Invest In Home Improvements

You could increase your home value by making significant improvements, such as remodeling your kitchen or fixing the roof. Just ask yourself which will save you more money in the long run: Paying for improvements to secure a better deal on refinancing, or paying more to refinance now?

Understanding your LTV ratio can prepare you for the refinancing process, and hopefully get the best deal possible.

How Do Lenders Calculate A Propertys Value

Lenders use independent valuers to give them an accurate and unbiased appraisal of a propertys value. There are a few factors lenders use to determine how much a property is worth. These include property type, age and condition and geographic location, as well as current market conditions and zoning restrictions. There are also three different types of valuations.

Full valuations: This involves a full, in-person inspection of the home. Its generally used in scenarios where there is a higher risk to the lenders, such as high loan amounts, more complex transactions or properties in areas where there was been a rapid increase in property prices that may not be sustainable.

Curbside valuations: This is essentially a drive-by valuation of the property, where the lender will examine the condition and location externally from the street. This is generally used in situations with a lower loan amount, where no lenders mortgage insurance will be paid.

Desktop valuations: This is when no inspection of the property is carried out and the lender calculates the LVR using the median price of the property. Its generally used in capital cities and with low loan to value mortgages.

Next Take A Look At How Banks Calculate Equity

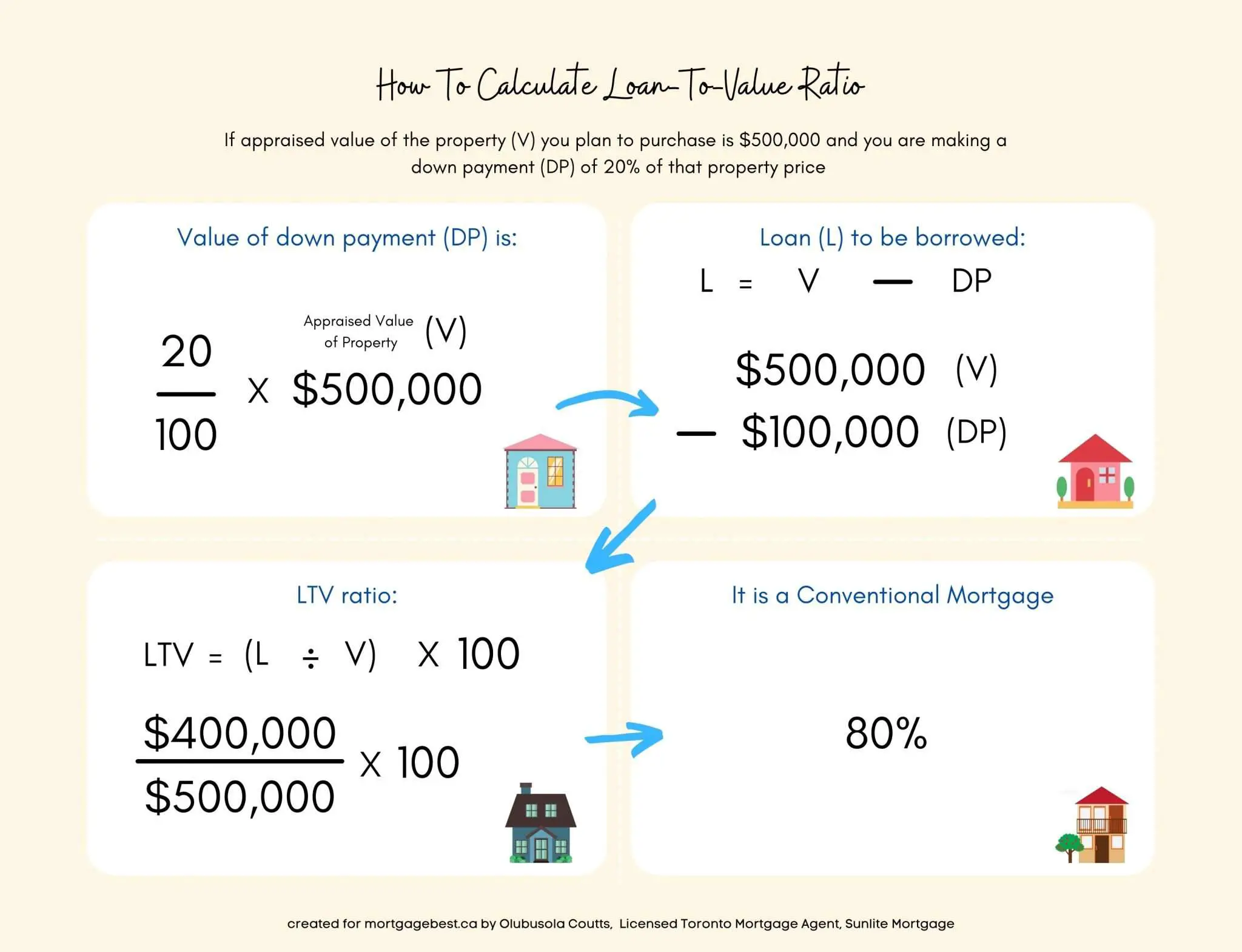

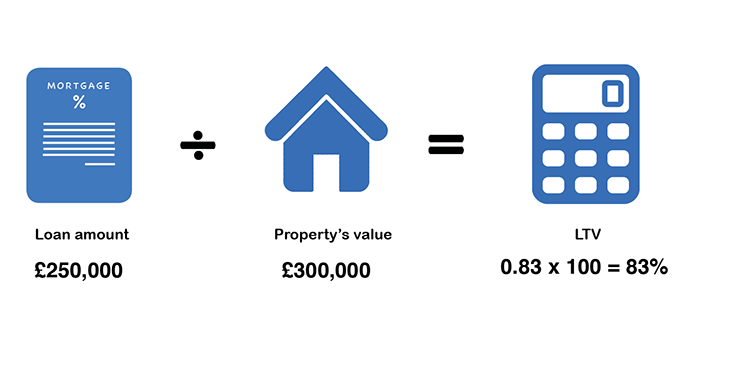

Mortgage, refinance and home equity loan providers may use additional calculations when deciding how much theyâre willing to lend you â or even whether theyâre willing to lend to you at all. One measure they use is the loan-to-value ratio. When you first apply for a mortgage, this number reflects the amount of the loan youâre seeking relative to the homeâs value. If you have a mortgage, your LTV ratio is based on your loan balance. Your LTV ratio can affect whether you pay private mortgage insurance or if you might qualify to refinance. A professional appraisal is key to accurately figuring out your LTV ratio. Thatâs why your lender often will require an on-site appraisal as part of the process for obtaining a loan. To figure out your LTV ratio, divide your current loan balance by your homeâs appraised value. Multiply by 100 to convert this number to a percentage. Carolineâs loan-to-value ratio is 35%.

Recommended Reading: Usaa Car Refinance Rates

How Do You Calculate Combined Loan To Value

4.6/5calculatecombined loan-to-valueloansvalueCLTVvalue

Furthermore, how do you work out LTV?

You can do this by dividing your mortgage amount by the value of the property. You then multiply this number by 100 to get your LTV.

Furthermore, what is a good loan to value ratio for refinance? A good loan-to-value depends on the type of mortgage or refinance loan you’re applying for. A prime LTV for a home loan is 80%. More than 80% and you may have to get private mortgage insurance. FHA loans have a LTV of 97% with a requirement of 3% down.

Just so, what does 60% LTV mean?

LTV stands for loan-to-value and, put simply, it’s the size of your mortgage in relation to the value of the property you want to purchase. This means that 75% of the property’s value is paid for by your mortgage and 25% is paid for out of your own money .

What is the difference between LTV CLTV and Hcltv?

HCLTV DefinedThe HCLTV is similar to the CLTV because it takes into consideration the total loans on the property. It stands for High Combined Loan to Value. The difference between the two is this ratio considers the full available line amount.

Do You Have To Pay Back A Home Equity Loan

Yes, just like any typeof credit, you must pay back a home equity loan within the timeframe laid outin your terms. Failure to do so can result in legal action or in a lendertaking your property as payment. However, you generally have a much longer timeto pay back a home equity loan, as well as more flexible terms aroundrepayment.

Need help securing a loan to purchase your dream property? Our experienced brokers have access to hundreds of competitive home loan deals, so we can help you find the right lender for you.

Read Also: Usaa Auto Refinance

Buy A Less Expensive Home

You may know what your dream home looks like, but can you afford it? If your dream house is out of reach right now, consider looking for a more affordable option. It may make money sense to buy a home that lets you make a larger down payment and lowers your LTV.

Bonus: If you want to add on to your home later, your lower LTV will make it easier to refinance or get a home equity loan in the future.

Loan To Value Ratio Needed For Investment Property

Lenders will allow different LTV ratios based on the type of property for which you are seeking a mortgage. Mortgages for investment properties usually require lower LTVs to minimize the risk of foreclosure.

Rental or vacation properties are generally treated more like investment properties since they are not full-time residences for the person seeking the mortgage.

Commercial lenders are more likely to approve loans with an LTV lower than 80 percent.

Mortgages for commercial properties, like office buildings or apartment complexes, have a different set of underwriting criteria than residences or single-family homes. These loans are often based more on the projected income stream of the property, such as its rental history or the commercial potential of the area in which it is located, than on factors like the credit history of the owner.

In these, cases, however, the LTV may still be considered, as it gives a picture of how much risk the lender is taking on by offering a mortgage.

Read Also: Car Loan With Credit Score Of 600

Why Lvr Is Important With A Home Loan Application

Loan-to-value ratio is a key calculation with a home loan application to buy a property. It shows the ratio of the value of your property to the size of your loan as a percentage. Banks commonly use LVR to assess the risk of a loan, with a higher LVR representing a higher risk to the lender.

Having an LVR of 80% or lower may help you borrow more at lower rates and with lower repayments. If you have an LVR of more than 80%, you may need to pay Lenders Mortgage Insurance or ask a family member to act as a guarantor to offset the risk.

Make Your Monthly Payments + Extra

The easiest way to lower your LTV is to make your mortgage payments on time and in full every month. If you want to speed the process up, try paying a little extra each month. Every extra dollar goes directly toward paying down your mortgage balance.

Even an extra $100 a month can lower your LTV faster and shave years off your mortgage repayment schedule. That can save you a lot in interest over the life of your mortgage.

Read Also: Car Loans Usaa

How To Impact Your Ltv

One of the best ways to help reduce your loan-to-value ratio is to pay down your home loans principal on a regular basis. This happens over time simply by making your monthly payments, assuming that theyre amortized . You can reduce your loan principal faster by paying a little bit more than your amortized mortgage payment each month .

Another way to impact your loan-to-value ratio is by protecting the value of your home by keeping it neat and well maintained.

Add A Free Loan To Value Ratio Calculator Widget To Your Site

You can get a free online loan to value ratio calculator for your website and you don’t even have to download the loan to value ratio calculator – you can just copy and paste! The loan to value ratio calculator exactly as you see it above is 100% free for you to use. If you want to customize the colors, size, and more to better fit your site, then pricing starts at just $29.99 for a one time purchase. Click the “Customize” button above to learn more!

Read Also: Usaa Pre Qualify Auto Loan

Which Loan To Value Ratio Should I Go For

With LTV ratio, a good rule of thumb is as low as you can go. The bigger your deposit in relation to your property value, the better mortgage deals you will be offered, the lower your repayments will be, and the less money youll repay overall. Its sad but true: the more money you have to buy a property, the less you need.

On the other hand, there can be some advantages to buying with a smaller deposit . For one thing, you should be able to buy sooner, get on the property ladder, save on rent and benefit from any increases in house prices. The longer you wait, the more house prices may rise out of reach unless you can save at a faster rate.

As with many things, its a balancing act. What you may be able to do is buy with a high LTV ratio and then try to reduce it step by step every time you remortgage. Remember that you may benefit from more income in the future so your first mortgage is only your first step.

Definition And Example Of Loan

A loan-to-value ratio tells you how much of a property you truly own compared to how much you owe on the loan you took out to purchase it. Lenders use LTVs to determine how risky a loan is and whether they’ll approve or deny it. It can also determine whether mortgage insurance will be required.

- Acronym: LTV ratio

For example, if you buy a home that appraises for $200,000 and make a down payment of $20,000, you are borrowing $180,000 from the bank. The loan-to-value ratio on your mortgage would then be 90%.

The ratio is used for several types of loans, including home and auto loans, and for both purchases and refinances.

LTVs are part of a bigger picture that includes:

- Your credit score

- Your income available to make monthly payments

- The condition and quality of the asset youre buying

It’s easier to get higher LTV loans with good credit. In addition to your credit, one of the most important things lenders look at is your debt-to-income ratio, your debt payments divided by your income. This is a quick way for them to figure out how affordable any new loan will be for you. Can you comfortably take on those extra monthly payments, or are you getting in over your head?

Also Check: Usaa Auto Loan Eligibility Requirements

Looking To Apply For A Loan

Whether youre applying for a mortgage, car loan, or any other similar type of loan that typically requires some form of down payment, your loan-to-value ratio matters. In addition, the type of loan product you choose and the lender you work with also matter. When youre ready to apply for a loan, get in touch with Loans Canada to help guide you to the right lender and loan product for your needs.

What Is The Maximum Ltv A Mortgage Lender Will Allow

It is possible to get a 100 per cent mortgage under certain circumstances, meaning you are borrowing the entire property value from the lender, and dont need a deposit. However, such deals come with important conditions and caveats.

The vast majority of 100 per cent mortgages require guarantors who are willing to take responsibility for the loan if the buyer cant keep up repayments. Typically, the guarantors own home might be used as collateral . Additional mortgage insurance might also be necessary.

A mortgage broker can help you find these 100 per cent deals and decide whether they are suitable for you. Read up on mortgage broker fees.

You May Like: Usaa Auto Refinance Rate

Does Loan To Value Affect Mortgage Interest Rates

Most mortgage lenders price their mortgages in LTV bands, and this allows them to offer lower mortgage rates for lower LTV mortgages. They do this because a lower LTV means there is more equity in the property. Should house prices fall, there is the risk that the value of the property is less than the amount of the mortgage. If the lender needs to recover the mortgage debt by selling the property, they prefer to be more certain they can recover the full debt. For example, at 60% LTV, house prices have to drop by 40% before the lender will lose money compared to 90%, where a 10% drop would result in negative equity.

Whats A Good Ltv For A Car Refinance Loan

While every lender will have their own guidelines for approvals, a loan-to-value ratio over 125% will make it harder to get approved for refinancing. Others will offer refinance loans to borrowers with LTVs over 125% but may require a higher credit score, lower DTI, or other condition in order to lessen the risk to the lender because a high LTV is seen as a high risk.

Bottom line, if you can get your LTV below 125%, youll increase your chances of getting approved for an auto refinance loan.

Don’t Miss: Which Of These Loan Options Is Strongly Recommended For First-time Buyers

Start With A Baseline Calculation

You can figure out how much equity you have in your home by subtracting the amount you owe on all loans secured by your house from its appraised value. This includes your primary mortgage as well as any home equity loans or unpaid balances on home equity lines of credit. In a typical example, homeowner Caroline owes $140,000 on a mortgage for her home, which was recently appraised at $400,000.

What Is A Good Lvr Score

Below 80% is generally an optimal LVR score, anything above 80% and lenders may consider you too risky. To negate that risk, theyll often require you to pay whats called Lenders Mortgage Insurance .

LMI is protection for the lender if you cant repay your loan . Although this fee may help you get into the market quicker, it can be expensive. If you want to avoid LMI, you can always choose to hold off, and save for a bigger deposit.

Read Also: Prosper Loan Denied After Funding

What Is A Good Ltv Ratio For A Mortgage

Generally, a good LTV to aim for is around 80% or lower. Managing to maintain these numbers can not only help improve the odds that youll be extended a preferred loan option that comes with better rates attached. It can also boost your chances of being able to avoid paying mortgage insurance and potentially being able to save thousands of dollars in mortgage payments.

In other words, should your LTV come in higher than 80%, youll likely have to pay extra for mortgage insurance. Mortgage insurance basically serves as a form of risk mitigation for lenders that helps protect them in case you default on the loan and helps provide them with needed reassurance if they opt to take on the risk of lending to you.

However, be advised that an acceptable LTV ratio can differ based on the type of mortgage that youre getting. This is true in the case of FHA loans and VA loans as well.

Importance Of The Loan

Generally, a high LTV ratio indicates a high level of lending risk. The rationale behind this is that the purchased property in the mortgageMortgageA mortgage is a loan provided by a mortgage lender or a bank that enables an individual to purchase a home. While its possible to take out loans to cover the entire cost of a home, its more common to secure a loan for about 80% of the homes value. is used as collateral. Thus, the LTV ratio essentially compares the size of the loan requested to the size of the pledged collateralCollateralCollateral is an asset or property that an individual or entity offers to a lender as security for a loan. It is used as a way to obtain a loan, acting as a protection against potential loss for the lender should the borrower default in his payments..

Due to the abovementioned reason, the assessment of the LTV ratio serves a crucial role in mortgage underwriting. For example, conventional mortgage lenders usually provide good loan terms if the LTV ratio is less than 80%.

Also Check: Nerdwallet Loan Calculator

How To Calculate Loan To Value

Your LTV is calculated by dividing the value of the mortgage you need by the value of your property . For example, if you want to buy a house with a value of £250,000 and you have a deposit or equity of £100,000, then you will need a mortgage of £150,000. Here is the LTV calculation:

£150,000 / £250,000 = 0.6

Should I Speak To A Mortgage Broker

Mortgage brokers remove a lot of the paperwork and hassle of getting a mortgage, as well as helping you access exclusive products and rates that arent available to the public. Mortgage brokers are regulated by the Financial Conduct Authority and are required to pass specific qualifications before they can give you advice.

Call or request a callback

Mortgage Advice Bureau offers fee free mortgage advice for Moneyfacts visitors that call on 0808 149 9177. If you contact Mortgage Advice Bureau outside of these channels you may incur a fee of up to 1%. Lines are open Monday to Friday 8am to 8pm and Saturday 9am to 1pm excluding bank holidays. Calls may be recorded.

Your home may be repossessed if you do not keep up repayments on your mortgage.

Read Also: Auto Loan Payment Calculator Usaa