What Is A Bad Credit Score

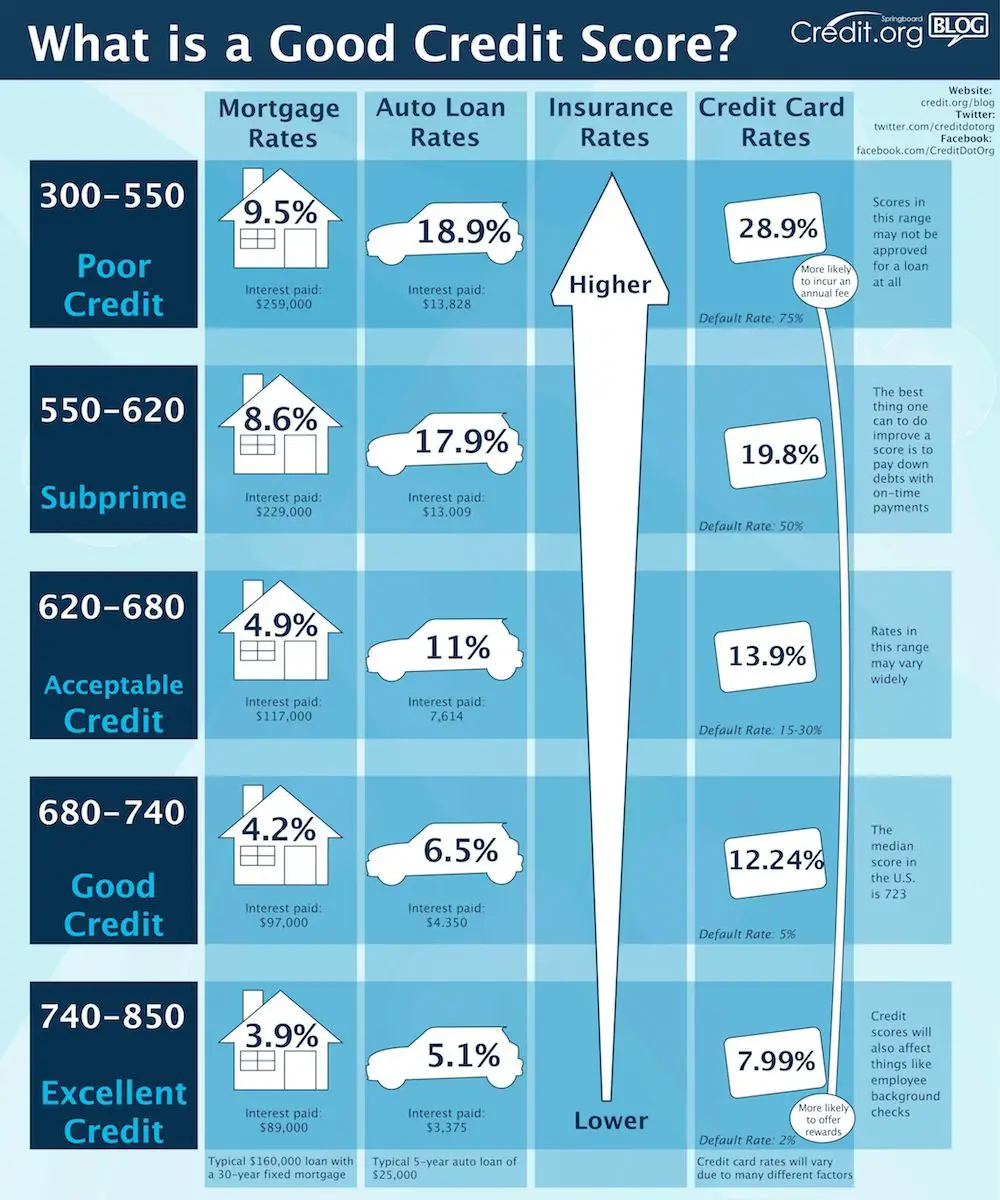

Lenders use credit scores to determine the level of risk associated with lending to individuals. Credit scores are determined based on payments you make on things like loans, utilities, and medical bills, among other expenses.

The range of , and this number essentially measures how good you are at paying your bills on time.

Hard times come when they are least expected. And sometimes that can lead to you falling behind on debt obligations, which result in late payments, repossessions, and defaults all of which can harm your credit score. But there are also ways to raise your credit score or establish credit if you have none.

Applicants who fall in the poor category are unlikely to get a loan, and if they do, they usually are charged a very high interest rate.

Applicants in the fair category may also have a hard time getting a loan. However, options are still available with interest rates slightly lower than those available for consumers with e a very poor credit rating.

Credit scores that fall into these bottom two tiers are typically what people consider bad credit scores.

Where To Find The Best Auto Loans

There are many different avenues you can use to find the best auto loan.

- Banks. If you already have a relationship with a bank and have a high credit score, your bank may provide one of the most competitive interest rates. But read the entire agreement before you sign some banks write in a clause that allows them to take from your checking or savings.

- Like a bank, if youre a member of a credit union, it may offer a competitive interest rate. And if you have less-than-perfect credit a credit union may be willing to look past that and still extend a reasonable rate.

- Online lenders. There are several online lenders that offer auto loans you can prequalify for. As with most direct lenders, youll likely get a better rate than you would by applying with a dealership.

- Car dealers. This is one of the biggest ways that you can get stuck with a higher interest rate. Dealers add markups to interest rates provided, which means youll be stuck paying more than if you went to the lender directly. Check with several different lenders before going to a dealership to get the best deal possible.

Getting Preapproved For A Car Loan Can Lower Your Rate

Getting preapproved for a car loan before you set foot on the dealership lot can have several benefits. First, you can compare offers from multiple lenders ahead of time to get the best auto loan rates. Check with banks, credit unions, and online lenders.

Those savings can translate to thousands of dollars over the lifetime of the car loan. Of course, youll also know in advance what your car budget will be.

A preapproved auto loan also gives you leverage when negotiating the price with the dealer. Car salesmen will see you as a buyer and not just a browser.

Theyll know youre serious about purchasing a car, and it now becomes their job to make sure you buy a car from them. This can mean receiving discounts or incentives they otherwise may have left off the table.

You will likely get a lower auto loan rate and maybe even a better deal on the car loan if the dealership gives you a price break. This lowers the total amount of your car loan and the amount of interest you pay on your vehicle.

Also Check: Can I Get Out Of My Car Loan

Avoid A Hard Credit Check Until You Need One

Look for companies that offer a preapproval process that does not require a hard credit check. What this means is that you will self-report your FICO score and income information to the lender. You will then be made a provisional auto loan offer. This is not an official offer, and your terms may not be finalized until after a hard credit check.

Do not submit to a hard credit check unless you are fairly confident you will accept the loan offer. You want to limit any negative impact to your credit score while you are still considering your options.

If youre just shopping around, you can use one of the many car loan calculators available online to get a general idea of your budget without handing over your personal information.

Rate Hikes Will Lift Home Equity Loan Rates

- Home equity loan: 8.75%

Homeowners are sitting on a record amount of home equity, but theyll have to pay even more this year to tap into it. Home equity loans and HELOCs are directly pegged to the prime rate, which typically holds 3 percentage points above the Feds key rate. In other words, the higher the Feds rate climbs this year, the more home equity loan rates will soar as well.

McBrides forecast shows the average HELOC rate climbing to 8.25 percent by the end of 2023, about 63 basis points higher than where it settled at the end of 2022.

The important takeaway for current HELOC borrowers is that another 1 percentage point in rate hikes by the Fed means your rate will move up by 1 percentage point, McBride says. The average rate available to new borrowers will rise less than that due to various introductory offers.

The average home equity loan rate is projected to hit two-decade highs in the second half of the year, McBride adds, rising a full percentage point from its current level to 8.75 percent.

Existing borrowers, however, will only be impacted if they have a variable-rate loan. Borrowing costs on home equity loans, for example, are fixed, meaning their interest rate lasts for the life of the loan. Yet, fewer lenders offer them, McBride says. Variable-rate HELOCs are the most common way homeowners borrow from their homes equity.

Also Check: Do You Get Student Loan All At Once

Car Loan Interest Rates Faqs

1. What is a Car Loan EMI? How is it calculated?

EMIs or Equated Monthly Instalments relate to the monthly contributions you make to the lender in order to repay the car loan. Such payments include both the principal sum and the interest. The number of EMI you have to pay depends on the duration of your car loan. For longer periods of time, the repayment of the debt is distributed over a greater amount of years and the payments are lower, while for shorter periods, the instalments would be larger.

2. What is the highest amount of new car loan that I can avail?

The maximum amount of new car loan provided by most lenders is 80% to 90% of the cars on-road costs. This may vary depending on the brand and the variant of your preferred vehicle. Your salary is also a determinant of the full value of the loan you are eligible for. Many banks have a minimum income threshold that you must fulfil in order to get the loan accepted.

3. Which car models are funded by the regular car loans in India?

Almost all small to medium-sized cars, Sports Utility Vehicles and Multi Utility Vehicles are eligible for car loans available in India, unless otherwise stated. However, as noted above, refer to the loan brochure of the lender for exceptions to this regulation.

4. Do I need a collateral or personal guarantee while applying for a car loan?

5. What is the maximum tenure available for Car Loans?

Car Loans usually come with a tenure of 1 year to 7 years.

Average Interest Rates For Car Loans

The average APR on a new-car loan with a 60-month term was 4.96% in the first quarter of 2021, according to the Federal Reserve. But as mentioned above, your credit scores and other factors can affect the interest rate youre offered.

|

Loan type |

Note: Experian doesnt specify which credit-scoring model it uses in this report.

The table above isnt a guarantee of the rate you may be offered on an auto loan. Instead, it can help you estimate an interest rate to enter into the auto loan calculator, based on the average rates people with various credit scores received on auto loans in the first quarter of 2021.

Keep in mind that there are different and that various lenders use may different ones. For example, auto lenders may look at your FICO® Auto Scores. And available interest rates and APRs can vary by lender, so be sure to shop around and compare both across your loan offers.

You May Like: What Loan Can I Get With Bad Credit

How Do Auto Loan Rates Work

Auto loan interest rates are determined through risk-based pricing. If a lender determines you’re more at risk of defaulting on your loan because of your credit score and other factors, you’ll typically be charged a higher interest rate to compensate for that risk.

Factors that can impact your auto loan interest rate include:

Whatever auto loan interest rate you qualify for, it’ll be represented in the form of an annual percentage rate , which may include the cost of both interest and fees. The lender uses your interest rate to amortize the cost of the loan. This means that you’ll pay more interest at the beginning of the loan’s term than at the end.

Auto Credit Express: Best Customer Ratings

Auto Credit Express is another online lending marketplace that specializes in car loans for bad credit. The company has helped millions of customers since its founding in 1999. There are no credit score requirements for securing a loan through Auto Credit Express, and loan amounts can range from $5,000 to $45,000. Here are a few more highlights:

- Customer service: Auto Credit Express has a 4.7-star rating from customers on Trustpilot, and the company has an A+ rating with accreditation from the BBB.

- Good option for during or after bankruptcy: You can find lenders that specialize in auto loans after bankruptcy and even some that provide options during bankruptcy.

- Resource center: Auto Credit Express provides a variety of resources for shoppers, including information on credit reports, auto insurance, and refinancing, plus a loan estimator and payment calculator.

You May Like: Loans For Start Up Business

Fico Score Factors And Percentage Of Credit Score

How To Increase Your Credit Score

If you can take some time to postpone financing a new vehicle, work on some of the following things to raise your score:

- Make sure all bills are paid up to date.

- Refinance loans that have high interest rates.

- Focus on paying down your smallest debts first.

- Consolidate debts into one monthly payment with lower interest.

- Dont close credit cards or charge accounts after you pay them off.

- Avoid hard inquiries on your credit report unless absolutely necessary.

- Shoot for using 30% of your available credit or less. You can try increasing your current credit limits to do this.

- Review your full credit report and look for any errors to resolve. You can get a free report from each credit bureau every year.

- If you can open a new credit card with good terms , do this to raise your total credit limit. But, only charge what you can pay off each month.

Average Auto Loan Rates By Credit Score

The table below shows the average auto loan rates by credit score for new and used car purchases, according to the 2022 Q1 Experian State of the Auto Finance Market report.

- Interest rate: 10.87%

- Total paid over 60 months: $19,510

As you can see, your credit score is a major factor in the rates you get on auto financing and other loans. People with good credit scores can typically find loans with nearly any financial institution at reasonable rates, but people with a credit score under 600 may have more difficulty.

Recommended Reading: Will I Get Approved For Home Loan

How A Subprime Auto Loan Works

There is no official cutoff score for subprime status, but usually, the borrower has a between 580 and 619 to be considered subprime.

In evaluating a borrower, an auto-loan lender may ask to see pay stubs or W-2 or 1099 forms to prove income. If a borrower is in a line of work in which its hard to prove incomea restaurant server who has a lot of income in cash tips, for examplethey may need to bring in bank statements that indicate a history of consistent cash deposits to their account. Some lenders will accept bank statements in place of, or in addition to, standard pay stubs.

In general, its best to shop around for rates if forced to go with a subprime loan. Not all lenders use the same criteria and some charge larger fees than others. The interest rates can be quite steep compared to a standard car loan because the lender wants to ensure it can recoup costs should the borrower default on the payments.

Alternatively, borrowers might try to improve their credit scores before they try to get financing for an automobile purchase. That way, they could qualify for a loan with much better terms.

Auto Credit Express: Best For Bad Credit Car Financing

Loan amount: Varies by lenderBest for: A range of buyers with good, fair, or bad creditCar financing types: Purchase loans, refinancing loans, bad credit lease options

Auto Credit Express is a bit different from most other lenders on our list. Thats because it isnt technically a lender. It works with hundreds of finance companies and auto dealers across the country to connect buyers with opportunities that work for them.

Auto Credit Express can help subprime buyers find loans that have low down payment requirements, which makes it a bit easier to get approval for a used or new car loan. Lenders in their network can also work with people who have had a bankruptcy.

Recommended Reading: What Is The Current Interest Rate For Student Loan Consolidation

Can I Get An Auto Loan With Bad Credit

It is possible to get a car loan with bad credit, although having bad credit will raise the rates you’re offered. If you are having trouble getting approved or finding acceptable rates, try taking these steps:

What Are Good Interest Rates & Aprs For Car Loans

When it comes to purchasing a vehicle, theres a lot to consider, such as what make and model youd like, what gas mileage you need, and so on. But figuring out how to finance your next vehicle purchase is one of the most important steps in the process. When youre comparing car loan options, youll see two terms interest rate and APR. These both give you an idea of how much it costs to take out a car loan. Well show you the difference between APR and interest rate and share some tips to help you get better rates next time you buy a vehicle.

Read Also: What Is The Max Student Loan Amount

Capital One Auto Refinance: Best For Bad Credit Auto Loan Prequalification

Loan amount: $7,500 to $50,000Best for: Refinance and prequalificationCar financing types: New and used purchase loans, refinancing loans

If you want a large bank experience, we recommend checking out Capital One Auto Refinance. Capital One offers prequalification for both purchase loans and refinancing loans.

Capital One doesnt have a credit score requirement for loan approval. However, it requires you to make at least $1,500 or $1,800 per month depending on your credit. If you are prequalified, you can get a loan at one of Capital Ones 12,000 participating dealerships.

What Factors Determine Your Car Loan Interest Rate

If you want to figure out the average car loan interest rate for buyers like you, you should know which factors potential lenders will consider. Even if you already know what kind of car you want, knowing this information can help you decide if now is the best time to buy a car, or if you should wait until your financial situation improves:

Don’t Miss: How To Get Out Of Student Loan Delinquency

Whats The Difference Between New And Used Car Interest Rates

Loans for newer cars tend to have lower interest rates than those for used cars. Lenders see newer cars as less of a risk theyre less likely to break down and lenders can identify exactly how much theyll depreciate over time. Newer cars also have more predictable resale value than older cars, and that predictability results in a lower interest rate.

What Does That Mean For You

It means that although different lenders use different measures, people with exceptional or at least good credit scores may qualify for lower rates, while people with lower credit scores will often qualify only for higher rates.

High Credit Score Low Interest Rate

Average Credit Score Medium Interest Rate

Low Credit Score High Interest Rate

Read Also: Who Is Eligible For Va Loans

What Is A Good Interest Rate For A Car Loan

Interest rates vary depending on your credit score. The best rates are typically reserved for highly qualified applicants applicants with damaged credit receive higher rates. A good interest rate for a car loan, though, is one that allows you to finance a car with manageable monthly payments for your budget.

Here are interest rates you can expect for each credit score tier, according to Experian.

| Average loan rate for a new car | Average loan rate for a used car |

|---|---|

| Deep subprime | 14.39% |

| 4.29% |