Va Mortgage Loan Options

Purchase loan:

If you are a conventional home buyer, you will most likely be looking to secure VA-backed purchase loans. This loan will help you buy, build, or improve a home with a competitive interest rate and the option to put no money down without restriction.

Interest Rate Reduction Refinance Loan :

If you already have a VA home loan and would like to reduce your monthly mortgage payment or interest, an Interest Rate Reduction Refinance Loan could be the right choice for you.

Cash-out refinance loan:

A VA-backed cash-out refinance loan can help you take cash out of your home equity. This loan will replace your current loan with a new VA loan under different terms. You can also use a VA cash-out refinance to refinance a non-VA loan into a VA-backed loan.

We would also like to mention that the VA offers a Native American Direct Loan . If you are veteran, and either you or your spouse is Native American, you may qualify for this loan. Because the VA directly backs this loan, you do not need to contact a private lender the U.S. Department of Veterans Affairs will serve as your lender.

How To Buy A House That Costs More Than The Maximum Va Loan Guarantee

If you do not have your full entitlement and want to use the VA loan to buy a house that costs more than $144,000, you may need to put make a down payment on the loan. The amount of the down payment will depend on your lenders policies, the cost of your home, the amount you are borrowing, your income, credit profile, debt-to-income ratio and other factors.

If you want to buy a home that costs more than the loan guarantee, you need to make a down payment, usually 25% of the amount above the VA loan limit.

For example, if you want to buy a home that costs $747,200 in a county with a loan limit of $647,200, you would likely need to make a $25,000 down payment .

Larger down payment may be a good idea: You can always make a larger down payment if you have the available funds, and there are some benefits to doing so. For example, a larger down payment reduces your outstanding balance on your home, reduces your monthly payments and reduces the amount of interest you pay over the life of the loan.

Additional loan costs to consider: You still may need to come up with the VA loan funding fee, which the VA charges for guaranteeing your loan. However, the funding fee may be waived for some disabled veterans. Alternatively, you can often roll the funding fee into your loan.

Why Two Va Loans

My original VA loan was for a home near Shaw AFB. That property is financed with a low rate , 15 year mortgage. The rental income almost covers the payment each month, but the loan is paying off fast! I did not want to sell the home but rather wanted to keep paying it off for a while to gain equity.

We did not plan on buying a home when we moved to Robins AFB, but after looking for several months we changed our mind. Rent is fairly high in Warner Robins and many nice, affordable homes were for sale that kept us well under BAH.

We had enough money for a small down payment on a house, but not the 20% that is typically required to avoid Private Mortgage Insurance , which can add over $100 per month to your mortgage. I was also unsure if we would qualify for an almost 100% financed home without VA.

Read Also: Usaa New Car Loan

Va Loan Calculator Estimate Your Monthly Mortgage Payment And Va Funding Fee

About Ryan Guina

Ryan Guina is The Military Wallet’s founder. He is a writer, small business owner, and entrepreneur. He served over six years on active duty in the USAF and is a current member of the Illinois Air National Guard.

Ryan started The Military Wallet in 2007 after separating from active duty military service and has been writing about financial, small business, and military benefits topics since then. He also writes about personal finance and investing at Cash Money Life.

Ryan uses Personal Capital to track and manage his finances. Personal Capital is a free software program that allows him to track his net worth, balance his investment portfolio, track his income and expenses, and much more. You can open a free Personal Capital account here.

Featured In: Ryan’s writing has been featured in the following publications: Forbes, Military.com, US News & World Report, Yahoo Finance, Reserve & National Guard Magazine , Military Influencer Magazine, Cash Money Life, The Military Guide, USAA, Go Banking Rates, and many other publications.

How Do Interest Rates Impact Affordability

Interest rates have a direct impact on VA loan affordability. Mortgage rates reflect the cost of borrowing money, and they can vary depending on the lender, the borrowers credit profile and more.

VA borrowers benefit from having the industrys lowest average interest rates.

More:See today’s VA loan interest rates

Recommended Reading: Usaa Prequalify Auto Loan

Can I Take Out More Than Two Va Loans

Man you are greedy! Just kidding. From what I have read, technically you could take out as many loans as you want as long as you do not go over your VA eligibility.

So for most areas your entitlement is $417,000. You could purchase four homes at $100,000 each, all financed on VA loans. The catch is that you have to live in every one of those homes to get the initial loan. So that would have to be four separate assignments where you purchased homes at each.

First Citizens Auto Loan

1. Free Auto Loan Payment Calculator | First Citizens Bank Learn the payments you should expect to make with our auto loan payment calculator. Heres an easy way to calculate your monthly vehicle payment. Finance your new ride with an auto loan. Get access to competitive fixed rates, flexible terms

Don’t Miss: Usaa Pre Qualify

Basics Of The Calculator Inputs

Several factors could affect the monthly payments as shown on a VA calculator.

10 Best VA Home Loans 2022

Compare 2022’s Best VA Home Loans. Federally Insured. 0% Down. Active Duty, Vet & Family. Tap to Compare Rates. No Money Down.

Comparing is quick, easy, and free!

Here are a few basics to consider while calculating your monthly payments.

- Although it is not mandatory, making a downpayment reduces what you owe monthly.

- Monthly payments differ for different loan types. Choosing to refinance an existing loan into a VA loan can cost more than borrowing a VA purchase loan.

- Selecting an extended loan term will decrease your monthly payments but raise your interest rates.

- Depending on the benefits available to other service types, a veterans loan may differ from a reservists loan.

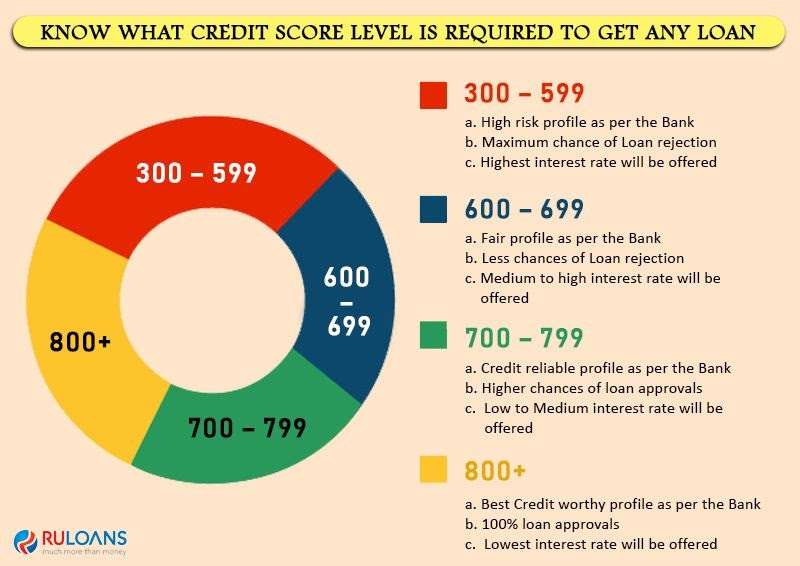

- VA loan interest rates depend on factors like your credit score, bank statement, credit history, and market conditions like current mortgage rates, inflation, demographics, and demand supply.

- Unlike a conventional loan, you are not required to pay either the downpayment or Private Mortgage Insurance .

Why You Would Use A Va Loan If Your Home Costs More Than The Va Will Guarantee

There are several good reasons to apply for a VA loan. The first is that you may be able to buy a home with a lower down payment than you would with a conventional mortgage, unless you are willing to pay for private mortgage insurance , which may add a fairly substantial amount to your monthly payment.

Interest rates are another important factor in your decision. Because VA loans are guaranteed by the VA, they often have slightly lower interest rates than conventional loans .

That said, it pays to shop around. A mortgage is often the largest purchase you will ever make, and even a few decimal points on your interest rate can save you a substantial amount of money, or cost you thousands, over the life of your loan.

Read Also: Capital One/auto Pre Approval

How Much Can You Qualify For With A Va Loan

When you’re considering buying a home and using your VA home loan benefit, one of the first questions you want answered is “How much can I qualify for?” VA loans are guaranteed, meaning any loan that the VA lender approves, has a government-backed guarantee of 25% of the loan amount. As long as the lender followed established VA lending guidelines, the guarantee is in place. The VA doesn’t approve the loan but establishes specific rules that lenders must follow in order to receive the VA guarantee. One of those rules limits how much you can borrow based upon a formula called the debt to income ratio, or simply “debt ratio.”

How To Apply For A Va Loan The Process

Remember, not all lenders are equal., VA mortgages can only be issued by Lenders who have been approved by the Department of Veterans Affairs in the United States. Second, although some Lenders focus almost solely on the VA loan program for military clients, others specialize in traditional loans. Using a VA specialized Lender who is familiar with the VA loan process rather than a Lender who only funds a few VA mortgages each year, may result in a smoother and speedier loan process.

A knowledgeable lender can assist you in obtaining a Certificate of Eligibility . The COE will show that you meet the VAs first qualifying requirements. It will also inform the Lender of your entitlement, or the amount that the Department of Veterans Affairs will guarantee on your VA loan. To acquire your COE, youll need to provide some information about your military service to your Lender. A COE can usually be obtained promptly online using a Lenders portal or the VA.gov websites eBenefits portal. Those servicemembers or surviving spouses who cant access their COEs online, will have to wait for them to arrive in the mail. A VA Lender or the VA can assist you in finding the best resource for your case.

Read Also: Auto Loan With 650 Credit Score

How Many Times Can I Take Out A Va Loan

You can take out a VA loan a seemingly limitless amount of times. However, the VA funding feefee the VA charges to guarantee the loancan be higher after the first home loan, depending on your down payment amount.

For instance, if you put down less than 5% of your loan amount, youd pay 2.3% on the first use versus 3.6% for the second time and beyond. However, if you put down 5% or more of the loan amount, youll pay the same VA funding fee no matter whether its your first or seventh loan.

You may be exempt from paying the VA funding fee, though, if one of the following applies:

- Youre eligible to or are receiving compensation for a service-connected disability.

- Youre a surviving spouse of a veteran who died while serving, or from a service-connected disability or was totally disabled. You must receive Dependency and Indemnity Compensation to qualify.

- Youre a service member with an in-process or memorandum rating of eligibility for compensation because of a pre-discharge claim before the date the loan closes.

Also, you can apply for a refund of the VA funding fee if youre awarded VA compensation for a service-connected disability after the closing date if awarded retroactively.

Also Check: Drb Student Loan Review

How To Use Nerdwallet’s Va Mortgage Calculator

Enter the price you expect to pay for a home and your down payment. VA loans typically don’t require a down payment, but paying a chunk of money upfront will lower your monthly mortgage payment and make you a more competitive buyer in a hot real estate market.

Enter an estimated interest rate. Unsure? Check current VA mortgage rates to see what lenders are offering.

Choose a loan term of 15 or 30 years. You’ll pay less interest over the life of the loan with a 15-year term. Your monthly payment will be lower with a 30-year term because the repayment of the loan is stretched over a longer period.

Select whether this is your first VA mortgage. Your answer will affect the amount of your VA funding fee, a one-time charge most borrowers must pay.

Check the results. The “total monthly cost” estimates your monthly VA mortgage payment, including estimated costs for property taxes and home insurance. The “total cost” is how much you’ll pay over the life of the loan, including the VA funding fee.

For more detail, select the “Monthly” or “Total” box under “Breakdown of costs.” Some VA borrowers roll their funding fee into the total loan amount. If thats your plan, take the funding fee amount, found under the “Total cost breakdown,” and add it to the amount you expect to spend on a home under “Mortgage details.” That will adjust your monthly payment to include the financed VA funding fee.

» MORE: See how much house you can afford

Don’t Miss: Does Interest Accrue While In School

How Many Va Home Loans Can You Have

There is no limit to how many VA loans you can have simultaneously, but they must be used for primary residences and have strict occupancy criteria. It is feasible to have two VA loans for multiple residencies at the same time.

Lets imagine you purchase a property in your current duty station and, years later, receive PCS orders. As an alternative to selling the house, you could rent it and use your remaining VA loan eligibility to buy a new property at your new duty station.

See all of the different VA loan types you can choose from!

Use This Va Mortgage Calculator To Get An Estimate

This VA loan calculator provides customized information based on the information you provide. But, it assumes a few things about you. For example, that you’re buying a single-family home as your primary residence. This calculator also makes assumptions about closing costs, lenders fees and other costs, which can be significant.

Estimated monthly payment and APR example: A $225,000 base loan amount with a 30-year term at an interest rate of 4.125% with no down-payment would result in an estimated monthly payment of $1,126.45 with an Annual Percentage Rate of 4.471%.1

Don’t Miss: Usaa Bad Credit Auto Loans

Whats My Va Loan Limit

That depends. VA loan limits vary by county. In fact, within a single state the limit could differ by as much as $500,000 between counties. Limits are higher in wealthier counties where the cost of living is higher. In most places around the country, the current limit is $424,100. That applies to loans closed on or after January 1, 2017. But limits can top a million dollars in the most expensive counties.

When Do Va Loan Limits Apply

An applicant with partial or no entitlement is subject to VA loan limits.

What Is Entitlement?

The VA offers entitlement to eligible veterans, service members, and survivors. If the borrower fails to repay the loan on time, the department will pay the lender up to a certain percentage of the loan amount.

This specific amount is called VA loan entitlement. It equals the lesser of 25% of the loan amount or $36,000.

This means that the VA will either pay 25% of the loan amount or $36,000 to the lenders if the borrower defaults in any way.

You might have full entitlement if you have never used VA loan benefits before or have repaid your previous loan in full.

According to the amendments made in 2020, VA loan limits are no longer applicable to a person with full entitlement. Consequently, there is no cap on how much a person with full entitlement can borrow, even without making a downpayment.

You can check your remaining entitlement on a VA mortgage calculator or VA COE.

Recommended Reading: Specialized Loan Servicing Settlement

Who Is Eligible For A Va Loan

You may be eligible for a VA loan by meeting one or more of the following requirements:

- You served 90 consecutive days of active service during wartime.

- You served 181 days of active service during peacetime.

- You have 6 years of service in the National Guard or Reserves.

- You are the spouse of a service member who has died in the line of duty or as a result of a service-related disability.

If you think you meet this eligibility requirements, you can access your Certificate of Eligibility from VA.gov

A COE certifies to a lender that you are eligible for a VA home loan.

Any veteran who served on active duty during wartime or peacetime is eligible to apply for a VA loan. There are also specific requirements for reservists and members of the National Guard. As a veteran, you may need to provide a DD214 form that shows the character of your discharge and the dates of your service.

You may also need to provide other documentation, such as proof of residency, financial statements, and credit reports. The best way to determine your eligibility is to speak with a VA loan specialist. They will be able to review your situation and advise you on the steps you need to take to apply for a VA loan.

Can I Get A Coe In Any Other Situations

You may be able to get a COE if you meet at least one of the requirements listed below.

At least one of these must be true. You:

- Are a U.S. citizen who served in the Armed Forces of a government allied with the United States in World War II, or

- Served as a member in certain organizations, like a:

- Public Health Service officer

- Cadet at the United States Military, Air Force, or Coast Guard Academy

- Midshipman at the United States Naval Academy

- Officer of the National Oceanic & Atmospheric Administration

- Merchant seaman during World War II

Don’t Miss: Va Handbook Manufactured Homes