How Much House Can You Afford

When you are pre-approved for a mortgage, a lender will tell you the maximum loan amount for which you qualify, based on responses in your application. Your mortgage application asks about your estimated down payment amount, income, employment, debts, and assets. A lender also pulls your credit report and credit score. All of these factors influence a lenders decision about whether to lend you money for a home purchase, how much money, and under what terms and conditions.

As a general guideline, many prospective homeowners can afford to mortgage a property that costs between 2 and 2.5 times their gross income. For example, if you earn $100,000 per year, you can afford a house between $200,000 and $250,000.

Rather than simply borrowing the maximum loan amount a lender approves, youre better served by evaluating your estimated monthly mortgage payment. Say, you get approved for a $300,000 loan. If your monthly mortgage payment and other monthly debts exceed 43% of your gross monthly income you might have trouble repaying your loan if times get tight. In other words, be cautious about buying more house than you can reasonably afford.

Beyond buying a house, you may also want to contribute to other financial goals such as saving for retirement, starting a family, shoring up an emergency savings fund, and paying down debt. Taking on a too-high monthly mortgage payment will eat up cash that could otherwise go toward some of these important goals.

Conforming Loan Limits In High

Home prices differ quite a bit from state to state, and even from county to county. This makes having a single conforming loan limit for the entire country difficult after all, its hard to compare home prices in, say, rural Ohio to home prices in Manhattan, one of the most expensive real estate markets in the country.

This is why the FHFA has a higher limit for areas it deems to be high cost, a designation based on an areas median home values compared to the baseline conforming loan limit.

The exact conforming loan limit varies depending on the median home value in a given area, up to 150% of the baseline conforming loan limit. In 2021, this limit is $822,375. To see what the limit is in your county, use the FHFAs interactive map.

To see what this might look like in practice, lets say youre considering buying a $700,000 house in California.

If you were to buy that house in San Bernardino County, which isnt an FHFA high-cost area, youd likely need to take out a jumbo loan, since youd be exceeding the $548,250 baseline loan limit.

However, say youre buying a $700,000 house in San Diego County, where the conforming loan limit is $753,250. Since youre within the limit for that county, youd be able to get a regular, conforming loan.

Youd also be able to get a conforming loan for this property in Los Angeles County, where the conforming loan limit is at the loan limit ceiling of $822,375.

While It Is Sometimes Possible To Find Special Programs That Waive Private Mortgage Insurance It Is Almost Always Required On Conventional Loans When You Put Less Than 20% Down

Government-backed loans also allow for lower down payments. The VA doesnt require any minimum down payment unless the home is worth less than youre buying it for and theres no private mortgage insurance required. However, there is an up front mortgage loan fee equal to a percentage of the borrowed amount. FHA loans enable you to buy with as little as 3.5% down, but you then pay mortgage insurance for either 11 years or the life of the loan.

Recommended Reading: What Credit Score Is Needed For Usaa Auto Loan

Mortgage Down Payment Options

From a low down payment mortgage to using your Registered Retirement Savings Plan as a source of funds, buying a home has never been easier.

The down payment is that portion of the purchase price you furnish yourself. The balance is obtained from a financial institution in the form of a mortgage. The amount of the down payment should be determined well before you start house hunting.

How Much Money Do You Need To Buy A House

In addition to the down payment, which well go into detail about in a bit, there are other expenses to the actual listing price of a home.

Most of these can be summed up in the closing costs, which include expenses such as the earnest deposit, the inspection and appraisal of the property, and other things like title insurance and a portion of property taxes. Its estimated that youll need between $7,000 and $10,000 set aside for closing costs, in addition to any money toward a down payment.

Don’t Miss: How Long For Sba Loan Approval

Can A Second Mortgage Eliminate Pmi

A loan option that is rising in popularity is the piggyback mortgage, also called the 80-10-10 or 80-5-15 mortgage.

This loan structure uses a conventional loan as the first mortgage , a simultaneous second mortgage , and a 10% homebuyer down payment. The combination of both loans can help you avoid PMI, because the lender considers the second loan as part of your down payment. A piggyback loan can make homeownership accessible for those who may not yet have saved a down payment.

For an in-depth look at these loans, see our piggyback loan blog post.

Down Payment Requirements: Conventional Fha Va And Usda

Down payment requirements vary depending on the type of mortgage loan you qualify for, but very few lenders are willing to accept no down payment at all.

Loans are typically broken into two high-level categories: government and conventional, says Arielle Minicozzi, CFP of Modern Money Advisor, a virtual financial planning firm. Within each of those categories, there are several loan programs.

Typically, for a conventional mortgage through a private lender, you should be prepared to put down 20% of the purchase price of your home, but factors such as your credit score and property type may influence the down payment your lender expects.

If you qualify for government-backed loans, your required down payment may be closer to 3% or even as low as zero. First-time home buyers may also have more flexibility when it comes to down payments, depending on qualification for assistance programs.

According to the Profile of Home Buyers and Sellers from the National Association of Realtors, the median down payment was 12% for all buyers in 2019. For first-time buyers, the median was 6% and repeat buyers paid a median 16%.

Also Check: Usaa Refinance Auto

How Do You Qualify For A Conventional Loan

A lot of home shoppers thinkits too hard to qualify for a conventional mortgage, especially if their financialsituations arent perfect. But thats not really the case.

Just like with an easygovernment-backed loan, qualifying for a conventional loan requires you toprove:

- You make enough money to cover monthly payments

- Your income is expected to continue

- You have funds to cover the required down payment

- You have a good credit history and decent score

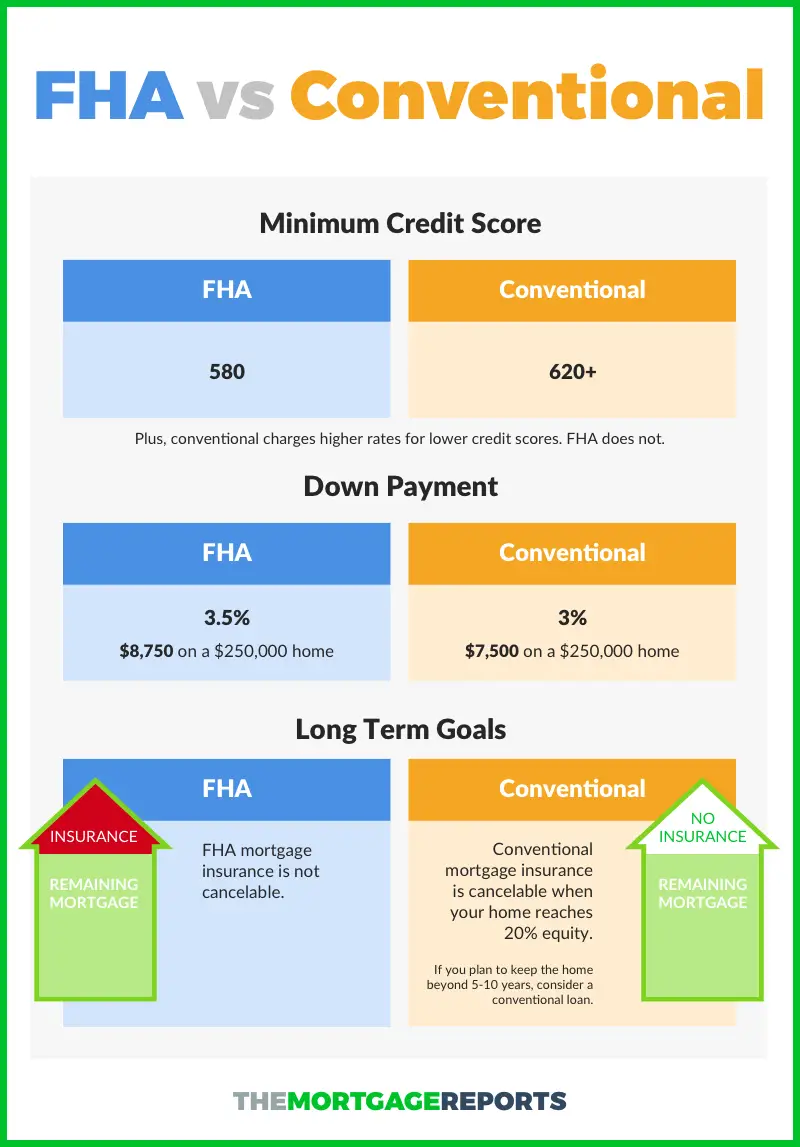

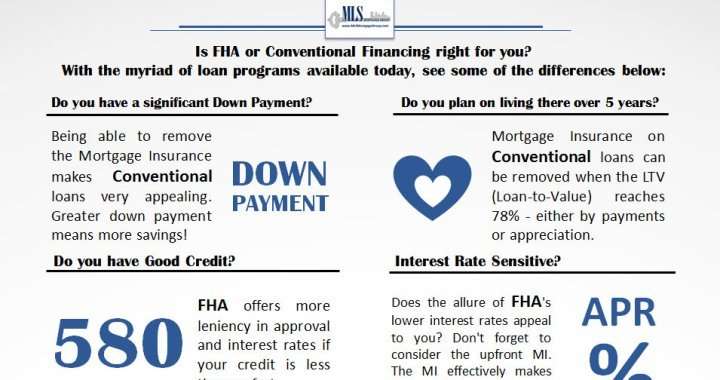

True, the standards toqualify for a conventional loan are slightly higher than for an FHA or VA loan.But theyre still flexible enough that most homebuyers are able to qualify.

According to loan softwarecompany Ellie Mae, the average credit score for all applicants who successfullycomplete a mortgage is around 720. This is plenty high to get approved for aconventional loan.

The minimum credit score required for most conventional loansis just 620.

We want to know that peoplepay their bills on time and are financially disciplined and good at moneymanagement, says Staci Titsworth, regional vice president sales manager withPNC Mortgage in Pittsburgh, PA.

A slightly lower credit score may pass the credit scoretest, but thelender will typically charge a higher interest rate to compensate for thegreater risk.

Applicants with lower creditmay want to choose an FHA loan, which does not charge extra fees or higherrates for lower credit scores.

Employment and income

Seasonal income is also accepted with proof in a tax return.

Conventional Loan Rates In 2020

Mortgage rates are influenced by a variety of factors, including market conditions, 10-year Treasury yields, your ZIP code and your personal qualifications.

For example, as of January 2020, the average rate for a 30-year fixed conventional home loan is between 3.50% and 3.625%, according to Mortgage News Daily. However, the rate youre offered might vary based on where you live, how much you intend to borrow, the size of your down payment and your credit score.

When looking for the best mortgage rates, its a good idea to shop around and compare offers. Additionally, it can make sense to get a guarantee from your lender that the rate they quote you will be good for at least 30 days, so youre protected if mortgage rates rise. Many lenders will guarantee to honor a lower rate if conventional loan rates rise and give you the lower rate if mortgage rates drop during that period.

Also Check: What Credit Score Is Needed For Usaa Auto Loan

Check Your Conventional Loan Eligibility

The bottom line is that itsvery important for home buyers to shop around for a conventional mortgage withat least three lenders.

Todays rates are very low,and can be even lower with the right shopping practices.

Check your conventional loaneligibility and rates today.

Popular Articles

How Much Money Do I Need To Buy A House For The First Time

As of September 2021, the median home price in the U.S. is around $370,000. Assuming a 20% down payment, you would need $74,000 for a down payment, plus several thousand more for closing costs and fees to your lender, realtor, lawyer, and title company. Still, no set amount is required and home prices vary state-to-state and city-to-city. It’s all dependent on what you’re looking for in terms of size and type of property, neighborhood, amenities, and any other details specific to your situation.

Recommended Reading: What Car Loan Can I Afford Calculator

What Is A Home Down Payment

Your down payment is the sum of cash you commit upfront toward your loan. A down payment is required on nearly all mortgages, and while standard best practices recommend putting 20% of your homes sale price down, some mortgage lenders allow much lower payments.

Your down payment will affect your loan-to-value ratio, which in turn could affect your interest rate, whether you need private mortgage insurance , and even if you qualify for a loan. A larger down payment also means a smaller loan principal, which will help you save on interest in the long run. Because of this, its best to carefully consider how much to put down. Experts recommend a 20% down payment if you can afford it.

Cons Of A Big Down Payment

Saving money is great, but making a big down payment does have its drawbacks, too. For example, a big down payment can:

Delay your home purchase. Since a big down payment requires more money, it may take longer to save up, which could delay your home purchase.

Drain other funds. You may be tempted to pull from other places, like an emergency fund, to make the payment but you could be shorting your other accounts. This can be a problem when you need to access those accounts for an emergency or home repair. Tying your available cash up in your home puts you at risk for going into debt if something unexpected happens.

Only provide some benefit. The money-saving benefits of a big down payment dont happen right away. Theyre more long-term, so if you dont stay in the home for a long time, you may not even experience the full benefit of a big down payment.

Also Check: How To Qualify For Loan Modification

Is It Better To Put A Large Down Payment On A House

If you can afford to put a sizeable down payment on a property, the benefits include more options for a mortgage, lower interest rates, more negotiating power with a seller, and the avoidance of having to pay mortgage insurance and certain other fees. But if putting a large down payment would result in you not having enough money for other monthly expenses or your long-term savings goals, a smaller down payment may make more sense.

How Credit Score Impacts Your Down Payment

Your impacts on your loan and interest rate options. Buyers with credit scores as low as 500 might still be able to get a loan for a home, but they’ll likely face higher interest rates and have fewer options. The higher your credit score, the lower your interest rate.

A strong credit score also means lenders are more likely to be lenient in areas where you may not be as strong, such as your down payment. Your credit score shows you have a proven history of making payments on time and that youre less of a risk. In these instances, they might allow you to get a great interest rate while making a smaller down payment.

Recommended Reading: Does Va Loan Work For Manufactured Homes

Fha Mortgage Insurance Premium

If you cant qualify for a conventional loan product, you might consider an FHA loan. Like some conventional loan products, FHA loans have a low-down payment optionas little as 3.5% downand more relaxed credit requirements.

Lenders require mortgage insurance for all FHA loans, which are paid in two parts: an up-front mortgage insurance premium, or UFMIP, and an annual mortgage insurance premium, or annual MIP. Both costs are listed on the first page of your loan estimate and closing disclosure.

Fannie Mae And Freddie Mac Programs

Fannie Mae and Freddie Mac, government-sponsored enterprises that buy and sell most U.S. mortgages, require only 3% down for borrowers with strong credit. Both programs will consider some borrowers with no credit score by building a non-traditional credit reportas long as those borrowers meet certain debt-to-income and loan-to-value ratio guidelines in addition to other requirements.

Fannie Maes HomeReady mortgage program allows a 97% LTV ratio for borrowers with a minimum credit score of 620. Freddie Macs Home Possible Advantage mortgage also offers a 97% LTV ratio for borrowers but requires a minimum credit score of 660 to qualify.

Recommended Reading: What Credit Score Is Needed For Usaa Auto Loan

Va Loan And Usda Loan: Zero Percent

The U.S. Department of Veterans Affairs and the U.S. Department of Agriculture guarantee zero-down payment loans for qualified homebuyers.

VA loans are available to most members of the armed forces and veterans and their families. USDA loans, on the other hand, are available to borrowers planning to purchase homes in designated rural areas. The USDA has maps on its website that show which areas are eligible.

Neither loan program requires mortgage insurance. With VA loans, youll pay a one-time funding fee, which ranges from 1.40 percent to 3.60 percent, depending on how many VA loans youve had and your down payment amount. With USDA loans, youll pay an upfront and annual guarantee fee, both of which are independent of your down payment amount.

Reasons For Not Putting 20% Down

While a 20% down payment may help save costs, there are plenty of reasons why it might not be possible. For some, waiting to save up 20% for a down payment may cost too much time. While youre saving for your down payment and paying rent, the price of your future home may go up. So putting less than 20% down might be worth it to get into your first home sooner and start building valuable equity.

If you have high-interest credit card debt or other debt, its wise to work to pay down your balances even if that means youll have less for a down payment. Also, private mortgage insurance is an extra monthly cost, but its not a bad idea to weigh the pros and cons of PMI to become a homeowner.

Our down payment calculator can help you understand the costs and benefits of different down payment amounts so you can decide what makes the most sense for you.

The down payment amount thats right for one person, wont necessarily be right for another. Its important to consider the benefits of different down payment amounts and get advice from loved ones, your real estate agent and a mortgage loan officer to determine whats right for you.

Recommended Reading: What Happens If You Default On Sba Loan

What Is A Conventional Loan

When most people think of a mortgage, theyre thinking of a conventional loan.

Conventional loans are the closest you can get to a standard mortgage. There are no special eligibility requirements, pretty much all lenders offer them, and you can qualify with just 3% down and a 620 credit score.

Thanks to their low rates and wide availability, conventional loans are the most popular mortgage for home buying and refinancing.

This conventional loan information is accurate as of today, September 3, 2021.