Whats Next: Is An Fha Loan Right For You

If youre considering an FHA loan, here are a few more things to think about before you apply.

- Whats my budget for a home?

- How much money can I put toward a down payment?

- Whats my credit like?

- Do I want to buy a fixer-upper? A new build?

- Am I OK paying more each month for mortgage insurance?

- Do I have a preferred lender?

You should shop carefully among lenders to find the loan thats best for your situation and consider all of your options before making a long-term commitment.

About the author:

Read More

What Exactly Are Fha Loans

An FHA loan is a type of mortgage which is guaranteed by the FHA or Federal Housing Administration. The reason that this is important is that, since it is backed by the government, lenders are more likely to approve them.

When you apply for a traditional mortgage, lenders are putting themselves at risk. If you were to default on your mortgage, they are stuck dealing with the financial fallout. The money that they loan you is lost until they sell the property or go through some other means. This is why they require such high qualifications to ensure they are minimizing their risk.

With an FHA loan, lenders arent putting their money at such a high risk. They know that if you default on your mortgage, the government will take care of everything, so they do not lose the money they lend to you.

Imagine a friend asking you to borrow money. You want to loan it to them, but maybe you know that their repayment history isnt the greatest. You worry you wont get your money back, so you turn them down.

What if that same friends mom promised to repay you if your friend couldnt, though? You know their mom is true to her word she just doesnt have the funds on hand to loan them at the moment. However, you know she has it and has always taken care of things that she promised to do.

Who Can Qualify For An Fha Loan

There are certain requirements that a person needs to meet in order to be eligible for an FHA loan. There are certain minimum standards set by the FHA, but the private lenders might have their own rules. Generally, you will need to have a credit score of at least 500. However, there will usually be a higher down payment that you need to make if your credit score is below 580.

If your credit score is at least 580, the down payment can often be just 3.5%. However, this can rise to 10% of the home price if you have a lower credit score. There is the option to use gift money as a way to make the down payment for the FHA loan, which is useful. In terms of the minimum required debt to income ratio, it needs to be lower than 50. There are also minimum requirements that the home you are looking to purchase has to meet.

The FHA will need an appraisal that is outside of the regular home inspection. The FHA needs to be confident that this will be a good investment for the borrower. Finally, there will be FHA mortgage insurance that is built into each loan. An upfront mortgage insurance payment has to be paid when you obtain an FHA mortgage. There will then be monthly payments necessary in some cases.

Also Check: 84 Month Auto Loan Usaa

What Are The Benefits Of An Fha Loan

The biggest benefit of having an FHA loan is that borrowers can usually purchase a home with a smaller down payment than what is required by most conventional loan programs. FHA loans also make it a little easier for people to qualify for a mortgage when compared to a conventional loan. They allow people to buy a home with a down payment as small as 3.5%, compared to the usual 20% to 30% down required by conventional loans. This makes home ownership more available and more affordable for low to moderate income families. Plus, FHA doesnt allow a lender to charge for unnecessary fees.

In addition to the lower down payment requirement, FHA loans have other benefits, too. For example, its easier to use gifts from friends or family to cover down payment and closing costs, and theres no prepayment penalty. This is a giant advantage for subprime borrowers. If you do qualify for an FHA loan, it may be assumable, and the FHA offers some leniency during tough financial times.

Benefits Of An Fha Loan

- Easier to Qualify FHA provides mortgage programs with lower requirements. This makes it easier for most borrowers to qualify, even those with questionable credit history and low credit scores.

- Competitive Interest Rates FHA loans offer low interest rates to help homeowners afford their monthly housing payments. This is a great benefit when compared to the negative features of subprime mortgages.

- Bankruptcy / Foreclosure Having a bankruptcy or foreclosure in the past few years doesn’t mean you can’t qualify for an FHA loan. Re-establishing good credit and a solid payment history can help satisfy FHA requirements.

- Determining Credit History There are many ways a lender can assess your credit history, and it includes more than just looking at your credit card activity. Any type of payment such as utility bills, rents, student loans, etc. should all reflect a general pattern of reliability.

After learning about some features of an FHA mortgage, undecided borrowers often choose FHA loans over conventional loans because of lower down payment requirements, better interest rate offerings, and unique refinance opportunities.

Read Also: Capital One Auto Loan Approval

More Good News About Fha Loans

Here are some more pros to FHA loans:

-

They have no prepayment penalty.

-

You can use gift funds and down payment assistance programs to help pay for the down payment and closing costs.

-

Sellers can pay toward your closing costs.

-

There are no household income restrictions.

-

Co-signers and non-occupying homebuyers can apply with you.

-

You can purchase manufactured homes.

-

For borrowers with student loans, the FHA recently lowered the balance percentage that counts toward your overall debt profile from 1% to 0.5%.

Fha Vs Conventional Loans

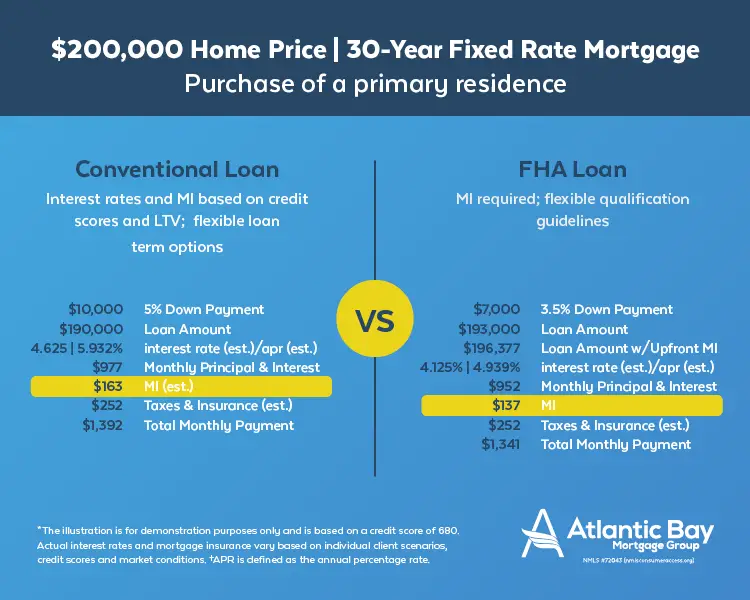

A conventional loan is a common alternative to an FHA loan. Though conventional mortgages require a stricter set of financial qualifications, they also typically come along with lower interest rates. Lets take a closer look at some of the differences between conventional and FHA loans.

Read Also: Capital One Pre Approved Car Loan

Bottom Line: Are Fha Loans Good

An FHA loan is a good idea for homebuyers who have a low to moderate income and may not have funds available for a large down payment. Homebuyers with good credit only have to put down 3.5% with an FHA loan. Conventional loans often require a much larger down payment.

This type of loan is also a good idea for homebuyers with less-than-perfect credit because FHA loans have lenient credit score requirements. If you are looking to move into your home fast, an FHA loan is a good option.

If you prefer the benefits of a conventional loan but dont quite qualify for one yet, we recommend you work on improving your credit score and getting out of debt. Even waiting a year or two can make all the difference in your credit score and other qualifying criteria.

- Article sources

- ConsumerAffairs writers primarily rely on government data, industry experts and original research from other reputable publications to inform their work. To learn more about the content on our site, visit our FAQ page.

- US. Department of Housing and Urban Development . FHA Mortgage Limits,. Accessed January 28, 2021.

- US. Department of Housing and Urban Development . Local Homebuying Programs,. Accessed January 28, 2021.

- US. Department of Housing and Urban Development . Lenders Guide to the Single Family Mortgage Insurance Process,. Accessed January 28, 2021.

Why Would The Fha Pre

FHA loans are easier to qualify for but not everyone who applies for an FHA loan will get approved. These are a few of the reasons we have encountered which resulted in pre-approvals getting denied:

- A bankruptcy within the past two years

- A foreclosure within the past three years

- No two-year work history

- Unable to document income or income that is documented is too low

- The proposed property to be financed is not the primary residence

- No down payment

These situations above occur but in some instances like the down payment issue, there are ways to still get the financing that you need. .

Recommended Reading: Usaa Loans For Bad Credit

Fha Loan Down Payments

Your down payment is a percentage of the purchase price of a home, and is the upfront amount you put down for that home. The minimum down payment youre able to make on an FHA loan is directly linked to your credit score. Your credit score is a number ranging from 300 to 850 thats used to indicate your creditworthiness.

An FHA loan requires a minimum 3.5% down payment for credit scores of 580 and higher. If you can make a 10% down payment, your credit score can be in the 500 579 range. Rocket Mortgage® requires a minimum credit score of 580 for FHA loans. A mortgage calculator can help you estimate your monthly payments, and you can see how your down payment amount affects them.

Note that cash down payments can be made with gift assistance for an FHA loan, but they must be well-documented to ensure that the gift assistance is in fact a gift and not a loan in disguise.

Documentation Needed For Your Fha Pre

The FHA lender will be looking at the following documentation as part of their pre approval process.

All of this information above will be used to determine what your maximum loan amount is for an FHA loan today.

*Monthly Liabilities On your credit report, you will see a column which indicates what your minimum monthly payment is for all of your liabilities. You may see a car payment and minimum required payment for your credit cards. Add all of these monthly payments together and that will be your total monthly liabilities.

Read Also: Capitalone Com Auto Pre Approval

Types Of Fha Home Loans

There are several different types of FHA loans. The type of FHA loan you choose limits the type of home you can buy and how you can spend the money you receive. This makes it especially important to be sure that youre getting the right type of loan. If none of the following loan types match your goals, you might want to consider another type of government loan.

Lets look at a few different FHA loan classifications.

Is An Fha Loan Right For You

If youre still debating the merits of an FHA loan compared to a conventional loan, you should know that a conventional loan is not government-backed. Conventional loans are offered through Fannie Mae or Freddie Mac, which are government-sponsored enterprises that provide mortgage funds to lenders.

They have more stringent requirements, so keep in mind that youll need a higher credit score and a lower DTI to qualify. FHA loans, on the other hand, are nonconforming loans, meaning they dont satisfy Fannie Mae or Freddie Macs requirements for purchase.

Regardless of whether you choose a conventional or FHA loan, there are a few other costs of which youll need to be aware. You’ll have to pay closing costs, which are the fees associated with processing and securing your loan. These can vary depending on the price of the house and the type of mortgage, but you should budget 3% 6% of your homes value.

You should also budget 1% 3% of your purchase price for maintenance. The exact percentage is going to depend on the age of the house. If your house is newer, odds are less things are likely to break right away. Meanwhile, if the house is on the older end, you may need to set aside more. Finally, if you live in an area with homeowners association fees, youll end up paying for those on a monthly or yearly basis.

You May Like: Usaa Rv Buying Service

Advantages Of An Fha Home Loan

The FHA loan is the most popular government-backed home loan in the country. These low down payment loans are made by qualified lenders and guaranteed by the Federal Housing Administration .

FHA loans require just a 3.5% down payment for borrowers with a 580 credit score or higher. For homebuyers with less-than-perfect credit, FHA loans offer additional significant benefits. The government backing means average FHA interest rates are typically lower than average rates for conventional mortgages.

Borrowers with credit scores as low as 500 can qualify for an FHA loan with a 10% down payment. Guidelines and policies will vary by lender.

This historic home loan program continues to open the door to homeownership for millions of Americans who might struggle to secure conventional financing.

How Long Is A Fha Well Water Test Good For

A disinterested party, such as a professional water testing company, will test the water and issue a certificate confirming that the water quality meets local minimum requirements. These results are valid for 90 days and must be submitted to the FHA within this period.

How long are well tests good for?

Q. How often should I get tested? Many state and federal governments recommend annual water testing for coliforms and nitrates. Other contaminants should be tested at least every five to ten years.

How long is an FHA approval good for?

The FHA evaluation is valid for 120 days. Eligible borrowers may receive a 30-day extension. The FHA appraisal process usually takes the same amount of time as a conventional mortgage.

Don’t Miss: One Main Financial Bill Payment

Where Can You Apply For An Fha Loan

Most banks and other mortgage lenders offer FHA loans. However, their lending standards, and the fees and rates they charge, can vary significantly from lender to lender, so it’s important to shop around and compare rates and terms that lenders will offer you. One way to do that is by using the from at the top of this page to request free rate quotes from several lenders at once.

Once you choose a lender, there are two ways you can apply for an FHA loan. You can go to the bank itself, obtain the necessary application forms, fill them out either there or at home, then submit them to your loan officer for review.

However, many lenders now allow you to apply for an FHA loan online as well. You log into a special section of the lender’s web site where you can complete the necessary forms, scan or otherwise obtain electronic copies of the documentation required, and submit the whole thing electronically. Your loan officer can then review your FHA loan application and let you know if other information is needed, which you can conveniently submit from home.

Keep in mind that an FHA loan doesn’t issue the loan itself, but ensures lenders are in line with the generous rates and that all the advantages are presented to the borrowers.

How Do I Qualify For An Fha Loan

To get an FHA loan, you must meet some requirements:

- You must pay mortgage insurance: FHA mortgages require you to pay Upfront Mortgage Insurance Premium and an annual MIP. Your UFMIP can be rolled into your mortgage or paid during closing while the Annual MIP is paid each month.

- You must work with an FHA-approved lender: A lender like Assurance Financial is qualified to offer you a home loan and can walk you through the application process.

- You must have steady work: Since FHA mortgages rely less on stellar credit, lenders place more emphasis on employment. You may need to show you have worked with your current employer for at least two years or that your employment history is steady.

- You must be purchasing a home: FHA loans are not intended for investment properties.

- Your home must be approved: You need an appraisal from an FHA-approved appraiser, and your home must meet certain requirements.

- Your loan must meet certain limits: You can only use this type of financing to cover about 115% of the median home price for your county. The FHA publishes the limits for each area, so you can see how much of a home loan you may qualify for.

- Your home must be your primary residence: To get an FHA loan, you must be purchasing a home that will be used as your primary residence.

Recommended Reading: Usaa Rv Loan Reviews

How Do You Qualify For An Fha Loan

Because FHA loans are backed by a government agency, they’re usually easier to qualify for than conventional loans. The purpose of FHA loans is to make homeownership possible for people who would otherwise be denied loans.

You don’t need to be a first-time homebuyer to qualify for an FHA loan. Current homeowners and repeat buyers can also qualify.

The requirements necessary to get an FHA loan typically include:

- A credit score that meets the minimum requirement, which varies by lender

- Good payment history

- No history of bankruptcy in the last two years

- No history of foreclosure in the past three years

- A debt-to-income ratio of less than 43%

- The home must be your main place of residence

- Steady income and proof of employment