Different Loans For Different Folks

Before getting into the different types of available loan programs, lets do a quick refresher on how exactly student loans work. Like any type of loan , student loans cost some small amount to take out and they require interest and principal payments thereafter. Principal payments go toward paying back what youve borrowed, and interest payments consist of some agreed upon percentage of the amount you still owe. Typically, if you miss payments, the interest you would have had to pay is added to your total debt.

In the U.S.A., the federal government helps students pay for college by offering a number of loan programs with more favorable terms than most private loan options. Federal student loans are unique in that, while you are a student, your payments are deferredthat is, put off until later. Some types of Federal loans are subsidized and do not accumulate interest payments during this deferment period.

What Are Subsidized Student Loans

Federal Direct Subsidized Loans are student loans that the U.S. Department of Education offers undergraduate students who demonstrate financial need. The main advantage of subsidized loans has to do with who pays interest at different times during the life of the loan.

Generally, youre responsible for interest on student loans as soon as the loan is paid out even if you arent yet required to begin repaying the loan itself. This could be while youre in school, in a grace period after graduation, or in loan deferment. With unsubsidized loans, this interest accumulates and is added to the total amount youre required to pay back.

With subsidized loans, the government actually pays your interest during these periods, potentially saving you thousands of dollars when you begin to repay the loan. This cost savings makes Direct Subsidized Loans a clear first choice for student borrowers.

How Long Should Your Student Loan Term Be

Choosing the right student loan term can help a consumer pay off their loans faster.

Students rely on federal and private student loans to fill a gap not met by federal student aid. For many, it will take years maybe even decades to repay their student debt.

That’s why it’s important to understand student loan terms from the get-go, especially how long your student loan term should be. But what’s the right student term length for you?

Here’s what you need to know.

You May Like: What Credit Bureau Does Usaa Use

Rehabilitate Any Loans In Default Before Collections Resume

The CARES Act promised an additional reprieve for federal student loan borrowers in default: a halt to collections and garnishments of wages and other monetary benefits. The Department of Education has also said it would refund $1.8 billion worth of recent seizures.

To avoid such penalties in the future, strategize how to get your loans out of default. Your options for federally owned debt include the following:

| What to know | |

|---|---|

| If you have the cash to do it, zero out your balance | Not practical for most borrowers |

How Do Subsidized Student Loans Work

To be eligible for a federal subsidized loan, you must be enrolled at least half-time in a college or university that participates in the governments Direct Loan Program.

You must also demonstrate financial need, as determined by the information on your familys finances that you provide in the Free Application for Federal Student Aid . Financial need is the difference between the cost of attendance of your school and the amount of money your family is considered able to afford to pay, called your expected family contribution .

Your school will determine how much you can borrow in subsidized loans. But these loans do have maximums that are based on your year in school. The subsidized loan limits are:

- $3,500 for first-year undergraduates

- $4,500 for second-year undergraduates

- $5,500 for third-year undergraduates and subsequent years

The amount you can borrow in subsidized loans is limited to $23,000. The federal government pays the interest on subsidized loans while you are:

- Enrolled in school at least half-time

- In the grace period

- In loan deferment

You must also pay a loan fee on Direct Subsidized Loans, currently set at just over 1% of the loan amount. This fee is deducted from the money disbursed to your school.

You May Like: Usaa Auto Loan Approval

What Are The Consequences Of Missed Payments Defaulting

Student loans never disappear. Theres no statute of limitations, and student loans are rarely discharged even in bankruptcy a fact reaffirmed in March by the U.S. Second Circuit Court of Appeals.

With few exceptions and pending direct relief from Washington your student loans will follow you until you pay them off.

When payment schedules resume, if there are no changes and you make a late payment on a federal student loan, you may be responsible for a late fee equal to 6% of the payment.

Defaulting on federal student loans results in more severe penalties. Before the CARES Act forbearance, you were considered delinquent when you havent made a payment in 90 days. When you havent made a payment in 270 days , you go into default and suffer plenty of consequences for it.

The government can garnish up to 15% of your wages and Social Security benefits, as well as offset income tax refunds. The government may also deduct 25% of each payment for collections fees, making the loan cost significantly more.

Late or missed payments also show up on your credit report and can harm your score.

If you cannot afford your payments, it is much better to contact your loan servicer and review your repayment options rather than simply not paying. Not paying and remaining silent is never a good combination.

Pressure Campaign To Convince Biden To Extend The Payment Pause Is Intensifying

Student loan borrower activists, advocates, and allies have been dramatically increasing the pressure on Biden to act. Last month, a broad coalition of over 200 civil rights, labor, and consumer protection organizations sent a letter to Biden urging him to extend the payment pause, citing inflation and ongoing economic uncertainty. This week, hundreds of student loan borrower activists descended on Washington, D.C. and held a protest and march, urging Biden to extend the payment pause and cancel student loan debt through executive action.

Meanwhile, top Democrats in Congress have been ramping up the pressure on Biden to extend the payment pause, as well. This includes Senate Majority Leader Chuck Schumer , Senator Patty Murray who holds a key position as Chair of the Senate Health, Education, Labor, and Pensions Committee, and House Majority Whip James Clyburn , a key Biden ally. Biden needs Congressional allies to try to pass his agenda this year.

Also Check: Stilt Loan Processing Time

Graduate Student Loan Debt Repayment Timelines

Graduate and professional students, on average, borrow more for school than undergraduate students. Their income rates tend to be higher, as well.

- 4.3% is the interest rate for Direct Unsubsidized federal student loans to graduate or professional borrowers.

- 5.3% is the interest rate for Direct PLUS loans, which go to graduate or professional borrowers as well as parents of undergraduates borrowing on their behalf.

- $58,300 is the average student debt for a borrower who graduated from a public institution with a Masters degree.

- $96,700 is the average debt for masters degree holders who attended a private, for-profit institution.

- $101,200-$175,600 is the range of average debt for doctoral degree holders.

- $243,300 is the average debt for professional degree holders who attended private, nonprofit institutions.

- $77,800 is the average salary for a masters degree holder.

- $96,800 and $97,900 are the average respective salaries for people with professional and doctoral degrees.

| 7 yrs, 4 mos |

Federal Student Loan Holders

- To learn more about your student loans, including how much you owe, your interest rate, loan repayment status, and the name of your loan servicer, follow these steps:

- Visit studentaid.ed.gov to create your Federal Student Aid ID if you do not already have one. Note: The FSA ID is the same username and password you used when you filed your Free Application for Federal Student Aid .

- With your FSA ID, log in to the National Student Loan Data System at NSLDS.ed.gov.

- Using NSLDS, you can find out how much you owe and who services your loans. A loan servicer manages your loans and will be your primary point of contact in repaying your loans, picking a payment plan, consolidating your loans, or answering your questions.

Read Also: Fha Loan Refinance

How Long Does It Take To Pay Off A Student Loan

Contact your loan servicer to discuss repaymentplans available to you because repayment plans will be different depending onwhether you have federal or private student loans.

Federal student loans

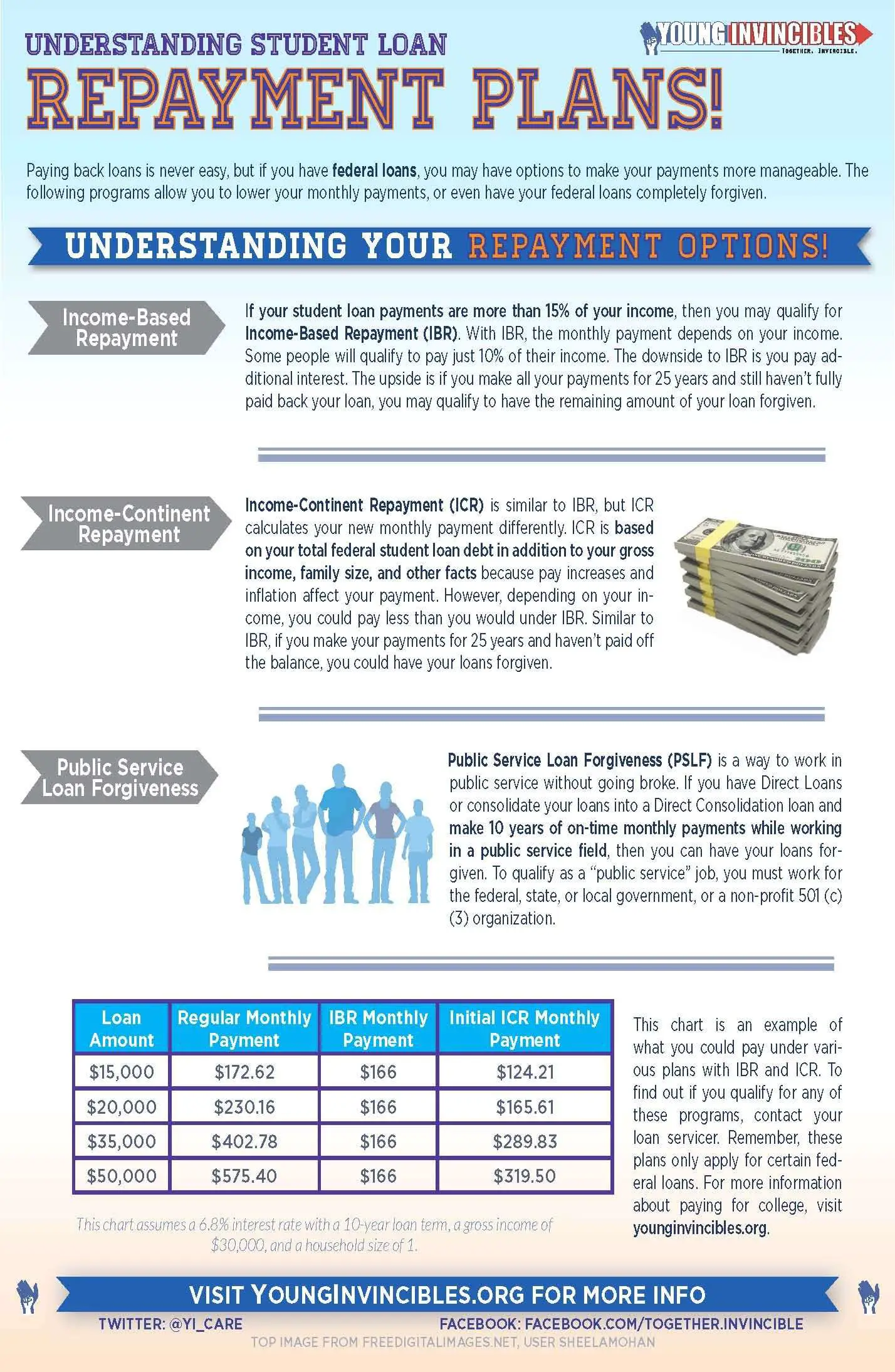

If you have federal student loans, there are several repayment plans that may be available to you. Contact your servicer to discuss repayment plans and learn more about how to apply and enroll in a different repayment plan.

Privatestudent loans

Unlike federalstudent loans, there is no standard repayment schedule for private studentloans. Generally speaking, many private student loans give you 120 months to repay. However, some private student loan terms have you repay over25 years. Check the terms and conditions of your loan, or contact your servicerfor more details to find out how long it will take you to repay your privatestudent loans.

You may have options to lower your monthly payment. Manycompanies say that they have alternate payment programs for borrowers who mightnot be able to make a full payment. These plans may include:

- Graduatedrepaymenta plan where yourpayments start out lower and gradually increase over time.

- Extendedrepaymenta plan where you payless each month but extend the life of your loan over a longer period of time.

Asking for help when you run into trouble can keep you fromfalling further behind. Contact your student loan servicer and ask what optionsare available to you. Your student loan servicer is the company that sends youa bill each month.

How Do You Repay Subsidized Student Loans

You must repay federal subsidized loans after you leave school or drop below half-time enrollment. First, youll have a six-month grace period in which you dont have to make payments allowing you time to get established in a job and set a budget. During this time, your loan servicer will give you instructions on how to make your payments and let you know when your first payment is due.

Your loan servicer can also help you determine which repayment plan is right for you. The default is the Standard Repayment Plan, in which you pay off your loan with regular, fixed monthly payments over 10 years. All borrowers are eligible for this plan.

Other repayment plans you may consider include:

You May Like: Usaa Vehicle Loan Rates

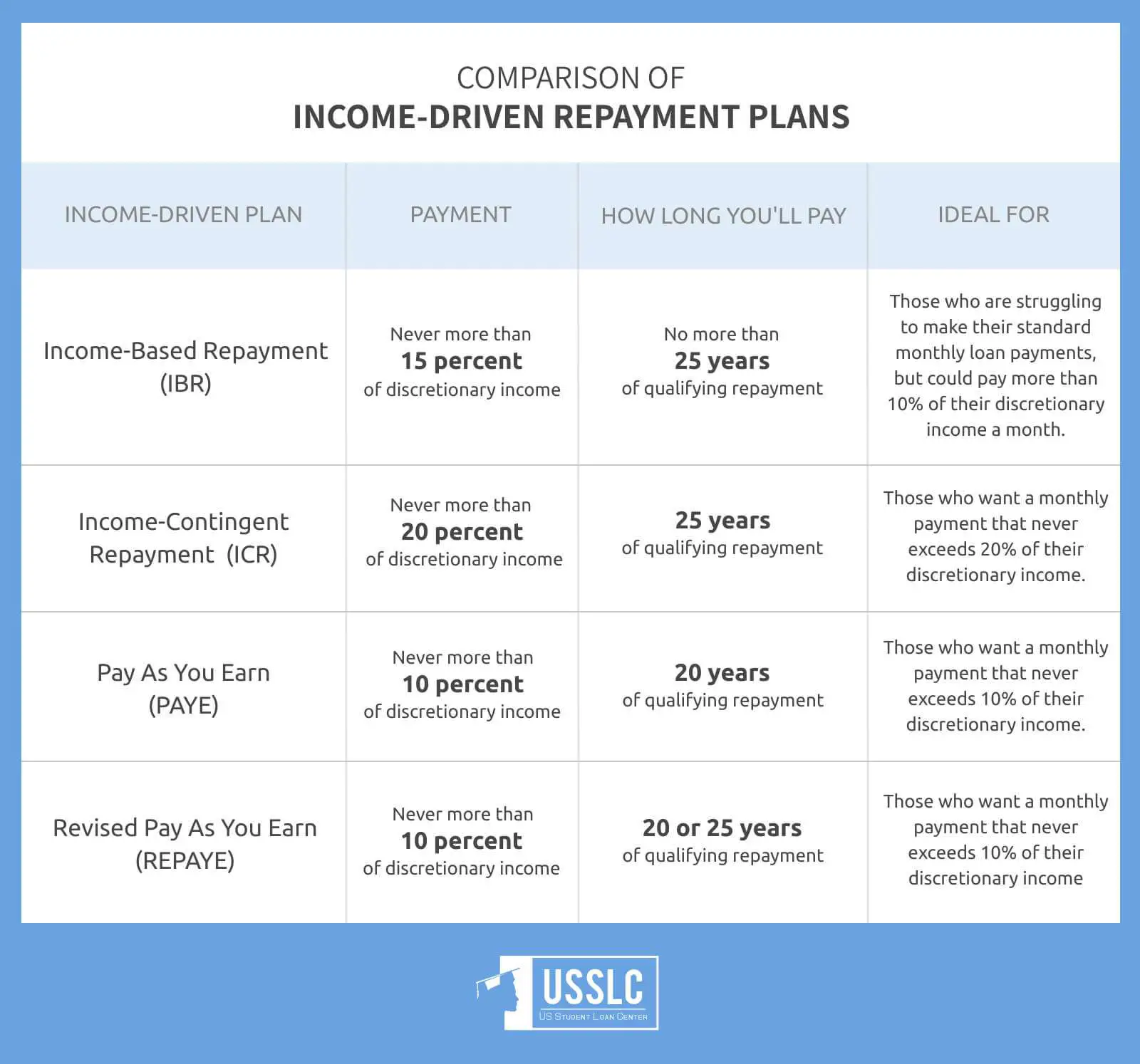

Revised Pay As You Earn

REPAYE sets your monthly payment at 10% of your discretionary monthly income. Under this plan, your repayment period is 20 years if all of your loans were for undergraduate studies. If any loans were for graduate studies, the repayment period jumps to 25 years. For the purposes of this program, discretionary income equals the difference between your annual income and 150% of the poverty guideline for your family size and state.

The REPAYE plan is good for those with high balances and a modest income. It is also a solid plan for an individual who doesnt mind if their monthly payment is larger than what it would be under the standard repayment plan, since there is no cap. Additionally, for those with very large loan balances, the government subsidizes some of the interest that accrues if your monthly bill is not large enough to cover the interest payment.

Pros

- Any borrower with eligible federal loans can choose REPAYE

- Access to loan forgiveness at the end of your repayment period

- Monthly payments will decrease if your income decreases, keeping the payment affordable

Cons

- If you dont recertify your income and family size annually, you will be removed from the plan, which could make your payment jump

- Depending on your income and family size, your monthly payment might be higher than the amount youd pay under the standard repayment plan

- Due to the longer payment period, you may pay more in interest

How Extra Payments Pay Off Loans Faster

Say, for example, you borrow $20,000 in student loans with an interest rate of 5%. Your monthly payment for 10 years would be $212 and you would pay $5,440 in interest.

What if you paid $100 a month more toward that loan? Your monthly payment would rise to $312 but you would pay about $2,000 less in interest and be debt-free nearly four years earlier.

The more payments you can tack on, the less youll pay in interest and the closer youll get to freedom from student debt. If it feels like you have no cash to spare, try making biweekly student loan payments instead its a simple way to trick yourself into making one full extra payment each year.

The standard repayment plan takes 10 years to pay off a student loan. But repayment can last longer if you change your repayment plan for example, income-driven options can last up to 25 years.

You can pay off a student loan as quickly as you’re financially able to. There’s never any penalty for prepaying a student loan, and paying off your loan quickly will result in paying less overall.

You can calculate your student loan payoff date based on your current loan balance, the loan’s interest rate and the amount you pay each month. If you’re on an income-driven repayment plan, your student loan will be paid off when the amount you owe is paid in full or your repayment term reaches its end, whichever happens first.

» MORE: Best refinance lenders for paying off student loans fast

Also Check: Va Handbook Manufactured Homes

Do Student Loans Go Away After 10 Years

Student loans can go away after 10 years if you work full-time in the public service and qualify for the Public Service Loan Forgiveness Program. To qualify, you’ll need to make several payments on Direct Loans under an income-driven repayment plan. If you have loans made under the Federal Family Education Loan Program or the Perkins Loan Program, you’ll need to apply for Direct Loan Consolidation.

Check the Federal Student Aid website to see what type of loans you have.

While the PSLF Program will forgive your federal student loans after 10 years, there are no student loan forgiveness programs for private student loans after 10 years. You’re stuck with them until you pay them off, negotiate a settlement, or the statute of limitations runs out .

PSLF Limited Opportunity Waiver: The Department of Education recently announced that it was temporarily expanding the PSLF program to help borrowers get more credit towards loan forgiveness. You can read more about those changes here. You can also get my PSLF Waiver: Guide to Applying for comprehensive answers and step-by-step instructions to take advantage of this limited opportunity.

What Is Loan Consolidation

Consolidation means your lender has given you a “repayment date.” It starts on the first day of the seventh month after you stopped attending full-time studies or withdrew from classes.

The National Student Loans Service Centre will automatically send you a consolidation agreement, approximately 45 days before you enter repayment.

Your consolidation agreement shows:

- The details of your current outstanding Canada-B.C. integrated student loans balance.

- Your monthly payment and when it is due. Please note that your payments will be prorated to your Canada and BC student loan debt, based on each loans portfolio outstanding balance.

- How long you have to repay.

- The interest rate charged on your loan.

- The bank account from which payments will be withdrawn.

Your credit rating stays in good standing with Canada-British Columbia integrated student loans and/or other BC and Canada student loans when you meet the terms of the consolidation agreement and repayment schedule by making your monthly payments on time.

The consolidation agreement lets you:

- Review your loan information.

- Review your bank account information.

- Establish your loan repayment options including:

- Setting up the pre-authorized payment plan

- Choose the fixed-rate interest option

- Review repayment assistance plans

Important:not

Read Also: How Far Back Do Underwriters Look At Bank Statements

Start Repaying 6 Months After Leaving School

After finishing school, there is a 6-month non-repayment period. No interest accrues on your loan during this time. When this period is over you have to start making payments on your Canada Student Loan.

Contact your province for information on interest charges to your provincial loan.

The 6-month non-repayment period starts after you:

- finish your final school term

- reduce from full-time to part-time studies

- leave school or take time off school

If you need to take leave from your studies, you might qualify for Medical or Parental Leave.

Adjust Your Repayment Plan Or Monthly Dues If Necessary

Enrolling in an income-driven repayment plan could make your payments more affordable once the student loan freeze ends. IDR plans limit your monthly dues to 10% to 20% of your discretionary income. They also account for your family size.

And you dont have to wait until January or February to enroll. In fact, you can review your IDR options at any time the governments loan simulator tool could help you decide. After choosing the best repayment option for your situation, you can apply in 10 minutes, free of charge.

If youre already repaying your debt via an IDR but have seen a decrease in household earnings , you could recalculate your monthly dues via studentaid.gov.

You May Like: Refinance Options For Fha Loans