What You Need To Refinance

To refinance an existing loan, you need the following :

Refinancing Your Car: Good Idea Or Bad Idea

Its not uncommon for homeowners to refinance their home loans, but have you ever considered refinancing the loan on your car? Its surprisingly common and far easier than the sometimes painful process of trying to refinance your mortgage. But before you get too excited, weve listed some helpful hints for drivers trying to decide whether it would be a good or a bad idea to refinance a car loan.

When Its a Good Idea to Refinance

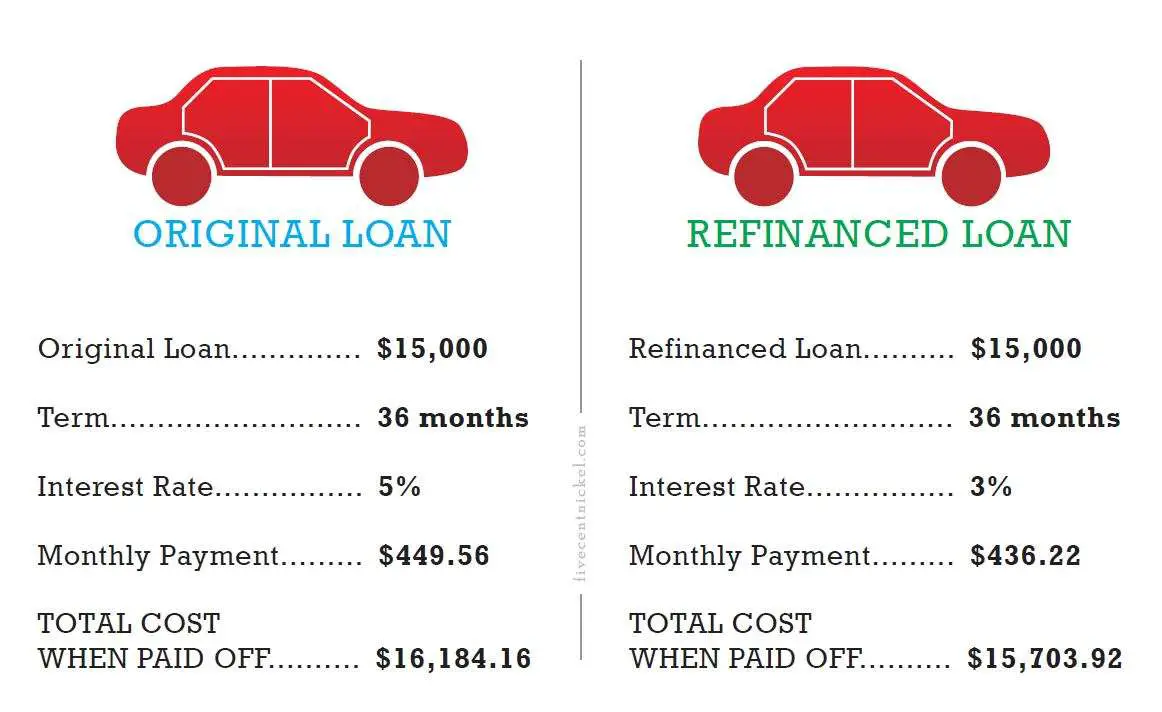

There are several situations in which it may be beneficial to refinance your car loan. One is if youre trying to take advantage of lower interest rates. For example, if you purchased your car several years ago back when rates were higher, you may want to consider refinancing in order to get a better rate. Doing so will lower your payment, but most importantly, it will decrease the amount of interest you have to pay on the loan.

Its also a good idea to consider if your credit situation has improved substantially compared to when you bought the car. If youve improved your credit enough, your interest rate is likely to go down, and that means youll make a lower monthly payment and youll pay out less money in interest.

When Its a Bad Idea to Refinance

Should You Do It?

Related Car Financing Articles:

The Hard Credit Inquiry Could Hurt Your Score

The process of applying for car loan refinancing usually includes a credit check, and it will likely count as a hard inquiry against your credit profile, which can dock your score a few points.

After a credit hit, You might not qualify for a rate you thought you did before, said Benjamin Schandelson, a loan originator with MJS Financial LLC in Boca Raton.

The degree to which a hard credit inquiry will hurt your score varies. According to FICO, a hard credit check might reduce your FICO score by as little as five points since the new credit factor of your score only has a 10% weight in the calculation.

That said, the hit could be greater for certain people: A hard inquiry might be more impactful if you have few accounts on your credit report and a short credit history.

Read Also: Usaa Refinance Car

Has Your Credit Improved

If your credit has improved, refinancing could result in a lower interest rate, which could save you money in interest over the life of the loan. But if your credit hasnt improved, getting a lower rate may be difficult unless interest rates have dropped since you got your current loan.

If youre not sure, check your credit to get an idea of where your credits at. Checking your credit reports can also help you identify any potential errors that may be impacting your credit scores and work on disputing them.

Penfed Credit Union: Top Credit Union

Starting APR:1.79% for 2020 or newer vehicles, 2.39% for used vehicles or vehicles with over 7,501 milesLoan amounts:$500 to $100,000Loan terms: 36 to 84 months Availability:50 statesMinimum credit score:610

Based on our research, PenFed Credit Union tends to offer some of the lowest interest rates for refinancing auto loans in the industry. Its 1.79% starting APR for refinancing new vehicles is one of the lowest rates our team found.

However, the lender has a slightly higher minimum credit score requirement than some of its competitors, so you may not be eligible to refinance your auto loan with PenFed if you have a low credit score. While you need to be a member to get financing, anyone can join either through their job or by making a donation to an approved charity.

Don’t Miss: Marcus Goldman Sachs Loan Reviews

Apply For Anauto Refinance Loan

Once youve shopped around, collected all of your information and made a decision, youre ready to apply.

Youll need to complete a loan application for the lender you choose. This is where the documentation you gathered can come in handy, as you may have to provide it in the application. This application will count as a hard inquiry, which can lower your credit scores by a few points.

If your loan is approved and you sign the loan paperwork provided by the lender, you should get a document from your lender with all the terms of your new loan. Keep a copy for your records, as it will include details on when your payment is due, the minimum amount youll need to pay each month and your options for making loan payments.

History Of Same Employment

If you have a history of being in the same line of work and have just changed jobs, most lenders only require you to provide a pay-stub with 30-days year-to-date income to receive approval for a refinance loan. If you have a position that provides a contract the lender might even use the employment contract to document your income. If you just graduated from college and your degree directly relates to your new job, you will not have to wait to establish a work history prior to refinancing a home.

You May Like: Usaa Used Car Loan Calculator

Rules For Refinancing Usda Loans

The U.S. Department of Agriculture offers two mortgage programs for rural home buyers: guaranteed loans and direct loans. To refinance a guaranteed loan, you must have had the mortgage for at least 12 months. For direct loans, there is no waiting period for refinancing.

The USDA offers three options for refinancing into another USDA loan. If you get a streamlined refinance or non-streamlined refinance, you must have made on-time payments in the last 180 days. For the streamlined assist program, you must have been current on your mortgage payments in the last 12 months.

Apply For Your Auto Refinance Loan

There are a few steps youll need to take to apply for an auto refinance loan. Once youve decided on a lender, youll need to gather all required documents before applying. This can include information about yourself, like your name, address, and social security number, as well as information about your vehicle and your previous loan.

If youre interested in applying for an auto refinance loan, its a good idea to wait to apply until your finances are in order. For example, if your credit score is near a threshold, you might want to take steps to raise your score before applying to qualify for lower rates. Once your application is accepted, youll need to begin repaying your new loan. Its a good idea to set up automatic payments each month to make sure you never miss a payment.

You May Like: Credit Needed To Refinance Home

When Should You Refinance A Car

When to refinance depends on your circumstances and needs. Refinancing could make sense if your credit score has recently improved, if car loan rates have fallen, or if you need a lower monthly payment. Overall, consider refinancing when you can get a better deal on your car loan and it won’t cause you to pay more for the vehicle.

You Cant Afford Your Car Loan Payments

Refinancing typically offers the option of extending the loan beyond the original ending date. That, along with any reduction in your rate, can reduce your monthly payments. But a longer term will also eat up some or even all of the savings from a lower refinancing APR. As a last resort, you also could consider cash-out refinancing, in which a lender will refinance your loan and give you cash up to and in some cases more than the difference between the amount you owe and the vehicles value, if higher. But such borrowing is extremely risky, especially since youre already in a pinch.

You May Like: Usaa Refinancing Car Loan

Coronavirus Auto Finance Relief

COVID-19 has hurt lots of peoples finances. If youre worried about being able to keep your car, you may be able to get some help. Credit Karma has gathered a list of automakers and lenders that are offering relief options. We also have some other resources if youre looking for financial assistance.

But you may be looking to refinance to take advantage of lower interest rates which resulted from the Fed dropping its rates because of the pandemic. If thats the case, youll want to consider the advice in the article above.

In addition, some dealers are offering extreme financing deals for new vehicles, which may make sense for you if you were already considering trading in your car.

About the author:

Read More

How Long Before I Can Refinance My Car Loan

Question: How long before I can refinance my car loan? I am not happy with the interest rate or local bank the dealership used to finance my new car. My credit rating is ‘fair’, but I feel my rate is way too high. Prior I had refinanced my trade-in with a credit union that gave me a great interest rate and lowered my payment considerably. I asked the dealership to use this credit union, they stated that this credit union was in their network, but didn’t use them. How long do I have wait before I can refinance my new car with the credit union that gave me such a great interest rate? Thanks

Answer:

Recommended Reading: Capitalone Autoloans.com

When Refinancing Might Be A Bad Idea

While refinancing your car loan can have a positive impact on your finances, there are some pitfalls to watch out for.

- Your loan has a prepayment penalty. A prepayment penalty can kick in if you pay off your loan in full before it’s due. While this fee isn’t too common among major car lenders, it does exist. If your loan documents show a prepayment penalty, refinancing likely won’t make sense if the savings you get from the loan switch don’t exceed the cost of the penalty.

- You want to extend the loan term. While this strategy can be helpful if the alternative is defaulting on the loan and losing your car, it’s generally not a good idea if you can afford the payments you currently have. That’s because if you replace your current loan with one that has a longer repayment term, you will pay more in interest over the life of the new loanunless you can manage to pay it off early.

- You owe more than it’s worth. If you’re underwater on your car loanmeaning you owe more than the value of the vehiclerefinancing is still possible but not always a great idea. This is primarily because your original lender will require you to pay the difference as a lump sum before considering the matter closed. If you don’t have enough cash lying around, you’ll have a difficult time making it work.

What Should I Know Before Refinancing

Say you financed your car with a 6% interest rate, but you see a lender offering 5%. Sounds like a good offer, right? Not necessarily. There are more factors that play into refinancing than just the interest rate.

Once youve determined that it makes sense for you to refinance, youll need to consider a few factors before starting the process.

- Determine if youll incur any fees. Youll need to find out if your lender imposes a fee on those who pay off their loans before a certain date, like a prepayment penalty. Some contracts include this in fine print, and the lender uses it as an incentive for you to stick with them through the life of your loan. If your auto loan is through PSECU, theres no fee for paying off your loan early.

- Calculate your new estimated payment. Compare what your monthly payment is now and what it would be if you refinance. If youre only saving a few dollars, it may not be worth it to refinance.

- Review your credit history. Remember that lenders take your payment history into consideration when reviewing a loan application. Having good credit could get you a better rate. Your payment history is a factor that impacts your score significantly. So, if youve missed payments on your current loan, you may be less likely to get approved for refinancing.

Don’t Miss: 84 Month Auto Loan Usaa

When Your Credit Health Has Improved

Your credit scores are a factor in determining your auto loan rate. If your scores have gone up since you bought the car, and youve made on-time car payments, you might get a better rate, which could save you money in interest over the life of the loan.

Lenders may use your FICO® Auto Scores or base credit scores to help determine your creditworthiness. But no matter which they use, better credit scores can indicate to lenders that youre more likely to pay off your loan, so they may give you a lower rate.

Not sure if your scores have improved? On Credit Karma, you can get your free VantageScore 3.0 credit scores from TransUnion and Equifax.

When To Consider Refinancing Your Auto Loan

While an auto loan refinance can save you money, its not the right fit for everybody. You should assess your needs to decide if its a good time to refinance your auto loan before you apply. For example, if your credit score has improved or interest rates have dropped, you may be able to secure more favorable terms than your original plan. If youre having trouble making your monthly payments, refinancing your auto loan can also be an opportunity to lower premiums to meet your budget.

If your credit score is lower than when you initially applied, or if interest rates are much higher, it usually doesnt make sense to apply for an auto loan refinance. You should only go through with an auto loan refinance if the rates and terms are better than your original loan.

Read Also: Diy Loan Agreement

You Want A New Lender

Some banks, , and other lenders reward loyal customers with low rates. They may also offer special deals to attract new customers, especially those unhappy with the car loan they got at their local dealership. If youve developed a relationship with one of these lenders and qualify for a competitive rate, auto refinancing may be the way to go.

Auto Refinance Calculator

Compare Auto Refinance Loans

Before applying for an auto refinance loan, you should be sure to compare quotes from multiple different providers. Some factors to take into consideration include:

- Loan amounts: Most lenders have minimum and maximum loan amount requirements, usually somewhere between $7,000 and $100,000. Make sure that the loan you want to refinance is in between these limits.

- Rates: One of the main goals of refinancing an auto loan is to lock in lower rates. Make sure to compare rates from multiple different providers to ensure youre getting the best possible deal.

- Repayment terms: Whether you want to pay off your loan faster, or need a longer-term length with smaller monthly premiums, look for an auto refinance loan with repayment terms that meet your needs.

- Some lenders have minimum credit score requirements for borrowers. If your credit score isnt where you want it to be, consider holding off on applying until you raise your score.

- Car requirements: Not all lenders will issue auto refinance loans for all cars. Make sure that your car meets the requirements of any lenders that youre interested in.

Recommended Reading: Usaa Car Payment Calculator

You Want Lower Monthly Payments

Are you having a difficult time covering your monthly payment?

Refinancing for a longer term can bring down your monthly costs and make balancing your checkbook more manageable.

The answer depends on your individual situation, but lets say your current loan balance is $20,000 at a 6% interest rate with a five-year payoff time frame.

Keep in mind that while lower monthly payments may help you in the short term, a longer-term loan could put you at more financial risk. You may be stuck paying off a large portion of your loan after your cars value has significantly depreciated.

If your immediate goal is to reduce your monthly expenses, an auto loan refinance could still be a good choice. Consider refinancing now but increasing your monthly payment once your financial situation has improved.

You can always enter your desired loan terms into an online debt repayment calculator to see if refinancing could reduce your monthly payments and how much your total interest cost could decrease.

When Is It A Good Time To Refinance Your Car Loan

car insuranceGET AN ONLINE CAR INSURANCE QUOTE

In collaboration with Loans Canada

Do you already have an auto loan to help finance your car? Are you looking to take advantage of lower interest rates to save money on your existing loan? If so, refinancing your loan could help you save money over the long haul and ease your financial burden.

If keeping more money in your pocket is on your agenda for the new year, you may want to consider refinancing your current car loan for one that comes with a lower interest rate. Let’s take a look at auto loan refinancing to see if it’s the right fit for you.

How Refinancing a Car Loan Works

Refinancing an auto loan involves taking out a new loan to pay off the remainder of your existing car loan principal. Like your original car loan, refinancing is secured by your vehicle and paid off in regular installments over a certain amount of time until the amount is paid off. Your replacement loan will come with new terms and a new interest rate, hopefully lower than what you’re paying right now.

Can Anyone Refinance Their Car Loan?

Before you apply to have your auto loan refinanced, it’s important that you understand the requirements for such an arrangement, which typically include the following:

Type of vehicle – Certain vehicle types might not qualify for auto loan refinancing, such as commercial vehicles or RVs.

In order to refinance an auto loan, you will need to gather the following documentation:

Choosing a Lender to Refinance With

- Tags:

Also Check: Loan Originator License California