What Is The Maximum Income To Qualify For Financial Aid 2021

For 2021, if your familys adjusted gross annual income is less than $27,000 and your EFC is calculated at zero, then you may receive the maximum amount in Pell Grant funding of $6,495 per year. You can determine your Pell Grant funding based on Cost of Attendance and Expected Family Contribution.

Federal Borrowing Limits For Graduate Students

| $138,500 | $65,500 |

Your federal borrowing limits are higher if youre working on a masters or doctorate program, including an M.A., MBA, M.D., J.D., or Ph.D.

The annual borrowing limit for grad students is $20,500 a year, and you can borrow up to $138,500 in total, including the loans you took out as an undergraduate. Since July 1, 2012, grad students arent eligible to take out subsidized loans anymore. But its possible for grad students who took them out before then to have up to $65,500 in subsidized loans.

Medical school students can take out up to $224,000 in federal loans before turning to grad PLUS or private student loans. For most medical school students, the annual borrowing limit on the more affordable federal student loans is $40,500.

Learn More: Graduate Student Loan Limits: How Much Can You Get?

What Happens If I Reach My Lifetime Limit

If you reach your lifetime loan limit, you cannot receive any more of that type of loan. If you exceed your limit, aid already disbursed will be billed back. You will have to find alternate ways to finance your education. Therefore it is to your advantage to borrow only what you need for educational expenses, and to keep track of your cumulative debt. Our counselors are happy to work with you to find ways to minimize your borrowing.

Also Check: Apply For Second Upstart Loan

Studying At A Private Institution

If you study at a private institution, you should be aware that that you may not receive the full tuition fee loan support to cover your tuition fees.

You will be responsible for funding the difference in the additional cost of your tuition fees. You should find out what tuition fees are charged by the private institution and what tuition fee loan support is available from your local Student Finance NI office before you start the course.

Read Also: Advance Auto Parts Loaner Tools

How Do I Apply For A Loan

Students who want the option of taking out a student loan must submit the Free Application for Federal Student Aid form. Your college bases its financial aid offer on information in the FAFSA form, and their offer may include federal student loans. You can choose to accept the offer or deny all or part of the offer.

Read Also: Usaa Rv Buying Service

How Much Should You Borrow In Student Loans

You should borrow as much as you need and not necessarily all that lenders make available to you. The more you borrow now, the more student loan debt youll have to pay off laterwith interest.

To determine how much you should borrow in student loans, calculate your cost of attendance. This includes:

- Tuition and fees

- Room and board or other living expenses

- Books

- Supplies and technology costs

- Loan fees

- Transportation

If your cost of attendance is less than what youd get from the maximum federal student loan limit, borrow only what you need.

If your cost of attendance exceeds what youll receive from federal student loans, you may need to tap into other resources. This includes private student loans or borrowing money from friends and family. If a certain college is just too much of a stretch financially, consider less expensive schools. Use resources like collegesnet price calculators on their websites to determine how much theyll cost you after taking into account grants and scholarships you could receive.

You also can set how much you borrow based on your anticipated future earnings, which might be a bit harder to estimate. But if you know the starting salary of your future post-graduate position, that can help you determine what you can afford when the time comes to repay your student loans. Some experts recommend limiting your total student loan borrowing to the amount you plan to earn your first year out of school.

Can Students Get Loans Without Parents

You can get a private student loan without a parent, as well, but theres a pretty big catch. Private student loans generally require a creditworthy cosigner, but the cosigner does not need to be your parents. The cosigner can be someone else with very good or excellent credit who is willing to cosign the loan.

You May Like: Ida Auto Finance

What Student Loan Borrowers Need To Know About Filing Taxes In 2022

There are thousands of financial products and services out there, and we believe in helping you understand which is best for you, how it works, and will it actually help you achieve your financial goals. We’re proud of our content and guidance, and the information we provide is objective, independent, and free.

But we do have to make money to pay our team and keep this website running! Our partners compensate us. TheCollegeInvestor.com has an advertising relationship with some or all of the offers included on this page, which may impact how, where, and in what order products and services may appear. The College Investor does not include all companies or offers available in the marketplace. And our partners can never pay us to guarantee favorable reviews .

For more information and a complete list of our advertising partners, please check out our full Advertising Disclosure. TheCollegeInvestor.com strives to keep its information accurate and up to date. The information in our reviews could be different from what you find when visiting a financial institution, service provider or a specific product’s website. All products and services are presented without warranty.

Plus, H& R Block Free Online is one of the most robust free filing options for simple returns and includes the student loan interest deduction. Check out H& R Block here > >

5 Tips For Filing Taxes With Student Loans In 2022

Ascent Student Loans Disclosures

Ascent loans are funded by Bank of Lake Mills, Member FDIC. Loan products may not be available in certain jurisdictions. Certain restrictions, limitations and terms and conditions may apply. For Ascent Terms and Conditions please visit: AscentFunding.com/Ts& Cs.

Rates are effective as of 10/01/2021 and reflect an automatic payment discount of either 0.25% OR 1.00% . Automatic Payment Discount is available if the borrower is enrolled in automatic payments from their personal checking account and the amount is successfully withdrawn from the authorized bank account each month. For Ascent rates and repayment examples please visit: AscentFunding.com/Rates.

1% Cash Back Graduation Reward subject to terms and conditions, please visit AscentFunding.com/Cashback. Cosigned Credit-Based Loan student borrowers must meet certain minimum credit criteria. The minimum score required is subject to change and may depend on the credit score of your cosigner. Lowest APRs are available for the most creditworthy applicants and may require a cosigner.

Recommended Reading: What’s Needed To Qualify For A Home Loan

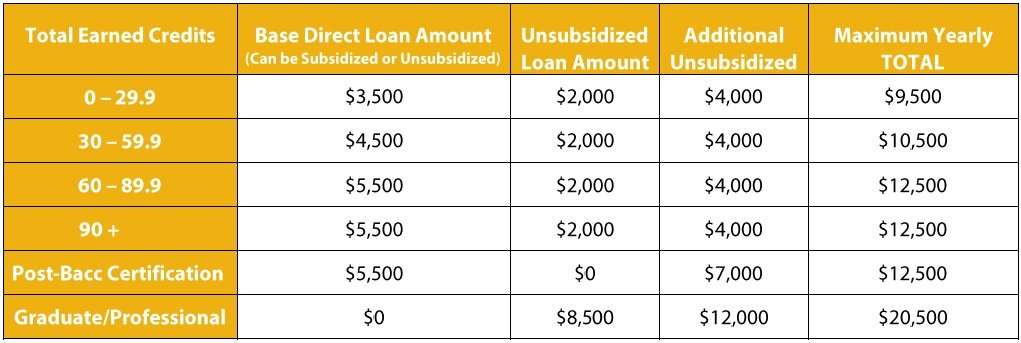

Direct Subsidized & Unsubsidized Federal Student Loan Limits

How much can you get in student loans from the federal government? If you are planning on taking out Direct Subsidized or Unsubsidized Loans, you should know that there are limits on how much you can borrow each year and aggregate loan limits.

The aggregate loan limit is how much you can borrow in total to pay for your undergraduate and graduate education.

As of the 2020-2021 academic year, the following student loan maximums apply:

Need Help Talk To A Tax Professional

Tax season is likely not your favorite time of the year. Unfortunately, the process of amassing documents and filing your taxes isnt always fun. If student loans are a part of your financial picture, then you may need help sorting through all of your options. Luckily, you dont have to go it alone. Instead, you can talk to a tax professional. Competent tax professionals can guide you through the process. It is easy to meet with a helpful tax professional virtually at H& R Block Online, or in person at one of more than 10,000 branches nationwide.

With the help of an H& R Block tax professional, you can avoid the headaches involved with filing your taxes alone. Plus, youll have the peace of mind that comes with a professional experience. If you have student loans and want to file your taxes without any doubts,reach out to H& R Block today.

Read Also: Is Usaa Good For Auto Loans

% Subsidized Loan Limit

Below are the maximum lengths of time a student can receive Direct Subsidized Loans for depending on their academic program. If a student reaches the 150% Subsidized Loan Limit, they are no longer eligible to borrow any additional Direct Subsidized loans. Also, if they continue attending, they will lose the interest subsidy on their previously borrowed loans beginning on the first day of continued enrollment.

|

Length of Degree Program |

|

7.5 Years |

Maximum For Unsubsidized Direct And Plus Loans

Cost of Attendance

+ $2,500 Maximum Unsubsidized loan

= $7,500 Maximum Direct loan

A dependent students maximum eligibility, whether it subsidized or a combination of subsidized and unsubsidized loans, cannot exceed the amounts shown above. Independent students, however, are eligible to borrow additional funds from the Unsubsidized Direct Loan program. In cases where the parents of the dependent student are denied eligibility for the Parent Loan for Undergraduate Students due to a negative credit history, the dependent student may borrow additional funds from the unsubsidized loan program. Student borrowers do not need a co-signer and there is no credit check done by the federal government.

Frequently Asked Questions

How do I apply for a Stafford Loan?

The same way you do the other federal student aid, by completing the Free Application for Federal Student Aid . You will need to submit a loan request form to your CUNY college to get a Stafford loan processed. You will also need to sign a promissory note, a binding legal document that states you agree to repay your loan according to the terms of the note.

What is my repayment period?

The repayment periods for Stafford Loans vary from 10 to 30 years depending on which repayment plan you choose. When it comes to repayment you can pick a repayment plan thats right for you. You can get more information about repayment by going to the U.S. Department of Education web site www.studentaid.ed.gov.

What if I cant make my payments?

Don’t Miss: Student Loans Fixed Or Variable

Cost Of Attendance Loan Limits

Your financial aid office is not allowed to offer you financial aid in excess of your cost of attendance. Your cost of attendance is determined by your school for each academic year you are enrolled. The cost of attendance will include costs like, tuition, fees, as well as, housing, meals, transportation, etc. Now to apply this to the way you’re awarded financial aid. Your school will typically add student loans to your financial aid offer after they apply your scholarships, grants, and work-study aid. Meaning, the cost of attendance limit is your cost of attendance minus other financial aid received.

The cost of attendance limit may be applied in addition to the annual loan limit. This loan limit is intended to prevent the total of all financial aid, including the student loans, from exceeding your school’s determined cost of attendance.

Not Enough Consider These Alternatives

Talk to your schools financial aid office about which alternatives might be available to you. These might include:

- Scholarships and grants. You might be eligible for additional funding besides the work study and scholarships you got through the FAFSA.

- Extra employment. Getting a part-time job or even a side gig could help offset some of your personal and educational expenses before you get a loan.

- Personal loans. You can apply for a personal loan with a cosigner if youre out of other options though its less flexible and often more expensive than a student loan.

- Dropping to part time. Still cant cover your costs this semester? Dropping to part time can lower your tuition costs. Just dont drop below part time then you wont be eligible for most student loans and you could trigger repayments.

Dont borrow more than you need

Just because you can borrow up to a certain amount per year doesnt mean you necessarily should. If you need help covering personal expenses like housing, transportation and food, budget out how much you need first before borrowing the maximum amount youre eligible for.

Also Check: How To Get A Mortgage License In California

Your Nationality And Residency Status

Nationality and residency status is undoubtedly the murkiest of all the eligibility criteria, and its the one that tends to catch students out the most.

As a general rule, you should be eligible to receive a Maintenance Loan if youre a UK national , normally live in the UK and have done so for the three years prior to the start of your course.

But its worth noting that all three of those things must apply to you to guarantee your eligibility. There are countless stories of students who were born and raised in the UK but moved to, say, the USA at 11-years-old and assumed that theyd be eligible for a Maintenance Loan as a British citizen. No dice.

In some instances, you may be able to successfully appeal and receive a Maintenance Loan anyway to do this, youll often need to prove that youve retained economic ties to the UK in your absence , or that one/both of your parents had to move abroad for work.

There are also special exceptions made for specific groups, including refugees and stateless people.

As we said earlier, its best not to let these eligibility criteria confuse you too much.

We stand by our statement that the majority of students at the majority of universities will be eligible to receive a Maintenance Loan especially if youve been studying at a school in the UK and will be attending a relatively well-known university.

But, as ever, if youre unsure, its best to contact your funding body and ask them to clarify things for you.

Is It Possible To Get No Money From Fafsa

If you completed the FAFSA and didn’t receive financial aid, there a could be a few problems you need to address. You did not complete the correct FAFSA. If you’re selected to complete verification, it’s required that you provide your financial aid office additional information before they can award you financial aid.

You May Like: Capital One Auto Loan Private Seller

Student Loan Origination Fee Update

The U.S. Department of Education recently decreased the student loan origination fees for Direct Subsidized and Unsubsidized loans and for Parent PLUS loans. These decreases will take effect for loans first disbursed on or after October 1, 2020 and prior to October 1, 2022.

Due to federal sequestration, Subsidized and Unsubsidized origination fees will be 1.057% of the loan principal. Parent PLUS origination fees will be 4.228% of the loan principal.

There are examples available of how the student loan fee is calculated.

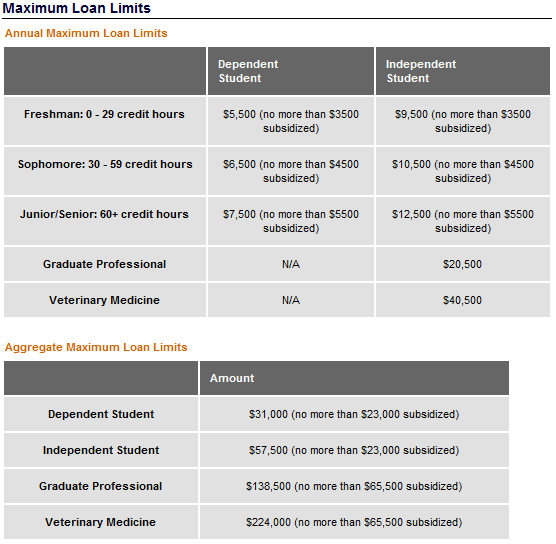

What Are Current Annual And Aggregate Student Loan Limits

If youre a college student or the parent of one, you should be aware of the Department of Educations federal student loan limits. These limits could affect how you plan to pay for college.

So how much can you borrow through federal student loans? Lets examine two types of limits:

There are two main limits on direct subsidized loans and direct unsubsidized loans:

- Annual federal student loan limits: how much you can borrow for each school year.

- Aggregate federal student loan limits: how much you can borrow throughout your time in college or graduate school.

For undergraduate students, annual federal student loan limits are determined by your year in school and your dependency status.

| Dependent Undergraduate Student | Graduate and Professional Degree Student | ||

|---|---|---|---|

|

First Year |

A maximum of $3,500 may be subsidized |

$9,500 A maximum of $3,500 may be subsidized |

$20,500 |

|

A maximum of $4,500 may be subsidized |

$10,500 A maximum of $4,500 may be subsidized |

$20,500 | |

| Third, Fourth, and Fifth Years |

$7,500 A maximum of $5,500 may be subsidized |

$12,500 A maximum of $5,500 may be subsidized |

$20,500 |

|

A maximum of $23,000 may be subsidized |

$57,500 A maximum of $23,000 may be subsidized |

$138,500 The graduate debt limit includes direct loans received for undergraduate study. |

*These limits may also apply to dependent students whose parents are denied for a parent PLUS loan.

Also Check: Capital One/auto Pre Approval

What Are Plus Loans

These are federal direct loans that are made to parents of dependent undergraduate students, as well as to graduate or professional students enrolled in school at least half time. PLUS loans don’t have a cap on the amount that can be borrowed, but you can’t borrow more than the cost of attendance at the specific school youor your child, if you’re the parentsare attending. This kind of loan does have drawbacks, so research them carefully.

Federal Borrowing Limits For Dependent Undergraduates

| Year in school | |

|---|---|

| $31,000 | $23,000 |

If you depend on your parents for support, youre considered a dependent student. Dependent undergraduate students can take out $5,500 to $7,500 in federal student loans each year in theyre in school, up to a total limit of $31,000. If your family qualifies, up to $23,000 of your total borrowing can be in subsidized loans.

If you hit your annual or total borrowing limit and your parents cant qualify for a PLUS loan, the higher loan limits for independent undergraduates apply.

Don’t Miss: Usaa Pre Approval For Mortgage