Should I Get A Va Loan I Heard The Va Funding Fee Was Too Expensive

Some will tell you to avoid VA loans because of the VA funding fee. Heres what you need to know about VA funding fees:

- 2.3% of the loan amount for firsttime VA loan users with zero down

- 3.6% for repeat users

- 0.5% for streamline refinances

Most home buyers will pay a VA funding fee of $5,750 for a home price of $250,000 with no down payment.

At first, that sounds like a lot, but its reasonable given the benefits of the program.

Most nonVA home buyers must come up with a 3% to 5% down payment. Thats at least $7,500 on the same home a big hurdle, especially for firsttime homebuyers.

You can wrap the VA funding fee into the loan amount, meaning it can still be a zerooutofpocket loan. With a conventional or FHA loan, you must make the down payment in cash.

Making a down payment is the single biggest barrier to homeownership for buyers today.

Good Mortgage Rates Look Different To Everyone

What is a good mortgage rate? Thats a tricky question. Because many of the rates you see advertised are available only to prime borrowers: those with high credit scores, few debts, and very stable finances. Not everyone falls into that category.

Of course, you can look at average mortgage rates. But how reliable are those as a guide?

On the day this was written, Freddie Macs weekly average rate for a 30year, fixedrate mortgage was 2.99%. But the daily equivalent on Mortgage News Dailys website was 3.13%. So theres clearly a lot of variance across the market.

Can You Obtain Va Loans Above Conforming Loan Limits

New Law Starting January 2020

Military veterans and activy duty military members can now obtain VA loans with no money down for homes exceeding the conforming loan limit:

In January, Mr. Colletti and his wife, Rachel Ewing Colletti, closed with no money down on a $965,000 house.

The new rules also affect refinances. Evan Banning, president of California Housing and Lending, a real-estate brokerage and mortgage firm in San Diego, said he refinanced a loan for a vet and active reservist in mid-January. The client had purchased a house for $1.7 million a few years earlier with 10% down, but didnt use a VA loan. Under the prior VA rules, refinancing would have required his client to boost his home equity. Instead, Mr. Banning provided a refinance of $1.62 million with no additional money down. He lowered the rate from 4.125% to 3.25%, he said.

Law Before 2020

Before the new law came into being, if you purchase a home valued above the local conforming mortgage limit then you will need to cover the downpayment for the portion of the loan which is above the local limit. For example, if you lived in a county where the maximum conforming loan limit is $636,150 and wanted to buy a house which cost more than this, then you would need to make a down payment of 25% of the amount beyond the limit. If you were to buy a house for $836,150 with a VA loan then you would need to cover 25% of the loan amount above the local limit.

- $836,150 – $636,150 = $200,000

You May Like: Becu Autosmart

If One Type Of Mortgage Isn’t Right For You You Have Many Others To Choose From

Lindsay VanSomeren is a credit card, banking, and credit expert whose articles provide readers with in-depth research and actionable takeaways that can help consumers make sound decisions about financial products. Her work has appeared on prominent financial sites such as Forbes Advisor and Northwestern Mutual.

If you’re like most people, you’ll need to take out a mortgage to buy a home. According to the U.S. Census Bureau, 96% of people who bought a home in 2020 purchased it with a mortgage.

But when you start shopping around for a mortgage, it’s easy to get overwhelmed. There are lots of different types of mortgages, each of which is better for some people than others. Here’s how to tell which type of mortgage might be best for you.

Who Sets Va Loan Rates

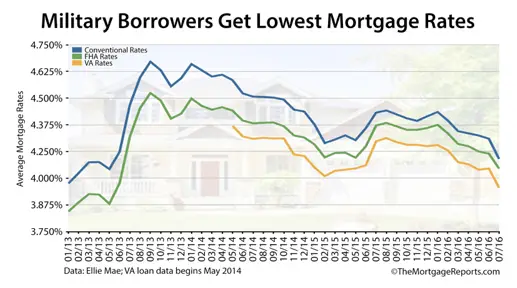

VA loan lenders determine VA loan rates, which can be lower than the interest rates for conventional loans. VA loans come from a variety of mortgage lenders, including banks, non-bank institutions and credit unions.

Its important to shop around, as rates can differ widely by lender. In fact, a 2020 study by mortgage technology company Own Up found that in a cohort of 20 VA loan lenders, the interest rates from the highest-cost lender and lowest-cost lender differed by up to 1.25 percentage points. However, a 2021 update by Own Up found the difference had narrowed to 0.52 percentage points. In either case, a gap like that, and even slight changes in interest rate, can significantly impact the overall cost of your loan.

Bankrate can help you shop around for the best deal on a VA loan.

You May Like: How To Transfer Car Loan To Another Person

Lowest Rates Or Lowest Upfront Fees

You will have to decide which is more important to you: the lowest rate or the lowest fees. Paying fewer upfront fees usually results in a higher rate.

Or, you can choose a belowmarket rate and pay more upfront for it. This strategy should pay off over the life of the loan if you stay in the home for decades.

When Should I Use A Va Loan

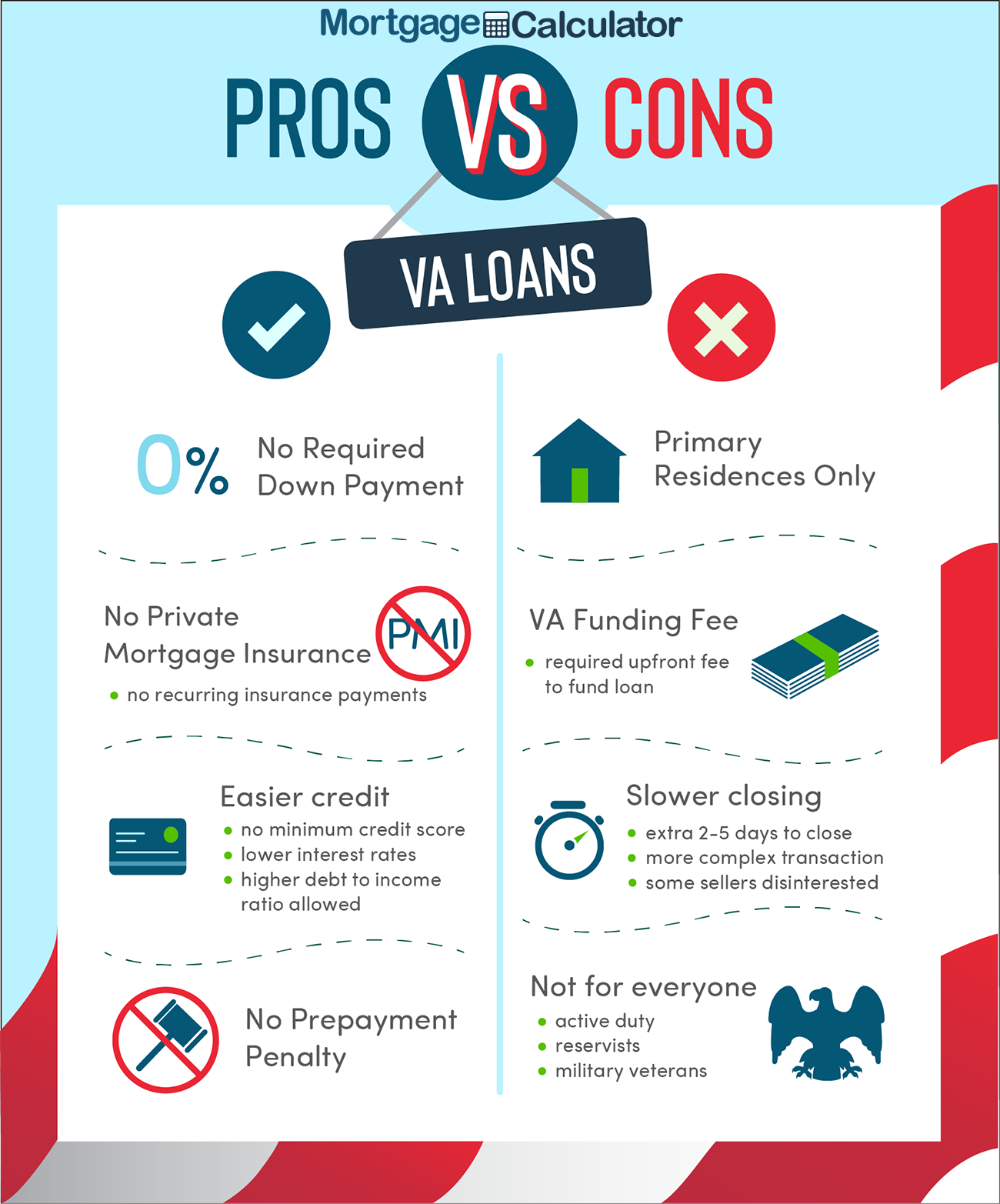

If youre looking to buy a home but dont want to make a down payment or pay for private mortgage insurance, it may be the right time to use a VA loan.

Additionally, a VA loan must be used on your primary residence and may carry additional fees if its not the first time youve used it. VA loans also carry a maximum loan amount that changes each year, which may limit the options available if youre planning to buy a more expensive home.

For most U.S. counties, the 2020 limit is $510,400 an increase from $484,350 in 2019. However, in more expensive housing markets, the limit can be as high as $756,600 an increase from $726,525 in 2019.

If youre looking to secure the best loan rate in 2020 without making a large down payment, it may be the right time to consider a VA loan. If you want to see how a VA loan can benefit you and your family, be sure to check out our helpful mortgage calculator.

Read Also: 1-800-689-1789

Va Energy Efficiency Mortgages

Though the VA does not offer conventional home improvement loans, it does offer an option for homeowners to borrow additional funds to pay for energy efficiency improvements at the time they buy their home.

A VA Energy Efficiency Mortgage allows homebuyers to borrow up to an additional $6,000 to pay for energy improvements on top of what’s needed to purchase their home. These funds can be used for new windows, insulation, a high-efficiency furnace or water heater and more.

The amount borrowed is rolled into the VA home loan, so there’s only one loan and monthly mortgage payment to deal with.

Va Interest Rate Reduction Refinance Loan

The VA IRRRL is only available to Veterans who presently have a VA loan. The IRRRL is available to Veterans who want to refinance their current mortgage to a lower interest rate, shorten their loan term, or to convert an adjustable-rate mortgage into a fixed-rate mortgage.The IRRRL requires that the new interest rate be lower than the current interest rate, and has a time restriction for recouping expenses and penalties. All of which contribute to Veterans receiving the maximum financial advantage.The IRRRL program is also known as a VA Streamline, because it’s simple, low-cost refinance loan that may not require credit underwriting, appraisal, or income verification.

Also Check: Can You Refinance Fha Loan

Benefits Of A Va Loan

VA loans come with countless benefits, but the biggest perk is that they require no down payment.

Unlike other mortgage programs, which ask for anywhere from 3% to 20% down, VA loans require no down payment at all. This can offer significant savings right off the bat. .

Some other benefits of VA loans include:

- Competitively low interest rates

A lower interest rate translates to a lower monthly mortgage payment and substantial savings over the life of your loan.

Veterans United: Best Customer Satisfaction

One of the largest VA mortgage lenders in the U.S., Veterans United limits its focus to only VA loans, offering superior customer satisfaction compared to many other lenders.

As is typical of VA loans, there is no minimum down payment required to secure a VA loan through Veterans United. In addition to the easy online application process, Veterans United is home to the Lighthouse program, offering credit counseling services to help active duty military and veterans build and improve upon their credit scores, manage their finances, set budgets and secure VA loan preapproval.

Veterans United offers 30-year and 15-year fixed loan options with competitive APR percentages and touts high rates of customer satisfaction.

Read Also: Usaa Auto Loan Credit Score Requirements

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

How Are Va Mortgage Rates Set

At a high level, mortgage rates are determined by economic forces that influence the bond market. You cant do anything about that, but its worth knowing: Bad economic or global political worries can move mortgage rates lower. Good news can push rates higher.

What you can control are the amount of your down payment and your credit score. Lenders fine-tune their base interest rate on the risk they perceive to be taking with an individual loan.

So their base mortgage rate, computed with a profit margin aligned with the bond market, is adjusted higher or lower for each loan they offer. Higher mortgage rates for higher risk lower rates for less perceived risk.

So the bigger your down payment and the higher your credit score, generally the lower your mortgage rate.

» MORE: Get your credit score for free

You May Like: Mlo Endorsement

A Note On Discount Points

Heres an insider tip when comparing mortgage rates: lenders often advertise rates based on the assumption youre going to buy discount points.

Those discount points are an extra sum you can choose to pay at closing to shave a little off your mortgage rate.

Often, you pay 1% of the loan amount to reduce your interest rate by about 0.25%. So, on a $200,000 loan, you might pay $2,000 to reduce your 3% rate offer to 2.75%.

Theres nothing wrong with these points , and theyre often a good idea. But comparing an advertised rate that assumes youll buy discount points with ones that dont make the same assumption is like comparing apples with oranges. You wont get a fair answer.

Best Jumbo Loan: Usaa

-

No loans over $3 million

-

No auto pay discount

USAA is an organization that offers military members and their families a comprehensive range of financial products and services that are competitively priced. They offer benefits, insurance, advice, banking, investment products, specialized financial resources, and member discounts.

USAA lends nationwide to veteran borrowers seeking a jumbo home loan up to $3 million without needing to pay private mortgage insurance, and wrapping the VA funding fee into the loan.

USAAs VA loan products include a fixed-rate 30-year purchase loan with rates starting at 2.625%, a jumbo fixed-rate purchase loan at 2.828%, and a VA refinance option: the VA interest rate reduction refinance loan at 2.625%. USAA also has non-VA loan options.

To service your loan, USAA offers an autopay process, however, there are no discounts for using the program. Customer service is available through online chat, mobile app, and by telephone at 800-531-USAA .

Read Also: Advance Auto Loaner Tools

How To Navigate The World Of Mortgage Rates

The trick is knowing what a good mortgage rate looks like for you. And that will depend on a few different factors, including:

Clearly, there are a lot of variables affecting your interest rate. Whats an attractive rate for one borrower may be way too high for another.

And all lenders weigh these factors differently. So making the same application with three different lenders will most likely get you three different rates and sets of fees.

Allowed Uses For Va Loans

A VA mortgage loan can be used for a wide range of purposes related to home ownership. You can use one to buy a single-family home, a unit in a residential condominium or a manufactured home and lot.

A VA cash-out refinance lets eligible veterans and service members borrow money for any purpose, including home repairs and improvements, or as a military consolidation loan to pay off existing bills. There’s also a VA Energy Efficient Mortgage that lets you borrow up to $6,000 for energy efficiency improvements on top of what you need to purchase or refinance your home.

There’s a VA Streamline Refinance option that makes it easy to refinance an existing VA loan to a lower mortgage rate. Eligible veterans can also use a VA mortgage loan to refinance another existing mortgage, even if the current mortgage is not a military loan.

Here’s a look at the various types of home loans for veterans that are available with VA backing.

Also Check: Loan License In California

How Are Reali’s Refinance Rates

Reali Mortgage keeps its mortgage refinance rates very low, usually hovering right at or below the national average. Even better, Reali’s refinance rates are a little lower than its purchase loan rates. And to get the same rate on a refinance loan, you pay less in points than for a comparable purchase loan.

Qualifying For A Va Loan

The VA doesnt set specific financial standards for its loans, though private mortgage lenders the companies who actually issue the loans do. These vary from one lender to the next, but in most cases, borrowers need at least a 620 credit score and a debt-to-income ratio of 41% or less.

If you fall short of these requirements, you still might qualify. Just make sure to shop around for your lender, work on improving your credit, and consider making a down payment. These steps can all help you better qualify for a mortgage loan .

Recommended Reading: Fha Loan Refinancing Requirements

How Much Does A Va Refinance Cost

Refinance loan closing costs average 3% to 6% of the loan amount, which can add up to thousands of dollars for the average mortgage refinance. The exact fees you pay will vary by lender, so its important to shop around and compare Loan Estimates from a few lenders.

Which type of VA refinance loan you use will also impact the fees you pay. All VA loans come with a funding fee unless you can qualify for a funding fee waiver. For VA streamline refinance loans, the funding fee is 0.5% of the loan amount or $500 for every $100,000 borrowed. One advantage of a streamline loan is you may avoid paying for a new appraisal, which can cost $300 to $600.

A VA cash-out refinance will be more expensive than a streamline refinance. Not only do cash-out refinance loans typically have higher interest rates, but the funding fee is also increased. If your refinance is your first use of your VA loan benefits, the funding fee is 2.3% and 3.6% for each subsequent refinance.

Va Mortgage Rates Today

Mortgage rates overall are currently at an all-time low due to nationwide economic issues stemming from the coronavirus pandemic. However, due to the already-low nature of VA home loan rates, VA mortgage rates have experienced little change over the last couple of months. The average VA loan interest rate as of July 8, 2020 is 2.5% for a 30-year fixed mortgage. The average VA loan interest rate as of August 21, 2020 is 2.890% for a 30-year fixed mortgage.

Don’t Miss: Credit Needed To Refinance Home

Fixed Vs Adjustable Rate Mortgages

A fixed-rate mortgage is a mortgage where your interest rate is fixed for the entire term of your loan. If you close on a 30-year mortgage on Jan. 1, 2022, at an interest rate of 2.99%, and you never move, refinance, or make additional payments, then your interest rate is still 2.99% when you make your final payment on Jan. 1, 2052. A mortgage calculator can show you the impact of different rates on your monthly payment.

An Adjustable-Rate Mortgage conversely has a rate that changes at set periods of time. The most common mortgage ARMs are 7/1 and 5/1, but technically any ARM term is possible. On a 7/1 ARM, the rate remains the same for the first seven years and is then adjusted every single year thereafter.

Adjustable rate mortgages became very popular prior to the subprime mortgage crisis because they offered lower initial payments, but then lead to a wave of foreclosures as the rates increased and made the mortgage payments unaffordable for thousands of Americans. ARMs are risky for most borrowers and are generally not a great choice unless they intend to pay off their mortgage or refinance before their rate adjusts.