You Can Make An Offer That Sellers Take Seriously

Preapproval lets you know the price range of homes the lender may approve. You can look for houses in neighborhoods and home styles that suit that range, knowing that approval is likely.

Finally, preapproval gives you a competitive edge over other buyers.

If more than one person bids on the home you want, the seller is very likely to choose folks who have been preapproved. Sellers are picky in this market and will simply toss out offers without strong financing attached.

Refinancing An Existing Fha Loan

Suppose someone uses an FHA loan to finance the purchase of a primary residence. The owner may move out of the home down the road, but they continue to own it and rent it out for income. In other words, the house becomes an investment property. Suppose also that interest rates drop, and the owner wants to refinance for a better deal.

Even though he no longer lives in the house, FHA rules allow him to refinance into another FHA loan. An FHA-to-FHA refinance is also known as an FHA streamline refinance.

There are several requirements to qualify for refinancing:

- A minimum of 210 days must have passed since you closed your original home loan.

- You must have made at least six monthly payments on your FHA-issued mortgage.

- If you have only had your FHA loan for less than a year, you cannot have any payments overdue by more than 30 days. If you held your FHA loan for more than a year, you are allowed a single 30-day late payment within 12 months, but that late payment cannot have been within the last 90 days.

- The refinance must lower your monthly principal and interest payments, which is often described as a net tangible benefit. For example, if your previous monthly payment was $1,100, your new monthly payment after the refinance should be $1,050 or lower. Refinancing into a mortgage with a shorter term also qualifies a net tangible benefit.

How Many Times Can I Use An Fha Loan

FHA loans are intended to provide assistance to low and moderate income wage earners helping them to take part in the joy and benefit of homeownership. The program is generally for a borrower to have one FHA loan at a time. However, there is no limit to the number of times a borrower can obtain an FHA loan.

You May Like: What Credit Score Is Needed For Usaa Auto Loan

How Can I Know If An Fha Loan Is Right For Me

FHA loans are designed for moderate- and low-income borrowers. It may be the right choice if you:

- Have a great score of 580 or higher

- Can afford a monthly mortgage payment but dont have a large down payment saved

- Are willing to buy a home within the FHAs loan limits

There are no income or geographic restrictions on FHA loans. They can be a great choice if you have only a low down payment available or have a spotty credit history that has affected your credit score.

What Are Fha Loan Requirements In Nc And Sc

FHA loans in Charlotte, NC or other areas in the Carolinas are available to buyers as long as they meet FHA loan requirements. North and South Carolina FHA loan requirements include:

- A credit score of at least 580. However, if your score is between 500 and 579, you may still be eligible for an FHA loan if you make a down payment of at least 10% of the homes purchase price.

- Borrowing no more than 96.5% of the homes value through the loan, meaning you need to have at least 3.5 percent of the sale price of the home as a down payment.

- Choosing a home loan with a 15-year or 30-year term.

- Purchasing mortgage insurance, paying 1.75% upfront and 0.45% to 1.05% annually in premiums. This can be rolled into the loan rather than paying out of pocket.

- A debt-to-income ratio less than 57% in some circumstances.

- A housing ratio of 31% or less.

FHA lenders in NC and SC will provide you with all the information you need and can help determine if you qualify for an FHA loan.

Income Requirements for FHA Loans

Theres a common misconception that FHA loan requirements include income restrictions. While FHA income guidelines can be confusing, FHA loans are available to those who have any type of income. There are no minimum or maximum income requirements.

You May Like: Usaa Car Loans Credit Score

Trusted Fha Loan Officers

Assurance Financial has FHA-approved loan officers, but we also have much more. We pride ourselves on being The People People. We dont just focus on numbers our experts get to know you and help you find the right home loan for your situation. We always answer your questions and stay responsive.

Assurance Financial also uses the most current application technology to allow you to apply online or with a real persona quickly and easily. Abby, your virtual assistant, can walk you through the application process online so you can get your free quote. You dont even have to fax over your paperwork since Abby can guide you to log into your bank account and payroll information to confirm your financial details.

Downsizing On Home Purchase With Social Security Income

A large percentage of Americans decide to downsize to a smaller home when they retire or when their children leave the home and are on their own.

- Many times they choose a smaller home but more expensive home because it might be waterfront or golf course frontage

- Even though borrower might have a substantial down payment and a lot of assets, they might run into problems in obtaining a mortgage loan if they retire and qualify with only their social security income

There are options and creative ways of obtaining a mortgage for those planning on retiring.

You May Like: Va Home Loan For Mobile Home

Fha Loans And Credit Score

There are a lot of factors that determine your , including:

- The type of credit you have

- Whether you pay your bills on time

- The amount you owe on your credit cards

- How much new and recent credit youve taken on

If you have a higher score, you might be able to qualify with a higher debt-to-income ratio, or DTI. DTI refers to the percentage of your monthly gross income that goes toward paying debts. Your DTI is your total monthly debt payments divided by your monthly gross income . This figure is expressed as a percentage.

To determine your own DTI ratio, divide your debts by your monthly gross income. For example, if your debts, which include your student loans and car loan, reach $2,000 per month and your income is $8,000 per month, your DTI is 25%.

The lower your DTI, the better off youll be. If you do happen to have a higher DTI, you could still qualify for an FHA loan if you have a higher credit score.

The FHA states that your monthly mortgage payment should be no more than 31% of your monthly gross income and that your DTI should not exceed 43% of monthly gross income in certain circumstances if your loan is being manually underwritten. As noted above, if you have a higher credit score, you may be able to qualify with a higher DTI.

How To Apply For An Fha Loan

Application for an FHA loan requires some financial and personal documents including:

- Proof of being a permanent resident

- Proof of being eligible to work in the U.S.

- Your Social Security Number.

| 3.5 |

If you are not sure which lender is a good fit for your needs, then , answer a few questions and find which lender can be most suitable for your needs.

Read Also: What Credit Score Is Needed For Usaa Auto Loan

Who Qualifies For An Fha Loan

Qualifying for an FHA loan is often easier than qualifying for a conventional loan because the credit requirements aren’t as strict. You need a FICO credit score of at least 580 to qualify for a 3.5% down payment. If your score is between 500 and 579, you can still qualify for an FHA loan with a 10% down payment from some lenders.

FHA loan qualifications are relatively straightforward, but lenders can impose their own minimums on credit scores. Borrowers pay private mortgage insurance every month, which usually has an annual cost of around 0.85% of the loan amount. The PMI is rolled into your monthly payment and protects the lender if the borrower defaults on the loan.

Once you have paid off enough of the loan that you owe 80% or less of the home’s value, you can refinance your FHA mortgage to a conventional mortgage and get rid of your PMI payment. For more information, read about how an FHA loan works.

You need a FICO credit score of at least 580 to qualify for a 3.5% down payment. If your score is between 500 and 579, you can still qualify for an FHA loan with a 10% down payment from some lenders.

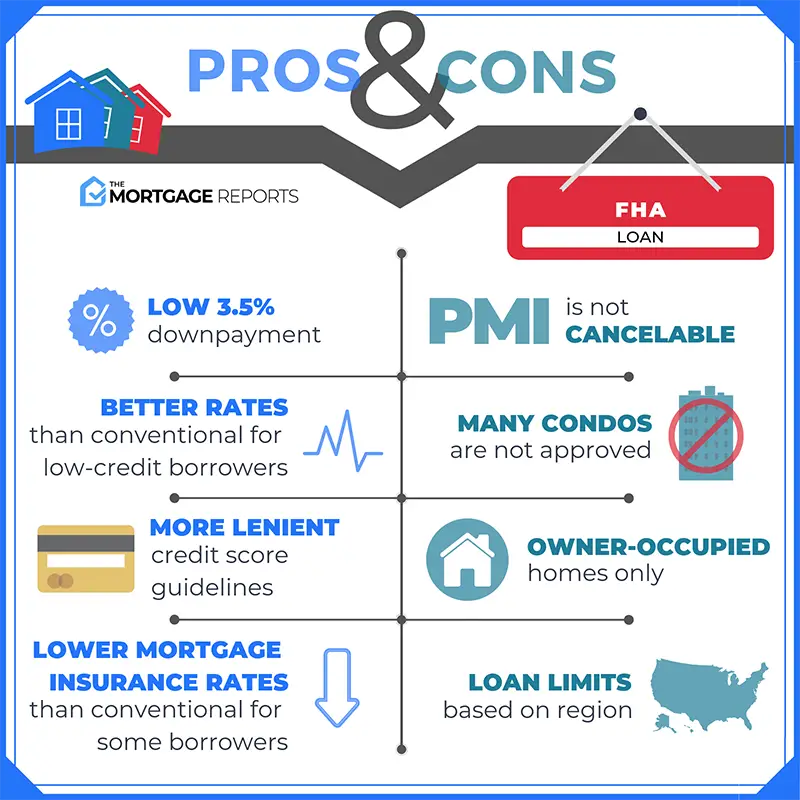

Downsides Of Fha Loans

- Mortgage insurance can be costly. You may pay a price for making a small down payment. Youll have to pay a one-time upfront mortgage insurance premium, as well as an annual premium thats collected in monthly installments. The one-time premium is generally equal to 1.75% of the home purchase price and can be financed in the mortgage or paid for in cash but not a combination. The annual premium depends on your loan amount and loan-to-value ratio.

- Theres a limit to how much you can borrow. The FHA establishes loan limits based on median home prices in metro areas and counties. As of July 2020, the FHA maximum for a single-family home in a low-cost area is $331,760 while its $765,600 in a high-cost area. Alaska, Hawaii, Guam and the Virgin Islands are exceptions with a maximum of $1,148,400 for a single-family unit. These loan limits change periodically, so be sure to check for updated information. The Department of Housing and Urban Development has a search tool on its website to identify mortgage limits by county and state, so you can find out how much youre able to borrow where you live.

- Good credit? Consider other options. If you have strong credit and dont have enough money for a large down payment, you still might want to consider other options because of FHA loans mortgage premiums. Just keep in mind that if you dont put at least 20% down, youll likely have to pay private mortgage insurance, or PMI.

Don’t Miss: What Percentage Does A Loan Officer Make

What Is A Federal Housing Administration Loan Loan

A Federal Housing Administration loan is a mortgage that is insured by the Federal Housing Administration and issued by an FHA-approved lender. FHA loans are designed for low-to-moderate-income borrowers they require a lower minimum down payment and lower credit scores than many conventional loans.

In 2020, you can borrow up to 96.5% of the value of a home with an FHA loan. This means you’ll need to make a down payment of 3.5%. You’ll need a credit score of at least 580 to qualify. If your credit score falls between 500 and 579, you can still get an FHA loan as long as you can make a 10% down payment. With FHA loans, your down payment can come from savings, a financial gift from a family member, or a grant for down-payment assistance.

Because of their many benefits, FHA loans are popular with first-time homebuyers.

Why Is My Credit Score Important

Your is not only important for qualifying for a mortgage, but its also the key to getting a lower interest rate. The better your credit score, the lower your interest rate will be, which can save you quite a lot of money.

Consider that a borrower with a $300,000, 30-year mortgage with a 3% interest rate will pay $29,635.90 less over the life of the loan than a borrower who has a 3.5% rate. On a monthly basis that equals $82 in savings.

Don’t Miss: What Credit Score Is Needed For Usaa Auto Loan

How Many Times In My Life Can I Get An Fha Loan

How many times in my life can I get an FHA loan? If you are buying your first home, this is a question you might not ask until later. But its a good idea to know what your options are should you need to sell your first home later and begin a new house hunt.

Understanding FHA Loans

Knowing that FHA home loans are intended for owner-occupiers who want to use their property as their home address and primary residence helps a lot when trying to understand FHA loan rules. If you dont plan to use the property you want to buy as your home, you wont be able to use an FHA single-family home loan to purchase it.

There are certain exceptions for government agencies and non-profit groups, but a typical buyer should be aware that the occupancy rules will definitely apply for their FHA mortgages.

FHA Loan Rules: First Time Buyers Only?

FHA loans are not strictly intended for first-time home buyers. That means that you can buy a home using an FHA loan if you are financially qualified, even if you have purchased a home or land before. It also means that you can have other investment property in your name and still qualify for an FHA mortgage, as long as you intend to use the property you buy with the FHA loan as your home.

How Many FHA Loans Can I Have At The Same Time?

Those circumstances include job relocations, changes in family size, and situations where a co-borrower vacates the property with an existing FHA mortgage loan to purchase a home of their own.

Fha Vs Conventional Loans

Unlike FHA loans, conventional loans are not insured by the government. Qualifying for a conventional mortgage requires a higher credit score, solid income and a down payment of at least 3 percent for certain loan programs. Heres a side-by-side comparison of the two types of loans.

FHA loans vs. conventional mortgages| Conventional loan |

|---|

Recommended Reading: How Much Do Loan Officers Make Per Loan

Contact Multiple Lenders Now

Consumers typically dont think twice about shopping around for cars, or even basic household items. Dont be afraid to apply this same logic when it comes to shopping for a mortgage loan.

Applying for more than one mortgage at once allows you to compare costs, rates, program options and even test-drive lenders prior to committing to just one lender.

At the link below, get connected with multiple loan experts and start the shopping process today.

Popular Articles

Resources

What Are The Fha Mortgage Qualification Requirements

The FHA program is designed for low and middle-income Americans, but you dont have to be eating ramen noodles five nights a week to qualify. There are no minimum or maximum salary requirements.

You must, however, have at least two established credit accounts like a car loan or credit cards. And you cant have any outstanding debts to the federal government.

Applicants also must have a FICO credit score of at least 580 if they want to qualify for the lowest down payment, which hovers around 3.5%. The average FICO score for a first-time homebuyer using an FHA loan was 668, in 2019. For repeat buyers it was 673.

You are not out of luck if your score is less than 580. It just means youll have to put down a 10% down payment if you want a loan.

If your FICO score is below 500, you probably are out of luck and need to enroll in a debt management program before attempting to buy a cheeseburger, much less a house.

FHA loans also have a debt-to-income requirement. That is determined by taking your monthly bills and dividing that by your gross monthly income.

For instance, if your monthly bills are $2,000 and your monthly pay is $5,000, your DTI is 40% . To qualify for an FHA loan, your DTI cannot be above 50%.

Recommended Reading: Refinancing Auto Loan With Same Lender

What Is The Difference Between An Fha Loan And A Conventional Mortgage

- With an FHA insured loan it is possible to finance a purchase of up to 97.5% of the sales price.

- The FICO score requirement is lower for an FHA loan. Usually a conventional loan will require a 620 FICO score. FHA will allow you to have a FICO score as low as 500 but a larger down payment is required. Most lenders that we work with will allow a 3.5% downpayment with a score of 580 or higher.

- You can be two years out of bankruptcy or 3 years from a previous foreclosure.

- The down payment can come as a gift and the closing costs can be paid for by the seller or lender.

- You can use a cosigner to help you qualify.

- The loan can be assumed by a new buyer if you decide to sell your home at a later date.

- Some FHA loans allow you to borrow more than the purchase price to pay for repairs.

Many conventional lenders require at least a 680 700 FICO score if you want less than a 25% down payment. Most conventional loans now typically require anywhere from 10 to 30 percent down. Typically, conventional loans involve much stricter qualifying standards. Waiting times for bankruptcies and foreclosure are usually much longer with conventional loans.

The source of the down payment will usually be required to come from the borrowers own funds and usually the borrower must also have the funds to pay the closing costs. Often the borrower must have up to 6 months PITI in cash reserves after the close of escrow.