What Is Better To Look At Apr Vs Interest Rate

To get a true assessment of costs, look at both interest rates and APRs. This might require some extra work, but it can save you money in the long run.

It is also important to understand that APRs can differ for federal student loans, in which case the APR might not include a loans origination fee.

To ensure youre shopping for student loans with the right information:

- Begin your research early.

- Dont assume the lender with the lowest interest rate is the least expensive option. Ask lots of questions.

A can help you figure out how paying interest while youre still in school can contribute to saving on your overall loan cost.

When you loan shop from an informed place, you can find and commit to the best student loan for your financial situation.

What Is The Difference Between The Interest Rate And Apr On A Loan

June, 2020 by David

Choosing the right loan can be confusing. How do you know if youre getting a good value loan? Often we are left scratching our heads trying to figure out what is the difference between the interest rate and APR on a loan. Many lenders use different words to describe the cost of borrowing but the APR is the best figure to compare. Some interest rates look more enticing and cheaper than others, we aim to explain and make it simple.

What Is An Interest Rate

An interest rate is the cost to borrow money. When you borrow money to buy a home or a car, you pay interest. When you lend money, you earn interest. If you have a savings account or certificate of deposit, youre lending money to a bank and theyre paying you a small return so youll have an incentive to put your money there.

Interest is usually expressed as an annual rate. Freddie Mac, which publishes a weekly Primary Mortgage Market survey, found in late August 2020 the U.S. average weekly mortgage rate was 2.91% on a 30-year fixed-rate mortgage.

You May Like: How To Get An Aer Loan

How Are Interest Rates Calculated

You may be wondering, how are mortgage rates determined? Your lender calculates your interest rate using your individual data. Every lender uses their own individual formula to determine how much youll pay in interest. Its possible to get 10 different interest rates from 10 different mortgage providers. Lenders also take into account things like current market interest rates and real estate economy conditions when they calculate your rate.

There are a few ways that you can get a lower interest rate from your mortgage lender. Anything that you do to lower the risk for your lender will in turn lower your rate. The first thing that you can do is raise your credit score. Your credit score is a three-digit number that tells lenders at a glance how you use credit. If you have a high credit score, you usually make payments on time and you dont borrow more money than you can afford to pay back.

Lenders see you as riskier if you have a low credit score. You may have a history of missed payments, so a lender may compensate for the risk that your score presents by offering you a higher interest rate.

Here are some ways to raise your credit score:

- Always make your minimum loan and credit card payments on time.

- Limit the amount of money that you put on credit cards.

- Pay down as much of your debt as you can.

- Avoid applying for new loans when youre preparing to get a mortgage.

What Do I Need To Know About Student Loan Interest Rates

The interest rate represents the amount your lender is charging you to borrow money. Its expressed as a percentage of your principal and doesnt reflect any fees or other charges that might be connected to your loan.

Since interest is spread out over the life of a loan, the number of years it takes you to pay the loan in full will affect how much total interest you pay. The total interest can be estimated, of course, but if it takes you longer to pay off the loan than you estimated, youll pay more interest.

Recommended Reading: Is Bayview Loan Servicing Legitimate

How To Find Your Apr

Your APR should be simple to find in fact, the Truth in Lending Act states that lenders must be transparent about the terms and cost of a loan. Your loan agreement should disclose the:

- Interest rate

- Fees

Before you take out a personal loan, read your loan agreement carefully to make sure the terms are favorable and youre able to repay what you borrow.

Summary Of Mortgage Rate And Apr

- The mortgage and the APR are both rates used by banks to calculate charges that apply to borrowing.

- Mortgage rate is the interest rate charged on a principal amount borrowed. The APR is a rate that comprises of the interest to be charged and additional fees such as credit card charges, settlement fees, closing fees and so much more.

- The mortgage rate and the APR differ in that the first is less than the later.

- The mortgage interest rate is paid monthly but the APR is a yearly rate.

- The APR changes when the individual refinances or dells, however the fixed mortgage rate remains constant during refinancing or selling.

Recommended Reading: How Does Paypal Business Loan Work

Understanding Apr On A Mortgage

A home loans annual percentage rate is also displayed as a percentage, but is higher than the accompanying interest rate. Thats because an APR not only takes your interest rate into account, but also factors in other costs, such as most closing costs and lender fees. The APR provides a more holistic view of your total mortgage cost on an annual basis.

That said: not all costs are represented in APRsuch as your lender-required credit report, appraisal, inspection fees, and/or other third-party fees. Youll want to find out whats included so you have the most accurate understanding of the cost of the loan and can compare apples to apples between different lenders.

Personal Loan Apr Vs Interest Rate: Whats The Difference

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It may not have been previewed, commissioned or otherwise endorsed by any of our network partners.

When shopping for a personal loan, youll likely want to seek the loan that costs the least amount of money to borrow. Two common factors in measuring loan cost are the interest rate and the annual percentage rate .

Interest rate is a percentage of a loan paid to the lender, while APR is a broader measure of the cost of a loan, including interest and origination fee. In other words, interest rate is just one factor in measuring APR. The lower your APR, the lower the overall cost of a loan will be.

-

Learn more about interest rates and APRs below:

- How to calculate APR on a loan

Don’t Miss: What Car Loan Can I Afford Calculator

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Learn How The Interest Rate And Apr Affect Your Home Loan

Tags:Mortgage,,Interest rate,Refinance,Loans

If youre new to the home loan process, you might be surprised to see two different rates on your mortgage agreement: your interest rate and your annual percentage rate . That duality is commonly misunderstood. Learn the difference between interest rate and APR and the strategy involved in choosing the right rate.

Visit usbank.com to find our current interest and APR rates.

Mortgage and Home Equity products are offered by U.S. Bank National Association. Loan products are offered by U.S. Bank National Association and subject to normal credit approval.

Investment and Insurance products and services including annuities are:Not a Deposit Not FDIC Insured May Lose Value Not Bank Guaranteed Not Insured by any Federal Government Agency

U.S. Wealth Management U.S. Bank and U.S. Bancorp Investments is the marketing logo for U.S. Bank and its affiliate U.S. Bancorp Investments.

U.S. Bank, U.S. Bancorp Investments and their representatives do not provide tax or legal advice. Your tax and financial situation is unique. You should consult your tax and/or legal advisor for advice and information concerning your particular situation.

For U.S. Bank: Equal Housing Lender.

U.S. Bank is not responsible for and does not guarantee the products, services or performance of U.S. Bancorp Investments, Inc.

U.S. Bancorp Investments Order Processing Information.

Also Check: How To Transfer Car Loan To Another Person

What Is Interest Rate

Your interest rate is the percentage you pay to borrow money from a lender for a specific period of time. Your mortgage interest rate might be fixed, which means it stays the same throughout the duration of your loan. Your mortgage interest rate might also be variable, which means it might change depending on market rates.

Youll always see your interest rate expressed as a percentage. Youre responsible for paying back both the initial amount you borrow plus any interest that accumulates on your loan.

Lets look at an example. Say you borrow $100,000 to buy a home, and your interest rate is 4%. This means that at the start of your loan, your mortgage builds 4% in interest every year. Thats $4,000 annually, or about $333.33 a month.

Your principal balance is high during the beginning of your loan, and youll pay more money toward interest as a result. However, as you chip away at your principal through monthly payments, you owe less in interest and pay a higher percentage of your payment to your principal. This process is called mortgage amortization.

How To Determine If Youre Getting A Good Rate

There are a lot of numbers involved with buying a new car, and your loans APR is just one of them. Getting a good APR, however, means that youre not giving up any more of your hard-earned cash than you need to.

But how do you determine if youre getting a good APR?

When youre comparing loan offers from two or more different lenders, pay special attention that youre comparing apples-to-apples APR to APR, not APR to interest rate. Auto loans arent as regulated as mortgages and some other types of loans, so you may have to do some digging through paperwork to find the APR of a given loan.

Make sure, too, that youre comparing APRs based on the same loan term. The APR of a 36-month loan, for instance, is going to be less than that of a 48-month term. If, however, a 36-month term is out of your budget, it doesnt matter what that offers APR is.

Don’t Miss: Amortization Schedule For Auto Loan

What Is An Apr

APR is broader and typically a bit higher because it is the annual cost of the loan to the borrower including fees and one-time costs like mortgage insurance, closing costs, loan origination fees, broker fees, etc., says Michael Foguth, founder of Foguth Financial Group, a financial planning agency in Michigan. The APR is required by law to be disclosed on the loan agreement. Your monthly payment, however, is based on the interest rate on your loan.

Keep in mind, though, that the APR may not include every fee, such as appraisal, inspection and credit reporting fees. When comparison shopping, its always a good idea to ask your lender what is and what is not included in the APR they quote so you have an accurate picture of all the costs of buying a home.

Summary Apr Vs Note Rate

The difference between APR and Note Rate is dependent on which costs are taken into consideration in its calculation. Due to the inclusion of total cost, use of APR is more beneficial than Note Rate. It also allows effective comparison of rates than the Note Rate. On the other hand, Note Rate is the usual rate used to demonstrate the annual interest on borrowings by many financial institutions.

References

Image Courtesy

Read Also: Becu Auto Loan Payoff

Learn More About Home Loans

We think it’s important for you to understand how we make money. It’s pretty simple, actually. The offers for financial products you see on our platform come from companies who pay us. The money we make helps us give you access to free credit scores and reports and helps us create our other great tools and educational materials.

Compensation may factor into how and where products appear on our platform . But since we generally make money when you find an offer you like and get, we try to show you offers we think are a good match for you. That’s why we provide features like your Approval Odds and savings estimates.

Of course, the offers on our platform don’t represent all financial products out there, but our goal is to show you as many great options as we can.

Difference Between Rate And Apr

December 28, 2010 Posted by Andrew

Rate vs APR

Loans are part of our everyday life we all take loans for our houses, cars and business. It is important to know the difference between Rate and Annual Percentage Rate or APR, because they play a very important role in deciding terms and conditions of your loan. Rate and APR determine your monthly payments, which you have to pay to lender, against the loan you have taken.

Rate

Rate is the fee, which you pay to borrow money. We all take loans, sometime to buy homes, sometime for cars, or even when we shop through credit cards we are borrowing money from our bank. The fee which bank or other lender will be charging from us, for lending us his money, is rate. Actually, it is interest rate or mortgage rate, but generally called as rate. It is the charges, which we pay for our convenience, as we can buy a new car by taking a loan, which we might not afford otherwise. Rate is usually a round figure like 4% or 5%, for instance, if you have taken a loan of $ 100,000 and your rate is 5%, you have to pay $ 5,000. It is just the interest rate on the amount of your loan nothing else is included.

Differences and Similarities between Rate and APR

You May Like: How To Get An Aer Loan

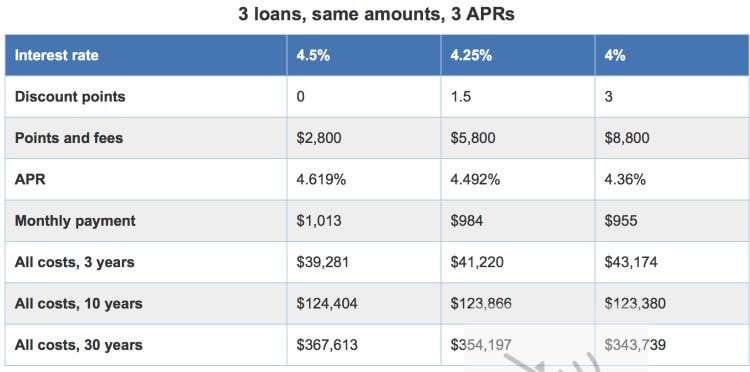

The Total Cost Of A Loan Rates Points And Fees

Mortgage lending transactions contain two terms to explain the difference between interest APR. The amount financed and the loan amount. In fact, the actual amount borrowed before costs and fees equals the amount financed. The loan amount is what you actually owe after including costs and fees financed in the loan. The amount financed is the amount of money you actually get and the loan is the amount you actually owe.

Defining The Interest Rate

Your VA home loan interest rate is what your loan costs over the lifetime of the mortgage. You will be offered an interest rate, which you can multiply by the amount of the loan multiplied by the percentage of the interest. The amount you get is the interest you would pay on that loan for the year.

A $200,000 loan charged four percent interest would cost $8,000 per year. You can divide $8,000 by 12 to see how much the loan costs per month. You can multiply $8,000 by the term of the VA mortgage to see how much you will pay in interest over the entire term.

When you shop around for a VA mortgage, you will find each lender lists an interest rate for that days mortgage loans. The rates are subject to change, and can change daily, or even more often depending on market conditions.

But you should keep in mind that the advertised interest rate is not necessarily the rate you will be offered by the lender. This is because the advertised rate assumes best execution, or a home loan application from an extremely well-qualified borrower . Your experience WILL vary depending on your credit and other issues.

That is why some borrowers are disappointed in times when rates are lowthey assume rates are lower for EVERYONE, and that isnt always true for those coming to the VA loan process with past that show credit management patterns the lender might decide are a bad risk.

Don’t Miss: How To Transfer Car Loan To Another Person

What Additional Fees/charges Might Be Included In Student Loan Apr

For student loans, the most common fee is the loan origination feean upfront fee most lenders charge for processing your loan application. Another fee that might be charged is an application fee, which is generally non-refundable even if you dont end up taking out the loan. Fees related to non-payment are late fees and returned check fees, both of which add to the total amount of your loan, accrue interest, and increase the amount you must repay.

Fees can vary widely from one lender to the next, and some lenders, including SoFi, may not charge any fees.

Another factor included in the APR is the time the loan might be in deferment or forbearance , when payments are on hold but interest is still accruing.

When payments resume, that accrued interest is capitalized , which means the amount spent on interest increases, so your APR increases, too.

Since its unknown if and when you might put your loan in forbearance, a new loans APR wont typically reflect this cost, but it will likely affect your APR on the back end.