How To Apply For A First Responders Loans

At First Integrity Mortgage Services, we understand the common issues that homebuyers face: Competitive housing markets, confusing financial lingo, uncertainty of qualifications, and just too many options. This can leave folks feeling overwhelmed and discouraged. Thankfully, our incredible team of experienced mortgage professionals will help you navigate the home financing process, answer questions, and empower you with the tools you need to have the home of your dreams.

To apply or to learn more about our BackStoppers loans, contact us at 314-878-7900 or apply online today.

Adjustable Rate Home Loans

Compared to a fixed rate loan, these loans have lower initial interest rates, which mean lower monthly payments. Even after the initial rate hold period, rates cannot adjust more than 1% annually or 5% over the life of your loan. They also feature:

- A 5 or 7-year initial rate hold4

- Rate adjusts annually after the initial rate hold

- Rate caps to provide added security

- Low or no-points options

- Pre-qualification with no obligation

- Financing up to 99% loan to value1

How To Buy Your First House

Buying a home can be complicated, even under the best circumstances. It’s crucial to start researching your options as soon as you think you may be ready for a mortgage. If you aren’t sure where you start, reach out to one of our mortgage specialists. They can help you understand how much money you can spend and how your various options affect your monthly house payment amount.

Read Also: How To Calculate Loan Payments In Excel

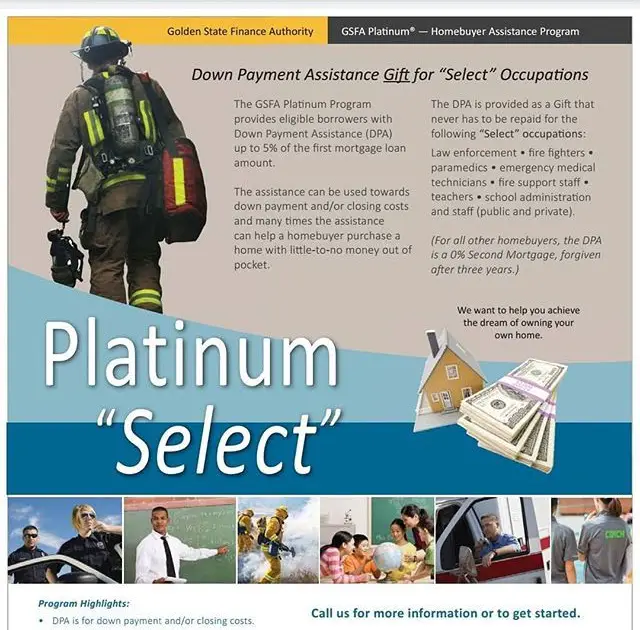

First Responder Mortgage Programs And Discounts

There are many government, state, and local homeownership benefits available for first responders to consider. But before you start taking a closer look at possible home financing options, it’s critical to know whether you’re eligible to verify as a first responder. ID.me defines such an individual “as an active or retired employee of an emergency service who is likely to be among the first people to physically arrive at the scene of an emergency.”

You may qualify for a first responder mortgage if your occupation is a law enforcement officer, firefighter, emergency medical technician , or 911 dispatcher. However, occupational titles such as registered nurses, doctors, or other medical professionals aren’t considered first responders. Check out the ID.me website for information about verifying as a first responder.

Please note that state and local first responder mortgage programs can vary by location. So be sure to review your state and local municipality websites to fully understand your options.

Local Firefighter Mortgage Programs

Many states, counties, and cities run special homeownership programs for firefighters, law enforcement officers, EMS, teachers, and other public employees.

These may offer preferential mortgage rates and assistance with down payment and closing costs. Some are limited to first-time homebuyers or career firefighters, but not all of them.

Simply do a web search for firefighter mortgage programs in your city, ZIP code, county, or state to see whats available.

You May Like: When Should You Refinance Your Car Loan

Buying A Home With The Fha Gnnd Program

The process begins with identifying whether or not the borrower is eligible for the Good Neighbor Next Door program based on their employment. If they work in one of the eligible positions , then they can access the GNND Sales program through HUD and view current available listings.

These home listings will be offered at 50% off the list price seven days from the date they joined the program. After the seven day period, the homes will be marketed to the general public for sale at the full list price.

Because the homes are only offered at a discount for a very short period of time, borrowers will need to move quickly if they want to take advantage of the significant savings. For this reason, its important to stress the need to get pre-approved for FHA financing before they begin their home search.

Once the borrower finds a home through the GNND Sales program, they will need to follow through with securing their FHA financing through an approved lender.

Good Neighbor Next Door Program

The US Department of Housing and Urban Development offers an incentive called the Good Neighbor Next Door Sales Program, which provides a 50% discount on the list price of a home in revitalization areas. This incentive is available to law enforcement officers, firefighters, and emergency medical technicians who meet certain requirements. To qualify, the recipient must be employed full-time as a firefighter, EMT, or police officer and serve in the same locality as the house they are looking to purchase.

Don’t Miss: Are Fha Loan Rates Higher Than Conventional

First Responder Mortgage Programs And Down Payment Assistance

Buying a home is expensive, especially in New York City. However, buyers may not be aware that they can get help with upfront costs. Are you a first responder looking to buy a home? There are loan and down payment programs designed with you in mind. Check out these first responder mortgage programs and make your dream of becoming a homeowner a reality.

Unsecured Vs Secured Personal Loans

When applying for a personal loan, inquire as to whether the loan is secured or unsecured.

Unsecured loans dont require collateral.

These are convenient, but they typically involve higher interest rates and youll need a higher credit score to qualify. This is due to the higher risk for lenders.

Secured loans are easier to get.

The problem, though, is that you must pledge personal property as collateral. This protects the lender in the event of default. If you dont repay the loan, the lender can take your collateral as repayment.

The different types of collateral for a personal loan include:

- title to a paid-off car or other vehicle

- savings account

Read Also: How To Loan Money For Profit

First Responders Loans For St Louis Families

BackStoppers, Inc. is a non-profit organization that provides financial support and assistance to the spouses and dependent children of first responders who have fallen in the line of duty or suffered a catastrophic injury.

At First Integrity Mortgage Services, we are dedicated to building strong communities in our local market. We also believe in supporting those who keep our communities safe. As part of our dedication to building strong communities, First Integrity Mortgage Services has partnered with BackStoppers, Inc. to offer a loan program that helps first responders injured in the line of duty and surviving families through difficult times.

First Integritys First Responders Loan Program Highlights

- $500 closing cost credit for any First Responder closing a mortgage through First Integrity.

- First Integrity makes a $250 donation to BackStoppers on your behalf with every BackStoppers loan closed.

- Applies to any of the following residential loans offered by First Integrity Mortgage Services:

- Conventional loans

How To Purchase A Home Before You Sell

As a homebuyer, you have to weigh your needs and your wants to identify which house you should purchase. Aim to purchase your home at a time where the market is trending low. It is important not to overpay for your home, and always be aware of the APR you agree to on your mortgage. Not all home loans are created equally.

Is it time for you to buy a home?

Buying a home is not easy, and not everyone is always prepared for the realities of being a homebuyer. To buy a home youll need to have enough money saved for a down payment , have a good credit score , and have a solid work history of about two years to show that you will be able to make regular mortgage paymnts. If you do not have all three of the above requirements, youll want to continue saving, perfecting your credit score, and building your good work history. This way, when you go to apply for a mortgage in the future, you will be prepared to buy your dream home.

Search for a home

Next is the fun part and the hard part. Youve saved your money, built up your credit, and stayed with the same employer for the last two years to show you are a good candidate for a loan to purchase a home. As you go about the homebuying process, youll want a trusted real estate agent at your side to help you find the house of your dreams. You owe it to yourself to purchase a house that you and your family can prosper and grow in for years to come.

Home Inspection

Congratulations! You are now a homeowner.

Read Also: How To Qualify For Navy Federal Personal Loan

Mortgage Program Options For First Responders

When you are ready to buy a home, Boston housing prices can seem high. A scarcity of homes for sale and rising costs combine to create a challenging environment for potential homebuyers who are also Boston first responders. Median house prices rose 12.1% between July 2020 and July 2021. Homes in Boston generally sell for their asking price, with a median sale price of $750,000.3

Do First Responders Get Help With Mortgages?

Yes. First10 eliminates the requirement for a down payment, so you can get financing for up to 100% of the total mortgage amount. There’s no private mortgage insurance requirement and during the first 10 years of the mortgage, there’s a fixed interest rate, so your payment stays the same each month. A 40-year amortization schedule helps keep your monthly payments low. With a $600,000 mortgage, the First10 program saves borrowers $380 per month.

You’ll pay a low adjustable interest rate during the first ten years of your mortgage, which could help you own a home while satisfying Boston’s residency requirements. After 10 years, the interest on your mortgage goes up slightly. At that point, you can choose to sell or refinance your home.

What Other Homebuyer Assistance Is Available For Teachers And First Responders

Many states and cities offer down payment assistance to public-sector employees, so if youre shopping around, its worth seeing what programs are available in your area.

The U.S. Department of Housing and Urban Development also administers the Good Neighbor Next Door Program, which allows teachers and first responders to purchase property in designated revitalization areas at a 50 percent discount off the list price, so long as they commit to living there for at least 36 months.

Read Also: How To Decrease Interest Rate On Car Loan

Overall Affordability And First Responder Home Loans

The question of overall affordability is on everyones mind, especially with the bidding wars and escalating prices. If you simply cant afford the homes you are looking at, you may feel stuck. The HUD Good Neighbor Next Door Program faces the affordability issue head on. This program from the U.S. Department of Housing and Urban Development Agency gives 50% off the price of a home for community heroes, including all first responders. HUD offers these deep discounts to encourage community revitalization by having police, firefighters and EMS workers live in the communities they serve.

What does revitalization mean? The homes in the Good Neighbor program are in revitalization areas as identified by HUD. That means they are in areas where:

- Household income is lower than average.

- Homeownership rate is lower than the surrounding areas.

- FHA-insured foreclosure activity is higher than surrounding areas.

These neighborhoods require economic and community development, so HUD makes these foreclosed properties available to first responders at half off.

There are some requirements for the buyers in the program. For example, you need to promise to live in the house for 36 months. Also you can only choose from the houses on HUDs list.

They have a tool that lists eligible properties.

First Responder Home Loans

Last Updated on August 9, 2022 by Luke Feldbrugge

The first responder home loans we are covering in this post have specific discounts or deals that are tailored to firefighters, EMS workers and police officers. You can spend a lot of time searching for them or you can let us do it. Homes for Heroes has been serving the first responder community for more than 20 years, so we can help you find savings that could make your new home more approachable.

We begin with the simple question: are there any special first responder mortgage programs? We get a lot of results, and then its time to comb through them. They fall into a few categories:

- Explaining how mortgages work

- Help for the overall affordability of a home

You May Like: What Is Origination Charges In Loan

What Is The Helper Act

The HELPER Act, which stands for Homes for Every Local Protector, Educator, and Responder, was introduced last month by Reps. John Rutherford , Bonnie Watson Coleman , John Katko , and Al Lawson .

The ongoing pandemic has put a long overdue spotlight on some of Americas most important unsung heroes, Katko said.

From teachers, to police officers, to paramedics, EMTs, and firefighters, we saw these professionals faithfully support our nation during the pandemic, and at times put their own lives at risk to uphold their duties.

Unfortunately, these heroes, who make great sacrifices for our communities, often are unable to find affordable housing in the communities they serve.

The HELPER Act aims to combat this problem, offering a new, affordable loan option under the Federal Housing Administration.

Other Programs To Explore

If the FHA Good Neighbor Next Door loan program does not work for a scenario perhaps one of these programs will better suit your borrowers needs:

- VA Fully Amortized Fixed, for eligible veterans and active duty military ready to take advantage of 100% financing and no private mortgage insurance

- Fannie Mae HomeReady, designed to help low- to moderate-income borrowers achieve homeownership for as little as 3% down

- FHA Streamline Refinance, for current FHA borrowers ready to refinance to a new FHA loan

You May Like: How Does The Va Loan Work

Why Bank With Armed Forces Bank

Whether youre a military servicemember or a first responder, Armed Forces Bank is committed to serving Heroes.

Were a full-service military bank thats been committed to serving those who serve since 1907. We provide a vast array of affordable, easily accessible financial products to both active and retired military and civilian clients in all 50 states and across the world.

And if youre ready to purchase your first home, we offer loan solutions to make it easier on you. With $0 down payment options, we commit to being beside you every step of the way.

First Responder Home Loan Offer Details

- This offer is reserved for those who provide initial response by going out to the emergency scene in roles such as police, fire fighter, paramedic, EMS or EMT

- Spouses of First Responders are eligible as well

- Eligible for Purchase or Refinance

GMFS reserves the right to determine the qualification of the applicant for the First Responders Mortgage Solutions program based on our ability to satisfactorily verify the applicants current employer and/or position/title . GMFS Mortgage First Responder offer cannot be combined with other home loan offers. Due to constantly changing market conditions and mortgage regulations, the availability of the First Responder home loan offer is subject to change at anytime, without prior notice. Please contact a GMFS Mortgage Loan Officer to check the current availability of the First Responder offer program.

Note: If you refinance your existing loan, your total finance charges may be higher over the life of the loan.

Contact a GMFS Mortgage Loan Officer today!

Swipe left to see more reviews

Recommended Reading: How To Apply For Home Improvement Loan In Pag Ibig

What Is A Hero Loan And How Does It Work

When you hear about a Hero Loan, you may think of a Home Energy Renovation Opportunity loan. But at Armed Forces Bank, it means something different. Thats because our Hero loans are specifically for the heroes of our local community — our first responders.

Heres what you need to know about our Armed Forces Bank Hero Loans.

- Our Hero Loan program is unique to Armed Forces Bank. That means you wont find it anywhere else.

- An Armed Forces Bank Hero Loan is a portfolio loan. This means we will never sell these loans to agencies such as Fannie Mae or Freddie Mac.

- Hero Loan borrowers must also be Armed Forces Bank checking account holders.

- Hero Loans are for owner-occupied residences only.

- Hero Loans require mortgage insurance.

At Armed Forces Bank, we know how important it is to put down roots in the communities you love and serve. And were here to support you on your journey of achieving homeownership. Because you deserve the very best.

For our military heroes, Armed Forces Bank provides VA Loans, which are specific to servicemembers — both active and retired — and also offer $0 down payment. However, buyers may have to pay a funding fee, based on exemption status, which can be paid off over time.

Both Hero Loans and VA Loans are subject to credit approval.

For Eligible First Responders

FRDALP helps financially eligible first responders buy a home in San Francisco. It is a downpayment loan up to $375,000, to bid on a property on San Francisco’s open market. The loan is used on the downpayment of a single unit that will become a primary residence.

The FRDALP is a silent second loan that requires no monthly payments. When the property is sold or transferred, the owner pays MOHCD back the principal amount of the loan, plus an equitable share of appreciation of the property.

Also Check: How Much Va Loan Can I Get

Home Loans For First Responders

When they hear the word hero, some people tend to think of fictional characters who wear capes. But as you know, many real-life heroes uniforms consist of firefighter, police and EMT gear. You work to save lives on a daily basis, so we want to help you save in a different kind of way with home loans for first responders.

Whether you want to buy a house, renovate or refinance, our programs are designed to fit your specific financial situation. With a wide variety of loan options and flexible credit requirements, along with our streamlined and stress-free mortgage process, you can count on us.