How To Calculate Monthly Loan Payments

The Balance / Julie Bang

The monthly payment formulas calculate how much a loan payment will be and include the loan’s principal and interest.

Learn how to calculate how much you’ll pay on the most common types of loans and how to decide whether you can afford them or not.

Ways To Negotiate Sales Prices And Online Alternatives To Haggling

Many Americans do not like to haggle for a better deal. However, haggling is commonplace in some cultures. If a buyer will haggle over the price of a new or used vehicle, they stand a chance of obtaining a better purchase price for the vehicle. Haggling simply means that the purchaser makes a counter-offer to the dealer or seller once they have presented the purchaser with a selling price. Haggling is simple negotiation. Dealers in particular have some bargaining leeway when it comes to the purchase price of their new and used vehicles. When shopping, the purchaser has nothing to lose. They should attempt to negotiate a lower selling price. Even a $500 break is often equivalent to a monthly payment. Buyers should always attempt to gert a better price than the asking price of the seller.

For those who are uncomfortable with the prospect of haggling for a better price, some websites offer services that allow users to comparison shop for the same make and model of vehicle. Sites such as CarsDirect and TrueCar allow users to search for a specific make and model in their geographical area. The search results provide the asking prices of various sellers and dealers. The site user may then contact the seller or dealer and even offer a lower price, if the so choose.

Calculate A Payment Estimate

The selling price of the new or used vehicle for monthly loan payment calculation.Estimated sales tax rate for the selected zip code applied to the sales price.Add title and registration here to include them in your estimated monthly payment.Available incentives and rebates included in the monthly payment estimate.The value of your currently owned vehicle credited towards the purchase or lease of the vehicle you are acquiring. If you select a vehicle using the “Value your trade-in” button, the value displayed in the calculator will be the Edmunds.com True Market Value trade-in price for a typically-equipped vehicle, assuming accumulated mileage of 15,000 miles per year.The remaining balance on a loan for your trade-in will be deducted from the trade-in value.The cash down payment will reduce the financed loan amount.Generally available financing interest rate for the estimated loan payment.Your approximate credit score is used to personalize your payment. A good credit score is typically between 700 and 750, and an excellent credit score is typically above 750.

Read Also: Usaa Loan Approval

How Do You Calculate A Payment With Interest

Auto Loan Calculator: Estimate Your Car Payment

Shopping around for the right auto loan can help you find the best terms but before you start applying, you need to use an auto loan calculator to understand how much your car payment will be and what interest youll pay over the life of your loan.

Many or all of the companies featured provide compensation to LendEDU. These commissions are how we maintain our free service for consumers. Compensation, along with hours of in-depth editorial research, determines where & how companies appear on our site.

More calculators:Refinance car loan calculator& boat loan calculator

You May Like: How Does Capital One Auto Loan Work

Try Our Calculator For Yourself

If youve learned anything today, we hope its that its important to weigh all factors when buying a vehicle, either new or used. Our car financing calculator will be a great tool to help you plan your next vehicle purchase.

It can help determine how much money you want to put down . Based on how much your trade-in value is, it can be a great help when deciding what kind of term you want to choose. Note: some interest rates are term-specific, so even if your credit history says you can get 1.99% interest, for example, you may have to choose a certain term length in order to qualify for that interest rate.

How To Use Our Auto Loan Calculator

Enter your loan amount, loan term and interest rate. The auto loan calculator will estimate your monthly loan payment and total amount of interest charged by the lender.

You can adjust your loan term and interest rate to estimate another monthly car payment.

- Loan amount is based on how much you plan on borrowing. Subtract the trade-in value of your current vehicle and the amount of your down payment. Then add the estimated sales tax youll need to pay to the purchase price. This will get you to the total loan amount.

- Loan term is how long you plan on making monthly payments. Most dealerships and lenders offer terms between 24 months to 84 months, or two to seven years.

- Interest rate is the most important factor when it comes to your auto loan payment. The average interest rate on a new car loan was 3.54% as of May 2021. To qualify for this, youll need to have good credit typically 670 or higher. You can also browse average auto loan rates based on credit score to determine what you might be qualified for.

Read Also: Usaa Auto Refinance Calculator

What Are The Pros And Cons Of Paying The Total Cost Of An Auto Loan

Determining how to pay off an auto loan depends on your budget and the circumstance, as well as your preference when its time to repay the loan. As we learned above, monthly payments are beneficial if youre looking to establish or improve your credit score. However, paying off an auto loan in full comes with some benefits, too:

benefits of paying off the total cost of an auto loan

- You’ll Have More Money in Your Pocket– With no monthly payments towards an auto loan, youll have extra cash on hand to spend on other priorities such as education expenses or debt, rent or mortgage, utilities, and your savings goals.

- Youll Save Money on Interest – With each monthly payment you make, a portion goes towards your interest , and the rest goes towards your principal . Paying off the entire auto loan upfront can reduce the interest paid on your loan tremendously.

- You Have Full Ownership of Your Car – Once you pay off the car, the car title is YOURS and no longer belongs to the lender.

- Your Debt-to-Income Ratio is Improved – Your DTI ratio is a percentage that represents your monthly debt payments and tells a lender if you can afford the loan. When you pay off your car loan early, your DTI lowers. And, the lower your DTI, the better you look to creditors and lenders in the future!

disadvantages of paying off the total cost of my auto loan

|

Should You Put Cash Down On A Car

Putting money down on a vehicle has plenty of advantages. The larger the down payment, the lower your monthly payment will beand you’ll probably get a better interest rate, to boot. A larger down payment also helps you build equity faster and protects you and the lender against depreciation and potential loss.

Should I put 50 down on a car?

When you make a really large down payment, say around 50%, you’re going to see your auto loan really change for the better. Making a down payment as large as 50%t not only improves your chances for car loan approval, it also: Reduces interest charges. Gives you a much smaller monthly payment.

Recommended Reading: What Is The Fha Loan Limit In Texas

Computing Your Total Interest Using An Online Calculator

Why An Auto Loan Calculator Is Important

If youre planning on financing your new vehicle purchase, the overall price of the vehicle isnt really the number you need to pay attention to. The most important number, for you, is the payment. Because, as our auto loan calculator will show you, the price you ultimately end up paying depends on how you structure your deal.

The factor that will change your monthly payment the most is the loan term. The longer your loan, the less youll pay each month, because youre spreading out the loan amount over a greater number of months. However, due to the interest youll be paying on your loan, youll actually end up spending more for your vehicle by the time your payments are over. Why? Because the more time you spend paying off your loan, the more times you will be charged interest.

Speaking of interest, the interest rate is the second most important number to consider when structuring a car loan. The interest rate is the percentage of your purchase that is added to the cost of your vehicle annually. So, if you buy a vehicle with 4.99% financing, then youre paying roughly 5% of your vehicles overall price in added interest every year.

Next, consider how much your vehicle is worth if youre trading it in. If youre trading in a vehicle thats worth $7000 and youre buying a vehicle thats worth $22,000, then you will only have to take an auto loan out for $15,000 .

You May Like: Does Upstart Allow Co Signers

What If The Math Still Doesn’t Add Up

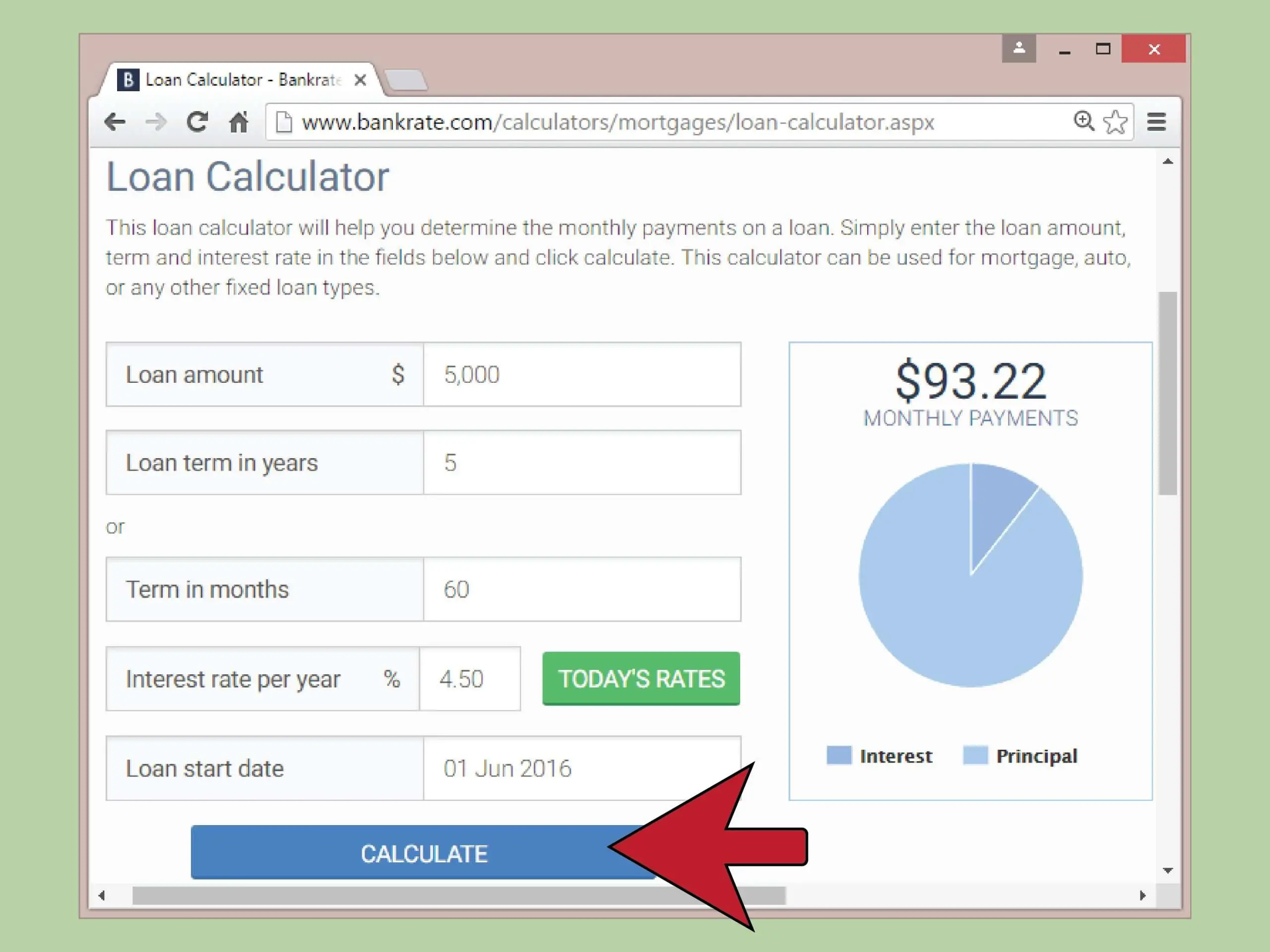

If these two steps made you break out in stress sweats, allow us to introduce to you our third and final step: use an online loanpayment calculator. You just need to make sure you’re plugging the right numbers into the right spots. The Balance offers for calculating amortized loans. This loan calculator from Calculator.net can do the heavy lifting for you or your calculator, but knowing how the math breaks down throughout your loan term makes you a more informed consumer.

Things To Consider When Shopping For A Vehicle

When an individual buys a car, they are typically buying the transportation they will rely on for years to come. For most people this is a major investment, second only to the purchase of a home. Most drivers intend to own the car for a long while. After all, few people have the resources or options to upgrade their vehicle often. The average auto loan hit a record of $31,455 in the first quarter of 2018, with the average used car loan running $19,708. Americans have over $1 trillion in motor vehicle credit outstanding.The following table from Experian shows how much people with various credit ratings typically are charged for loans.

| Borrower |

|---|

Don’t Miss: What Is The Average Interest Rate On A Commercial Loan

Calculate On Your Own

It’s easy to calculate a monthly payment on your own if you follow these easy steps:

How To Use The Reverse Auto Loan Calculator

If you know what you can afford each month, a reverse auto loan calculator can tell you how that translates into the total amount you can borrow. Of course, there are variables: the length of the loan and the interest rate you get.

Below you can see how your loan amount changes by moving the sliders for payment and loan term. We’ve provided average rates by credit tier as determined by Experian Automotive.

About the authors:Philip Reed is an automotive expert who writes a syndicated column forNerdWallet that has been carried by USA Today, Yahoo Finance and others. He is the author of 10 books.Read more

Shannon Bradley covers auto loans for NerdWallet. She spent more than 30 years in banking as a writer of financial education content.Read more

Recommended Reading: Do Loan Officers Get Commission

Buying A Car With Cash Instead

Although most car purchases are made with auto loans in the U.S., there are benefits to buying a car outright with cash.

There are a lot of benefits to paying with cash for a car purchase, but that doesn’t mean everyone should do it. Situations exist where financing with an auto loan can make more sense to a car buyer, even if they have enough saved funds to purchase the car in a single payment. For example, if a very low interest rate auto loan is offered on a car purchase and there exist other opportunities to make greater investments with the funds, it might be more worthwhile to invest the money instead to receive a higher return. Also, a car buyer striving to achieve a higher credit score can choose the financing option, and never miss a single monthly payment on their new car in order to build their scores, which aid other areas of personal finance. It is up to each individual to determine which the right decision is.

How To Use The Car Payment Calculator

The main purpose of this calculator is to help you compare estimated payments for loans with different term lengths and interest rates. When you apply for a loan, youll get to choose a term length, which is the number of months youll make payments. Your interest rate may change based on which term length you choose, and your rate will also change based on your credit score.

As you use this tool, youll find that the interest rate and loan amounts have already been filled in. These pre-filled values are national averages, so if you aren’t sure what to enter, you can leave these values in place. However, providing specific information will give you a more accurate result for your situation.

Once you enter all the information below, click Calculate and youll be shown a breakdown of your monthly payment, along with information about how much youll pay in interest and sales tax. If you click Add another option to compare payment, you can enter a different term and rate to see how the payment changes. Comparing these payment estimates could help you choose the term and interest rate that fits better within your budget.

Here is an overview of each field:

Read Also: Www Capitalone Com Auto Pre Approval

How To Get A Lower Car Payment

If it looks like you wont be able to afford the monthly payment for your dream car, dont worry. You can lower your car payment by making a few changes. Check out the following list for tips on how to lower your car payment:

- Pick a cheaper car. One easy way to lower your payment is by reducing the cost of the car, which will lower your loan amount. The lower your loan amount, the less youll have to pay each monthand the less youll pay overall in interest.

- Save for a larger down payment. Your down payment is the money you pay upfront when you purchase the car. If you aren’t in a rush to get a new car, saving for a bigger down payment will reduce your loan amount and could help you lower your monthly payment. Furthermore, reducing the size of your loan with a big down payment may help you lock in other favorable loan terms.

- Shop around for a lower interest rate. When you take out an auto loan, youll be assigned an interest rate that represents the cost to borrow money to pay for your car. Interest is paid as part of your monthly payment, and the lender determines your rate based on your creditworthiness and other factors. If you can lock in a lower interest rate, your monthly payment should be lower as a result. Rates vary by lender, and an improved credit score could help you land a lower one.

If you don’t know your credit score, you can get a free copy of your credit report and FICO® Score from Experian to get an updated view of where your credit stands.