Is 24 Hour Deposit Guaranteed

While no lender will guarantee that you will receive your loan instantly in minutes or even within 24 hours, most accepted borrowers will indeed see the cash in their account within one business day.

This means that if you apply and sign the contract during the working week and there are no issues at your bank, the funds are likely to arrive the very next day.

Note: if you submit your information on Friday you probably won’t see the funds until at least Monday.

There are also a number of national holidays when the banks do not process transactions , so take this in to account when applying.

Work Today For Pay Today

Searching for this phrase online turns up lots of results. We’ve researched 26 legitimate side jobs that can provide a quick income boost, ranging from driving passengers or packages to freelancing from home.

You can also try the Craigslist jobs or gigs sections, which often have postings for short-term work in food service, housekeeping and general labor.

Why My Credit Score Is Low

There can be many reasons for your credit score to go down, and sometimes its just a matter of you not knowing about some of the things that can negatively affect your score. Here are a few things that can cause your credit score to drop:

- Applying for too many credit cards

Whether you are accepted or not, applying for too many loans or lines of credit can cause points to come off your credit score.

- A history of late payments

Maybe you have been doing everything you are supposed to now, but you had some delinquent accounts or lots of late payments from years ago holding you back.

- A huge mistake from the past

If you declared bankruptcy within the last 10 years, its going to haunt you, and theres nothing you can do about it.

- Too much credit card debt

Your credit score will suffer until you can properly manage your debt, including your credit card debt.

- Not having enough credit diversity

Its important to have various credit sources, including both installment and revolving debt, loans, credit cards, mortgages, etc.

- Not being old enough

Even if your credit is perfect, if you are young, you have not been demonstrating you can handle debt for a long enough time, which could hold you back.

- Having errors on your credit report

When is the last time you checked your credit report for errors? Cleaning them up can take time, but you will notice an increase in your credit score by doing so.

Don’t Miss: Usaa Auto Loan Rates Used Cars

How Do I Find A Direct Lender Near Me

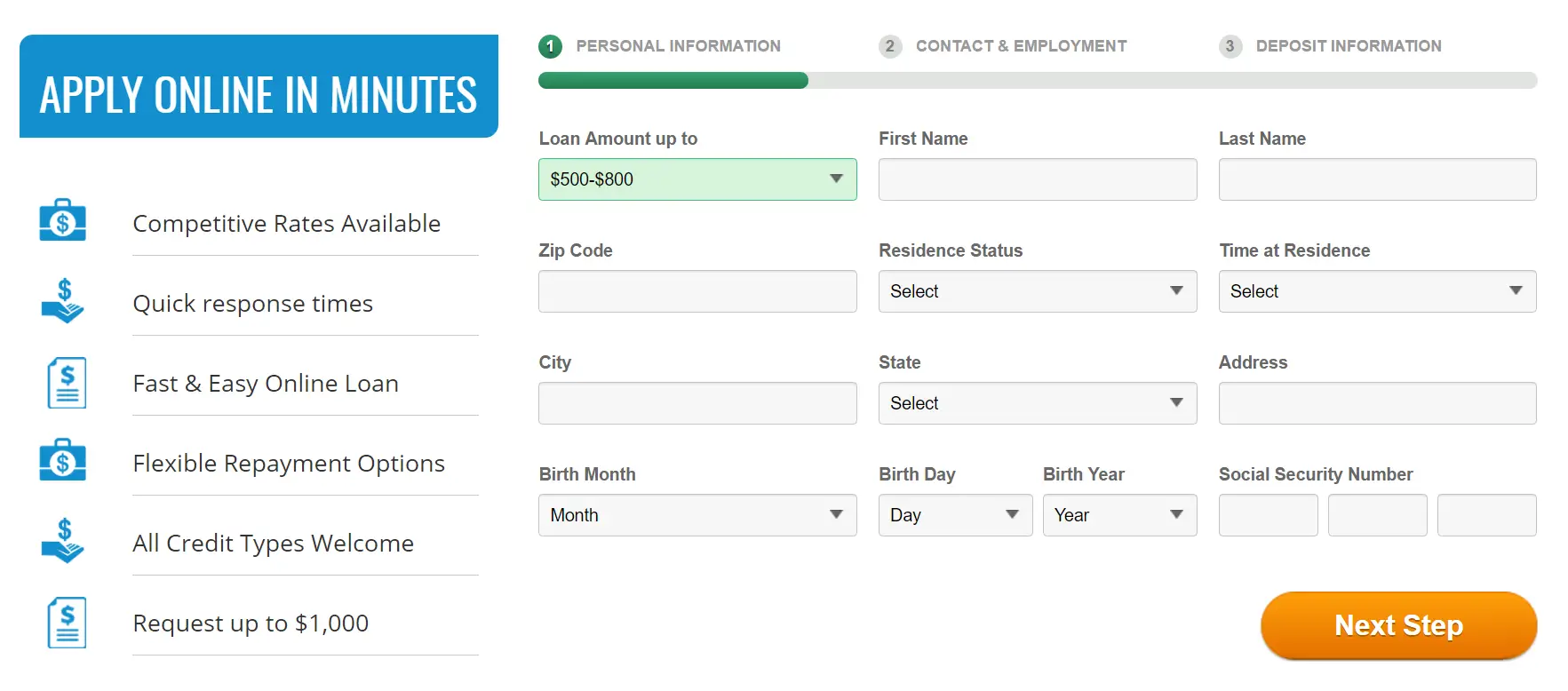

Once a borrower is offered a loan, the details are usually sent via email. The borrower can go through all the details and then electronically sign the loan contract.

Everything moves quickly because the process is over the internet no need to search for a loan store near me.

When you evaluate the loan offer, you should carefully read through all the terms. You must understand the total cost of the loan. Do not simply fixate on the number of monthly repayments. More about consumer tips here.

What To Do If You’re The Victim Of A Personal Loan Scam

If you believe that youre a victim of a personal loan scam, there are a few steps you can take to report the crime but it may be difficult to get your money back.

- File a complaint with the FTC. While the FTC cant resolve individual complaints, it can direct you to the proper bureau to file a complaint.

- File a report with your state attorney general’s office. Your state attorney general’s office keeps tabs on potential loan scams and works to build a case against scammers in your area.

- File a police report for the amount youve been defrauded.

- Contact the Internet Crime Complaint Center. This partnership of the FBI and National White Collar Crime Center is for victims of fraud that began with Internet contact.

Recommended Reading: Usaa Used Auto Loan

Sell Unused Gift Cards

Cardpool kiosks offer instant cash for gift cards valued between $15 and $1,000. Youll get slightly less there the company pays up to 85% of the cards value at its kiosks, while it pays up to 92% if you sell through its website. You can also go through an online gift card exchange like Gift Card Granny, but most take a few days because you have to mail the card and then wait for a check or direct deposit.

Figure Out The Money You Need To Borrow

Dont get carried away. Remember, you will pay back the loan. So, calculate the number you need. Then, go ahead and figure out a plan on how youre going to repay the loan. It ensures that you remain realistic to avoid drowning further in debt if you cant pay the amount you owe.

Its also advisable to have a fixed number of months you wish to repay the money. Remember that a longer repayment period means that you will pay a high amount in the end.

You May Like: Upstart Loan Calculator

How To Find Legit Loan Companies And Avoid Scams

- Payday loans are illegal in many states

ElitePersonalFinance created a table where we extracted all payday loan regulations by state. You can see that there are states where payday loans are absolutely illegal. In other states, they are legal but not regulated by the law. And in some states, they are legit and regulated by the law. State laws regulate:

- The highest amount allowed, which is $500 in most cases.

- The APR.

- The loan terms.

There are still many lenders that are illegal in their states but operate with no problems.

- Upfront fees

Every lender that requires you to pay upfront fees to qualify for a loan is a fraud. Many free-application loan companies are allowing you to compare offers with no upfront fees. Asking for an upfront fee is not legal.

- Hidden fees

When you accept an offer, make sure that the loan company has listed all of the fees. They have to be carefully explained and included in the contract. Legitimate lenders must disclose all contract fees and even explain them to you if you ask them for clarification. When you accept the offer, be sure that you understand these fees:

Like with payday loans, many states put legal restrictions on auto title loans.

- Personal information

- Avoid lenders that wont check your credit score

- Avoid unsecured and unsafe sites

Every legitimate loan company should have an SSL certificate on your application form where you reveal your personal details if you apply online.

- Avoid sites that look like a scam and relatively new sites

Take Out A Personal Loan

Some lenders can fund a personal loan in a day if you have good credit, youll probably have many choices. If your credit is a challenge, youll need to find a lender that not only delivers fast cash but also accepts poor credit. Rates for borrowers with bad credit from mainstream lenders top out at 36% APR. You may find other lenders offering fast funding without a credit check, but youll pay triple-digit interest rates. Dont fall for it.

Also Check: What Car Can I Afford Based On Salary

Are There Benefits Of Taking A Bad Credit Loan

Acquiring a bad credit loan is one of the methods of increasing your credit score. In addition, you can use the loan for debt consolidation. Doing so can reduce the average interest rate you have to pay across institutions since the debt you owe will now be with one lender. Additionally, you dont have to remember different payment dates.

Access to quick cash is another advantage with bad credit loans. It can help you take care of bills while making progress on your credit score.

Does Where I Live Affect My Payday Loan

Every state regulates payday loans differently. In some states, including Georgia, they are banned outright. In other states, interest rates are capped to such an extent that they are essentially banned. In total, 18 states ban payday loans. Other states, such as Oregon, have some restrictions in place, but payday lenders still operate in them. Payday loans come with few restrictions in 32 states. Any restrictions in these states tend to focus on the maximum number of loans someone can take out and not on rates.

State laws do change though. In 2016, South Dakota passed a ballot initiative that capped interest rates on payday loans at 36% where there had previously been no restrictions, while Colorado set the same limit on rate in 2018, as did Nebraska in 2020, and Illinois in 2021.

Beware of lenders that try to skirt these laws. For example, many set up on Native American tribal land to get around state laws. We also noticed some online lenders are based outside the U.S. and offer uniformly high rates no matter where you live.

A good rule of thumb is to see if a payday lenders website lists individual states. If theres a flat rate no matter where you live, stay away.

You May Like: Auto Refinance Calculator Usaa

The Lender Isnt Registered In Your State

The Federal Trade Commission requires that lenders and loan brokers register in the states where they conduct business. Check the lenders website to verify the list of states where it legally conducts business. If a lender youre interested in does not list any registered states, you could be dealing with a loan scam.

Checking registration is a key step to ensure that youre dealing with a reputable company, separating the frauds from the legitimate businesses.

Takeaway: Verify lenders are registered in your state before sending over banking and personal details. If they dont operate in your state, they dont have the authority to loan you money.

Payday Loans And Credit Ratings

Payday loans are an attractive proposition to people with very bad credit or perhaps no credit rating at all. Most payday loan companies do not check the credit history of the customer, so simply applying for or taking out a payday loan will not usually affect an individuals credit rating.

Some payday loan companies have schemes where if a customer makes on-time payments, they report this to the credit rating companies so customers can slowly build up better credit . The downside of course is that if there are missed payments or a customer defaults on a loan, this information also gets reported.

Recommended Reading: Usaa Car Loan Rates

How Does Bad Credit Affect Your Loan

Generally, a score below 630 can affect your probability of getting a loan. Lenders view bad credit borrowers as high risk. So, they can deny your loan request or offer unfavorable terms.

For example, if you need a loan to buy a home, financial institutions require a FICO score of at least 620. A lower score can mean putting down at least 10%, and youll also have to pay mortgage insurance. Consequently, this will increase your borrowing cost tremendously.

Q1 What Is A Credit Score

The credit score represents the applicants creditworthiness. It varies from 300 to 850, and the higher these digits are, the better the score will be. It depends on the clients monthly payments for their credit cards and bank loans. A bad credit score can be easily improved by paying off the credit cards on time.

Applicants with higher scores can get a loan with better terms. The credit score determines the interest rates and the APR, so clients with bad credit scores can get loan approval with higher fees and interest rates.

Read Also: Reloc Line Of Credit

Factors To Consider Before Applying For An Online Loan

- The loan amount

It is not recommended to borrow more funds than needed because higher loan amounts have higher interest rates and APR. It is best to calculate how much you will need to borrow and repay the loan depending on the monthly income. The loan amount determines the APR and interest rates, and it should improve your finance, not worsen them.

- The monthly income

Some online lending platforms require minimum monthly income to qualify for a loan. The lenders also want to know more about the clients monthly incomes to ensure that the applicant can repay the loan in the determined time. If the client thinks his monthly income is not enough to cover the repayments, it is best to search for a more suitable offer.

- Lenders charges

All loans have charges that the loan requires. APR is a charge that the applicant has to pay for the borrowed money. It may vary from 5.99% to 35.99%, depending on the loan amount. Some lenders may charge additional costs like administrative fees, early pay-off, and late repayments penalties. It is best to avoid loans with additional costs.

- Eligibility criteria

Fast Personal Loans: Best Lenders For Quick Cash

Fast loans are one way to pay for emergencies and other short-term borrowing needs. Compare rates and terms and stick with reputable lenders.

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Fast personal loans can provide cash to pay for car repairs, unexpected medical bills or moving expenses. Online lenders are convenient and quick some can provide same-day or next-day funding for qualified borrowers.

Consider rates and terms in addition to the time a lender takes to fund a loan when you compare fast cash loans from online lenders.

The personal loans listed here are from reputable online lenders that check your credit as part of the application process. They all say it takes a few days or less to fund a loan.

Fast personal loans can provide cash to pay for car repairs, unexpected medical bills or moving expenses. Online lenders are convenient and quick some can provide same-day or next-day funding for qualified borrowers.

Consider rates and terms in addition to the time a lender takes to fund a loan when you compare fast cash loans from online lenders.

Also Check: Mortgage Originator License California

Badcreditloanscom: Instant Loans For Bad Credit Online Runner Up

BadCreditLoans.com is one of the leading online lending networks. The company has been around since 1998. Like MoneyMutual, the site is a marketplace for lenders and borrowers. As such, you apply for a loan, and BadCreditLoans.com connects you to their network of state, tribal lenders, and financial service providers.

Unlike other sites, BadCreditLoans.com discloses lots of information. So, before you even apply, youll have an idea of what youre getting into.

Features

Lenders on BadCreditLoans.com are willing to extend up to $10,000 in the loan amount. The limit is interesting for online loans. The lenders do not perform a hard credit pull. However, you still need to submit your credit score. As a result, the lender can determine how much they are willing to offer you. Still, for anyone with a bad credit score, lenders can only offer up to $1000.

Perhaps the best thing about BadCreditLoans.com is that they do not require physical collateral. The platform asks the usual name, age, SSN, etc. The lender may have more questions like proof of steady income and bank type. What we know is that no lender asks for physical collateral.

Another feature that BadCreditLoans.com reveals is the cost of loans. Loaners have an APR range of 5.99% 35.99%. Not all of them have origination fees. And again, the penalty for missed payment is at the discretion of the lender.

Pros

- The loan limit for bad credit is relatively low

- Some loans attract higher APRs than others

Customer Experience

What Is A Cash Advance Loan

A cash advance loan, sometimes referred to as a payday loan or a cash loan, is an unsecured, short-term personal loan that is usually for a relatively small amount of money.

Unlike mortgages or auto loans that extend your credit up to tens or hundreds of thousands of dollars, cash advance loans are more of an emergency loan option. The loans in this category help you cover an unexpected expense as opposed to making a major purchase.

Cash advance loans are a quick solution for cash you can use to cover a car repair, a medical bill, or even utility bills and other expenses that can come up unexpectedly. Since theyre generally for a smaller sum of money, the interest rates tend to be on the higher side and you may be charged an origination fee.

Payday lenders set repayment terms that are shorter and stricter than those available with installment loan options.

You May Like: Usaa Car Loan Application

How Can You Improve A Bad Credit Score

If your credit score is below average, it can take forever to restore. But there are several ways you can improve. Some of these will improve your credit score in 30 days.

The first thing youll want to do is to avoid late payments. Your payment history has the most significant impact on your score. And its not just about debt. Timely payments for utilities, credit cards, cell phone bills, etc., can impact your credit score positively.

Your credit utilization also affects your credit score. Its best to use 30% of your credit limit to keep your balance low. You can do this by always paying what you owe before the end of each billing cycle.

Additionally, you can ask for a higher credit limit if you cant keep credit utilization below 30%. It will instantly lower your credit utilization.

Lastly, if mistakes are affecting your credit score, fixing them can improve your score instantly. The process involves reading your credit report, looking for errors, and disputing them with credit reporting bureaus. Alternatively, you can have a credit repair company do it for you.