Benefits Of A First Midwest Personal Loan

One of the biggest benefits of getting a personal loan from First Midwest Bank is the low cost. Although some of the best personal loan companies offer interest rates as low as those advertised by First Midwest Bank, many require spotless credit to qualify for those rates.

First Midwest Bank does have higher credit requirements than some other lenders offering personal loans, but the maximum interest rates are on the lower end of the spectrum. This means borrowers could save money using a First Midwest Bank personal loan.

In addition to the lower interest rate potential, the application process is both short and easy to complete. The phone call required as part of the process only takes a few minutes to get through once information is submitted online. After those details are verified, a loan application can be approved the same day.

There are also no additional fees above and beyond the documentation fee for a new personal loan, and no prepayment penalties if you wanted to pay off your loan balance early.

What To Do If You Are Rejected From First Midwest Bank

Your loan application may get rejected for various reasons, including insufficient income, poor credit or incomplete application details. When this happens, the first thing to do is figure out what caused the lenders decision.

Take the time to contact the bank to understand the reason behind your unsuccessful application since this will help prevent another rejection.

While you can still submit new applications in the future, you may need to take the time to build your credit score and improve other factors beforehand.

You can start a new application with a different lender, but you risk impacting your credit score if it gets denied. MoneyGeek recommends that you focus on improving your weak scores before submitting any new applications.

Downsides Of A First Midwest Personal Loan

Although there are a handful of benefits offered with personal loans from First Midwest Bank, disadvantages exist and should be considered. As with many bank loans, the minimum credit score of 680 may make it difficult for individuals with less-than-ideal credit to qualify. Compared to some other online personal loan lenders, First Midwest Bank does have more stringent credit requirements.

> > Read More: Personal loans for bad credit

The loan maximum may also be a disadvantage for some borrowers. Personal loans from other lenders have far higher loan amounts, allowing borrowers to receive more financing for their needs. Borrowers who need more access to cash may want to look at other lenders to get what they need.

Finally, First Midwest Bank offers same-day loan application approval so long as the borrower is available for the required follow-up phone call. However, funding from the personal loan may not reach a borrowers bank account until two or three business days after approval takes place.

Some lenders provide personal loan funding more quickly in some cases, the same business day which may be more beneficial for borrowers who are in a hurry to get their cash.

You May Like: How To Check Car Loan Balance

Merits Of Consumer Fraud Claim

The trial court’s judgment in favor of the Bank on the Consumer Fraud Act counts is supported by the additional reason that the record would adequately support a finding that there was no evidence of any intent on the part of Schwartz that Stepanich rely on any concealment. In that regard, the record contains ample evidence from which it could be concluded that Schwartz did not know about Sparks’ financial condition and did not intend for Stepanich to rely on any alleged omissions. Schwartz testified that he believed that Sparks had the ability to pay the loan amount, he did not know about Sparks’ other loans at the Zion branch, and did not see Wix’ letter until after Stepanich had cosigned. Moreover, since he knew Stepanich and Sparks were such good friends and Stepanich did not inquire from Schwartz about Sparks’ financial condition, Schwartz could have reasonably concluded that Stepanich was informed by Sparks of all the material facts surrounding the transaction.

At A Glance: First Midwest Bank Personal Loans

- 5.23% to 12.99%APR Range

- 670Minimum Credit Score

- $5,000 to $35,000Loan Amount Range

- 12 to 84 monthsRepayment Terms

- Same DayTime to Receive Funds

WHY WE GEEK OUT

Established in 1940 as Union National Bank and Trust Company of Joliet, First Midwest Bank has merged with various financial institutions over the years, with Old National being the most recent.

The lender provides customers with an unsecured personal loan between $5,000 and $35,000 at a fixed APR of as low as 5.23%. Applicants must meet the minimum credit score limit of 670 to get approved for the loan, which comes with no prepayment penalty or late fees.

Borrowers can also pre-qualify for a personal loan at First Midwest Bank without negatively affecting their credit score since the bank conducts soft credit checks.

First Midwest Bank does not have restrictions on how borrowers use the funds. You can spend on unexpected expenses, consolidate debt, cover large purchases and renovate your home. However, the bank may not be suitable if you have a low credit rating or if you need more than $35,000.

PROS & CONS

- No prepayment or late fees

- Soft credit checks

- Only available in three states

- No co-signers allowed

- Maximum loan amount of $35,000

- Customers with new or no credit not are ineligible

LENDER DETAILS

- Minimum/maximum loan amount: $5,000 – $35,000

- Minimum credit requirements: 670

- Repayment terms: 12 – 84 months

- Time to receive funds: 1 day

Also Check: Are Fha Loan Rates Higher Than Conventional

Types Of Personal Loans Offered By First Midwest Bank

First Midwest Bank offers an unsecured personal loan that can be used to:

- Consolidate existing debt: Use the loan to refinance some of your existing high-interest debt in a single fixed-rate loan.

- Cover unexpected expenses: You can use the loan funds to cover unexpected expenses, such as those arising from an emergency or other unexpected events.

- Improve your home: The funds from this personal loan can also be used to make improvements or repairs to your home without pledging your home as collateral.

- Pay for large purchases: If you need to make a large purchase, the funds from your loan can be used to cover these costs.

U.S. citizens or permanent residents at least 18 years old are eligible to apply for a personal loan with First Midwest Bank. To qualify, youll need to meet its requirements. While specific credit score details are not disclosed, youll likely need a good credit score to get approved for a loan.

Most lenders classify credit scores of at least 670 as good. If your credit score isnt above 670, work on improving it. Having good credit makes it easier to get approved and get better loan rates and terms.

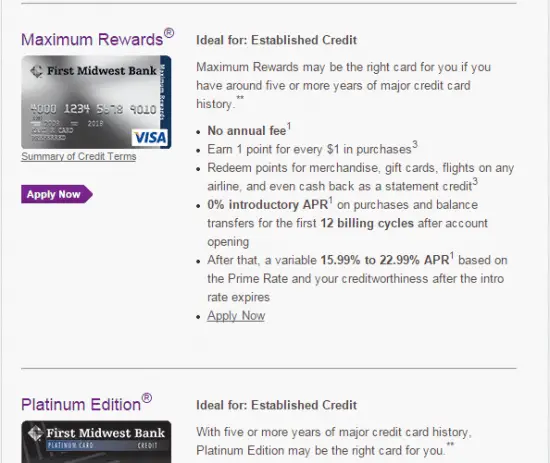

In addition to having a good credit score, youll need to have at least five years of good . This means you cant have any bankruptcies, repossessions, foreclosures, or other significant issues reported on your credit during this period. Additionally, you may be required to provide proof of your income and current employment.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Read Also: How Can Someone Take Over My Car Loan

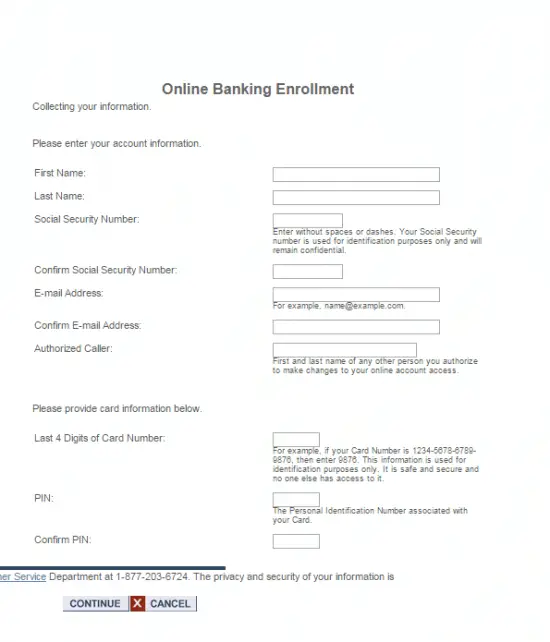

S For Online Enrollment Of Digital Banking

There are several options for enrolling online:

Once on the enrollment page:

select the box and click Complete Sign Up.

If the information matches, then you will be directed to the login.If the information does not match, you will receive Pending or Declined message. For Pending applications, you should receive an email within 1 business day advising the status of your registration.If youre a business client, please visit a banking center or call 1-800-731-2265 for assistance with enrollment.

For security purposes, Old National Digital Banking has certain system and browser requirements. If you are having issues, we recommend the following:

First, test your browser to ensure it is fully compatible with Old National Digital Banking. If not, you may need to upgrade your current browser.

If you have trouble testing your browser, view our list of suggested solutions. If after following the suggested solutions, you still aren’t able to view the test, please contact Client Care at

First Midwest Bank Is Best For Debt Consolidation

When trying to consolidate your debt, you want to find a personal loan that adds as little extra expense as possible. First Midwest Bank could be a great choice for borrowers looking to consolidate their debt, with APRs as low as 5.23 percent quite low compared to the 10.3 percent average APR for borrowers with excellent credit as of December 2021. It also has a documentation fee of $150, but this is lower than some origination fees you might find with other lenders.

However, First Midwest Bank might not be for you if you are looking for in-person service and do not live in Illinois, Indiana, Iowa or Wisconsin. While these are not the only states where personal loans are available, borrowers outside of these states do not have the option to visit a branch without traveling. First Midwest also does not disclose on its website how long the loan funding process will take. If you are looking for fast funding, it may be a good idea to look elsewhere.

Read Also: Which Type Of Loan Has The Highest Interest Rate

Old National And First Midwest Announce Merger To Create Premier Midwestern Bank

- $45 billion in total assets and $34 billion in total deposits

- Unlocks immediate scale and positions for continued in-market growth

- Accelerates opportunities to strengthen communities and drive positive change

- Transaction expected to close in late 2021 or early 2022

Evansville, Ind. and Chicago, Ill. June 1, 2021 Old National Bancorp and FirstMidwest Bancorp, Inc. , jointly announced today they have entered into adefinitive merger agreement to combine in an all-stock merger of equals transaction with a total market value of $6.5billion to create a premier Midwestern bank with $45 billion in combined assets.

With nearly 270 combined years of service and a shared commitment to Midwestern values, Old National and FirstMidwest are two organizations driven by a customer-centric approach to banking, an unwavering commitment tocommunity and a strong focus on corporate social responsibility, making the combined entity the premier choice foremployees, clients and shareholders.

Additional leadership positions for the combined entity include:

- Jim Sandgren, CEO of Commercial Banking

- Brendon Falconer, Chief Financial Officer

- Kendra Vanzo, Chief Administrative Officer

- Kevin Geoghegan, Chief Credit Officer

- Thomas Prame, CEO of Community Banking

- Chady AlAhmar, CEO of Wealth Management

Delivering Exceptional Value to Clients, Employees and Communities

Strategic benefits of the merger include:

Delivering Financially Compelling Benefits to Shareholders

Timing

Participants in Solicitation

Personal Loans For When Life Happens

Got questions? Get answers.

What is the minimum amount I can borrow? How long does an application take? Is there a prepayment penalty?

Ready to speak to a personin person?

You have your own unique goals to meet, and it all starts with a short conversation with one of our team members. You can reach us directly at 877-310-2373

What is a personal loan?

Great question. Personal loans are installment loans with fixed interest rates and fixed monthly payment amounts over a scheduled period of time that may help you deal with an unexpected expense, see a new part of the world, or simply help you achieve your personal financial goals. Personal loans cannot be used for postsecondary education expenses, for any business or commercial purpose, to purchase securities, or for gambling or illegal purposes.

To help the government fight the funding of terrorism and money laundering activities, Federal law requires all financial institutions to obtain, verify, and record information that identifies each person who opens an account. As a result, under our customer identification program, we must ask for your name, street address, mailing address, date of birth, and other information that will allow us to identify you. We may also ask to see your drivers license or other identifying documents.

Don’t Miss: How Home Equity Loan Calculator

Payday Loans In Richmond Hill Ontario

Hard working Richmond Hill residents that are looking for some extra cash are in luck. Emergency expenses can arise unexpectedly and a cash advance can help a lot. Oftentimes, it is difficult to obtain a payday loan due to complex applications and long line ups. Further, if you have bad or poor credit the procedure can become even more difficult. Thankfully, payday loans in Richmond Hill can be obtained without having to wait in long line ups or dealing with complex applications.

Smarter Loans is your one stop shop for payday loans available all online. With a directory of loan providers at your fingertips you are able to get a cash advance fast and easily.

No more than 1 or 2 business days are all it takes to get money into your bank account regardless of bad or poor credit. Weve taken all the top local payday loan providers and placed them into our directory for your to search through and compare for the ideal match.

Below you will find our directory of local loan providers. Click on Apply Now next to the provider of your choice and complete their online application. Upon competition one of their friendly representatives will get in touch with you. In the alternative, you can also pre-apply with Smarter Loans and we will connect you with a local loan provider to process your application.

Time To Receive Funds

Although the time to receive your funds will vary based on your situation, your loan funds might be deposited in your bank account as quickly as 24 hours after your loan is approved, but it could take up to several days for this to happen. This funding speed is reasonable when compared to the competition.

Review your application for accuracy and completeness before you submit it. Also, the quicker you respond to any requests for information from the lender, the quicker youll get a loan decision.

Read Also: How To Get Small Loan Online

How To Apply For A Loan With First Midwest Bank

First Midwest Banks application process is straightforward and fast. Enter some basic information in the online application, including your name, Social Security number, employment information and income. The application also asks if you rent or own your residence. Homeowners have to provide some information about their monthly payment obligations, including mortgage payments, taxes and insurance.

While it doesnt specify a hard minimum, First Midwest states that it looks for a good credit score, but it will also consider other factors, including employment and income. Youre also required to have at least five years of credit history that is free of bankruptcies, foreclosures, repossessions and other major credit issues.

The bank will not tell you online whether your loan has been approved. It will call you either with a decision or to request identification and additional supporting documentation.

Applicants can either upload the requested information or visit a physical branch. When its time to sign and finalize your loan, you have the option to e-sign or do it at a branch.

Before finalizing your loan, First Midwest will do a hard credit check with TransUnion, which can temporarily lower your credit score.

Why Choosemariner Finance

We recognize that people are short on time, so we try to respond with answers quickly. We also realize everyone has their own experiences and circumstances, so we take the time to get to know the person behind every personal loan, and we try to provide resources that help borrowers make more informed decisions. Simple, but true.

How has Mariner come through for you?

Don’t Miss: Usda Loan Income Limits 2022

Types Of Personal Loans

A personal loan can meet a variety of needs, including medical emergencies, home improvement projects, vacations, weddings and debt consolidation. Mariner Finance may have a solution that fits your needs.

Debt Consolidation

This type of loan helps streamline a variety of debtfrom medical bills to credit card paymentsinto a single monthly payment solution.

Covering Unexpected Expenses

Major appliance breakdowns, auto repairs, medical costs , and plumbing repairs: All of these costs can be unexpected and could happen at an inconvenient time.

Making Home Improvements

You might not always have sufficient funds to cover potentially value-enhancing investments like new countertops, flooring, or deck additions. Consider making those upgrades a possibility with one of our personal loans.

Paying for a Vacation

Eager to see more of the world, or just another part of the country? Ready to finally book that cruise? Due for a family reunion? Begin planning the trip youve been putting off.

Taking care of Wedding Expenses

Sometimes, love just cant wait for your bank balance to catch up, and wedding costs are often more than we anticipate. Consider a personal loan to help make your dreams come true when youre planning your dream wedding.

First Midwest Bank Personal Loan Details And Requirements

-

First Midwest Banks annual percentage rate for personal loans ranges from 5.23% and 12.99%.

-

To qualify for a personal loan from First Midwest Bank, borrowers need a credit score of at least 670.

-

Income Requirements

You do not need verifiable income to qualify for a personal loan from First Midwest Bank.

-

Loan Amounts

First Midwest Bank personal loans range from $5,000 to $35,000.

-

Loan Terms

Borrowers can repay First Midwest Bank loans within 12 to 84 months.

-

Permitted Uses

You can use your First Midwest Bank loan to cover any expense, including debt consolidation, large purchases and home renovations.

-

Prohibited Uses

There are no restrictions on how borrowers use their First Midwest Bank personal loan.

-

Time to Receive Funds

After applying for a personal loan from First Midwest Bank, you will receive the funds in one day.

-

Origination Fees

First Midwest Bank does not publicize any origination fees on their website. Contact the lender for more details.

-

Late Fees

First Midwest Bank wont charge you any fees for late payments.

-

Prepayment Penalty Fees

Personal loans from First Midwest Bank come with no prepayment penalty.

-

Co-signers and Co-applicants

First Midwest Bank does not allow co-signers on personal loans.

-

Perks

The bank conducts a soft credit inquiry that does not affect your credit score.

-

Mobile Application

First Midwest Bank has a mobile app that borrowers can use to manage their personal loan.

Show more

Is First Midwest Bank Right for You?

You May Like: What Is The Difference Between Loan Rate And Apr