Whats The Maximum You Can Borrow

Theres no limit set by the VA on how much youre allowed to borrow for a home. But the VA does cap the amount of insurance provided to the lender, and most lenders limit the loan amount as a result. You can find out the limit in any U.S. county through the VA website.

The maximum loan limit varies from one lender to another, so this is another reason to shop around.

If youve already received a VA loan, the amount youre allowed to borrow with no down payment may be smaller.

What Are Va Entitlements And Why Are They So Important

A key feature of VA loans is the entitlement. A VA loan entitlement is basically the amount of the loan that the VA will guarantee to the lender if you default.

There are two types of entitlement:

- Basic entitlement: up to $36,000 for loans worth less than $144,000, or 25 percent for loans of that amount or more.

- Bonus entitlement: Up 25 percent of the Federal Housing Finance Agency loan limit, minus the basic entitlement.

For those who need to purchase a home that costs more than $144,000, the bonus entitlement can be used. For example, in most counties in the U.S., the FHFA conforming loan limit in 2021 is $548,250 and $647,200 in 2022. In that case, 25 percent of the loan amount would be $137,062.50 in 2021 or $161,800 in 2022. However, for the total entitlement, you need to subtract out the basic entitlement, leaving you with $101,062.50 in bonus entitlement money for 2021 and $125,800 in 2022.

Many lenders are willing to loan those who qualify for a VA loan up to four times the amount of their entitlement, so you might be able to get a loan for $144,000 on the basic entitlement of $36,000.

For those who live in high-cost areas, the bonus entitlement is figured in the same way, but based on the higher FHFA conforming loan limit, which is based on the county where the house is located. Before applying, check the FHFA website for more information on the loan limits in your area.

Qualifying If You Receive Child Support Or Alimony

Buying a home after a divorce is no easy task.

If, prior to your divorce, you lived in a two-income household, you now have less spending power and a reduced monthly income for purposes of your VA home loan application.

With less income, it can be harder to meet both the VA Home Loan Guarantys debt-to-income guidelines and the VA residual income requirement for your area.

Receiving alimony or child support can counteract a loss of income.

Mortgage lenders will not require you to provide information about your divorce agreements alimony or child support terms, but if youre willing to disclose, it can count toward qualifying for a home loan.

Different VA-approved lenders will treat alimony and child support income differently.

Typically, you will be asked to provide a copy of your divorce settlement or other court paperwork to support the alimony and child support payments.

Lenders will then want to see that the payments are stable, reliable, and likely to continue for another 36 months, at least.

You may also be asked to show proof that alimony and child support payments have been made in the past reliably, so that the lender may use the income as part of your VA loan application.

If you are the payor of alimony and child support payments, your debt-to-income ratio can be harmed.

Not only might you be losing the second income of your dual-income households, but youre making additional payments that count against your outflows.

Read Also: Capital One Auto Loan Apr

Va Loans Have A Government Guarantee

Theres a reason why the VA loan comes with such favorable terms.

The federal government guarantees these loans meaning a portion of the loan amount will be repaid to the lender even if youre unable to make monthly payments for whatever reason.

This guarantee encourages and enables private lenders to offer VA loans with exceptionally attractive terms.

Va Loan Eligibility Requirements

In general, you will qualify for a VA home loan if you served in the Army, Navy, Air Force, Marine Corps or Coast Guard after Sept. 15, 1940. You must have served for at least 181 continuous days during peacetime or at least 90 days, any part of which occurred during wartime. If you were dishonorably discharged or did not serve long enough, you may not be able to get a VA loan.

National Guard members and reservists qualify if they are mobilized for active duty for at least 90 days or discharged because of a service-connected disability. They also qualify after six years of honorable service.

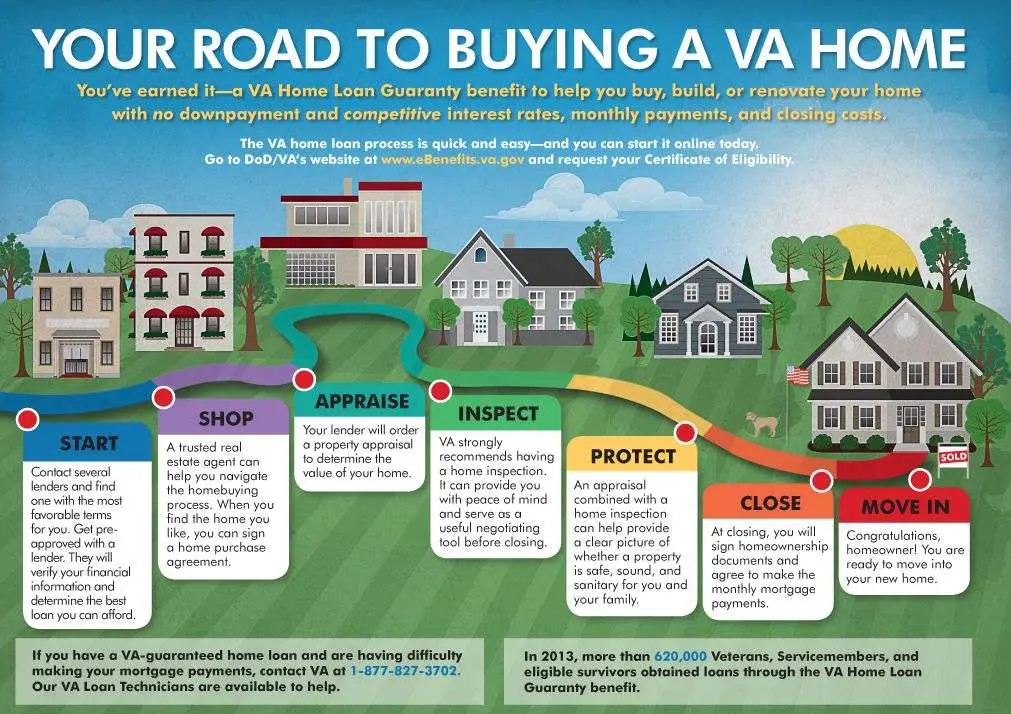

Youll need a certificate of eligibility to participate in the VA loan program. You can apply for your COE online or by mail, or your VA lender can get it for you.

Surviving spouses also can sometimes get VA loans if their husband or wife passed away while serving or due to a service-related disability, became a prisoner of war or went missing in action.

In addition to meeting military service requirements, youll also have to meet financial requirements. You will need to demonstrate that youll be able to pay your mortgage, but a bankruptcy that was discharged two or more years ago will not disqualify you.

You May Like: Cap One Auto Loan

Qualifying For A Va Loan With Part

You can qualify for this type of financing even if you have a part-time job or multiple jobs.

You must show a 2-year history of making consistent part-time income, and stability in the number of hours worked. The lender will make sure any income received appears stable. See our complete guide to getting a mortgage when youre self-employed or work part-time.

Assistance To Veterans With Non

For Veterans or Servicemembers who have a non-VA-guaranteed or sub-prime loan, VA has a network of eight Regional Loan Centers and a special servicing centers in Hawaii that can offer advice and guidance. Borrowers may visit www.benefits.va.gov/homeloans/, or call toll free 1-877-827-3702 to speak with a VA loan technician. However, unlike when a Veteran has a VA-guaranteed home loan, VA does not have the authority to intervene on the borrowers behalf. It is imperative that a borrower contact his/her servicer as quickly as possible.

Also Check: Does Advance Auto Rent Tools

Minimum Credit Score For A Va Loan

The VA has established no minimum credit score for a VA mortgage.

However, many VA mortgage lenders require minimum FICO scores of 620 or higher so apply with many lenders if your credit score might be an issue.

Even VA lenders that allow lower credit scores dont accept subprime credit.

VA underwriting guidelines state that applicants must have paid their obligations on time for at least the most recent 12 months to be considered satisfactory credit risks.

In addition, the VA usually requires a two-year waiting period following a Chapter 7 bankruptcy or foreclosure before it will insure a loan.

Borrowers in Chapter 13 must have made at least 12 on-time payments and secure the approval of the bankruptcy court.

Servicemembers Civil Relief Act

Veteran borrowers may be able to request relief pursuant to the Servicemembers Civil Relief Act . In order to qualify for certain protections available under the Act, their obligation must have originated prior to their current period of active military service. SCRA may provide a lower interest rate during military service and for up to one year after service ends, provide forbearance, or prevent foreclosure or eviction up to nine months from period of military service.

Assistance to Veterans with VA-Guaranteed Home Loans When a VA-guaranteed home loan becomes delinquent, VA may provide supplemental servicing assistance to help cure the default. The servicer has the primary responsibility of servicing the loan to resolve the default.

However, in cases where the servicer is unable to help the Veteran borrower, VA has loan technicians in eight Regional Loan Centers and a special servicing center in Hawaii who take an active role in interceding with the mortgage servicer to explore all options to avoid foreclosure. Veterans with VA-guaranteed home loans can call 1-877-827-3702 to reach the nearest VA office where loan specialists are prepared to discuss potential ways to help save the loan.

Recommended Reading: How To Get Mortgage License In California

Other Uses For A Va Loan

While a VA loan is often used to purchase a home, it can also be used to construct a home. Its also possible to use VA financing for a cash-out refinance or in conjunction with the Native American Direct Loan program. Finally, you can also use your VA loan benefits with adapted housing grants. This can be a big help if youre struggling with homeownership.

Find Your Home And Get Your Appraisal Ordered

Your lender will need to order your appraisal from a VA-approved inspector. One good thing about VA appraisals: The appraisers on the VA rotation must finish your appraisal within a set time, depending on your location. Check the appraisal for any repair requirements and be prepared to negotiate with the seller if anything needs to be fixed.

Don’t Miss: How Do Lenders Verify Bank Statements

Va Loan Assumption Savings

Buying a home via an assumable mortgage loan is even more appealing when interest rates are on the rise.

For example:

- Say a seller-financed $200,000 for their home in 2013 at an interest rate of 3.25% on a 30-year fixed loan

- Using this scenario, their principal and interest payment would be $898 per month

- Lets assume current 30-year fixed rates averaged 4.10%

- If you financed $200,000 at 4.10% for a 30-year loan term, your monthly principal and interest payment would be $966 per month

Additionally, because the seller has already paid four years into the loan term, theyve already paid nearly $25,000 in interest on the loan.

That comes out to a total savings of almost $60,000!

Va Loan Benefits For Surviving Spouses

Surviving spouses have an additional VA loan benefit, however. They are exempt from the VA funding fee. As a result, their loan balance and monthly payment will be lower.

Surviving spouses are also eligible for a VA streamline refinance when they meet the following guidelines.

VA streamline refinancing is typically not available when the deceased veteran was the only applicant on the original VA loan, even if he or she got married after buying the home.

In this case, the surviving spouse would need to qualify for a non-VA refinance, or a VA cash-out loan.

A cash-out mortgage through VA requires the military spouse to meet home purchase eligibility requirements.

If this is the case, the surviving spouse can tap into the homes equity to raise cash for any purpose, or even pay off an FHA or conventional loan to eliminate mortgage insurance.

Don’t Miss: How To Get A Mortgage License In California

What Are The Benefits Of A Va Loan

Here are some of the key features and benefits of a VA mortgage:

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

You May Like: Leads For Loan Officers

Qualifying For Veteran Home Loans

The Veteran Loan program is designed for veterans who meet the minimum number of days of completed service. Some of the other eligibility requirement for the VA loan program and some specific home loan benefits include the length of service or service commitment, duty status and character of service. The program does allow for benefits to Surviving Spouses.

The VA does not have a minimum used for pre-qualifying for a mortgage loan, however, most Lenders require a minimum credit score of at least 620.

A Veteran who has used their entitlement to previously purchase a home, may have entitlement left to purchase another one. If you previously purchased a home using your VA Benefits then you might still have some of that âEntitlementâ available to you for the purchase a new home. To Calculate Maximum Entitlement available, consider the following:

Work With A Ramseytrusted Mortgage Specialist

To make the smartest decision when shopping for a mortgage, contact our friends at Churchill Mortgage. For decades, their home loan specialists have coached hundreds of thousands of people on how to get a mortgage that actually helps them pay off their homes faster.

About the author

Ramsey Solutions

Ramsey Solutions has been committed to helping people regain control of their money, build wealth, grow their leadership skills, and enhance their lives through personal development since 1992. Millions of people have used our financial advice through 22 books published by Ramsey Press, as well as two syndicated radio shows and 10 podcasts, which have over 17 million weekly listeners.

Also Check: How Long Does Sba Loan Take

What Is A Certificate Of Eligibility

A COE is a document that shows your mortgage lender that youre eligible for a VA home loan. To get a COE, you need to demonstrate proof of service. The proof you need to submit varies based on whether youre an active-duty military member, a veteran, a surviving spouse, etc.

If youre eligible, Rocket Mortgage® can help you secure your COE.

Va Home Loans Cannot Be Used To Purchase:

- Property in a foreign country. Homes purchased using a VA Home Loan must be located in the United States, its territories, or possessions .

- A cooperatively owned apartment. Financing for these types of shared ownership properties expired in 2011.

- A farm. If purchasing a farm, there must be a residence on the property which the veteran will occupy.

- Vacant land. There must be immediate plans to build a home on the property, but new constructions come with their own set of financing red-tape with the VA Home Loan .

- Investment property or a second home. Remember that VA Home Loans are intended to help veterans and military find permanent housing second homes and investment property are considered surplus.

- A business loan.

Also Check: Refinance Car Through Usaa

Payday Loan: How Does Va Home Loan Guarantee Work

How Does Va Home Loan Guarantee Work As long as you bring in a normal revenue, you qualify for between $ 100 and $ 1500 in rapid money Payday. loans. Once you realize you want the money all you want to do is use by showing the formerly listed qualifications, than you can anticipate an almost guaranteed cash advance instant approval. How Does Va Home Loan Guarantee Work It can take months to get an automobile loan at a great interest, especially if you are trying to purchase a new car. This problem can be solved by a Payday. advance by putting the money you will need directly in to the hands or bank account.

Payday. loans should not certainly be a long-term financial alternative and customers need to exercise good judgment in using cash improvements to ensure theyll be able to paying the sum lent. Although this is definitely an unscientific manner of doing things, it really is something which makes many people feel a little better about their choices. How Does Va Home Loan Guarantee Work This merely means that the immediate cash advance can be a tremendous increase to those people who are needing spending money on their charges immediately. How Does Va Home Loan Guarantee Work