What Is A Good Credit Score For A Credit Card

Like other lenders, credit card issuers will consult your credit score to determine the risk of doing business with you before approving you for a new credit card. If you want to open a premium travel rewards credit card, you may need good and perhaps even excellent credit scores to qualify. For other types of credit cards, even some with 0% introductory APR offers, a good credit score may be sufficient to be approved for the card.

Beyond qualifying for a credit card, your score can also have a significant impact on the APR and other terms of your account. Credit card issuers not only rely on credit scores to help them determine whether or not to approve applications, but they also use scores to set the pricing on the accounts they approve.

Take this list of top credit cards, for example. Youll notice that every credit card offer features not a specific rate, but rather an APR range. A card issuer might advertise an APR of 13.49% to 24.49%. The reason for that range is because the card issuer will base the final rate it offers you on the condition of your credit.

Defining a specific number that a credit card issuer defines as a good score is tough for two reasons:

How Does Credit Score Affect Your Interest Rate

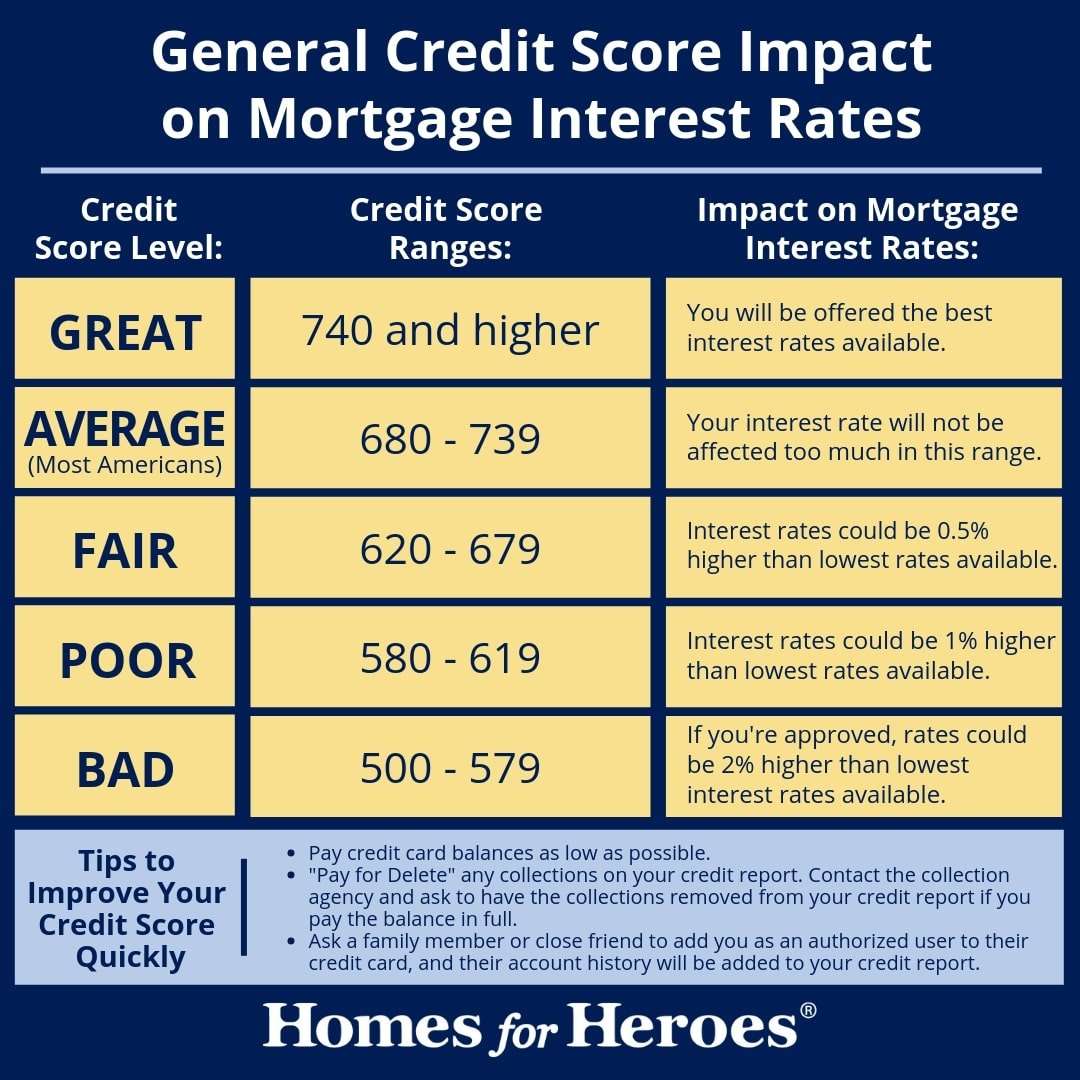

The interest rate you receive on a home loan is largely tied to your credit score. Generally, borrowers with higher credit scores qualify for lower mortgage rates, which can save them thousands of dollars over the life of a mortgage.

Every lender will have a different formula for setting your interest rate, but even a small difference on your credit score can help you save substantially. For example, bumping your credit score from 660 700 may help you shave $61 off your monthly payment on a $300,000 mortgage. Thats a difference of $21,960 over a 30-year mortgage term.

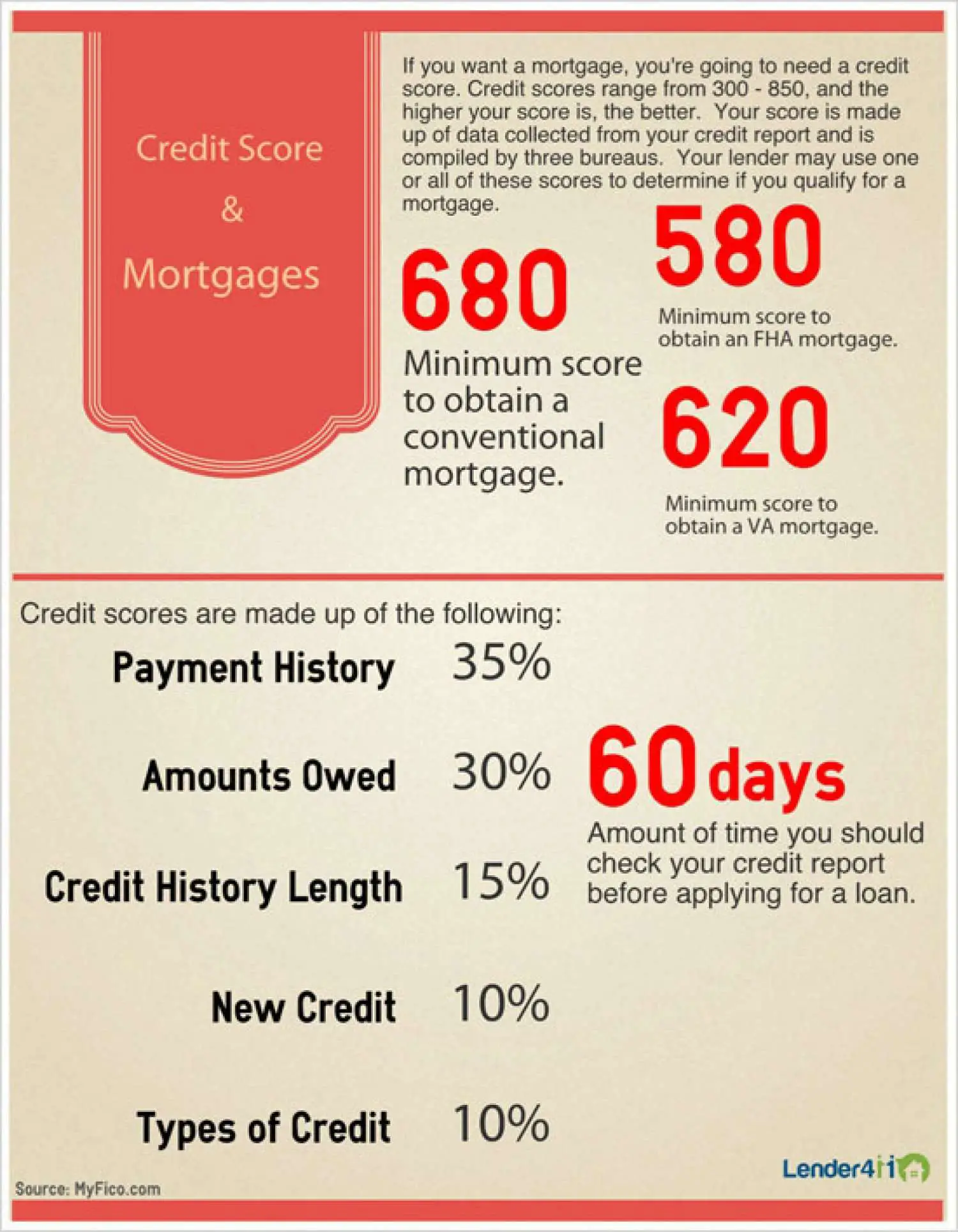

Whats The Minimum Credit Score To Buy A House

Home buyers are often surprised at the range of low credit home loans available today.

Most lenders will issue government-backed FHA loans and VA loans to borrowers with credit scores as low as 580. Some even start at 500-579 .;

With a credit score above 600, your options open up even more. Low-rate conventional mortgages require only a 620 score to qualify. And with a credit score of 680 or higher, you could apply for just about any home loan.

So the question isnt always can I qualify for a mortgage?, but rather which one is best for me?

Read Also: What Do Mortgage Loan Officers Do

Which Credit Score Do Mortgage Lenders Use Cnbc

Dec 2, 2020 For the majority of general lending decisions, such as personal loans and credit cards, lenders use your FICO Score. Your FICO Score is;

Mar 25, 2021 FICO credit scores are used by most lenders to evaluate a borrowers creditworthiness. The FICO scoring methodology has been updated over the;

8 days ago What Credit Score Do Mortgage Lenders Use? · Experian FICO® Score 2 · Equifax FICO® Score 5 · Transunion FICO® Score 4.

Can I Get A Mortgage If My Credit Score Is Low

When we talk about minimum credit scores required to get approved for a mortgage, were talking about conventional lenders, such as big banks. These traditional lenders are usually quite stringent about their mortgage approval requirements, including the credit scores needed for mortgage approval.

There are options for bad credit borrowers who are looking for a mortgage to finance a home purchase. Credit unions, trust companies, and subprime lenders are potential sources for mortgages for borrowers who cant qualify with their banks because of their sub-par credit scores. These sources often deal with people who may be viewed as risky to conventional lenders.

Have you considered a bridge loan to help purchase the home of your dreams?

It should be noted that if you do plan to apply for a mortgage with one of these lenders with a bad credit score, you will likely pay a higher interest rate than you would if you had a higher credit score and applied with a conventional lender.

Thats why its best to consider taking the time to improve your credit score before applying for a mortgage. That way youll have an easier time getting approved for a home loan and clinch a lower rate, which will make your mortgage less expensive.

Loans Canada Lookout

You May Like: What Is Escrow In Mortgage Loan

How Do I Get A Mortgage If I Have Bad Credit

Bad credit can limit your ability to get a mortgage. You may have options available to you, but the interest rates youâll qualify for wonât be cheap. If you donât want to put off purchasing a new home, there are immediate steps you can try taking to get a mortgage with bad credit. If youâre willing to wait, you should take time to improve your credit score and qualify for better mortgage options. Here are ways you can get a mortgage with bad credit.

Make a larger down payment

If your credit score isnât great, there are other ways to demonstrate your financial stability to lenders. Making a large down payment of 20% or above provides you with more leverage when working with lenders. It shows that you have a sizeable income and demonstrates your budgeting skills. It will also help you reduce your regular mortgage payments, making them more manageable in the long-run. In short, a larger down payment will often make you a more attractive borrower to mortgage lenders.

Use an alternative mortgage lender

If your credit score falls below 600, you will have a very difficult time getting approved from Canadaâs major banks. Youâll more than likely have to work with an alternative lender.

Alternative lenders are more lenient when it comes to credit. However, youâll usually need to make a heftier down payment of between 20% and 35%. Interest rates also tend to be higher with alternative mortgage lenders.

Get a co-signer or a joint mortgage

Improve your credit score

Improving Your Credit Score

If youre considering applying for a mortgage, its a good idea to check your credit score to see if theres room for improvement.

Start by requesting your credit reports and looking for errors, which could potentially drag down your credit scores. You can get a free credit report from TransUnion®, Equifax® and Experian every week through April 2021. If you find inaccurate information, file a dispute with the creditor and the credit reporting agency. Getting rid of errors may help boost your credit score.

Next, get to know how credit scores work. Heres a list of what influences your credit score and how to make improvements before applying for a mortgage:

You May Like: What Credit Score Is Needed For Conventional Loan

Make Payments On Time

How do you bring your score back up to its pre-mortgage level? By making on-time payments every time. Dont sign up for those services that say they can raise your credit score fast. Simply make your mortgage paymentsand all other payments, for that matteron time. As you prove that youre a responsible borrower, your score will naturally rise.

Pay your bills on time and in full. If your busy lifestyle sometimes forces bill-paying lower on your priority list, set up an automatic payment through your bank so you never forget.

How To Improve Your Credit Score

So, its clear that a good credit score is one of the more important factors when trying to gain mortgage approval. Since its also a factor in calculating the interest rate youll be given, a favourable score can also save you thousands of dollars over the course of your amortization. Therefore, its best to get your credit score in the best shape you can manage before you apply with any lender. If your score is lower than 600-650, or you would simply like to improve it as much as possible, there are a few simple tricks you can use.

- Paying bills on time and in full

- Do not carry a large amount of unpaid debt

- Use no more than 30% of your available credit card limit

- Dont apply for too much new credit in a short amount of time

- Review a copy of your credit report for mistakes or signs of identity theft

- Consider a secured credit card if youre building from the ground up

Also Check: What Is Auto Loan Interest Rate

First Lets Talk About Credit Scores

Your credit score can range from 300 at the low end to 850 at the high end. A score of 740 or above is generally considered very good, but you dont need that score or above to buy a home. Credit scores are maintained by the national credit bureaus and include debt like credit cards, auto loans or student loans.

Your score is influenced by many factors, but the two biggest are whether you pay your bills on time and how much debt you owe. Having a credit score based on these factors gives lenders a quick way to see if youre likely to pay your future bills like your mortgage, for example.

Mortgage Overlays: Credit Requirements Vary Bylender

A mortgage overlay isan additional mortgage guideline imposed by a lender, which goes beyond theloans official minimum standard.

For example, FHA allows FICO scores as low as 500, but some lenders set their minimums at 620.

According to FannieMae, the majority of mortgage lenders apply mortgage overlays. The most commonoverlay relates to credit scores.

About half of lenderssurveyed apply overlays to the minimum credit score requirements of a mortgageloan. Your 500 FICO score, therefore, may not get you FHA-approved, even if theFHA allows it.

This is why its smartto re-apply for a mortgage if youve recently been denied. Your loan may havebeen turned down, but that could be because of an overlay. Theres a chance you could be approved by a lenderwith looser guidelines.

Apply at a differentbank, you may get better results.

How mortgage lenders pull credit

When you apply for amortgage, lenders pull a credit report from all three credit bureaus on you.Their decisions to lend, and the terms of your loan,;depend;on theresult of those reports.

Lenders qualify youbased on your middle credit score.

For example, if your scores are 720, 740, and 750, thelender will use 740 as your FICO. If your scores are 630, 690, and 690, thelender will use 690 as your FICO.

When you apply with aspouse or co-borrower, the lender will use the lower of the two applicantsmiddle credit scores.

Don’t Miss: Can The Bank Loan You Money

What Low Credit Score Mortgages Are Available

If youre fed up with renting and want to apply for a home loan with bad credit, government-backed mortgage loan programs may help. Furthermore, if you dont have a credit score, theres still a way to get home loan financing.

- FHA loans: For traditional mortgages, the lowest credit score to buy a house is 500. Besides coming up with 10% for a down payment, youll likely need a solid income history, extra reserves and a lower DTI ratio. The FHA program is more commonly offered as a 580 credit score home loan for borrowers with at least a 3.5% down payment.

- VA loans: Although VA home loans dont have a particular minimum, your credit history is still important. If you have a poor credit payment history, other compensating factors such as extra reserves in the bank or a lower DTI ratio may be required.

- Nontraditional credit loans: Recent college graduates might not have enough credit history for a regular credit score. However, they still may be able to get a mortgage with no credit score by proving on-time payments for bills such as rent and utilities.

- Alternative mortgage loans: Recent foreclosures or bankruptcies may knock your credit score down, and in most cases, applicants must wait two to seven years before applying for a new mortgage unless they apply for an alternative mortgage loan. With a large down payment, alternative lenders may offer home loans to borrowers one day after a major credit event with scores as low as 350.

Can I Get A Car / Auto Loan W/ A 600 Credit Score

Trying to qualify for an auto loan with a 600 credit score is very expensive. Theres too much risk for a car lender without charging very high interest rates.

Even if you could take out an auto loan with a 600 credit score, you probably dont want to with such high interest.

There is good news though.

This is completely avoidable with a few simple steps to repair your credit.

Your best option at this stage is reaching out to a credit repair company to evaluate your score and see how they can fix it.

Recommended Reading: How To Calculate Bank Loan

What Credit Score Do You Need To Buya House

You dont need perfect or even good credit to buy a house. In fact, the minimum credit score to get a mortgage is 580 which is considered only fair.

Remember, mortgage lenders dont look at your credit score in a vacuum.

They also look at your credit report, debts, and down payment. The stronger you are in these areas, the more likely you are to get away with a low credit score.

The downside to lower credit is that youll pay a higher interest rate. But many buyers with low scores choose to buy now and refinance for a better rate when their credit improves later on.

How Does Credit Score Determine Loan Type

Conventional loans require that you have a higher credit score, while Federal Housing Administration loans are a bit more forgiving when it comes to your score.

With an excellent credit score, you can expect to pay less for your loan because your interest rate will be lower.;

Not only will a poor score affect your ability to get a loan, but if you do qualify for one, you could be paying thousands of dollars extra over the life of your loan due to a higher interest rate.

Don’t Miss: Who Should I Refinance My Car Loan With

Is There Any Mortgage For Bad Credit

Yes, you can still have an FHA mortgage for bad credit. But once again, the lender will most likely ask you to pay off past dues first.;

Subprime mortgages were most common as they didnt require any type of credit score threshold, before the mortgage meltdown that happened in 2008. But since these loans were the very reason for the Meltdown, they mainly disappeared. However, there are rumours that theyre coming back. Even if they do, it will be on a limited basis.;

Can You Get A Mortgage With Bad Credit

A bad credit score for a mortgage is below 620. While its possible to get a mortgage with a low credit score, youll pay higher interest rates and have higher monthly payments.

If your credit score is lower than the minimum required, you might still be able to get the loan if you add a co-signer to the mortgage, use a larger down payment or lower your debt-to-income ratio.

Don’t Miss: How To Apply For Fha Loan In Illinois

Whats Considered Good Credit For A Mortgage

Although its possible to buy ahouse with only fair credit, youll get a lower mortgage rate and better loanterms with a higher score.

So whats considered good creditfor a mortgage? FICOs credit tiers are a good starting point, as FICO is thestandard scoring model used by mortgage lenders.

- Exceptional credit:800-850

- Fair credit: 580-669

- Poor credit: 300-579

Fortunately, you dont need anexceptional score in the 800-850 range to get a prime mortgage rate. Mosthome buyers dont have credit anywhere near that high.

In fact, the average credit score for closed mortgage loans in 2020 was just under 750.

Fannie Mae and Freddie Mac give the best rates to borrowers with scores above 740

Mortgage lenders understand thatperfect credit is not the norm, and they arent expecting sky-high scores.

Fannie Mae and Freddie Mac, the agencies that back most home loans, give the best rates to borrowers with scores above 740 which means the average buyer in 2020 qualified for prime rates.

Tips To Boost Your Credit Score

If your credit score isnt great, there are still options. Instead of settling for the mortgage rates youre currently qualified for, consider postponing homeownership and working to revive your score and improve your options. Here are some quick tips to help:

Read Also: How To Discharge Student Loan Debt

What Credit Score Do You Need To Buy A House Rocket

Aug 12, 2021 Its recommended you have a credit score of 620 or higher when you apply for a conventional loan. If your score is below 620, you might be;

Apr 22, 2021 Most lenders determine a borrowers creditworthiness based on FICO® scores, a Credit Score developed by Fair Isaac Corporation . This;

What numbers do mortgage lenders look at? Lenders use credit scores to determine a borrowers level of risk. Three credit bureaus Equifax, Experian,;

Jun 11, 2020 Which FICO Score Generation Do Mortgage Lenders Use? · Experian: FICO Score 2, sometimes referred to as FICO V2 or FICO-II · TransUnion: FICO;

Jan 6, 2017 The orders explained that the credit score models most often used by lenders are those developed by Fair Isaac Corporation. You may know these;