Accion: Best Lender For Microloans

We selected Accion Opportunity Fund as our best pick for microloans because it is focused on working with underserved business borrowers and will extend loans for as little as $500. When you work with Accion, you get more than a small business loan. The nonprofit, which has served the small business community for more than two decades, offers educational resources, training, coaching and networking opportunities. We like that about this lender. When you are a small business starting out you can use all the help and advice you can get.

Editor’s Score: 6.5/10

It’s easy to apply for a loan from Accion; the lender boasts its application process takes 15 minutes. You can apply online, in person or by phone. You are then assigned a specialist who works with you to determine the best loan amount and terms for your business. We also like that Accion has relaxed qualifications. It’s hard for new business owners to get funding, even if it’s for a small amount. That is not an issue with Accion, which doesn’t have a credit score requirement. You can be no more than 30 days late on any bills, loans and credit card payments. If there is a late balance of under 30 days, it has to be less than $3,000. You need to be in business for 12 months and have more than $50,000 in annual sales, which isn’t a big hurdle for many small business owners to overcome.

Fundbox: Best Lender For Line Of Credit

We recommend Fundbox as the best lender for lines of credit because it not only has competitive rates, but it is extremely transparent about its pricing. When you get a line of credit from Fundbox, you’ll know exactly how much it will cost before you finalize the transaction. Not many lenders offer so much transparency. It enables you to make an informed decision.

Editor’s Score: 6.5/10

Fundbox can extend up to $150,000 and has repayment terms of 12 or 24 weeks. That is shorter than other lenders, but that isn’t necessarily a bad thing. A line of credit is not a term loan it’s designed to provide working capital or peace of mind. If you need money to cover a pricey piece of equipment or a longer-term business expense, a term loan is the better option.

We also like that Fundbox makes it easy to pay back your line of credit by withdrawing the money from your bank account weekly. Some business owners may prefer monthly payments, but paying weekly means smaller chunks coming out of your cash flow. The lender also offers an easy online application and next-day funding. That’s another reason we selected it as one of our best picks. Time is money. The sooner you can get the cash you need, the faster you can put it to work for you.

Fundbox’s line of credit may not be for startups or those with limited sales. It has competitive rates, quick funding and very transparent pricing.

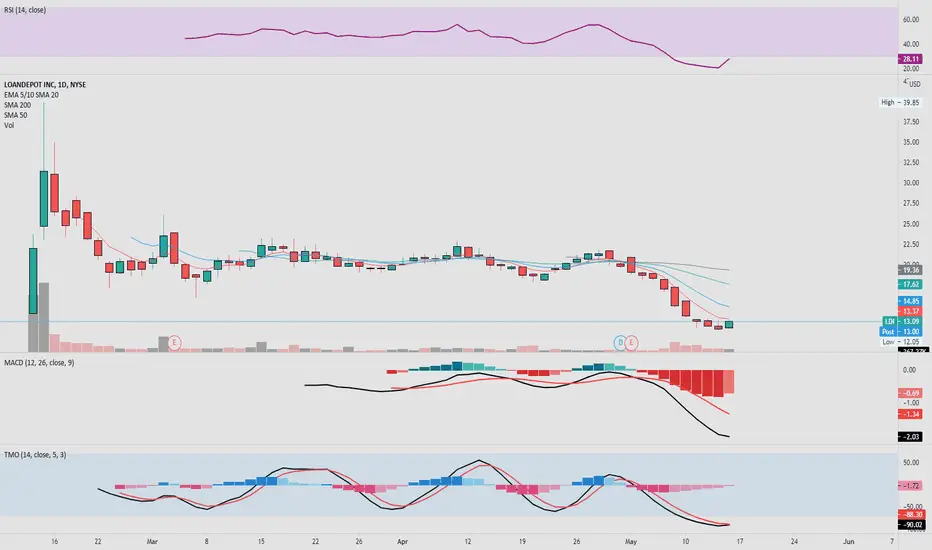

Loandepot Review For 2021

LoanDepot has made its name in tech-first mortgage lending and refinance. Many customers love this model, but as with any lender, there are pros and cons.

Advertising Disclosure

Our #1 priority is that our readers make great financial decisions. That’s something we don’t compromise on even if we make less money because of it. While we are compensated by our lending partners, and it may influence which lenders we review, it does not affect the outcome. It’s our mission to give you accurate, transparent information so you can make the best choice of lender or service on or off our site.

3.5%

- Innovative mortgage technologies may help you close quickly

- Good range of mortgage products offered

- High levels of customer satisfaction

Drawbacks

- Rates and closing costs are about average

- You have to apply to see any mortgage rates

- No USDA loans

Don’t Miss: How To Calculate Bank Loan

My Wife Has Her Own Business Doing

My wife has her own business doing contract to close for a number of realtors and had worked with Mr. DeMars in the past. She stated that she was impressed with his attention to detail and his ability to maintain contact with his clients and keep the process moving smoothly. After speaking withDeMars on the phone I knew we had picked the right person. He stated he had started a new Loandepot office and we would be impressed with the process and we were. Things moved quickly and the website is easy to navigate. I especially liked the ability to link our investments and bank accounts electronically rather than having to print and upload statements, a true time saver. We would highly recommend Mr. DeMars and Loandepot for anyone considering a mortgage.

Does Applying For A Business Loan Affect Your Personal Credit Score

Often, to be approved for a small business loan, you must personally guarantee the debt, meaning you will pay back the loan yourself if your company doesn’t. The lender has every right to go after you individually if the loan is delinquent, and that could hurt your personal credit score. The same applies to a business line of credit. If you personally guarantee any loan and the business is unable to repay it, you are on the hook for it.

Don’t Miss: How Much Can I Borrow Personal Loan Calculator

Boat: Required Documents For Obtaining A Lien Release

1. Title or Non-Negotiable Title or Inquiry Report

A copy of the Title or Non-Negotiable Title for the craft that you are requesting to be released. The copy must be legible and clearly show:

- Owner’s Name

- Year

- Make and Model

If the Title or Non-Negotiable Title has been lost or is unavailable, you will have to request a printout from the State containing the title information, and provide it to us. This printout is sometimes called an Inquiry Report or Title Report. Depending on the State in which you live, you may have to go to the Department of Parks and Wildlife, Department of Motor Vehicles, Department of Public Safety, or the local Tax Office for this printout and there may be a small fee for it.

Please note that a registration certificate is not the same as a title report and is not acceptable.

If the boat is classified as an “Ocean Vessel” you will have to obtain a title report from the Coast Guard and provide it to us.

2. Proof of Payoff

Proof that the loan was paid in full. Proof of Payoff may include such things as a copy of a “PAID” Note, copies of payment checks, or any other documentation that would indicate payment. This should greatly reduce the amount of research time and expedite our handling of your request.

The FDIC will not accept a copy of the borrowerâs credit report as proof of payoff.

Loandepot: Loan Types And Products

LoanDepot says it has more than 300 loan products, so whether you need to purchase a home or refinance an existing mortgage, youll probably find what youre looking for. Right now loanDepot offers the following major types of mortgages:

- Conventional loans

- Refinance loans

- Cash-out refinance loans

- FHA 203 renovation loans, which allow you to take out just one loan to fund both the purchase and renovations. You can also use this type of loan for a refinance if your home needs improvements.

LoanDepot also offers a choice between fixed-rate and adjustable-rate mortgage loans. With an ARM, the rate will be fixed for the first three, five, seven or 10 years. After the fixed period ends, the rate may increase or decrease annually for the rest of the loan term.;

You may notice a few options missing from loanDepots lineup, though. The company doesnt offer U.S. Department of Agriculture loans, home equity loans, or home equity lines of credit.;

Recommended Reading: How Much Do I Pay For Student Loan

Why Loandepot Billionaire Thinks Hell Beat Rocket Mortgage And Wells Fargo

Anthony Hsieh worked several jobsincluding installing custom sound systemsbefore starting as a mortgage loan officer in his early 20s. Thirty years and four startups later, the entrepreneur is a billionaire thanks to LoanDepot.

LoanDepot.

On a Wednesday evening in November 2015, Anthony Hsieh was about to dig into a celebratory dinner in a conference room on the top floor of Morgan Stanleys midtown Manhattan offices. His then-five-year-old mortgage lender LoanDepot was set to go public on the New York Stock Exchange the following day. It would have been a dream come true for the first-generation Taiwanese-American immigrant who began his career in the mortgage industry as a commission-based loan officer. But Hsieh was troubled by the turbulent marketsJack Dorseys Square was forced to price its IPO lower the following weekand in a last-minute decision, he pulled the plug.

“It felt like a last meal at the time. I second-guessed myself many times after that,” he says in a Zoom call from New York while on a business trip in early April, reminiscing on his first attempt at a public listing. But looking back now, that was absolutely the right decision.

“LoanDepot has got a best-in-class technology platform and strong brand awareness, says Ryan Carr, a senior associate at investment bank Jefferies. It helps disproportionately capture a higher share of first-time homebuyers, which is becoming an increasing percentage of the cohort.

Where Can You Get A Loan With Loandepot

NMLS ID: 174457

LoanDepot has branch locations in the following states:

- AK, AL, AR, AZ, CA, CO, CT, DC, FL, GA, HI, ID, IL, IN, KS, KY, LA, MA, MD, ME, MI, MN, MO, MS, NC, ND, NH, NJ, NM, NV, NY, OH, OK, OR, PA, RI, SC, TN, TX, UT, VA, WA, WI, and WV

You can also apply for a loanDepot mortgage or refinance online in any state.

Overall, the company seems geared more toward tech-savvy borrowers than those who prefer a traditional experience.

Thats not to say youll be on your own, adrift in cyberspace. LoanDepot employs more than 2,000 licensed loan officers, and youll have one assigned to your loan to help you through the process.

You May Like: How To Be Eligible For Fha Loan

Loandepot: Rates And Fees

LoanDepots website doesnt advertise daily refinance and purchase rates, as some of its competitors do, and doesnt offer a list of lender fees. This can be frustrating for buyers looking to quickly compare loan offers. Although several links seemingly lead to sample ratessuch as home loan rates, refinance rates, and compare mortgage ratesclicking on them only leads to loan term definitions, not actual rate quotes.;

Truist Review: Best Lender For Sba Loans

We selected Truist as our best pick for SBA loans because this lender has years of experience issuing SBA loans and is willing to provide support for your business beyond supplying it with money. Truist, which is a preferred SBA lender, was created by the merger of SunTrust and BB&T Bank, two traditional banks that have been in business for years. The experience the two banks have in issuing SBA loans stood out to us. Applying for an SBA loan can be a complicated and document-heavy process. Approval and funding can take several weeks, and any mistakes with the application can delay it further. When you work with Truist, you get guidance throughout the application process to ensure your loan can be funded as quickly as possible.

Editor’s Score: 6.0/10

Truist offers SBA 504, SBA 7 and SBA Express loans. Truist SBA loans offers lower down payments, longer terms and lower interest rates than other financing products. We also like that Truist provides short- and long-term loans and equipment financing. If you decide against an SBA loan, you have other options available to you with this lender. Truist also stood out because it has a team of advisors that can provide advice to help you run your business.

The process of applying for an SBA loan can be arduous. Truist makes the process easier. It knows the ins and outs of this type of funding and the mistakes that could delay processing your loan.

Read Also: Can I Get Another Loan From Upstart

What Are Some Assets Business Owners Can Use As Collateral For A Loan

Lenders vary about the collateral they’ll accept, but in general, anything valuable can be used. Common types of collateral for business loans are equipment, vehicles, real estate, inventory and accounts receivables. Some lenders may require you to offer personal collateral not tied to your business. This could include vehicles, real estate and cash in the bank.

What Type Of Business Loan Is Best For Your Small Business

There are a lot of options when it comes to business loans. The one that makes the most sense for you depends on your credit score, time in business and the amount of money you’re looking to borrow. The speed in funding and the terms also vary from one product to the next. With that in mind, here’s a look at the small business financing options available to you.

Read Also: Should I Refinance My Truck Loan

How To Cancel A Loan Application

The number of consumers with unsecured personal loans increased from 15.7 million to 20.9 million between 2017 and 2020, reports TransUnion. If, for some reason, you decide to cancel loan applications, you should be able to do it without facing repercussions. Timing is everything. Before you take this step, note that each lender has a different policy.

Tip

If you apply for a personal loan and then change your mind, you may cancel it before receiving the funds. To cancel a mortgage application, you’ll have to notify the lender in writing prior to signing the closing documents.

Can Borrowers With Bad Credit Get Approved For A Business Loan

It can be hard, but it’s not impossible. Some lenders don’t use your credit score as a determining factor in whether you qualify for a business loan or not. Some weigh your financial history and business success more than your credit score.; If your , shore up other parts of your business value, such as revenue or sales.;

Also Check: How Do I Make Sure My Ppp Loan Is Forgiven

Car Or Truck: Required Documents For Obtaining A Lien Release

1. Title or Non-Negotiable Title or Vehicle Inquiry Report, Title Report or a TWIX

A copy of the Title or Non-Negotiable Title for the vehicle that you are requesting to be released. The copy must be legible and clearly show:

- Owner’s Name

- Year

- Make and Model

If the Title or Non-Negotiable Title has been lost or is unavailable, you will have to request a printout from the State containing the title information, and provide it to us. This printout is sometimes called a Vehicle Inquiry Report, Title Report or a TWIX . Depending on the State in which you live, you may have to go to the Department of Motor Vehicles, Department of Public Safety, or the local Tax Office for this printout and there may be a small fee for it.

Please note that a registration certificate is not the same as a title report and is not acceptable.

2. Proof of Payoff

Proof that the loan was paid in full. Proof of Payoff may include such things as a copy of a “PAID” Note, copies of payment checks, or any other documentation that would indicate payment. This should greatly reduce the amount of research time and expedite our handling of your request.

The FDIC will not accept a copy of the borrower’s credit report as proof of payoff.

Where Can I Apply For An Sba Loan

You can DIY by searching for lenders who are approved by the SBA. Armed with that list, you can comparison shop and apply directly on the lenders’ websites or through their mobile apps.

Another, easier, option is to use the SBA’s Lender Match tool, which connects borrowers with SBA lenders. You answer a series of questions, which the SBA says takes five minutes, and two days later you’ll receive an email with offers from lenders. It is up to you to pick the lender, but once you’ve settled on one, you apply directly with them.

Don’t Miss: Can You Pay Off Sofi Loan Early

Compare Our Best Picks

| $10,000 in monthly sales, 500 credit score, 6 months of business | |

| Fora Financial | $12,000 in monthly sales, decent credit score, no open bankruptcies; |

| Biz2Credit | $250,000 in annual sales, 660 credit score, 18 months in business |

| Rapid Finance | 500 credit score, 3 months in business |

| Noble Funding | 2 years positive net income, 500 credit score, 18 months in business |

| Balboa Capital | $300,000 in annual sales, 6 months in business, decent credit score |

| Crest Capital | 24 months in business, 650 credit score |

| Fundbox | 24 months in business, 650 credit score |

| Accion | $50,000 annual sales, decent credit score, 12 months in business |

| Truist |

Flexibility is important to small businesses. You don’t want to be locked into a loan for a long time. You also don’t want to scramble to find the cash to repay a loan in too short of a period. If you need short, medium or long-term funding, SBG Funding has an option for you. We like that terms for SBG Funding’s loans can be a short as six months or as long as five years.

Editor’s Score: 7.5/10

SBG Funding’s flexibility doesn’t end with its terms. You can borrow as much as $5 million, depending on the type of loan. That allows you to grow with this lender. You may need a $10,000 short-term loan to start but later need a loan to buy a $1 million piece of equipment. SBG Funding can support that growth with its loan products.

Editor’s Score: 7.5/10

Editor’s Score: 9.5/10

Editor’s Score: 9.5/10