homebuyer canwithdraw money from 401 to buy a homeand pay a lot of fees or get an FHA loan with a lower down payment requirement. Todays average FHA rates are as low as 2.25%, while conventional rates are as low as 2.875%. However, if you have a great credit score you might qualify for a lower conventional rate.You also have to consider the annual mortgage insurance rate with each loan.Depending on your credit score and down payment, conventional mortgage insurance rates could be higher or lower than FHA insurance rates. This will affect which loan is cheaper overall.

Check out ourConventional vs FHA Loanspage for more information.

The following table highlights the key differences between FHA loans and conventional loans.

| FHA Loan |

|---|

There are advantages and disadvantages to both loans as shown in the table.

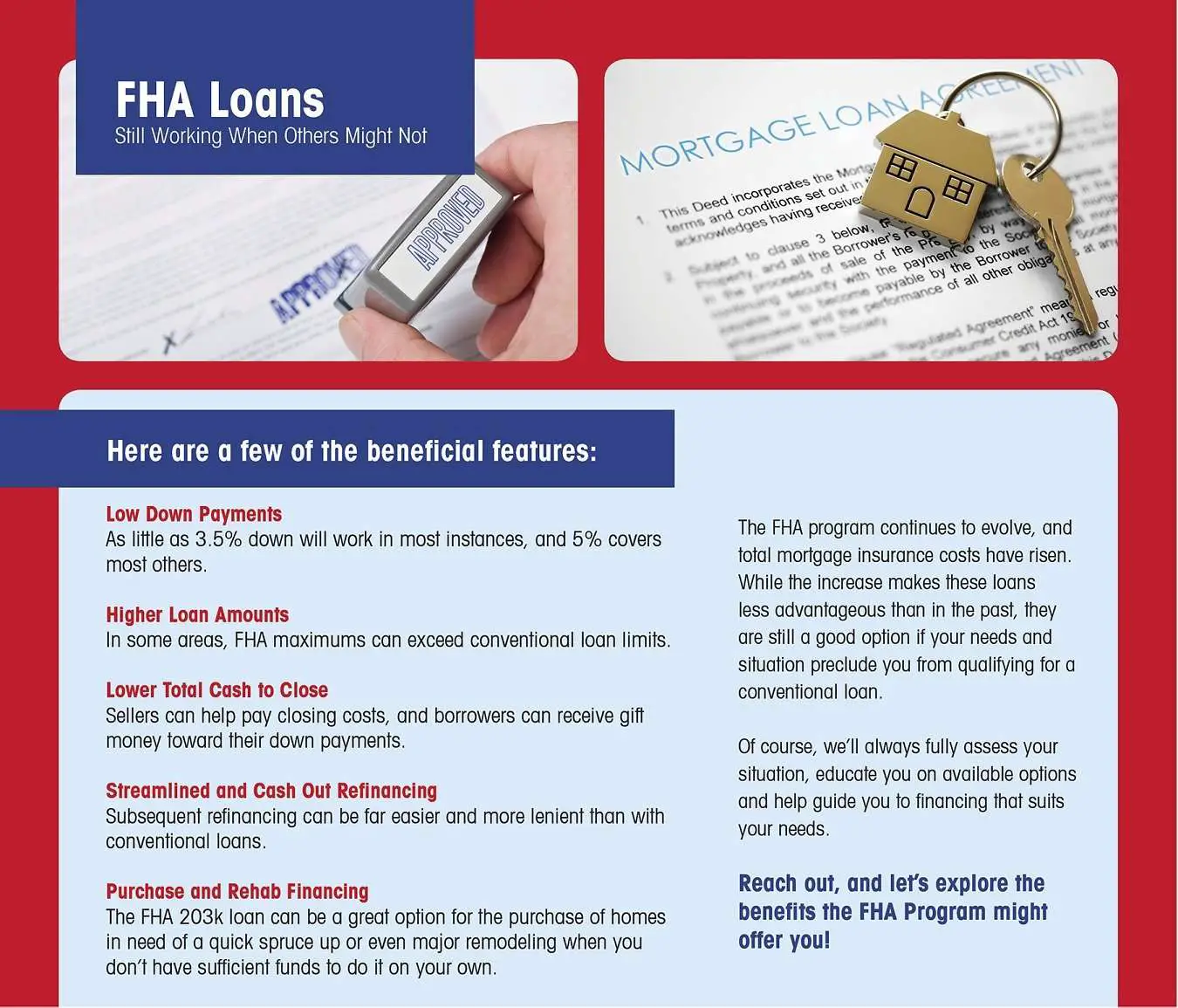

Benefits Of An Fha Loan

- Easier to Qualify FHA provides mortgage programs with lower requirements. This makes it easier for most borrowers to qualify, even those with questionable credit history and low credit scores.

- Competitive Interest Rates FHA loans offer low interest rates to help homeowners afford their monthly housing payments. This is a great benefit when compared to the negative features of subprime mortgages.

- Bankruptcy / Foreclosure Having a bankruptcy or foreclosure in the past few years doesn’t mean you can’t qualify for an FHA loan. Re-establishing good credit and a solid payment history can help satisfy FHA requirements.

- Determining Credit History There are many ways a lender can assess your credit history, and it includes more than just looking at your credit card activity. Any type of payment such as utility bills, rents, student loans, etc. should all reflect a general pattern of reliability.

After learning about some features of an FHA mortgage, undecided borrowers often choose FHA loans over conventional loans because of lower down payment requirements, better interest rate offerings, and unique refinance opportunities.

You May Like: How To Calculate Dti For Car Loan

Who Can Apply For An Fha Loan

FHA loans are open to US citizens, and also for permanent resident aliens and non-permanent resident aliens who provide proof they are eligible to work on the U.S.

FHA loans are not limited to first-time homebuyers, nor are there maximum income limits or geographic restrictions associated with the program. If youve purchased a home before, you may qualify for FHA. But if you currently own a home with an FHA loan on it, you will probably not be allowed to purchase another home with FHA until youve sold your previous home.

Those who have defaulted or are delinquent on a Federal debt may not be eligible. However, for most homebuyers, FHA is a great tool to gain access to homeownership.

- FHA has more lenient credit guidelines. Those with less-than-perfect credit may qualify.

- FHA loan interest rates are lower than low-down-payment conventional loans.

- Minimal down payment of only 3.5% of the purchase price. Keeps more cash in your pocket.

- You can opt for the FHA 203k option if the home is in need of repairs.

- The seller can pay most if not all your closing costs.

- Requires less income and assets than other loan types.

- You can use gift money for the down payment.

- You may be able to use a co-signer .

- If you choose to refinance in the future, the process is streamlined.

What Is The Fha

The Federal Housing Administration better known as the FHA has been part of the U.S. Department of Housing and Urban Development since 1965. But the FHA actually began more than 30 years before that, as a component of the New Deal.

In addition to a stock market crash and the Dust Bowl drought, the Great Depression saw a housing market bubble burst. By early 1933, roughly half of American homeowners had defaulted on their mortgages.

The FHA was created as part of the National Housing Act of 1934 to stem the tide of foreclosures and help make homeownership more affordable. It established the 20% down payment as a new norm by insuring mortgages for up to 80% of a home’s value previously, homeowners had been limited to borrowing 50%-60%.

Today, the FHA insures loans for about 8 million single-family homes.

» MORE: Facts about FHA home loans

Also Check: Is Max Loan 365 Legit

How An Fha Loan Works

First-time and repeat home buyers alike can use the FHA loan program to buy or refinance a home affordably.

The FHA program backs mortgages for single-family homes being used as a primary residence. But you could buy a multi-unit property, like a duplex or triplex, as long as you live in one of the units.

Since the federal government insures FHA loans, buyers with smaller down payments and lower credit scores can qualify for mortgages.

This can make home buying much more approachable for those with lower incomes, who might have trouble saving for a down payment and closing costs.

To qualify, you will need to meet FHA loan requirements. But, fortunately, these are much more lenient than many other loan programs.

Fha Loans And Credit Score

There are a lot of factors that determine your , including:

- The type of credit you have

- Whether you pay your bills on time

- The amount you owe on your credit cards

- How much new and recent credit youve taken on

If you have a higher score, you might be able to qualify with a higher debt-to-income ratio, or DTI. DTI refers to the percentage of your monthly gross income that goes toward paying debts. Your DTI is your total monthly debt payments divided by your monthly gross income . This figure is expressed as a percentage.

To determine your own DTI ratio, divide your debts by your monthly gross income. For example, if your debts, which include your student loans and car loan, reach $2,000 per month and your income is $8,000 per month, your DTI is 25%.

The lower your DTI, the better off youll be. If you do happen to have a higher DTI, you could still qualify for an FHA loan if you have a higher credit score.

The FHA states that your monthly mortgage payment should be no more than 31% of your monthly gross income, and that your DTI should not exceed 43% of monthly gross income in certain circumstances if your loan is being manually underwritten. As noted above, if you have a higher credit score, you may be able to qualify with a higher DTI.

You May Like: Is Fast Loan Advance Safe

Fha Loan Requirements For 2022

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Mortgages backed by the Federal Housing Administration have different requirements from other types of home loans. Though you don’t have to be a newbie, FHA loans are often popular with first-time homeowners because they couple lower down payment requirements with more lenient standards for credit scores and existing debt. Here’s a rundown of the key FHA loan requirements.

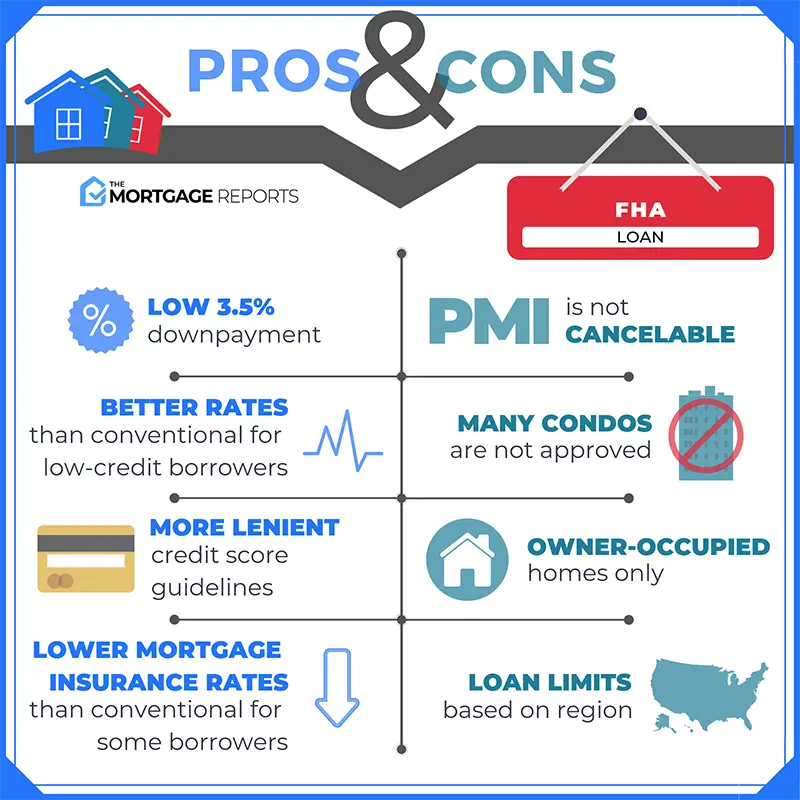

Pros And Cons Of Fha Loans

Before you fill out a loan application, heres a quick recap of FHA loan pros and cons.

| FHA loan pros | |

|---|---|

| You may qualify with a lower credit score than conventional loans | Youll pay higher mortgage insurance costs |

| You may qualify with more debt than a conventional loan | You wont have as much borrowing power due to FHA loan limits |

| You can purchase a two- to four-unit home with a down payment as low as 3.5% | You cant use an FHA loan to finance a second home or investment property |

| You dont have to be a first-time homebuyer to qualify | Youll pay mortgage insurance for the life of the loan in most cases |

| Youll have several loan programs to choose from with lenient qualifying requirements | You pay mortgage insurance regardless of how much equity you have |

| You wont be subject to any income maximums | Youre more likely to end up with a higher-priced mortgage loan |

Don’t Miss: Allotment Loans For Postal Employees With Bad Credit

What Is An Fha Loan

FHA is an agency regulated and operated by the Department of Housing and Urban Development. FHA loans are insured and backed by the government which means the organization is responsible for recovering all the losses in the future if somehow the applicant becomes a defaulter.

No doubt FHA loans have a minimum credit score and a 10% down payment requirement. But keep in mind that they come with high mortgage interest rates. Also, home buyers need to pay mortgage insurance.

You dont have to be a first-time home buyer when applying for FHA loans. Lets check some of the major benefits of getting FHA loans:

- Low credit score requirements as compared to other loan options.

- Minimum 10% down payment.

- Even buyers with bankruptcy and poor transaction records can apply.

- Closing costs can be compensated and rolled into your loan.