How Do I Repay My Student Loan Balance

The earliest youll have to start repaying your loan is 6 April in the year after you finish your course.

If you are employed, repayments are typically taken from your monthly pay at source. They only start once youve started earning above a certain salary threshold. This threshold depends on which repayment plan you are on.

The actual amount you pay will depend on the amount you earn over the threshold during any given pay period. If your income falls below the threshold at any point, then your repayments will pause.

If you are self-employed, HMRC will calculate what you owe each year in repayments once you file your tax return.

Checking Your Federal Student Loan Balance If You Dont Know Your Servicer

If you dont know who your loan servicer is, another option for finding your loan balance is to call up your schools financial aid office. They should have access to this information and be able to tell you.

However, if you have attended more than one school, your current schools financial aid office may not have the total loan balance. In that case, you can go to the FSA website and check your loan information there.

On the website, click Log In if you already have an FSA ID. If you do not, then click Create Account instead. You will be asked to enter your information, including your Social Security number and other data. Once your account is set up, you can expect it to take one to three days before your information is verified and your loan information is viewable.

All federal student loan information is stored in the National Student Loan Data System . When you log into the FSA website, they retrieve your loan information from this source.

How Can I Clear My Student Loan Balance More Quickly

If you want to clear your student loan balance more quickly, you can make single extra payments directly to the SLC on top of the standard repayments you must make when your income is over the threshold amount for your repayment plan.

You can make these extra repayments at any time using your online account, by cheque or by bank transfer.

You also have the right to pay off your outstanding student loan balance in full at any time.

However, before choosing this route, make sure you have first considered how this will affect your financial wellbeing and whether there is another way to make better use of your money.

Also Check: Loan Originator License California

If Youre Having Trouble Repaying

If you need help with repaying your Canada Student Loan, you may qualify for the Repayment Assistance Plan .

If youre having trouble repaying a provincial student loan, contact your student aid office. For repayment assistance with a loan or line of credit provided by your financial institution, contact your branch to determine what your options are.

Understand that by making your payments smaller, it will take you longer to pay back your loan. Youll end up paying more interest on your loan.

If you consider refinancing or consolidating your student loan, note that there are important disadvantages.

If you transfer your federal or provincial student loan to a private lender, you will lose any tax deductions on your student loan interest. You wont qualify for the interest free period while you’re in school and will end up paying more interest over time.

What Is The National Student Loan Data System

The NSLDS shows your loan balance, type of loan and repayment status. For example, the NSLDS shows whether you are in grace period, repayment, forbearance, deferment or paid off. You can also understand which loans are subsidized or unsubsidized. Unfortunately, the NSLDS will not show you information regarding your private student loans or Parent PLUS Loans.

Also Check: Mortgage Commitment Fee

Why You Need To Know Your Student Loan Balance

How much do I owe in student loans? is a common question. You know you borrowed money to fund your education, but the exact amount might be unclear. You might even be in denial about how much you really owe and want to ignore your loans.

Trust me, I know how comforting it is to be in denial. But from experience, it will catch up with you, so facing your student loan debt head on is best.

Its important to know your student loan balance for various reasons:

- You know the exact amount you owe.

- You have the information for your accounts, so you dont miss a payment.

- You can create a plan of attack once you know your student loan balance.

- You can review your monthly payments and interest rate.

Knowing all of this and taking action can help you pay back your loans, avoid delinquency and default, and be in control of your debt. If youre experiencing financial hardship and your monthly payment amounts are high you can look into deferment, forbearance, or other repayment plans such as income-driven repayment.

If you have federal student loan debt, you may also look into Public Service Loan Forgiveness . To streamline repayment, you may consider consolidation loans or even refinancing to lower your interest rate.

While it can be tough to learn your student loan balance and see that number in front of you, doing so can help you create a clear plan with your student loan payments. Do you need help with your student loans? Get in touch for a custom plan.

Learning How Much You Owe In Student Loans

What you originally borrowed to pay for school is likely not what you owe now. Unfortunately, you probably owe more.

Unless you have federal subsidized loans or made in-school payments, your balances grew over the years due to interest. Depending on your rate, you could end up owing hundreds or even thousands of dollars more after graduation than what you originally borrowed.

To find out what you owe with the accrued interest, try out some of the following tools for tracking your federal and private student loans.

Don’t Miss: How To Get An Aer Loan

How Do I Consolidate Student Loans

The process for consolidating your student loans depends on whether you have private or federal student loans. If you have private loans or want to combine private and federal loans into one, you’ll need to refinance them with another private loan. You can consolidate multiple federal loans into one new federal loan through a Direct Consolidation Loan, which you can set up through the Federal Student Aid website.

Why You Should Track Your Student Loans

While it might seem complicated, it is essential to keep track of your student loans and the amount of debt you owe, including knowing how much you borrowed and how much you owe once you add interest. This can be helpful while you are in college, and as you start your budgeting process after graduation. Many options exist for repayment plans, including the following:

- Standard plans: Payments are calculated to guarantee loans are paid off within 1030 years.

- Graduated plans: These are designed to ensure loans will be repaid within a certain amount of time, but payments will increase gradually over time.

- Income-based: These repayment plans calculate your monthly payments based on how much you earn, with higher wages equaling higher payments.

Once you have a solid number to start with, you can begin to create a repayment plan to get rid of that debt as quickly as possible. You can develop a repayment plan that works for your salary and lifestyle and pays down the debt quickly to save you money over time. You can always contact your loan servicer to update your payment plan if your situation changes. This does not have a negative impact on your credit.

Also Check: How To Transfer Car Loan To Another Person

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Get A Loan Out Of Default

| Loan | ||

|---|---|---|

| The collection agency listed on your collection notice |

You can confirm which collection agency holds your account by calling: |

|

| Ontario Student Loans | The collection agency listed on your collection notice | You can confirm which collection agency holds your account by calling the Account Management and Collections Branch, Ministry of Finance: |

Learn how you could be eligible for financial relief and how the deferral may apply to your debt.

Read Also: Va Manufactured Home 1976

Health Resources And Services Administration

If you have medical-specific loans, you may have gotten them through the Health Resources and Services Administration . If you have specific questions about your existing HRSA loans, you can contact the HRSA. This way, you can find your student loan balance and get information for medical-specific loans that may have been administered by the HRSA.

Policymakers Must Reconsider The Path Before And After Default

These findings show that the federal government must study the path students take into and out of default more thoroughly and comprehensively. For instance, the long lag between entering repayment and default suggests that, in some cases, deferment or forbearances may not help with long-term payment success but rather delay bad outcomes. If that is the case, policymakers must consider other interventions for delinquent and at-risk borrowers.

Similarly, policymakers must take a closer look at the effectiveness of options to get students out of default. This should start with understanding how defaulters pay off their loans. For instance, are they doing so due to the seizure of a tax refund? Are they burning through an emergency savings cushion, putting themselves at greater risk should other financial challenges arise? This has implications for considering whether a bigger push for getting students back on a regular, affordable payment schedule may be better for them. Finally, policymakers should also look at how successful rehabilitation is at preventing redefault, compared with consolidation.

Policymakers should also consider how the options to get out of default are presented to borrowers. Are student loan collection agencies effective at guiding borrowers to their best path out of default? Do the incentives for collection agencies best align with borrower success, or would those functions be better handled by loan servicers?

You May Like: Aer Scholarship For Spouses

Keeping Track Of Your Total Student Loan Balance While In School

Its always a good idea to keep track of your student loan balance as you go through school. After all, you dont want to end up with a surprise upon graduation.

As you borrow money, you should never borrow more than you need. If there are other ways to fund your education through scholarships or grants, or even savings from a summer job, it can save you considerably in the long run.

Its also a good idea to keep track of which loans are subsidized or unsubsidized. This is because unsubsidized loans gain interest, and after several years in school, that interest might be considerable.

When it is time to start repaying your loans, all unpaid interest becomes capitalized, meaning it is added to the total loan balance and will gain interest itself.

To avoid interest accrual and capitalization on your unsubsidized loans, you may want to pay off the interest as you go. Then, the balance will not grow while you are in school and be more manageable after graduation.

What If I Forgot My Fsa Id

Not to worry.

If you entered and verified an email address and/or cell phone number when you signed up for your FSA ID originally, a code will be sent to either one to help you retrieve it.

Alternatively, you will have to answer a few challenge questions to verify your identity.

The last resort if neither of the two processes above work will be to call Federal Student Aid Information Center at 1-800-4-FED-AID .

Read Also: Genisys Loan Calculator

Include Payments In Your Budget

Build your student debt payments into your budget and make payments that are larger than the minimum payments. You can also speak with your financial institution about setting up automatic payments.

When planning your budget and automatic payments, make sure you know when your payments are due. Remember that if you have more than one loan or line of credit, you may have more than one payment due date.

Log On Your Student Loan Account

The federal government outsources student loan management to several different companies, and you may have student loans with multiple providers. If you already know who your student loan servicers are, you can log on to their websites to view your total balance. The balance may be listed on your most recent statement or on the main dashboard.

If you’re having trouble finding the balance, contact the customer service department and ask them where to look.

Once you’re logged in, you can view your total balance. Your balance may change throughout the month if your loans are deferred, and the lender is still charging you interest during this time.

You May Like: How To Find Student Loan Number

How To Find The Balance On Your Private Student Loans

Retrieving balances on private loans is a little trickier than finding information on federal loans. Theres no national website for private student loans like there is for federal loans. Also, the financial institution that originally issued the loan might outsource the loan servicing elsewhere or sell your loans to a different entity.

However, there are other ways to find your private loan balances:

- Ask your original lender : Your original lender is always the best place to begin this search. Hopefully, youve kept your original loan documents with the lenders contact information. One phone call should help you find your student loan balance and current servicer.

- Ask your school for help: If youre having trouble tracking down your loans, talk to your universitys financial aid office. They can help you identify who currently manages your debt.

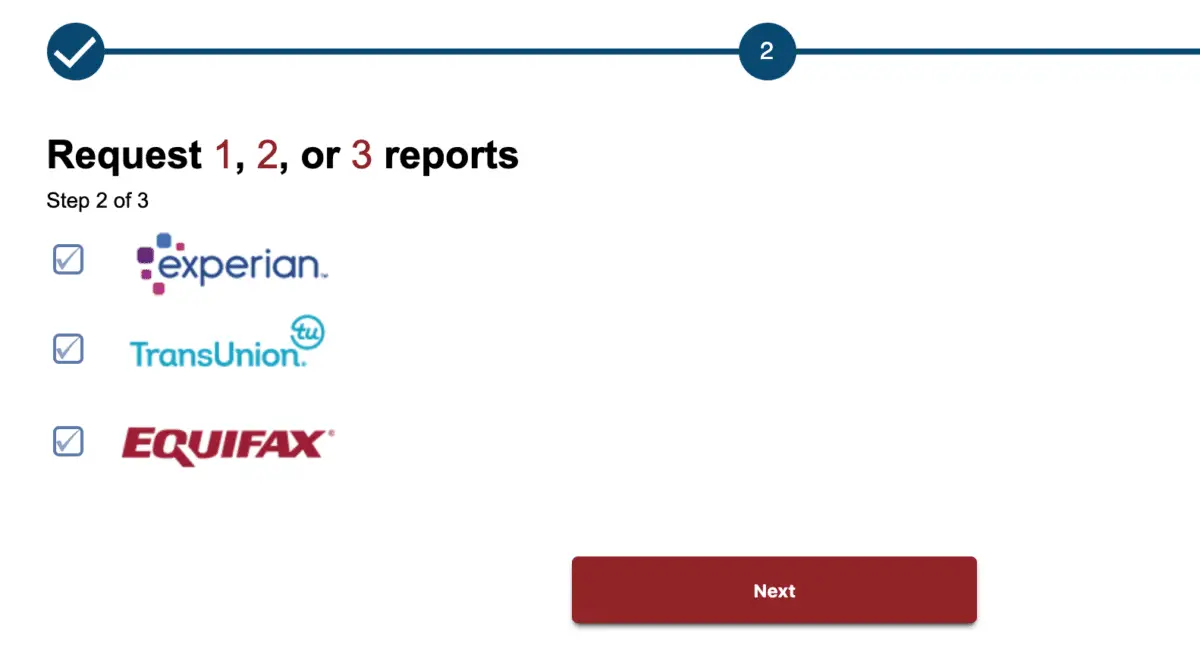

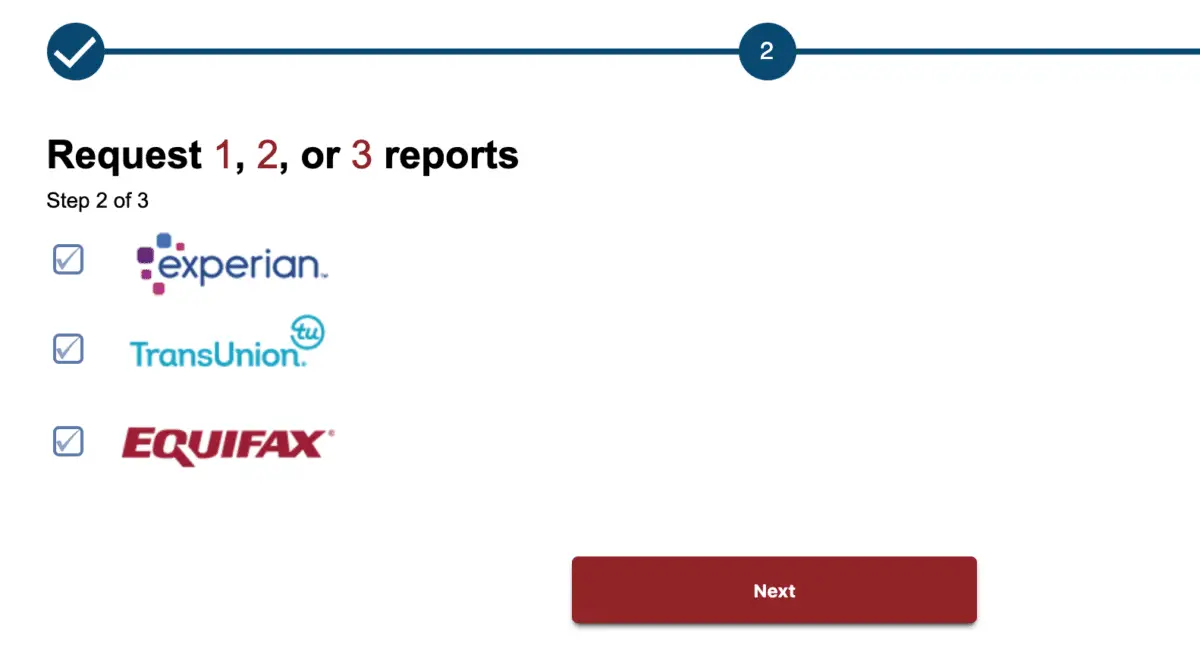

- Check your credit report: Credit reports list all of your current and past credit obligations, including student loans. It will list the amount you borrowed and the loan servicer, which you can then contact to find the status of your account or to make payments. You can get a free credit report from the three main credit reporting agencies Experian, TransUnion and Equifax by visiting AnnualCreditReport.com.

Checking Your Private Student Loan Balances

Each private student loan lender handles them differently theres no national database for private loans. If youre unsure where to start, use these tips:

Recommended Reading: How To Transfer A Car Loan

Who Needs To Start Repaying

You may need to start paying back your OSAP loan six months after your study period ends.

Youll be making payments to the National Student Loans Service Centre , not to OSAP.

You dont need to start paying back your OSAP loan if your school confirms your enrolment for the next study period and we approve your application for one of the following programs:

- OSAP for Full-Time Students

If you received loans through the OSAP micro-credentials program, learn about repayment for micro-credentials programs.

Managing Your Student Loans

While it may sound complex, learning how to answer How much do I have in student loans? is an important first step in managing your debt. Once you know how much you owe and who your loan servicers are, you can come up with a repayment plan that works for you.

If you want to pay off your debt as quickly as possible so you can save money, check out these strategies that can help you pay off your student loans faster.

If youre wondering how long itll take to pay off your student loans, enter your current loan information into the calculator below to find out. Use the slider to see how increasing your payments can change the payoff date.

Enter loan information

You May Like: How Much Do Mortgage Officers Make

Finding How Much You Owe In Student Loans

Finding your student loan balance is important for a few reasons.

First, because of interest, your current student loan balance may be higher than when you originally took out your loans if youre just starting to make payments. Knowing your current balance helps you shape your budget and determine whether you still have a good rate.

Its also possible that your lender – the company that distributes and processes your loans – has transferred or sold your loans to another lender. Keeping up with your student loan information helps you know where to send payments.