What Does 60% Ltv Mean

When applying for a mortgage loan, a 60% loan-to-value ratio means that you can borrow up to 60% of the homes appraised value and you have deposited 40% of the home value.

For example, lets say you find a home with an appraised value of $300,000 and made a down payment of $120,000.

Youll need to borrow $180,000. In calculating your LTV, you will divide your down payment by the home appraised value.

That is, $180,000 divided by $300,000 equals 0.6 or 60%.

Like we mentioned in the earlier part of this article, the lower your LTV ratio, the broader your choices of mortgages will be. With an LTV ratio of 60%, you are more likely to receive a lower interest rate.

Borrowers Can Reduce Their Ltv In A Variety Of Ways

- Come in with a larger down payment if its a home purchase loan

- Ask for gift funds to increase your down payment

- Or break your mortgage up into two separate loans

- Make extra payments or a lump sum payment for a refinance to get the LTV down before you apply

- Or simply wait for natural amortization and home price appreciation to lower your LTV over time

If were talking about a home purchase, simply bring in more down payment money and the LTV will be lower. Easier said than done, sure, but possible for some.

Perhaps someone will gift you the money or act as a co-borrower?

Alternatively, you can look into breaking up your financing into two loans, with both a first and second mortgage.

If its a mortgage refinance, simply pay down the mortgage balance a bit more before you apply, whether on schedule or by making extra mortgage payments.

This can be especially helpful if youre super close to a certain LTV threshold, or just above the conforming loan limit.

Speaking of, pay close attention to your LTV if its just above 80% or some other meaningful tier, think about adjusting your loan amount down .

Lastly, theres another way existing homeowners can get their LTV down and it requires no effort whatsoever.

You dont have to do anything except sit back and watch your property value increase over time, thereby lowering your LTV in the process. Of course, the opposite can happen too if home values drop!

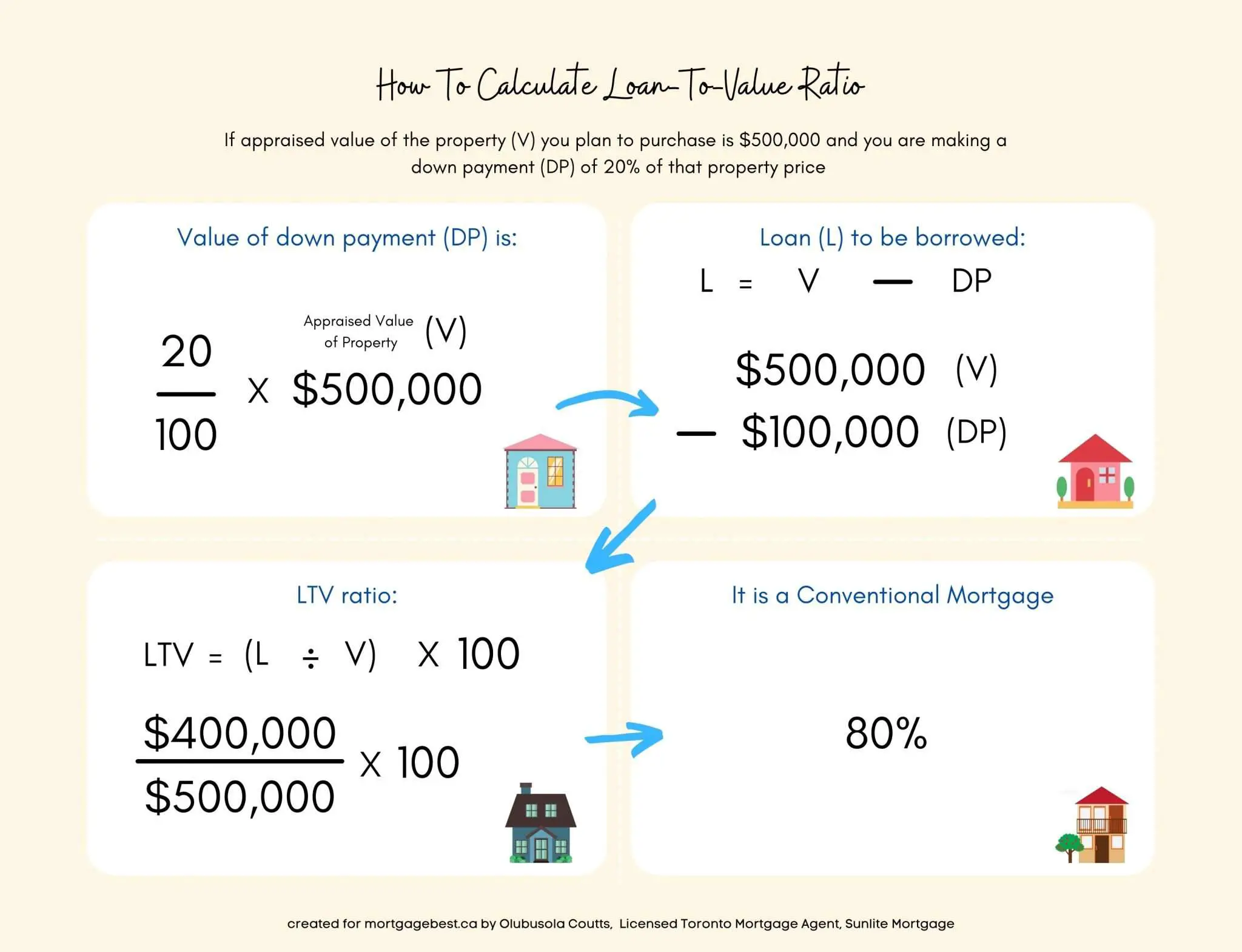

How To Calculate Ltv Ratio

I mean, how in the world do you calculate the loan to value ratio? Lets just say that you are getting a loan for $50,000 USD. And whats the value of the property?

Lets say the value of the property is $100,000 USD. How are you going to calculate the loan to value or the LTV?

In this case, were going to take the $50,000 loan amount that were trying to get, and were going to divide it into the value of $100,000. And thats going to give us: 0.50 or 50%. So, thats a 50% loan to value loan. When you youve got a loan amount of $50,000, and the value of the property is $100,000. Now why is that important?

Most of you are just shaking your head going, So, now what? What does that all mean to me as a borrower? And what does that mean to a lender?

Read Also: Does Va Loan Work For Manufactured Homes

How To Use A Loan

Its all about walking into a lender, or applying online, with all you need to know to get the best terms possible. And calculating your loan-to-value will help you decide:

-

The loan term that works best for you. A 30-year fixed-rate loan will allow more affordable monthly payments, but youll pay a lot more interest over time. A 15-year fixed-rate mortgage means you pay less interest over the life of the loan your interest rate will be lower, too but your monthly payment will be considerably higher.

-

If an adjustable-rate mortgage might be a good option. If you have a high loan-to-value, you might be able to lower your interest rate by considering an ARM. This can be especially suitable for home buyers who plan on being in a home for only a few years.

-

Am I trying to buy too much house? A high loan-to-value may mean youre trying to buy more house than your down payment allows. Scaling back a bit on your dream home can make your down payment go farther and lower your LTV.

-

How much of a down payment should I make? Its a good question to ponder. If your LTV is below 80%, you wont have to pay mortgage insurance. That can save you quite a bit of money.

What Does My Loan

LTV is used by mortgage lenders to assess risk when deciding whether or not to extend credit to you. A high LTV ratio would be riskier for a mortgage lender, while a low LTV ratio would be safer. This can have impacts on your mortgage approval and your mortgage interest rate.

As you pay off your mortgage, your LTV ratio will decrease. Your LTV ratio can also decrease if your property value increases.Torontos housing markethas performed well, and only 13% of mortgages within Toronto were high-ratio mortgages in 2016. Similarly, only 10% of mortgages within Vancouver were high-ratio. In comparison, Calgary had 36% and Halifax had 45% of mortgages being high-ratio in 2016.

Likewise, your LTV ratio can increase if your property value decreases. Having a LTV ratio above 100% means that you owe more on your mortgage than what your property is worth, and is also known as negative equity or being underwater on your loan. Borrowers with underwater mortgages are more likely to default.

Don’t Miss: What Credit Score Is Needed For Usaa Auto Loan

What Is A Loan

A loan-to-value ratio basically measures the loan amount against the value of the asset being purchased with the loan. The loan balance is divided by the value of the asset to calculate the loan-to-value ratio.

A higher LTV ratio means that you need a higher loan amount to pay for the purchase of the asset. Over time, your LTV will decrease as you continue making loan payments and as the assets value appreciates.

Do you know what the true cost of borrowing is? Find out here.

What Is A Good Ltv

If you’re taking out a conventional loan to buy a home, an LTV ratio of 80% or less is ideal. Conventional mortgages with LTV ratios greater than 80% typically require PMI, which can add tens of thousands of dollars to your payments over the life of a mortgage loan.

Some government-backed mortgages allow you to get away with very high LTV ratios. For example, the minimum down payment for a Federal Housing Administration loan is 3.5% . Loans through the U.S. Department of Agriculture and the Department of Veterans Affairs don’t require any down payment at all . Those loans typically require a forms of mortgage insurance or include extra fees in the closing costs to offset the risk connected with their higher LTVs.

LTV ratio is a less crucial factor with auto loans. While you might pay higher interest on a car loan with a higher LTV ratio, there’s no threshold comparable to the 80% LTV that earns the best mortgage loan terms.

Don’t Miss: What Credit Score Is Needed For Usaa Auto Loan

How Ltv Affects Your Ability To Get A Home Loan

In order to get approved for a home loan, its generally good to plan to make a down payment of at least 20% of the homes valuethis would create an LTV of 80% or less. If your LTV exceeds 80%, your loan may not be approved, or you may need to purchase mortgage insurance in order to get approved.

LTV is also important because, if youre buying a home and the appraised value of the home turns out to be substantially lower than the purchase price, you may need to make a larger down payment so that your LTV doesnt exceed limits set by your lender.

If you already own a home and are thinking about taking out a home equity line of credit , most lenders will let you borrow up to 90% of your homes value, when combined with your existing mortgage. If the value of your home has fallen since you purchased it, you may not even be able to get a home equity loan or HELOC.

Lets say you own a home that you bought five years ago and is worth $100,000. If you have a mortgage with an outstanding balance of $65,000, that means that your current LTV is 65%. If your credit is good and you qualify for additional financing, you may be able to borrow up to an additional $25,000 through a HELOC, bringing your total LTV up to 90%.

How To Calculate Loan

To calculate LTV, you would divide the mortgage amount over the property value. If you are purchasing a home, the property value would be the purchasing price of the home, while the mortgage amount would be the purchasing price subtracted by the amount of your down payment. If you are refinancing or switching mortgage lenders, you may be required to have a home appraisal to get an up-to-date home value. Appraisal fees are typically paid by the borrower.

Read Also: How To Reclassify A Manufactured Home

Looking To Apply For A Loan

Whether youre applying for a mortgage, car loan, or any other similar type of loan that typically requires some form of down payment, your loan-to-value ratio matters. In addition, the type of loan product you choose and the lender you work with also matter. When youre ready to apply for a loan, get in touch with Loans Canada to help guide you to the right lender and loan product for your needs.

Find Out If You Qualify For A Mortgage

Loan-to-value is the ratio of how much youre borrowing compared to your homes worth. Its a simple formula, but its the basis for most mortgage lending.

Once you know your LTV, you can figure out which mortgages youre likely to qualify for and which lender offers the best rates for your situation.

Popular Articles

Read Also: What Bank Has The Lowest Home Equity Loan Rates

How To Calculate Your Loan

Your loan-to-value ratio, or LTV, is usually expressed as a percent. To calculate your LTV ratio, divide the amount of your loan by the appraised value of the asset securing the loan.

For example, say you want to purchase a home for $200,000, which is also its appraised value. If you have $40,000 for a down payment, you would need a $160,000 loan.

The LTV would be the loan amount of $160,000 divided by the appraised value of $200,000, which is 0.80, or 80%. Your LTV is 80% of the propertys value.

Your LTV ratio can be one indicator of whether you can afford the home or vehicle you want.

Va Loan: Up To 100% Ltv Allowed

VA loans are guaranteed by the U.S. Department of Veterans Affairs.

VA loan guidelines allow for 100 percent LTV, which means that no down payment is required for a VA loan.

The catch is, VA mortgages are only available to certain home buyers, including:

- Active-duty military service persons

- Members of the Selected Reserve or National Guard

- Cadets at the U.S. Military

- Air Force or Coast Guard Academy members

- Midshipman at the U.S. Naval Academy

- World War II merchant seamen

- U.S. Public Health Service officers

- National Oceanic & Atmospheric Administration officers

Learn more about the benefits of 100% LTV VA financing here.

Don’t Miss: What Kind Of Loan Do I Need To Buy Land

How To Lower Your Loan

Try one of these steps to knock your LTV ratio down and boost your home equity.

- Get a gift for a bigger down payment. A family member, employer or friend can contribute a gift to use toward your down payment amount and closing costs.

- Make extra principal payments. Your LTV ratio drops with every mortgage payment. If you make even one extra payment each year, youll lower the LTV ratio faster.

- Pick a shorter-term loan. If your budget can handle a higher monthly payment, a 15-year fixed mortgage will lower your LTV ratio more quickly than a 30-year loan.

- Buy a less expensive home. Choosing a home at the lower end of your down payment budget can help you avoid a high-LTV ratio loan.

Bottom Line: What Is Loan

Your loan-to-value ratio reveals the size of your home loan compared to the appraised value of the home you intend to purchase.

And the lower your LTV ratio, the higher your chances of getting approved for a mortgage.

Keeping your LTV ratio at 80 percent or below is one of the many ways to avoid paying for mortgage insurance and high-interest rates.

Before applying for a mortgage loan, it is advisable that you save up for a more significant down payment, shop across lenders, and find homes within your budget.

While your LTV ratio is a small piece of a bigger pie, it can impact the money you spend monthly on mortgage payments.

Keep Reading:

Read Also: Loans Without Proof Of Income

How To Lower Your Ltv

Generally speaking, reducing LTV on your loans, especially on mortgage loans, means lower total costs over the life of the loan. Because there are only two variables that determine LTV ratiothe loan amount and the value of the assetthe approaches to reducing LTV are pretty straightforward:

- Make a larger down payment.Saving for a big down payment may test your patience if you’re really eager to get into a house or car, but it can be worth it in the long run.

- Set your sights on more affordable targets. Buying a home that’s a little older or smaller than the house of your dreams could allow your current savings to serve as a larger portion of the purchase price.

Whether you’re applying for an auto loan or a mortgage, it’s important to understand how your LTV ratio affects overall borrowing costs, what you can do to decrease LTV, and how doing so can save you money over the lifetime of a loan.

Combined Loan To Value Ratio

Combined loan to value ratio is the proportion of loans in relation to its value. The term “combined loan to value” adds additional specificity to the basic loan to value which simply indicates the ratio between one primary loan and the property value. When “combined” is added, it indicates that additional loans on the property have been considered in the calculation of the percentage ratio.

The aggregate principal balance of all mortgages on a property divided by its appraised value or purchase price, whichever is less. Distinguishing CLTV from LTV serves to identify loan scenarios that involve more than one mortgage. For example, a property valued at $100,000 with a single mortgage of $50,000 has an LTV of 50%. A similar property with a value of $100,000 with a first mortgage of $50,000 and a second mortgage of $25,000 has an aggregate mortgage balance of $75,000. The CLTV is 75%.

Combined loan to value is an amount in addition to the Loan to Value, which simply represents the first position mortgage or loan as a percentage of the property’s value.

Recommended Reading: How Do I Find Out My Auto Loan Account Number

Choose A Less Expensive Home

If youre unable to make a larger down payment and are on a strict budget, the other option is to focus on less expensive homes. This will lower your LTV and might help you get a preferable loan option.

Remember, you already have the equation. That means you can manipulate the variables to get a lower, preferable LTV. Finding a home with a lower property value will improve your LTV ratio.

For example, if you know you only have $10,000 to use toward a down payment, this is how the price of a home can lower your LTV:

Home One

As Prices Rise Or Fall In Your Area Your Home Equity Also Shifts Heres A Quick Guide For Figuring Out How Much You Have Plus Tips To Potentially Increase It

WEâVE ALL DONE ITâthat mental calculation where you try to figure out how much youâd clear if you were to sell your house and pay off your mortgage. But it can be more than just an idle exercise. Even if you never sell your home, the equity you have can help you pursue important personal goals. So understanding how to calculate your equityâand how banks view itâis critical, especially if you want to borrow money against that equity to pay for a home improvement project, cover emergency expenses or help pay for your childâs college tuition, for example. In fact, your homeâs equity could also affect whether you need to pay private mortgage insurance and could determine which financing options may be available to you.

Start With a Baseline Calculation

You can figure out how much equity you have in your home by subtracting the amount you owe on all loans secured by your house from its appraised value. This includes your primary mortgage as well as any home equity loans or unpaid balances on home equity lines of credit. In a typical example, homeowner Caroline owes $140,000 on a mortgage for her home, which was recently appraised at $400,000.

Next, Take a Look at How Banks Calculate Equity

Possible Effects on Insurance

What About Home Equity Loans?

Ways to Potentially Increase Your Equity

This article was adapted from Better Money Habits®. Visit BetterMoneyHabits.com for more practical financial information.

More for you icon

Don’t Miss: Can You Buy A Mobile Home With A Va Loan