Wed Like To Introduce Ourselves

Were Kasasa® a financial and technology services company. We believe that small banks and credit unions supply critical resources to drive the growth of businesses and families. Nobody knows your communitys needs the way you do.

At Kasasa®, we also partner with institutions like yours, providing our relationship platform, Kasasa, as a comprehensive strategy. It begins with innovative banking products and includes marketing, training, compliance, research, support, and consulting.

Together we can show the next generation of banking customers an experience the mega-banks will never match.

Other Important Things To Remember

- Make sure that your lender is licensed by the Australian Securities and Investments Commission . You should also make sure that interest rates and other fees are lower than what youre currently paying for.

- Lenders may deny your request for debt consolidation if there are poor conduct on your credit report. These conduct let them know if youve been paying your bills on time or not.

- You can get higher interest rates over time if your loan term gets extended by not paying for the principal regularly.

Interest And Partial Principal

In the U.S. a partial amortization or balloon loan is one where the amount of monthly payments due are calculated over a certain term, but the outstanding balance on the principal is due at some point short of that term. In the UK, a partial repayment mortgage is quite common, especially where the original mortgage was investment-backed.

You May Like: Should I Get An Unsubsidized Student Loan

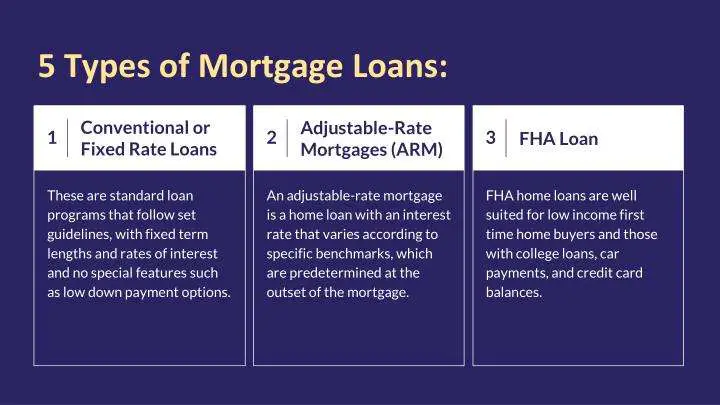

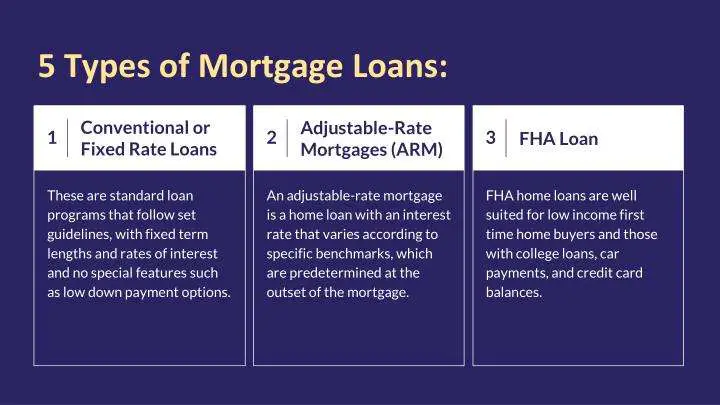

What Is The Most Common Type Of Mortgage Loan

Because they have fewer restrictions and are available for more property types, conventional mortgages are the most common type taken by consumers. But how common a loan type is shouldnt be a criterion in determining which mortgage is right for you.

If youre a veteran, a VA loan will undoubtedly be the better choice. For individuals with impaired credit, FHA is the preferred mortgage. If youre purchasing a very expensive property, and need a considerable loan amount, jumbo mortgages will be the best option. And if you live in a rural area, you may find a USDA mortgage to be the preferred option.

Mortgage Types: Conventional Fha Usda Va Jumbo & More

Many or all of the products here are from our partners. We may earn a commission from offers on this page. Its how we make money. But our editorial integrity ensures our experts opinions arent influenced by compensation. Terms may apply to offers listed on this page.

There are many different types of mortgages. Before you apply for a home loan, you need to understand how each one works. This includes conventional mortgages and government-backed loans, such as FHA or VA mortgages. It also includes both fixed- and adjustable-rate loan options.

This guide explains all of the different mortgage types so you can make an informed choice about which loan is right for you before you apply for mortgage pre-approval.

Read Also: How Much Can We Borrow Home Loan

Types Of Mortgage Loans For Buyers And Refinancers

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Many types of mortgage loans exist, and they are designed to appeal to a wide range of borrowers’ needs.

For each type of mortgage listed below, youll see its advantages and the kind of borrower it’s best for. This page concludes with a glossary of terms describing different types of mortgage loans.

What Option Is Right For Me

;When it comes to;choosing the right mortgage term and payment options, you should assess the risk involved with each, as well as how each option;fits into your budget.;

It’s wise to determine how;much you can afford monthly, including the cost of your taxes and insurance. Another great tip: Try to borrow as little as possible, so you do not end up;underwater on your mortgage.;

Generally speaking, a fixed-rate traditional mortgage is the best option. These options usually offer the best interest rates, as well as a set payment throughout the life of the loan. You’ll also likely be able to;avoid paying;PMI if you choose this option and put 20% down.;

Another point to consider: If you cannot the afford mortgage payments on a 30-year mortgage with a fixed rate, you likely are not in a position to buy a home.;

But there are some things you can do to work toward your goal of buying a home.;

- Work to improve your , so you qualify for better interest rates, which;means a lower monthly payment.

- Save up a larger down payment. This will reduce the amount that you need to borrow, which can make your mortgage payments more affordable and your interest rate lower.;

- You may also consider buying a;fixer-upper;or moving to a different city or neighborhood that has more affordable housing options.;

Recommended Reading: What Loan Can I Afford Calculator

Understanding Different Types Of Mortgage Lenders

One of the most confusing parts of the mortgage process can be figuring out all the different kinds of lenders that deal in home loans and refinancing. There are direct lenders, retail lenders, mortgage brokers, portfolio lenders, correspondent lenders, wholesale lenders and others.

Many borrowers simply head right into the process and look for what appear to be reasonable terms without worrying about what kind of lender they’re dealing with. But if you want to be sure of getting the best deal, or are looking for a jumbo loan or have other special circumstances to address, understanding the different types of lenders involved can be a big help.

Explanations of some of the main types are provided below. These are not necessarily mutually exclusive – there is a fair amount of overlap among the various categories. For example, most portfolio lenders tend to be direct lenders as well. And many lenders are involved in more than one type of lending – such as a large bank that has both wholesale and retail lending operations.

My Mortgage Shopping Experience

All these types of mortgages have pros and cons associated with them. Finding the right one for you largely depends on a few key questions:

How good is your credit history?

How much down payment can you afford?

Does where you want to live rule out types of mortgages?

In my personal story, the conventional loan was the best choice. My area wasn’t eligible for USDA, I am not a veteran, and based on my finances the conventional loan made more financial sense. Once you know your best option, it is time to start shopping around for lenders and securing your pre-approval letter. Along the way, make sure you seriously consider the interest rate, closing costs, downpayment, and of course the mortgage loan qualifications and insurance needs. Happy shopping!

Read Also: When Will I Receive My Student Loan

Understanding Different Types Of Mortgage Loans

There are several types of loans, each available to help borrowers in different ways, based on their financial goals and qualifications. Mortgage loans differ in many ways, including:

- The minimum credit score required

- The minimum down payment required

- The length of the loan term

- The mortgage rates charged

- Whether the loan conforms to government-backed guidelines or not

Types Of Mortgage Loans Faq

What are the 4 types of home loans?

The four main types of home loans are conventional loans, FHA loans, VA loans, and USDA loans. Conventional loans are not backed by the federal government, but most need to meet lending guidelines set by Fannie Mae and Freddie Mac. FHA, VA, and USDA loans are all backed by the federal government but offered by private lenders. Most major lenders offer all four mortgage programs, though USDA loans can be a little harder to come by.

What is the most common type of home loan?

The most common type of home loan is a conventional mortgage, which is any mortgage not backed by the federal government. This is what most people think of as a standard mortgage. Conventional loans are flexible; down payments can range from 3 to 20 percent or more, and you only need a 620 credit score to qualify with most lenders. These loans make up about 80 percent of the mortgage market, according to the ICE Mortgage Technology Origination Report.

What type of home mortgage is best?

The best type of home loan depends on your situation. If you have great credit and a 20 percent down payment, conventional loans usually offer the best value. If you need extra help qualifying due to lower credit scores or income, an FHA loan might be better. And if youre a qualifying veteran or military member, a VA loan is almost always the best bet. Your loan officer can help you compare loan options and find the right loan for your needs.

Are there mortgages with no down payment?

You May Like: Should I Refinance My Home Equity Loan

Be Updated Regarding Current Debts

All debts must be taken into account if you intend to consolidate your debts. Ask yourself the following questions to help you get up to speed on your current obligations:

- How much do you currently owe on each debt?

- How much are the interest rates on each debt?

- How long is the payment term?

- Are there any extra fees or charges because of multiple debts?

Purchasing The Proper Way

Weve already remarked about how to buy a homethe 100% down plan! May possibly not be easy, but its worthwhile. Group just like you save for several years to make this happen mission! If youre gonna pick your dream house with a home mortgage, you must have the fundamentals dealt with. Heres what we should suggest:

- Youre entirely debt-free.

- You may have three to half a year of cost conserved in a serious event investment.

- Youve spared a big downpayment. We recommend at minimum 10%, but 20% is even better due to the fact allows you to eliminate PMI money.

Your property financing must a traditional, fixed-rate mortgage loan with a 15-year words. Arent getting a 30-year loan! A $175,000, 30-year home loan with a 4% interest rate can cost you $68,000 furthermore the life span belonging to the loan than a 15-year loan will. Thats lots of money you could utilize to produce your very own pension investment or save your self to suit your boys and girls college or university.

Your very own monthly payment shouldnt go beyond 25per cent of your own take-home afford. More than thatll bind an excessive amount of your revenue and slow down how youre progressing through the staying child actions.

One of the recommended cities to begin with your own home hunt happens to be our personal free mortgage calculator to have an improved thought of what you might allow.

Don’t Miss: Which Bank Gives Loan For Land Purchase

Fixed Rate Loan Vs Adjustable Rate Loan

Mortgages are available with two different types of interest rates: fixed and adjustable.;

- On a fixed-rate loan, the interest rate stays the same for the entire life in the loan. That means you lock in the interest rate of todays market for the next 15-30 years.

- On an adjustable-rate loan, the interest rate varies along with the broader financial market. Its likely to go up and down over the course of the loan, which could cause big swings in your mortgage payments.

Rates right now are historically low.; An adjustable-rate mortgage might get you a lower interest rate upfront, but you have to be prepared for that to go up over time.

If youre looking at that adjustable-rate mortgage, and youre getting in at what is probably the bottom now, odds are your rates are going to be higher, Bacon said.

But if you plan to stay in this home for many years, youll likely want to lock in a low fixed rate now.;

Wholesale And Retail Lenders

Wholesale lenders are banks or other institutions that do not deal directly with consumers, but offer their loans through third parties such as mortgage brokers, credit unions, other banks, etc. Often, these are large banks that also have retail operations that work with consumers directly. Many large banks, such as Bank of America and Wells Fargo, have both wholesale and retail operations.

In this type of lending, the wholesale lender is the one that is actually making the loan and whose name typically appears on loan documents. The third party – bank, credit union, or mortgage broker – in most cases is simply acting as an agent in return for a fee.

Retail lenders are exactly what they sound like, lenders who issue mortgages directly to individual consumers. They may either lend their own money or may act as an agent for Again, retail lending may simply be one function offered by a larger financial institution, which may also offer commercial, institutional and wholesale lending, as well as a range of other financial services.

Don’t Miss: How To Discharge Student Loan Debt

Mortgage Insurance: What You Need To Know

Mortgage insurance helps you get a loan you wouldnt otherwise be able to.

If you cant afford a 20 percent down payment, you will likely have to pay for mortgage insurance. You may choose to get a conventional loan with private mortgage insurance , or an FHA, VA, or USDA loan.

Mortgage insurance usually adds to your costs.

Depending on the loan type, you will pay monthly mortgage insurance premiums, an upfront mortgage insurance fee, or both.

Mortgage insurance protects the lender if you fall behind on your payments. It does not protect you.

Your credit score will suffer and you may face foreclosure if you dont pay your mortgage on time.

Types Of Mortgages In India:

Read Also: How To Get 150k Business Loan

Conforming Vs Nonconforming Mortgage Loans

The first category that all mortgages fall into is conforming and nonconforming loans. A conforming loan is one that meets the guidelines of government-sponsored entities Fannie Mae or Freddie Mac. Any loan that doesnt get the backing of Fannie Mae or Freddie Mac is considered nonconforming, including loans from government agencies.

The requirements for something to be a conforming loan break down into a few categories.

In order to have a conforming loan, a client needs a qualifying credit score of 620 or higher. Beyond the score itself, negative marks on your credit can also have an impact on whether you qualify.

For example, you may have a harder time qualifying or you may not qualify at all if you have multiple late mortgage or rent payments in the last year. Additionally, if youve had a more serious issue like a bankruptcy, you could have to wait up to 4 years in order to get a mortgage.

Government loans and other private lender offerings often allow you to qualify sooner than you might for a conforming loan if you have a lower credit score or dings on your credit.

Debt-To-Income Ratio: When evaluating how much house you can afford, mortgage lenders calculate your DTI ratio. This is a comparison of your gross monthly income with your monthly debts, including installment debts like a mortgage, car payment or student loan, and revolving debt like credit cards.

United States Department Of Agriculture Loans

Backed by the U.S. Department of Agriculture, USDA loans;help low- to moderate-income buyers in designated rural and suburban areas. While it might seem to be only for farmland on the surface, USDA loans can buy primary residences;for qualified applicants.

Borrowers looking to buy a home in areas designated as eligible by the USDA need to meet strict income limits. These limits are specific to the locality;where youre buying a home. Buyers under the USDA program typically dont qualify for mortgages from other sources. USDA loans are available from a wide variety of local and online lenders and, in some cases, directly from the USDA itself for some low-income applicants.

The USDA doesnt set minimum credit score guidelines. Borrowers with a score of 640 or higher are said to experience a more streamlined loan process. Down payments can be as low as 0%, but, as with an FHA or conventional mortgage, buyers will have to pay PMI if they put down less than 20%.

You May Like: Can You Take Out More Than One Student Loan

What Types Of Mortgage Loans Are Available To You

If you’re like most homebuyers, youll probably need a loan to fund the purchase of your home. But shopping for a mortgage is a lot like shopping for a homethere are different options that cater to different needs, and youll want to find the one that fits your financial priorities. While all mortgages share the same purposefunding the purchase of propertythey each come with different advantages, disadvantages, and unique terms. Ultimately the type of home loan you choose will have a tremendous impact on your future mortgage payments and overall financial health.

The types of home loans youre likely to encounter fall into two general categories: conventional mortgage loans and government-backed mortgage loans. While Better currently only offers conventional loans, its still good to review all the options that might be available to you through different lenders and weigh the benefits and costs of each.