Are Payday Loans Different

Online payday loans should be settled on your next payday. There are many types of installment loans, such as title loans on your vehicle, personal loans, and lines of credit.

Long-term installment Loans can last years if you take out a mortgage. Many people are looking for a personal loan for several months.

Payday loans are short-term products and should be repaid quickly. They range from $100 to $1000 in most states and $255 if you reside in California.

Monthly payments mean you are able to plan in advance for your financial repayments .

If you are ready for a payday loan for bad credit or installment loan, call our customer service now at 233-9435

Find Out If Your Approved In Minutes

Once youve opened your account with MoneyLion, you can get a Credit Builder loan up to $1,000 at a low APR. Just submit a request for the loan through the MoneyLion app and get ready to have money deposited into your account within seconds. Your payments will be automatically deducted on your pay dates, making it easier and more manageable than alternative payment methods.

What Will My Monthly Payment Be

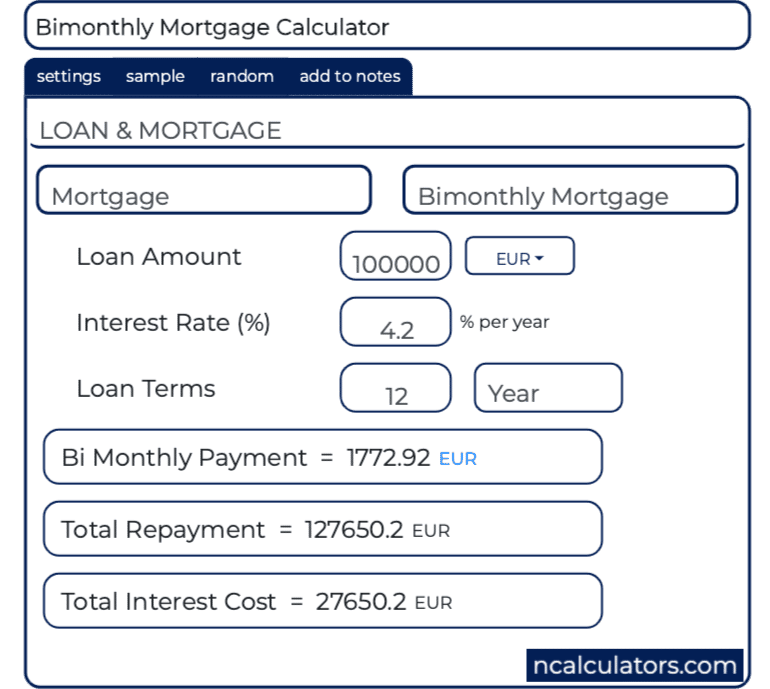

Every loan has different factors that affect monthly installments. Several online tools can help you get an idea of how much youll have to pay to settle your debt.

When estimating your monthly payment, you need to consider your total loan amount, repayment term, and interest rate. The more money you borrow, the larger your monthly installment will be. Your interest rate will also greatly impact your payment amount.

For example, a $5,000 loan with 5% interest and 36 months of payments will cost you $149.85 per month. That same loan with a 3% interest rate will cost $145.81.

Examples of monthly loan payments from PersonalLoans.com.

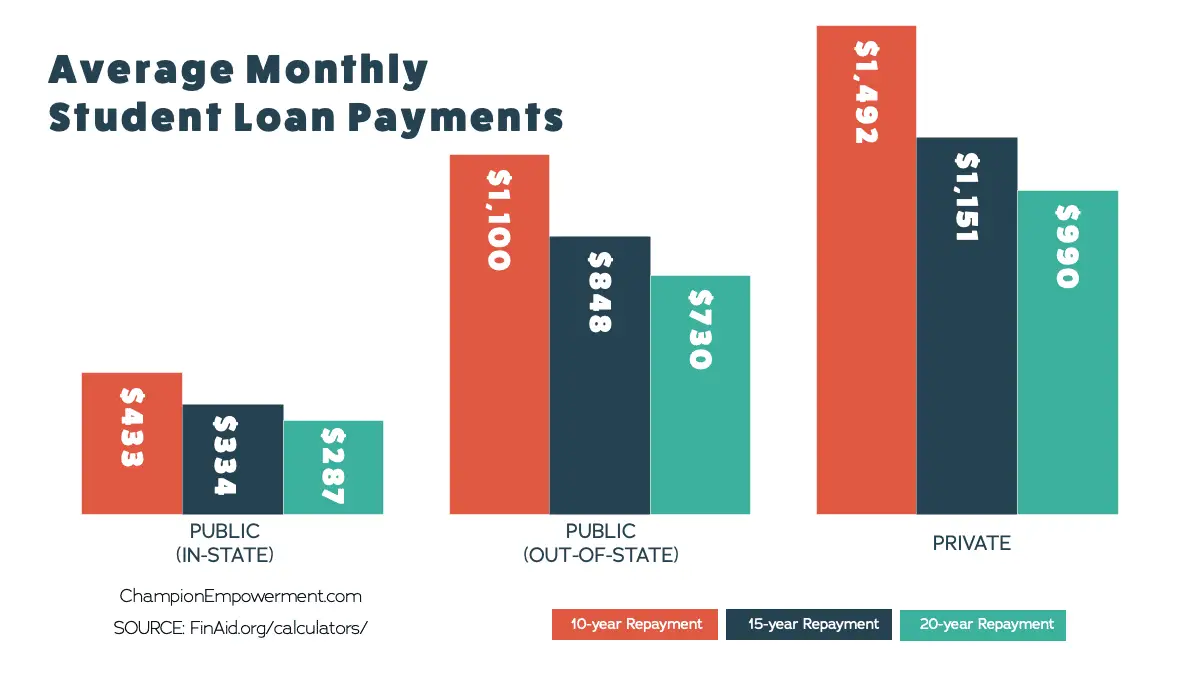

You can lower your monthly payment by extending your repayment term, but this isnt always the best financial decision. While you wont have to pay as much each month, youll almost always end up paying more over the life of the loan. Thats because more payments equal more interest paid.

To show this, well look at that same $5,000 loan with 5% interest and a 36-month repayment term. After three years, you will pay $5,394.76 to settle the debt for a total of 394.76 in interest.

If you take that same loan and extend it for six years , youll only pay $80.52 per month, but the amount needed to pay off the loan would equal $5,797.78 including $797.78 in total interest. Thats $403.02 more in interest than if you were to pay the loan off in three years.

And, if you accept a larger loan, those numbers get even larger.

Read Also: Can My Spouse Be On My Va Loan

Get Your Next Loan From King Of Kash

While its true that you can get bad credit installment loans so easily nowadays, you still need to find a lender that will genuinely care and be understanding of you as borrower. Should you need a same day installment loan, get them from King of Kash.

King of Kash has been providing installment personal loans for decades now, and more than just a business, King of Kash strives to provide the best financing tools and services to their customers. A great and reputable lender works flexibly with your financial circumstances and provides you with the best available options, on top of fast processing, high approval and excellent customer service.

Consider All Of Your Options

Depending on your score, you may need a co-signer to get approved for a private loan with a fair interest rate. Suppose you cannot find a co-signer or the providers you are contemplating do not allow co-signers. In that case, you may be able to receive a protected personal loan instead of an unsecured one.

Don’t Miss: Bad Credit Online Loans Guaranteed Approval

Can I Make Partial Payments

Yes, customers have the option to make partial payments. Partial payments are first applied to the finance charge and then the principal loan amount.

The due date will not be extended unless the entire finance charge and the entire principal amount have been paid. A partial payment can be accepted whether the customer is on time or late.

*Check City currently offers installment loans in Utah, Colorado, Idaho, Missouri, Nevada, Texas, and Wisconsin.

The details of your installment loan may depend on the state you live in. For more details about the rates, fees, terms, and conditions that apply to your installment loan find your state on the Check City Locations Page.

Customer Service:

How Fast Can You Get A Personal Loan

How fast you can get a personal loan depends on the type of lender you use. Here are the typical funding times to expect:

- Online lenders: Less than five business days

- Banks and credit unions: One to seven business days

Online lenders are usually the quickest option many offer approval decisions within minutes, which can help speed up the loan funding time. Some online lenders even offer next-day or same-day loans if youre approved.

Recommended Reading: What Is Home Equity Loan

Installment Loans Vs Payday Loans

Besides the funds from installment and payday loans being paid out as a lump-sum amount, they dont have many similarities.

- Installment loans: Installment loans are typically paid off over the course of years, usually with fixed monthly payments. Installment loans are also generally more affordable compared to payday loans. In addition, installment loan payments are usually reported to the credit bureaus, which can help you build credit over time if you make your payments on schedule.

- Payday loans: Payday loans are expected to be repaid by your next paycheck, although you can renew the loan for a fee if you cant make the payment. Payday loans also tend to charge high fees that consumer protection groups regularly flag for predatory lending practices. In addition, payday loans dont report your payments to the credit bureaus and dont help you build credit.

How Do These Loans Work

In a nutshell, when a bank or credit union reviews an application for a borrower with poor credit, theyll either deny it outright or approve it, but with a higher interest rate or longer term. This is because they look at those borrowers as higher risks than one with good credit. Yes, youre being charged more money than someone else simply because you had some financial hardships. Is that fair? No, but thats how the lending industry works.

Lenders balance out that higher risk of funding a loan for someone with poor credit history with higher interest rates. Typically, people with poor credit have a history of not paying their bills on time, or not paying them at all. Lenders are basically trying to recoup the initial loan as fast as they possibly can before the borrower starts missing payments. Again, is this fair? No, but we dont work that way.

At King of Kash, our fast loans for bad credit work exactly the same as our quick personal loans. We treat every potential buyer exactly the same and give you the best possible interest rate we can.

Recommended Reading: Where To Apply For Small Business Loan

Online Installment Loan Considerations

Installment loans should have affordable monthly interest rates. Online lenders consider various factors while evaluating loan applications.

Your credit rating, earnings, other liabilities, debt-to-income ratio, and employment determine your interest rate and APR.

Before giving installment loans, lenders must be confident customers can repay. Before applying for an installment loan, you might also want to improve your credit.

Increasing your credit score could cut your rates.

Your financial position affects installment loan interest rates and expenses. This is also true of credit cards.

Comparing The Costs Of Different Loans

No matter what type of loan you decide to go after and whether or not you undergo a hard credit check to get it you should never sign on the dotted line on a loan agreement until youve done some math to determine the actual cost of your loan.

The best personal loans are those that charge you the least in the long run.

With installment loans, this cost is usually pretty easy to figure out. The typical personal installment loan from a reputable lender will have two main costs:

- The interest fees: These are simply the cost of borrowing money and will be included in your monthly loan payments. Installment loan interest fees are calculated according to the annual percentage rate, or APR, and the length of your loan, with longer loans costing more overall.

- The origination or administration fee: Most lenders will charge a fee to cover the costs associated with evaluating your loan request and discharging a loan. Origination fees typically range from 3% to 8% of the loan amount, and they come out of the loan when it is disbursed.

So, in essence, the cost of your installment loan is simply the total interest you pay plus the amount of your origination fee both of which should be clearly laid out in your loan terms. And, because installment loan lenders disclose your origination fees and interest rates the same way, its easy to compare one installment loan offer with another offer.

And yes, this is math you really should be doing.

Recommended Reading: What Is Hard Money Loan

How To Apply For A Personal Loan Online

The application process for online personal loans is lender-specific. However, most lenders follow the same general application and underwriting process. Follow these basic steps to apply for a personal loan online:

Home Equity & Refinance Loans

Although hardly the only reason to purchase a home, one of the many reasons people like to buy property is that it can appreciate in value over time. Even if your home hasnt increased in value, however, your equity in your home will increase over time as you pay down your mortgage loan.

The equity that you build in your home can represent significant value, and not just when it comes to reselling. You can often use that equity as collateral to obtain a home equity line of credit or a home equity loan. Most lenders who offer mortgages will offer home equity loans, including some of our picks below.

| 4 minutes | 8.5/10 |

If a home equity loan or credit line doesnt suit, another way to get extra cash out of your homes equity is through a cash-out refinance loan. In a regular mortgage refinance, youd take out a new loan for the same amount that you owe on your current mortgage, and use the new loan to pay off the old loan. Ideally, the new loan has a lower APR to reduce your costs.

A cash-out refinance loan is basically the same, except instead of the new loan being for only what you still owe on your existing mortgage, the new loan is for a larger amount based on how much equity you have in the home. The extra money can then be used for anything you need, from paying off debt to covering an emergency.

Read Also: How Quickly Can You Refinance An Fha Loan

Why Do You Need A Personal Loan

There are several justifications for getting a personal loan. Almost everything may be paid for with a personal loan, which you can get from a bank, credit union, or online peer-to-peer borrower without security. They are more appealing because of their flexibility and how quickly they are approved most of the time.

In many cases, the loan money may be placed into your account within one week or even less if your credit is strong and the lender is happy with the income information you supply.

Here are some guidelines for when getting a personal loan makes sense. Additionally, there are many possible applications for personal loans, but the following are some of the most important ones:

What Are The Best Installment Loans

The best installment loans come with flexible terms and conditions to help more people get a loan. You can find payday lenders online who will offer a quick cash advance on the same business day, and you can have money in your account within hours. It is much better than using your credit cards to make payments for medical or hospital bills. Although direct lenders installment loans have a much higher rate of interest, the instant money transfer makes it a great choice.

Don’t Miss: How Much Is The Interest Rate For House Loan

Where Can You Find Installment Loans With Monthly Payments Bad Credit

Several payday lenders will agree to give you an installment loan even if your credit score is abysmal. This type of loan turns out to be more affordable and beneficial than payday loans. Unlike a payday loan, you dont need to repay the loan amount on the next paycheck.

You get a longer loan duration, which reduces the interest rates and allows you to repay the loan amount in small monthly installments. Many payday lenders will offer a quick instant cash loan without any credit check.

If you apply with a traditional bank with credit below 630, they verify a lot of information about you, including the amount of debt you have, the kind of transactions you make, your total earnings, financial behavior, and so on.

Gathering that kind of information takes time, and that explains why the traditional lenders often have you waiting for days or even weeks before they approve or reject your loan application. With payday direct lenders, this is not the case.

These lenders offer a loan without any credit check, so even if you have a bad credit history, you will still get the money transferred to your account. Due to no paperwork or faxing of documents required, the loan gets processed considerably fast, and you can expect the cash to get to your checking bank account on the same day.

Your full name

Age

Physical address

Reason for taking a loan

Employment or alternative source of income

What To Consider When Getting Installment Loans

A lot of factors come into play when taking bad credit installment loans and they are often connected with one another.

First, theres the loan amount. They are typically available in several hundred to a few thousand dollars. Work out the amount you need and try not to borrow more to keep your loan as manageable as you can.

Second, theres the interest rate. Most rates for small installment loans are fixed and lenders usually compute it as a percentage of the principal amount you wish to borrow. Other factors that may be considered would be the cap on interest rates in your state as well as credit score.

Lastly, theres the term of the loan. Most personal installment loans can run between 6 months to five years. You must choose the loan term properly depending on your goals and financial circumstances. If you want to be over the loan sooner, you can opt for a short term but expect heavier installments. The longer the loan term, the smaller the amount that you need to pay but the longer you are locked into the said commitment. If you want to opt out of the loan pay it off early, you are welcome to do so without incurring any charges.

Apart from these, you must also determine your financial readiness to take on the loan payments for the next few months or years and your purpose for needing such a loan. Taking a big loan can also be a big decision and you must first determine all your available options and identify the best ones for your situation.

Also Check: What Mortgage Loan Fees Are Negotiable

Does Pheabs Offer Installment Loans Near Me

Yes, we can facilitate installment loans across the USA, so wherever you live, you can get the right product for you. We work with trusted lenders across the West Coast including California and Texas and the East Cost of Illinois and Florida and everywhere in between. Your application will be connected to the lender who operates legally in your State, but we also work with national providers too so you can get the best of both worlds.

You do not have to enter a store or visit a branch, since everything with Pheabs is handled online from start to finish.

Can I Get An Installment Loan With Poor Credit

If you are looking for installment loans for bad credit direct lenders only, then you are in for luck because you will find several payday lenders who offer such loans for bad credit individuals. These lenders understand that people may get a poor credit rating for no fault of theirs and due to an unavoidable circumstance. Hence, despite a poor credit history, these lenders still come forward to offer instant cash loans without any collateral.

Also Check: How To Small Business Loan

Know What Youre Getting Yourself Into

For consumers with bad credit, the words, Credit check required, often elicit the same reaction as when vertically challenged kids come up against the sign stating, You must be this tall to ride.

But, while not reaching the minimum height requirement on a roller-coaster means youll miss out on the ride, having to undergo a credit check doesnt necessarily mean youll be rejected for a loan even with a low credit score.

In the end, the best way to get a loan with poor credit isnt to avoid lenders that will check your credit. The key is to select lenders that lend to people with bad credit. This may mean your local credit union, or it may mean a reputable online lender that specializes in subprime borrowers.

Either way, its important to keep in mind that credit checks arent just for the lenders peace of mind. Credit checks help lenders reduce their overall risk, which, in turn, can help keep costs low for all of a lenders customers, not just the ones with the best credit.