How To Stop Student Loan Wage Garnishment Before It Starts

You can stop a student loan wage garnishment before it starts by making payment arrangements with the creditor. Most federal student loan borrowers can prevent the garnishment by:

- Negotiating a payoff

- Entering the loan rehabilitation program

- Signing up for a monthly repayment agreement

Federal student loan settlements are expensive: you’ll typically save 50% of the outstanding interest and 10% of the principal loan balance. You’ll have to pay that amount in 90 days. Learn more about the federal student loan settlement process.

Consolidation gets you out of default fast, but you’ll have to apply before a wage garnishment order is sent to your employer. You can’t consolidate a loan that’s subject to garnishment. Read more about how to consolidate defaulted student loans.

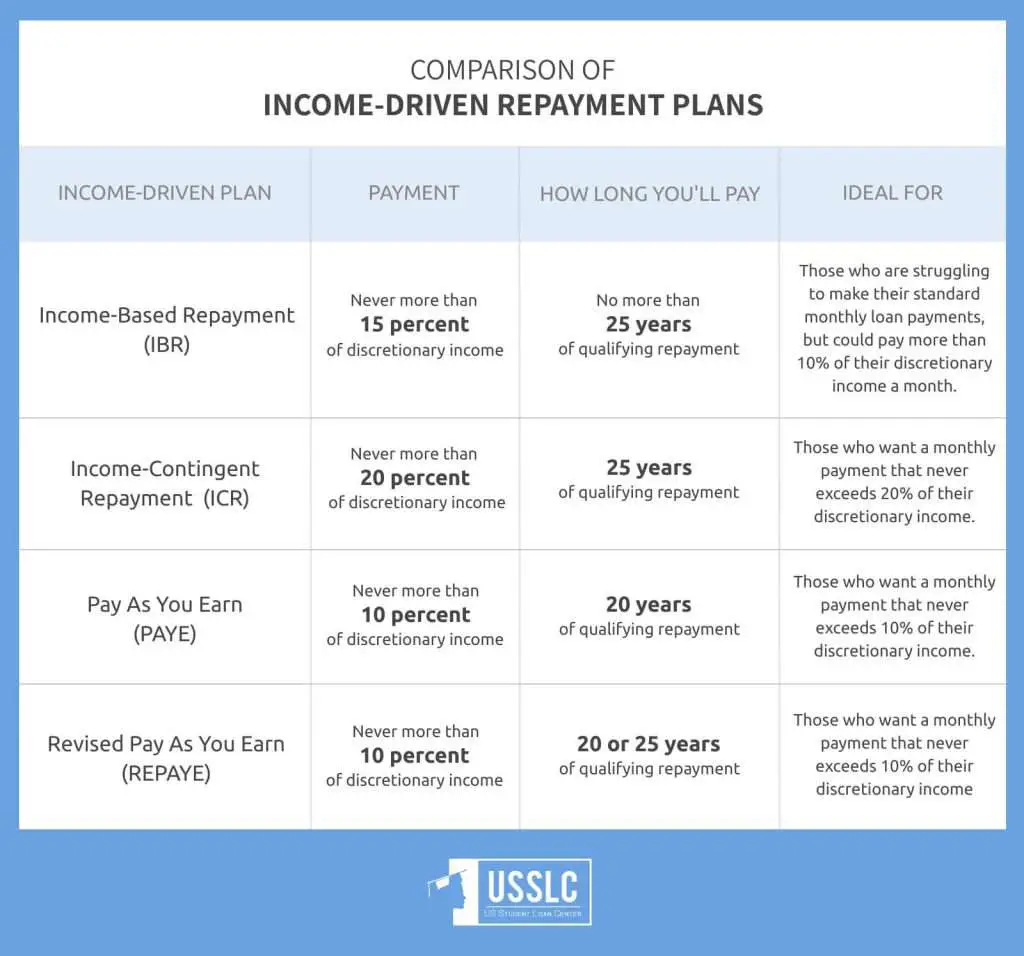

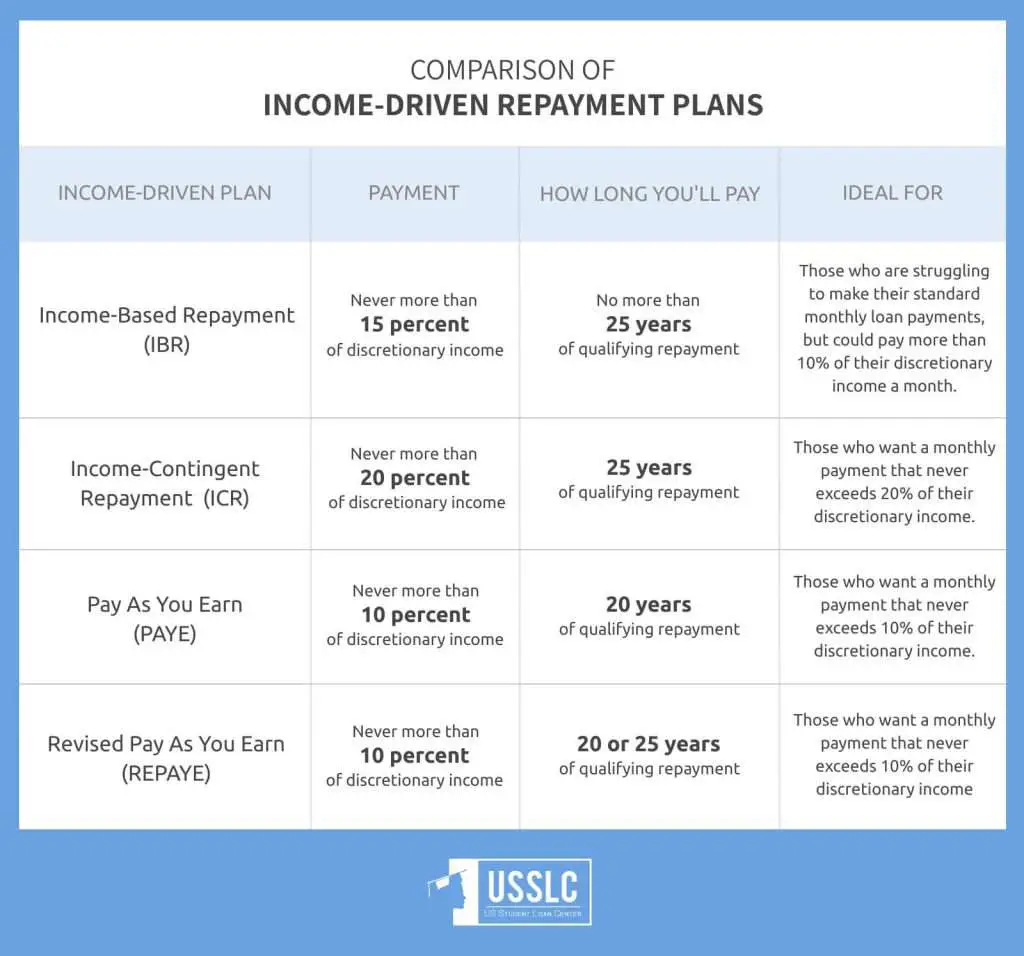

Loan rehabilitation is a one-time program that stops wage garnishment and the offset of tax refunds and Social Security payments. To enroll, youâll agree to make nine monthly payments that will either be 15% of your discretionary income or your monthly income with accepted living expenses deducted. Rehabilitation is popular because it’s the only option that removes the default status from a credit report. But that benefit typically doesn’t significantly raise a credit score. Learn how student loan rehabilitation works.

Learn More:Collection Costs on Defaulted Student Loans

How Much Should I Borrow In Private Student Loans

Unlike federal student loans, private student loans typically allow you to cover up to the total amount of your schools certified cost of attendance. Of course, you want to try to minimize how much you borrow, since more debt means more interest costs.

Borrowing only what you can reasonably afford to repay, based on your projected postgraduate income and monthly budget, is a good rule of thumb to follow.

To get a sense of exactly how much you need, take a look at your financial aid award letter. It should detail your cost of attendance, as well as your offer of gift aid and federal loans, which should almost always be prioritized over private loans.

Wait For School Certification

Once youve signed your loan documents, youve pretty much completed your responsibilities in the private student loan process. Your lender and school will take care of the rest that is until your repayment begins.

During the stage, your lender will send your loan details to your school to confirm several things, including your enrollment status , your anticipated graduation date, and your requested loan amount.

Note that your private student loan amount cannot exceed the schools calculated cost of attendance, once they factor in other loans or aid youre receiving. Your school can then certify the loan as is, with changes , or not at all.

If your school makes changes to the loan, your lender will often need to generate new disclosures to make sure you have the latest information. You may need to accept the new disclosure, so keep an eye out for communications.

How long does a student loan certification process take?

The timing of certification is determined by your school and . Sometimes it can take longer especially if its a busy time of year when many students are .

You May Like: Usaa Loan Credit Score Requirements

What Is A Student Loan Disbursement

Looking for a student loan disbursement meaning? Its just a fancy term for the payout of funds from your lender. Note that after you agree to borrow a loan, you typically dont get the money deposited in your bank account right away.

Instead, you have to wait for a certain period of time while your lender gets your application in order. You might also have to take various steps before your lender will disburse the funds, such as student loan entrance counseling.

Before your student loan is disbursed, both your school and your lender should notify you in writing that the money is on its way. This notification should also detail how much you borrowed, and when and how you will receive your funds.

Heres How Funds Are Sent To Your School

When certification is received, and after the right to cancel period has expired, your student loan is ready to be disbursed.

- A disbursement is funds that are sent to your school. Loan funds may be divided into multiple disbursements .

- If you chose a repayment option that requires in-school payments, your monthly payments will begin as soon as your funds are disbursed.

Recommended Reading: Usaa Car Loans Credit Score

How Long Does It Take To Get A Student Loan Private Student Loans

Bear in mind that college students should always opt to take federal student loans if they can. The last resort should be a private student loan. How long it takes to get one of these varies, unlike federal ones’ timeline, which is standard. It could take over two months to receive the funds for private student loans. The maximum period is typically no more than 10 weeks, and the average usually is less. Most college hopefuls get this kind of student loan money within two weeks to 10 weeks.

The way the money is provided depends on the kind of loan chosen. A financial aid office is not always the collector. If a borrower opted for a direct to consumer loan, the school’s financial aid office would not get the funds. Instead, the process would involve the money going directly into the personal bank account of the borrower. On the other hand, school-certified loans are paid to the school’s financial aid office.

Of course, college students have variable rates to deal with where private loans are concerned, so they can never ignore that factor.

Getting Your Financial Aid Award Packagetime: March Or April Of The Aid Year

Your colleges financial aid office will receive the FAFSA® information and, based on what is provided, determine your financial aid eligibility.

If the college deems you eligible for student aid, it will prepare and issue a financial aid award letter in the latter part of March or at the beginning of April. The financial aid office is solely responsible for administering federal student loans.

The letter contains information about need-based federal student loans and might also include information about non-need-based loans. Some of these loans include the Parent PLUS Loan, Direct Subsidized Loan, and the Direct Unsubsidized Loan.

Also Check: Student Loans Fixed Or Variable

How To Apply For A Student Loan

The loan application process depends on the kind of loan a college student wants to get for school. How long it may take to get the loan also depends on this. If someone wants to get federal student loan funds, the Free Application for Federal Student Aid is the avenue to access that money. Parents who have dependent college students may elect to complete the form on the student’s behalf.

If a college student wants to make sure a financial gap is closed after maxing out federal loans, or if the person didn’t qualify for government financial aid, a private student loan may be in order. Any student who hopes to get a student loan this way must go through the process stipulated. Private student loan providers have different processes, and they must be followed to completion before any money is turned over.

Review And Accept The Offer

After you complete the FAFSA, you will get a financial aid letter which will explain how much you and/or your family is expected to contribute . This is a general letter, and is not yet specific to your school.

After you have enrolled in a college, you will receive another financial aid award offer that outlines exactly which loans, and the amounts, you are eligible for and can get for the academic year. You need to review and accept this letter, either on the FAFSA website or on your college website.

Don’t Miss: How Does Pmi Work On Fha Loan

Managing Your Private Student Loans

Starting with your first semester, itll be helpful to keep track of both your federal and private student loans. Here are some tips for managing them:

How Long Does It Take To Get A Student Loan

Taking out either federal or private student loans can take a few weeks or a few months though private student loans might be the faster option if you need funds quickly.

Edited byAshley HarrisonUpdated October 7, 2021

Our goal is to give you the tools and confidence you need to improve your finances. Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. Credible Operations, Inc. NMLS # 1681276, is referred to here as “Credible.”

If youre looking for financial aid to help pay for your education, you might wonder how long it takes to get a student loan. The entire process loan application, approval, and disbursement depends on whether you get a federal student loan or private student loan. But knowing the rough timeline to expect will help you figure out when to apply for your student loans.

Heres how long it takes to get a student loan and how to check on your loans progress while youre waiting:

Also Check: Usaa Auto Refinance Reviews

How Long Does It Take To Get Federal Student Loans

a few weeks to a few months

If you want federal student loans, youll need to start with the Free Application for Federal Student Aid . Once youve completed your application, it could take anywhere from three to five days to process.

After your application is processed, your Student Aid Report is sent to the schools you listed on your FAFSA. You should typically receive a financial aid award letter from your school within three weeks of submitting your FAFSA but keep in mind that each schools process for this is different. If you havent heard from your school after three weeks, its a good idea to contact the financial aid office.

Federal student loans are typically disbursed at the start of each term. If there are funds left over after paying for your tuition, fees, and student housing, most colleges will refund the remaining balance to you within a couple of weeks of receiving your loan funds. Keep in mind that some schools add a 30-day delay to this as an added protection for first-time borrowers.

Read More:

How Long Do School

School-certified loans are private loans that undergo a verification process with the chosen college before disbursement. When youre approved for the loan, your school confirms things like your enrollment status and the estimated cost of attendance. Direct-to-Consumer loans are also private loans but are not verified by the school.

Private loans are either school-certified or direct-to-consumer. Both types have similar disbursement timelines, which often last between a few weeks and two months.

Recommended Reading: Auto Refinance Calculator Usaa

Researching Private Loans On Fastchoice

Borrowing Essentials is a loan counseling tool, which provides an interactive overview of some basic information about borrowing money to pay for your education. Please allow 20 minutes to complete the optional loan counseling tool.

Loan Options provides a comparison list of lenders that USF students have borrowed from within the last three years. The list is NOT a preferred lender list or lender arrangement. If you are considering a lender that does not appear on our list, you should collect the same comparative information in order to make an informed decision.

*Please Note: USF does not certify private loans for non-degree seeking students. Refer to your lender’s terms and conditions to determine if meeting satisfactory academic progress standards is required.*

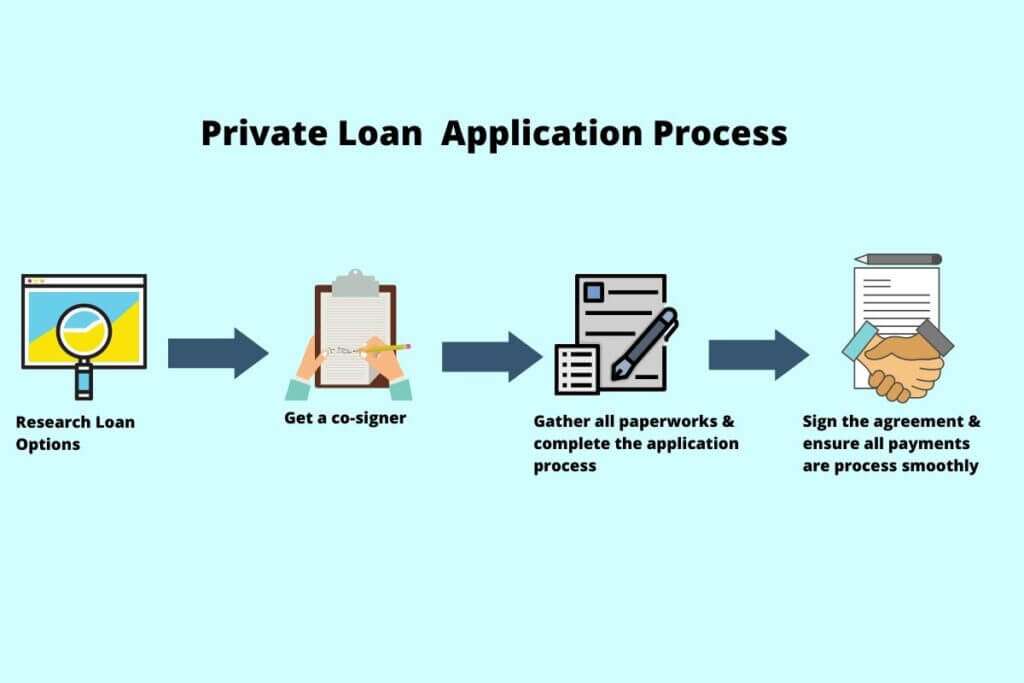

Applying For Private Student Loans

You can apply for private college loans directly from each lenders website. You should apply after youve made your school decision and once you know how much you need to borrow, so you wont have to submit separate student loan applications for schools youre considering.

How to get a private student loan

Theres no cost to apply for private student loans, but there are a few things you should know before you start:

- Youll fill out basic personal information and financial information.

- Youll be asked to choose the for your loan.

- You generally can apply with a during the application process. If you apply with a cosigner, theyll have to supply their financial information in the student loan application.

Our private student loan application process only takes about 15 minutes to receive a credit result.

Recommended Reading: How Long Does Sba Loan Approval Take

How Long Does It Take To Receive Fafsa Money

The FAFSA timeline is important to understand in order to receive financial aid for college. Learn about the FAFSA timeline in this article.

Christy Rakoczy Bieber

Overall, schools distribute grant or loan money in disbursements at least once per term at the start of each semester/trimester or quarter so expect it twice per year if youre on the semester system.

How Long Does It Take For Fafsa To Process

First things first, the FAFSA becomes available in October of each year and you have a long time to submit your Free Application for Federal Student Aid. In fact, if you want to be considered for financial aid during the 2021 to 2022 academic year, the FAFSA for the year opened October 1, 2021 and will remain open until June 30, 2022 .

It should take you less than an hour to complete the FAFSA. And once you submit your forms they should be processed quickly — typically within:

- Three to five days if you completed your forms online and provided an email address

- Seven to 10 days if you submitted your forms online but didn’t provide an email address

- Three weeks if you file a paper FAFSA

After your FAFSA has processed, you will receive a Student Aid Report detailing your Expected Family Contribution. The schools you indicated you’re considering attending will also receive an Institutional Student Information Record. They will use it to prepare your financial aid package.

Don’t Miss: Bayview Loan Servicing Reviews

How Does Student Loan Wage Garnishment Work

Before it can garnish your wages, the Education Department must send a garnishment notice to the last address it has on file for you. You have 30 days to make payments arrangements â otherwise, a garnishment order will be sent to your job.

The federal government is allowed to garnish 15% of your disposable pay â the amount remaining after payroll deductions. But if you have defaulted student loans owed to the both the Department of Education and guaranty agencies for FFEL loans, they can take more â up to 25%.

Private student loans have to get a court order before they can garnish your wages. Many lenders don’t sue immediately after your account turns past due. Instead, they typically wait until the statute of limitations is close to running out before they file a lawsuit against you or your cosigner. You can fight the lawsuit or try and negotiate a settlement for a reduced amount payable in a lump sum, monthly payments, or a combination of the two.

Learn More:Student Loan Cosigner Rights

Fafsa Processing Time 3 To 10 Days

Once you submit your FAFSA, youll need to wait for it to process. According to the Federal Student Aid website, it takes about three to five days for your application to be fully processed if you submitted it online.

If you submit it via the mail, itll take between seven to 10 days after the date you mailed your application.

When youre done with your FAFSA, youll get access to your Student Aid Report , which outlines the info you provided, including your Expected Family Contribution . Your EFC that determines your eligibility for Pell Grants and how much you should receive in federal student loans and overall aid.

Recommended Reading: Silt Loan

Prepare To Get Approved For A Personal Loan

So how long does it take to get approved for a personal loan? Muskus said the more you do to prepare yourself, the less time itll take to get approved. Here are a few of his recommended steps:

While you might need to get a personal loan as fast as possible, do your best to prioritize one that suits your needs. Loans that offer the lowest interest rates and friendly repayment terms are good places to start. Make sure you know what youre applying for and whats required of you before agreeing to a personal loan.

*ValuePenguin is an affiliate of LendingTree, Student Loan Heros parent company.

How Long Does It Take To Refinance A Federal Student Loan

Once you enter the repayment period, you may decide to simplify your federal student loans. This can be done either through a Direct Consolidation Loan or a private refinance.

Consolidating your federal student loans is a fairly straightforward process that generally takes less than an hour to complete. Through this free process, youre able to combine all your federal student loan debt into one loan with a fixed interest rate and one single monthly payment. The new interest rate will be the average of the interest rates on the federal loans youre consolidating, so it may not necessarily be lower than any of your current rates.

To refinance your federal student loans, youll need to go through a private lender. This means youll lose out on certain benefits only offered to federal loan borrowers, like student loan forgiveness. The private loan process may differ from one lender to the next and can take anywhere from one business day to a week or more.

Recommended Reading: Will Va Loan On Manufactured Homes