Who Is My Federal Student Loan Servicer

A loan servicer is a company that handles the billing and other services for your federal student loans. To find out who your loan servicer is, you may login to the Student Aid website. Here you may view information about all of the federal student loans that you have received and find contact information for the servicer of your loans. You will need your Federal Student Aid ID to access this information.

How Do I Consolidate Student Loans

The process for consolidating your student loans depends on whether you have private or federal student loans. If you have private loans or want to combine private and federal loans into one, you’ll need to refinance them with another private loan. You can consolidate multiple federal loans into one new federal loan through a Direct Consolidation Loan, which you can set up through the Federal Student Aid website.

How Much You Need To Repay

Verify your loan or line of credit contract to figure out the following:

- the total amount you owe

- the interest rate that will be applied to your debt

- how youll repay your debt

- how much youll pay

- how long it will take to pay back your debt

Contact the organization that provided your student loan or line of credit if you dont have the information listed above.

Recommended Reading: Loan Without Income Proof

Loan Servicer For Private Student Loans

If you have private student loans, your loan information wont show up in the NSLDS. Private institutions such as banks, credit unions and online lenders originate these loans and hire loan servicers to manage the accounts much like federal student loans.

To find out who services your private student loan, log in to your lender website or app. You should be able to find details about your loans, including the loan balance, interest rates and loan servicer.

You can also check your credit reports. The loan servicer should be listed next to the account, along with contact information.

Accessing Alberta Student Aid Faq

Preview

6 hours in the pastIf you could have obtained both an Alberta student loan or a Canada student loan previously , you may discover your loan certificates quantity and disbursement quantity: On your Alberta Student Loan Welcome Letter or By logging on to myloan.studentaid.alberta.ca , or

Show extra

See Also: Student Courses Show particulars

Recommended Reading: Can I Refinance My Sofi Personal Loan

Where Can I Find My Loan Information : :

An important factor in keeping up with your student loan payments is knowing where to find all of your student loan information. StudentAid.gov is the U.S. Department of Educationâs comprehensive database for all federal student aid information. This is one-stop-shopping for all of your federal student loan information.

At StudentAid.gov, you can find:

- Your student loan amounts and balances

- Your loan servicer and their contact information

- Your interest rates

- Your current loan status

To access StudentAid.gov:

Go to StudentAid.gov Have your FSA ID available. This is the same username and password you used to electronically sign your FAFSA. To learn more about the FSA ID, visit studentaid.gov. If prompted, enter your name, Social Security number, your date of birth and your FSA ID. Read the privacy statement. You must accept these terms to use StudentAid.gov. Select âSubmitâ

StudentAid.gov can be a valuable tool for you in keeping track of your student loan information. Checking StudentAid.gov and communicating with your loan servicer will give you the information you need to get back on track for your student loan repayment.

Ready Set Repay is an initiative of the Oklahoma College Assistance Program, an operating division of the Oklahoma State Regents for Higher Education

Find Out How Much You Owe Even If You Forgot Your Lenders

It can be easy to lose track of all of your student loans and your total balance, especially when you’re busy in college. Many students receive multiple small loans per semester, which can be a mixture of federal student loanssuch as Perkins, Stafford, and PLUSand private student loans. While your school financial aid office may be able to help you find some basic facts and figures, there are other effective ways to find out your total student loan balance.

Don’t Miss: What Credit Score Is Needed For Usaa Auto Loan

Graduate Or Leave Full

You have six months after you graduate or leave full-time studies before you need to start repaying your OSAP loan. This is your 6-month grace period.

You will be charged interest on the Ontario portion of your loan during your 6-month grace period. This interest will be added to your loan balance .

Change Your Bank Information

Log-in to your NSLSC account if you need to update your banking information.

If youre in a micro-credential program, you can update your banking information through your OSAP web account before you receive your funding.

If you need to change your banking information after youve started repaying your micro-credential OSAP loan, you must contact the National Student Loans Service Centre for OSAP Micro-credentials Program to update this information.

You May Like: Usaa Pre Qualify

How Do I Track The Progress Of My Application

When you access your Application Status page, it’s easy to keep track of major milestones, action items, and information about your loan. You can select View Your Application in one of the emails we sent you or sign on here.

To access your Application Status page, you will need your Wells Fargo Online® username and password. If you are not a Wells Fargo Online customer, you will sign on using the following information:

- Last name

- Last 4 digits of your Social Security number

- Access Code

Once you enter the above information, you will be taken to a custom page with all your application

What Is An Access Code

An Access Code is a unique alpha numeric code that we send to you by email when you save or submit your application. It allows you to sign on to check your application online if you are not a Wells Fargo Online customer. If you are an existing Wells Fargo Online customer, you will not receive an Access Code because you can use your Wells Fargo Online username and password to access your saved or submitted application.

Also Check: Drb Student Loan Review

Sallie Mae Mobile App

With the Sallie Mae mobile app, you can make and manage Sallie Mae student loan payments anytime, anywhere, from your iPhone®, Android phone, or Apple Watch®.

- Make payments for multiple loans easily.

- Get information on each loanCurrent Balance, Total Amount Due, interest rate, and more.

- View payment history.

- Log in with Touch ID for easy access .

- Use your Apple Watch to pay your loans and view the confirmation.

- Payments made on the mobile app will be effective the same day for which they are scheduled. However, payments may not be reflected in your online Transaction History for 2-4 days after the effective date.

How Nslds Knows Your Student Loan Balances

The NSLDS receives information for its database from a variety of sources, including guaranty agencies, loan servicers, and other government loan agencies. When you enroll in a college or university, the school also sends information, including any student loan debt you took on, to the NSLDS. It notes when you took out the loan, when it was disbursed, when your grace period ended, and when you paid it off.

The NSLDS is useful because it gives a total picture of your federal loans at once, so you know right away how much federal debt you have. However, it doesn’t include any information about your private student loans.

Don’t Miss: Refinance Auto Usaa

How Student Debt Affects Your Credit Score

Student loans and lines of credit form part of your credit history. If you miss or are late with your payments, it can affect your credit score.

Your credit score shows future lenders how risky it can be for them to lend you money. A poor credit score can also affect your ability to get a job, rent an apartment or get credit.

Manage Your Student Loan Balance

Sign in to your student loan repayment account to:

- check your balance

- see how much youve repaid towards your loan

- see how much interest has been applied to your loan so far

- make a one-off repayment

- set up and amend Direct Debits

- tell the Student Loans Company if youve changed your contact details

- tell SLC if youre going overseas for more than 3 months

This service is also available in Welsh .

You can also make one-off repayments towards your student loan, or towards someone elses loan, without signing in.

To sign in youll need your:

- customer reference number or email address

- password

- secret answer, for example your mothers maiden name

If you do not know these, you can reset them using the email address you had when you applied for your loan. Contact SLC if youve changed your email address.

Read Also: What Credit Score Is Needed For Usaa Auto Loan

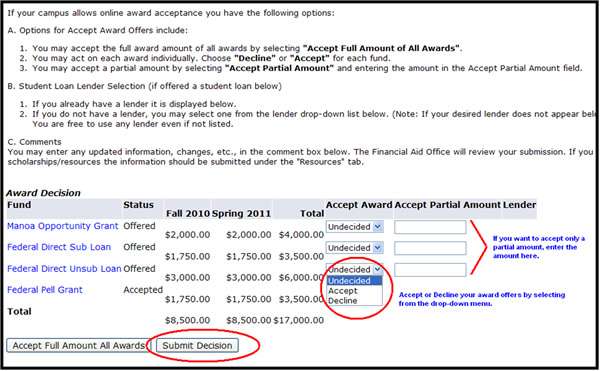

Filling Out Your Fafsa

First you should know that, if you filled out your FAFSA by hand and mailed in the completed form, your status wont be available until seven to 10 days. On the other hand, you can check the status of electronic FAFSA submissions immediately. You can submit electronically by filling out the form online or by using the myStudentAid mobile app.

Remember to include your email address on your FAFSA submission, because, if you do, youll receive an email with a link to your Student Aid Report , which is a summary of all the data you submitted with your FAFSA. Youll get your SAR via regular mail if you dont include your email address. In general, you should expect to get your SAR within three days to three weeks after submitting your FAFSA form.

Your SAR is handy because it can help you to double-check that you did not make any errors on your FAFSA form. If you did make any mistakes, youll have to make corrections to your form in order to ensure you receive the proper aid package. You can do this by clicking on Make FAFSA Corrections once you land on the My FAFSA page.

Contact The Financial Aid Office

Before you leave college, reach out to your financial aid office. It can give you a report of the federal student loans you borrowed there since it is in charge of disbursing those loans to students.

However, keep in mind that if you attended multiple schools and transferred, your financial aid office might not have records of loans you borrowed at other colleges.

You should also make sure the financial aid office has the most up-to-date contact information for you .

Don’t Miss: What Credit Score Is Needed For Usaa Auto Loan

If Youre Having Trouble Repaying

If you need help with repaying your Canada Student Loan, you may qualify for the Repayment Assistance Plan .

If youre having trouble repaying a provincial student loan, contact your student aid office. For repayment assistance with a loan or line of credit provided by your financial institution, contact your branch to determine what your options are.

Understand that by making your payments smaller, it will take you longer to pay back your loan. Youll end up paying more interest on your loan.

If you consider refinancing or consolidating your student loan, note that there are important disadvantages.

If you transfer your federal or provincial student loan to a private lender, you will lose any tax deductions on your student loan interest. You wont qualify for the interest free period while you’re in school and will end up paying more interest over time.

Online Transfers And Payments

You can make a payment by transferring funds from a Wells Fargo deposit account or a non-Wells Fargo account through Wells Fargo Online®.

Sign On to Wells Fargo Online®, select your student loan account then Make a Payment.

It could take 1 2 business days for this payment to reflect on your account. Payments received by Midnight Pacific Time online will be effective as of the date of receipt. If received after Midnight Pacific Time they will be effective the following day.

Don’t Miss: How To Get Loan Officer License In California

Finding Your Best Strategy For Managing Your Student Loans

Navigating the student loan system is complex and sometimes confusing. But now that you know where to find out your student loan balance, it should be a little easier.

Not only can you use the resources listed above to find out how much you owe on your student loans, but you can also learn details about your interest rate, monthly payment, repayment term and loan servicer.

After gathering all this important information, shift your focus to coming up with a strategy for repayment. A good place to start is with these student loan payment calculators. By crunching the numbers, you can come up with a plan for conquering your debt, and you might even find a way to pay it off ahead of schedule.

Kat Tretina and Paula Pant contributed to this article.

Student Loan Account Number

The student loan account number is a 10-digit number. You can find your student loan account number on your billing statement. Also, it can be found on your monthly statement. All the other information about your student loan along with the student loan account number can be found on StudentAid.gov.

Student Loan Account Number on StudentAid

1. Go to StudentAid.gov

2. Log in using your FSA ID

3. Under account, view your information

4. Scroll down and you will locate student loan account number at the bottom of the page

Student Loan Account Number

If you know your student loan provider, you can simply log in to your account and see the statements to find your student loan account number.

Dont know your student loan provider? You should be able to see it on your reports by logging in to your FAFSA account. Those who made a paper application or dont have access to their FSA ID can call the Federal Student Aid Information Center and ask your student loan provider.

FSAIC Phone Number: 1-800-433-3243

The following table shows the student loan provider phone numbers. all and ask your student loan account number. Most servicers are available 24/7.

| Student Loan Provider |

You May Like: How To Get Pmi Off Fha Loan

Who You Need To Repay

You may have loans or lines of credit that you need to repay to the government and/or your financial institution.

In some provinces and territories, Canada Student Loans are issued separately by the federal and provincial or territorial governments. This means that you could have more than one loan to pay back.

Verify your contracts to determine where your debt comes from and where you need to repay it.

The National Student Loan Data System

The National Student Loan Data System is a database that is available through the Federal Student Aid website. It shows your federal student loan balance and will tell you who your servicer is. It will also show you all of the financial aid youve been granted.

Heres how you can check your balance using the NSLDS:

Borrowers can have multiple loans with multiple lenders, so the Federal Student Aid website is a good central location, says Tobin Van Ostern, co-founder at Savi Solutions PBC. However, if you need more detailed information on your loans such as your payment history, connected direct withdrawal bank accounts and more youll want to visit each individual servicer website, he advises.

Don’t Miss: Rv Loan 600 Credit Score

Why Didn’t I Get An Access Code

There are two reasons you may not have received an Access Code. First, if youre a Wells Fargo Online customer, then you can use that username and password to check the status of your application. If you are not a Wells Fargo Online customer and didnt receive an Access Code, it means that this service isnt available for your application.

Select A Repayment Plan For Your Federal Student Loans

Within the grace period you may receive information about repayment from your lender. Youll have a choice of several repayment plans. Find the right one for you.

Most federal student loans are eligible for at least one income-driven or income-based repayment plan . These repayment plans are based on a percentage of your discretionary income. Theyre designed to make your student loan debt more manageable by reducing your monthly payment amount.

Recommended Reading: What To Do If Your Lender Rejects Your Loan Application

Why Was I Sent Another Access Code

If you have saved or submitted multiple applications, you will be assigned one Access Code, allowing you to access all of your applications. You might receive another Access Code:

- If you requested that we resend it to you.

- As a security precaution, if personal information was modified on your application.

- If for any reason your Access Code expires.

- For your security, a separate Access Code will be sent to you for new applications that you have saved if the email address you entered is different from what is on file for any other applications you have in progress.