How To Get A Lower Student Loan Interest Rate

If you’ve graduated from college or you’re a parent who borrowed on behalf of your child, you may be looking for opportunities to save money. Here are just a few to consider:

-

Get on autopay: Most federal loan servicers and private student loan companies offer a discount on your interest rate if you set up automatic payments. This discount is typically worth 0.25 percentage points.

-

Refinance your loans: You can refinance both federal and private student loans with a private lender and potentially secure a lower rate than what you’re paying right now. Keep in mind, though, that refinancing federal loans results in you losing access to federal benefits, including access to loan forgiveness programs and income-driven repayment plans. Also, you’ll typically need at least great credit and a good salary to secure a low rate.

Should You Refinance Your Student Loans?

Should You Refinance Your Student Loans?

Its not always just about getting a lower rate. We walk you through the factors to weigh before you decide on refinancing.

Can You Lower The Interest Rate On Your Student Loans

If you are in the process of taking out student loans, you should generally aim to exhaust eligibility for federal Direct Loans first. These tend to have lower rates and better borrower repayment benefits and protections than private loan options. Borrowers may be able to take advantage of deferment/forbearance, grace periods, income-driven repayment plans, and student loan forgiveness options too.

If you’ve maxed out your loans from the federal government, shop around among different private lenders to get the most competitive rate. You should also consider asking a cosigner to apply with you, as this can often help you get a better loan offer.

If you already have student loans, refinancing could potentially help drop your rate and reduce your total interest costs. You likely don’t want to refinance federal loans and give up the unique benefits they offer, but there’s no downside to refinancing private loans if you can qualify for a new loan at a lower rate than your current one is charging.

Historical Average Federal Student Loan Rates

Some borrowers may not just be interested in the current average rates, but may be curious about the answer to the question, what is the average student loan rate over time? Again, this depends on the type of loan you’re taking out. Here are the historical rates for Direct Subsidized Loans and Subsidized Federal Stafford Loans. If you take a look at this chart, you can see, for example, that the average rate for this type of loan over the past five years was 4.108%.

You can do this type of calculation with each of the different kinds of loans for which the Department of Education has made historical data available.

Don’t Miss: How To Pay Off Your Home Loan In 5 Years

Federal Direct Subsidized Loans

While direct subsidized loans are only available to college students with higher financial needs, they are preferable to unsubsidized loans in two significant ways: First, subsidized loans don’t accrue interest during the time that you’re attending school. Secondly, you are granted a six-month grace period post graduation before you’re required to start making payments toward the student loan balance. However, direct subsidized loan interest rates are the same as their unsubsidized counterpart.

Undergraduate Direct Subsidized Student Loans

| Disbursement Date |

|---|

Graduate Direct Subsidized Student Loans

| Disbursement Date |

|---|

| 6.80% |

Why The Rate Hike Matters

With this increase, rates will now be the highest theyve been since the 2018-19 academic year, prior to the COVID-19 pandemic. While an increase of a few percentage points may not seem like a large amount in the long run, a student loan calculator can show how much that increase affects the cost of the loan overall.

Lets say you borrowed $10,000 in unsubsidized loans for your bachelors degree with a standard 10-year repayment term. If you borrowed for the 2021-22 school year with a 3.73 percent interest rate, youd pay $11,996 over those 10 years. If you borrowed the same amount this upcoming school year with the 4.99 percent interest rate, youd pay $12,722 over 10 years.

Don’t Miss: Eidl Loan Denied But Advance Approved

Sallie Mae Study: Less Than Half Of Families With College

Among families with college-bound students, 47% think theyll need to borrow to finance a college education, according to Sallie Maes 2022 College Confidence study. Yet just under half of those families identified federal direct subsidized and unsubsidized loans as aid that needs to be repaid, underlining the importance of learning the obligations of the debt youve been offered before accepting it.

Additionally, those families with college-bound students arent clear on the purpose of the FAFSA 34% dont know why someone would submit the FAFSA, and 44% dont know that its for everyone, regardless of income level. If you or your child are considering going to college, familiarize yourself with all of the options available to you to fund that education and submit the FAFSA to be considered for the most aid possible.

Best Grad Student Loans

Highly reviewed and rated, these student loan companies can help make your graduate student dreams a reality. Specializing in private loans and refinancing, the top grad student loan companies will find the perfect option to fit your needs, budget, and school of choice.

- Provides private loans for graduate students

- Covers up to 100% of your costs including tuition & other fees

- Features 4 flexible methods for repayment

- Free & easy online application takes only minutes to complete

- Private graduate student loans designed for all fields of study

- Select from variable or fixed rate options

- Applying is fast and easy

- Multiple repayment options

- Helps graduate students to find the best private loan rates possible

- Select from a wide range of flexible loan terms

- Easily pre-qualify for free without any credit score impact

- Back by an industry-leading Best Rate Guarantee

- Enjoy flexible terms on private graduate student loans

- Check eligible interest rates without impacting credit score

- Easy online application allows for instant pre-qualification

- Take advantage of no early pre-payment penalties

- Provides private loans for graduate students

- Covers up to 100% of your costs including tuition & other fees

- Features 4 flexible methods for repayment

- Free & easy online application takes only minutes to complete

Also Check: How To Get An Sba 504 Loan

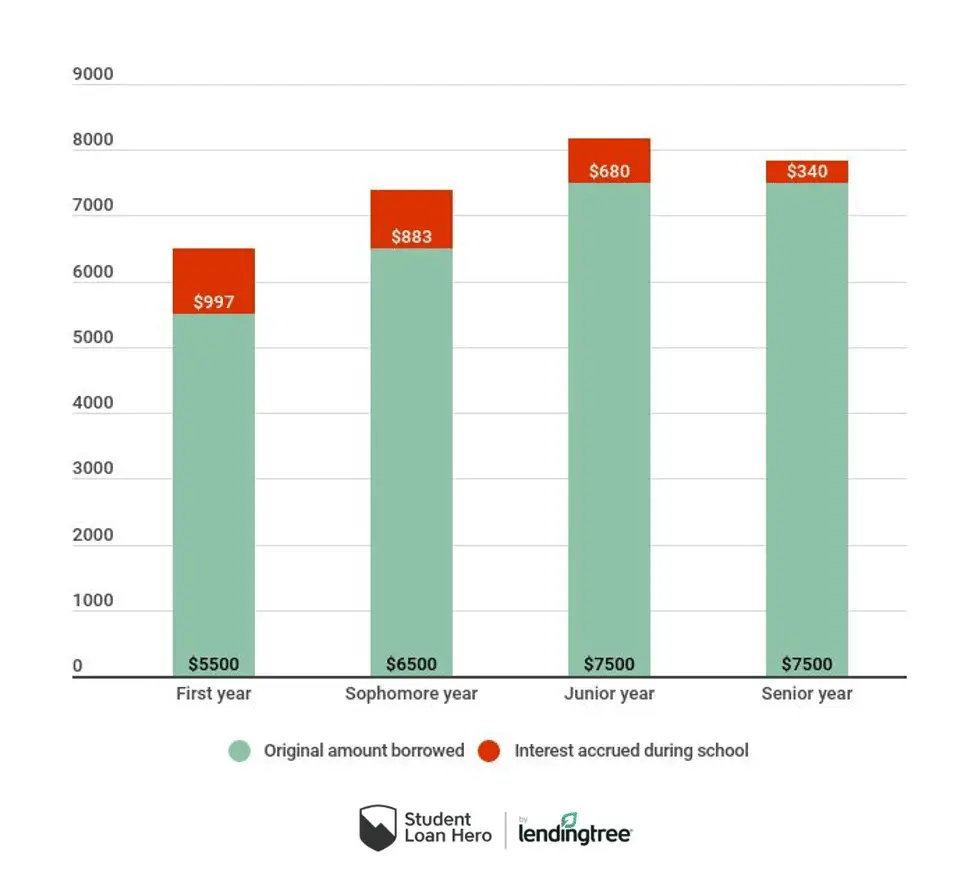

What Is Capitalized Interest On A Student Loan

Capitalized interest refers to the process of adding any accrued interest to your loans principal balance. When this happens, your loan balance grows and you begin accruing interest on the new, larger amount. Essentially, you are charged interest on your interest.

Interest only capitalizes during certain periods of your loans lifeexactly when that happens varies based on your loan. However, its common for interest to capitalize when you first begin repayment and after any temporary deferment or forbearance.

How Student Loan Rates Work

Student loan rates are the interest rates a borrower pays on an education loan. The higher your interest rate is, the more you will pay for your loans.

Interest is a percentage of the amount of money that you borrow. This amount is your principal balance. Your total payment, therefore, includes principal and interest.

The amount of interest that you need to pay on your student loan and when that sum needs to be repaid will depend on the type of student loan youve taken out and the loans terms.

Most student loans are daily interest loans. If you take out a daily interest student loan, your lender or loan servicer will calculate interest daily. That interest accumulates, increasing your payment.

Recommended Reading: When Will I Get My Loan Money For School

Are There Any Costs Associated With Refinancing

Usually no. Many lenders do not charge origination, application or disbursement fees for refinancing student loans. If youre not sure, ask your lender about its fee structure before you refinance.

Note that when you refinance student loans, you can choose to extend your repayment terms. Opting for a long term can result in higher interest costs over the life of your loan. If you want to reduce the amount you pay in interest, consider selecting a shorter repayment term.

No Interest Accrual On Subsidized Federal Student Loans

If you receive subsidized federal student loans based on financial need, you dont need to worry about interest charges while youre in school. Interest doesnt accrue on subsidized federal student loans while you attend school. It wont start to accrue until you graduate or drop below half-time enrollment.

Accruing interest also stops during a period of deferment.

Recommended Reading: Online Installment Loans No Credit Check

What Is An Apr

- The Annual Percentage Rate takes into account the interest rate, fees , length of your deferment period and how interest capitalizes.

- The APR is a number you can use to compare loans from different lenders since their interest rates, fees, deferment options and capitalization policy may differ.

- The APR does not represent the rate at which interest accrues.

- The APR may be different during the deferment period and the repayment period.

Student Loan Interest Rates From 2006

![U.S. Average Student Loan Debt Statistics [December 2019] U.S. Average Student Loan Debt Statistics [December 2019]](https://www.understandloans.net/wp-content/uploads/u-s-average-student-loan-debt-statistics-december-2019.png)

Over the past 12 years, interest on federal student loans has ranged from 3.4% to 7.90%, depending on the type of loan. Although these student loan rates have fluctuated through the years, rates have been rising since 2016. To see a visual representation of how student loan interest rates have changed over time, we’ve provided a chart that illustrates the rate pattern for three types of student loans since 2006.

*Note that in the above chart we didn’t include the historical rates for Stafford Loans or Federal PLUS Loans. Both loans were part of the Federal Family Education Loan Program , which was terminated in 2010. However, we have included their historical rates from 2006 and on in our breakdown below.

Recommended Reading: How To Get An Unsecured Loan With Bad Credit

What Is A Private Student Loan And Who Is Eligible

When you take out a private student loan, the lender pays for your college degree and associated expenses. You repay these funds over time according to the loan agreement. You can use your loan to cover tuition, fees, books, supplies, and living expenses.

Youre eligible for a student loan if youre enrolled at an eligible school, are at least 18 years old, and have a high school diploma or an equivalent. Most lenders will also require you to be a U.S. citizen or permanent resident.

How To Calculate Student Loan Interest

Calculating your student loan interest can help you determine your monthly budget. To calculate how much interest you pay each month, use the following steps:

Let’s say you’re charged 5 percent interest on your $10,000 loan every month. Here’s what those steps look like:

In this scenario, you’ll pay $41.10 in interest your first month. As you pay down the principal balance, less of your monthly payment will go toward interest.

Keep in mind that some private loans do carry a variable rate, so the daily interest rate may fluctuate over the life of the loan, typically on a monthly, quarterly or annual basis. You can also use a student loan calculator to calculate your monthly interest charge.

Don’t Miss: How To Pay Off Car Loan Faster Calculator

Compare Rates From Different Lenders

Before applying for a personal loan, its a good idea to shop around and compare offers from several different lenders to get the lowest rates. Online lenders typically offer the most competitive rates and can be quicker to disburse your loan than a brick-and-mortar establishment.

But dont worry, comparing rates and terms doesnt have to be a time-consuming process.

Credible makes it easy. Just enter how much you want to borrow and youll be able to compare multiple lenders to choose the one that makes the most sense for you.

What Is Student Loan Refinancing

Student loan refinancing is the process of taking out a new loan to pay off your existing student loans. When you refinance your student loans, you may qualify for a lower interest rate and a different repayment timeline, which could help you save money on interest or lower your monthly payments.

Refinancing is a good idea for people with a large monthly payment or a high interest rate, since refinancing into new terms can make loans more affordable in both the short- and long term. Borrowers with good credit, in particular, will qualify for the best rates and terms. You can refinance both federal and private student loans, though it’s usually best to avoid refinancing federal loans, since they come with a number of perks that aren’t available through private lenders.

Recommended Reading: How To Refinance Your Car Loan With Capital One

How To Calculate How Much Interest You Will Owe

Every month, the interest amount you owe on your loan is recalculated using a daily interest formula based on your total outstanding loan amount:

Interest amount = Outstanding principal balance x Number of days since last payment x Interest rate factor

The interest rate factor is your annual interest rate divided by the number of days in the year. Your loan servicer is responsible for billing you monthly and explaining how your payments are applied to the principal balance.

You can use our student loan payment calculator to see how much your loan will cost in the long run.

If you apply for forbearance or deferment or sign up for an income-driven repayment plan, your loans will accrue more interest over time, increasing the total interest paid.

> > Read More:How Student Loan Interest Works

What Is A Good Fixed Interest Rate For A Student Loan

The best fixed interest rate available depends on the borrowers qualifications and the current rates available. Both federal and private student loan interest rates depend on overall rates in the market.

However, federal interest rates do not depend on the borrowers credit score or income, while private interest rates do take those factors into account. You should compare both federal and private rates before taking out a loan to find the best fixed rate.

Don’t Miss: Which Bank Is Good For Personal Loan

Current Private Student Loan Interest Rates

Federal and private student loans have different interest rates. Federal loans often have lower rates because theyre set by the federal government and are not dependent on a borrowers credit score or income. Private lenders will determine your rate based on your credit score and income , the total loan amount, and more.

Rates will also vary depending on if youre an undergraduate student, graduate student, or a parent. Undergraduate students often have the highest interest rates because they usually have no credit history or income.

Graduate students usually receive lower rates because they often already have a good credit history. Parents who have good credit scores and high incomes may qualify for low interest rates when theyre taking out loans on behalf of their children.

Below, you will find private student loan interest rates from several lenders in the industry.

What Is A Fixed

Heres the difference between a fixed and variable rate:

- With a fixed rate, your monthly payment amount will stay the same over the course of your loan term.

- With a variable rate, your payments might rise or fall based on changing interest rates.

Comparison shopping for private student loan rates is easy when you use Credible.

Recommended Reading: How Long Does It Take To Get School Loan

What Will Happen With The Interest Rates On Private Student Loans

Each lender sets its own interest rates on private student loans.

Private student loans offer fixed and variable interest rate options.

Interest rates are usually based on an underlying index, such as the London Interbank Offered Rate index, Secured Overnight Funding Rate index and Prime Lending Rate. A fixed margin is added to the index rate to yield the interest rate that the borrower pays. The margin is based on the of the borrower and cosigner.

The interest rate on a variable-rate loan tends to float with changes in the index. Some lenders use a one-month average of the index rate, while others use a three-month average. The three-month index rates effectively phase in interest rate changes over a three-month period, while the one-month index is more immediate.

The interest rate on a fixed-rate loan is based not only on the current index rates, but also on projected future changes in the interest rate and the length of the repayment term. In a rising rate environment, a loan with a shorter repayment term will have a lower fixed rate than a loan with a longer repayment term.

Interest rates are currently at or near record lows. The lowest variable rate on private student loans for undergraduate students with excellent credit is 1.19%. The lowest fixed rate is 3.49%. These interest rates are likely to start increasing soon.

Who Sets Federal And Private Interest Rates

Congress sets federal student loan interest rates each year. These fixed interest rates depend on the type of federal loan you take out, your dependency status and your year in school.

Private student loan interest rates can be fixed or variable and depend on your credit, repayment term and other factors. As a general rule, the better your credit score, the lower your interest rate is likely to be.

You can compare rates from multiple student loan lenders using Credible.

Also Check: What Is Needed For Va Home Loan